Overview

We understand how challenging it can be to navigate the home buying process, especially for our valued veterans. That’s why veterans loans offer key benefits that truly make a difference:

- No down payment

- Lower interest rates

- Absence of private mortgage insurance (PMI)

These features work together to enhance affordability and accessibility for former service members, making homeownership more achievable.

Imagine a scenario where financial burdens are alleviated, allowing veterans to focus on what truly matters—building a home for their families. This is precisely the impact of veterans loans. Personalized support and resources from lenders like F5 Mortgage further empower veterans, ensuring they have the guidance they need every step of the way.

In conclusion, we’re here to support you on this journey. By taking advantage of these benefits, veterans can find a path to homeownership that feels both attainable and rewarding.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for veterans who have bravely served their country. However, veterans loans offer a unique opportunity that simplifies this journey, providing benefits often absent in traditional financing. In this article, we will explore seven key advantages of veterans loans, illustrating how they empower former service members to achieve their homeownership dreams without the financial burdens typically associated with buying a home.

But we also recognize that hidden challenges may arise in this seemingly advantageous process. How can veterans best prepare to seize these benefits? We’re here to support you every step of the way.

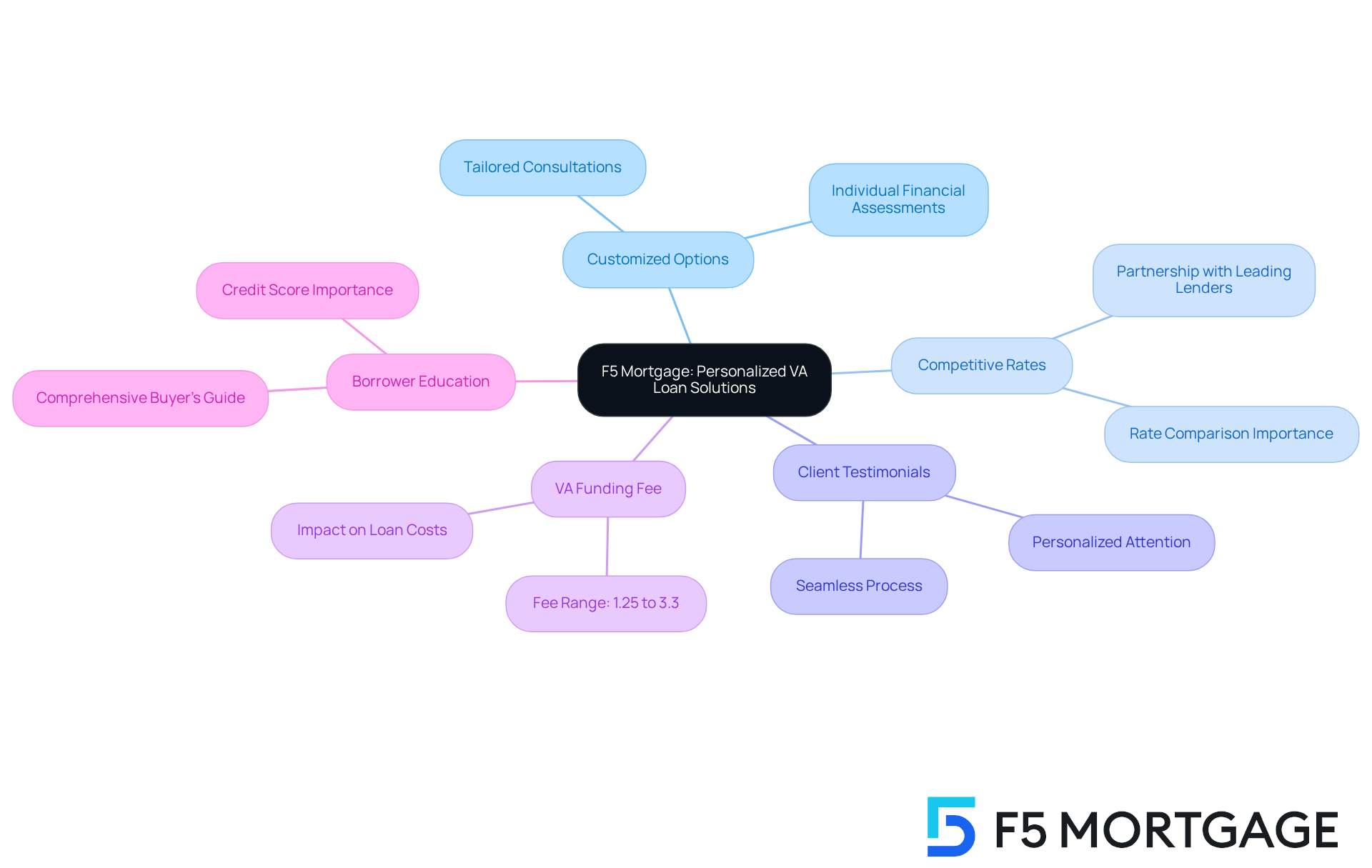

F5 Mortgage: Personalized VA Loan Solutions for Veterans

At F5 Mortgage, we understand how challenging it can be for service members to navigate the complexities of veterans loans financing. That’s why we excel in providing customized options that cater specifically to your unique needs. Our brokerage prioritizes outstanding service, ensuring that former service members receive thorough assistance every step of the way. Through tailored consultations, we assess individual financial situations, allowing us to recommend the most suitable loan options available.

By partnering with a network of over two dozen leading lenders, F5 offers competitive rates and conditions that align with your financial goals, simplifying the property purchasing process. We know that having the right information is crucial, which is why F5 Lending provides valuable materials, including a comprehensive buyer’s guide designed specifically for former service members. This guide equips you with the understanding needed throughout your financing journey.

Our commitment to individualized service truly sets F5 apart as a reliable ally for service members seeking efficient financing solutions. With a significant percentage of former service members utilizing veterans loans for home purchases, our focus on personalized support is vital in helping you achieve your homeownership aspirations.

As one satisfied client shared, “F5 Mortgage made the entire process seamless and stress-free. Their team was incredibly knowledgeable and supportive every step of the way.” Another individual echoed this sentiment, stating, “I felt valued and understood throughout the process, thanks to the personalized attention I received.”

It’s important to note that the VA funding fee ranges from 1.25% to 3.3%, a significant factor when assessing your financing choices. Industry experts emphasize that “VA borrowers should effectively comparison shop to gather up-to-date, customized pricing data and optimize their transaction.” Additionally, we encourage veterans to check their credit scores and compare rates from multiple lenders to ensure you secure the best possible terms.

F5 Mortgage is dedicated to educating borrowers and offering no-pressure assistance, further enhancing your experience. We strive to make the financing process seamless, often concluding in under three weeks. Remember, we’re here to support you every step of the way.

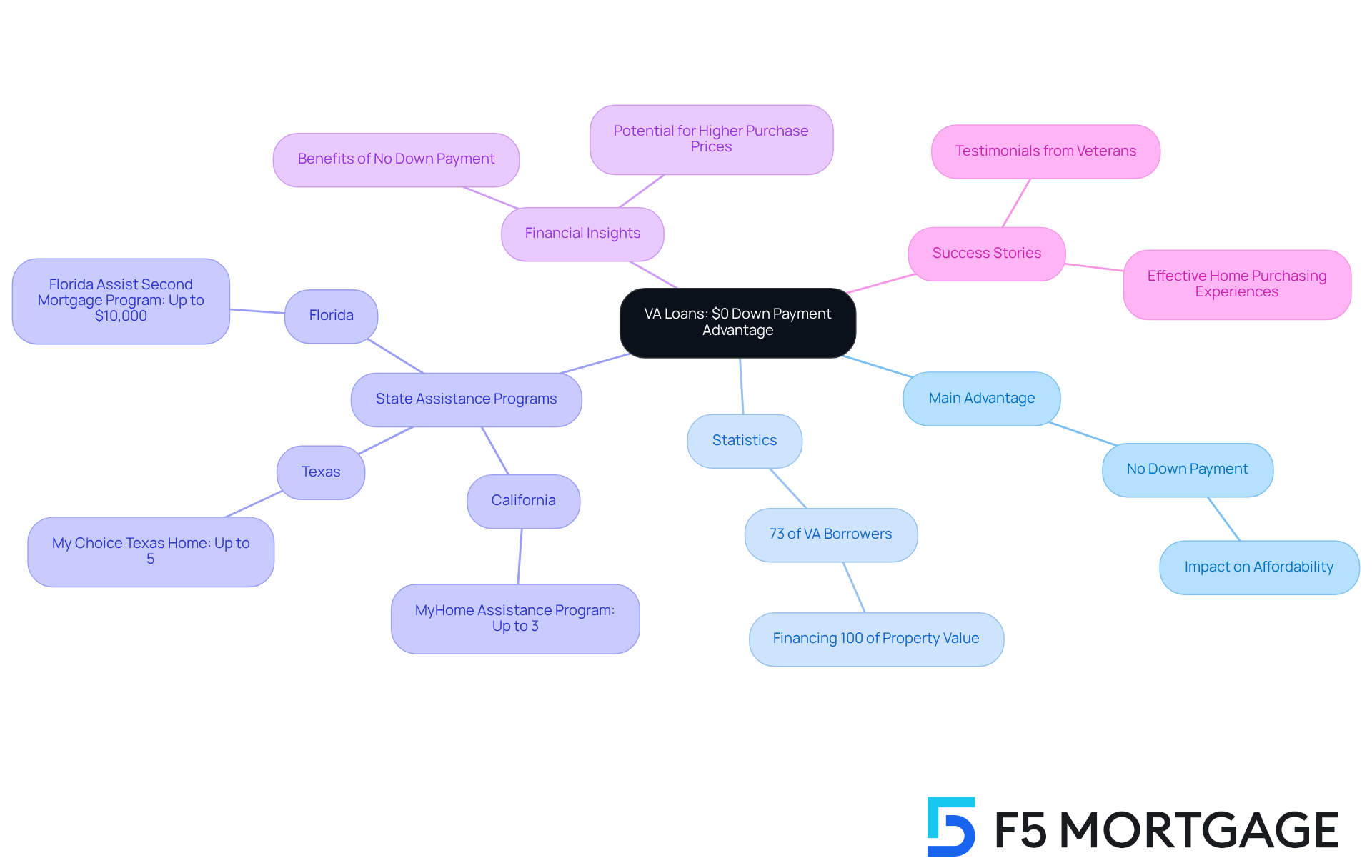

$0 Down Payment: A Major Advantage of VA Loans

One of the most compelling advantages of VA loans is the ability to acquire a residence with no down payment. We know how challenging it can be for former service members who may not have significant savings allocated for a down payment. In fact, around 73% of VA borrowers take advantage of this benefit, financing 100% of their property’s value. By removing this initial expense, VA financing makes property ownership more attainable. This enables service members to direct their resources toward other vital costs, such as relocation expenses or property enhancements.

In addition to offering veterans loans, F5 Financing provides various down payment assistance programs that can further enhance purchasing opportunities for veterans. For example:

- In California, the MyHome Assistance Program provides up to 3% of the property’s purchase price.

- Texas offers the My Choice Texas Home program, which includes up to 5% for down payment and closing assistance.

- Florida residents can benefit from programs like the Florida Assist Second Mortgage Program, which offers up to $10,000 for upfront costs.

These options not only lessen the initial financial strain but also significantly boost an individual’s purchasing power. This allows them to explore homes in higher price ranges without the necessity for a substantial upfront investment.

Financial advisors highlight that while providing a down payment can result in reduced monthly payments and improved financing conditions, the choice to purchase without one is a significant shift for many former service members. As one financial consultant observed, ‘Choosing a no down payment alternative can release resources for other significant investments, making homeownership more achievable for service members.’

Success stories are plentiful, illustrating individuals who have effectively maneuvered through the home purchasing process utilizing veterans loans with no down payment, along with support from F5 Mortgage’s programs. Testimonials from satisfied clients highlight how these unique benefits empower veterans to achieve their homeownership dreams through veterans loans. This contributes to their financial stability and overall well-being. However, it’s important to acknowledge that VA financing comes with mandatory property evaluations and appraisal processes, which can sometimes complicate the buying experience. We’re here to support you every step of the way. Veterans are encouraged to consult with a mortgage advisor at F5 Mortgage to explore their options and navigate these potential challenges effectively. For more details on financing choices, please consult our FAQs.

Lower Interest Rates: Cost Savings for Veterans

Veterans loans often provide lower interest rates compared to traditional mortgage options, thanks to the VA’s backing, which reduces the risk for lenders. This advantage becomes even more significant when former service members choose to refinance with F5, an independent broker dedicated to finding the best rates and terms tailored to their unique needs. By tapping into F5’s extensive network of over twenty lenders, veterans can access appealing veterans loans that can lead to substantial savings over the life of the loan.

Lower interest rates translate to reduced monthly payments, making it easier to manage budgets and allocate funds towards other financial goals. For instance, refinancing through F5 Home Loans with veterans loans could save a service member thousands of dollars in interest over a 30-year loan, enhancing their financial security and allowing them to invest in their future.

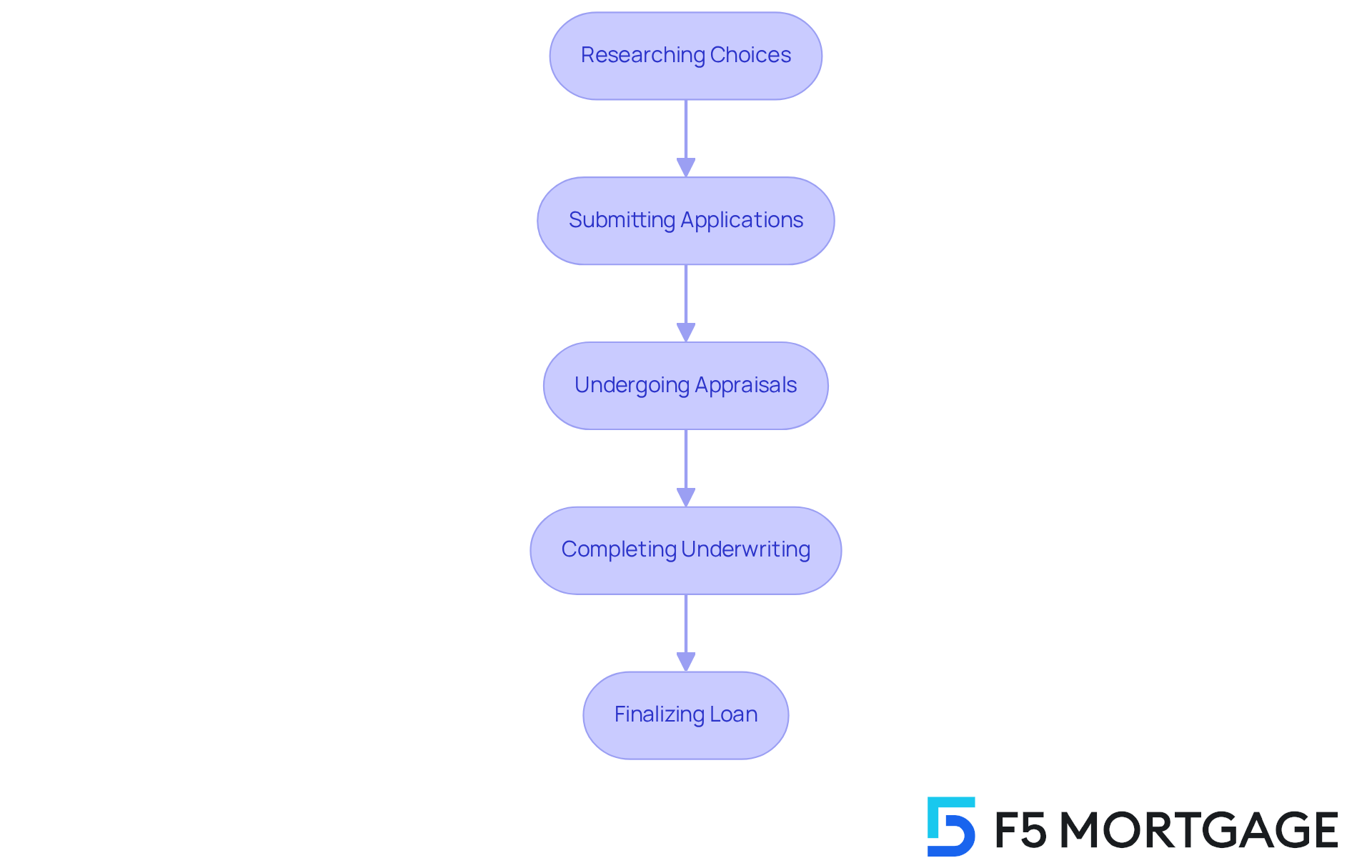

With personalized support throughout the refinancing journey, former military personnel can confidently and efficiently explore their options. The refinancing process includes:

- Researching choices

- Submitting applications

- Undergoing appraisals

- Completing underwriting

—all with the guidance of F5 Mortgage’s dedicated team.

Veterans can apply online, by phone, or via chat, ensuring a smooth experience that caters to their preferences. We understand how challenging this process can be, and we’re here to support you every step of the way.

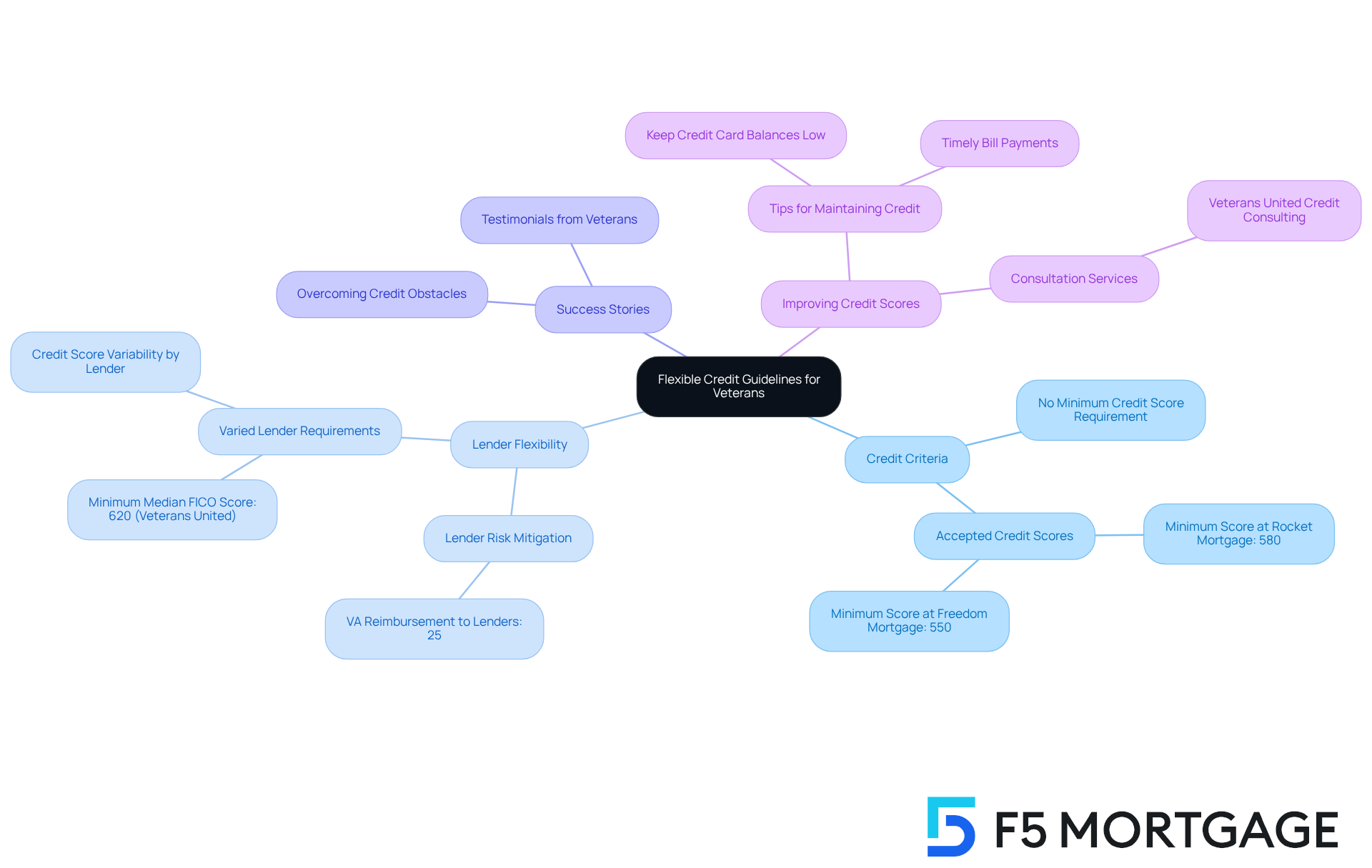

Flexible Credit Guidelines: Accessibility for All Veterans

Veterans loans are recognized for their flexible credit criteria, allowing service members with diverse credit backgrounds to secure home funding. Unlike traditional financing options that typically demand higher credit scores, veterans loans are accessible to those with lower credit ratings. Many lenders, including Rocket Mortgage, accept credit scores as low as 580, making the journey to homeownership much easier for individuals who may have faced financial challenges during or after their service.

This inclusivity is crucial, as the VA does not impose a minimum credit score requirement. This means that a significant number of service members with credit scores under 580 can still qualify for VA funding. There are numerous success stories of former service members who have overcome credit obstacles to obtain financing, demonstrating that VA financing is a viable option for many.

Mortgage specialists, like Tim Alvis, emphasize that veterans loans through the VA financing program are designed to support former service members, making homeownership attainable even for those with imperfect credit histories. Additionally, the VA reimburses lenders up to 25% of the loan amount if the borrower defaults, which reduces risk for lenders and enables favorable terms for service members.

For those former service members looking to enhance their credit scores, maintaining low credit card balances and making timely bill payments can significantly improve their chances of qualifying for VA financing. We know how challenging this can be, but we’re here to support you every step of the way.

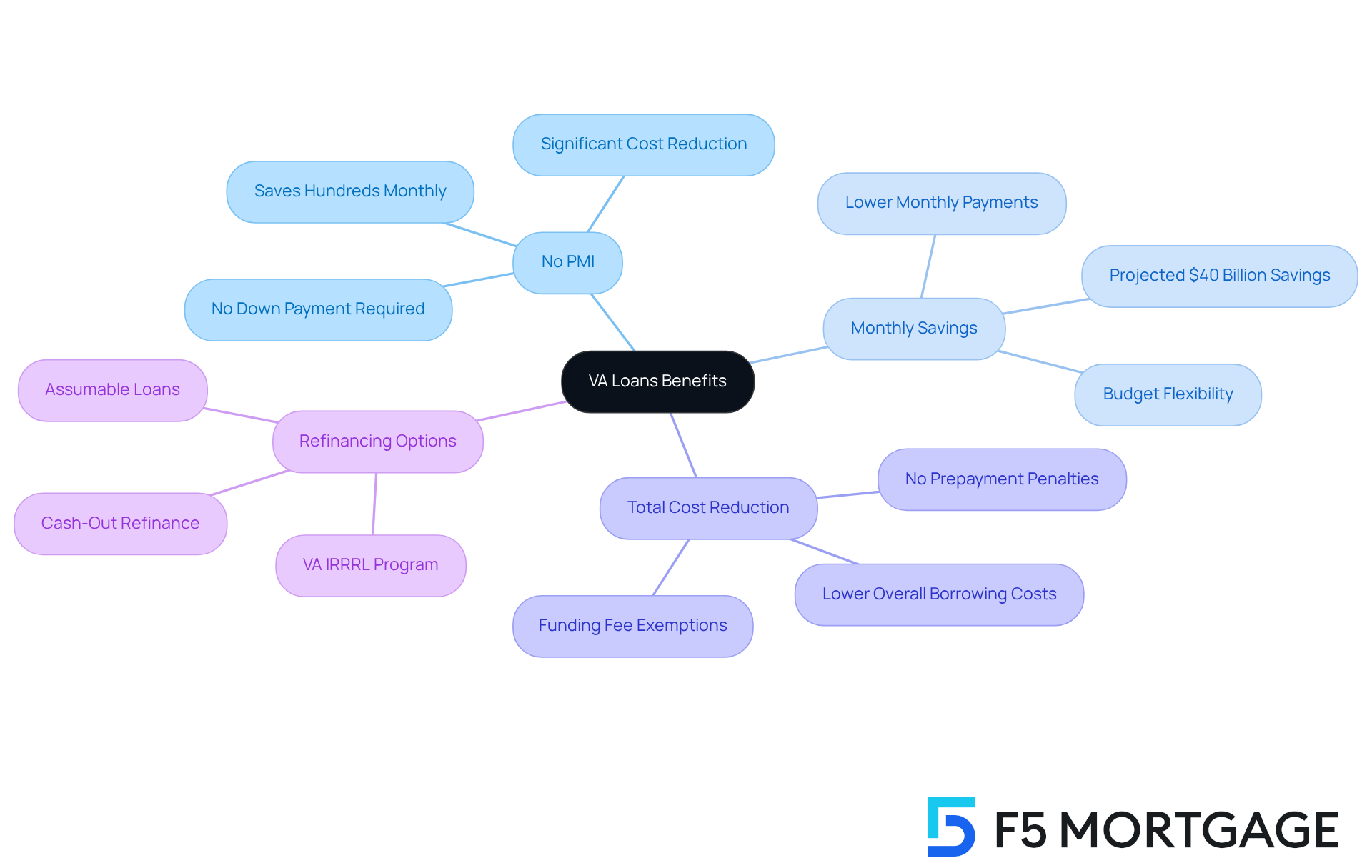

No Private Mortgage Insurance: Additional Savings for Borrowers

One of the standout benefits of VA loans is that they do not require private mortgage insurance (PMI). This is typically a requirement for conventional loans when the down payment is less than 20%. The removal of PMI can lead to significant monthly savings for former service members who take advantage of veterans loans. This insurance can increase monthly mortgage payments by hundreds of dollars. By avoiding this extra expense, former service members can allocate a larger portion of their budget toward their mortgage principal and interest, ultimately lowering the total cost of homeownership.

Indeed, former service members who obtained veterans loans last year are projected to save more than $40 billion in private housing expenses throughout the duration of their financing. This characteristic makes veterans loans an appealing choice for former military personnel who aim to optimize their financial assets while acquiring a home.

Consider this: an experienced buyer acquiring a $310,000 property with a traditional financing option would need to offer a $62,000 down payment to avoid PMI. This can be a considerable obstacle. As Chris Birk observes, ‘The reality is that a 20-percent down payment is challenging to gather for most purchasers.’ While VA financing includes a one-time funding fee, it still offers significant savings compared to traditional financing.

Moreover, former service members who acquired their properties via traditional financing and contributed less than 20% may also contemplate refinancing to eliminate PMI. This is especially relevant given the significant property appreciation rates in regions such as California. This strategy can further enhance their financial position. We encourage veterans to explore veterans loans for financing and refinancing alternatives to maximize their savings. We’re here to support you every step of the way.

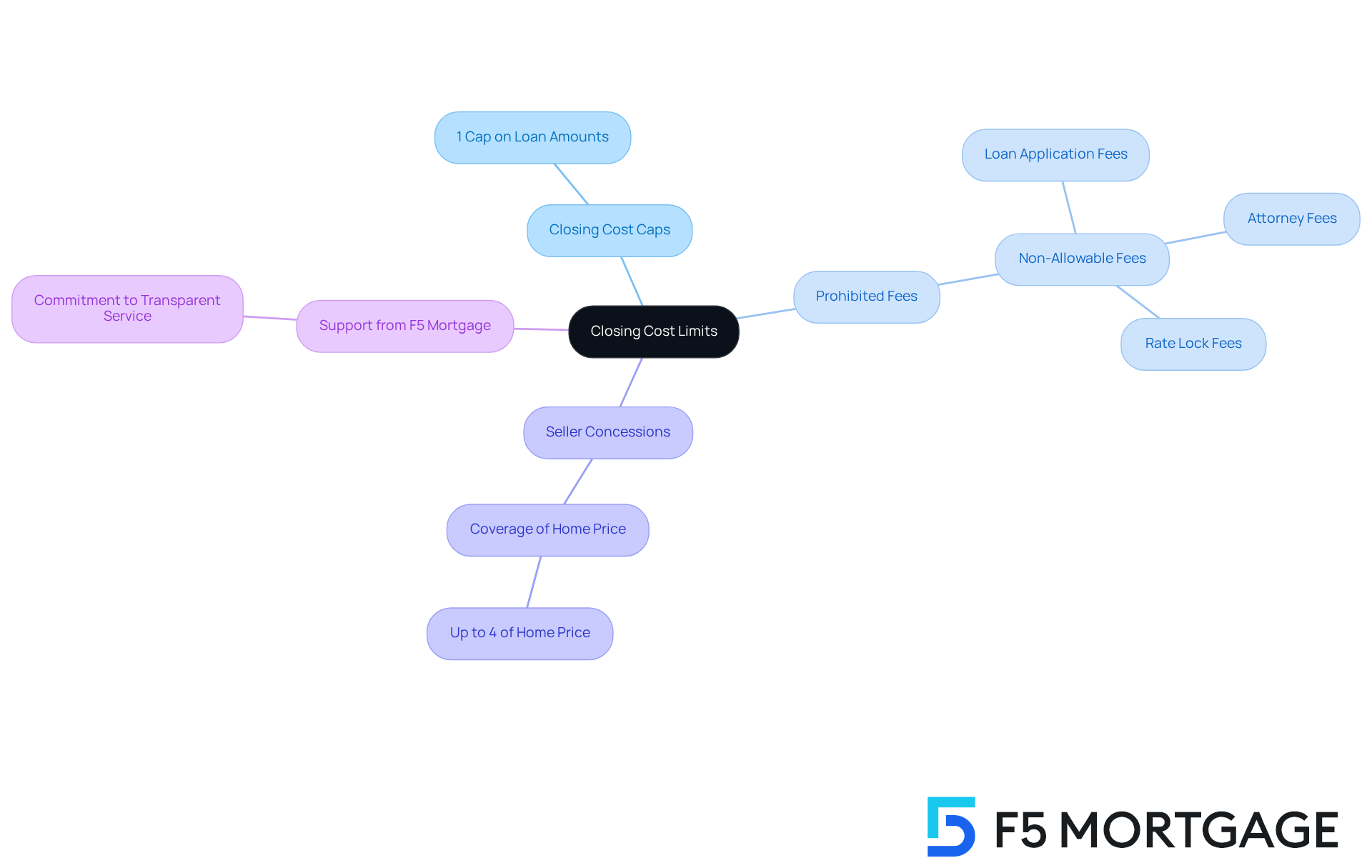

Closing Cost Limits: Protecting Veterans from High Fees

We understand how challenging the home purchasing process can be for service members seeking veterans loans. That’s why the VA sets stringent caps on closing expenses, providing a vital financial safeguard. Specifically, the VA caps closing costs at just 1% of the loan amount and prohibits certain non-allowable fees that lenders cannot impose. This regulatory framework ensures that former service members can navigate a transparent and manageable closing process for veterans loans, allowing them to budget effectively and avoid unexpected expenses.

By limiting closing costs, the VA empowers service members to retain more of their hard-earned income, significantly enhancing the affordability of homeownership with veterans loans. Additionally, former service members can benefit from seller concessions, which can cover up to 4% of the home price, alleviating their financial burden. Overall, these measures not only protect former service members but also facilitate their transition into homeownership by utilizing veterans loans.

At F5 Mortgage, we’re here to support you every step of the way. We utilize technology to offer exceptionally competitive mortgage rates while guaranteeing a tailored, no-pressure service, in line with the VA’s goal to assist service members financially. Our method removes aggressive sales strategies, enabling you to make informed choices without feeling pressured. This commitment to transparency and exceptional service reflects our dedication to empowering you throughout your home buying journey.

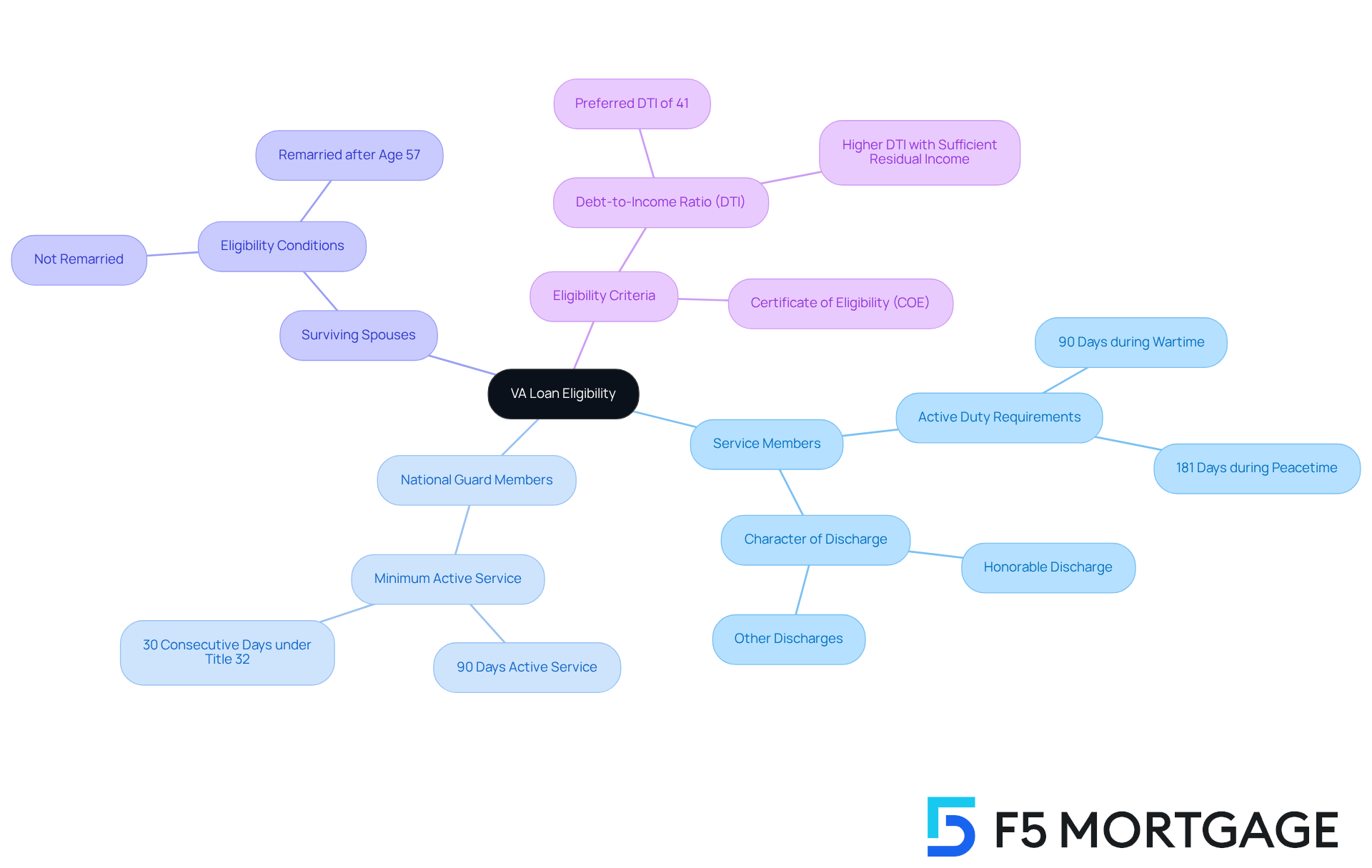

VA Loan Eligibility: Who Can Benefit?

To qualify for veterans loans, service members must meet specific criteria set by the Department of Veterans Affairs. Generally, eligibility depends on the length of service, duty status, and character of discharge. Veterans who have served on active duty for at least 90 days during wartime or 181 days during peacetime are typically eligible. Additionally, National Guard members with a minimum of 90 days of active service, including at least 30 consecutive days under Title 32, are now eligible. Surviving spouses of military personnel who passed away in service or due to a service-related disability may apply for veterans loans if they have not remarried, further expanding the reach of these loans.

In 2025, the VA continues to assist a diverse array of applicants, with a notable percentage of former military personnel qualifying based on their service duration. For instance, individuals with a minimum of 90 consecutive days of active duty service are qualified, showcasing the VA’s commitment to supporting those who have served. Success stories are plentiful, with many former service members achieving homeownership through veterans loans, which have benefited over 24 million individuals since their inception in 1944. The tremendous advantage of veterans loans, like the VA Home Loan, has enabled former military members to realize the dream of homeownership, often with competitive rates and favorable terms.

Veterans groups emphasize the importance of understanding these standards, as they empower former service members to effectively utilize veterans loans and the benefits of VA financing. By navigating the eligibility requirements, former military personnel can unlock opportunities for homeownership through veterans loans that might otherwise seem out of reach. Additionally, in competitive housing markets, a down payment may be necessary to secure a purchase, and the VA prefers a debt-to-income ratio (DTI) of no more than 41% for approval—an essential consideration for potential borrowers.

At F5 Mortgage, we know how challenging this process can be. We are committed to supporting service members every step of the way, ensuring they can fully utilize the benefits accessible to them.

VA Funding Fee: Understanding the Costs Involved

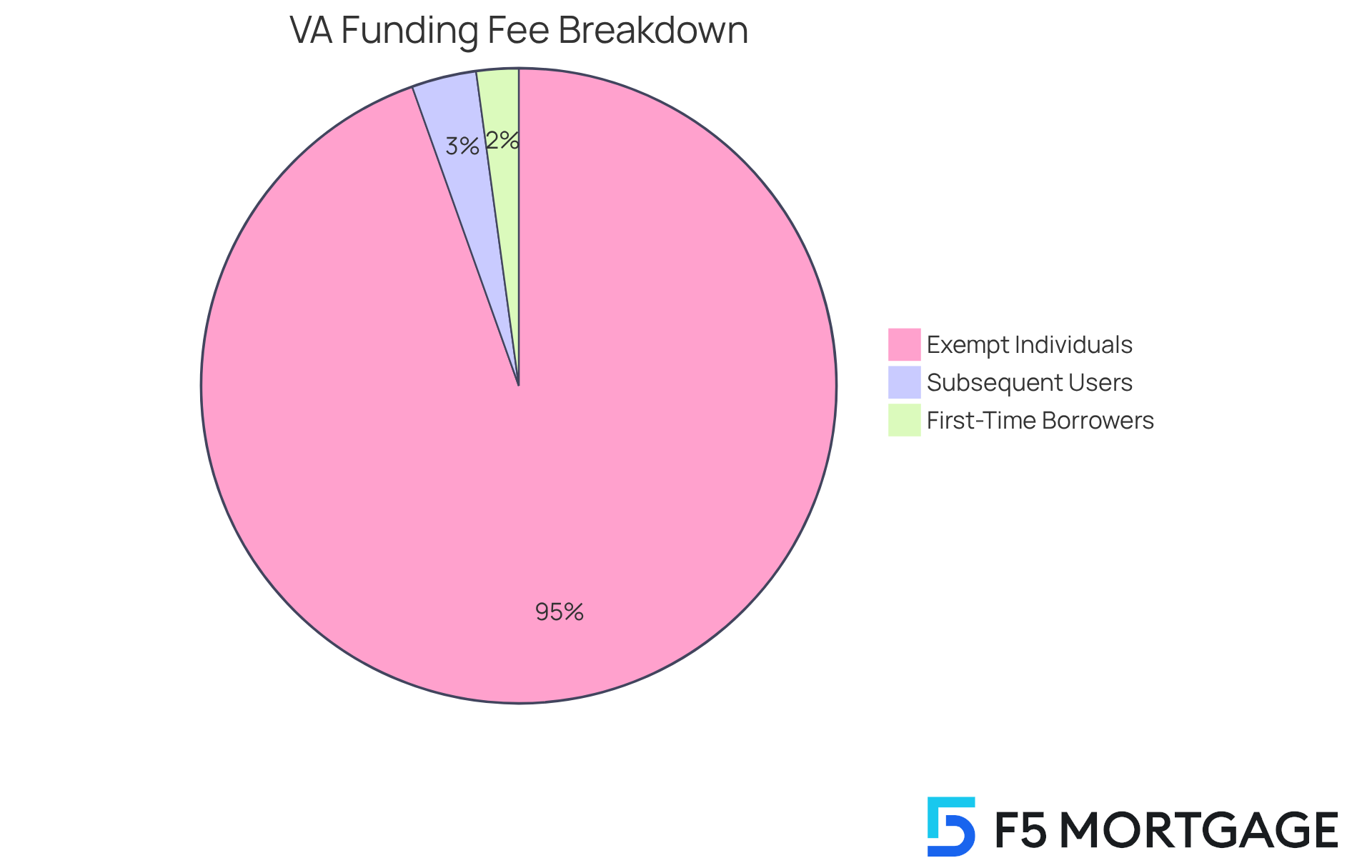

Understanding the VA funding fee is crucial for service members as they navigate the homebuying process using veterans loans. This essential one-time cost, faced by most service members when obtaining veterans loans, plays a vital role in maintaining the VA financing program. Typically calculated as a percentage of the total amount borrowed, the funding fee varies based on several factors, including the type of financing, the individual’s service history, and whether it is their first time using a VA financing option.

For first-time borrowers with no down payment, the funding fee stands at 2.15%. However, subsequent users may encounter a slightly higher fee of 3.3%. Importantly, individuals with service-related disabilities are exempt from this fee, significantly reducing their overall borrowing expenses. We know how challenging this can be, and understanding these details empowers former service members to effectively plan their finances with veterans loans.

As we look ahead, it’s essential to be aware of the funding fee and potential exemptions. With over 90,000 seriously delinquent VA credits reported in 2025, this knowledge is more important than ever. We’re here to support you every step of the way, ensuring you make informed decisions that align with your financial goals.

Comparing VA Loans: Understanding Your Options

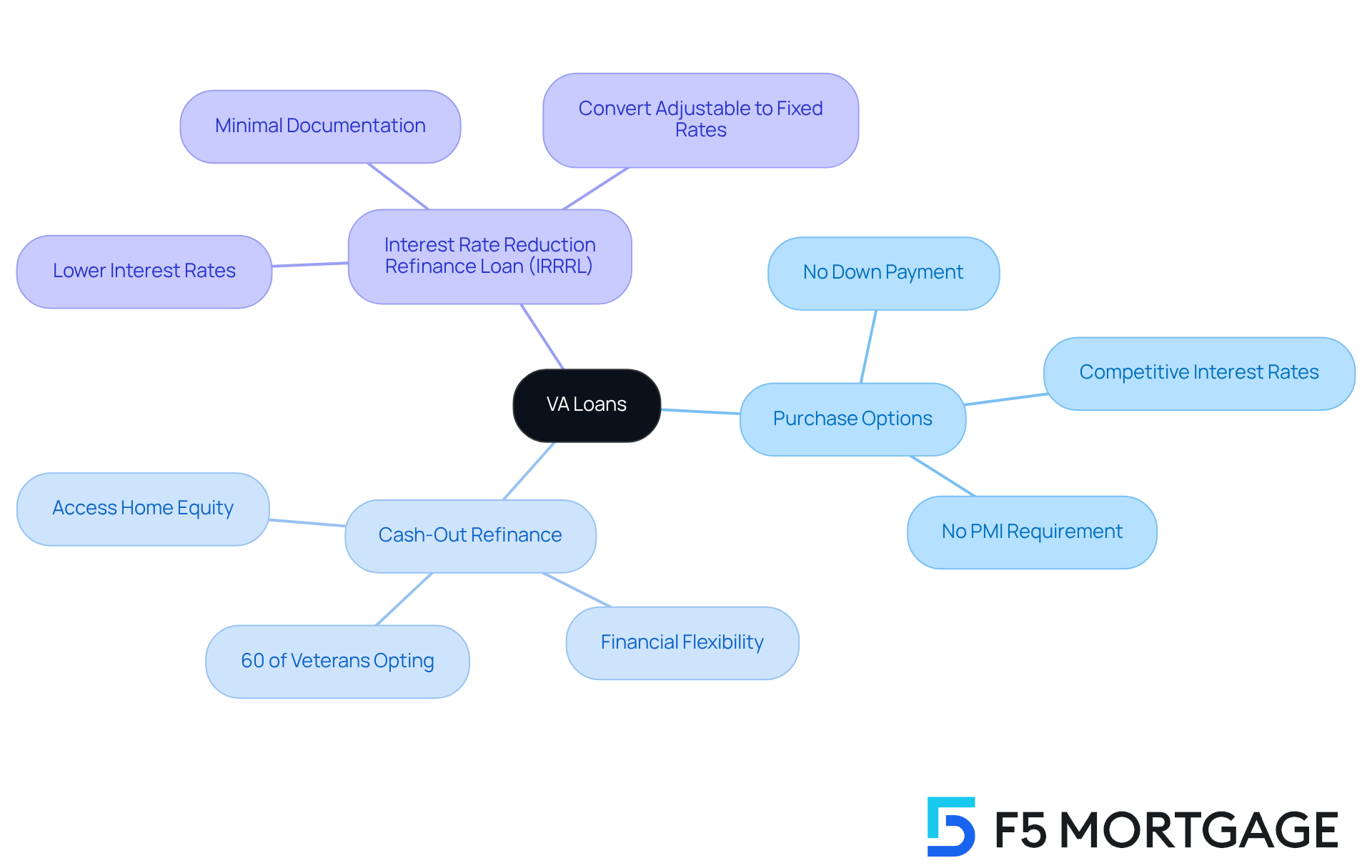

When contemplating veterans loans, we know how challenging it can be for service members to navigate the various options available to them. VA financing includes several types, such as purchase options, cash-out refinance options, and veterans loans like Interest Rate Reduction Refinance Options (IRRRL). Each type serves distinct purposes and offers unique advantages. For instance, a cash-out refinance allows service members to access their home equity for cash, providing financial flexibility for various needs. In contrast, an IRRRL is specifically designed to reduce the interest rate on an existing VA mortgage, potentially lowering monthly payments and overall costs.

Understanding these distinctions is essential for former military members to choose veterans loans that align with their financial objectives and homeownership dreams. Recent data shows that approximately 60% of veterans are opting for cash-out refinances, a trend that highlights the increasing use of veterans loans to leverage home equity. Consulting with an experienced mortgage broker, like F5 Mortgage, can offer valuable insights into which VA financing option is most appropriate for your personal circumstances. As mortgage consultant Jane Doe emphasizes, ‘Selecting the appropriate veterans loans can greatly affect your financial future, so it’s crucial to examine all available alternatives.’

Furthermore, former service members should be aware that the VA funding fee for 2025 varies from 0.5% to 3.3% of the mortgage amount, which is a significant factor when assessing their options for veterans loans. The recent VA Home Loan Program Reform Act (H.R. 1815) also presents new opportunities for former service members, making it even more crucial to stay informed about these changes. Success stories of former military personnel who have effectively navigated the veterans loans financing process can serve as motivational examples, illustrating the practical benefits of these financial options. We’re here to support you every step of the way in making the best decision for your future.

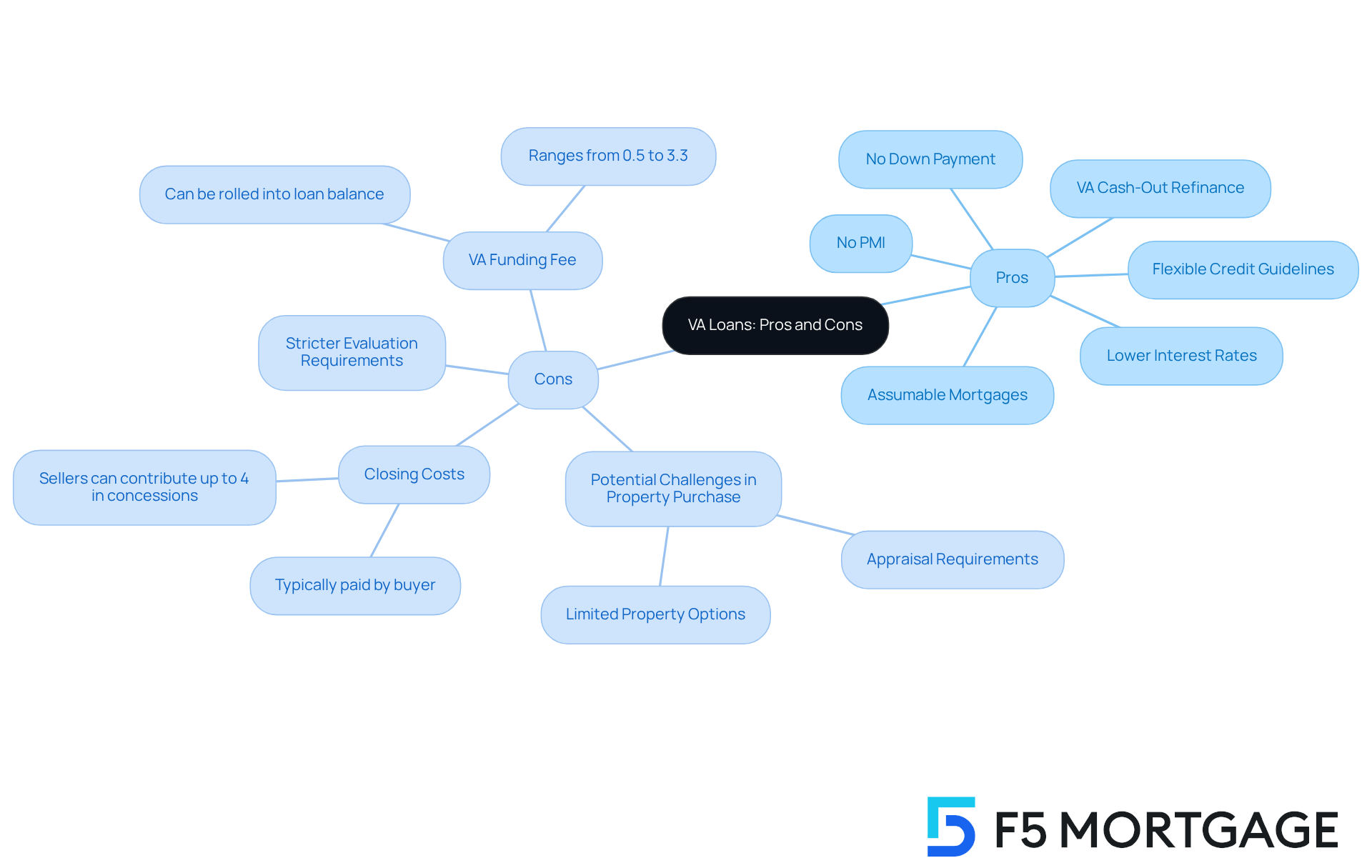

Are VA Loans Risky? Evaluating the Pros and Cons

While veterans loans offer numerous advantages, we know how crucial it is for former service members to assess the potential risks involved. One concern is the VA funding fee, which ranges from 0.5% to 3.3% of the loan amount, potentially adding to the overall cost of the loan. Furthermore, some former service members may face stricter evaluation requirements, with a significant percentage encountering challenges that could complicate the property purchasing process.

The lender will order a home appraisal to determine the current market value of the property, identifying how much equity the veteran has. This equity can significantly influence mortgage rates and overall borrowing expenses. However, the benefits of veterans loans—such as no down payment, lower interest rates, and no PMI—often surpass these risks.

The assumable nature of VA loans also enhances their attractiveness, especially in a high-interest-rate environment. This feature allows qualified buyers to take over the existing loan terms, making it a compelling option. Ultimately, former service members should weigh the pros and cons based on their individual financial situations and long-term goals.

Consulting with a knowledgeable mortgage broker can help veterans navigate these considerations and make the best choice for their home financing needs, especially when it comes to veterans loans. Additionally, checking their Certificate of Eligibility (COE) can provide clarity on their loan benefits. We’re here to support you every step of the way as you explore your options.

Conclusion

Veterans loans provide a unique opportunity for service members to achieve homeownership without the typical financial burdens associated with traditional mortgages. These loans offer remarkable advantages, including:

- No down payment

- Lower interest rates

- Absence of private mortgage insurance

Such benefits significantly enhance accessibility for veterans, allowing them to navigate the home buying process with confidence and make informed decisions that align with their financial goals.

Throughout this article, we’ve highlighted key insights, such as:

- Flexibility in credit requirements

- Limitations on closing costs

- Importance of the VA funding fee

These elements empower veterans to explore homeownership options that may have previously seemed unattainable. Moreover, the personalized support offered by F5 Mortgage ensures that service members receive tailored guidance, making their journey smoother and more manageable.

In a landscape where financial security is paramount, veterans loans stand out as a vital resource for former service members. By leveraging these benefits, individuals can not only secure a home but also invest in their future. It is essential for veterans to actively explore their options and consult with knowledgeable mortgage professionals. This will help maximize their potential savings and achieve their homeownership dreams. Remember, the path to owning a home is within reach, and the support is available to make it a reality.

Frequently Asked Questions

What services does F5 Mortgage provide for veterans?

F5 Mortgage offers personalized VA loan solutions, tailored consultations to assess individual financial situations, and access to a network of over two dozen leading lenders to provide competitive rates and conditions.

How does F5 Mortgage assist veterans in the home buying process?

F5 Mortgage provides thorough assistance throughout the financing journey, including a comprehensive buyer’s guide designed specifically for former service members, ensuring they have the necessary information to make informed decisions.

What is the advantage of VA loans regarding down payments?

VA loans allow veterans to acquire a home with no down payment, making property ownership more attainable for those who may not have significant savings. Approximately 73% of VA borrowers utilize this benefit.

Are there any down payment assistance programs available for veterans?

Yes, F5 Financing offers various down payment assistance programs, such as the MyHome Assistance Program in California, the My Choice Texas Home program in Texas, and the Florida Assist Second Mortgage Program in Florida, which can help cover upfront costs.

How do lower interest rates benefit veterans?

Veterans loans typically offer lower interest rates compared to traditional mortgages, leading to reduced monthly payments and significant savings over the life of the loan. This can enhance financial security and allow veterans to allocate funds toward other financial goals.

What is the refinancing process like with F5 Mortgage?

The refinancing process with F5 Mortgage includes researching options, submitting applications, undergoing appraisals, and completing underwriting, all with personalized support from F5’s dedicated team.

How quickly can veterans expect to complete the financing process with F5 Mortgage?

F5 Mortgage strives to make the financing process seamless, often concluding in under three weeks.

What should veterans consider regarding VA funding fees?

The VA funding fee ranges from 1.25% to 3.3%, which is an important factor to consider when assessing financing choices. Veterans are encouraged to compare rates from multiple lenders to secure the best possible terms.

How can veterans contact F5 Mortgage for assistance?

Veterans can apply for loans or contact F5 Mortgage online, by phone, or via chat, ensuring a smooth experience that caters to their preferences.