Overview

Understanding the timeline for earnest money is crucial for home buyers, especially after a seller accepts their offer. Typically due within 1 to 3 days, this timeline can vary based on local customs and the specifics of the purchase agreement. We know how challenging this can be, and recognizing the importance of this step can significantly influence your home buying journey.

The amount required for earnest money is not just a number; it reflects your commitment and can impact your credibility in competitive markets. We’re here to support you every step of the way, ensuring you feel confident in navigating this process. By grasping these details, you empower yourself to make informed decisions that resonate with your goals and aspirations in finding the perfect home.

Introduction

Navigating the home buying process can feel overwhelming. We understand how challenging this can be, especially when it comes to grasping the nuances of earnest money. This crucial payment not only shows a buyer’s commitment but also plays a significant role in securing a property during negotiations. Families looking to purchase a home will find it beneficial to explore the timing, amount, and conditions surrounding earnest money deposits. These factors can greatly influence their overall experience.

What happens if unexpected circumstances arise, such as job loss or inspection issues? We’re here to support you every step of the way. Understanding the intricacies of earnest money could make all the difference in ensuring a smooth transaction and protecting your investment.

Understand Earnest Money: Definition and Purpose

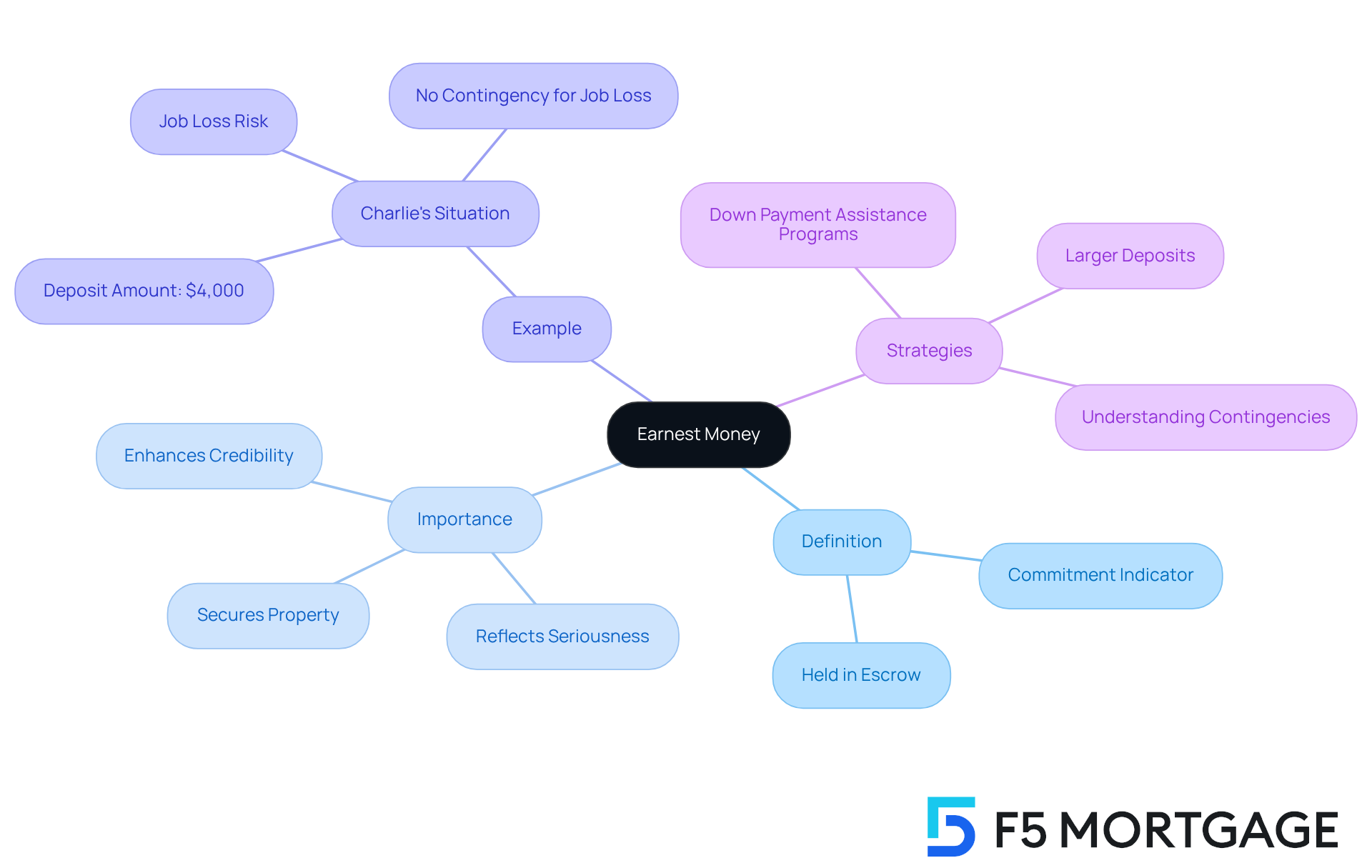

Earnest funds are a vital payment made by a purchaser to demonstrate their commitment to acquiring a home. Typically held in an escrow account managed by an impartial third party, this payment signals to the seller that the purchaser is serious about their offer. In 2025, the average good faith deposit ranges from 1% to 3% of the purchase price in stable markets, while competitive markets may see deposits of 4% to 5% or even higher. This financial commitment not only reflects good faith but also secures the property while the purchaser completes essential due diligence, such as inspections and securing financing.

The importance of deposit funds for home purchasers cannot be overstated. It serves as a tangible indication of the purchaser’s seriousness, allowing sellers to confidently remove the property from the market. For instance, consider a case involving a purchaser named Charlie. His $4,000 good faith contribution highlighted his commitment to buying a home. However, when Charlie unexpectedly lost his job, he faced the risk of losing his deposit since there was no provision for job loss in his contract. This situation underscores the necessity of having contingencies in place to protect earnest funds.

Real estate experts emphasize the strategic value of earnest money contributions. A larger deposit can enhance a purchaser’s credibility with the seller, signaling financial stability and commitment. Moreover, utilizing Down Payment Assistance Programs through F5 Mortgage can significantly strengthen a purchaser’s position. These programs enable buyers to make more competitive offers by increasing their down payment, resulting in a smaller loan amount and reduced mortgage payments. Understanding the terms of the purchase contract, including contingencies that allow for the retrieval of deposit funds, is crucial for protecting this investment. It’s essential for purchasers to never provide a deposit directly to the seller; it must be placed in an escrow account for security. By staying informed and proactive, families can navigate the home buying process with confidence and peace of mind.

Identify When Earnest Money is Due in the Home Buying Process

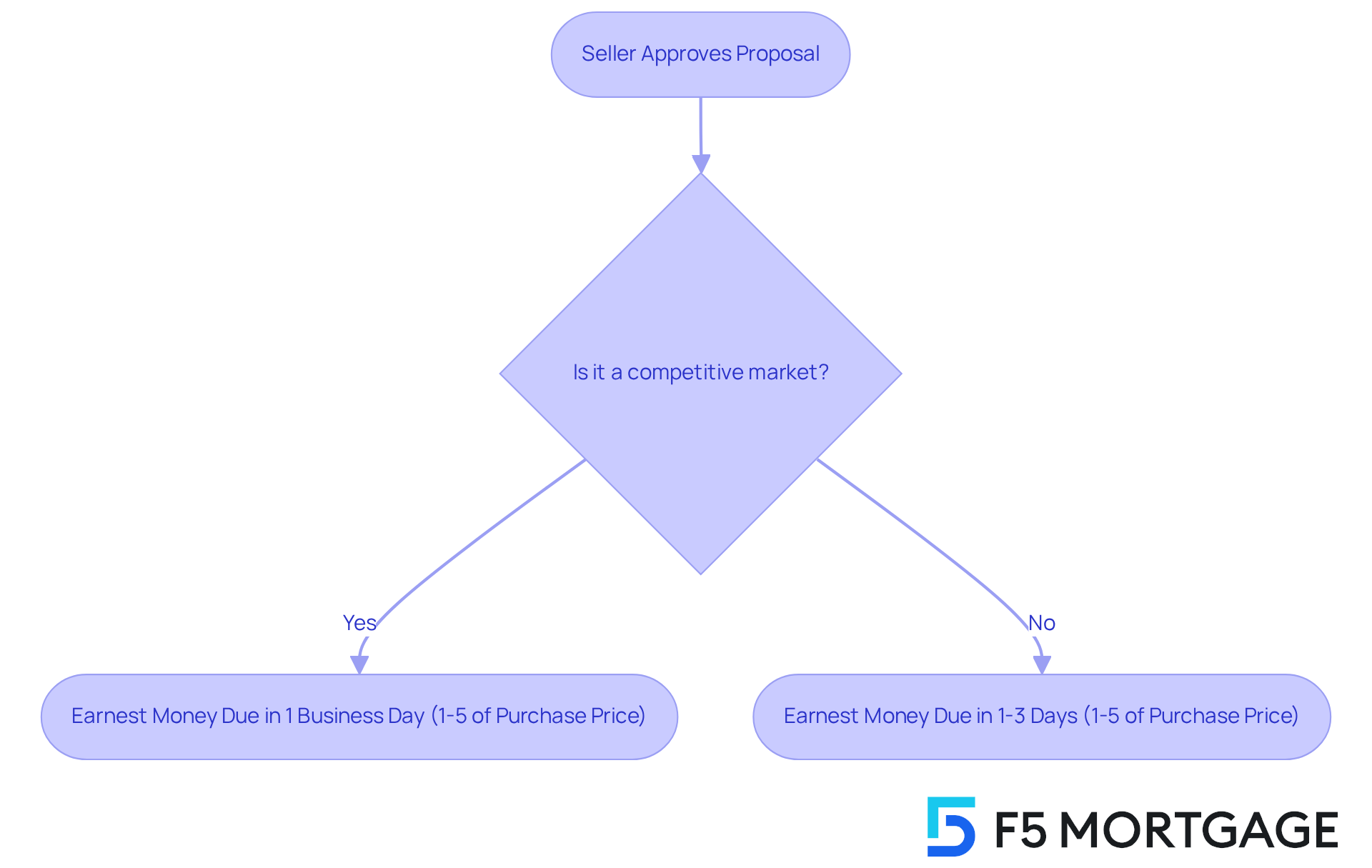

Typically, when is earnest money due? It’s required soon after the seller approves your proposal, often within just 1 to 3 days. We understand that this timeline can feel tight, and it may vary based on local customs and the specific terms in your purchase agreement. For instance, in competitive markets, you might need to provide your good faith funds within one business day to strengthen your offer. Being prepared to make this payment quickly can help you avoid any potential issues with the seller.

Real estate agents often recommend discussing these timelines in detail. This ensures everyone is on the same page, which can lead to a smoother transaction. In some cases, the amount of good faith funds can range from 1% to 5% of the purchase price, with larger sums suggested in more competitive situations. Understanding when earnest money is due and the associated amounts is vital, as it can significantly influence your home buying experience. Remember, we’re here to support you every step of the way as you navigate this process.

Determine How Much Earnest Money to Offer: Key Considerations

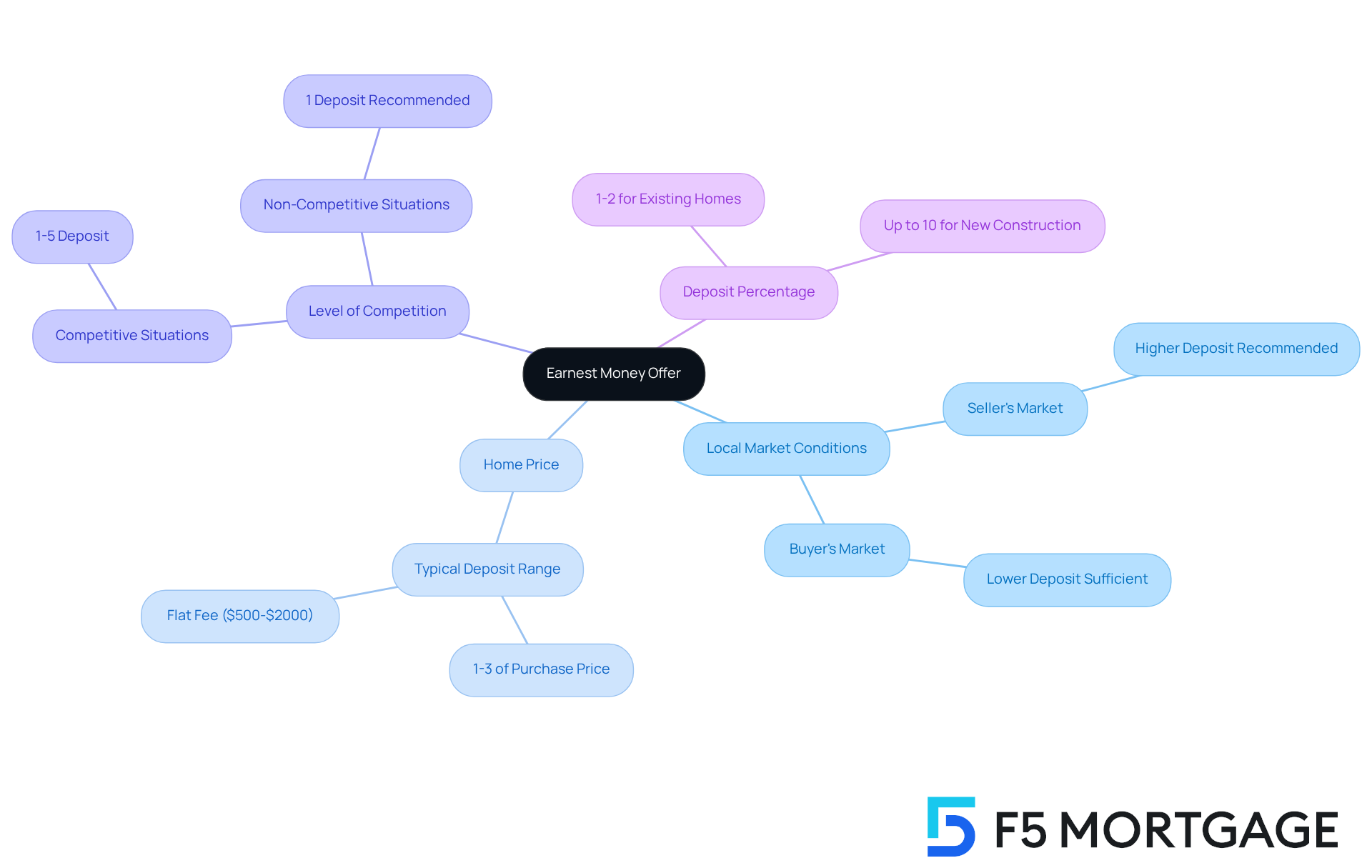

When determining how much deposit to present, it’s important for families to consider several factors. We understand how challenging this can be, and recognizing the local real estate market conditions, the price of the home, and the level of competition among purchasers is essential. In a seller’s market, presenting a larger upfront payment can significantly enhance the appeal of your offer. Conversely, in a buyer’s market, a lower deposit may suffice, providing some relief.

Typically, good faith deposits range from 1% to 3% of the purchase price. However, these can be adjusted based on your unique circumstances. Consulting with a knowledgeable real estate agent can offer valuable insights into what is customary in your area. Remember, we’re here to support you every step of the way as you navigate this important decision.

Explore Refundability: When Can You Get Your Earnest Money Back?

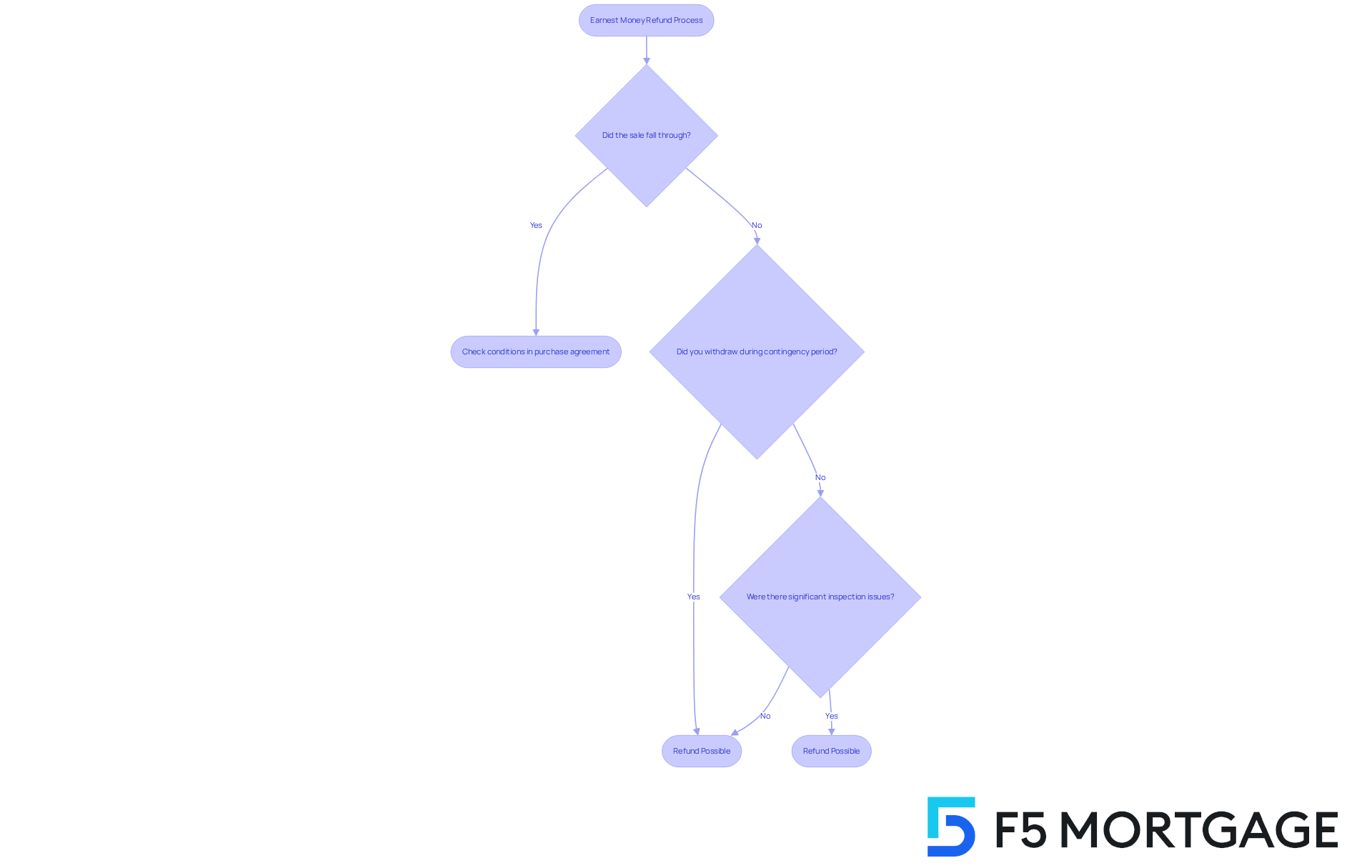

Understanding when earnest money is due is crucial, as it often hinges on the conditions laid out in your purchase agreement. We know how challenging this can be, especially when you consider situations where you might retrieve your deposit. For instance, if the sale falls through due to unsuccessful inspections or if funding isn’t secured, you may have options. Additionally, if you decide to withdraw within a designated contingency period, your deposit could be returned.

It’s essential for families to carefully review their purchase agreement and fully grasp the contingencies included. If an inspection uncovers significant issues, it raises the question of when is earnest money due for a possible refund. Remember, you’re not alone in this process—consulting with a real estate professional can clarify these terms and ensure that you feel protected every step of the way. We’re here to support you as you navigate these important decisions.

Conclusion

Understanding the nuances of earnest money is essential for families embarking on the home buying journey. We know how challenging this can be, and this financial commitment not only demonstrates a buyer’s seriousness but also plays a critical role in securing a property. By grasping the importance of earnest funds, their due timelines, and the factors influencing the deposit amount, buyers can approach the process with greater confidence and clarity.

Key insights from the article highlight the significance of earnest money in establishing credibility with sellers. Understanding local market conditions is crucial, as is having contingencies in place to protect the deposit. The timeline for submitting earnest money is often tight, which emphasizes the need for preparedness and open communication with real estate professionals. Additionally, knowing when and how much of the deposit can be refunded can safeguard buyers against unforeseen circumstances.

Ultimately, navigating the intricacies of earnest money can significantly impact the home buying experience. Families are encouraged to stay informed, consult with knowledgeable agents, and prepare adequately to enhance their chances of securing their dream home. By prioritizing earnest money strategies, buyers can not only protect their investments but also move forward in the home buying process with assurance and peace of mind.

Frequently Asked Questions

What is earnest money and its purpose in home buying?

Earnest money is a payment made by a purchaser to demonstrate their commitment to acquiring a home. It signals to the seller that the purchaser is serious about their offer and is typically held in an escrow account managed by a third party.

How much is the average earnest money deposit in 2025?

In 2025, the average earnest money deposit ranges from 1% to 3% of the purchase price in stable markets, while competitive markets may see deposits of 4% to 5% or even higher.

Why is earnest money important for home purchasers?

Earnest money serves as a tangible indication of the purchaser’s seriousness, allowing sellers to confidently remove the property from the market. It also secures the property while the purchaser completes essential due diligence, such as inspections and securing financing.

Can a purchaser lose their earnest money deposit?

Yes, a purchaser can lose their earnest money deposit if there are no contingencies in place to protect it. For example, if a purchaser loses their job unexpectedly and there is no provision for job loss in their contract, they risk losing their deposit.

How can a larger earnest money deposit benefit a purchaser?

A larger earnest money deposit can enhance a purchaser’s credibility with the seller, signaling financial stability and commitment to the purchase.

What role do Down Payment Assistance Programs play in earnest money deposits?

Down Payment Assistance Programs can strengthen a purchaser’s position by enabling them to make more competitive offers through a larger down payment, resulting in a smaller loan amount and reduced mortgage payments.

What should purchasers know about placing their earnest money deposit?

Purchasers should never provide a deposit directly to the seller; it must be placed in an escrow account for security. Understanding the terms of the purchase contract, including contingencies for retrieving deposit funds, is crucial for protecting this investment.