Overview

Navigating the world of home financing can be challenging, especially when considering options like a Home Equity Line of Credit (HELOC). We understand how important it is for families to have quick access to funds without the hassle of an appraisal. This is where lenders like F5 Financing come into play, streamlining the application process to help you access your equity efficiently.

Imagine being able to tap into your home’s value with minimal delay. The benefits of quick financing and competitive rates can make a significant difference in your financial journey. With F5 Financing, you’re not just another application; you receive personalized support and educational resources tailored to your needs.

We know how overwhelming this process can feel, but you’re not alone. The right lender will guide you every step of the way, ensuring you feel empowered and informed. Take that first step towards accessing your home equity today, and experience the support that makes all the difference.

Introduction

Navigating the world of home equity financing can often feel daunting. We understand how overwhelming the traditional appraisal process can be, adding layers of complexity that might leave you feeling uncertain. However, there is good news: a growing number of lenders are now offering Home Equity Lines of Credit (HELOC) without the need for appraisal. This presents a streamlined solution for homeowners like you who are seeking quick access to their equity.

In this article, we will explore seven innovative options that not only simplify the borrowing experience but also empower you to tackle your financial needs with confidence. We know how challenging this can be, and we’re here to support you every step of the way.

What challenges might arise in this new landscape of appraisal-free financing? How can you best leverage these opportunities? Let’s dive in together.

F5 Mortgage: Access HELOC Without Appraisal for Quick Financing

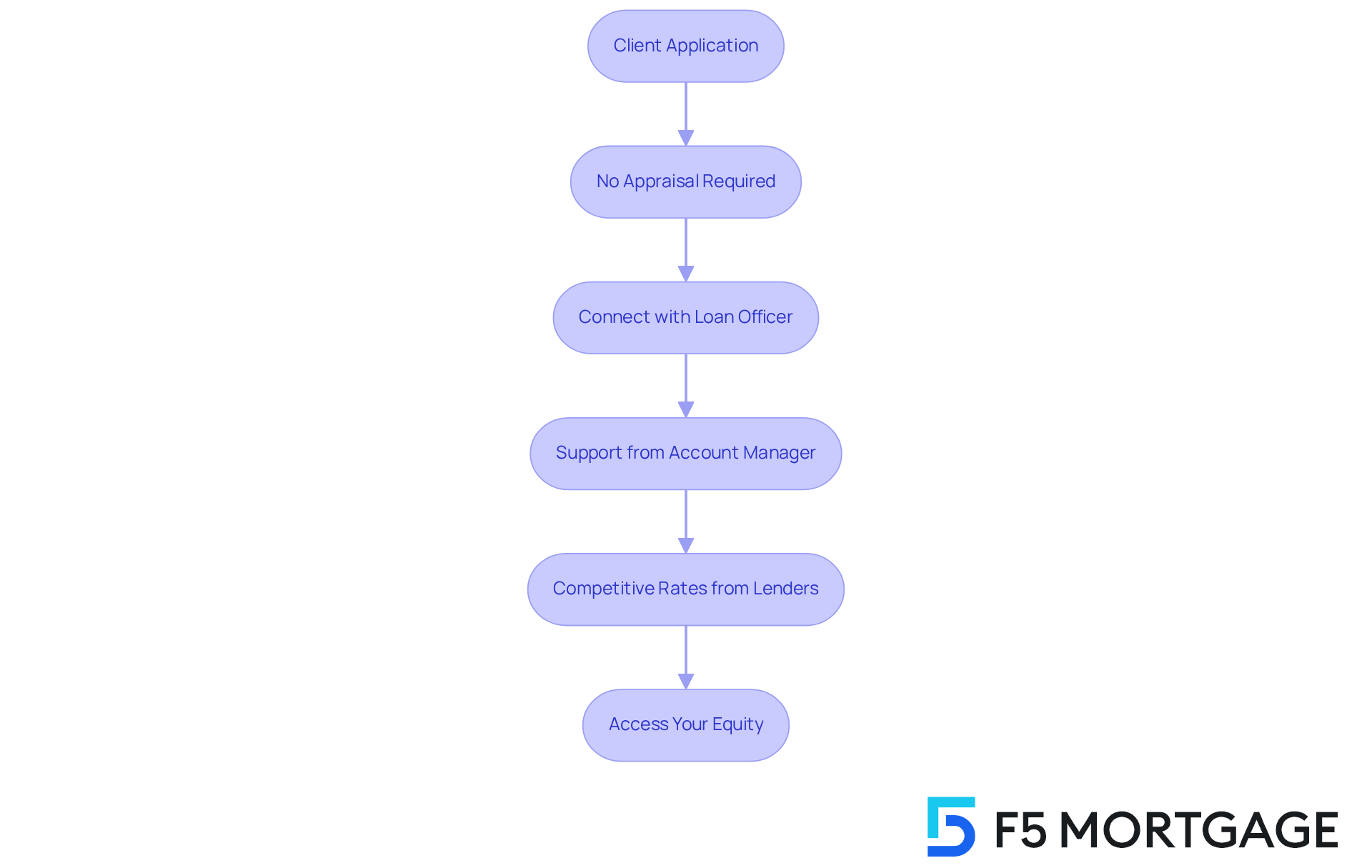

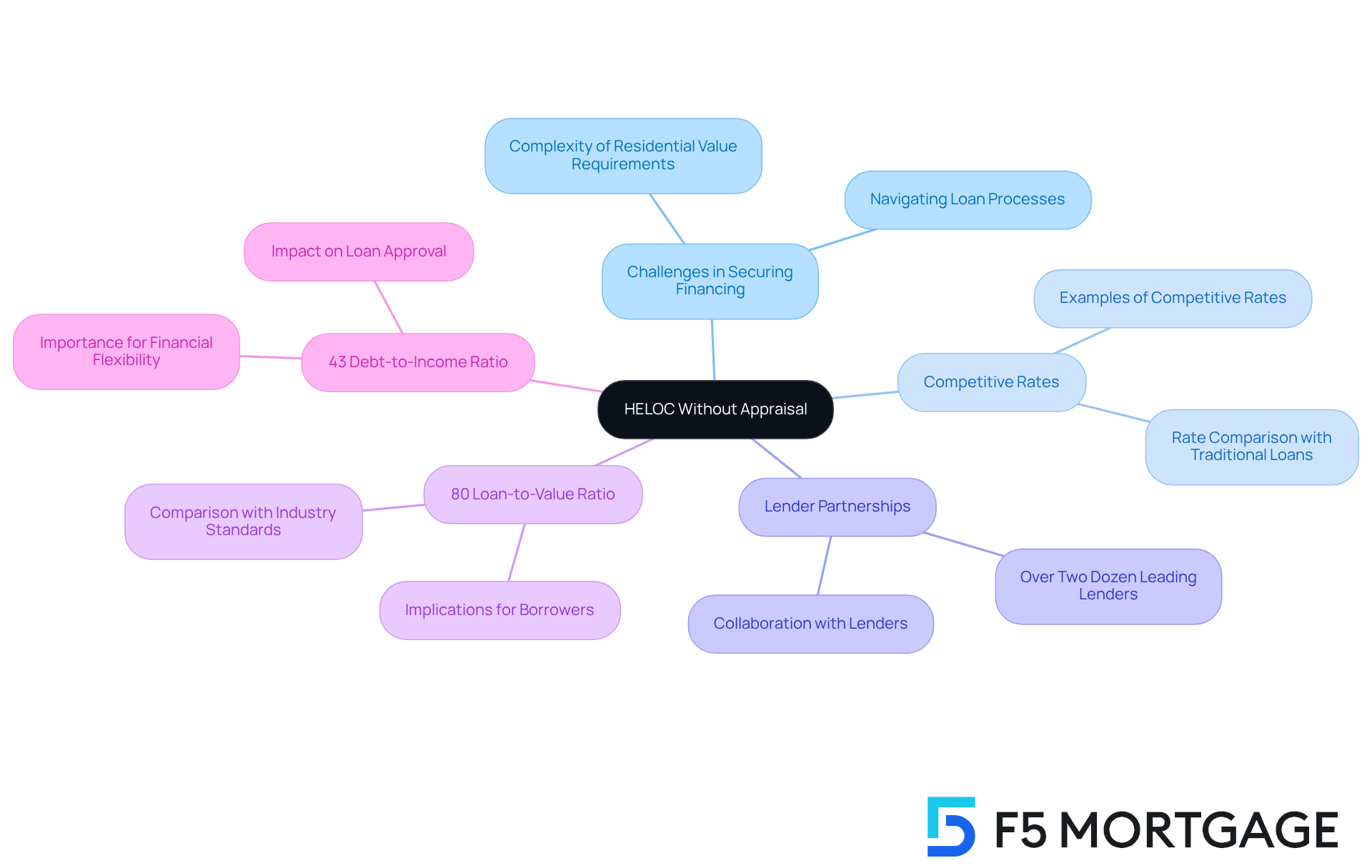

At F5 Financing, we understand how challenging it can be to access the equity in your home. That’s why we offer a HELOC without appraisal, removing the hassle for our clients. This means homeowners like you can quickly and efficiently access your equity with a HELOC without appraisal.

Our extensive network of over two dozen lenders allows us to provide you with competitive rates and terms. We believe that financing should be a smooth experience, and our user-friendly technology simplifies the application process, making it easier for you.

You won’t be alone on this journey. Our dedicated team, which includes a loan officer and an account manager, is here to support you every step of the way. We prioritize your needs and aim to make the refinancing process as straightforward as possible.

Moreover, we are committed to empowering you with knowledge. Our focus on client education and exceptional customer service ensures that you can make informed decisions about your financing options. With F5, you can feel confident in your path to assured homeownership.

Figure Lending: Fast HELOC Approval Without Appraisal

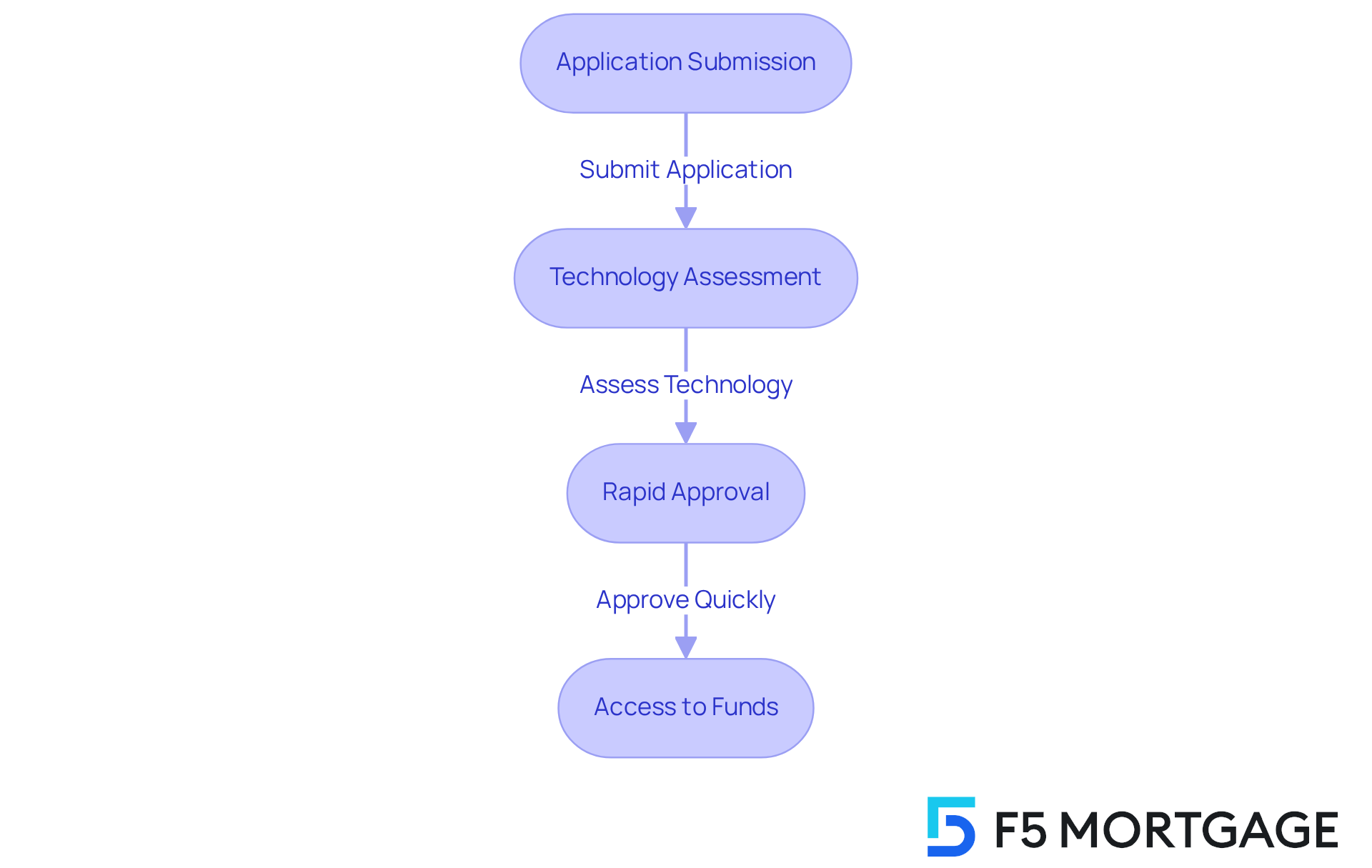

At F5 Financing, we understand how challenging it can be to secure a Home Equity Line of Credit (HELOC). That’s why we offer a highly efficient process for a HELOC without appraisal, eliminating the need for a traditional appraisal. By leveraging advanced technology, we facilitate rapid approvals—often within minutes—making it an ideal choice for homeowners who require immediate access to funds. This innovative approach not only expedites your access to funds but also alleviates the stress often linked to lengthy appraisal procedures. By providing a HELOC without appraisal, we significantly reduce the time and expenses typically associated with traditional HELOCs, allowing you to tap into your home equity quickly and efficiently.

Many clients have shared their positive experiences with our HELOC without appraisal, appreciating the speed and simplicity of the application process. With average approval times for HELOCs without appraisal being notably shorter than traditional methods, you can swiftly address urgent financial needs.

As one satisfied client expressed, “F5 made the process so easy and fast, I couldn’t believe how quickly I had access to my funds!” At F5 Lending, we are committed to transparency and client empowerment. We ensure that you receive impartial information and tailored service at competitive rates. This dedication to efficiency and client satisfaction positions F5 as a frontrunner in the HELOC without appraisal sector, making it an appealing option for those looking to utilize their property value without the usual delays. We’re here to support you every step of the way.

Bank of America: Competitive No-Appraisal HELOC Options

At F5 Lending, we understand how challenging it can be for property owners to navigate the complexities of home financing. That’s why we offer Rate-and-Term Refinance options, designed to help you enhance your property value. By modifying your interest rates or changing your loan terms, you can take advantage of today’s favorable mortgage rates. This approach not only simplifies access to your home’s value but also allows you to secure a lump sum for significant expenses or debt consolidation.

With competitive rates and flexible terms, we are dedicated to providing financial solutions that are tailored to families looking to improve their homes. Our refinancing options empower you to effectively access your assets, making it an appealing choice for those considering home improvements or debt merging. We’re here to support you every step of the way, ensuring you feel understood and guided throughout this process.

Citizens Bank: Simplified HELOC Process Without Appraisal

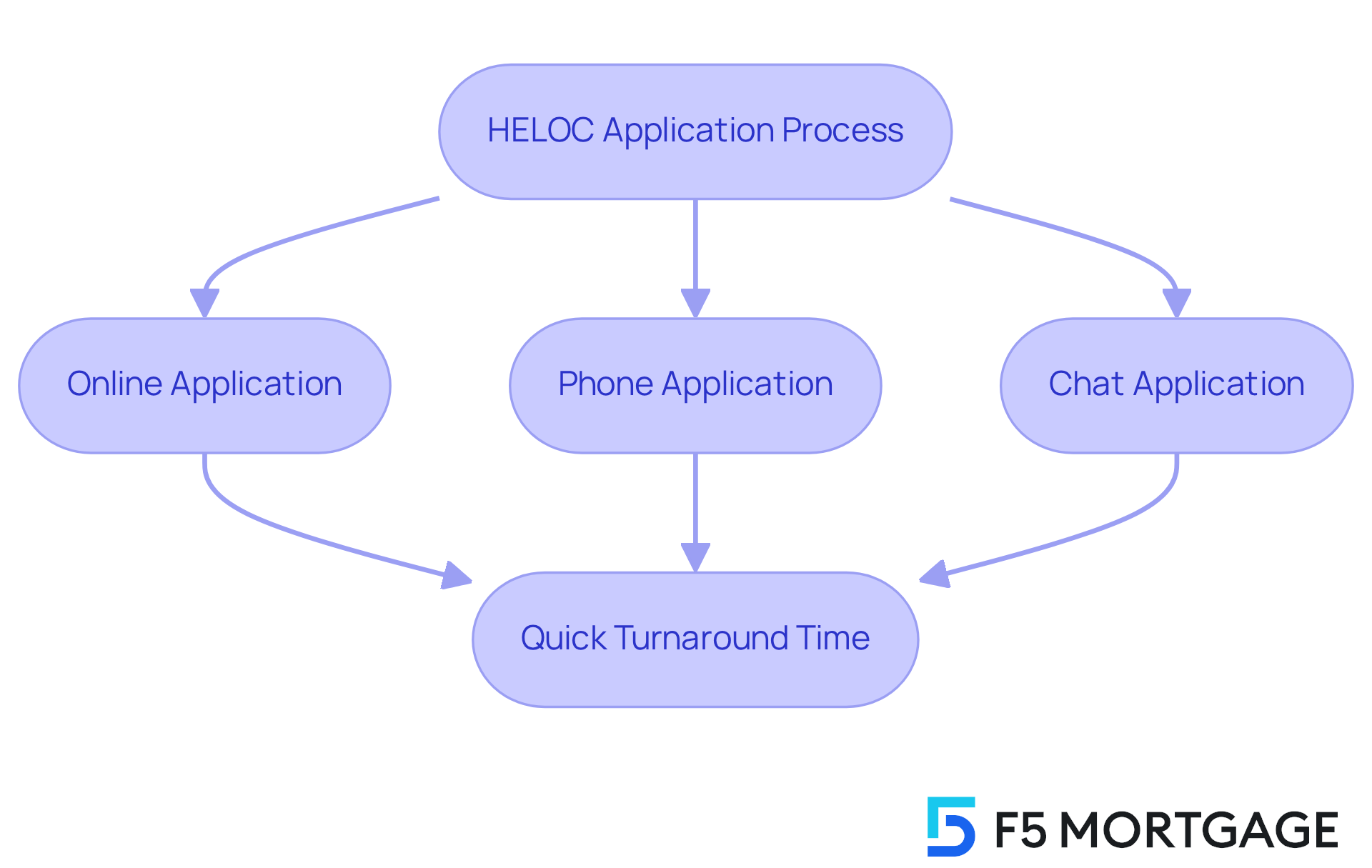

At F5 Lending, we understand how challenging it can be to navigate the home equity line of credit (HELOC) process. That’s why we have simplified our approach to offer a HELOC without appraisal. This change allows homeowners to access their assets with ease, giving you the freedom to make the financial decisions that best suit your needs.

We know that appraisals play a crucial role in determining property value and equity, which can affect your mortgage rates. With this in mind, we offer convenient application options available online, by phone, or through chat. This flexibility ensures that you can easily tailor a loan to meet your specific goals.

Our user-friendly application process and quick turnaround times make F5 Lending an appealing choice for families looking to finance home improvements or consolidate debt. By concentrating on customer experience, we position ourselves as a leader in the HELOC without appraisal market, ready to support you every step of the way.

Let us help you take the next step toward achieving your financial goals with confidence.

Alliant Credit Union: Member-Focused HELOC Without Appraisal

At F5 Lending, we understand how challenging the borrowing process can be. That’s why we offer a HELOC without appraisal option that prioritizes your needs, ensuring a seamless borrowing experience. With competitive rates and a commitment to personalized service, F5 truly stands out in the industry.

Our clients have shared their heartfelt appreciation for the exceptional support they receive throughout the process. Testimonials highlight how our dedicated loan officers, like Jeff and Jorge, provide expert guidance, making your experience smooth and stress-free. One client expressed, “They have an amazing attention to detail & guided me as a first-time home buyer step by step.”

What sets F5 apart is our technology-driven approach, which enables rapid access to funds through a HELOC without appraisal, eliminating the typical delays associated with conventional appraisals. Many satisfied clients have shared extraordinary experiences, emphasizing the friendly, no-pressure assistance we offer.

As lending trends evolve, F5 Finance remains committed to a client-centric approach. We’re here to support you every step of the way, making us an ideal choice for families seeking efficient and accessible HELOC solutions.

Money.com: Overview of No-Appraisal HELOC Lenders

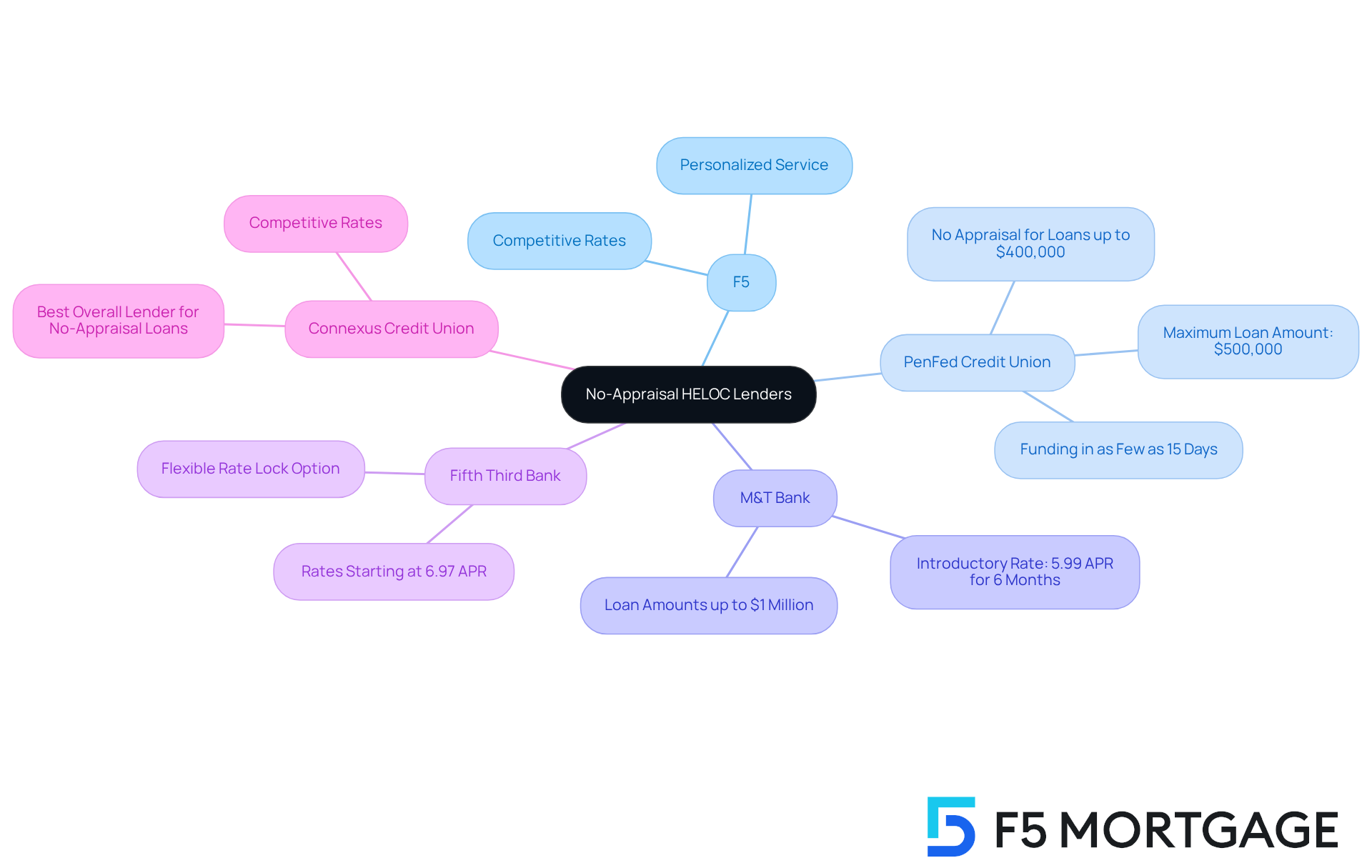

At Money.com, we understand how challenging it can be to navigate the world of financing. That’s why we provide an overview of various lenders offering HELOC without appraisal, highlighting the competitive rates and terms available in the market. This resource is invaluable for homeowners like you who want to compare options and make informed decisions about your financing.

By presenting various lenders, including F5, which offers competitive rates and personalized service, we empower you to discover the ideal match for your financial requirements. We know how important it is to utilize your property value efficiently, and we’re here to support you every step of the way. With our guidance, you can enhance your choices through rate-and-term refinance possibilities, ensuring you feel confident in your financial journey.

Connexus Credit Union: No-Appraisal Home Equity Loan Solutions

At F5 Mortgage, we understand how challenging it can be to secure the right financing for your family’s needs. That’s why we emphasize competitive rates and customized service, providing a HELOC without appraisal as a residential loan solution tailored for families looking to enhance their properties. By partnering with over two dozen leading lenders, we make it easier for you to access your assets with a HELOC without appraisal hurdles.

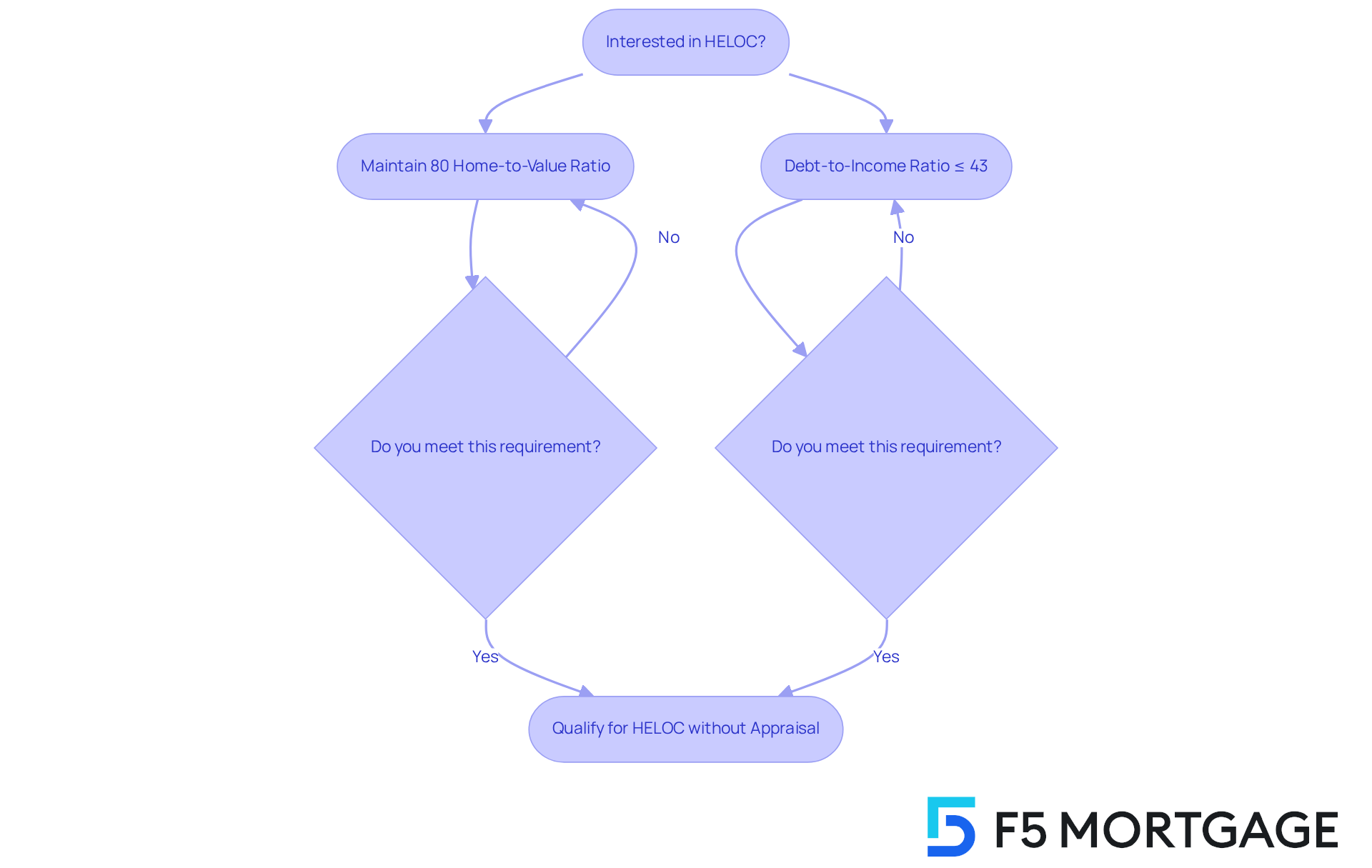

We know how important it is to navigate the complexities of residential value requirements. Our commitment to maintaining an 80% loan-to-value ratio and a maximum 43% debt-to-income ratio means we can provide you with tailored solutions that enhance your financial flexibility. We’re here to support you every step of the way, simplifying the lending process and collaborating directly with lenders on your behalf.

Explore your property value options with us today! Let’s work together to find the best solution for your family’s future.

Rate: Competitive HELOC Rates Without Appraisal

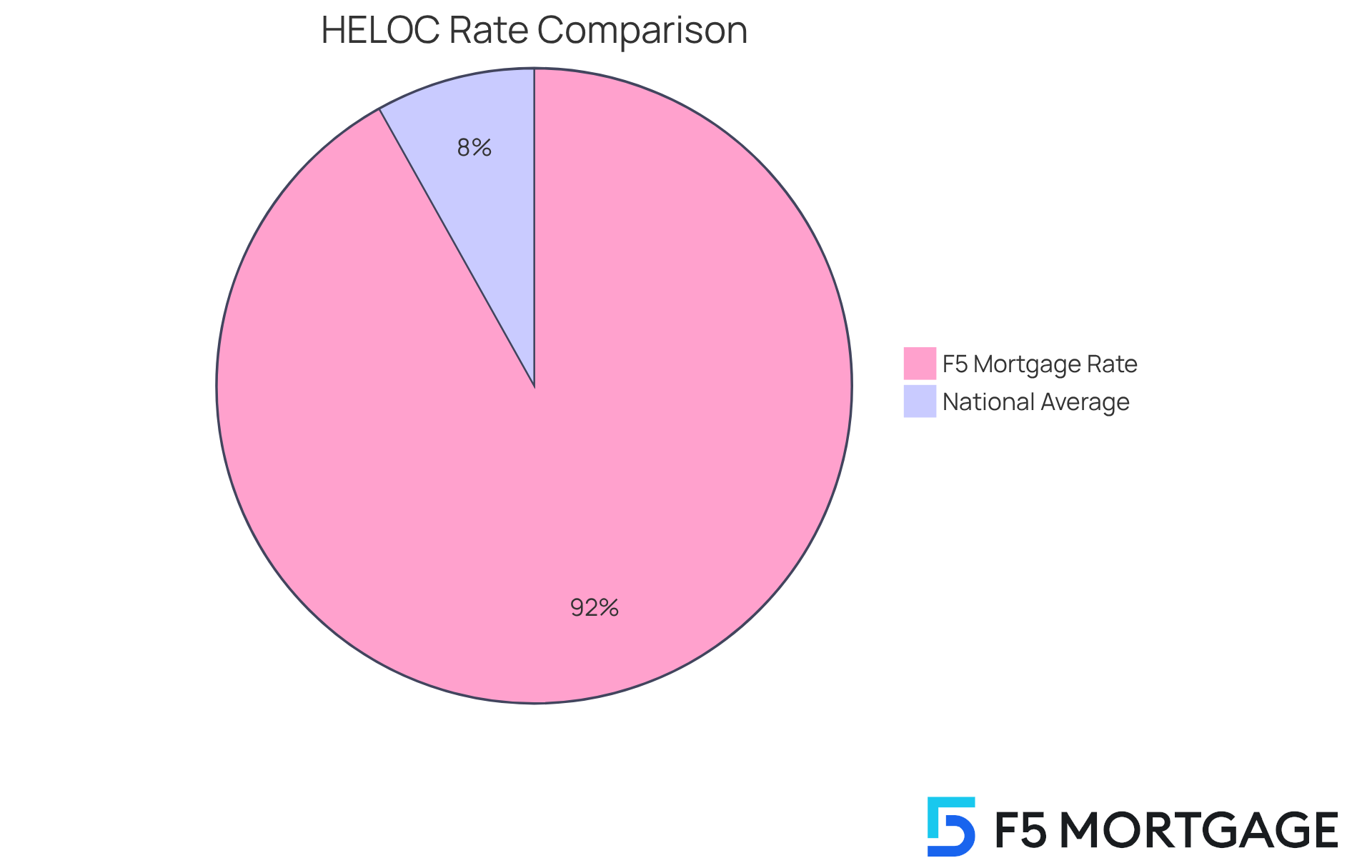

Navigating the world of HELOC without appraisal can feel overwhelming, especially given the current landscape featuring competitive rates. As of August 2025, the national average sits around 8.12%. At F5 Mortgage, we understand how important it is for you to maximize your home equity while minimizing costs. Our technology-driven approach allows you to explore attractive options that truly fit your needs.

We know that modifying interest rates or loan terms can be a significant decision. Our rate-and-term refinance options empower property owners to take advantage of today’s mortgage rates. By focusing on competitive rates and tailored service, you can ensure that you’re maximizing your borrowing potential.

Unlike conventional lenders who often rely on aggressive sales tactics, F5 prioritizes your needs. We’re here to support you every step of the way, offering a refreshing financing process that enables you to make informed choices. Let us help you navigate this journey with confidence and care.

PenFed Credit Union: No-Appraisal HELOC for Smaller Loans

At F5 Lending, we understand how challenging it can be to navigate the world of home equity lines of credit (HELOCs). That’s why we offer attractive HELOC without appraisal options tailored for property owners who want to utilize their assets without the hassle of standard appraisals. To qualify, homeowners typically need to maintain at least an 80% home-to-value loan ratio and a maximum debt-to-income (DTI) ratio of 43%.

While PenFed Credit Union provides similar services for lower loan amounts, F5 stands out by ensuring that you fully grasp these essential property value requirements and DTI ratios. This understanding can lead to more advantageous loan solutions that truly meet your needs. Our emphasis on personalized service and competitive rates means that we are here to streamline the borrowing process for families looking to enhance their homes.

Moreover, our commitment to exceptional customer service and quick processing times further enhances the appeal of our offerings. We’re here to support you every step of the way, making your journey toward home improvement as smooth and rewarding as possible.

Hometap: Innovative Equity Access Without Appraisal

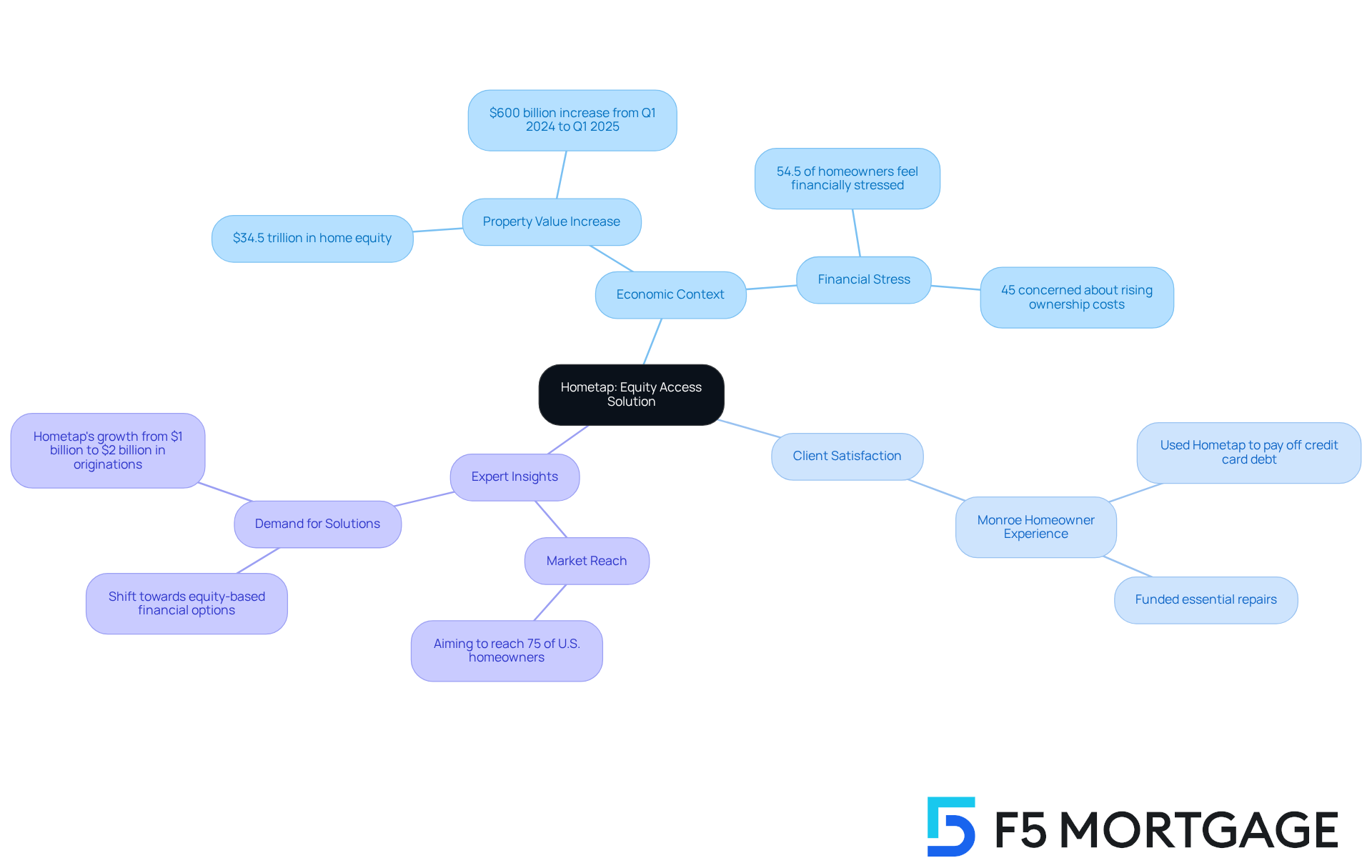

Hometap presents a compassionate solution for property owners looking to access their home’s value with a HELOC without appraisal. This innovative property investment model allows homeowners to receive cash in exchange for a portion of their residence’s future value increase, offering a flexible alternative to traditional loans. By eliminating the burden of monthly payments, this approach resonates with those seeking financial freedom in today’s challenging economic environment.

As of Q1 2025, American households boast an impressive $34.5 trillion in property value, marking a $600 billion increase from the previous year. However, with 54.5% of property owners feeling financially stressed and 45% concerned about rising ownership costs, Hometap’s model addresses these pressing issues by providing a practical means to access property value via a HELOC without appraisal, thereby avoiding additional debt. Many homeowners feel ‘house rich and cash poor,’ a sentiment echoed by Hometap’s Chief Financial Officer, Tom Egan, highlighting the urgent need for accessible capital solutions.

Client satisfaction with Hometap’s property investment model is evident, as numerous customers have shared positive experiences. For example, a homeowner from Monroe, North Carolina, successfully used Hometap’s services to pay off credit card debt and fund essential repairs. This illustrates how the model empowers property owners to manage their financial responsibilities effectively, fostering a sense of security and enhancing control over their financial futures.

Financial experts emphasize the importance of diversifying access to residential assets. Egan notes that the firm aims to extend its reach to approximately 75% of U.S. property owners, stating, ‘Many individuals are living in homes that are valued significantly higher than when they first purchased them — which, once again, is favorable — but they lack access to that capital.’ This highlights the increasing demand for innovative equity access solutions in 2025, positioning Hometap as a leader in the changing landscape of home financing. Moreover, Hometap’s strong securitization performance showcases its effective risk management and financial stability, further enhancing its appeal to potential clients.

Conclusion

Accessing home equity has never been easier, especially with HELOC options that do not require an appraisal. This innovative approach allows homeowners to quickly tap into their property value, eliminating the traditional hurdles associated with appraisals. It streamlines the financing process, providing much-needed financial relief.

Throughout this article, we’ve highlighted various lenders, including F5 Mortgage, Figure Lending, and Hometap, for their commitment to offering competitive rates and efficient services. Each lender presents unique benefits, from rapid approval times to tailored customer support. This ensures that homeowners can find the right solution to meet their financial needs without the stress of lengthy processes.

As you navigate the complexities of financing, it’s crucial to explore these no-appraisal HELOC options and understand their potential benefits. Embracing these innovative solutions can empower you to manage your financial responsibilities more effectively, paving the way for improved homeownership experiences. We know how challenging this can be, and we’re here to support you every step of the way. Consider reaching out to these lenders to discover how a HELOC without appraisal can enhance your financial flexibility and help you achieve your goals.

Frequently Asked Questions

What is a HELOC and how does F5 Financing facilitate it without appraisal?

A Home Equity Line of Credit (HELOC) allows homeowners to access the equity in their home. F5 Financing facilitates a HELOC without the need for a traditional appraisal, simplifying the process and enabling quick access to funds.

How does F5 Financing ensure a smooth application process for HELOC?

F5 Financing utilizes user-friendly technology and has an extensive network of over two dozen lenders to provide competitive rates and terms. Their dedicated team, including a loan officer and an account manager, supports clients throughout the refinancing process.

What are the benefits of choosing a HELOC without appraisal through F5 Financing?

Choosing a HELOC without appraisal through F5 Financing allows for rapid approvals—often within minutes—reducing the time and expenses typically associated with traditional HELOCs. This enables homeowners to quickly address urgent financial needs.

How do clients feel about the HELOC without appraisal offered by F5 Financing?

Many clients have shared positive experiences, appreciating the speed and simplicity of the application process. Approval times for HELOCs without appraisal are notably shorter than traditional methods, leading to quick access to funds.

What refinancing options does F5 Financing offer for homeowners?

F5 Financing offers Rate-and-Term Refinance options, allowing homeowners to modify interest rates or change loan terms. This helps them take advantage of favorable mortgage rates and access their home’s value for significant expenses or debt consolidation.

How does F5 Financing prioritize client education and support?

F5 Financing is committed to client education and exceptional customer service, ensuring that clients have the information needed to make informed decisions about their financing options. They aim to make the refinancing process straightforward and supportive.