Overview

A mortgage preapproval is typically valid for 60 to 90 days. However, some lenders may extend this period to 120 days based on their policies and the type of loan. We know how challenging this can be, especially when timing is crucial in the homebuying process.

It’s important to keep an eye on the expiration date of your preapproval letter. An expired approval may require you to reapply and submit updated documentation. This can add stress to an already complex journey.

To help you stay on track, consider setting reminders as the expiration date approaches. We’re here to support you every step of the way, ensuring that your homebuying experience is as smooth as possible.

Introduction

Understanding the intricacies of mortgage preapproval is vital for homebuyers navigating today’s competitive market. We know how challenging this can be, especially with many potential buyers unaware of the nuances involved. Obtaining a preapproval can not only clarify your financial limits but also significantly enhance your standing with sellers. However, the clock is ticking—how long does this preapproval truly last, and what happens when it expires?

Exploring the duration and renewal process of mortgage preapproval can empower you to maintain your edge in the housing landscape. By staying informed, you can make decisions that are best for your future. We’re here to support you every step of the way.

Understand Mortgage Preapproval

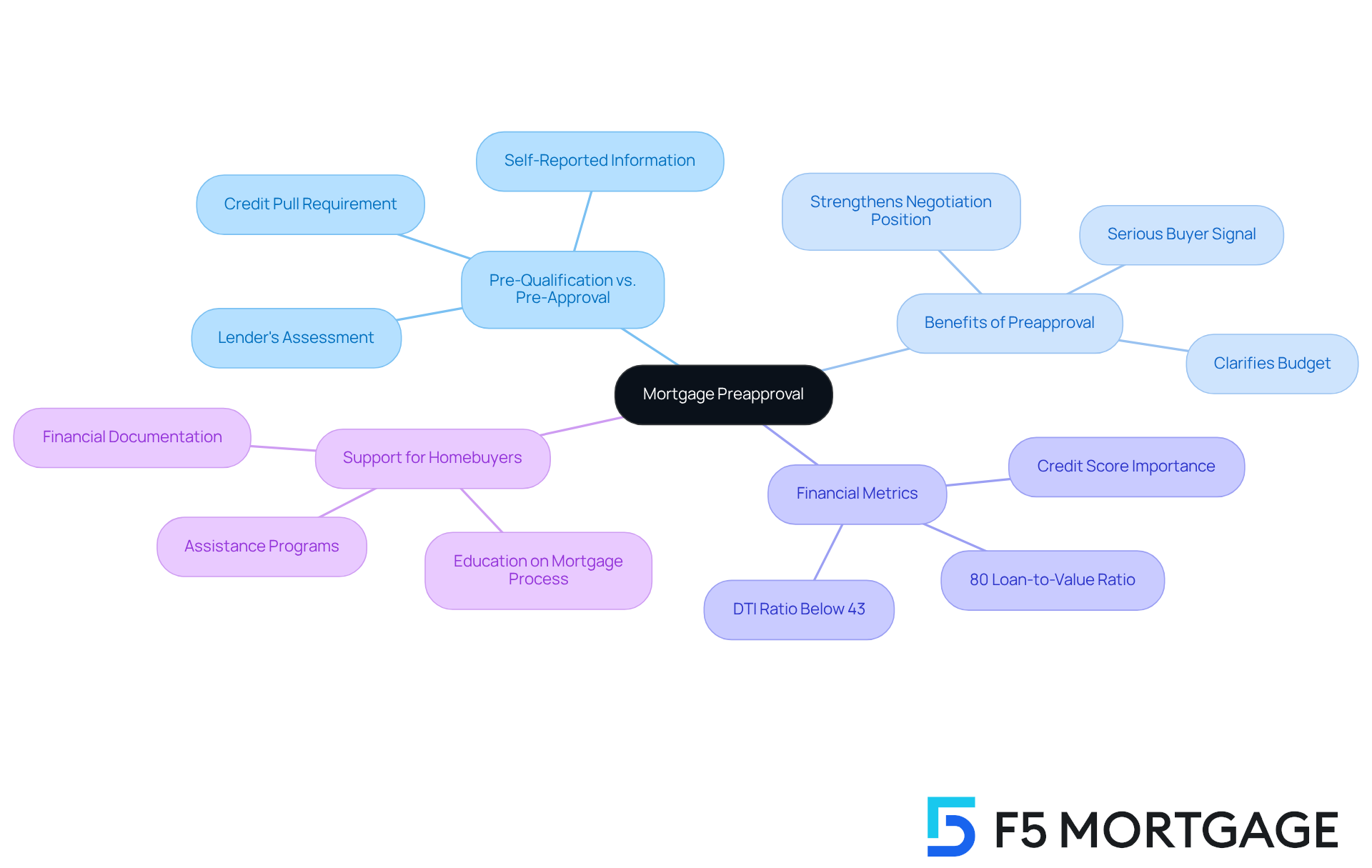

Mortgage pre-qualification is a crucial step in your home purchasing journey. It’s where a lender assesses your financial situation to determine how much they are willing to offer you. Unlike prequalification, which gives a rough estimate based on self-reported information, obtaining approval involves a comprehensive review of your financial documents, including credit reports, income verification, and debt assessments. This thorough process culminates in a letter of intent, detailing the highest loan amount you can secure, which significantly enhances your appeal to sellers.

Understanding the advance approval process is essential. It not only clarifies your budget but also strengthens your position in a competitive housing market. We know how challenging this can be, and research shows that about 60% of homebuyers are unaware of the intricacies involved in mortgage preparation. This highlights the importance of education in this area. Many first-time homebuyers have successfully leveraged prior approval to secure favorable conditions and streamline their buying journey.

In a market where multiple offers are common, having a preapproval letter can truly set you apart. It signals to sellers that you are a serious and financially capable buyer. Additionally, grasping the equity requirements—like maintaining at least an 80% loan-to-value ratio—and the importance of a favorable debt-to-income (DTI) ratio, ideally below 43%, can further enhance your mortgage options. This proactive approach can lead to better loan terms and a smoother transaction overall, making it a vital consideration for anyone looking to purchase a home. We’re here to support you every step of the way.

Determine the Duration of Preapproval

Navigating the mortgage pre-qualification process can feel overwhelming, and we understand how challenging this can be. Typically, a mortgage pre-qualification remains valid for about 60 to 90 days, leading to the question of how long is a pre approval good for, although some financial institutions may extend this period to 120 days. The exact duration often relates to how long is a pre approval good for, which hinges on the lender’s policies and the type of loan you are pursuing. For example, conventional loans might have different timelines for approval compared to FHA or VA loans.

It’s crucial to keep an eye on the expiration date of your approval letter, as it reflects your current financial standing. If your prior approval expires, you may need to reapply, which could involve submitting updated documentation and undergoing a new credit check. Understanding these timelines is essential for managing your property search effectively. By staying informed, you can ensure that you remain competitive in the market, empowering you to make the best decisions for your family’s future.

![]()

Renew or Extend Your Preapproval

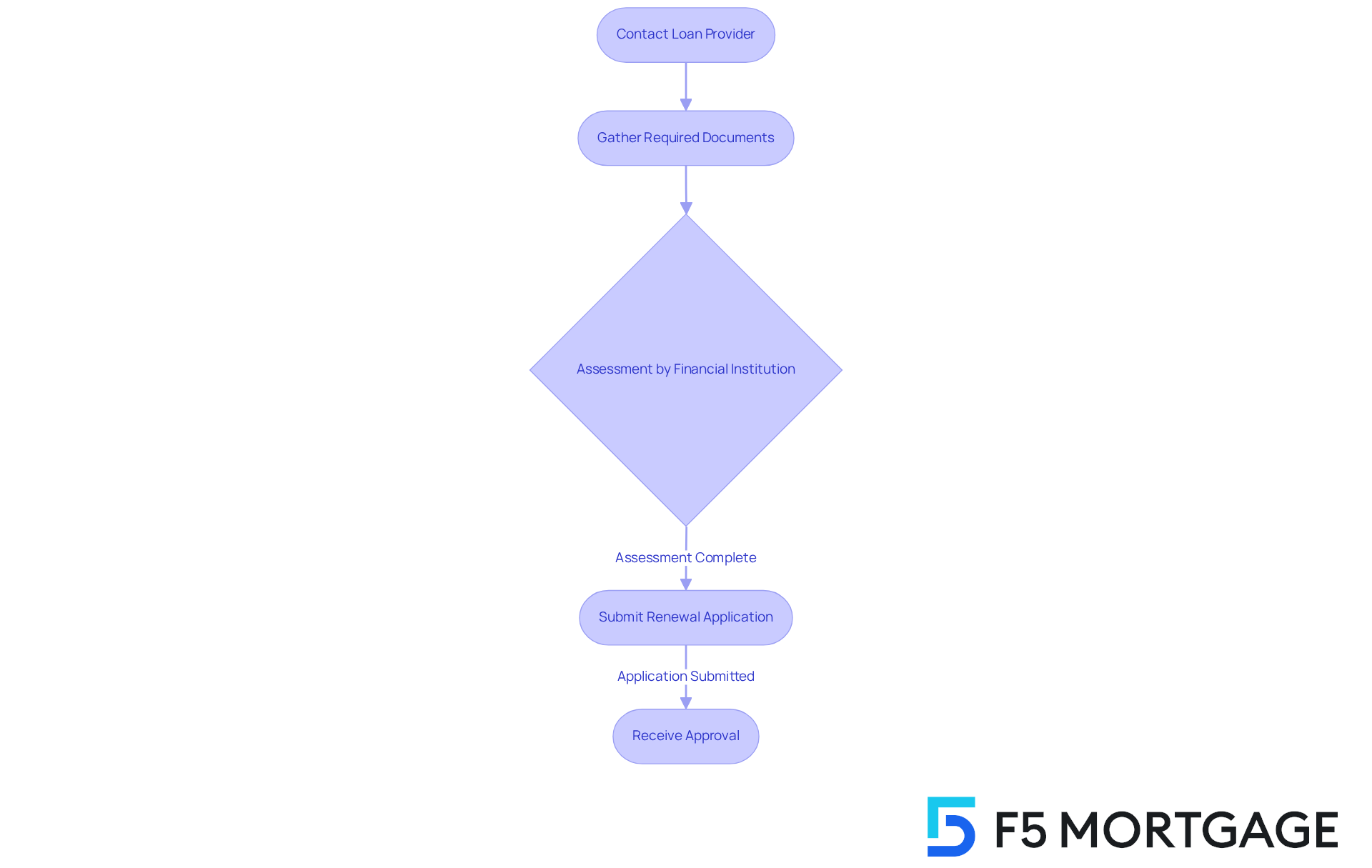

As your preapproval approaches its expiration and you haven’t yet secured a home, we understand how long a preapproval is good for can add to the stress of this time. Renewing or extending your preapproval is often a straightforward process, and we’re here to guide you through it. To begin, reach out to your loan provider. They may need updated financial documentation, such as recent pay stubs and bank statements.

Some financial institutions might conduct a quick assessment of your current application, while others may require a completely new application. It’s wise to start this process at least a week before finding out how long is a preapproval good for. This gives you ample time to gather the necessary documents, ensuring your home buying journey continues without interruption.

Successful approval extensions often involve borrowers who actively engage with their lenders. They make sure to understand the specific criteria for renewal. On average, the renewal process can take a few business days, similar to the initial approval timeline. Mortgage professionals emphasize the importance of being prepared with all required documents, which typically include:

- Proof of identity

- Income

- Assets

- Debts

By preparing these documents ahead of time, you not only streamline the renewal process but also enhance your chances of securing favorable loan terms. Remember, we’re here to support you every step of the way, making this challenging process just a bit easier.

Gather Required Documentation for Preapproval

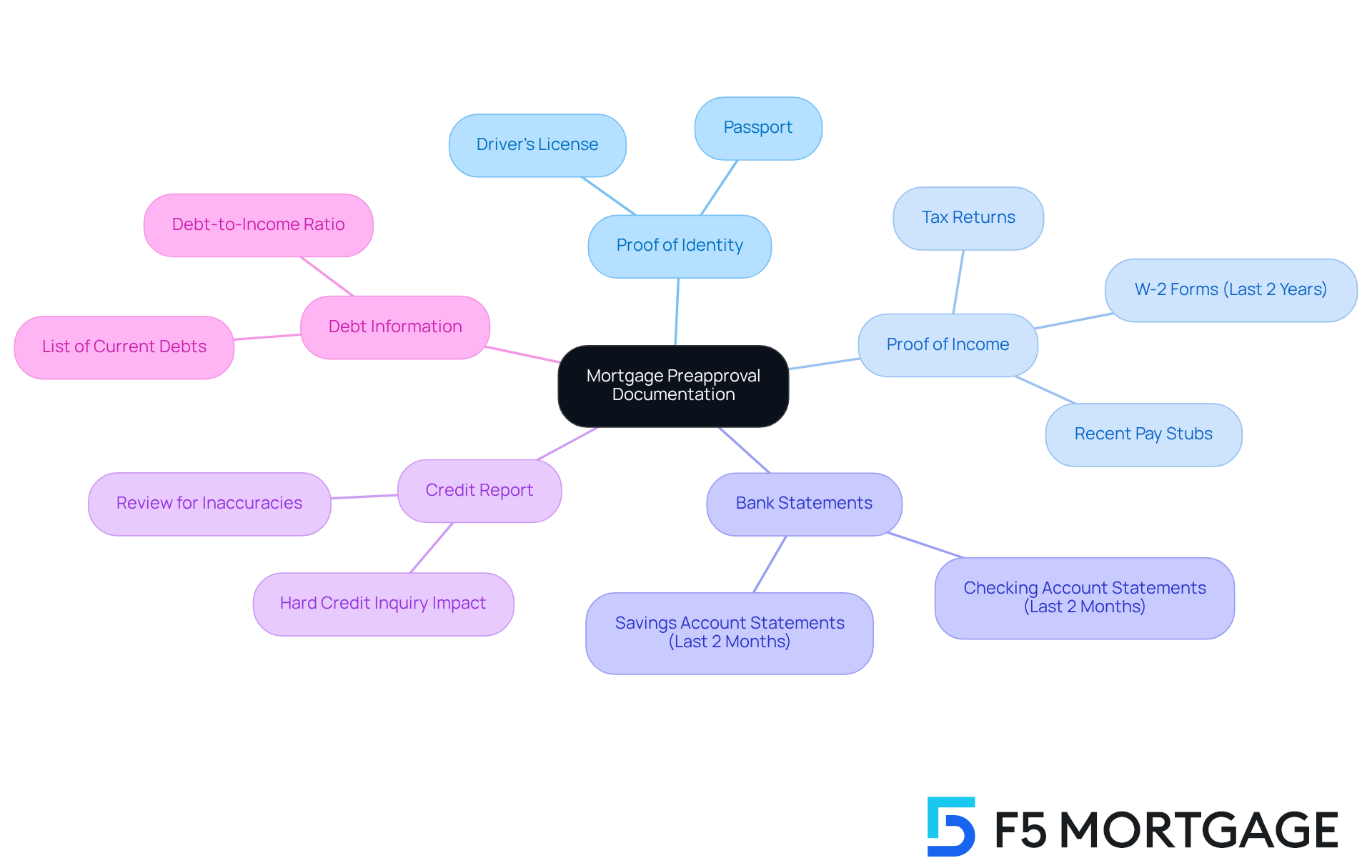

To obtain a mortgage pre-qualification, we know how essential it is to compile several key documents that demonstrate your financial stability and readiness. Here’s a detailed checklist to guide you:

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is necessary to verify your identity.

- Proof of Income: Gather recent pay stubs from the last 30 days, W-2 forms from the past two years, and your tax returns to provide a clear picture of your earnings.

- Bank Statements: Include statements from your checking and savings accounts for the last two months to showcase your financial health.

- Credit Report: While lenders will obtain your credit report, reviewing it beforehand can help you identify and rectify any inaccuracies. Remember, a hard credit inquiry during the preapproval stage may temporarily reduce your credit score by a few points.

- Debt Information: Prepare a comprehensive list of your current debts, including credit cards, student loans, and other financial obligations. Lenders usually favor a debt-to-income (DTI) ratio under 43%. Understanding your DTI can be essential in this situation. A better DTI can lead to more competitive mortgage rates, which is particularly beneficial for families looking to upgrade their homes.

Having these documents arranged and easily accessible can significantly accelerate the approval process. This enables lenders to evaluate your financial situation more precisely. It’s worth mentioning that documentation errors are a frequent problem in mortgage applications, with studies suggesting that up to 30% of submissions contain inaccuracies. Therefore, ensuring that all information is correct and complete is crucial for a smooth experience.

By following this checklist, you can enhance your chances of a successful preapproval and move closer to your homeownership goals. As you search for your new home, it’s important to consider how long is a pre approval good for, as preapproval letters typically remain valid for 60 to 90 days.

Conclusion

Navigating the competitive real estate market can be overwhelming, and understanding the nuances of mortgage preapproval is crucial for homebuyers. This process not only clarifies your budget constraints but also establishes your credibility in the eyes of sellers. By securing a preapproval, you significantly enhance your chances of obtaining your dream property, making it an essential step in your home buying journey.

Throughout this article, we’ve highlighted key insights regarding the typical validity period of preapproval letters, which generally ranges from 60 to 90 days, with some lenders allowing extensions up to 120 days. Staying informed about the expiration of your preapproval is vital, as it directly impacts your ability to make timely offers. Additionally, we outlined the necessary documentation for obtaining and renewing preapproval, underscoring the importance of preparation and organization in this process.

We know how daunting the journey to homeownership can be, but understanding the intricacies of mortgage preapproval empowers you to make informed decisions. By actively engaging with lenders and ensuring all your documentation is in order, you can navigate the complexities of the mortgage process with confidence. Embracing these insights not only streamlines your home buying experience but also positions you for success in securing your ideal home.

Frequently Asked Questions

What is mortgage preapproval?

Mortgage preapproval is a process where a lender conducts a comprehensive review of your financial documents, including credit reports, income verification, and debt assessments, to determine the maximum loan amount they are willing to offer you.

How does mortgage preapproval differ from prequalification?

Prequalification provides a rough estimate of how much you might be able to borrow based on self-reported information, while preapproval involves a detailed assessment of your financial situation and results in a letter of intent specifying the highest loan amount you can secure.

Why is mortgage preapproval important for homebuyers?

Mortgage preapproval clarifies your budget and strengthens your position in a competitive housing market, making you a more appealing buyer to sellers.

What percentage of homebuyers are unaware of the intricacies involved in mortgage preparation?

Research shows that about 60% of homebuyers are unaware of the intricacies involved in mortgage preparation.

How can first-time homebuyers benefit from mortgage preapproval?

First-time homebuyers can leverage mortgage preapproval to secure favorable conditions and streamline their buying journey, making the process smoother.

What does having a preapproval letter signify to sellers?

A preapproval letter signals to sellers that you are a serious and financially capable buyer, which can set you apart in a market with multiple offers.

What are the equity requirements for mortgage approval?

Maintaining at least an 80% loan-to-value ratio is an important equity requirement for mortgage approval.

What is a favorable debt-to-income (DTI) ratio for mortgage options?

A favorable debt-to-income (DTI) ratio is ideally below 43%, which can enhance your mortgage options.