Overview

Navigating the world of home financing can be overwhelming for families. This article shines a light on how you can effectively use an affordable mortgage calculator to explore your options and make informed decisions. We understand how challenging this process can be, and it’s crucial to grasp key factors that influence mortgage affordability, such as:

- Income

- Monthly obligations

- Credit scores

- Down payments

- Interest rates

By understanding these elements, you can accurately estimate your monthly payments and the overall costs of homeownership.

We’re here to support you every step of the way. Knowing the ins and outs of these factors not only empowers you but also helps you feel more confident in your financial decisions. As you consider your options, remember that this calculator is a valuable tool in your journey toward homeownership. It allows you to visualize your financial landscape, making the path clearer and more manageable.

In conclusion, take the time to utilize the mortgage calculator. By doing so, you’re taking a proactive step towards understanding your financial situation better. Together, we can navigate this journey and find the right home financing solution for your family.

Introduction

Understanding the complexities of homeownership can feel overwhelming, especially when it comes to financing. We know how challenging this can be. For families navigating the housing market, an affordable mortgage calculator emerges as a vital ally, transforming intricate financial data into manageable insights.

But how can you ensure you are leveraging this tool effectively? Avoiding common pitfalls and making informed decisions is crucial. This guide delves into the essential features of mortgage calculators, the key factors influencing affordability, and practical steps to utilize these resources.

We’re here to support you every step of the way, empowering families to confidently approach their home-buying journey.

Understand the Basics of Mortgage Calculators

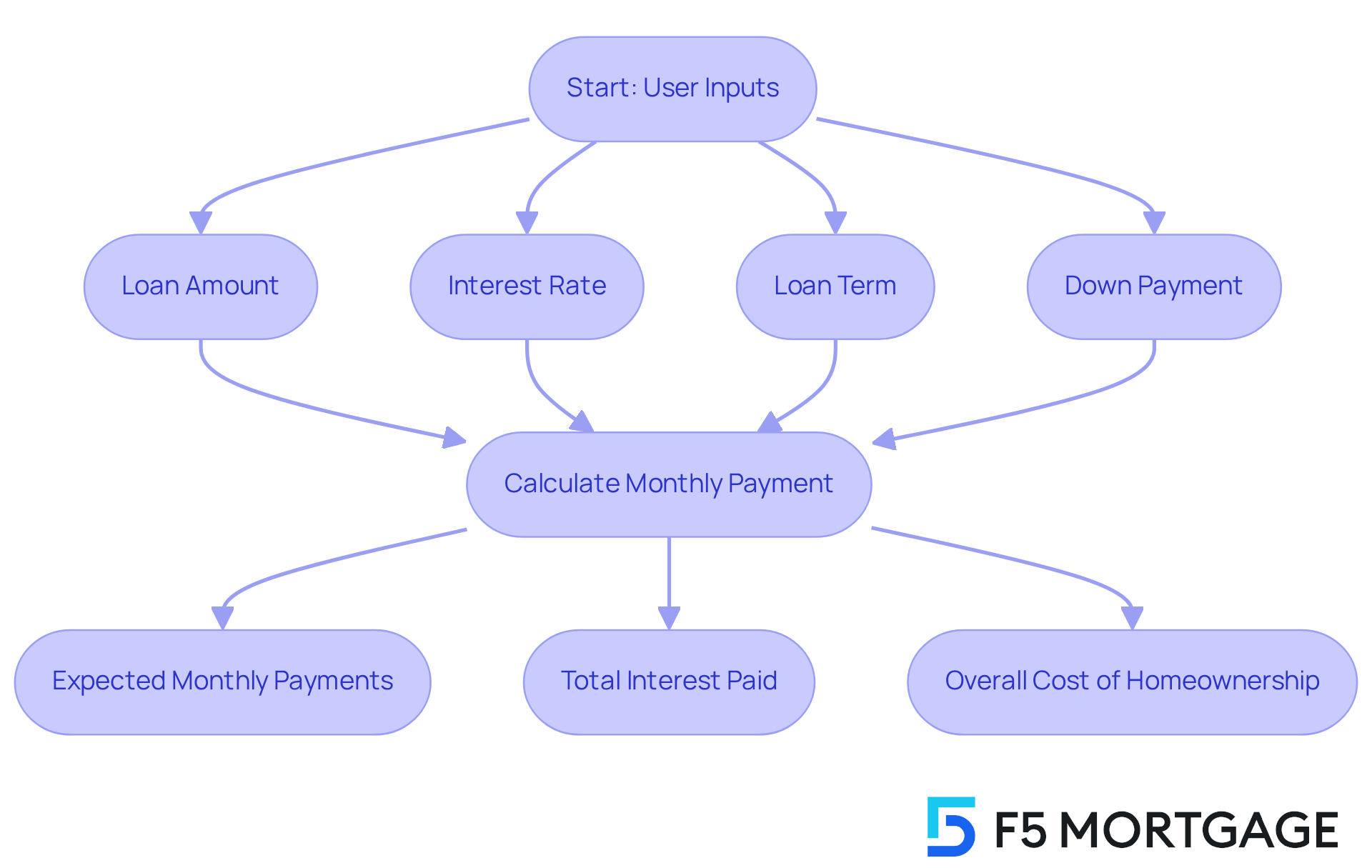

Mortgage calculators, particularly an affordable mortgage calculator, serve as essential digital tools for prospective homebuyers, allowing them to understand their monthly mortgage costs based on various inputs. We know how challenging this can be, so users typically enter details like the loan amount, interest rate, loan duration, and down payment. By processing these inputs, the affordable mortgage calculator provides important insights into expected monthly payments, total interest paid over the life of the loan, and the overall cost of homeownership. This understanding is crucial for making informed choices about mortgage options and effectively planning finances for a future home with the help of an affordable mortgage calculator.

Key features of mortgage calculators include:

- Loan Amount: The total sum borrowed to purchase the home.

- Interest Rate: The percentage charged by the lender for borrowing the money.

- Loan Term: The duration over which the loan will be repaid, typically 15 or 30 years.

- Down Payment: The initial payment made when acquiring the property, usually expressed as a percentage of the purchase price.

In 2025, approximately 78.9% of loan borrowers utilized calculators to assess their financial situations, highlighting their significance in the purchasing journey. Financial advisors emphasize that these tools, such as an affordable mortgage calculator, simplify complex calculations and enhance budgeting accuracy, enabling families to plan their finances more effectively. For example, a family interested in a property valued at $500,000 can input their desired down payment and loan terms to see how various scenarios influence their monthly payments. This assists them in making strategic financial decisions.

By familiarizing themselves with these features, users can navigate the loan landscape more effectively. We’re here to support you every step of the way, ensuring you are well-prepared for homeownership.

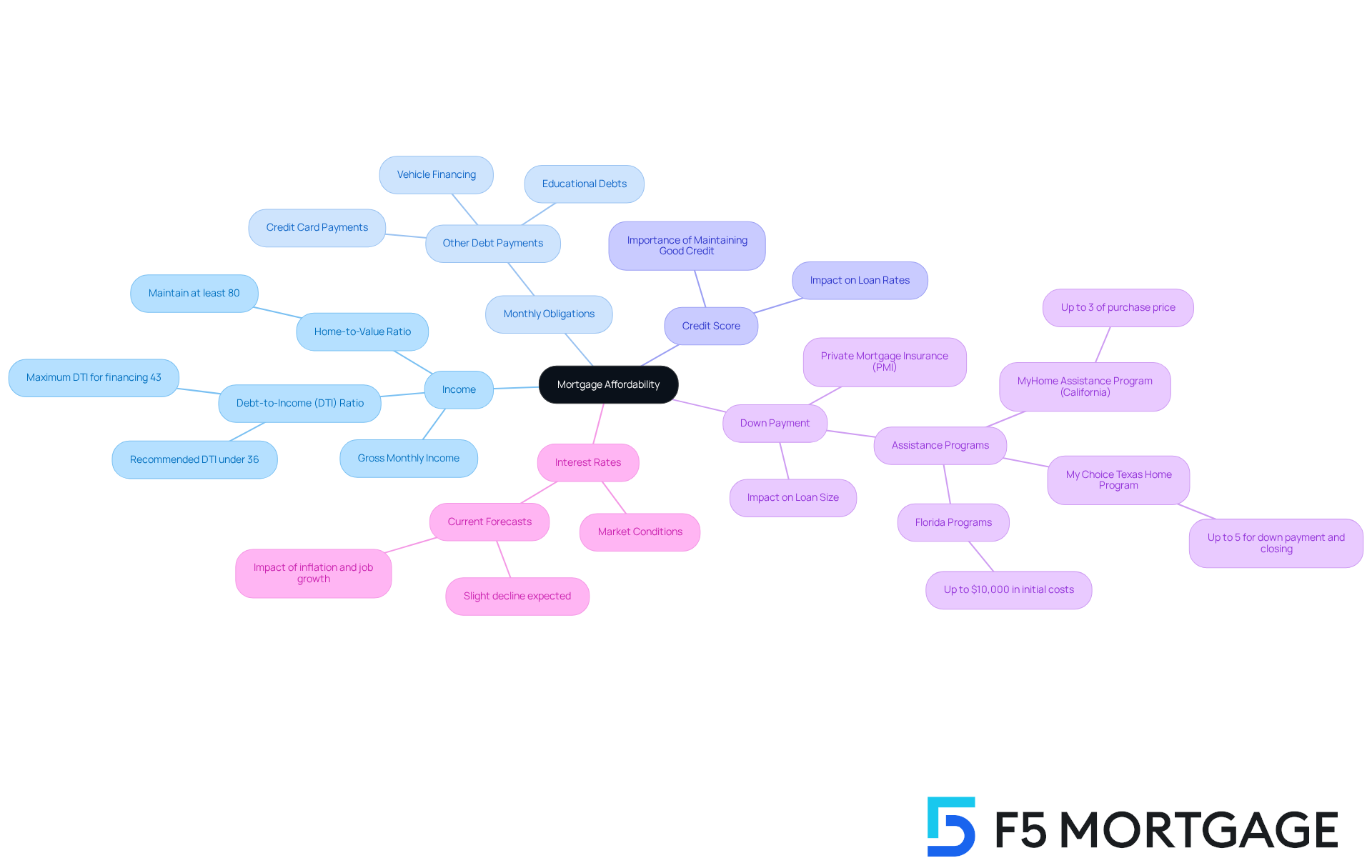

Identify Key Factors Affecting Mortgage Affordability

Understanding the key elements that influence an affordable mortgage calculator is essential for families aiming to make informed housing finance decisions. We know how challenging this can be, so let’s explore the primary factors you should consider:

-

Income: Your gross monthly income plays a pivotal role in determining your purchasing power. Lenders assess your financial health through the debt-to-income (DTI) ratio, comparing your monthly debt obligations to your gross income. Typically, it’s advised that homebuyers maintain a DTI ratio under 36% to ensure total monthly debt obligations remain manageable. Additionally, many lenders require homeowners to maintain at least an 80% home-to-value ratio, meaning they should have paid down at least 20% of their initial amount or that their home has appreciated in value.

-

Monthly Obligations: Beyond your home payment, lenders will evaluate other monthly obligations, such as vehicle financing, educational debts, and credit card payments. Managing these debts is crucial for sustaining a favorable DTI ratio, which can lead to more competitive loan rates and enhance your borrowing capacity. A maximum DTI ratio of 43% is often necessary for home financing, whether you’re obtaining a traditional home loan or refinancing an existing one.

-

Credit Score: A strong credit score signals to lenders that you are a reliable borrower, leading to more favorable interest rates and loan terms. In 2025, the impact of credit scores on loan rates remains significant; families with higher scores can secure better offers. Therefore, it’s essential to track and enhance your credit status. Insights from loan brokers emphasize that maintaining a good credit score is vital for maximizing your borrowing power.

-

Down Payment: The amount you can provide as a down payment affects your loan size and may influence insurance requirements. A larger initial deposit not only reduces your monthly costs but can also eliminate private mortgage insurance (PMI), further improving affordability. Families should explore down payment assistance programs offered by F5 Mortgage, such as the MyHome Assistance Program in California, which provides up to 3% of the property’s purchase price, or the My Choice Texas Home program, supplying up to 5% for down payment and closing support. Various programs in Florida also grant up to $10,000 in initial costs.

-

Interest Rates: Mortgage rates are influenced by market conditions and individual creditworthiness. With current forecasts suggesting a slight decline in rates, securing a lower interest rate can significantly reduce your monthly payment and the overall cost of your loan. Economic factors, such as inflation and job growth, can also impact these rates, making it important for families to stay informed about market trends.

By thoughtfully assessing these factors, families can better analyze their financial situations and utilize an affordable mortgage calculator to create a realistic budget for their property acquisition. We’re here to support you every step of the way. The current median property price stands just under $411,000, with modest price growth anticipated at around 2 to 3% for the year, which should be factored into your budgeting considerations.

Utilize the Mortgage Calculator: A Step-by-Step Guide

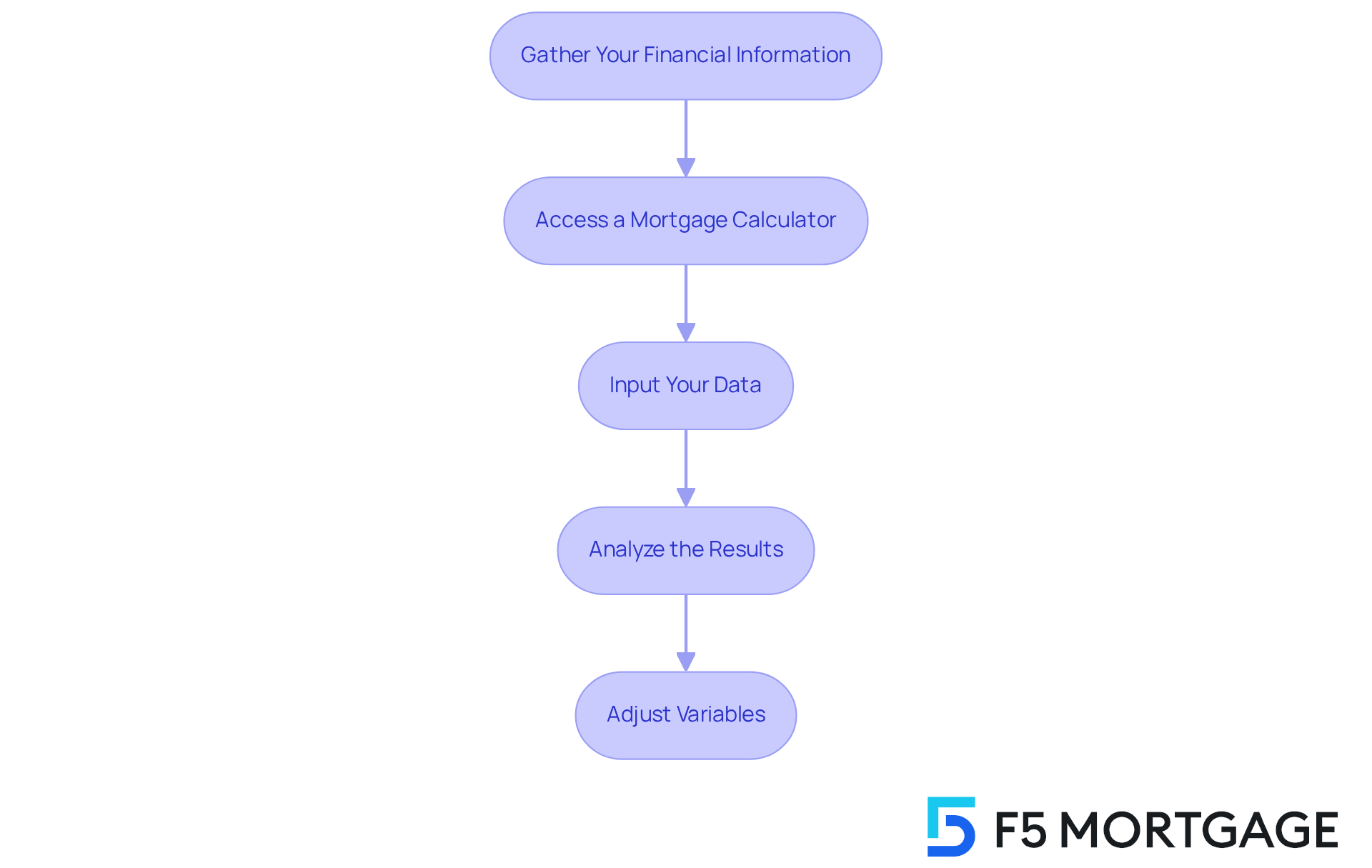

Using an affordable mortgage calculator can greatly simplify the process of assessing your home affordability. We know how challenging this can be, and here’s a step-by-step guide to effectively utilize a mortgage calculator:

Step 1: Gather Your Financial Information

Before diving into the calculator, ensure you have the following information ready:

- Gross Monthly Income: Your total income before taxes and deductions.

- Monthly Debt Payments: Include all recurring debts, such as credit cards and loans. This will help you calculate your Debt-to-Income (DTI) ratio, which should ideally be below 43% for competitive mortgage rates.

- Down Payment Amount: The initial sum you intend to make on the property. For instance, a deposit of $35,000 accounts for 10% of a $350,000 property. Remember, a down payment of less than 20% may require Private Mortgage Insurance (PMI), which can increase your monthly payments. Additionally, many lenders require homeowners to maintain at least an 80% home-to-value loan ratio, meaning you should have paid down at least 20% of your original loan amount or your home should have appreciated in value.

- Interest Rate: The current loan interest rate you expect, which is estimated at 6.5%.

- Loan Term: The duration of the loan, typically 15 or 30 years.

Step 2: Access a Mortgage Calculator

Choose a reliable mortgage calculator, such as those from reputable financial institutions or real estate websites. Look for a user-friendly interface that simplifies data entry.

Step 3: Input Your Data

Enter your financial details into the calculator:

- Input your gross monthly income and monthly debts to calculate your DTI ratio.

- Enter your desired amount, down contribution, interest rate, and term.

Step 4: Analyze the Results

After entering your data, the calculator will generate:

- Estimated Monthly Payment: This figure includes principal, interest, property taxes, and insurance. For a $350,000 house, the estimated monthly cost is roughly $2,426.

- Total Interest Paid: The cumulative interest you will pay over the duration of the credit.

- Amortization Schedule: A detailed breakdown of your contributions over time.

Step 5: Adjust Variables

Experiment with different scenarios by modifying the loan amount, interest rate, or down payment. If your down deposit is below 20% of the property’s purchase cost, keep in mind that PMI might be necessary, which can greatly affect your monthly expense. This enables you to observe how these modifications influence your monthly expenses and overall affordability, assisting you in determining a suitable price range for your new residence.

By following these steps, families can utilize an affordable mortgage calculator to make informed choices regarding their property funding alternatives, ultimately minimizing stress and improving their purchasing experience. We’re here to support you every step of the way, and understanding home equity requirements and the implications of your down payment can further empower you in your journey with F5 Mortgage.

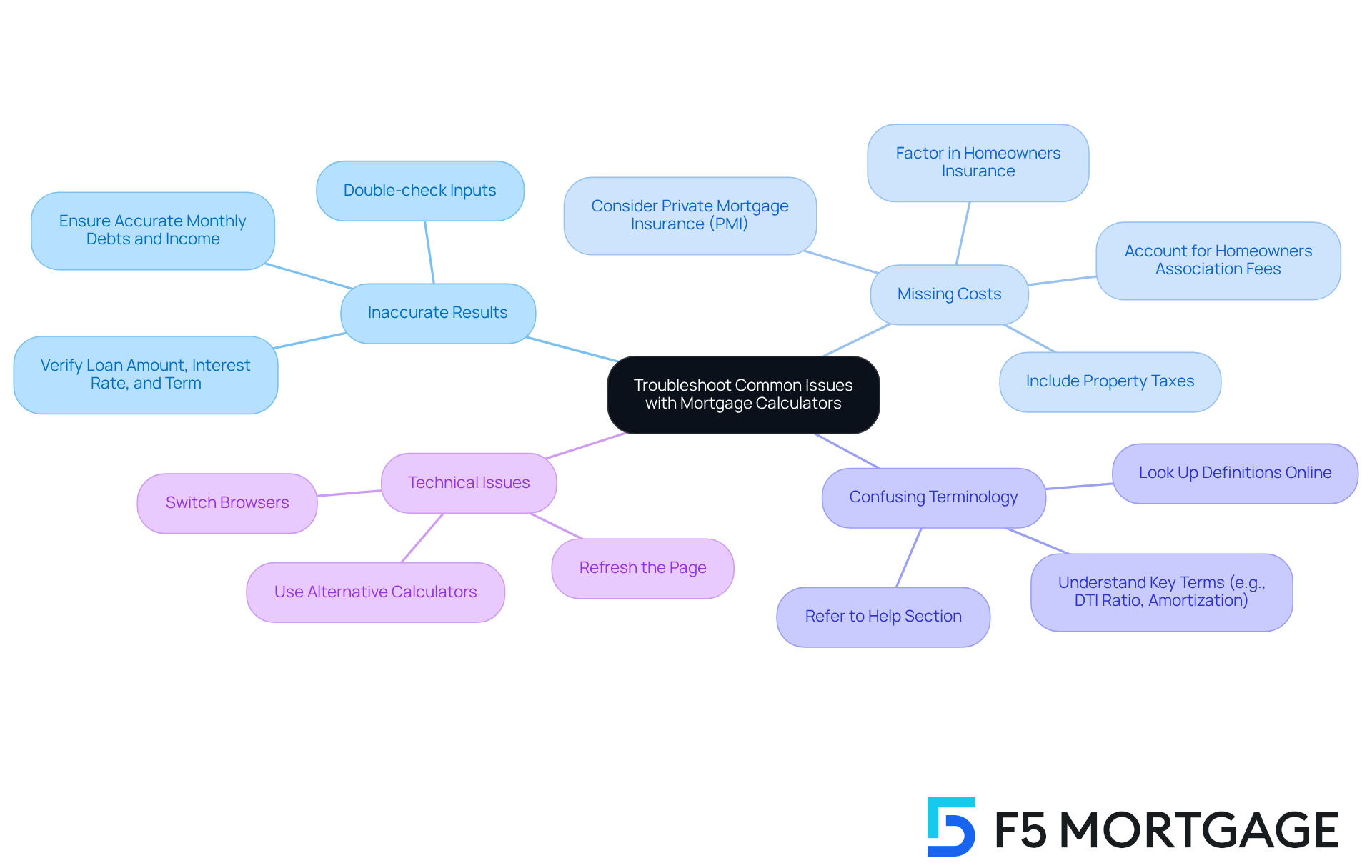

Troubleshoot Common Issues with Mortgage Calculators

While an affordable mortgage calculator is an invaluable tool for potential homeowners, we recognize the challenges users face when they encounter common problems that result in erroneous outcomes. Here are some effective solutions to help you troubleshoot these issues:

Inaccurate Results

If the calculator yields results that seem unrealistic, it’s essential to double-check your inputs. Make sure that the correct loan amount, interest rate, and loan term are entered. Also, ensure that your monthly debts and income are accurately reflected.

Missing Costs

Many calculators overlook critical costs associated with homeownership, such as property taxes, homeowners insurance, and private mortgage insurance (PMI). Financial specialists emphasize that loan calculators frequently neglect to incorporate significant elements that can affect loan costs. Using an affordable mortgage calculator, you can see how these expenses can greatly impact your monthly payments. It’s crucial to factor these into your budget when using an affordable mortgage calculator to analyze the results, ensuring you avoid underestimating your financial commitments. As Sonu Mittal from Citizens Bank observes, “Taxes, insurance, homeowner association fees, utilities, and general upkeep are factors not included in conventional loan calculators.”

Confusing Terminology

Encountering unclear terms can be frustrating. If you come across jargon like DTI ratio, amortization, or PMI, don’t hesitate to refer to the calculator’s help section or look up definitions online. Understanding these terms will help you interpret the results more effectively.

Technical Issues

Should the calculator malfunction, try refreshing the page or switching to a different browser. If issues persist, consider using an alternative calculator from a reputable site.

Real-World Example

For instance, a family may find that their initial calculations using a mortgage calculator did not account for property taxes and insurance, leading them to believe they could afford a higher-priced home than was realistic. By consulting with a financing expert, they were able to refine their budget and make a more informed decision.

By acknowledging these frequent obstacles and applying these remedies, families can confidently use an affordable mortgage calculator to evaluate their housing options and make informed choices. Remember, accurate inputs are vital; even minor errors can lead to significant discrepancies in your estimated monthly payments. As financial experts emphasize, relying solely on calculators without considering all associated costs can lead to unrealistic expectations about homeownership. We’re here to support you every step of the way, and consulting with a mortgage specialist can provide tailored advice based on your individual circumstances, ensuring a more accurate understanding of home affordability.

Conclusion

Mastering the affordable mortgage calculator is crucial for families facing the challenges of homeownership. We understand how overwhelming this journey can be, and by utilizing this powerful tool, prospective buyers can find clarity in their financial commitments. This ensures that decisions made align with both budgetary constraints and long-term goals.

Throughout this article, we’ve highlighted key insights that underscore the importance of understanding the various inputs affecting mortgage affordability. Factors such as income, monthly obligations, credit scores, down payments, and interest rates all play a significant role. By analyzing these elements and taking a step-by-step approach to inputting data into the calculator, families can accurately assess their purchasing power and explore financing scenarios that best suit their needs.

Ultimately, leveraging an affordable mortgage calculator empowers families to take control of their home buying journey. By staying informed about the intricacies of mortgage calculations and potential pitfalls, individuals can avoid common mistakes and make confident choices. We encourage engaging with financial advisors or mortgage specialists, as this can further enhance the process, ensuring families are well-prepared to embark on their path to homeownership.

Frequently Asked Questions

What is the purpose of a mortgage calculator?

A mortgage calculator helps prospective homebuyers understand their monthly mortgage costs based on inputs like loan amount, interest rate, loan duration, and down payment.

What inputs are typically required for using a mortgage calculator?

Users typically enter details such as the loan amount, interest rate, loan term, and down payment.

What insights does an affordable mortgage calculator provide?

It provides insights into expected monthly payments, total interest paid over the life of the loan, and the overall cost of homeownership.

Why is understanding mortgage costs important for homebuyers?

Understanding mortgage costs is crucial for making informed choices about mortgage options and effectively planning finances for a future home.

What are the key features of mortgage calculators?

Key features include loan amount, interest rate, loan term (typically 15 or 30 years), and down payment.

How prevalent is the use of mortgage calculators among loan borrowers?

In 2025, approximately 78.9% of loan borrowers utilized calculators to assess their financial situations.

How do mortgage calculators enhance budgeting accuracy?

They simplify complex calculations, enabling families to plan their finances more effectively and make strategic financial decisions.

Can you provide an example of how to use a mortgage calculator?

For instance, a family interested in a property valued at $500,000 can input their desired down payment and loan terms to see how various scenarios influence their monthly payments.