Overview

For families considering an upgrade to their homes, conventional home loans offer a range of benefits that can make the journey smoother. We understand how overwhelming this process can be, and we’re here to support you every step of the way. One of the key advantages is the lower closing costs, which can ease financial burdens. Additionally, with a sufficient down payment, you can avoid mortgage insurance altogether, providing further relief.

Flexible down payment options are another significant benefit, allowing families to choose a plan that best suits their financial situation. This flexibility can really make a difference, especially when navigating the complexities of home buying. Conventional loans not only provide financial flexibility but also feature quicker processing times, making them an appealing choice.

As you explore your options, remember that these loans can empower you to achieve your homeownership dreams more easily. We know how challenging this can be, but understanding these benefits is the first step toward making informed decisions. Take the time to consider how conventional loans can fit into your plans, and don’t hesitate to reach out for guidance tailored to your unique situation.

Introduction

Conventional home loans have become a popular choice for families eager to improve their living situations. They offer a blend of flexibility and financial benefits that can truly ease the home-buying journey. With options to customize loan terms, lower initial deposit requirements, and the possibility of avoiding mortgage insurance, these loans present a compelling case for families looking to enhance their financial well-being.

However, we know how challenging navigating the complexities of conventional loans can be. Questions about eligibility and strategies to maximize benefits often arise. What are the key advantages that make conventional loans the right choice for families aiming to secure their dream homes? We’re here to support you every step of the way as you explore these options.

F5 Mortgage: Personalized Service for Conventional Home Loans

At F5 Mortgage, we understand how challenging the mortgage process can be. Our steadfast dedication to individualized service ensures that you receive customized guidance as you navigate the complexities of conventional home loans. By prioritizing your unique needs, we empower you to understand your options and make informed decisions, resulting in a more seamless mortgage experience.

This tailored approach is especially beneficial for families looking to enhance their homes. We provide the opportunity to explore a variety of financing programs, including conventional home loans, that align with your distinct financial situation, such as options for first-time buyers and those with specific circumstances.

Moreover, our intuitive mortgage calculator makes it easy for you to estimate potential monthly payments. This tool simplifies your decision-making process and fosters confidence in your financial planning. With a focus on personalized consultations, F5 Mortgage exemplifies how tailored advice can significantly boost your satisfaction and engagement in the mortgage journey.

Each of our financing officers is committed to being accessible from dawn to dusk, merging excellent communication with exceptional problem-solving to ensure a seamless experience for you. As Cassidy Horton notes, “80% of consumers are more likely to make a purchase from a brand that provides personalized experiences,” highlighting the value of our approach. Additionally, research shows that “74% of customers feel frustrated when website content is not personalized,” underscoring the necessity of personalized service in the mortgage process.

By leveraging these insights and the expertise of our mortgage specialists, we continuously enhance our offerings to ensure that households feel supported and informed every step of the way. If you are considering an upgrade for your family, reaching out for a personalized consultation can be a crucial first step in navigating the mortgage landscape.

Flexibility of Conventional Home Loans: Tailored Options for Borrowers

We know how challenging home financing can be, but traditional options offer a variety of customizable choices tailored to meet your unique needs. Families can select from different loan terms, including:

- Conventional home loans

- Fixed-rate mortgages

- Adjustable-rate mortgages

This allows you to find a plan that aligns with your financial goals.

Additionally, initial deposit requirements can start as low as 3%, making homeownership more accessible than ever. For instance, a $10,000 deposit would be sufficient for a property valued at $333,000 or lower, easing the transition for families looking to improve their living conditions.

By partnering with F5 Mortgage, you can explore these flexible financing options and receive comprehensive support throughout the entire process. We’re here to help you discover solutions that fit your budget and lifestyle, ensuring you feel confident every step of the way.

No Mortgage Insurance Requirement: A Financial Advantage of Conventional Loans

One significant advantage of conventional home loans is the elimination of mortgage insurance when borrowers make a down payment of 20% or more. This requirement can greatly influence monthly expenses, as mortgage insurance can add hundreds of dollars to costs. For families looking to improve their homes, avoiding this expense can free up resources for other essential needs or savings, ultimately enhancing their financial flexibility.

We understand how challenging navigating these decisions can be. That’s why it’s crucial to recognize these benefits. At F5 Mortgage, we’re here to support you every step of the way in exploring your down payment strategies. Our goal is to help you maximize your savings and achieve your homeownership dreams.

Lower Closing Costs: Save More with Conventional Home Loans

Conventional home loans often present lower closing costs compared to government-supported loans, making them an attractive choice for families looking to enhance their homes. This reduction in upfront financial obligations can significantly ease the transition into a new property. In fact, families can save an average of 2% to 5% on closing expenses, which translates to thousands of dollars in potential savings.

At F5 Mortgage, we understand how overwhelming this process can be. That’s why we provide expert guidance on effective strategies to minimize closing costs. Here are some actionable tips to consider:

- Negotiate with Sellers: Many buyers successfully ask sellers to make repairs or cover part of the closing costs as a condition of purchasing the home. This can relieve financial pressure and strengthen your offer.

- Compare Lender Fees: It’s essential to shop around for the best lender fees, ensuring you secure the most favorable deal. Your lender will provide a Loan Estimate and a Closing Disclosure, which detail your costs and help clarify your financial obligations.

- Consult Real Estate Professionals: Leverage the insights of real estate specialists who can offer personalized guidance on reducing expenses during the home buying process. They can also assist in negotiating terms that align with your goals, such as move-in dates or repair requests.

Taking these proactive steps can lead to significant savings, ultimately making the home buying experience smoother for families. To maximize your savings, reach out to F5 Mortgage for personalized assistance tailored to your unique situation. We’re here to support you every step of the way.

Faster Processing Times: Quick Access to Conventional Home Loans

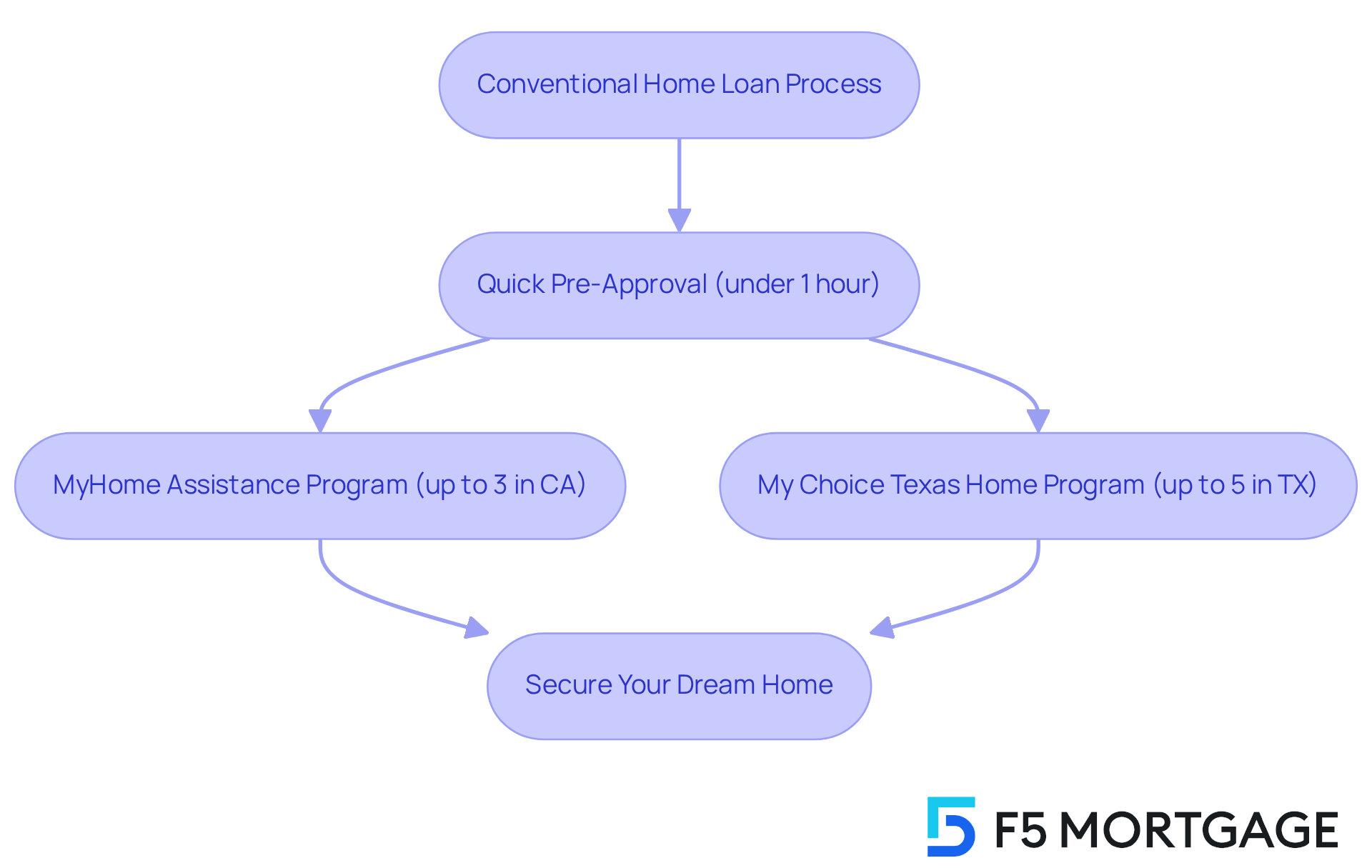

When it comes to securing a home, we know how challenging this can be. Conventional home loans usually provide quicker processing times compared to government-backed loans, which can be a significant relief for families eager to enhance their homes and minimize waiting periods before moving in. At F5 Mortgage, we leverage industry-leading technology to expedite the application and approval process, often achieving pre-approval in under an hour.

In addition to speed, families can take advantage of various down payment assistance programs available through F5 Mortgage. For instance:

- The MyHome Assistance Program in California provides up to 3% of the property’s purchase price.

- The My Choice Texas Home program in Texas offers up to 5% for down payment and closing support.

This rapid turnaround, combined with accessible assistance, empowers families to act swiftly in a competitive housing market, significantly increasing their chances of securing their dream home.

We’re here to support you every step of the way, ensuring you feel confident and informed throughout this journey.

Credit Score Requirements: What You Need for Conventional Home Loans

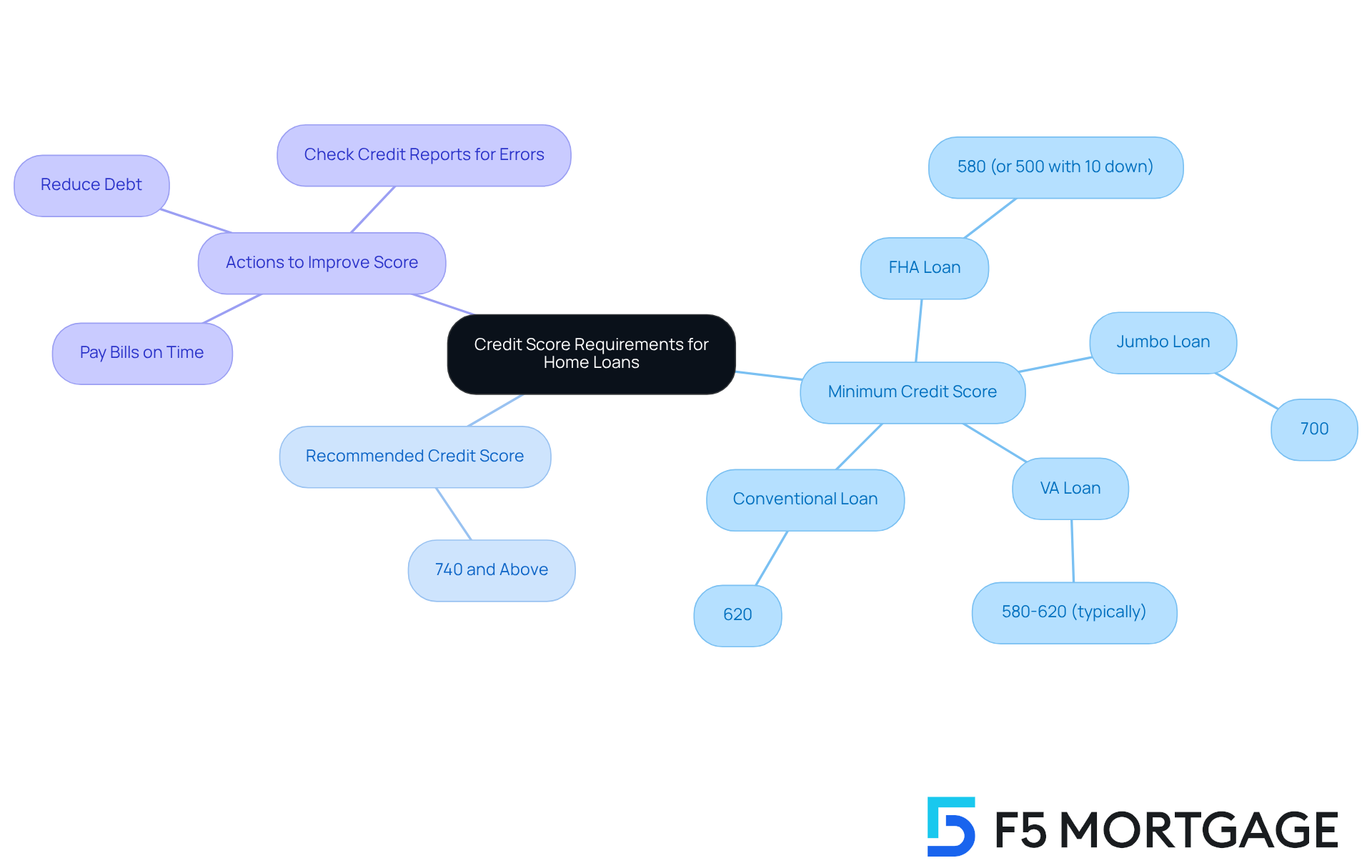

To qualify for a traditional mortgage, we know how challenging it can be to navigate the requirements. Typically, borrowers need a minimum credit score of 620. However, achieving a higher score can significantly enhance the terms and interest rates available. For instance, a score of 740 or above is often recommended to secure the best rates and avoid additional costs like private mortgage insurance. Understanding this is crucial for families aiming to upgrade their homes, as it informs them of their eligibility and the necessary steps to improve their credit standing.

At F5 Mortgage, we’re here to support you every step of the way. We provide personalized consultations to assist clients in navigating their credit options and developing effective strategies to enhance their scores. Families can take proactive measures, such as:

- Paying bills on time

- Reducing debt

- Checking credit reports for errors

to improve their creditworthiness. For example, individuals who actively manage their credit can see significant improvements, leading to better mortgage terms.

Statistics indicate that a higher credit score generally leads to lower mortgage rates, which can save households thousands over the duration of the loan. With the national average credit score in the U.S. reaching 715 in 2024, families with scores above this average are well-positioned to secure favorable financing options. By focusing on credit score improvement, families can increase their chances of obtaining the best possible mortgage terms, making their dream of homeownership more attainable.

Debt-to-Income Ratio: Key to Qualifying for Conventional Loans

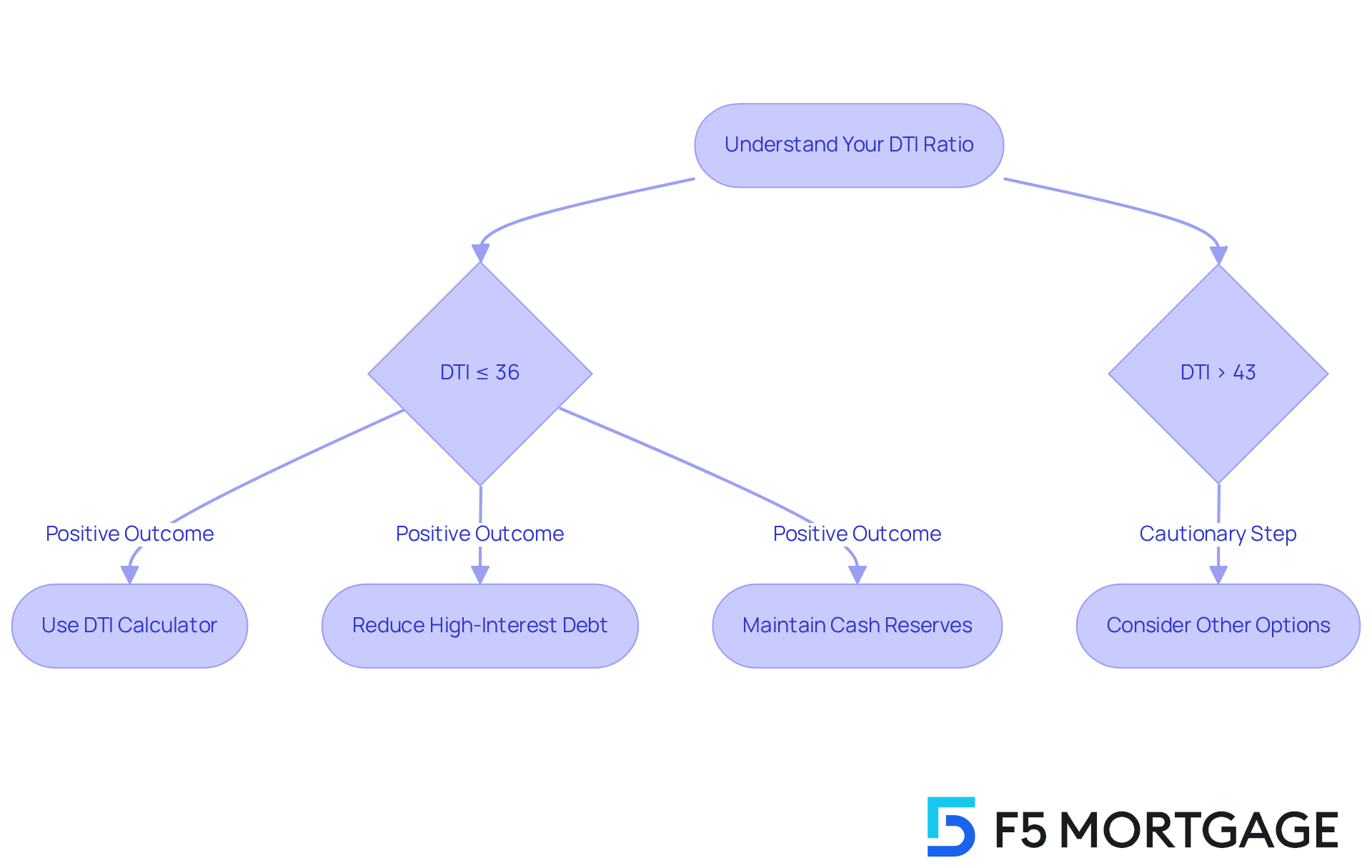

The debt-to-income (DTI) ratio plays a vital role in qualifying for conventional home loans, and we understand how crucial this is for families like yours. Lenders generally prefer a DTI ratio of 36% or lower, which means that no more than 36% of your gross monthly income should be allocated to debt payments, including your mortgage. If your DTI exceeds 43%, it may raise concerns for lenders. Therefore, understanding your DTI ratio is essential for assessing your financial readiness, especially when considering upgrading your home.

At F5 Mortgage, we’re here to support you every step of the way. We empower our clients with innovative tools, such as our online DTI calculator and personalized financial assessments, enabling you to accurately calculate your DTI and gain insights into your financial standing. Unlike traditional lenders who may rely on opaque practices, we prioritize transparency and client education. It’s important to remember that living expenses—like taxes, gas, utilities, insurance, and groceries—are not included in DTI calculations. By settling high-interest debts, such as credit cards, you can enhance your DTI, significantly improving your chances of financing approval.

For example, by following a comprehensive debt management checklist—like avoiding new credit accounts and maintaining a cash cushion—you can position yourself favorably in the mortgage application process. Lenders consider how many months of cash reserves you have when evaluating applications, further highlighting the importance of financial preparedness.

Mortgage experts emphasize that managing your DTI is one of the key elements in conventional home loans applications, as it provides lenders with a clear indication of your ability to meet monthly obligations. With F5 Mortgage’s dedication to clarity and outstanding service, understanding and managing your DTI ratio becomes a crucial step for families seeking to enhance their homes. This not only affects approval rates but also influences the overall financial well-being of your household.

Down Payment Options: Flexibility in Conventional Home Loans

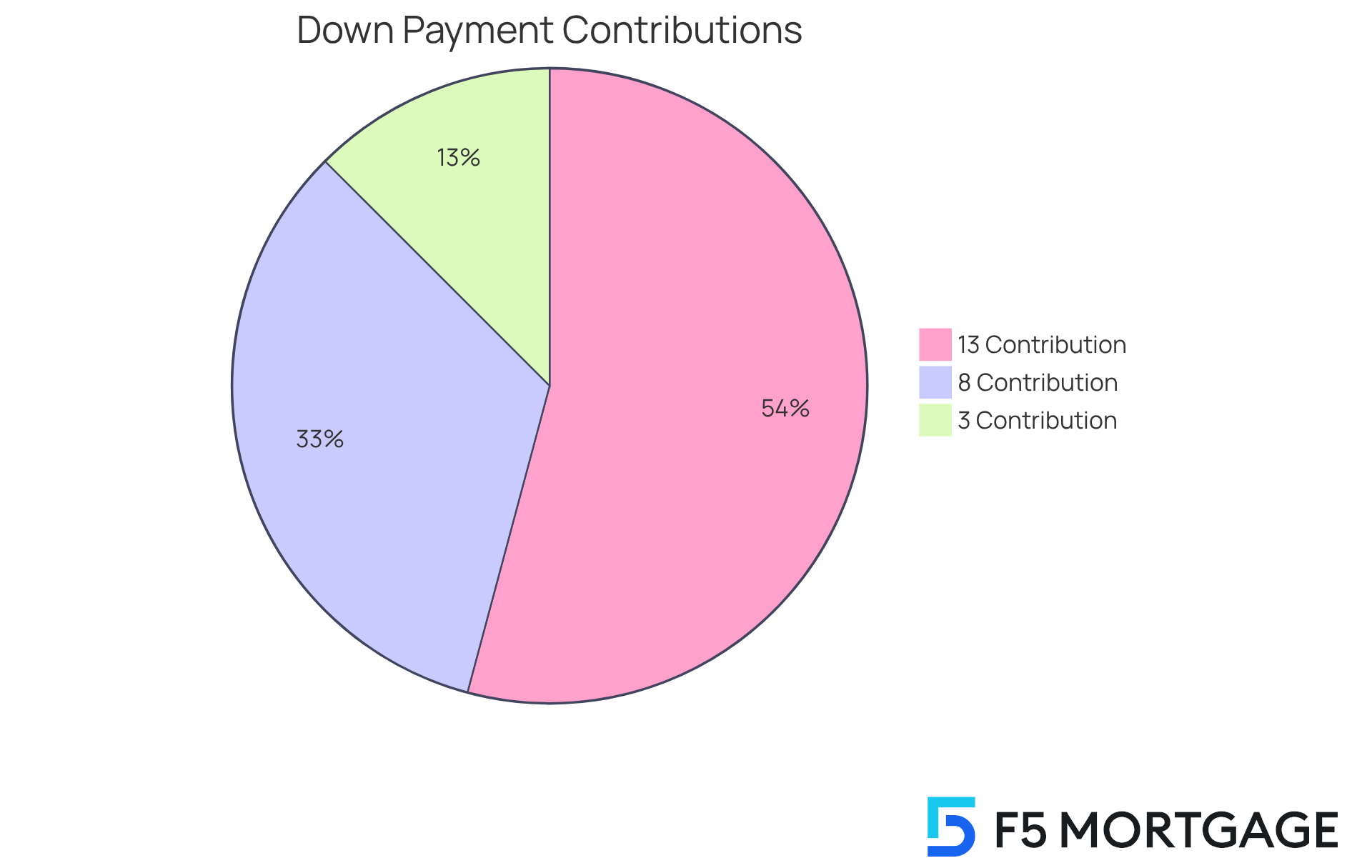

Traditional home financing presents a range of down payment options, making it accessible to many borrowers. We understand that families may feel overwhelmed, but the good news is that a conventional home loan can be secured with an initial contribution as low as 3%. This is especially beneficial for first-time homebuyers or those with limited savings. For instance, younger homebuyers, typically aged 23 to 31, often provide a median deposit of around 8%. This flexibility allows households to enter the housing market without the burden of a hefty upfront cost.

Moreover, opting for a larger initial deposit can lead to better financing terms and lower monthly payments, ultimately enhancing affordability. The median initial contribution for conventional home loans is about 13%, which translates to approximately $26,000. This figure reflects the rising trend of families upgrading their homes while effectively managing their financial resources. It’s crucial to note that down payments below 20% usually require Private Mortgage Insurance (PMI), which can increase monthly expenses but may be canceled once sufficient equity is built.

In Ohio, first-time homebuyers can benefit from various down payment assistance programs like YourChoice!, Grant for Grads, and Ohio Heroes. These programs offer financial support and have specific eligibility criteria designed to ease the homebuying journey. At F5 Mortgage, we are dedicated to helping clients navigate these options, providing personalized consultations to identify the most suitable down payment strategy based on individual financial situations and homeownership dreams. This tailored approach ensures that families can make informed decisions, enhancing their chances of securing favorable financing terms while alleviating financial stress.

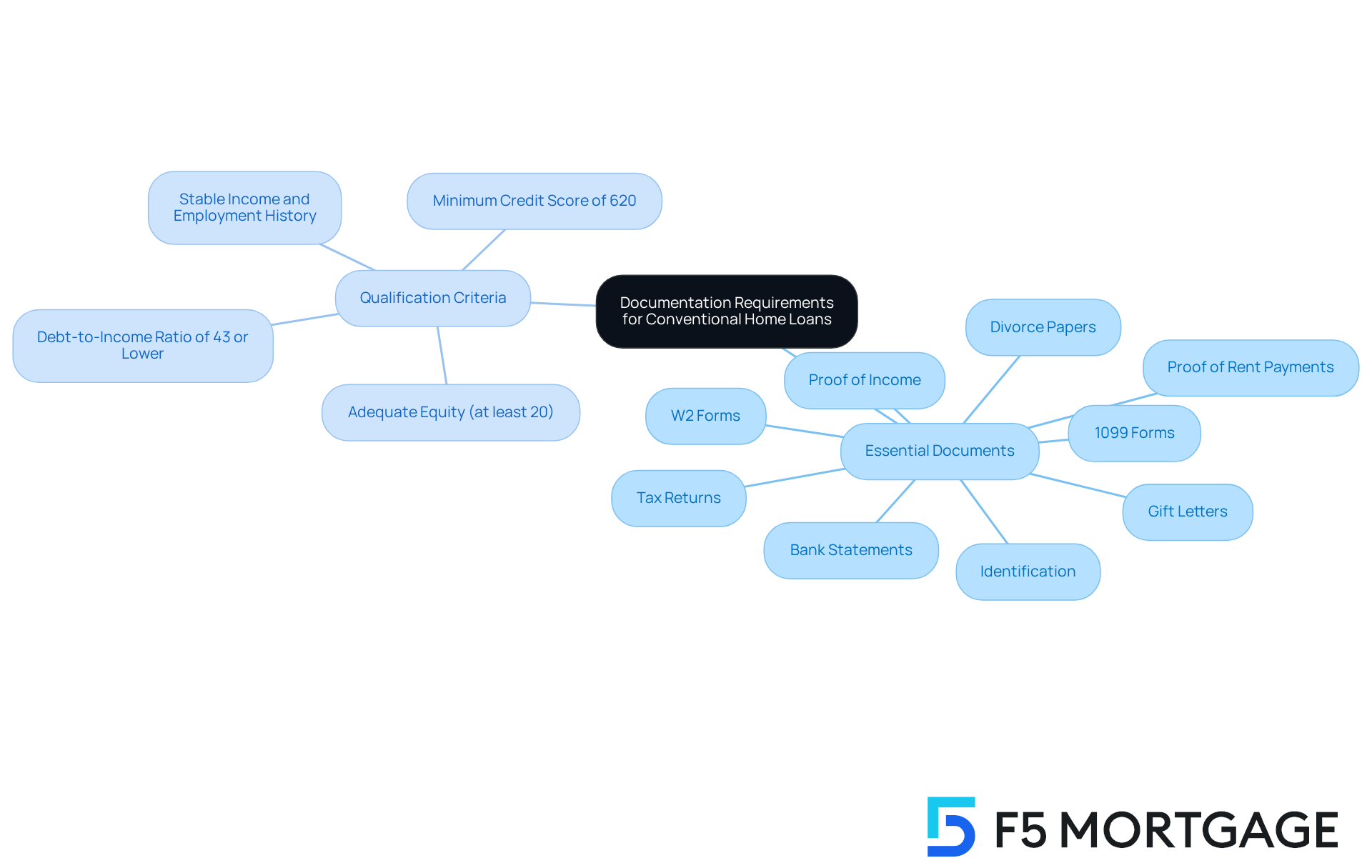

Documentation Requirements: What You Need for Conventional Home Loans

Applying for conventional home loans can feel overwhelming, but we’re here to support you every step of the way. To make the process smoother, borrowers need to submit specific documentation that verifies their financial status. Essential documents include:

- Proof of income, such as pay stubs

- W2 forms

- 1099 forms for contract employees

- Tax returns

- Bank statements

- Identification

For families enhancing their residences, understanding these requirements is crucial for a seamless application process.

When it comes to refinancing in California, obtaining conventional home loans typically requires meeting qualification criteria that include:

- A minimum credit score of 620

- A stable income and employment history

- Adequate equity in the property—often at least 20% for favorable mortgage rates

- A debt-to-income ratio of 43% or lower

We know how challenging this can be, but statistics show that well-prepared borrowers significantly increase their chances of approval. Organized documentation can expedite the review process, with many lenders noting that it can reduce processing times by up to 30%.

At F5 Mortgage, we provide a detailed checklist of necessary documents, including:

- Photo ID

- Divorce papers

- Gift letters

- Proof of rent payments

Our personalized support helps clients gather and organize their paperwork efficiently. Mortgage consultants emphasize the importance of being thorough and organized, stating that ‘having all your documents ready can make a significant difference in the approval timeline.’

Moreover, understanding the different refinancing options available, such as cash-out refinances or rate-and-term options, can empower households in their home improvement journey. This commitment to client assistance ensures a hassle-free experience, allowing families to focus on their home upgrade journey.

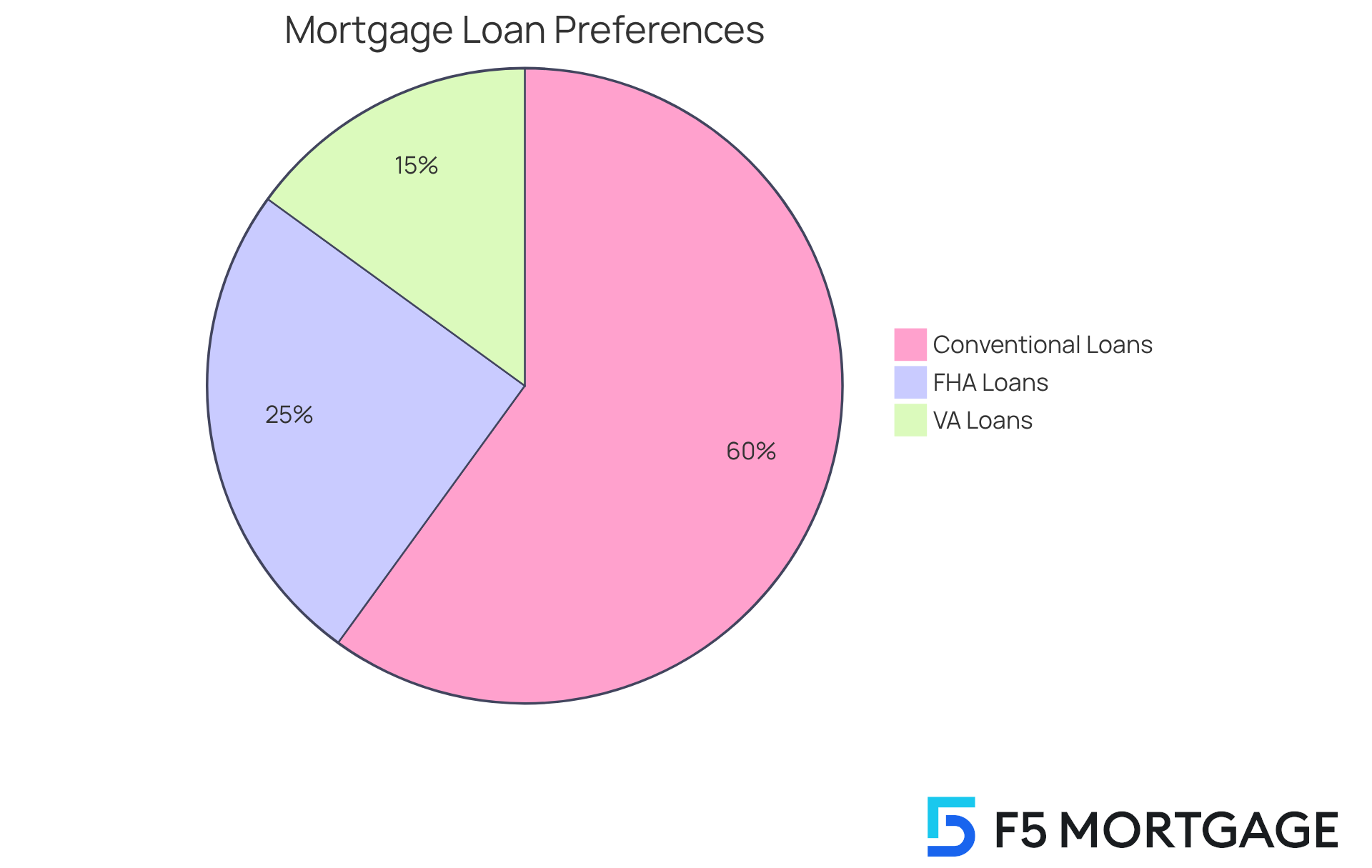

Conventional Loans vs. Other Loan Types: Making the Right Choice

Families assessing mortgage choices often find themselves weighing conventional home loans against alternatives like FHA or VA financing. Traditional mortgages stand out for their flexibility, particularly regarding down payments. They do not require mortgage insurance if a 20% down payment is made, leading to significant savings over time. Additionally, these financial products typically have fewer restrictions on property types, making them appealing to a broader range of homebuyers.

For instance, families renovating their homes frequently opt for traditional financing due to its attractive interest rates and the chance to avoid the extra costs associated with mortgage insurance. This financial benefit can be crucial, especially in today’s market, where the principal and interest payment on a median-priced home has surged by 78% since 2021, now averaging $2,891.

At F5 Mortgage, we know how challenging this can be. We provide personalized guidance on the pros and cons of each financing option, ensuring you make informed decisions that align with your financial goals. As mortgage trends evolve, many families are leaning towards conventional home loans, recognizing their potential for long-term savings and fewer restrictions, ultimately supporting their homeownership dreams. We’re here to support you every step of the way.

Conclusion

Conventional home loans offer a multitude of benefits, especially for families looking to upgrade their living spaces. We understand how important it is to find the right financing solution, and these loans provide the flexibility you need. With lower initial deposit requirements, no mortgage insurance for qualifying down payments, and reduced closing costs, conventional loans can significantly ease the financial burden of purchasing or refinancing a home.

One of the key advantages is the faster processing times that conventional loans typically offer. This means families can secure their dream homes more swiftly, which is often a top priority. Additionally, understanding credit score requirements and debt-to-income ratios is crucial for potential borrowers. These factors greatly influence loan eligibility and terms, and we know how challenging this can be.

The ability to customize down payment options further enhances the appeal of conventional loans, making homeownership more accessible for many families. In light of these insights, it’s essential to consider the significant advantages that conventional home loans provide. By leveraging the personalized services offered by F5 Mortgage, families can navigate the complexities of the mortgage process with confidence.

Taking the time to explore these options can lead to informed decisions that not only fulfill homeownership dreams but also enhance financial stability. The journey toward upgrading a home begins with understanding the right financing solutions, and conventional loans stand out as a compelling choice for families ready to make a move. We’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage provide for home loans?

F5 Mortgage offers personalized service for conventional home loans, providing customized guidance to help clients navigate the mortgage process and understand their options.

How does F5 Mortgage support families looking to enhance their homes?

F5 Mortgage allows families to explore a variety of financing programs, including options for first-time buyers, tailored to their unique financial situations.

What tools does F5 Mortgage offer to assist with financial planning?

F5 Mortgage provides an intuitive mortgage calculator that enables clients to estimate potential monthly payments, simplifying the decision-making process.

What is the commitment of F5 Mortgage’s financing officers?

F5 Mortgage’s financing officers are committed to being accessible from dawn to dusk, ensuring excellent communication and exceptional problem-solving for a seamless experience.

What is a significant advantage of conventional home loans regarding mortgage insurance?

A significant advantage is that borrowers who make a down payment of 20% or more can avoid mortgage insurance, which can significantly reduce monthly expenses.

What are some customizable options available with conventional home loans?

Conventional home loans offer various customizable choices, including fixed-rate mortgages and adjustable-rate mortgages, allowing borrowers to select a plan that aligns with their financial goals.

What are the initial deposit requirements for conventional home loans?

Initial deposit requirements can start as low as 3%, making homeownership more accessible. For example, a $10,000 deposit would be sufficient for a property valued at $333,000 or lower.

How does F5 Mortgage enhance its offerings based on customer feedback?

F5 Mortgage leverages insights from research indicating the importance of personalized service to continuously enhance its offerings, ensuring households feel supported and informed throughout the mortgage process.