Overview

This article shines a light on seven first-time home buyer grants available in Florida, designed to significantly assist individuals on their journey to homeownership. We understand how challenging this process can be, and these programs aim to make it easier for you. Initiatives like the Florida Assist program, the SHIP program, and the Florida Mortgage Credit Certificate offer crucial financial support for down payments and closing costs. By highlighting these resources, we hope to empower you and make homeownership more accessible for many potential buyers.

We know that navigating the world of mortgages can feel overwhelming. However, with the right support, you can take confident steps toward achieving your dream of owning a home. These grants not only alleviate financial burdens but also provide a sense of security and stability for you and your family. Remember, we’re here to support you every step of the way as you explore these opportunities.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for first-time buyers in Florida who are confronted with rising prices and intricate financing options. We understand how challenging this can be. Thankfully, there are various grants and assistance programs available to ease this journey. These resources provide essential financial support that can transform your dream of owning a home into a reality.

As the demand for affordable housing solutions continues to grow, it’s important to explore the most effective resources that can help you overcome financial hurdles and secure your new home. We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Solutions for First-Time Homebuyers

At F5 Mortgage LLC, we understand how daunting the home buying process can be, especially for those looking into first time home buyer grants Florida. That’s why we focus on streamlining your experience, making it as smooth and supportive as possible. Through personalized mortgage consultations, we provide you with access to a variety of loan options tailored specifically to your financial situation. We know how challenging saving for a deposit can be—approximately 38% of first-time purchasers identify it as their biggest hurdle.

Our user-friendly mortgage calculator is designed to simplify the process further. It allows you to grasp potential costs clearly, empowering you to make informed decisions. Our dedicated team of loan officers brings not only extensive expertise but also a personal touch to every interaction. We are here to guide you through each step of your mortgage journey, ensuring you feel supported and confident.

This commitment to personalized service enhances your buying experience and significantly boosts your confidence and preparedness as a first-time home buyer, especially when considering first time home buyer grants in Florida. We’re here to support you every step of the way, making your dream of homeownership a reality.

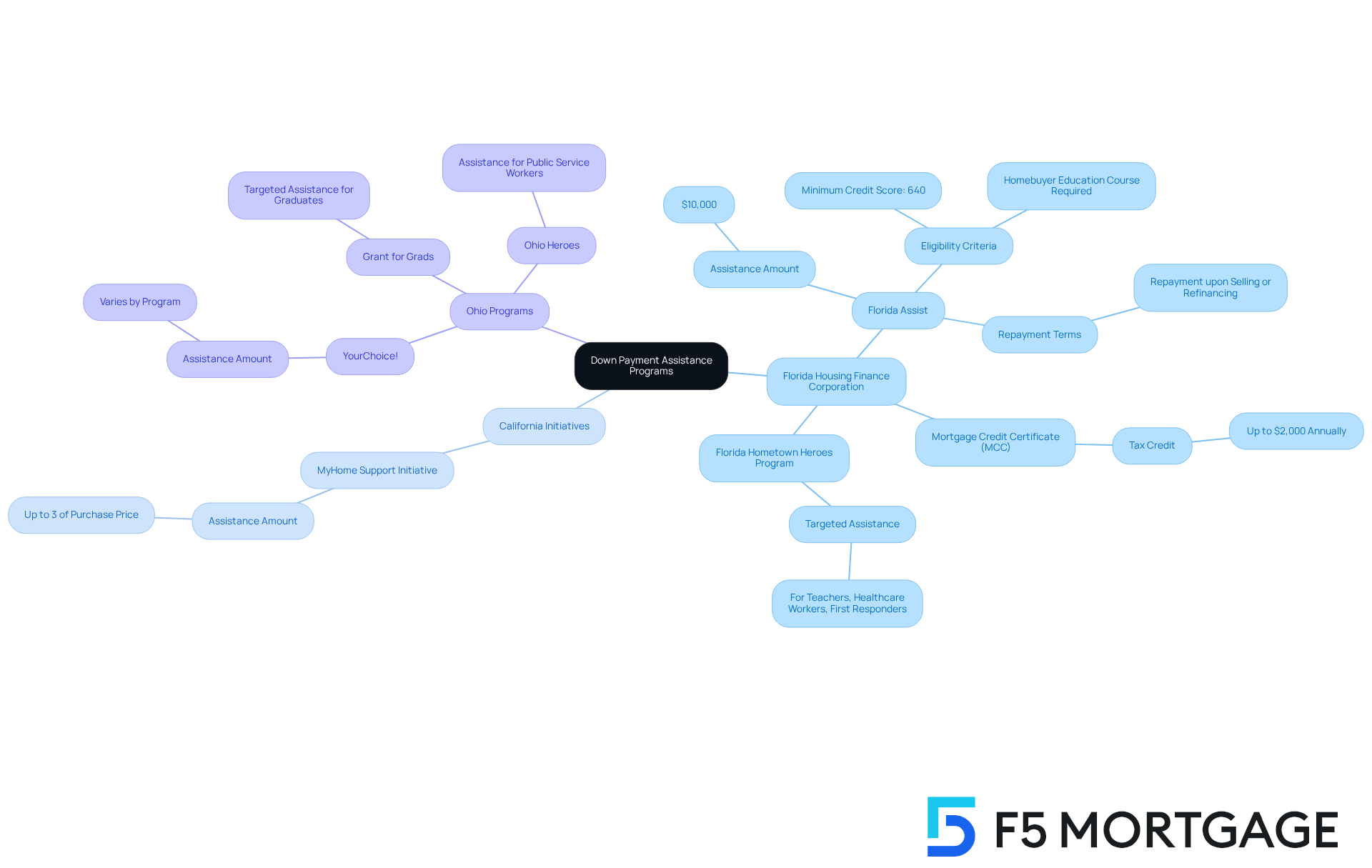

Florida Housing Finance Corporation: Down Payment Assistance Programs

Buying your first home can feel overwhelming, but the Florida Housing Finance Corporation (FHFC) is here to help. They offer various options designed to support you as a first time home buyer, including first time home buyer grants Florida, to help overcome financial challenges. These initiatives are crucial in making homeownership more accessible, providing eligible borrowers with funds for down payments and closing costs.

One standout option is the Florida Assist initiative, which allows for up to $10,000 in assistance through a deferred second mortgage. This can significantly alleviate the financial burden on new buyers. However, to qualify for FHFC initiatives, applicants must have a minimum credit score of 640 and complete a homebuyer education course.

While these initiatives make purchasing a home easier, it’s important to remember that repayment for the Florida Assist initiative is required when refinancing or selling the home. But don’t worry; you’re not alone in this journey. Other states also offer similar support. For instance, F5 Mortgage highlights the MyHome Support Initiative in California, providing up to 3% of the home’s purchase price, and the My Choice Texas Home scheme, which offers up to 5% for down payment and closing support.

If you’re exploring options in Ohio, there are initiatives like YourChoice!, Grant for Grads, and Ohio Heroes. These programs offer valuable assistance tailored to different buyer circumstances, complete with specific eligibility requirements and financial support information that can greatly benefit prospective homeowners.

Ultimately, these initiatives not only aid in acquiring homes but also enhance community stability by increasing ownership rates among those utilizing first time home buyer grants Florida. We know how challenging this can be, but with the right support, homeownership is within your reach. We’re here to support you every step of the way.

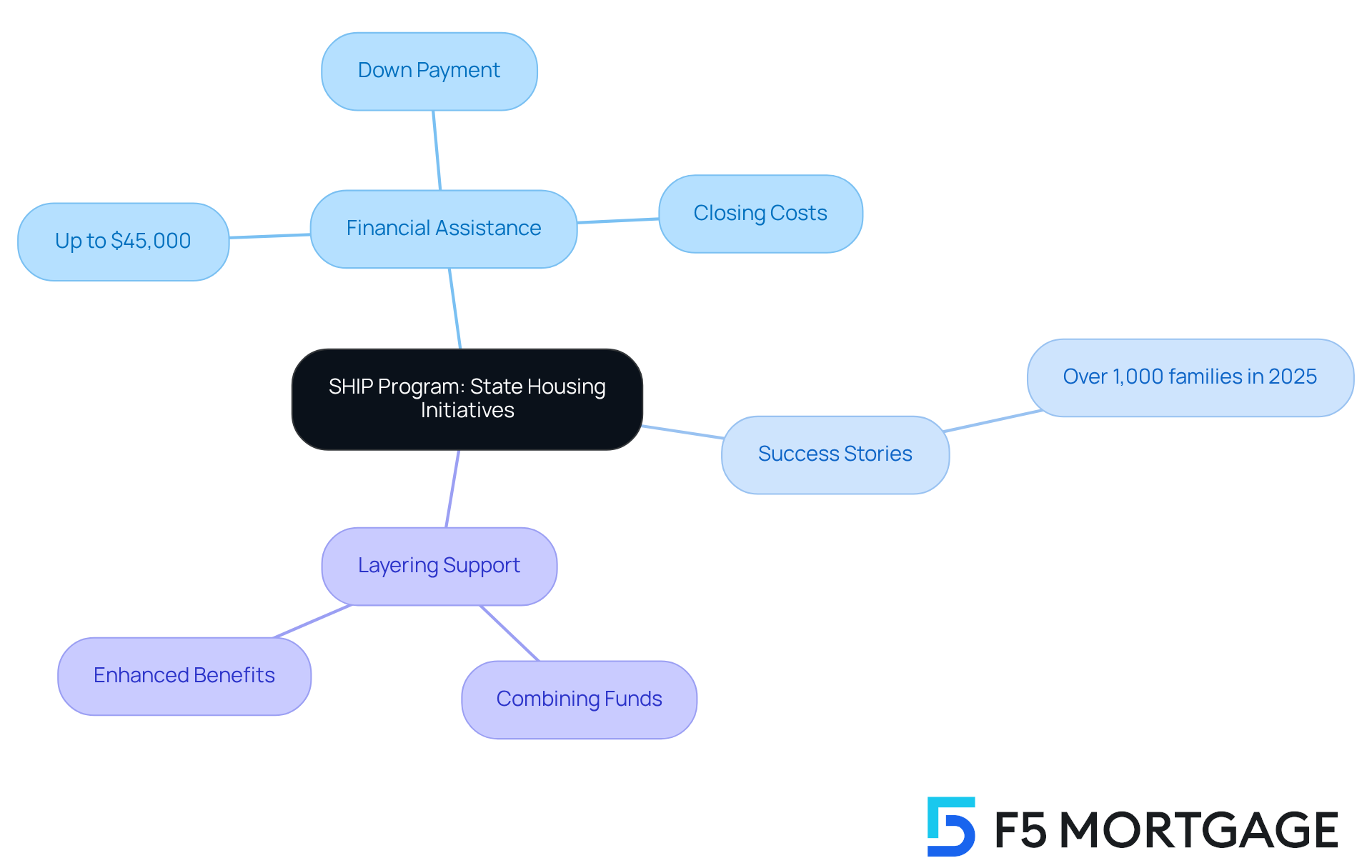

SHIP Program: State Housing Initiatives for First-Time Buyers

The State Housing Initiatives Partnership (SHIP) initiative stands out as a crucial resource for first time home buyer grants Florida. We understand how daunting the journey to homeownership can be, and this state-supported program is here to help. SHIP provides down payment and closing cost assistance to qualifying low- to moderate-income families, effectively reducing the financial strain linked to owning a home. With the potential to receive up to $45,000 in SHIP funds, families can take significant steps toward realizing their housing aspirations, even amidst the challenges of the real estate market.

Success stories are plentiful, with many families benefiting from the SHIP initiative’s financial assistance. In 2025 alone, over 1,000 families have found support through this program, showcasing its vital role in enhancing homeownership opportunities across the state. Housing authorities emphasize that the SHIP initiative is designed to assist those who may struggle to secure financing through traditional means. This makes it an essential tool for low-income families seeking a path to homeownership.

The SHIP initiative’s framework permits layering support, allowing families to combine these funds with other initiatives for even greater benefits. This approach not only increases the financial support available but also enhances the likelihood of successful home purchases. Many participants have reported a smoother transition into homeownership, thanks to the comprehensive support provided by SHIP.

In summary, the SHIP initiative represents a beacon of hope for those seeking first time home buyer grants Florida. It offers essential support that aids low- to moderate-income families in overcoming financial obstacles and realizing their dreams of owning a home. Remember, we’re here to support you every step of the way.

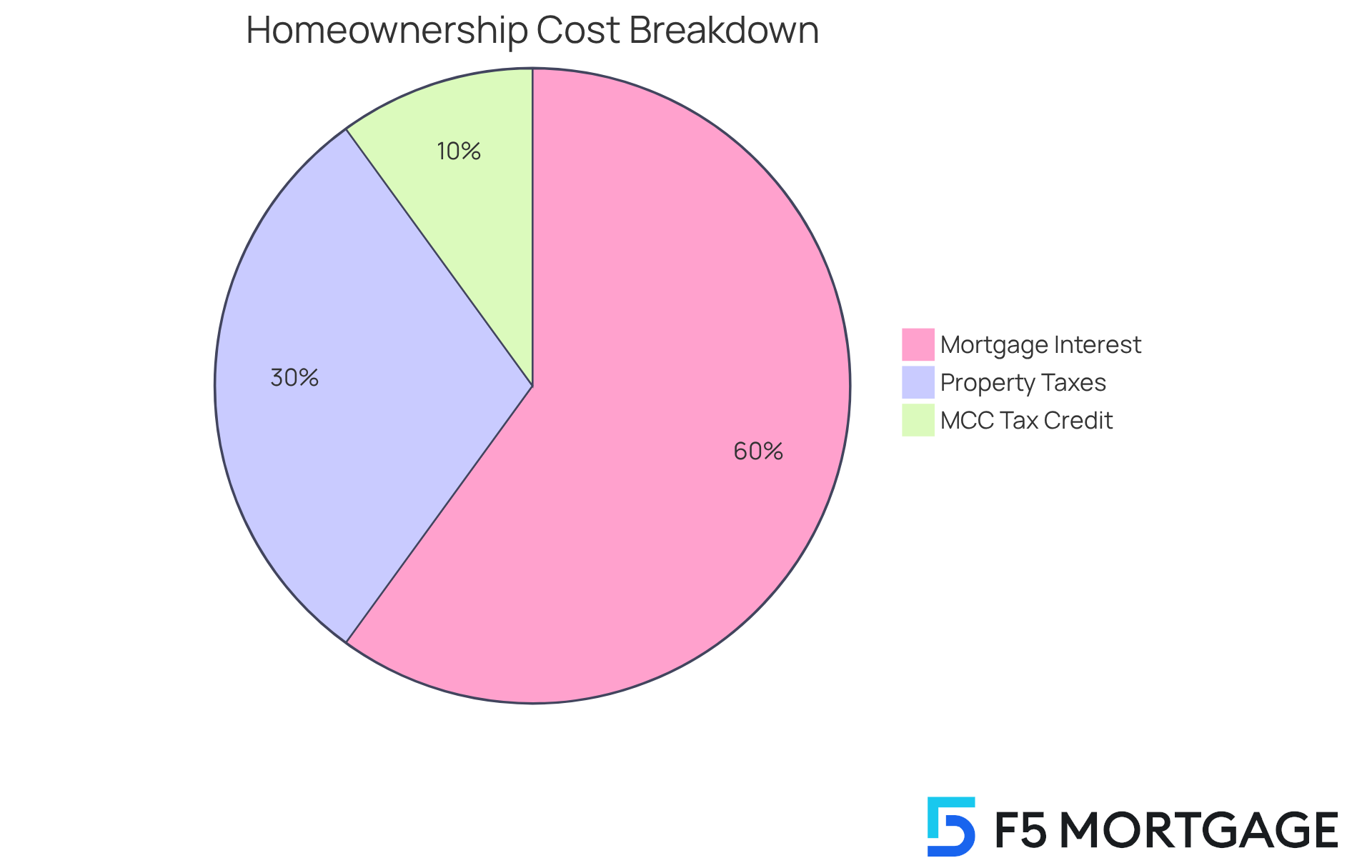

Florida Mortgage Credit Certificate Program: Tax Benefits for First-Time Buyers

The Florida Mortgage Credit Certificate (MCC) initiative provides first time home buyer grants Florida, offering significant tax benefits to first-time homebuyers. We understand how challenging it can be to navigate homeownership, and this program provides qualified borrowers with a tax credit of up to $2,000 each year on their mortgage interest. This effectively reduces the total expense of owning a home, making it more achievable for those on limited budgets.

Imagine the relief of having extra disposable income each month. For those taking advantage of first time home buyer grants Florida, average tax savings from utilizing the MCC can significantly lower monthly expenses. This boost in financial flexibility is crucial for families striving to create a stable home environment. Tax experts emphasize that combining the MCC with other support initiatives can further decrease initial and ongoing costs, paving a more sustainable path to homeownership.

Real-world examples show how families have embraced these tax credits, allowing them to invest in home improvements or save for future expenses. This not only fosters a sense of stability but also strengthens the community. We’re here to support you every step of the way as you explore the possibilities that the MCC offers.

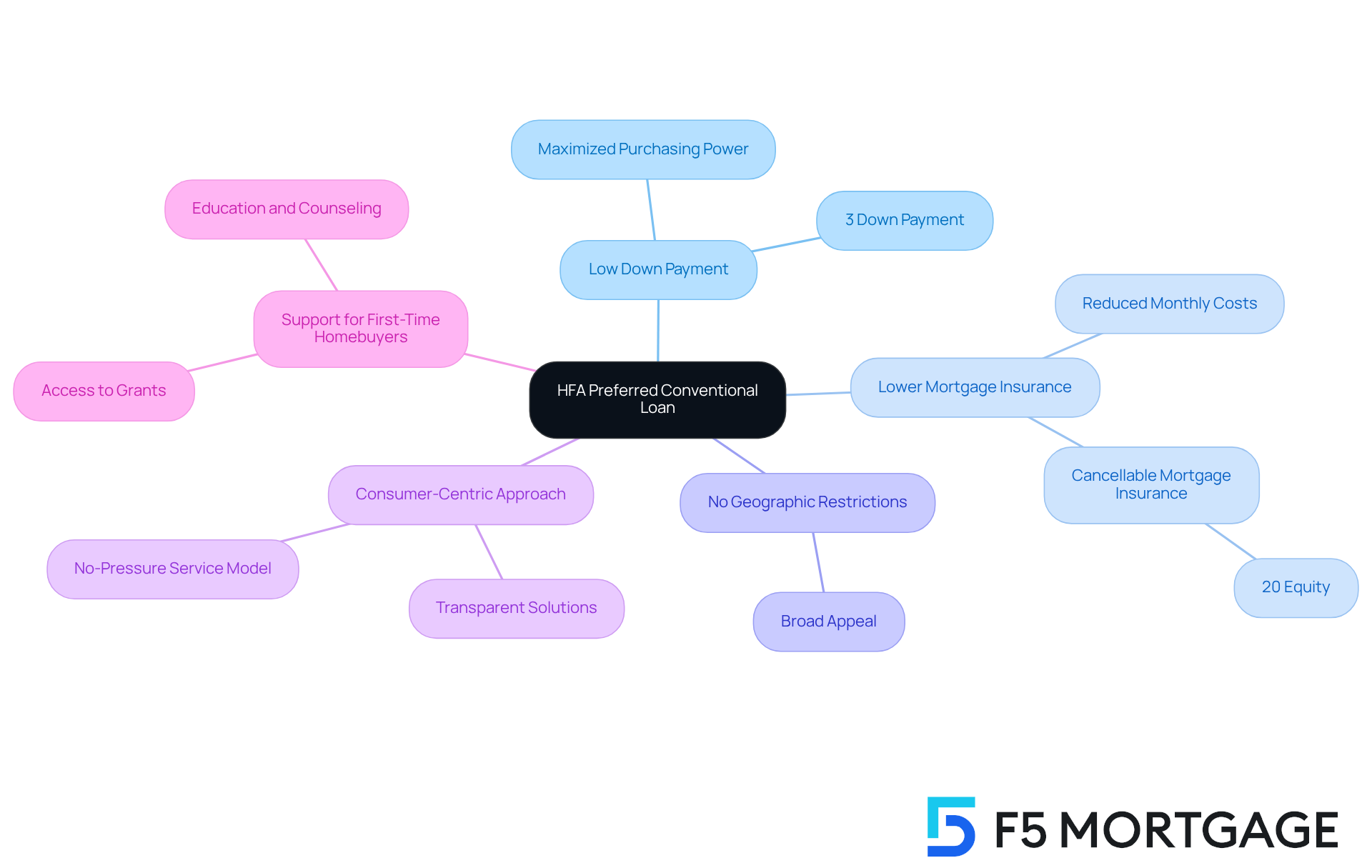

HFA Preferred Conventional Loan: Competitive Financing for New Homeowners

The HFA Preferred Conventional Loan offers an attractive financing option for those seeking first time home buyer grants Florida. With down payment requirements as low as 3%, this feature is particularly beneficial for those who may not have significant savings set aside for a home purchase. We know how challenging this can be, and this initiative also offers lowered mortgage insurance expenses, improving overall affordability for new homeowners. By minimizing upfront costs, the HFA Preferred loan empowers buyers to maximize their purchasing power, making homeownership more accessible.

Notably, this program has no geographic restrictions on loan amounts, broadening its appeal to a diverse range of buyers. Additionally, borrowers can take advantage of cancellable mortgage insurance, which can lead to reduced monthly costs once they achieve 20% equity in their home. Many families have successfully utilized this loan to secure their first homes while keeping their initial financial outlay manageable. This combination of competitive funding alternatives and reduced initial cost requirements positions the HFA Preferred Conventional Loan as an essential resource for first time home buyer grants in Florida.

At F5 Mortgage, we are dedicated to revolutionizing the mortgage experience. We leverage technology to provide transparent, consumer-centric solutions that empower buyers. Unlike traditional lenders who often employ hard sales tactics and provide biased information, F5 Mortgage offers competitive rates and a no-pressure service model. As Chris Thompson, Senior Managing Editor of SEO at SmartAsset, points out, ‘A residence is probably the largest acquisition you’ll undertake, as well as a significant investment.’ This makes it crucial for purchasers to investigate all accessible financing alternatives, including down assistance initiatives that can further improve affordability.

With our exceptional service and dedication to client satisfaction, we’re here to support you every step of the way in navigating the home buying process.

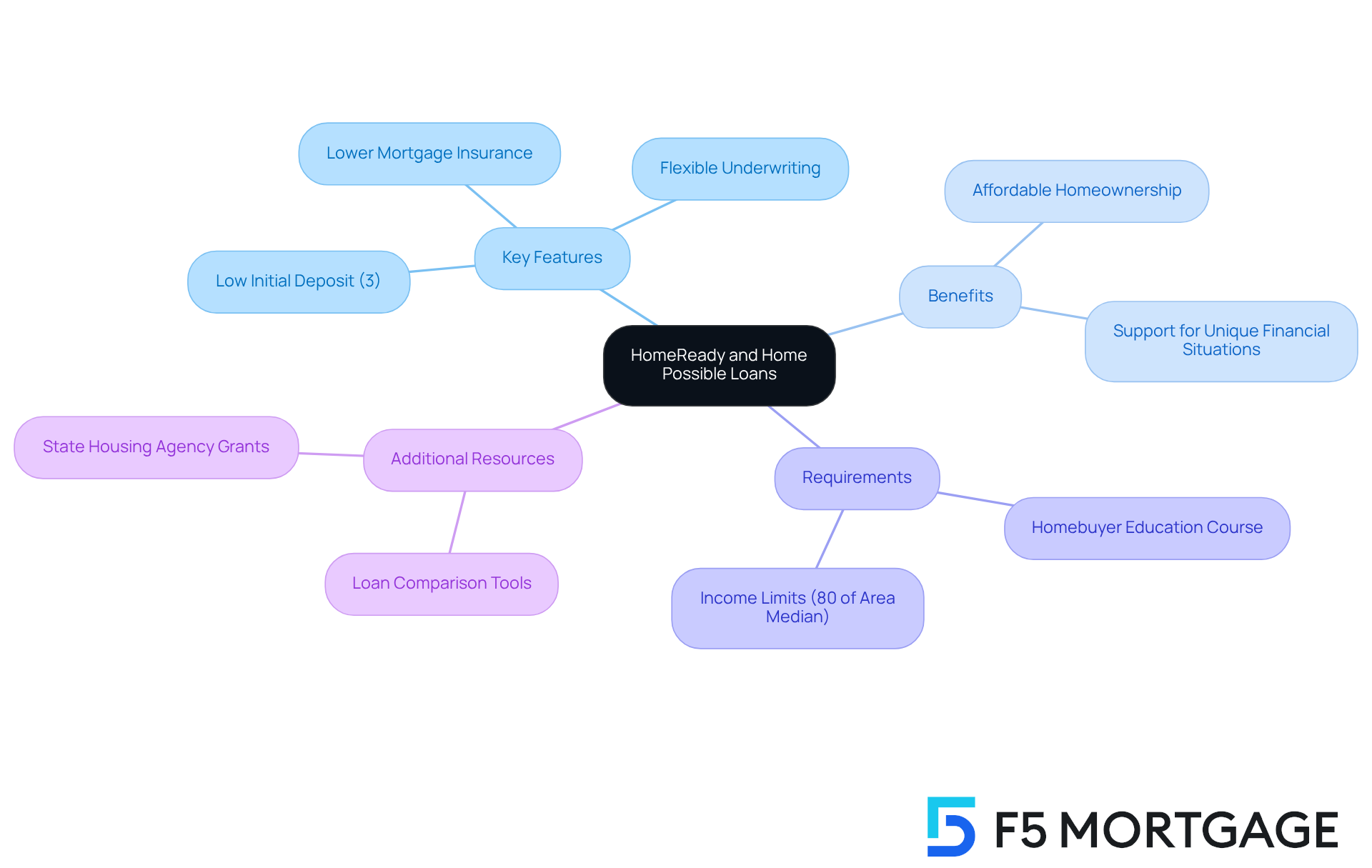

HomeReady and Home Possible Loans: Flexible Financing for First-Time Buyers

The HomeReady and Home Possible loan initiatives are here to empower first-time home buyers in Florida with flexible financing options, including first time home buyer grants Florida. We understand how daunting the process can be, which is why both programs require initial deposits as low as 3%. This makes homeownership more attainable for those with limited savings. Additionally, these loans offer lower mortgage insurance premiums compared to traditional loans, significantly reducing monthly expenses. We know how important it is to cater to individual circumstances, which is why the flexible underwriting standards accommodate borrowers with unique financial situations, including those with non-traditional income sources or lower credit scores. To further support you, borrowers are required to complete a homebuyer education course, preparing them for the responsibilities of homeownership.

As you navigate the home buying process, it’s common to request that sellers make repairs or upgrades as part of your offer. This could range from minor fixes to significant enhancements. However, it’s essential to consider how these requests might impact the overall purchase price. Understanding loan disclosures, such as the Loan Estimate and Closing Disclosure, is crucial. These documents outline the fees and costs associated with the loan, which can fluctuate before closing. By providing these advantageous financing solutions and insights into negotiation strategies, F5 Mortgage is dedicated to helping those seeking first time home buyer grants Florida navigate the home buying process with greater ease and confidence. We’re here to support you every step of the way.

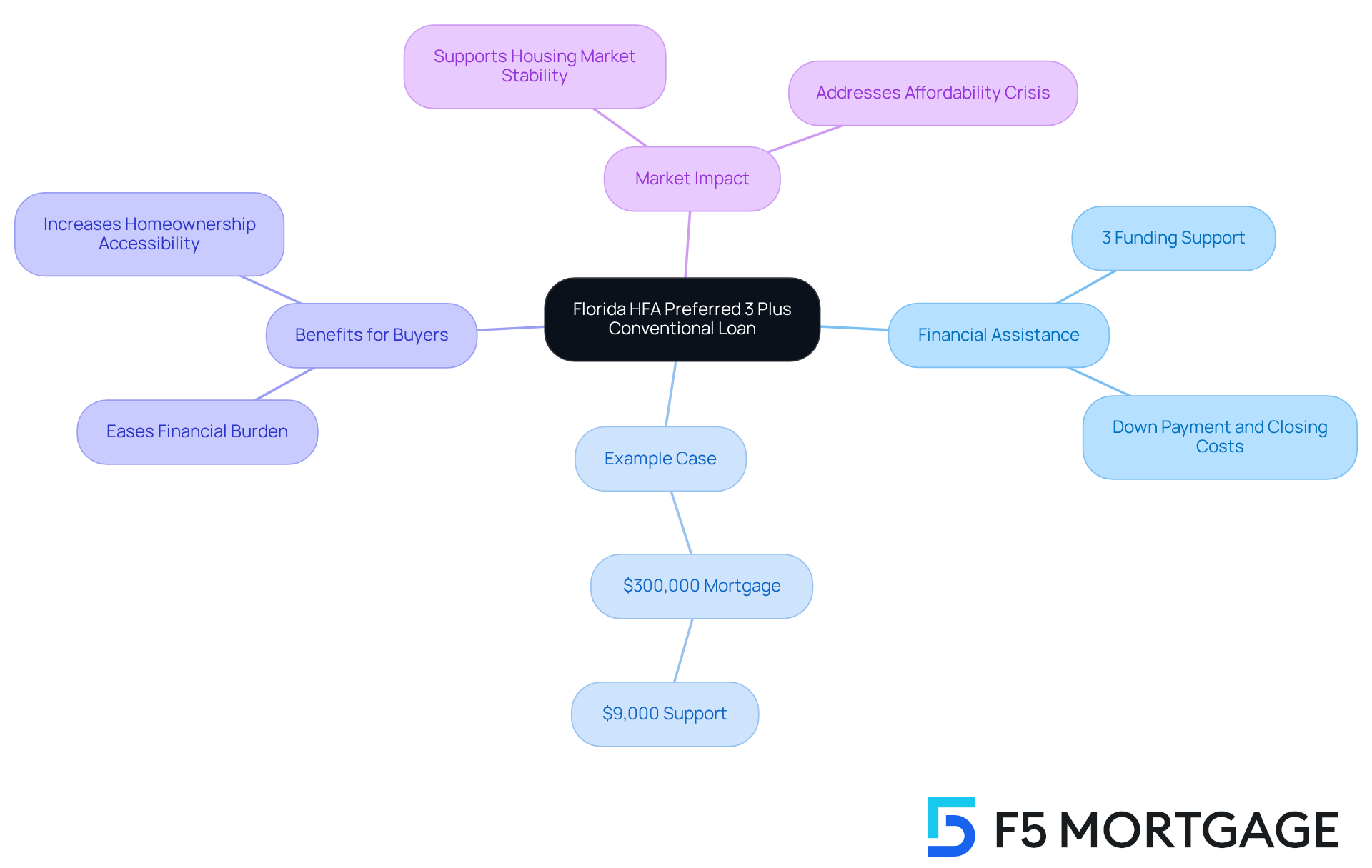

Florida HFA Preferred 3% Plus Conventional Loan: Enhanced Down Payment Assistance

The Florida HFA Preferred 3% Plus Conventional Loan is a vital resource for first-time homebuyers, offering improved funding support that can ease the financial strain of purchasing a home. This program provides eligible borrowers with an additional 3% of the loan amount, which can be used toward down payment and closing costs. By leveraging this support alongside a traditional loan, buyers can significantly lessen their initial financial commitments, making homeownership more attainable.

For instance, if a buyer secures a $300,000 mortgage, the 3% support translates to $9,000, which can greatly alleviate the burden of upfront expenses. This initiative is especially beneficial for those who find it challenging to amass sufficient funds for a down payment, facilitating a smoother transition into homeownership.

Moreover, the impact of enhanced down payment assistance programs like this one is profound. They not only help individuals achieve their dreams of owning a home but also contribute to the overall stability of the housing market. Housing finance experts emphasize that first time home buyer grants Florida are essential initiatives in tackling the affordability crisis many first-time buyers face, where rising home prices often outstrip wage growth. By providing tangible financial support, these programs empower buyers to navigate the complexities of the real estate market with increased confidence.

We know how challenging this can be, and we’re here to support you every step of the way as you embark on this journey towards homeownership.

Salute Our Soldiers Military Loan Program: Homeownership for Veterans

The Salute Our Soldiers Military Loan Program is here to help veterans and active-duty service members achieve their dream of homeownership. We understand how challenging this can be, and that’s why this initiative offers competitive interest rates and flexible financing options. These features make it easier for military families to purchase a home, providing the support they need.

Qualified borrowers can receive up to $15,000 in down payment assistance, significantly easing the financial burden of buying a home. This initiative reflects F5 Mortgage’s commitment to supporting those who have bravely served our nation. It plays a crucial role in enhancing housing opportunities for veterans in Florida.

In addition to this program, Florida provides various support options, including first time home buyer grants Florida for down payments. For example:

- The Florida Assist Second Mortgage Initiative provides up to $10,000 for upfront expenses.

- The Florida Homeownership Loan Initiative offers up to $10,000 for down payment or closing costs.

- First time home buyer grants Florida also offer up to $10,000 for down payment or closing costs.

By alleviating these upfront costs, these initiatives empower military families to secure stable housing, contributing to their overall well-being and financial security.

As Alley Cohen, a satisfied client, shared, “Everything went very smoothly!” At F5 Mortgage, we are dedicated to supporting military families through these initiatives, promoting property ownership among veterans every step of the way.

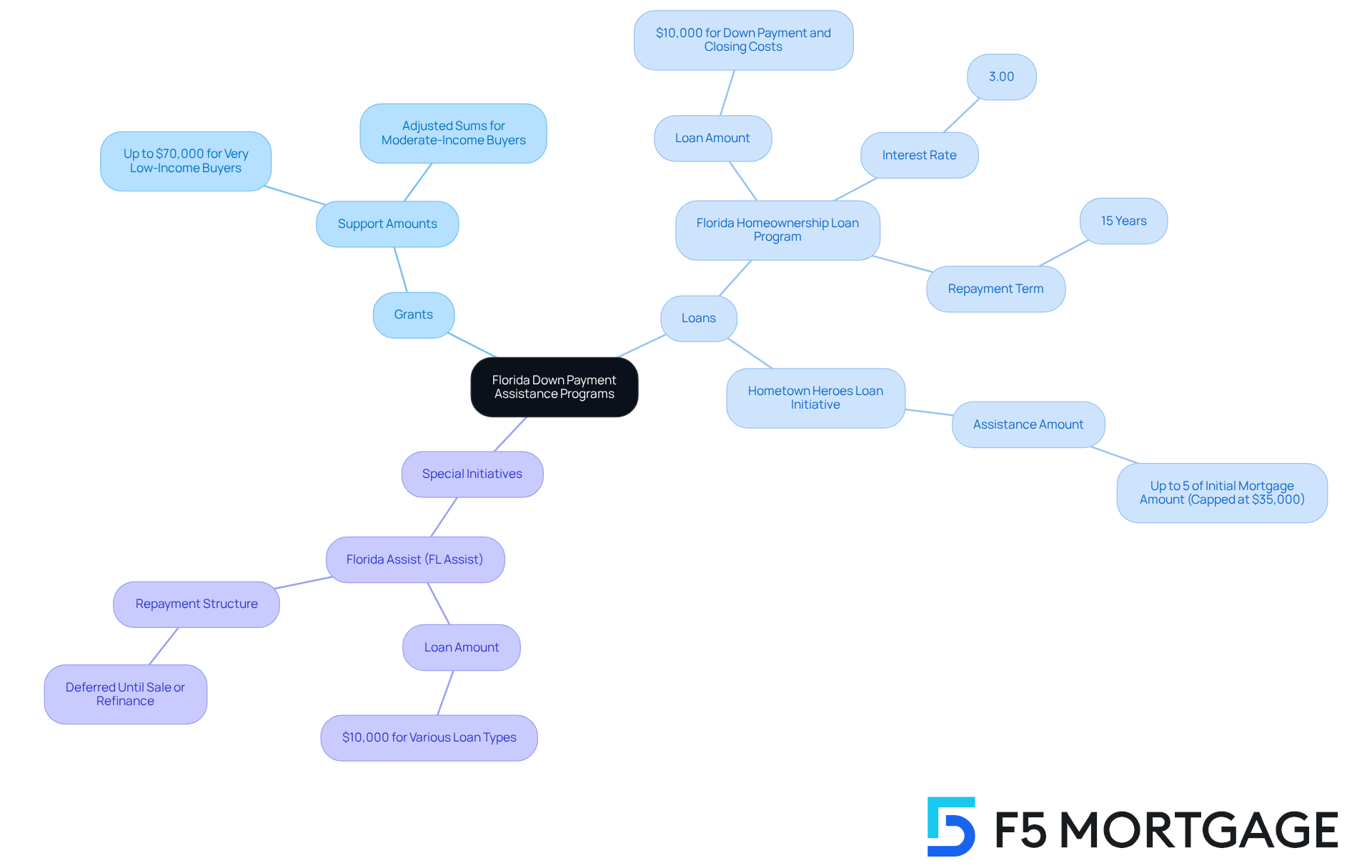

Florida Down Payment Assistance Programs: Financial Support for New Buyers

Florida offers a robust selection of first-time home buyer grants Florida designed to help first-time homebuyers achieve their dreams of homeownership. We know how challenging this can be, and these initiatives provide financial aid in various forms, including grants, zero-interest loans, and deferred payment options. For example, some counties offer support of up to $70,000 for very low-income buyers, while moderate-income buyers may receive adjusted sums based on their financial situations. This flexibility allows first-time buyers to navigate the complexities of home purchasing without the burden of significant upfront costs.

In addition to direct financial backing, initiatives like the Hometown Heroes Loan Initiative provide up to 5% of the initial mortgage amount in assistance, capped at $35,000, specifically for qualified community workers. Furthermore, the Florida Homeownership Loan Program offers loans up to $10,000 for down payment and closing costs, all at a competitive interest rate of 3.00%, repayable over 15 years.

Success stories abound, with many first-time homebuyers utilizing these state assistance programs to secure their dream homes. Financial specialists emphasize the significance of first-time home buyer grants Florida and loans, noting that they greatly reduce the obstacles to homeownership for many Floridians. By taking advantage of these resources, first-time buyers can turn their dreams into reality, making owning a home more attainable than ever. We’re here to support you every step of the way as you embark on this exciting journey.

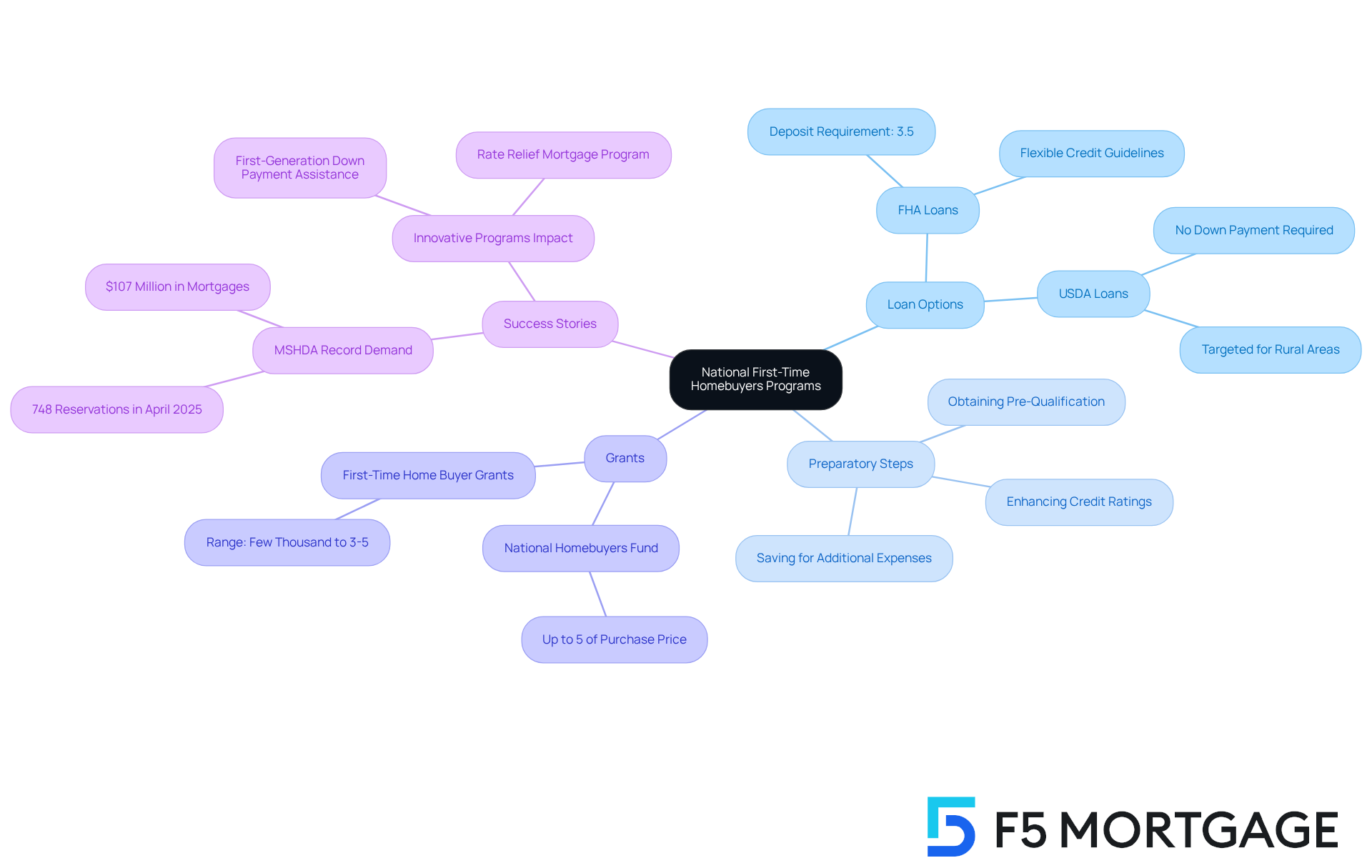

National First-Time Homebuyers Programs: Broader Resources for Homeownership

In addition to state-specific initiatives, there are numerous national programs, including first time home buyer grants Florida, designed to support homebuyers like you. The Federal Housing Administration (FHA) loans and USDA loans stand out as accessible financing options, featuring low deposit requirements that make owning a home more achievable. FHA loans allow deposits as low as 3.5%, while USDA loans offer the unique advantage of requiring no initial contribution. This makes them especially beneficial for buyers in rural and certain suburban areas.

Housing experts emphasize the importance of these loans for first-time buyers. They not only reduce upfront costs but also provide flexible credit guidelines. For example, FHA loans are crafted to accommodate borrowers with diverse credit histories, while USDA loans are geared toward low- to moderate-income families, further promoting homeownership.

Before seeking assistance for the down payment, novice purchasers should take a few preparatory steps. Enhancing credit ratings, saving for additional expenses, and obtaining pre-qualification from lenders can significantly improve your chances of receiving support. On a national level, first time home buyer grants Florida typically offer down payment assistance initiatives ranging from a few thousand dollars to 3% to 5% of the home’s purchase price. These first time home buyer grants Florida can significantly alleviate the financial burden associated with purchasing a home. For instance, the National Homebuyers Fund provides grants of up to 5% of the purchase price, which can be combined with FHA or USDA loans to cover the initial deposit and closing costs.

Real-world examples illustrate the effectiveness of these initiatives. In Michigan, the Michigan State Housing Development Authority (MSHDA) reported unprecedented demand for its single-family mortgage and down payment support programs, highlighting the success of efforts aimed at making homeownership attainable. In April 2025 alone, MSHDA documented 748 reservations totaling over $107 million in mortgages and support, showcasing the growing reliance on such resources.

By leveraging these national programs and focusing on local assistance options in Ohio, first-time home buyer grants Florida can provide you with the support needed to navigate the complexities of homeownership with greater ease. This approach ultimately enhances your chances of securing a home while minimizing financial strain. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Navigating the journey to homeownership can be challenging, especially for first-time buyers in Florida. We know how overwhelming this process can feel. However, a wealth of resources and grants are available to ease this journey, making the dream of owning a home more attainable. From personalized mortgage solutions at F5 Mortgage to various state and national assistance programs, potential homeowners have numerous avenues to explore that can significantly reduce financial burdens.

Key initiatives highlighted include:

- Florida Housing Finance Corporation’s down payment assistance programs

- SHIP initiative for low- to moderate-income families

- Florida Mortgage Credit Certificate program offering tax benefits

Each of these options plays a crucial role in supporting first-time buyers by providing financial aid, educational resources, and flexible financing solutions. The collective impact of these programs not only empowers individuals to achieve homeownership but also strengthens community stability through increased ownership rates.

Ultimately, leveraging these first-time homebuyer grants and assistance programs is essential for those looking to secure their first home in Florida. By taking proactive steps and utilizing available resources, prospective buyers can navigate the complexities of the real estate market with confidence. Embracing these opportunities not only paves the way for personal success but also contributes to a more vibrant and stable housing market, ensuring that the dream of homeownership remains within reach for many. We’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage provide for first-time homebuyers?

F5 Mortgage offers personalized mortgage consultations and access to various loan options tailored to the financial situations of first-time homebuyers. They aim to streamline the home buying process and provide support throughout the mortgage journey.

What challenges do first-time homebuyers face according to F5 Mortgage?

Approximately 38% of first-time purchasers identify saving for a deposit as their biggest hurdle when buying a home.

How does F5 Mortgage assist in understanding potential costs?

F5 Mortgage provides a user-friendly mortgage calculator that simplifies the process, helping buyers grasp potential costs clearly and make informed decisions.

What is the Florida Housing Finance Corporation (FHFC) and what does it offer?

The FHFC offers various programs to support first-time homebuyers, including grants for down payments and closing costs. Their initiatives aim to make homeownership more accessible.

What is the Florida Assist initiative?

The Florida Assist initiative provides up to $10,000 in assistance for down payments through a deferred second mortgage, aimed at alleviating financial burdens for new buyers.

What are the eligibility requirements for FHFC initiatives?

Applicants must have a minimum credit score of 640 and complete a homebuyer education course to qualify for FHFC initiatives.

What happens to the Florida Assist funds when refinancing or selling the home?

Repayment of the Florida Assist funds is required when the homeowner refinances or sells the property.

What other states offer similar support programs for first-time homebuyers?

Other states have similar initiatives, such as the MyHome Support Initiative in California and the My Choice Texas Home scheme, which provide financial assistance for down payments and closing costs.

What is the SHIP program and who does it assist?

The State Housing Initiatives Partnership (SHIP) program provides down payment and closing cost assistance to qualifying low- to moderate-income families, helping them overcome financial challenges associated with homeownership.

How much financial assistance can families receive through the SHIP program?

Families can potentially receive up to $45,000 in SHIP funds to assist with their home purchase.

Can SHIP funds be combined with other assistance programs?

Yes, the SHIP initiative allows for layering support, enabling families to combine these funds with other initiatives for greater financial benefits.

What impact has the SHIP initiative had on families in Florida?

The SHIP initiative has successfully supported over 1,000 families in 2025 alone, enhancing homeownership opportunities and providing essential assistance to those struggling to secure financing through traditional means.