Overview

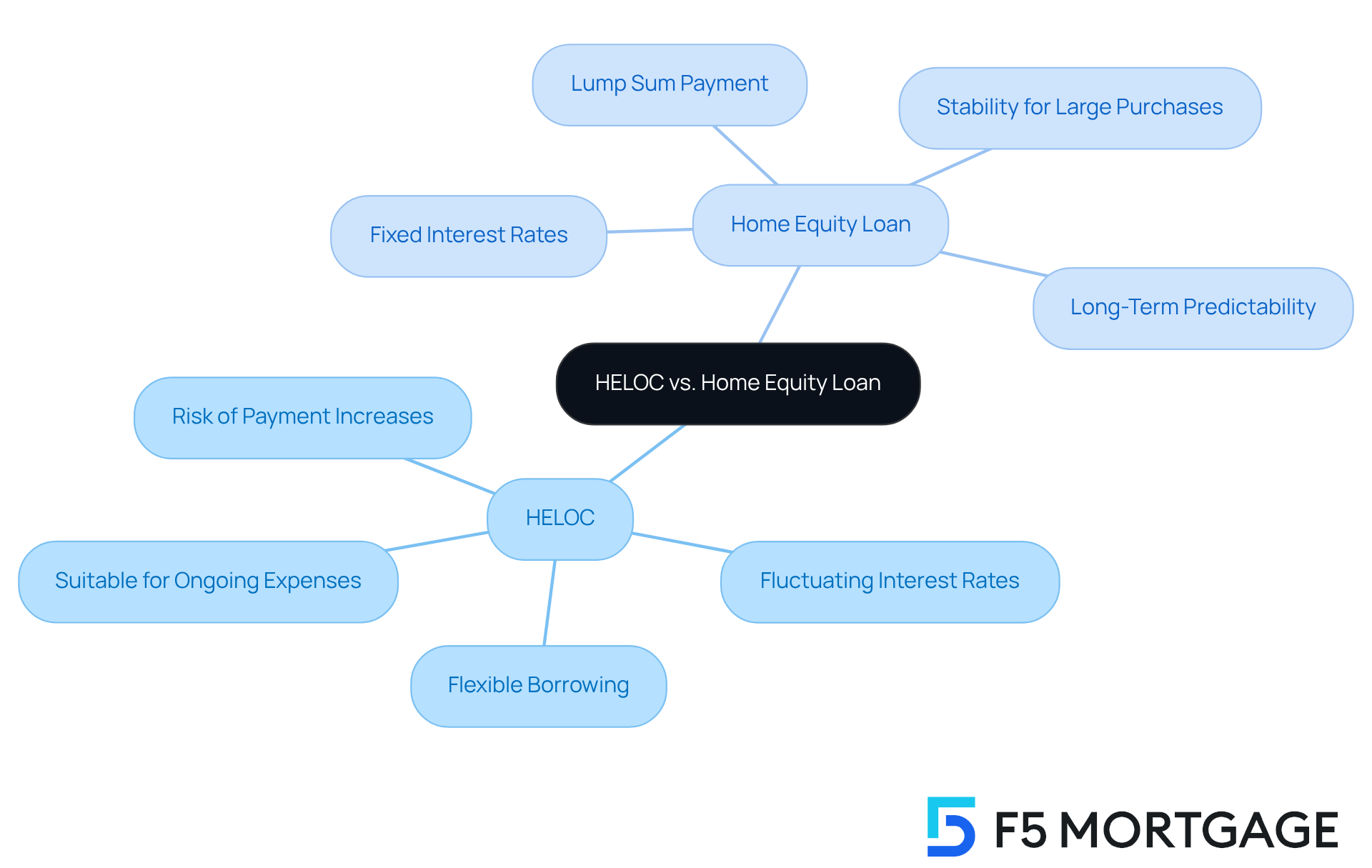

Navigating the world of home financing can be overwhelming, and we understand how challenging this can be. This article highlights seven key differences between a Home Equity Line of Credit (HELOC) and a Home Equity Loan, helping you make informed decisions that suit your needs.

HELOCs provide flexible borrowing options with variable interest rates, making them ideal for ongoing expenses. On the other hand, Home Equity Loans offer a lump sum with fixed payments, perfect for one-time costs. By understanding these distinctions, you can choose the option that aligns with your financial goals and risk tolerance.

We’re here to support you every step of the way as you navigate your financial journey. Remember, the right choice can empower you to achieve your dreams.

Introduction

Understanding the nuances of home equity financing can indeed feel overwhelming for many homeowners. We know how challenging this can be, especially with rising property values and fluctuating interest rates. The choice between a Home Equity Line of Credit (HELOC) and a Home Equity Loan is more critical than ever.

This article will guide you through the essential differences between these two financial products, highlighting how each can cater to your unique financial needs and goals. As you navigate this decision, consider which option best aligns with your circumstances. After all, in an unpredictable economic landscape, the question remains: which path offers you the most security and flexibility?

F5 Mortgage: Understanding Home Equity Lines of Credit vs. Home Equity Loans

Home Value Lines of Credit (HELOCs) and the comparison of home equity line of credit vs home equity loan are two common ways for property owners to access the value in their residences. A HELOC functions like a credit card, enabling you to borrow against your property’s value up to a set limit, with the ability to access funds as needed. In contrast, a property-backed loan offers a lump sum that is repaid over a set period, usually with consistent monthly payments.

We know how challenging it can be to navigate financial decisions, especially in today’s fluctuating economy. Recent trends suggest an increasing inclination towards property-backed financing, particularly as homeowners seek stability amid varying interest rates. With the typical residential asset financing rate around 8.22% and HELOC rates slightly higher at 8.90%, many borrowers are opting for the fixed-rate aspect of asset financing. This is especially true given the current economic climate, where interest rates are anticipated to rise again. These rates are influenced by the Federal Reserve’s decisions, which play a significant role in shaping the lending landscape.

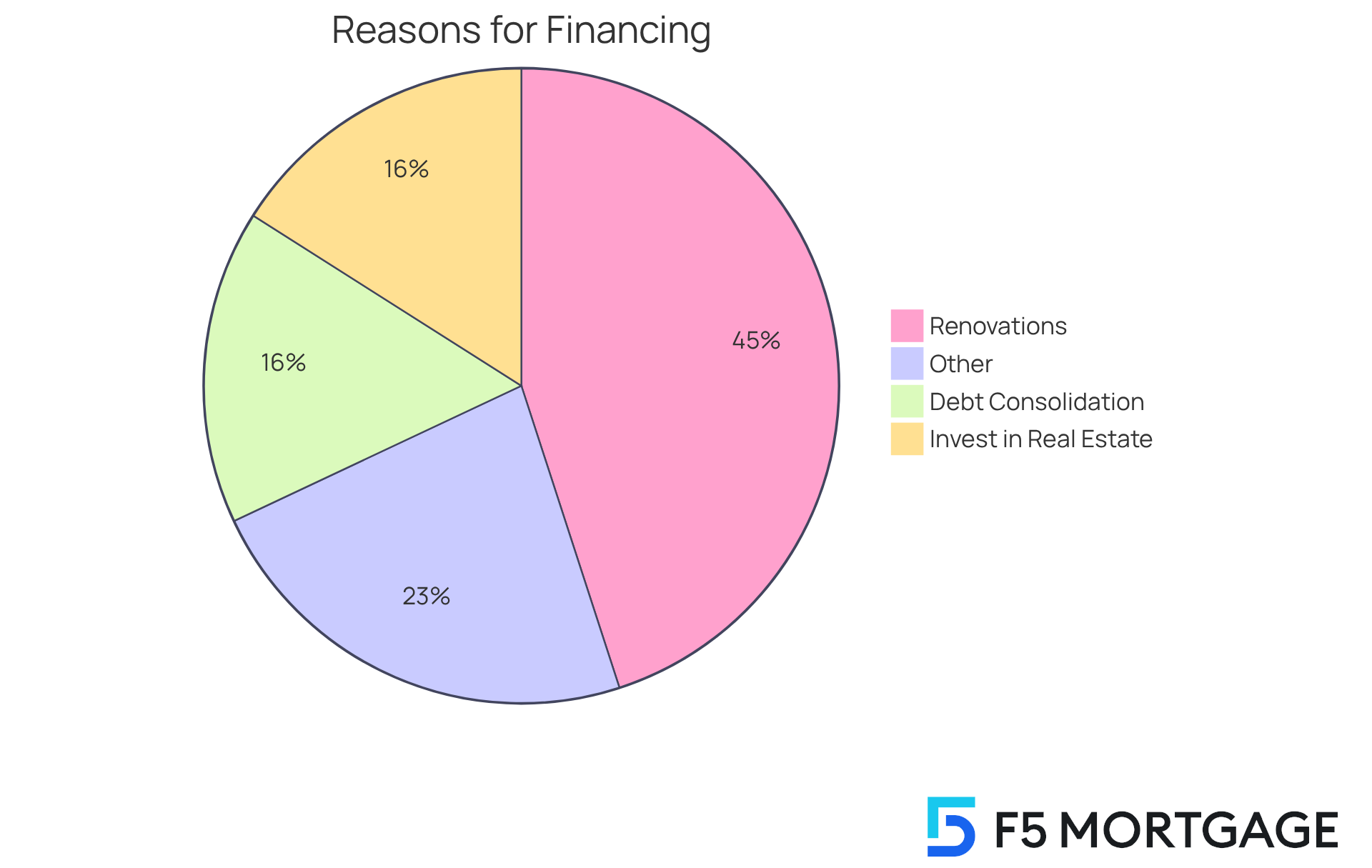

Practical instances demonstrate this change: property owners are increasingly utilizing property value loans for major costs such as renovations, debt consolidation, and even investing in new real estate. In fact, 45% of prospective borrowers mention property renovations as their main reason for seeking these financial products. Financial consultants stress that property-backed financing is ideal for individuals with specific, one-off costs who prefer consistent payments. This makes them a more secure option during unpredictable economic periods. As Scott Bridges, chief consumer direct lending officer, mentions, “The pleasant aspect of a property-backed loan is that even if the [prevailing] rate fluctuates slightly, these loans are funded over 15, 20, or 30 years.”

Looking ahead to 2025, the residential asset market is witnessing significant growth, with originations of new residential asset products rising by 10% annually. This increase is linked to escalating property values, with property owners now averaging $400,000 in value, a remarkable 41% rise since 2020. Furthermore, the denial rate for HELOC applications has reached 48%, emphasizing the difficulties faced by many borrowers. This makes property-backed financing a more attainable option for those who may feel overwhelmed.

In summary, while both a home equity line of credit vs home equity loan and property-backed financing options provide valuable methods to utilize residential value, the decision between them typically depends on personal financial circumstances and goals. If you require a lump sum for a specific reason, a property-backed loan may be the better choice. However, if you desire continuous access to funds, a HELOC might be more suitable—just be sure to keep an eye on the associated risks. Remember, we’re here to support you every step of the way.

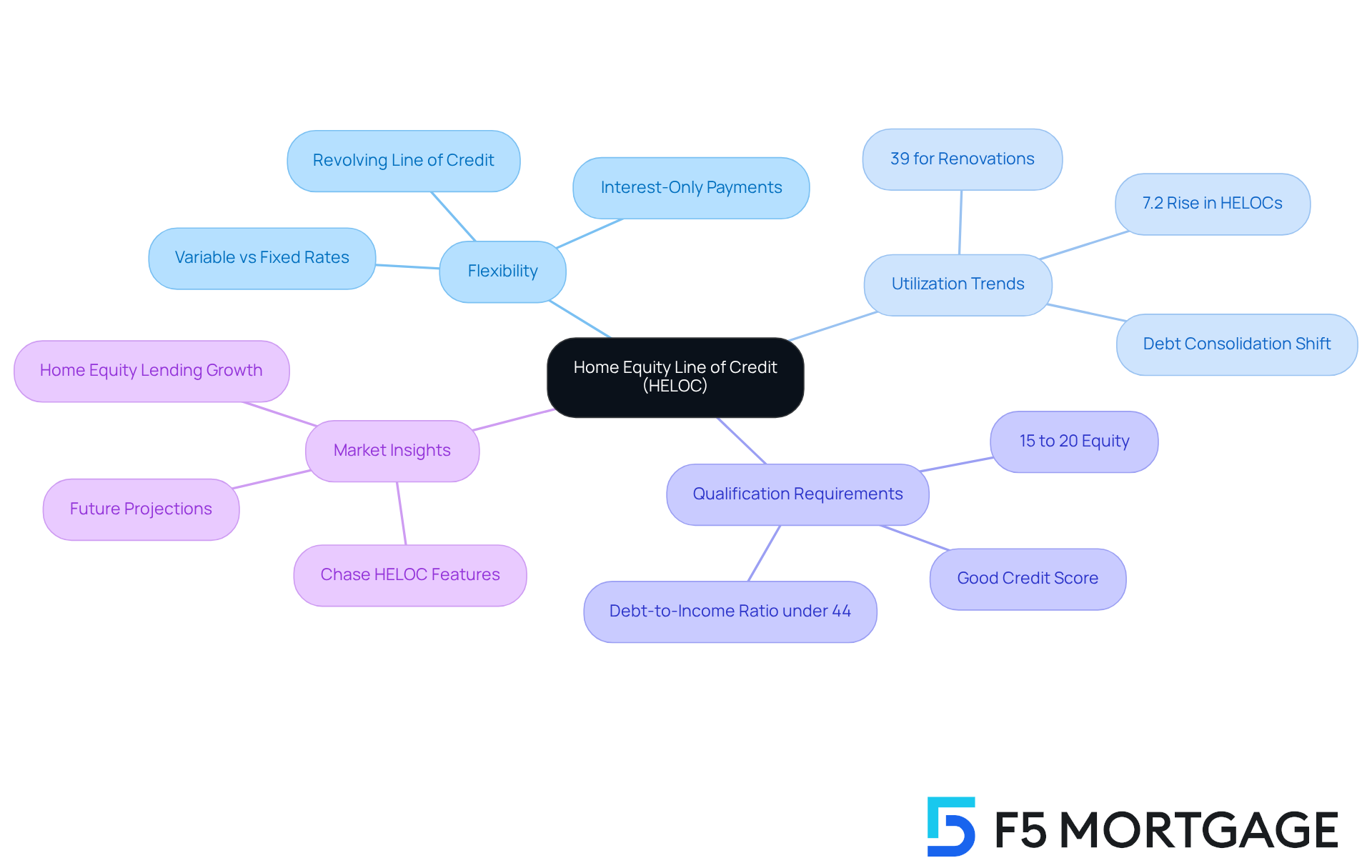

Home Equity Line of Credit (HELOC): Flexible Borrowing with Revolving Credit

A Home Equity Line of Credit (HELOC) offers property owners a revolving line of credit based on their equity, enabling them to borrow, repay, and borrow again, much like a credit card. This flexibility makes HELOCs an appealing option for ongoing expenses, such as home renovations or educational costs. With interest rates typically lower than those of personal loans, HELOCs can be a cost-effective solution for accessing funds. However, we know how challenging it can be to navigate variable interest rates, which can lead to fluctuating monthly payments.

In 2025, we anticipate a notable rise in HELOC utilization for renovations, as property owners increasingly rely on these lines of credit to fund enhancements. Recent statistics indicate that 39% of property borrowers are now pursuing funds for renovations, reflecting a shift in priorities. For instance, many homeowners have successfully utilized HELOCs to enhance their living spaces, demonstrating the practical benefits of this financial tool.

Moreover, the flexibility of HELOCs allows homeowners to draw funds as needed, making them ideal for projects that require ongoing financing. This adaptability is particularly beneficial in a fluctuating market, where homeowners can manage their borrowing based on current needs and financial situations. As the residential borrowing market continues to expand, with a reported 7.2% rise in HELOCs and residential financing last year, it’s clear that the attractiveness of HELOCs as a flexible borrowing alternative remains strong.

It’s important to note that to qualify for a HELOC, borrowers generally need to have 15% to 20% equity in their property and a debt-to-income ratio under 44%. A maximum DTI ratio of 43% is usually necessary for home financing, which can impact the competitiveness of mortgage rates. Additionally, repayment terms for HELOCs can extend up to 20 years, a crucial consideration for homeowners planning their finances. Some lenders also provide the option to switch from variable rates to fixed rates, offering additional flexibility in managing expenses. Furthermore, Colorado residents have various refinancing options available, including conventional loans, FHA loans, and VA loans, all of which can influence their overall financial strategy.

Home Equity Loan: Lump-Sum Financing with Fixed Payments

A Home Equity Loan offers a lump sum of cash, repaid over a fixed duration with regular monthly installments. This structure can be especially beneficial for property owners who are seeking a specific amount of cash upfront for significant expenses, such as renovations or debt consolidation. The predictability of set amounts provides reassurance, allowing borrowers to confidently organize their budgets around their monthly responsibilities.

In 2025, we saw a notable trend emerge, with 16% of homeowners considering home equity financing specifically for debt consolidation. This reflects a growing awareness of the benefits of consolidating higher-interest debts into one manageable sum. Financial planners often advocate for fixed payment agreements, emphasizing their stability in an unpredictable economic landscape. For instance, many property owners have successfully utilized property value loans to consolidate credit card debts, which typically carry an average interest rate of 20.12%, into a lower-rate property value financing currently averaging 8.22%.

According to Marina Walsh, CMB, MBA’s Vice President of Industry Analysis, lenders expect nearly 7 percent growth in residential loan debt year-over-year in 2025. This strategic approach not only simplifies financial management but also has the potential to save homeowners significant amounts in interest over time. As the residential value market continues to evolve, understanding the advantages of fixed installment frameworks is crucial for those looking to leverage their property value effectively. We encourage homeowners to carefully evaluate their financial situation and consider reaching out to a financial planner to explore the best borrowing options against their home equity. We’re here to support you every step of the way.

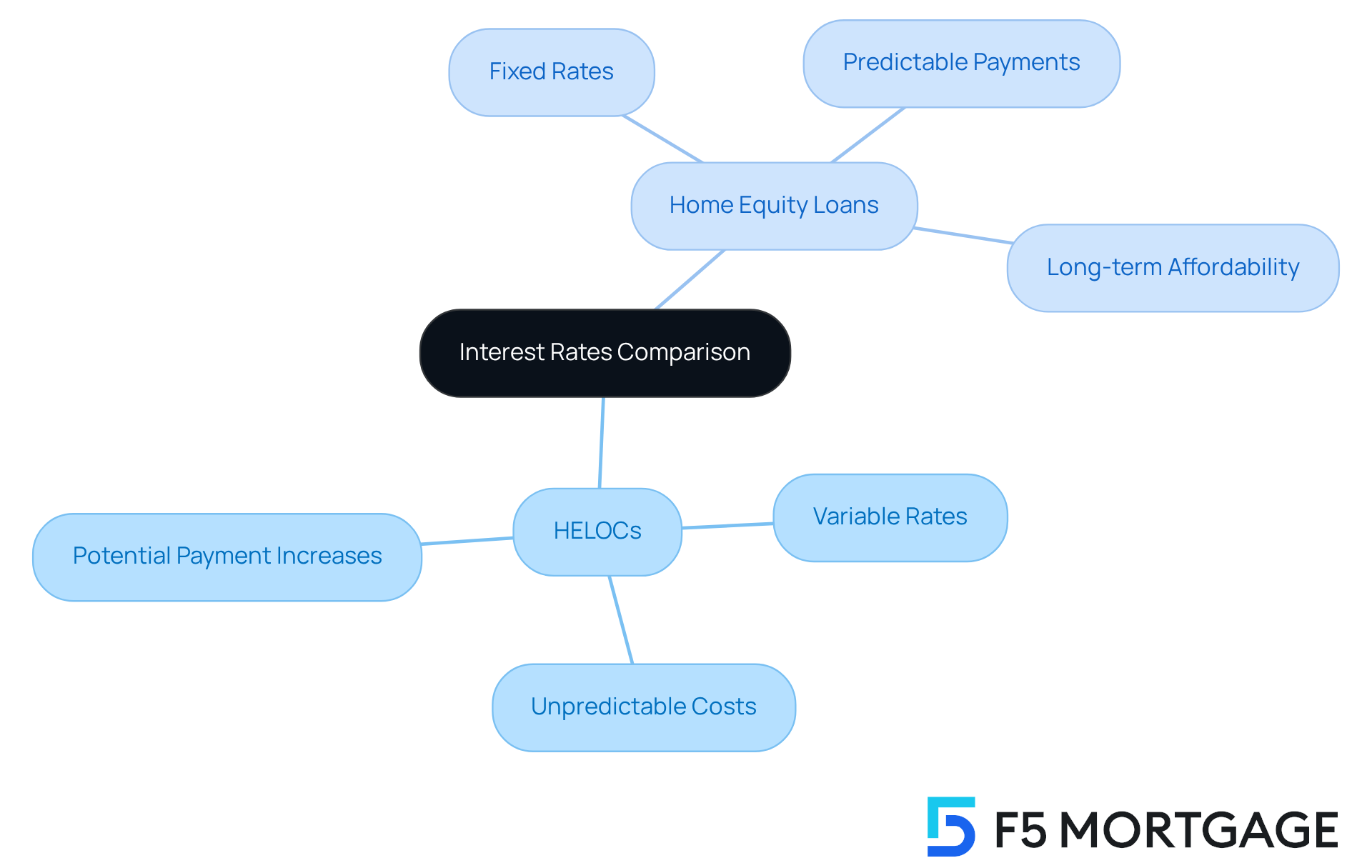

Interest Rates: Comparing Variable Rates of HELOCs with Fixed Rates of Home Equity Loans

HELOCs typically come with variable interest rates that fluctuate with market conditions, which can lead to unpredictable monthly costs. We know how challenging this can be; as interest rates rise, borrowers may experience significant increases in their expenses, impacting their overall budget. In contrast, residential asset financing generally offers fixed rates, ensuring steady monthly installments throughout the borrowing period. This predictability allows homeowners to manage their finances more effectively, as they can anticipate their financial obligations without the worry of sudden spikes.

In 2025, the typical property financing rate hovers around 8.25 percent, presenting a reliable borrowing option for those seeking long-term affordability. Conversely, HELOC rates, often lower than credit card APRs, can vary significantly based on the prime rate plus an additional margin. This variability means homeowners should be prepared for potential cost fluctuations, especially if they choose to pay only interest during the draw period, which can lead to larger amounts once the repayment phase begins.

Consider a real-world scenario: a homeowner with a HELOC might witness their monthly payment rise sharply if interest rates increase, while a borrower with a fixed-rate mortgage continues to pay the same amount each month, regardless of market changes. This distinction of home equity line of credit vs home equity loan is crucial for budgeting, as homeowners must weigh the flexibility of a HELOC against the stability of a property financing option when deciding which choice best aligns with their financial situation. Remember, we’re here to support you every step of the way as you navigate these important decisions.

Credit Score Requirements: HELOCs vs. Home Equity Loans

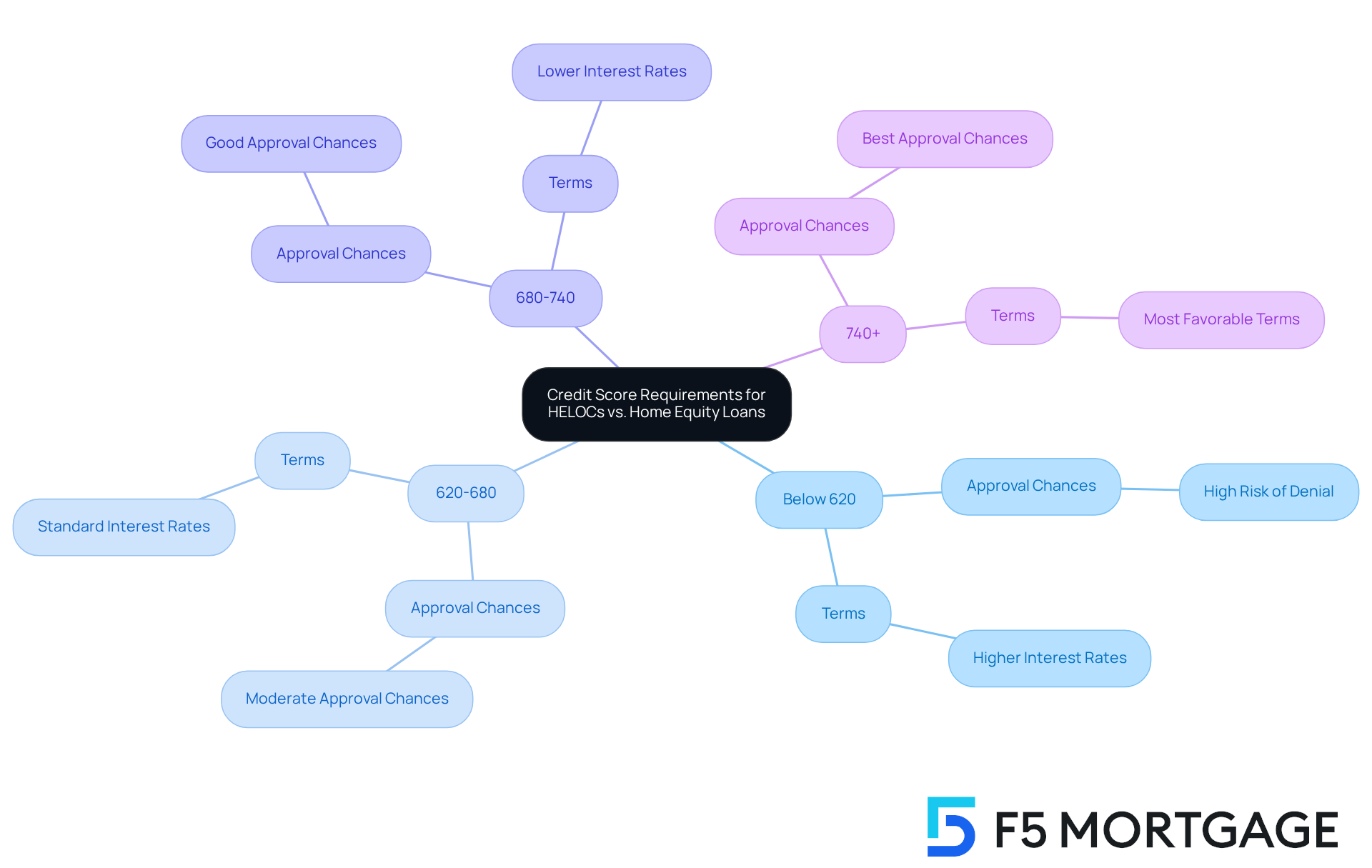

Navigating the world of home equity line of credit vs home equity loan can feel overwhelming, especially when it comes to understanding credit score requirements. Most lenders typically look for a strong credit score for approval, with minimum scores ranging from 620 to 680. We know how challenging this can be, but achieving a higher score can unlock more favorable terms. For instance, borrowers with scores exceeding 740 may benefit from lower interest rates and better borrowing conditions.

Lenders also consider other important factors, such as income stability and debt-to-income (DTI) ratios. Ideally, your DTI should be below 43% to enhance your chances of approval. Understanding these criteria is essential as you prepare for the application process. A solid credit profile significantly boosts your chances of obtaining financing.

Statistics show that borrowers with credit scores of 700 or higher have the best chances of approval. On the other hand, those with scores below 620 may face more challenges. For example, a borrower with a score of 680 might qualify for a home equity line of credit vs home equity loan, but the terms for the home equity line of credit may not be as favorable as those for someone with a score of 740.

As mortgage experts often emphasize, maintaining a favorable credit score and a manageable DTI ratio are crucial steps in navigating the differences between a home equity line of credit vs home equity loan. Remember, we’re here to support you every step of the way as you work towards achieving your financial goals.

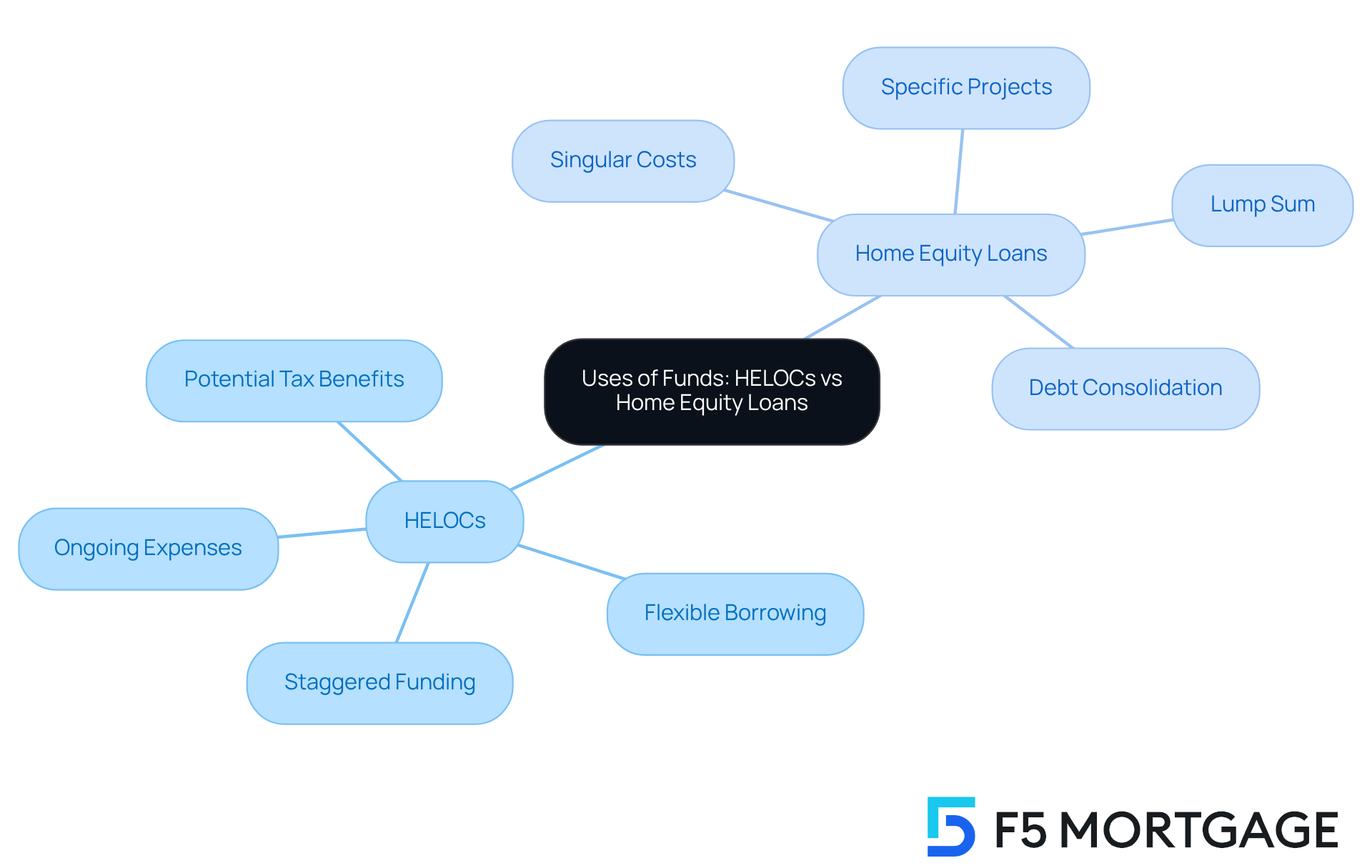

Uses of Funds: How HELOCs and Home Equity Loans Can Be Utilized

Equity Lines of Credit (HELOCs) are becoming a popular choice for ongoing expenses like renovations, educational costs, or emergency funds. Their flexible borrowing structure allows property owners to access funds as needed, covering only the interest on the amount borrowed. This flexibility can be particularly beneficial for projects requiring staggered funding over time, making it easier for families to manage their finances.

In contrast, property-backed financing is typically used for singular costs, such as significant renovations or debt consolidation. These financial products provide a lump sum that is repaid over a set period, making them ideal for homeowners with a specific project in mind, like a kitchen renovation or merging high-interest debts into a single, manageable payment.

Statistics reveal that in 2024, the average HELOC balance surpassed $45,000, while the average credit line exceeded $149,000 as of Q1 2025. This indicates a growing trend among property owners to tap into their home’s value for ongoing financial needs. Financial specialists, including Linda Bell, a certified HELOC professional, emphasize that when deciding on a home equity line of credit vs home equity loan, it’s essential for borrowers to evaluate their individual circumstances and goals. For instance, if a homeowner plans to undertake a series of renovations over several years, a HELOC may be more suitable due to its revolving credit nature. Conversely, for a significant, one-time project, property equity financing might be the better choice.

Additionally, using a HELOC for home improvements may offer potential tax benefits, as interest charges could be tax-deductible if the funds are allocated for substantial renovations. Ultimately, understanding the intended use of funds is crucial for borrowers to choose between a home equity line of credit vs home equity loan, ensuring that they select the right loan type that aligns with their financial objectives and circumstances. We know how challenging this can be, so as a practical next step, we encourage readers to assess their financial needs and consult with a mortgage expert to determine the best option for their situation.

Repayment Terms: Differences in Payment Structures for HELOCs and Home Equity Loans

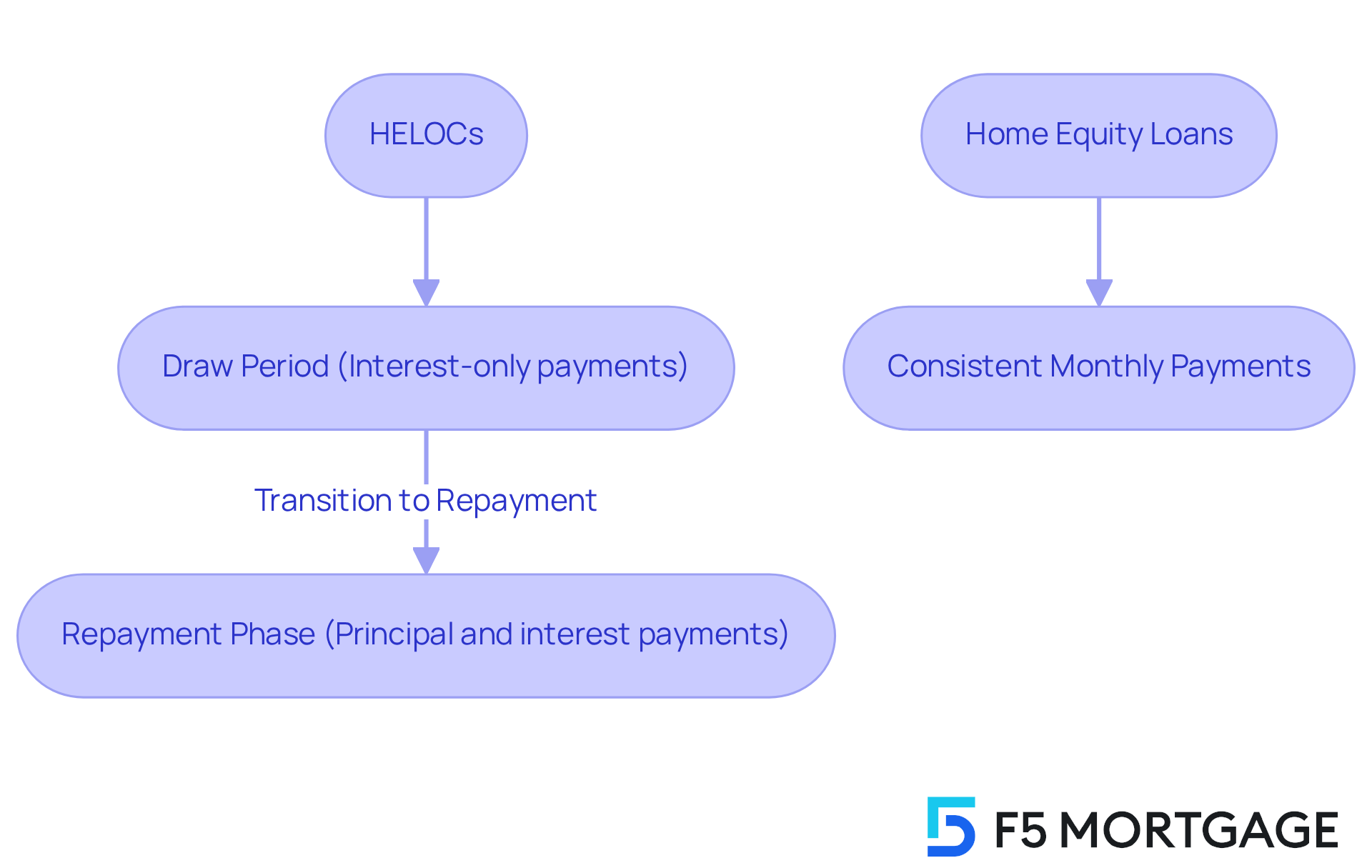

HELOCs come with a draw period followed by a repayment phase, which can feel overwhelming at times. During the draw period, borrowers have the flexibility to access funds and may only need to make interest payments, which can help manage ongoing expenses. Once this period ends, the transition to the repayment stage requires both principal and interest contributions, which can add to stress. In contrast, residential asset borrowing requires consistent monthly contributions right from the start, simplifying budgeting and financial planning.

For instance, consider a typical monthly charge for a $50,000 property mortgage over ten years at a fixed rate of 7.96%, which is around $605.58. This predictability can be comforting for families as it allows for better financial forecasting. Furthermore, residential value financing necessitates consistent monthly contributions from the outset, which is crucial for grasping their budgeting effects.

Currently, the typical HELOC rate is 8.27%. This context helps in comparing interest rates in the discussion of home equity line of credit vs home equity loan. Understanding these repayment structures is vital for effective financial management. As we look ahead to 2025, we see a growing preference among borrowers for predictable payment plans. Financial advisors emphasize the importance of budgeting for these repayments, noting that a clear repayment plan can significantly ease the financial burden associated with property-backed products.

For example, borrowers who manage their draw and repayment phases effectively can reduce financial pressure and make informed decisions regarding their property value options. We know how challenging this can be, but with the right strategies in place, you can navigate these waters with confidence. We’re here to support you every step of the way.

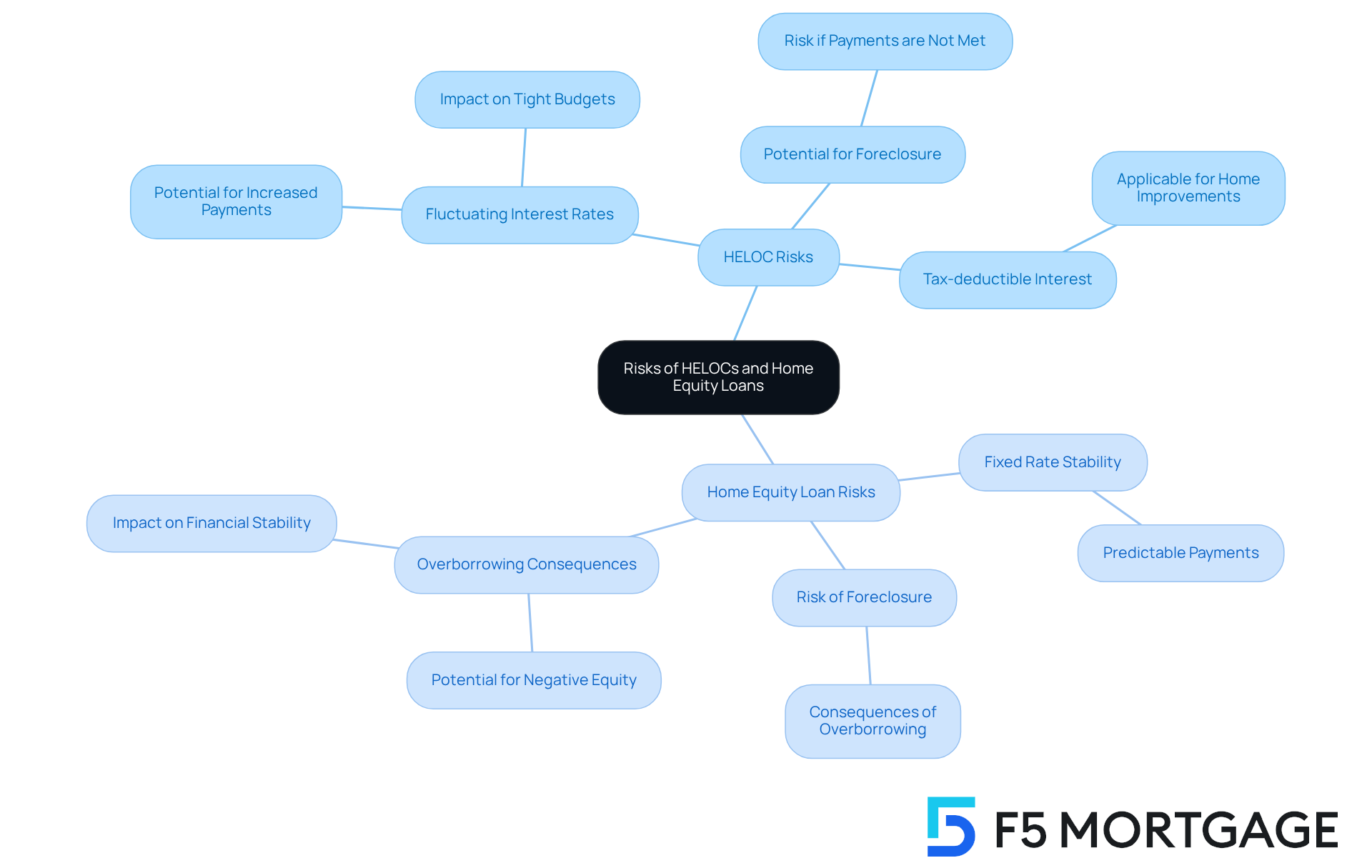

Risks Involved: Understanding the Dangers of HELOCs and Home Equity Loans

Navigating the differences between a home equity line of credit vs home equity loan can be daunting, and we understand how challenging this can be. Both options carry certain risks, primarily the possibility of foreclosure if obligations are not met. With HELOCs, fluctuating interest rates can lead to unpredictable charges, which may become overwhelming. Just imagine a $200 increase in your monthly payments—this could significantly strain tight budgets, especially for families whose debt-to-income (DTI) ratio exceeds the recommended 43%, as expert Glick points out.

Home equity loans offer more stability with fixed rates, but they still pose risks if payments cannot be met. As of Q1 2025, around 1.2 million homes in the U.S. are underwater, highlighting the potential consequences of overborrowing. This situation serves as a reminder of the importance of careful borrowing practices. On a positive note, interest paid on a HELOC might be tax-deductible if used for property improvements, providing a potential financial advantage.

Understanding these risks is essential for families looking to navigate their options wisely, particularly when comparing a home equity line of credit vs home equity loan to avoid financial pitfalls. To manage the uncertainties associated with variable interest rates, we encourage you to set a budget that considers possible payment increases. Additionally, exploring fixed-rate alternatives can offer the stability that many families prioritize. Remember, we’re here to support you every step of the way as you make informed decisions for your financial future.

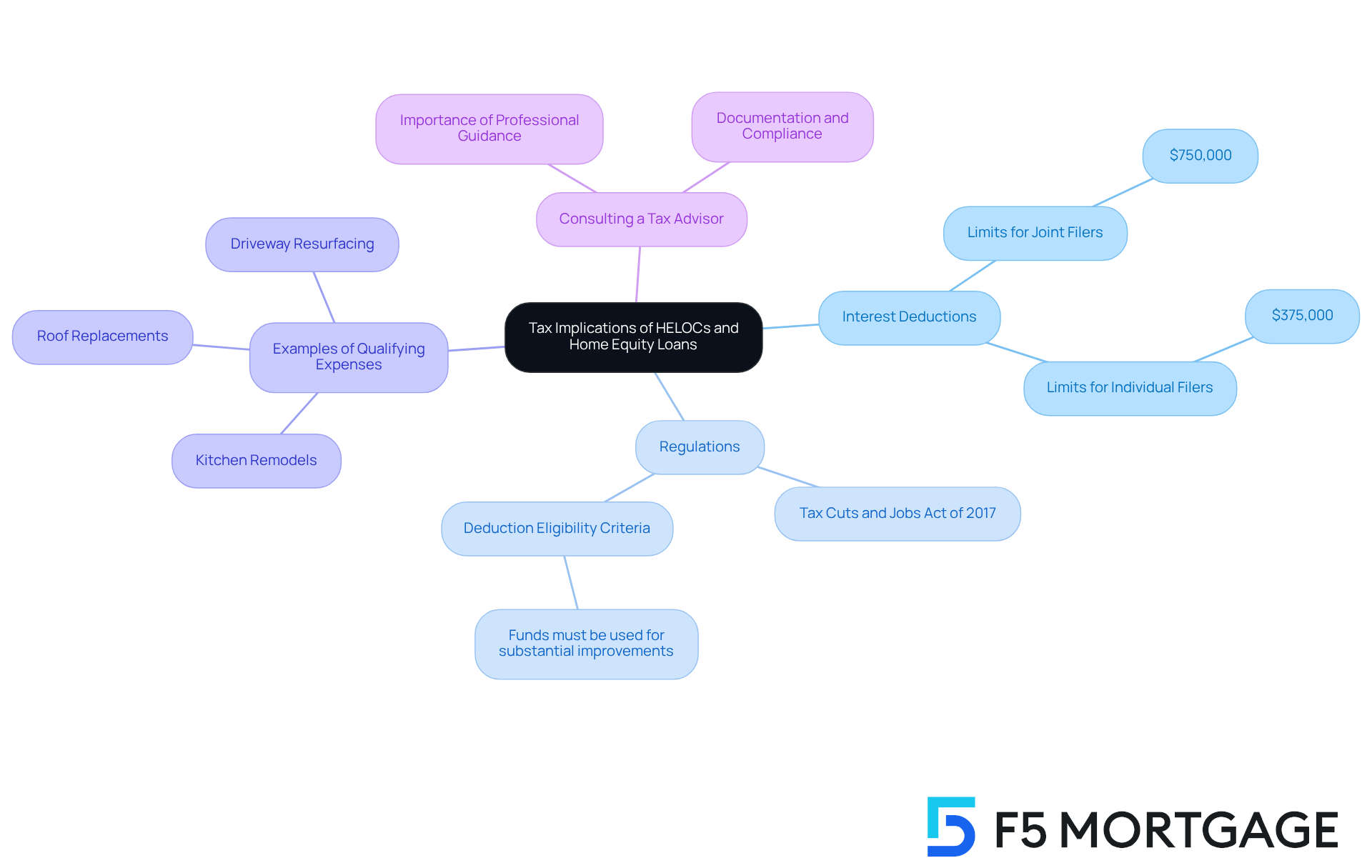

Tax Implications: How HELOCs and Home Equity Loans Affect Your Taxes

Understanding the nuances of tax deductions can feel overwhelming, particularly when considering the differences in home equity line of credit vs home equity loan and property equity financing. The good news is that interest paid on these loans can be tax-deductible, as long as the funds are used for significant property enhancements. According to the Tax Cuts and Jobs Act of 2017, this deduction is applicable only if the borrowed money is spent to ‘buy, build, or substantially improve’ the home that secures the loan. As we look ahead to 2025, it’s crucial to be aware of specific regulations:

- For credit secured after December 15, 2017, the interest deduction is limited to $750,000 for joint filers and $375,000 for individual filers.

This highlights the importance of understanding the timing and purpose of your borrowing to maximize your tax advantages.

Tax experts emphasize the need to keep detailed records of expenses related to residential enhancements. For example, significant renovations like kitchen remodels, roof replacements, or driveway resurfacing can qualify for deductions, while non-structural changes typically do not. To support your claims, it’s wise to retain receipts and invoices. Previously, homeowners could deduct interest on property collateralized borrowing up to $100,000, but under the new tax law, the differences between home equity line of credit vs home equity loan have created confusion.

Real-life examples can illustrate the potential benefits: many homeowners who utilized HELOCs for substantial renovations have successfully claimed deductions, which helped them reduce their taxable income. However, navigating these regulations can be tricky, so it’s essential to consult with a tax advisor who can ensure compliance with current laws and help optimize your tax strategies. By staying informed about these tax implications, you can make more strategic financial decisions regarding your property borrowing. Remember, we’re here to support you every step of the way.

Key Differences Recap: HELOC vs. Home Equity Loan

When comparing home equity line of credit vs home equity loan, it’s important to note that they serve distinct purposes, each with unique advantages and considerations. We understand that navigating these options can be challenging, so let’s explore how each can meet your needs.

HELOCs are defined by their adaptable borrowing features and fluctuating interest rates, making them especially beneficial for ongoing expenses like property renovations or unexpected medical bills. This flexibility allows homeowners to draw funds as needed, which can be particularly helpful for those managing variable costs. However, it’s important to be aware of the possibility of increasing interest rates, which can significantly raise monthly payments during the repayment phase.

On the other hand, property-backed financing offers a lump sum with consistent installments, making it suitable for significant one-time costs such as debt consolidation or large purchases. The predictability of fixed sums provides long-term stability, especially in an economic environment where interest rates may fluctuate. As of September 2025, residential property loans have an average interest rate of 8.37%, compared to HELOCs at 8.03%. This fixed rate can be particularly appealing for homeowners looking to lock in their borrowing costs.

When considering these options, it’s crucial to evaluate the associated risks. Both HELOCs and mortgage products are secured by the borrower’s property, which means that failure to make payments could lead to foreclosure. Additionally, hidden costs such as closing fees and appraisal expenses can impact the overall affordability of either product. A recent study showed that 54% of property owners hesitate to pursue lending against their assets due to affordability concerns, highlighting the importance of thorough financial planning.

Demographically, homeowners seeking flexibility, such as those planning phased renovations or managing variable expenses, often consider the home equity line of credit vs home equity loan. In contrast, when discussing home equity line of credit vs home equity loan, the latter is often favored by those with clear, one-time financial needs. As the market evolves, understanding these distinctions will empower you to make informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

Conclusion

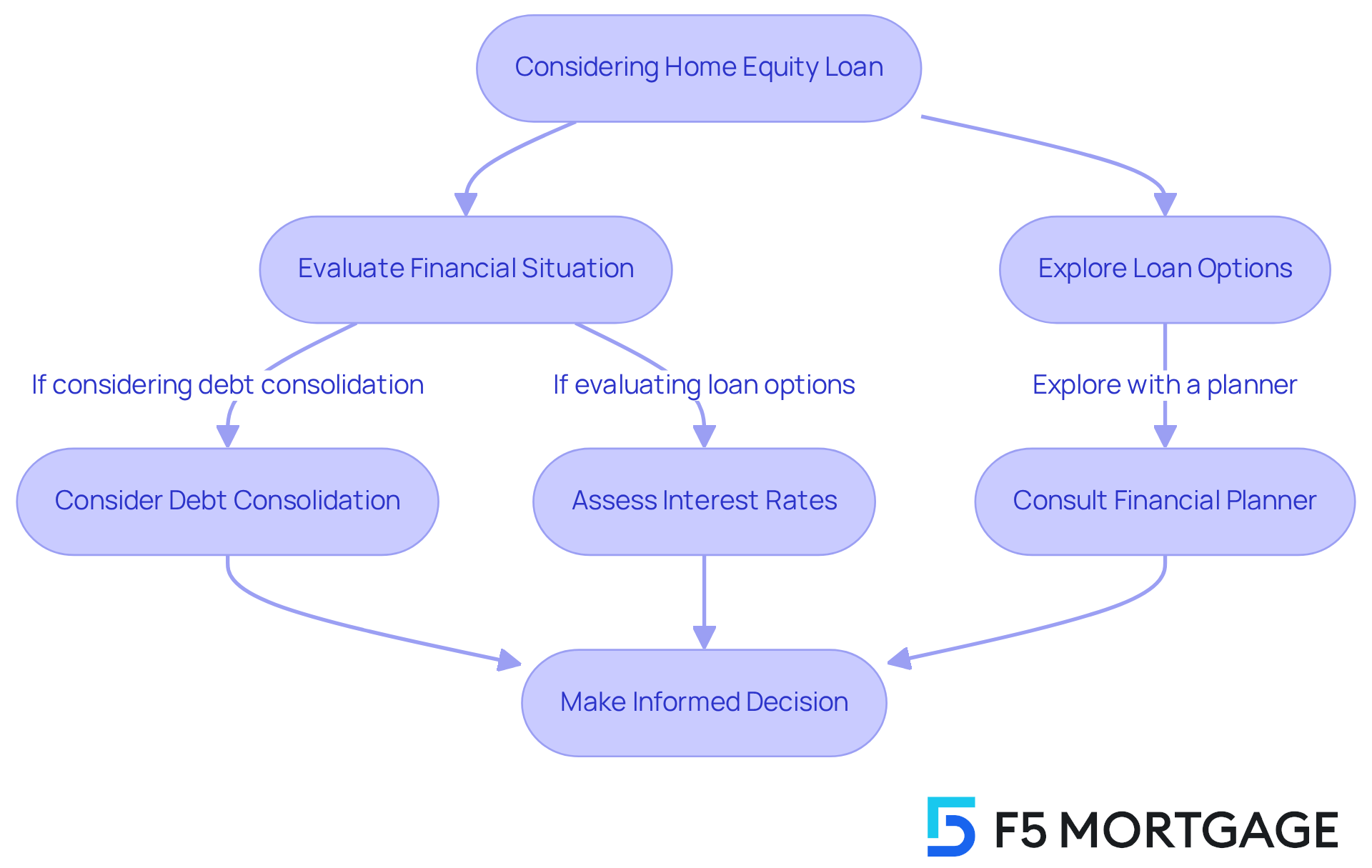

When weighing the options between a home equity line of credit (HELOC) and a home equity loan, it’s important to recognize that each offers unique benefits tailored to different financial needs. Understanding these differences is crucial for making informed borrowing decisions that align with your personal financial goals.

We know how challenging it can be to navigate these choices. HELOCs provide flexible access to funds, making them ideal for projects that require staggered financing. On the other hand, home equity loans offer a lump sum with fixed payments, providing stability for those with specific, one-time financial needs. Additionally, consider the impact of interest rates, credit score requirements, and potential risks associated with each option as you explore your choices.

Ultimately, your decision between a HELOC and a home equity loan should be guided by your unique financial circumstances and intended use of funds. As you assess your options, we’re here to support you every step of the way. Consulting with financial professionals can ensure that your chosen borrowing method aligns with your long-term financial strategies. By taking proactive steps to understand these financial tools, you can empower yourself to make sound decisions, maximizing the benefits of your property equity while minimizing potential risks.

Frequently Asked Questions

What is the difference between a Home Equity Line of Credit (HELOC) and a Home Equity Loan?

A HELOC functions like a credit card, allowing you to borrow against your property’s value up to a set limit and access funds as needed. In contrast, a Home Equity Loan provides a lump sum that is repaid over a set period with consistent monthly payments.

What are the current interest rates for HELOCs and Home Equity Loans?

The typical residential asset financing rate is around 8.22%, while HELOC rates are slightly higher at 8.90%.

Why are property-backed loans becoming more popular among homeowners?

Homeowners are increasingly opting for property-backed loans for stability amid fluctuating interest rates. These loans are often used for major expenses like renovations and debt consolidation.

What are the main reasons homeowners seek property-backed financing?

45% of prospective borrowers cite property renovations as their primary reason for seeking property-backed financing.

What are the advantages of a Home Equity Loan?

A Home Equity Loan offers a lump sum of cash with fixed monthly payments, providing predictability and reassurance for budgeting. It is particularly beneficial for significant expenses like renovations or debt consolidation.

What qualifications are generally needed to obtain a HELOC?

Borrowers typically need to have 15% to 20% equity in their property and a debt-to-income ratio under 44% to qualify for a HELOC.

How are HELOCs utilized in 2025?

There is an anticipated rise in HELOC utilization for renovations, with 39% of property borrowers seeking funds for this purpose.

What is the repayment term for HELOCs?

Repayment terms for HELOCs can extend up to 20 years.

What trend is emerging regarding Home Equity Loans in 2025?

A notable trend is that 16% of homeowners are considering home equity financing specifically for debt consolidation.

How can consolidating debts with a Home Equity Loan benefit homeowners?

Consolidating higher-interest debts into a Home Equity Loan can lower the interest rate from an average of 20.12% to around 8.22%, simplifying financial management and potentially saving significant amounts in interest over time.