Overview

Understanding home equity loan interest rates can seem daunting for families, but we’re here to support you every step of the way. It’s essential to recognize the difference between fixed and variable rates, as this knowledge can significantly impact your financial decisions. Fixed rates offer stability against market fluctuations, providing peace of mind. On the other hand, variable rates may lead to increased payments, which can be concerning.

Several key factors influence the interest rates available to you:

- Your credit score plays a crucial role, as lenders often use it to assess your reliability.

- The loan-to-value ratio is an important consideration that can affect the rates offered to borrowers.

- Current market conditions are also significant factors that can impact interest rates.

We know how challenging navigating these options can be, but understanding these elements empowers you to make informed decisions. By recognizing the differences in rates and the factors that influence them, you can take proactive steps towards securing the best possible terms for your home equity loan.

Introduction

Navigating the world of home equity loans can feel overwhelming for families seeking financial relief or investment opportunities. We understand how challenging this can be. These loans enable homeowners to tap into the equity in their properties, offering numerous benefits—from funding home improvements to consolidating debt. Yet, with fluctuating interest rates and various factors influencing these rates, it’s crucial for families to carefully weigh their options.

How can they determine the best approach to maximize their financial outcomes while minimizing risks? We’re here to support you every step of the way.

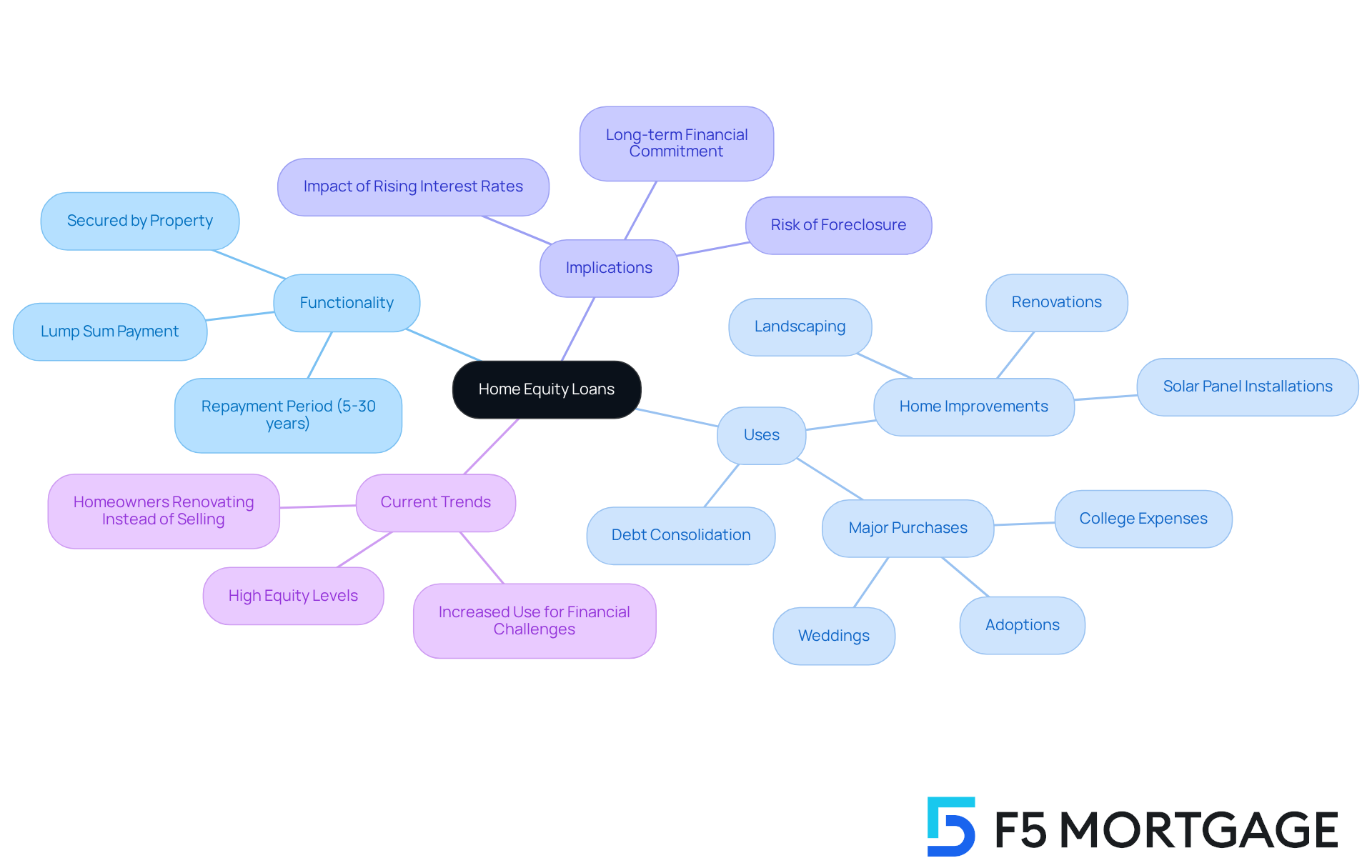

Define Home Equity Loans and Their Functionality

A property equity financing option, often known as a second mortgage, allows homeowners to tap into the home equity loan interest they have built in their home. Equity is simply the difference between your property’s current market value and the outstanding mortgage balance. These financial products provide a lump sum that is repaid over a set period, typically ranging from 5 to 30 years, and are secured by the property itself. This means that if repayment becomes difficult, there is a risk of foreclosure.

Home value financing can serve various purposes, making it a versatile financial resource for families. You might use it for:

- Home improvements

- Debt consolidation

- Major purchases

Current trends indicate that many households are increasingly using home equity loan interest as a way to tackle financial challenges. With interest rates varying, these financial products can offer attractive terms compared to other borrowing options. Financial advisors emphasize the importance of understanding the implications of home equity loan interest when borrowing against your property’s value, especially in light of rising mortgage rates that could lead to significant costs over time.

For instance, imagine a family using a property-backed loan to finance a major renovation. This not only enhances their living space but could also increase the home’s value. This strategic use of resources addresses immediate financial needs while also contributing to long-term investment in their home. As homeowners navigate the complexities of financing, residential value-based options remain a vital choice for those looking to achieve their financial goals. We’re here to support you every step of the way as you explore these opportunities.

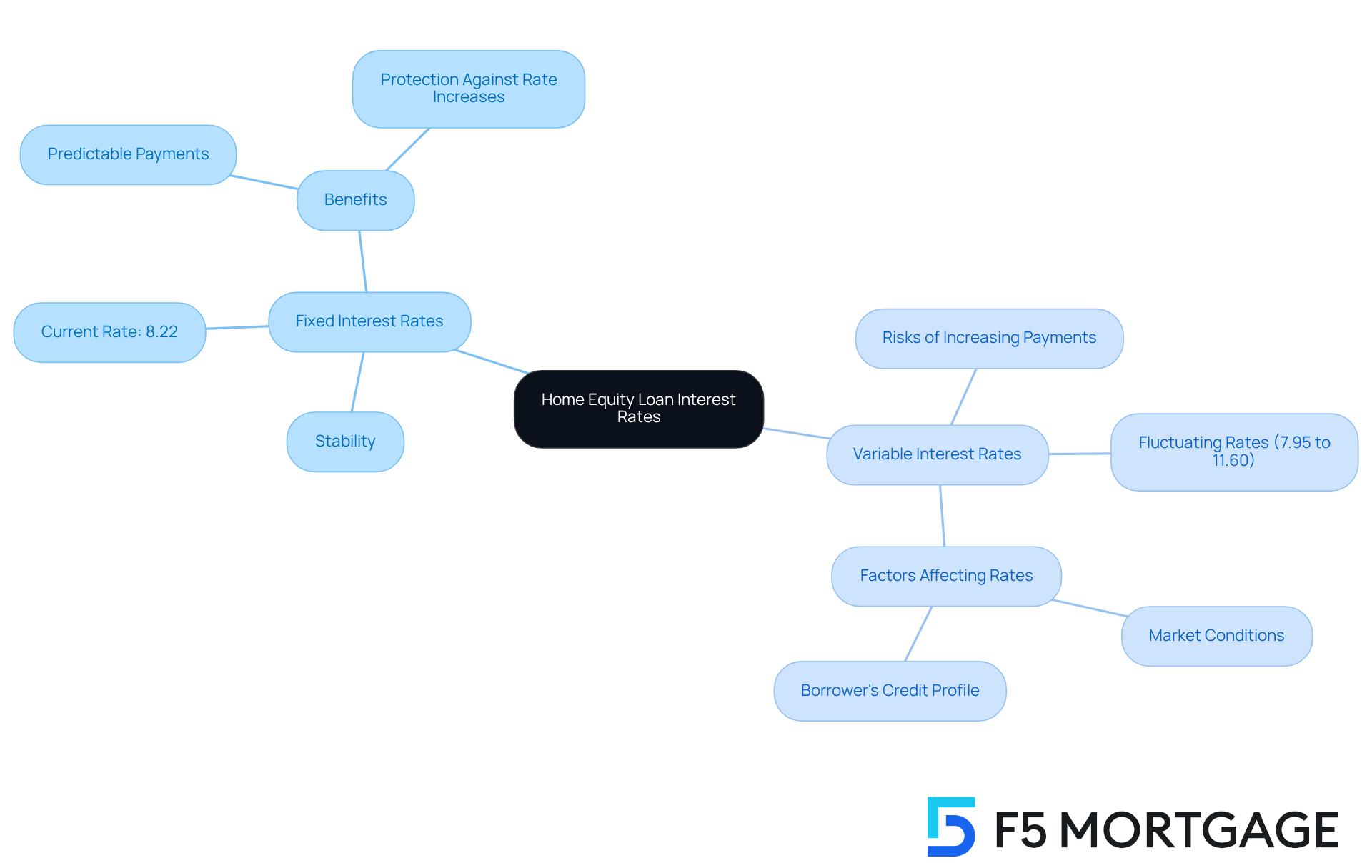

Explore Home Equity Loan Interest Rates: Fixed vs. Variable

When it comes to home financing options, families often find themselves weighing two primary choices: fixed and variable interest rates. A fixed-rate mortgage offers the comfort of knowing that your interest percentage remains the same throughout the entire financing term, ensuring steady monthly payments. This stability can be particularly beneficial in a rising interest environment, as it protects borrowers from future increases. As of August 2025, the typical fixed-rate residential borrowing interest percentage is around 8.22%.

On the other hand, variable-rate home equity lines showcase home equity loan interest percentages that fluctuate based on market conditions, typically linked to an index like the prime rate. While these loans may initially seem cost-effective, they come with the risk of increasing payments due to home equity loan interest if interest rates rise. Currently, variable percentages range from 7.95% to 11.60% APR, influenced by both the lender and the borrower’s credit profile.

We understand how important it is for families to evaluate their financial situation and risk tolerance when choosing between fixed and variable options. Financial analysts often emphasize that fixed-interest financing provides a safeguard against market fluctuations, making it a thoughtful choice for those concerned about future increases. For instance, homeowners with fixed-interest mortgages can budget more easily, free from the anxiety of unpredictable expenses—especially crucial in today’s economic landscape, where interest rates can change unexpectedly.

In real-life scenarios, families who opt for fixed-rate financing often find peace of mind in their financial planning. This allows them to focus on enhancing their homes or addressing other essential costs without the stress of potential rate hikes. Additionally, it’s vital for families to be aware of the closing costs associated with property financing, which typically range from 2% to 5% of the property value. Understanding these costs, along with identifying the break-even point for refinancing, is key for families looking to make the most of their property value. By assessing refinancing costs and potential monthly savings, families can empower themselves to make informed decisions that align with their financial goals.

Factors Influencing Home Equity Loan Interest Rates

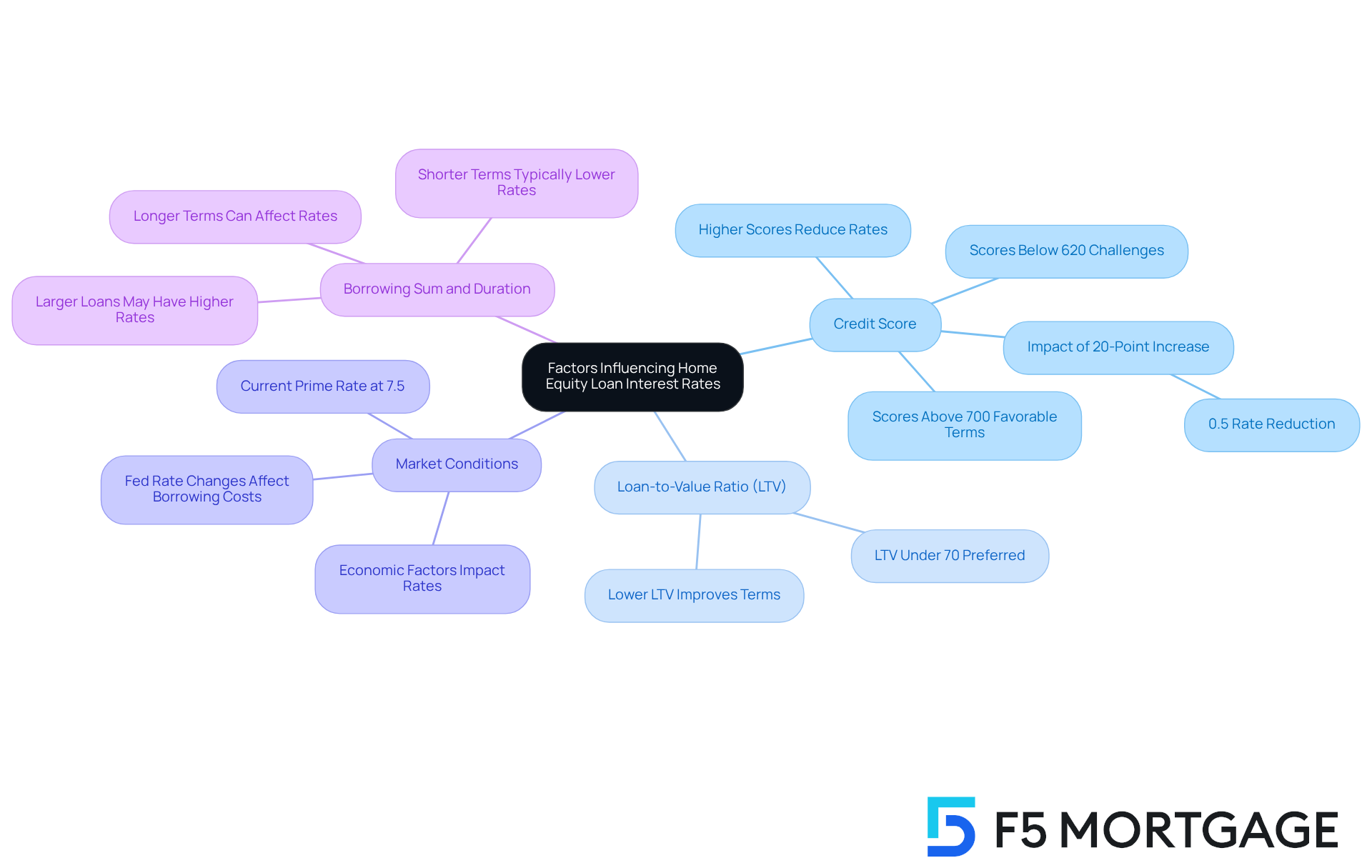

When considering home equity loans, several factors can significantly influence the interest rates you may encounter. Understanding these can empower you to make informed decisions that lead to better financial outcomes.

-

Credit Score: We know how challenging it can be to navigate credit scores. A higher credit score typically results in reduced interest charges, signaling to lenders that you present less risk. For instance, if your credit score is 700 or above, you are more likely to secure advantageous terms. Conversely, scores under 620 may pose challenges in acquiring financing.

-

Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the appraised value of your home. A lower LTV often leads to improved terms, indicating that you possess considerable equity in your property. For example, borrowers with an LTV of under 70% generally benefit from more appealing offers, which reflects decreased risk for lenders.

-

Market Conditions: It’s essential to consider how economic factors, such as inflation and the Federal Reserve’s monetary policy, can impact interest levels. When the Fed increases interest rates, home equity borrowing costs tend to rise as well. Currently, the prime interest rate sits at 7.5%, with potential adjustments based on economic indicators.

-

Borrowing Sum and Duration: The amount you wish to borrow and the duration of the loan can also affect interest charges. Larger loans or those with longer terms may come with different rates compared to smaller or shorter-term loans. It’s important to carefully assess your financial needs and how these elements might influence your overall borrowing costs.

By understanding these factors, you can navigate the home equity loan interest process with confidence. We’re here to support you every step of the way, ensuring you make the best choices for your family’s financial future.

Conclusion

Home equity loans offer a valuable opportunity for families to tap into the equity they’ve built in their homes. This access to funds can be crucial for various needs, such as home improvements, debt consolidation, or major purchases. We understand that navigating the intricacies of home equity loan interest rates, including the differences between fixed and variable rates, can feel overwhelming. However, grasping these details is essential for making informed financial decisions that align with your personal goals.

Several key factors influence home equity loan interest rates:

- Your credit score

- Loan-to-value ratio

- Market conditions

- The amount borrowed

A strong credit score can lead to better terms, while a lower loan-to-value ratio often indicates reduced risk for lenders. Additionally, the current economic landscape, shaped by the Federal Reserve’s monetary policy, significantly impacts borrowing costs. Families who understand these elements are better equipped to navigate the complexities of home equity financing.

Ultimately, the choice between fixed and variable interest rates should reflect your family’s unique financial situation and risk tolerance. Opting for a fixed rate can provide peace of mind amid fluctuating market conditions, while variable rates may offer initial savings but come with inherent risks. By thoughtfully considering these factors and staying informed about current trends in home equity loan interest rates, you can make empowered decisions that enhance your financial well-being and support your long-term objectives. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a property equity financing option, often referred to as a second mortgage, that allows homeowners to borrow against the equity they have built in their home. Equity is the difference between the property’s current market value and the outstanding mortgage balance.

How does a home equity loan work?

Home equity loans provide a lump sum amount that is repaid over a set period, typically ranging from 5 to 30 years. They are secured by the property itself, meaning that if repayment becomes difficult, there is a risk of foreclosure.

What are the common uses for home equity loans?

Common uses for home equity loans include home improvements, debt consolidation, and financing major purchases.

Why are homeowners increasingly using home equity loans?

Current trends show that many households are using home equity loans to tackle financial challenges, as these loans can offer attractive terms compared to other borrowing options.

What should borrowers consider when using home equity loans?

Borrowers should understand the implications of borrowing against their property’s value, especially with rising mortgage rates that could lead to significant costs over time.

Can using a home equity loan increase a home’s value?

Yes, using a home equity loan for major renovations can enhance the living space and potentially increase the home’s value, addressing immediate financial needs while contributing to long-term investment in the property.