Overview

Home equity loans can be a viable option for borrowers with bad credit. We understand how challenging this can be, and it’s important to know that these loans often come with lower interest rates. They also allow access to larger sums of money secured by your property.

In this article, we outline a structured approach to help you navigate the application process:

- Understand the eligibility criteria.

- Gather the necessary documentation.

- Compare lenders to find the best fit for your needs.

We’re here to support you every step of the way, especially when troubleshooting common challenges. By following these steps, you can improve your chances of securing a loan, even with credit issues. You deserve access to the financial resources you need.

Introduction

Homeownership can indeed feel like a double-edged sword, particularly for those facing the challenges of bad credit. We understand how overwhelming this situation can be. While the equity you’ve built over the years presents a potential lifeline, navigating home equity loans may seem daunting. This guide aims to illuminate the essential steps to leverage home equity financing, offering you an opportunity to access funds at lower interest rates, even in the face of financial difficulties.

However, various hurdles, such as documentation requirements and the need to compare lenders, can complicate the process. You might be wondering: how can you effectively maneuver through this intricate landscape to secure the best deal? Rest assured, we’re here to support you every step of the way.

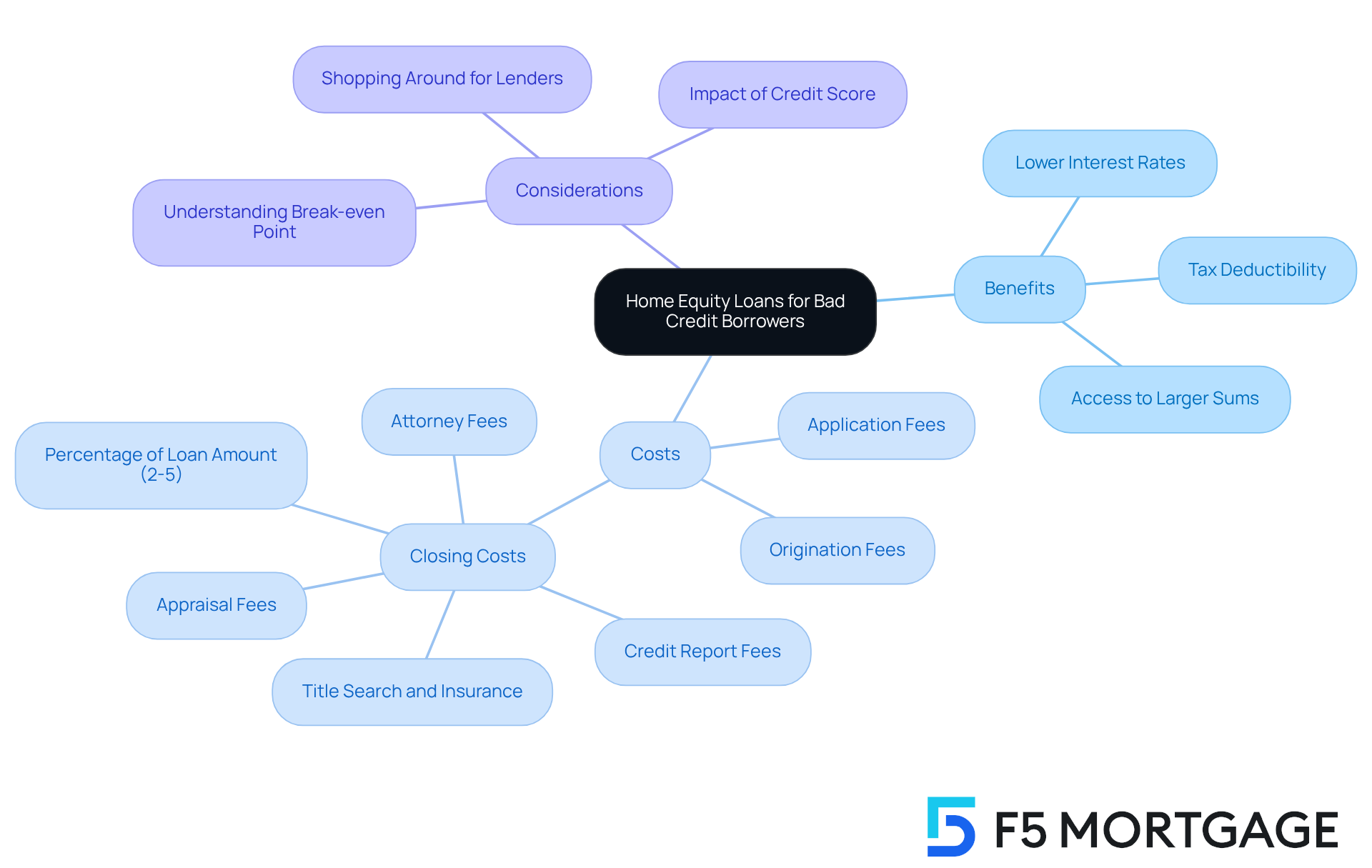

Understand Home Equity Loans and Their Benefits for Bad Credit Borrowers

Home equity financing allows homeowners to tap into the equity they have built in their property. For those facing financial difficulties, this option can be particularly advantageous, as it often comes with lower interest rates compared to unsecured loans. Since the financing is secured by the property, lenders may be more willing to offer a home equity loan for bad credit to individuals with lower credit scores. Understanding the benefits of a home equity loan for bad credit can empower borrowers to make informed financial decisions, especially when dealing with unexpected expenses or the need for debt restructuring.

When considering a home equity line, it’s crucial to understand the costs associated with refinancing in California. Closing costs typically range from 2% to 5% of the amount borrowed, which can significantly impact your overall financial plan. For instance, if you plan to borrow $300,000, you could expect to pay between $6,000 and $15,000 in closing costs. These costs may include:

- Application fees: Between $75 and $500

- Origination fees: Between 0.5% and 1.5% of the loan amount

- Credit report fees: Around $35

- Appraisal fees: Usually between $300 and $500, depending on location and property type

- Title search and title insurance: Between 0.5% and 1% of the loan amount

- Discount points: 1% of the loan amount for a 0.25% interest rate reduction

- Attorney fees: $500 or more

- Survey fee: $150 to $400

Calculating your break-even point—how long it will take to recover these costs through savings in monthly payments—can help you determine if refinancing is the right choice for you.

Additionally, it’s important to shop around for lenders. By comparing rates, fees, and terms, you can find the best option tailored to your needs. F5 Mortgage offers competitive rates and personalized support, making it a great choice for those looking to maximize their property value while navigating the complexities of refinancing.

Key Benefits:

- Lower Interest Rates: Home equity loans generally offer lower rates than personal loans or credit cards.

- Tax Deductibility: The interest paid on loans secured by property may be tax-deductible, depending on how the funds are used.

- Access to Larger Sums: Borrowers can access larger amounts compared to unsecured loans, making it ideal for significant expenses like renovations or debt repayment.

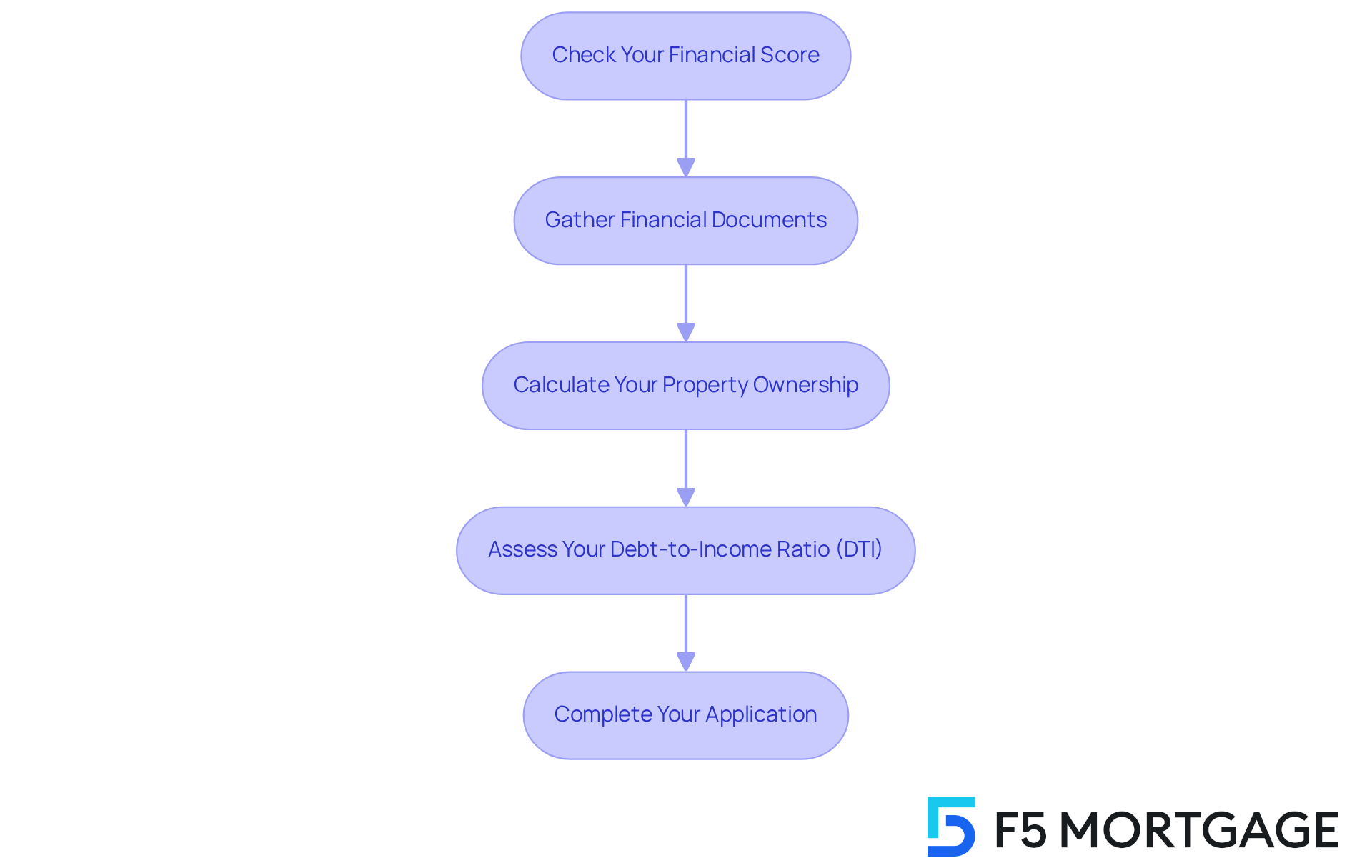

Gather Necessary Documentation and Assess Your Eligibility

Before applying for a home equity line of credit, we understand how important it is to gather the necessary documentation and assess your eligibility. Here’s a structured approach to help you navigate this process with confidence:

-

Check Your Financial Score: Start by obtaining your financial report and score. Many lenders view a score of 620 or above as suitable for financing, even if your financial history isn’t perfect. Some may accept lower scores based on additional factors. As Linda Bell, a certified HELOC expert, points out, excellent scores—typically 750 or above—are a vital trait of successful property loan borrowers.

-

Gather Financial Documents: Prepare the following essential documents:

- Recent pay stubs or proof of income

- Tax returns for the last two years

- Bank statements for the last few months

- Documentation of any existing debts, such as credit cards and loans

-

Calculate Your Property Ownership: Determine your property ownership by subtracting your mortgage balance from your property’s current market value. Most lenders generally require at least 15-20% equity to qualify for property equity financing, in line with usual combined loan-to-value (CLTV) ratio limits. Many lenders also ask property owners to maintain at least an 80% value-to-debt ratio, which means you should have reduced at least 20% of your initial borrowing amount or your residence has appreciated in value.

-

Assess Your Debt-to-Income Ratio (DTI): Calculate your DTI by dividing your total monthly debt payments by your gross monthly income. A DTI of around 40% is often regarded as advantageous, improving your chances of approval. Typically, a maximum of a 43% DTI ratio is necessary for housing financing, whether you’re obtaining a conventional mortgage or refinancing an existing agreement. Linda Bell notes that low creditworthiness, a high DTI, and inadequate ownership value can be reasons why applicants may not receive property financing options.

-

Complete Your Application: Fill out a refinancing application with your chosen lender. You’ll need details like Social Security numbers, bank statements, tax returns, and pay stubs.

Understanding these factors can greatly enhance your opportunities for obtaining a home equity loan for bad credit based on your property’s value, even if your financial rating is low. Remember, preparation and awareness of your financial standing are key to navigating this process successfully. We’re here to support you every step of the way.

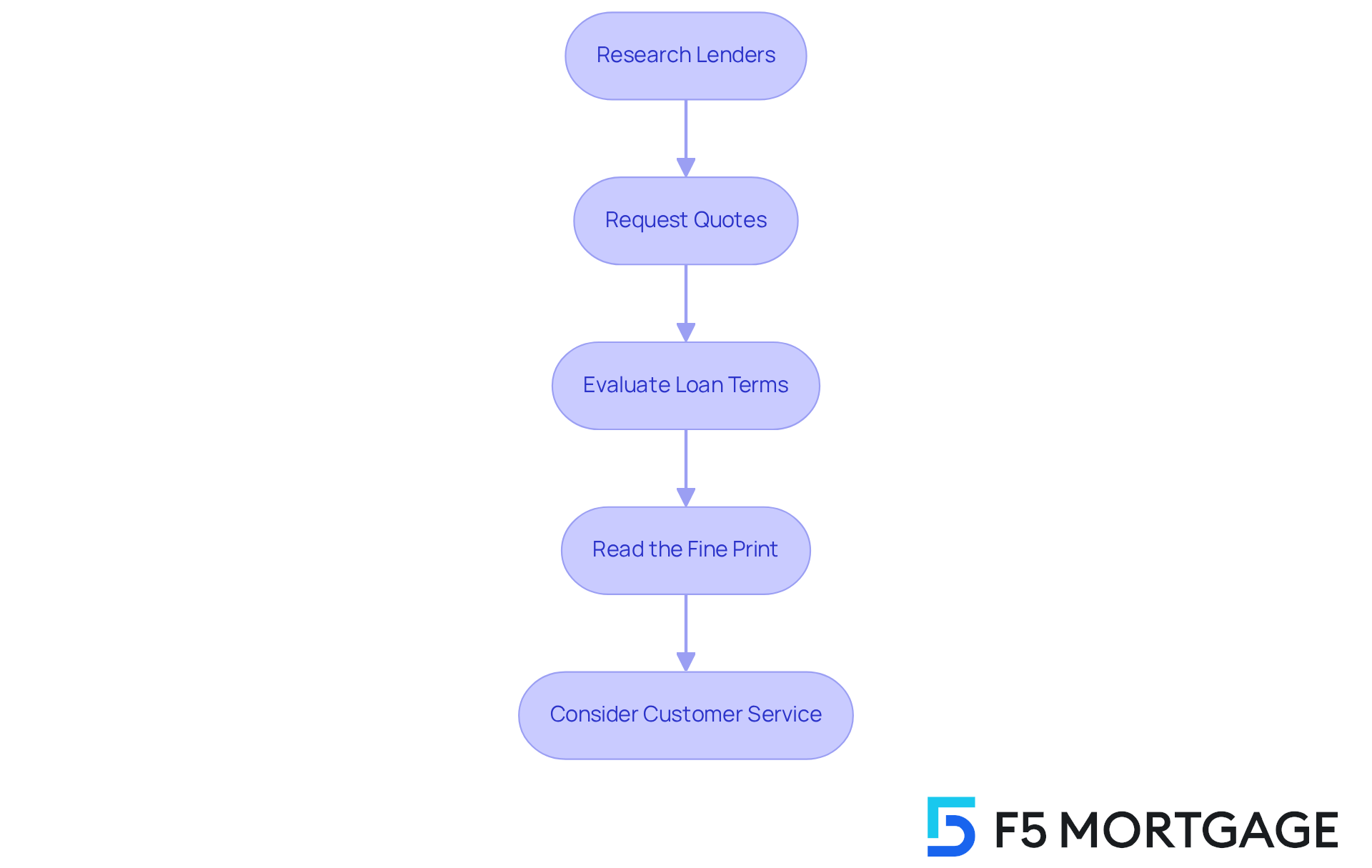

Compare Lenders and Choose the Right Home Equity Loan for Your Needs

After gathering your documentation and assessing your eligibility, the next step is to compare lenders and select the right property financing for you. Here’s how to navigate this process:

-

Research lenders by identifying those that specialize in home equity loans for bad credit for borrowers with poor credit. Online reviews and ratings can provide valuable insights into their reputation and service quality. Consider reaching out to F5 Mortgage, which offers a home equity loan for bad credit, recognized for its competitive rates and personalized service designed to meet your needs.

-

Request Quotes: Don’t hesitate to contact multiple lenders for quotes. It’s crucial to ask about interest rates, financing terms, and any fees involved when exploring a home equity loan for bad credit to gain a complete understanding of your options. F5 Mortgage can offer quotes tailored to your specific situation.

-

Evaluate Loan Terms: Pay attention to these key aspects:

- Interest Rates: Compare fixed and variable rates to see which aligns best with your financial strategy. Currently, typical interest rates for property collateralized borrowing range from 6.62% to 7.04%. F5 Mortgage provides competitive rates on a home equity loan for bad credit, which could help you save.

- Borrowing Amounts: Ensure the lender can accommodate the amount you wish to borrow, especially considering the average home equity borrowing amount is around $30,594.

- Repayment Terms: It’s important to understand the repayment period and monthly payment amounts, as these will directly impact your budget.

-

Read the Fine Print: Take the time to thoroughly review the credit agreement for any hidden charges or penalties for early repayment, as these can significantly affect your overall cost. F5 Mortgage prioritizes transparency in its agreements, ensuring you know what to expect.

-

Consider Customer Service: Opt for a lender that provides exceptional customer support. This is vital during the financing process, especially if you encounter challenges along the way. F5 Mortgage takes pride in offering personalized service to guide you through every step.

We understand how challenging this can be, and we’re here to support you every step of the way.

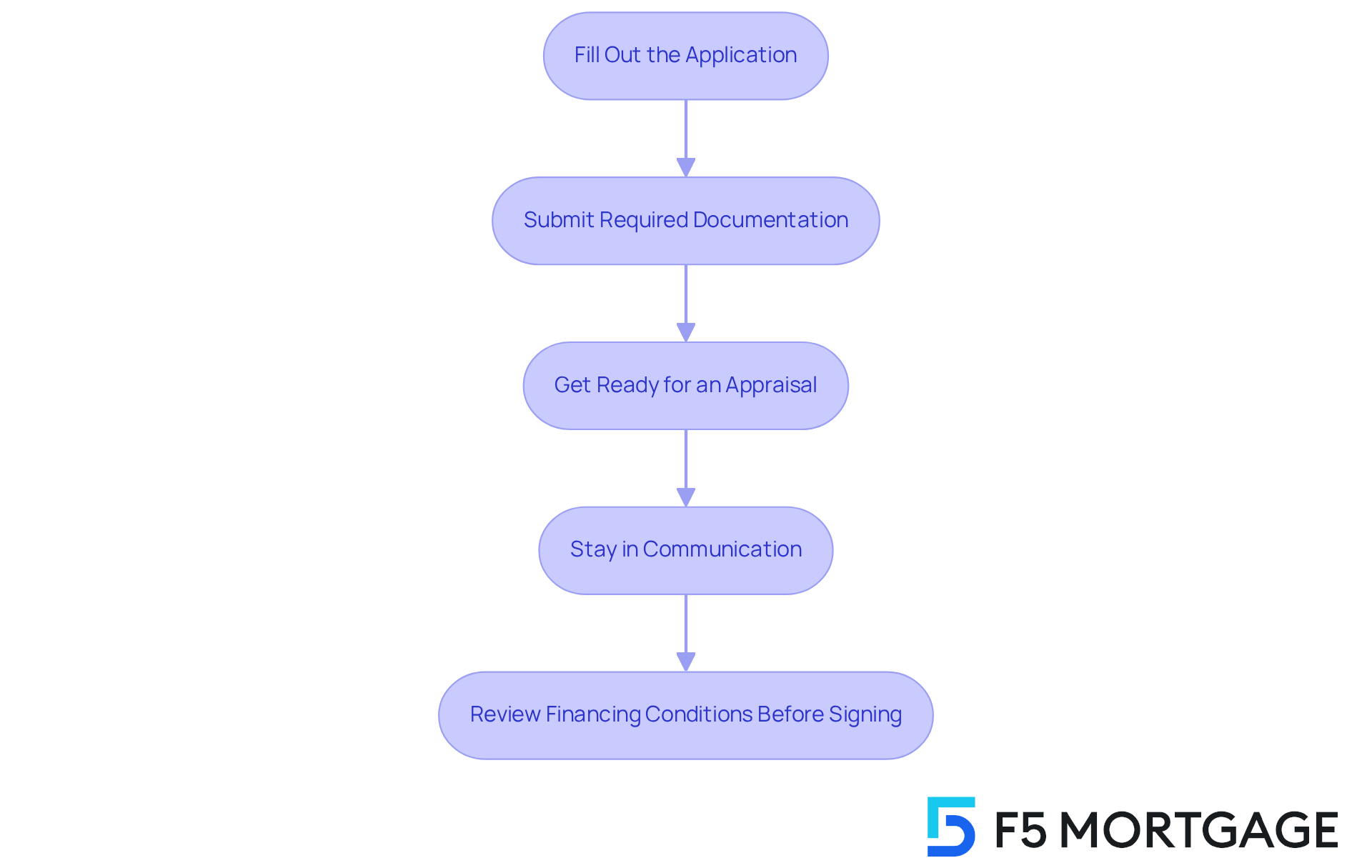

Complete Your Application and Prepare for Approval

Finalizing your application for a home equity loan for bad credit is a crucial step, especially for those who may have faced financial challenges in the past. We understand how overwhelming this process can feel, but with the right approach, you can navigate it effectively.

-

Fill Out the Application: It’s important to accurately detail your financial situation, including income, debts, and assets. Honesty about your credit history is key, as lenders typically prefer borrowers with a debt-to-income (DTI) ratio of 36% or below, though some may accept higher ratios.

-

Submit Required Documentation: Gather and attach all necessary documents you collected earlier, such as income verification and proof of property value. This may include W-2 forms, pay stubs, bank statements, Social Security numbers, and tax returns. A comprehensive submission can significantly expedite the approval process.

-

Get Ready for an Appraisal: Your lender will likely require an appraisal to assess your property’s current market value. Be prepared to schedule this, as it typically takes 2 to 6 weeks. Remember, lenders often favor borrowers who have at least 20% ownership in their properties, so this knowledge can help set realistic expectations.

-

Stay in Communication: Keeping open lines of communication with your lender throughout the process is essential. Respond promptly to any requests for additional information, as this can greatly affect the speed of your application.

-

Review Financing Conditions Before Signing: Once you receive approval, take the time to carefully examine the financing terms before signing. Ensure you fully understand your obligations, including the repayment schedule and any fees involved. This diligence can help prevent future misunderstandings and financial strain.

By following these steps, you can enhance your chances of securing a home equity loan for bad credit, even if your borrowing history isn’t perfect. Remember, preparation is vital for navigating the complexities of the approval process, and we’re here to support you every step of the way.

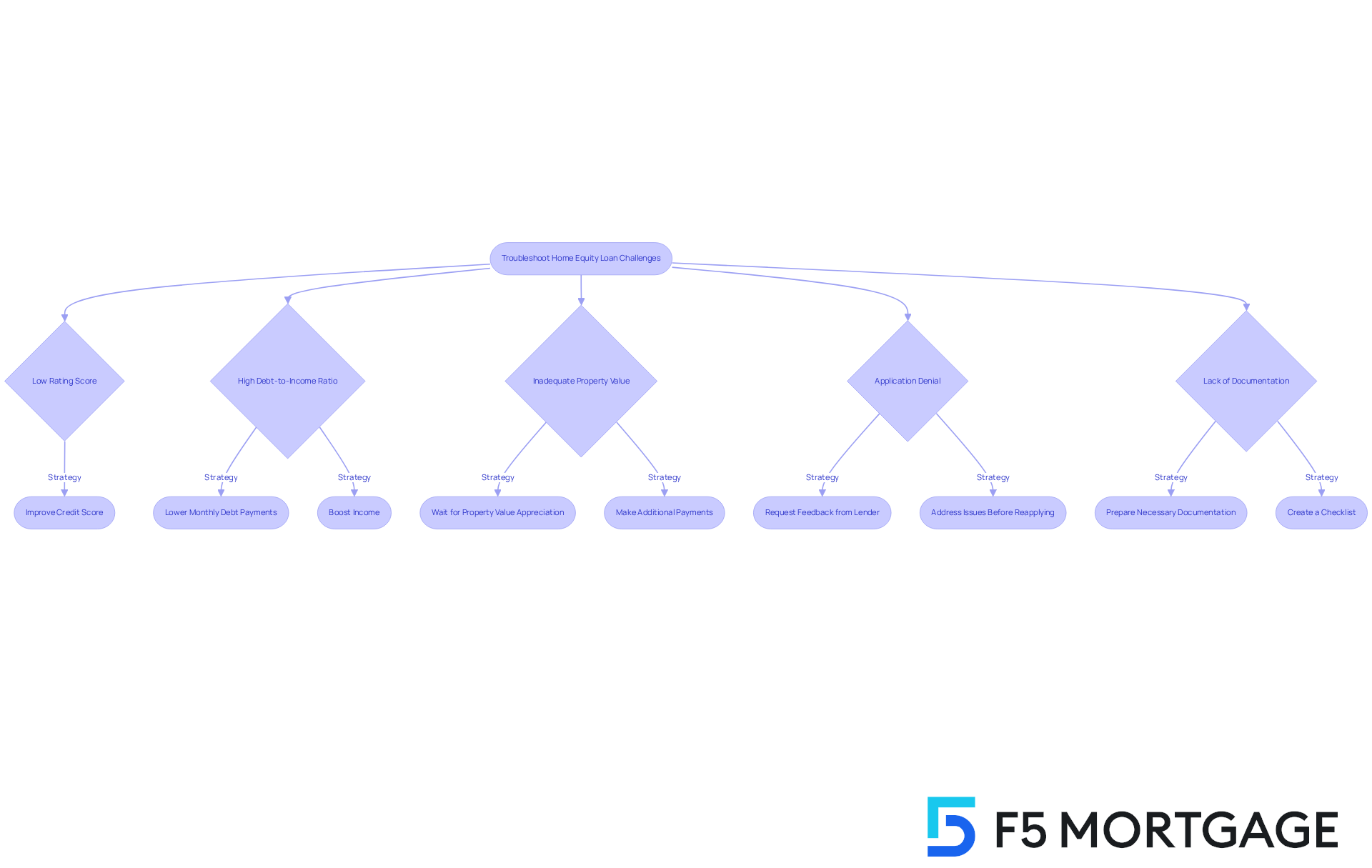

Troubleshoot Common Challenges in the Home Equity Loan Application Process

Navigating the application process for a home equity loan for bad credit can be particularly challenging for those with a less-than-ideal financial history. We understand how overwhelming this can feel, and we’re here to support you every step of the way. Here are some common issues you might encounter, along with strategies to help you troubleshoot them:

-

Low Rating Score: Many lenders require a minimum credit score of 640 for home equity loans, with scores above 700 being the norm for many institutions. If your score is below this threshold, focus on improving it by reducing existing debts and correcting any errors on your credit report. Regularly checking your report can help you spot inaccuracies that may be dragging your score down.

-

High Debt-to-Income Ratio: Lenders generally prefer a debt-to-income (DTI) ratio of no more than 43%, although some may allow up to 50%. If your DTI exceeds this limit, consider ways to lower your monthly debt payments, such as consolidating debts or negotiating for lower interest rates. Alternatively, boosting your income through side jobs or freelance work can also help improve your DTI.

-

Inadequate Property Value: To qualify for a property value loan, you typically need to have at least a 15% to 20% stake in your home. If you currently lack sufficient ownership value, think about waiting until your property value appreciates or making additional payments on your loan to build equity more quickly.

-

Application Denial: If your application is denied, don’t hesitate to ask the lender for specific feedback. Understanding the reasons behind the denial can provide valuable insights into what you need to address before reapplying. For instance, if your score is the issue, prioritize improving it before submitting a new application.

-

Lack of Documentation: Make sure you have all necessary documentation prepared to prevent delays in the application process. Commonly required documents include proof of income, tax returns, and details about your existing debts. Creating a checklist can help you stay organized and ensure you have everything you need.

By proactively addressing these challenges, you can enhance your chances of securing a home equity loan, even with a less-than-perfect credit history. Remember, you’re not alone in this journey, and with the right strategies, you can overcome these hurdles.

Conclusion

Navigating the complexities of home equity loans can be particularly beneficial for individuals with bad credit, offering a chance to leverage home equity for financial relief. We understand how challenging this can be, and this guide outlines essential steps to help you understand your options, assess eligibility, and make informed decisions when seeking a home equity loan, even in the face of credit challenges.

Key insights discussed include:

- The importance of recognizing the benefits of home equity loans, such as lower interest rates and potential tax deductions.

- Gathering proper documentation.

- Comparing lenders.

- Troubleshooting common application challenges.

These are crucial steps that we emphasize. By preparing thoroughly and approaching the process with awareness, you can enhance your chances of approval and secure the funding you need.

Ultimately, the journey toward obtaining a home equity loan for bad credit is not insurmountable. With the right preparation and a proactive mindset, you can overcome obstacles and find suitable financing options that align with your financial goals. Taking the first step toward understanding and utilizing home equity can pave the way for improved financial stability and future opportunities. We’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan and how can it benefit borrowers with bad credit?

A home equity loan allows homeowners to borrow against the equity they have built in their property. It can benefit borrowers with bad credit because it often comes with lower interest rates compared to unsecured loans, and lenders may be more willing to offer loans to individuals with lower credit scores since the loan is secured by the property.

What are the typical closing costs associated with refinancing a home equity loan in California?

Closing costs for refinancing a home equity loan in California typically range from 2% to 5% of the amount borrowed. For example, if you plan to borrow $300,000, you could expect to pay between $6,000 and $15,000 in closing costs, which may include application fees, origination fees, credit report fees, appraisal fees, title search and insurance, discount points, attorney fees, and survey fees.

How can borrowers calculate their break-even point when considering refinancing?

Borrowers can calculate their break-even point by determining how long it will take to recover the closing costs through savings in monthly payments. This calculation can help assess whether refinancing is the right choice.

What are some key benefits of home equity loans?

Key benefits of home equity loans include lower interest rates compared to personal loans or credit cards, potential tax deductibility of interest paid on secured loans, and access to larger sums of money for significant expenses like renovations or debt repayment.

What documentation is necessary to apply for a home equity line of credit?

Necessary documentation includes recent pay stubs or proof of income, tax returns for the last two years, bank statements for the last few months, and documentation of any existing debts.

How can borrowers assess their eligibility for a home equity loan?

Borrowers can assess their eligibility by checking their financial score, gathering necessary financial documents, calculating their property ownership by subtracting their mortgage balance from the property’s market value, and assessing their debt-to-income (DTI) ratio, which should ideally be around 40% to improve chances of approval.

What is the recommended debt-to-income (DTI) ratio for obtaining property financing?

A DTI ratio of around 40% is often regarded as advantageous, with a maximum of 43% typically necessary for housing financing, whether obtaining a conventional mortgage or refinancing an existing agreement.

What should borrowers do to complete their application for a home equity loan?

To complete the application, borrowers need to fill out a refinancing application with their chosen lender, providing details such as Social Security numbers, bank statements, tax returns, and pay stubs.