Overview

The mortgage commitment letter is an essential document that reflects a lender’s intention to offer credit to a borrower, contingent upon certain conditions being fulfilled. We understand how challenging this process can be, and this letter plays a pivotal role in your journey.

This letter is significant because it confirms that the lender has thoroughly reviewed your financial details. By having this assurance, you gain enhanced negotiating power in the home purchasing process. It also provides clarity on the terms and requirements necessary to finalize your loan, which can alleviate some of the stress that comes with buying a home.

Remember, we’re here to support you every step of the way. Understanding these details can empower you to make informed decisions as you move forward in your home buying journey.

Introduction

Navigating the home financing landscape can be overwhelming, and understanding the intricacies of a mortgage commitment letter is crucial. This essential document not only signifies a lender’s intent to provide funding but also serves as a powerful tool for you as a borrower to strengthen your negotiating position. We know how challenging this can be, and we’re here to support you every step of the way.

However, the journey to securing this letter can be fraught with complexities and uncertainties. What steps must you take to ensure a smooth transition from pre-approval to a solid commitment? Understanding the nuances of conditional versus final letters can truly make a difference in your homebuying process. Let’s explore this together.

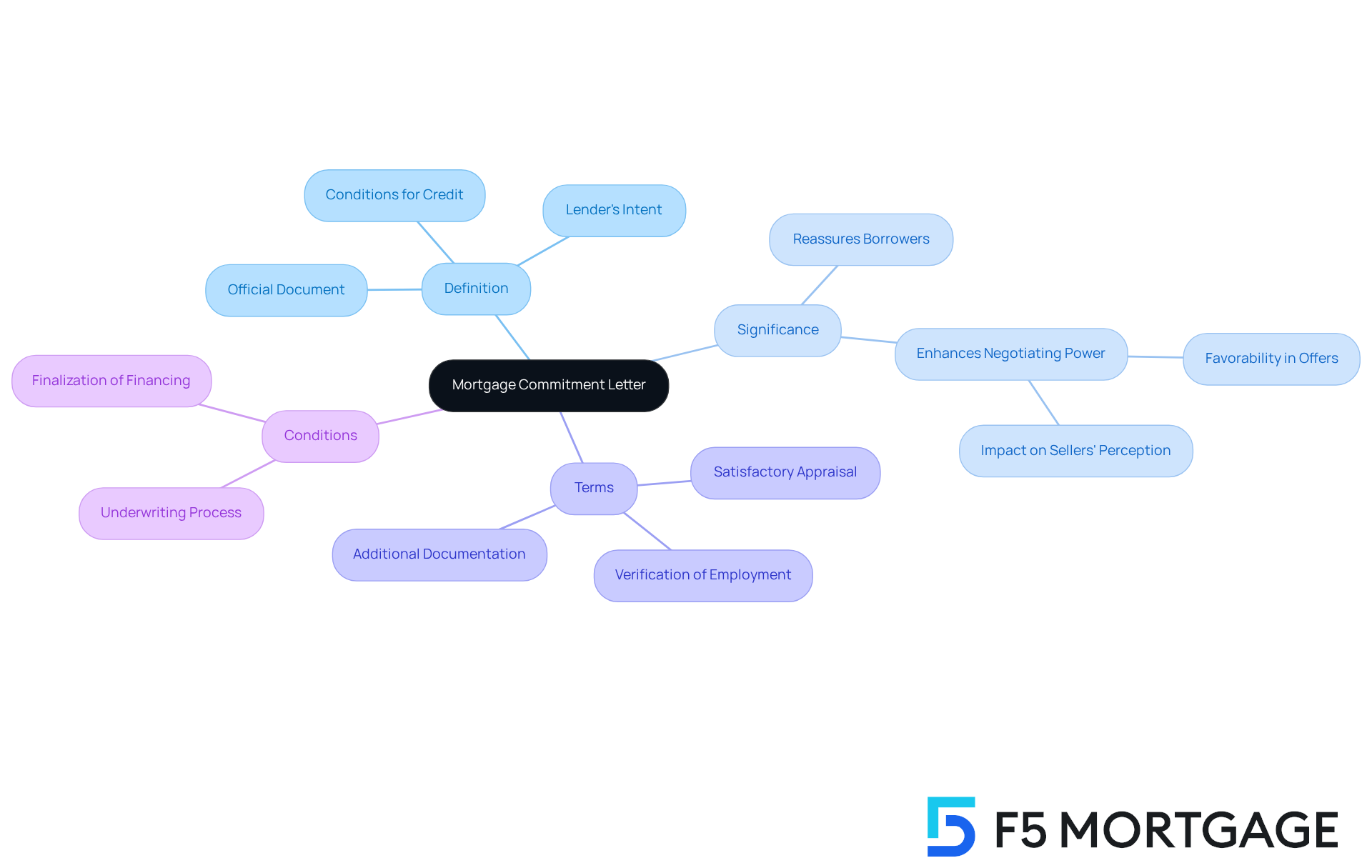

Define Mortgage Commitment Letter

A financing agreement is an official document provided by a lender that indicates their intention to extend credit to a borrower, contingent upon specific conditions being fulfilled. This document marks a significant milestone in the financing process, confirming that the lender has thoroughly reviewed the borrower’s application and financial details. Unlike a pre-approval, which is more preliminary, a loan confirmation document signifies that the lender has completed a thorough underwriting process and is ready to move forward with the financing, provided that any remaining conditions are met.

The significance of a financing agreement in the home purchasing process cannot be overstated. It not only reassures the borrower of the lender’s commitment but also strengthens their position when negotiating with sellers. For instance, a purchaser with a loan approval document is often viewed more favorably than one with just a pre-approval, as it indicates a greater level of financial readiness. This distinction is especially important for families upgrading their homes, as it can greatly impact their negotiating power.

Terms specified in a loan agreement may include the need for a satisfactory appraisal, verification of employment, or additional documentation. The appraisal is particularly crucial as it establishes the property’s current market value, revealing how much equity the borrower possesses and influencing loan rates. Meeting these conditions is essential for the financing to be finalized, and the assurance document serves as a guide for both the borrower and the lender, ensuring a smooth closing process.

Dan Green, a financing specialist with over 20 years of experience, emphasizes the importance of a financing agreement. He states, “A financing agreement is a crucial step that reflects the lender’s serious intent to support the purchase, providing peace of mind to the borrower.”

In summary, a financing agreement document is an essential element of the borrowing process, offering clarity and reassurance to both parties involved. It demonstrates the lender’s genuine desire to fund the acquisition, making it an invaluable resource for homebuyers navigating the challenges of obtaining financing. We know how challenging this can be, and we’re here to support you every step of the way.

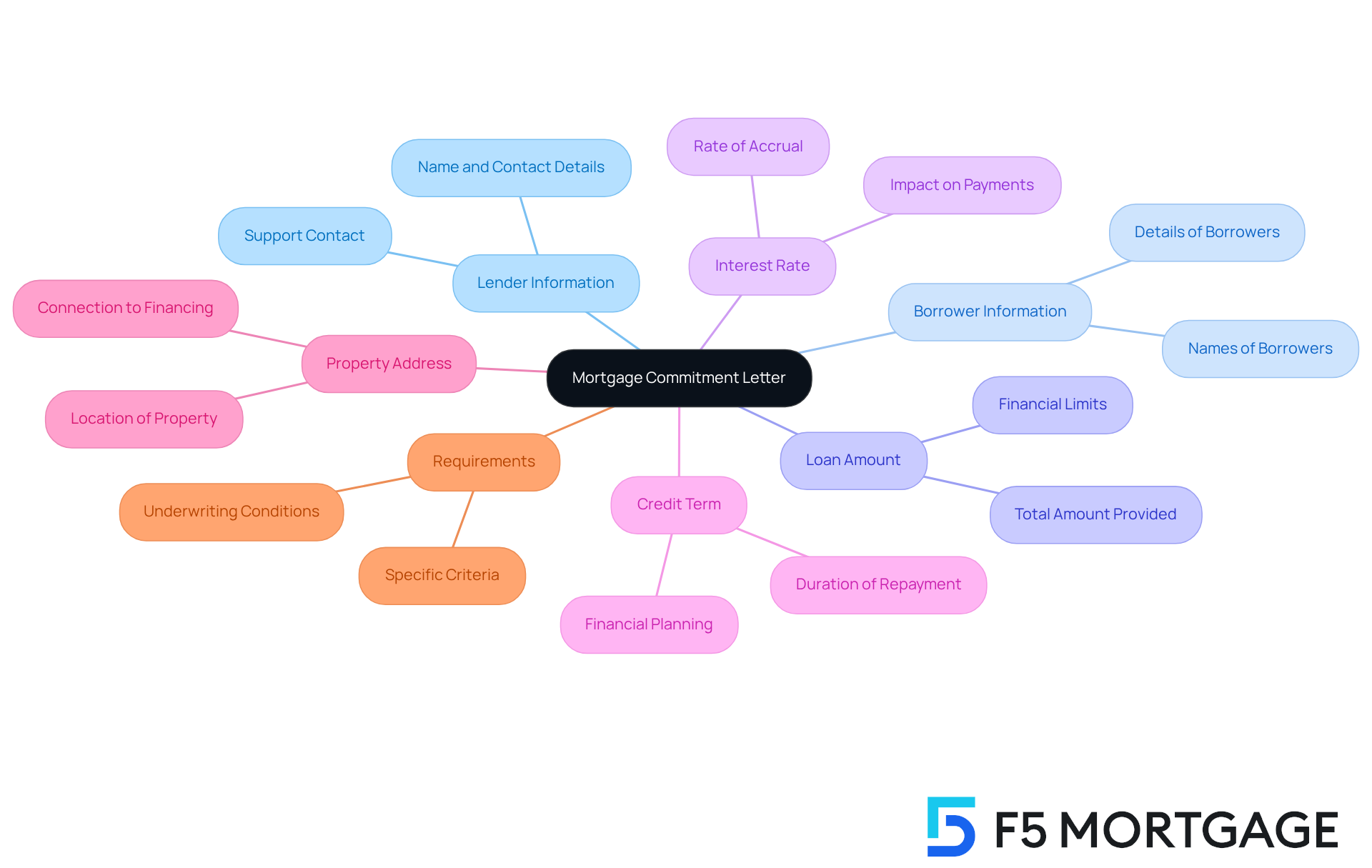

Outline Key Components of a Mortgage Commitment Letter

Understanding the key components of a mortgage commitment letter is essential in the loan process and can make a significant difference for borrowers. We know how challenging this can be, so let’s break it down together.

- Lender Information: This section includes the name and contact details of the lender providing the loan. It’s important for borrowers to know whom to contact for inquiries and support.

- Borrower Information: Here, the names and details of the borrower(s) receiving the funds are specified, establishing the parties involved in the agreement and ensuring clarity.

- Loan Amount: This indicates the total amount of money the lender is willing to provide. Knowing this is essential for understanding your financial limits.

- Interest Rate: The letter specifies the interest rate at which the financial advance will accrue. This is a critical factor that affects your monthly payments and overall expense.

- Credit Term: This indicates the duration over which the debt will be repaid, typically expressed in years. Understanding this helps borrowers plan their finances accordingly.

- Property Address: The site of the property being financed is included, connecting the financing to a specific asset that matters to you.

- Requirements: This section details any specific criteria that must be satisfied before the financing can be finalized. For instance, underwriters may necessitate a property appraisal to confirm that the property’s value corresponds with the amount borrowed.

Grasping these elements is crucial for efficiently managing the obligations outlined in your mortgage commitment letter. A financing agreement document not only indicates a lender’s willingness to offer credit but also acts as a guide for what is needed to complete the contract. With the average borrowing sum in mortgage agreements showcasing current market trends, being knowledgeable can greatly improve your standing in the competitive housing market. We’re here to support you every step of the way.

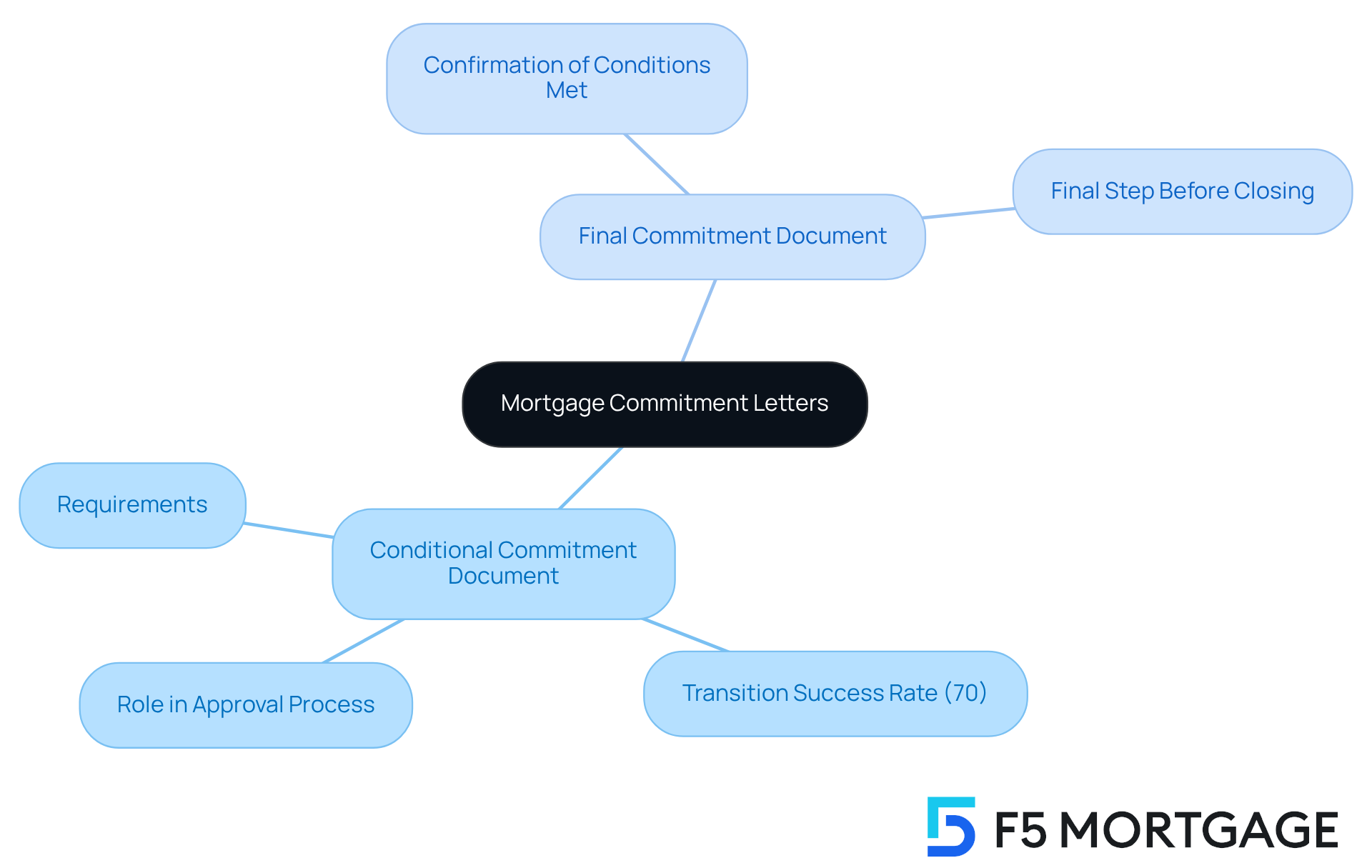

Differentiate Between Conditional and Final Commitment Letters

Mortgage approval documents, including the mortgage commitment letter, are essential in the financing journey and are categorized into two main types: conditional and final.

-

Conditional Commitment Document: This document shows the lender’s willingness to provide financing, contingent upon meeting specific requirements. These might include submitting additional paperwork, completing a property appraisal, or resolving any outstanding financial matters related to the borrower. It’s important to note that approximately 70% of conditional commitment documents, including the mortgage commitment letter, successfully transition into final agreements, highlighting their critical role in the approval process.

-

Final Commitment Document: On the other hand, a final commitment document confirms that all stipulated conditions have been met, allowing the lender to proceed with the financing without further requirements. This document represents the last step before closing, assuring the borrower of complete loan approval.

Understanding these distinctions is crucial for borrowers, as it equips them to navigate the complexities of the mortgage process and obtain a mortgage commitment letter with greater confidence. For instance, a borrower who receives a conditional mortgage commitment letter should proactively address any outstanding conditions to facilitate a smooth transition to a final commitment document.

Mortgage brokers emphasize that while conditional documents are a positive step, they require diligence to convert into a mortgage commitment letter for final approvals. Additionally, an approval reflects the lender’s assessment that you are a suitable candidate for a home loan based on your financial profile, often providing an estimate of your loan amount, interest rate, and potential monthly payment. This knowledge empowers borrowers to take the necessary actions to secure their financing effectively. A relevant case study involves a self-employed client who faced financial challenges; by addressing the terms outlined in their conditional agreement, they successfully obtained a final agreement and progressed with their loan.

Explain How to Obtain a Mortgage Commitment Letter

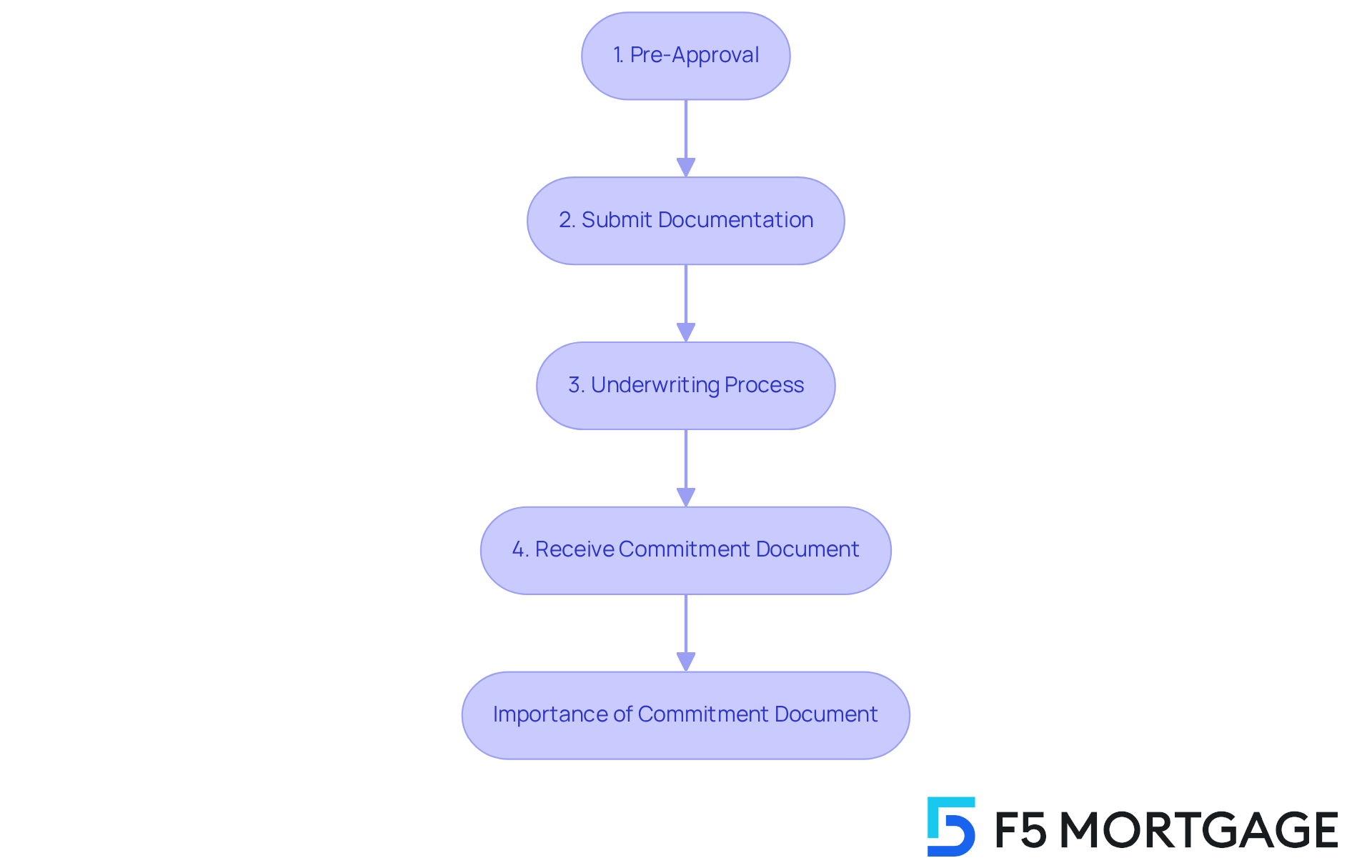

Navigating the journey to obtain a mortgage commitment letter may seem overwhelming, but by following these essential steps, you can make the process smoother and more manageable.

-

Pre-Approval: Begin with pre-approval for a home loan. This crucial first step involves sharing your financial information with the lender for a preliminary review, often completed in less than a day. An approval indicates that the lender sees you as a strong candidate for financing, providing an estimate of your funding amount, interest rate, and potential monthly payment.

-

Submit Documentation: Next, gather and submit all necessary documentation, such as proof of income and credit history. Timeliness and completeness are vital; delays can prolong the overall process, adding unnecessary stress.

-

Underwriting Process: The lender will then undertake a thorough underwriting process to assess your financial situation and the property in question. Typically, this stage lasts between three to six weeks, depending on the lender’s speed and the completeness of your documents.

-

Receive Commitment Document: If your application meets the lender’s criteria, you will receive a financing commitment document. This important document outlines the loan terms and any conditions that must be fulfilled before closing. It serves as an official assurance from the lender to provide financing, significantly strengthening your position in negotiations. For instance, if you’re negotiating with a seller, having this document can enhance your credibility, especially when requesting repairs or improvements as part of your offer.

It’s essential to understand that if your financing approval document expires before closing, you will need to reapply for the funds, which could affect the approved amount and interest rate. Often, the first type of agreement encountered is a conditional financing agreement, indicating that the lender is prepared to offer the loan, contingent upon certain conditions being met.

By diligently following these steps, you can effectively navigate the process of obtaining a mortgage commitment letter. This preparation is particularly important for families looking to upgrade their homes, as it ensures you are ready for negotiations and fully comprehend the implications of your mortgage approval. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

A mortgage commitment letter is a pivotal document in the home buying process. It signals a lender’s intent to provide financing, contingent upon the borrower’s fulfillment of specific conditions. This commitment not only enhances your confidence but also strengthens your negotiating position with sellers, setting you apart from those with merely a pre-approval.

Throughout this article, we’ve explored key insights into the mortgage commitment letter, including its definition, critical components, and the differences between conditional and final commitment letters. Understanding these aspects equips you with the knowledge necessary to navigate the complexities of the mortgage process effectively. By following the outlined steps to obtain a mortgage commitment letter, you can streamline your journey toward homeownership.

Ultimately, grasping the significance of a mortgage commitment letter is essential for any prospective homebuyer. It serves as a crucial assurance of financing, guiding you through the intricacies of securing a loan. Engaging with this process proactively not only enhances your confidence but also positions you favorably in the competitive housing market. Taking informed steps toward obtaining a mortgage commitment letter can significantly impact the success of your home purchasing endeavors.

Frequently Asked Questions

What is a mortgage commitment letter?

A mortgage commitment letter is an official document from a lender indicating their intention to extend credit to a borrower, contingent upon specific conditions being fulfilled. It signifies that the lender has thoroughly reviewed the borrower’s application and financial details.

How does a mortgage commitment letter differ from pre-approval?

Unlike a pre-approval, which is more preliminary, a mortgage commitment letter indicates that the lender has completed a thorough underwriting process and is ready to move forward with financing, provided that any remaining conditions are met.

Why is a mortgage commitment letter significant in the home purchasing process?

The mortgage commitment letter reassures the borrower of the lender’s commitment and strengthens their position when negotiating with sellers. It indicates a greater level of financial readiness compared to a pre-approval.

What conditions might be specified in a mortgage commitment letter?

Conditions in a mortgage commitment letter may include the need for a satisfactory appraisal, verification of employment, or additional documentation required to finalize the financing.

Why is the appraisal important in the mortgage commitment process?

The appraisal is crucial as it establishes the property’s current market value, revealing how much equity the borrower possesses and influencing loan rates. Meeting the appraisal condition is essential for finalizing the financing.

What role does a financing agreement play in the closing process?

The financing agreement serves as a guide for both the borrower and the lender, ensuring a smooth closing process by outlining the necessary conditions that must be met prior to finalizing the loan.

What is the overall importance of a mortgage commitment letter according to experts?

According to financing specialist Dan Green, a mortgage commitment letter is a crucial step that reflects the lender’s serious intent to support the purchase, providing peace of mind to the borrower. It is an invaluable resource for homebuyers navigating the challenges of obtaining financing.