Overview

In this article, we explore the differences between Home Equity Lines of Credit (HELOCs) and Home Equity Loans (HELOANs), focusing on what matters most to families like yours. We understand how challenging it can be to navigate these options, and we’re here to support you every step of the way.

HELOANs provide a lump sum with fixed payments, making them ideal for one-time expenses. This can be a great solution for families looking to fund a major project or consolidate debt. On the other hand, HELOCs offer a flexible credit line for ongoing needs, allowing you to access funds as necessary. This flexibility can be particularly beneficial for families facing unexpected expenses.

As you consider these options, it’s essential to evaluate your individual financial goals and risk tolerance. We encourage you to think about the potential costs associated with each choice. Remember, the right decision will empower you to manage your finances effectively and meet your family’s needs.

Introduction

Navigating the world of home financing can feel overwhelming, especially for families looking to tap into their property’s value. We understand how challenging this can be. With options like Home Equity Loans and HELOCs (Home Equity Lines of Credit) becoming increasingly popular, grasping their unique features is essential for making informed choices.

This article explores the key differences and considerations surrounding these financial tools, providing insights that can empower families to select the best option for their specific needs.

As interest rates fluctuate and financial landscapes shift, how can families ensure they choose the right path to achieve their financial goals? We’re here to support you every step of the way.

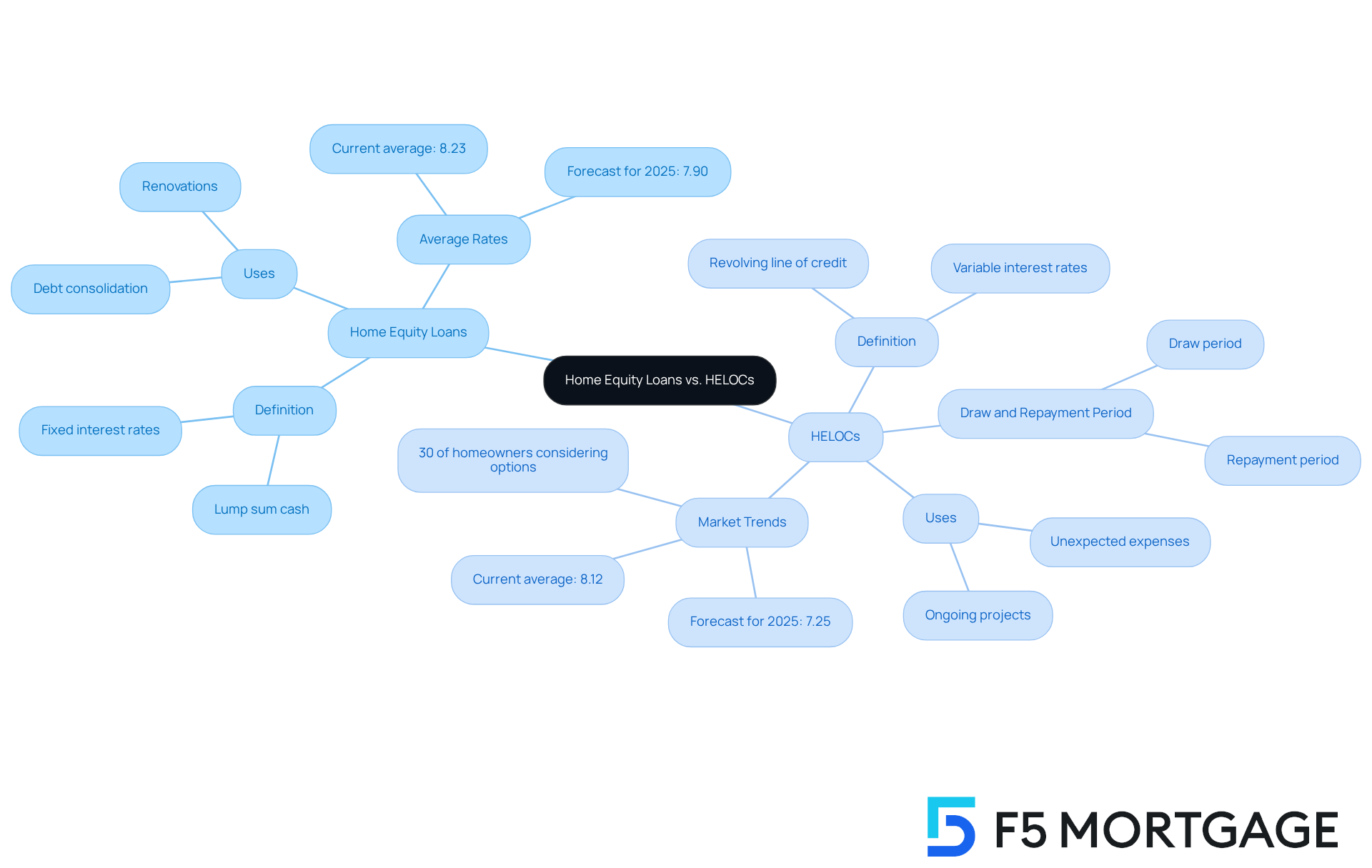

Understanding Home Equity Loans and HELOCs

Property value financing and HELOCs (Home Value Lines of Credit) are vital resources that can help you access your property’s value. A property equity loan provides a lump sum of cash, which you repay over a set period with regular monthly installments, often referred to as a second mortgage. This option can be especially beneficial for families needing a substantial amount of money upfront, whether for major renovations or consolidating high-interest debt.

On the other hand, a HELOC operates like a credit card, offering a revolving line of credit that homeowners can tap into as needed. This product typically has a draw period, during which you can withdraw funds, followed by a repayment period where you pay back what you borrowed. This flexibility makes HELOCs an appealing choice for families financing ongoing projects or managing unexpected expenses.

Recent trends reveal that nearly 30% of American property owners are considering mortgage options or HELOCs in the coming year. As we look toward 2025, the average rates for HELOCs stand at 8.12%, while residential equity loans average 8.23%. Although these rates are higher than some unsecured credit options, they remain competitive compared to credit cards, which average 20.13%.

Real-life examples show how families are leveraging these financial options. For instance, many property owners are utilizing HELOCs to fund renovations, with 45% of those likely to borrow citing this as their primary reason. Others are opting for property-backed financing to consolidate debt, enjoying lower interest rates compared to personal loans, which average 12.58%.

Understanding the differences between HELOC vs HELOAN is essential for families aiming to make informed financial decisions. By reflecting on your unique needs and financial situation, you can choose the option that aligns best with your goals, whether that’s addressing immediate cash needs or planning for long-term financial stability. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

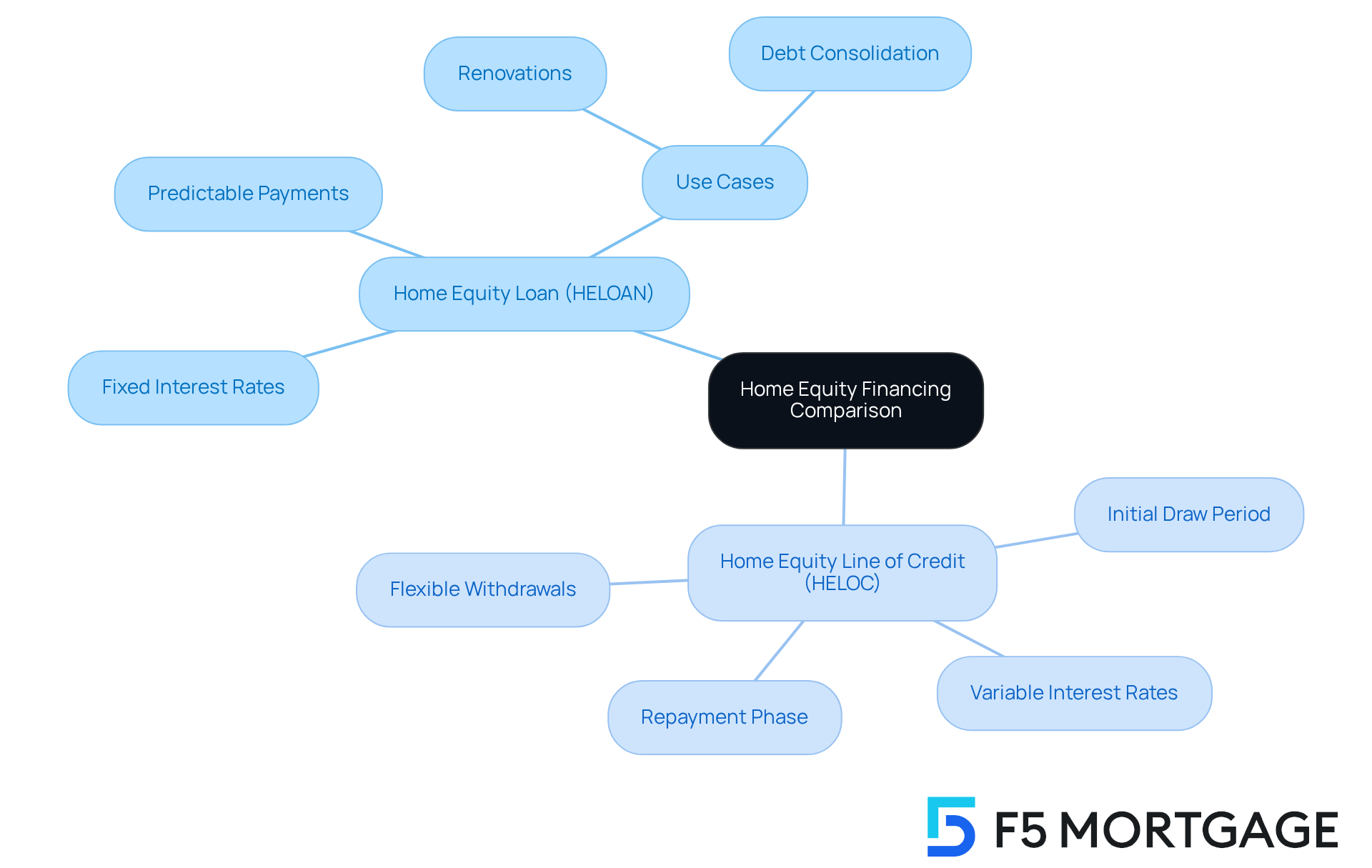

Comparing Structures: Home Equity Loans vs. HELOCs

When considering residential asset financing and evaluating HELOC vs HELOAN, it’s important to recognize the distinct frameworks that can impact your financial journey. Home equity loans typically offer fixed interest rates and repayment terms, which can provide you with predictable monthly payments. This structure is especially beneficial if you need a specific amount upfront for projects like property renovations or debt consolidation.

On the other hand, HELOCs feature variable interest rates, allowing you to withdraw funds as needed, adding a layer of flexibility. During the initial draw period of a HELOC, you may only be required to make interest payments, followed by a repayment phase where both principal and interest are paid. This flexibility can be particularly advantageous for families who may not need a lump sum immediately but prefer to access funds gradually as their needs arise.

As of mid-2024, the average HELOC rate was 8.26 percent, while home equity products averaged 8.25 percent. These figures reflect the current lending environment influenced by the Federal Reserve’s monetary policy. It’s crucial for families to be aware of the expenses linked to refinancing in California, which generally range from 2% to 5% of the borrowed amount. Understanding these costs, including:

- Application fees (between $75 and $500)

- Origination fees (0.5% to 1.5% of the loan amount)

- Appraisal fees (usually between $300 and $500)

is essential for making informed decisions.

To calculate the break-even point for refinancing, you can determine your refinancing costs, calculate your monthly savings by subtracting your new monthly payment from your current payment, and then divide your refinancing costs by your monthly savings. This analysis will help you understand how long it will take to recover the costs of refinancing.

We know how challenging this decision can be. Experts recommend that households thoughtfully evaluate their financial circumstances and future requirements when choosing between HELOC vs HELOAN, as this decision can greatly influence your long-term economic well-being.

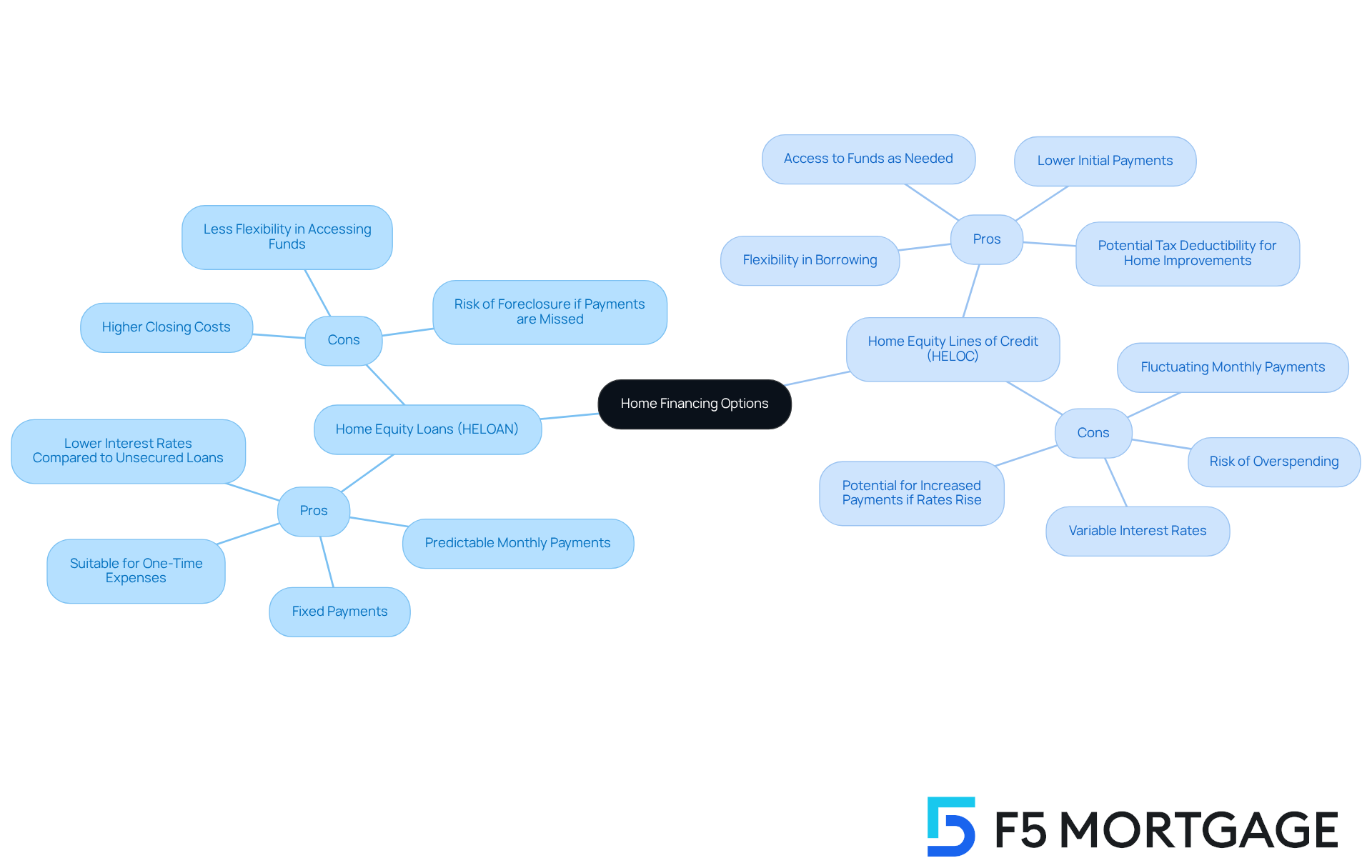

Evaluating Pros and Cons of HELOCs and Home Equity Loans

When it comes to home financing options, families often face the challenge of choosing between traditional home equity financing and the comparison of HELOC vs HELoan. Each option has its own unique benefits and drawbacks that deserve careful consideration. Home equity financing provides stability through fixed payments and interest rates, which can simplify budgeting. This option is particularly suitable for significant, one-time expenses like home renovations or debt consolidation. However, it’s important to be aware that these loans may come with higher closing costs and limited flexibility in accessing additional funds.

On the other hand, HELOCs offer a different kind of flexibility. They allow borrowers to draw funds as needed, making them ideal for ongoing projects or unexpected expenses. The initial payments are typically lower, but keep in mind that variable interest rates can lead to fluctuating monthly payments, which might pose a risk for households with tight budgets. Both options require adequate equity in the property and come with the risk of foreclosure if payments are missed.

For instance, families who relied on HELOCs for property enhancements could find themselves struggling with rising payments as interest rates increase. This underscores the importance of prudent financial planning. We know how challenging this can be, and budgeting for potential payment increases is crucial to avoid financial strain.

Additionally, it’s essential for families to be informed about the typical closing expenses associated with these agreements. These costs can vary significantly and affect overall affordability. Ultimately, understanding the stability of residential financing compared to the adaptability of HELOC vs HELOAN is vital for families exploring their financial choices in 2025. We’re here to support you every step of the way as you navigate these important decisions.

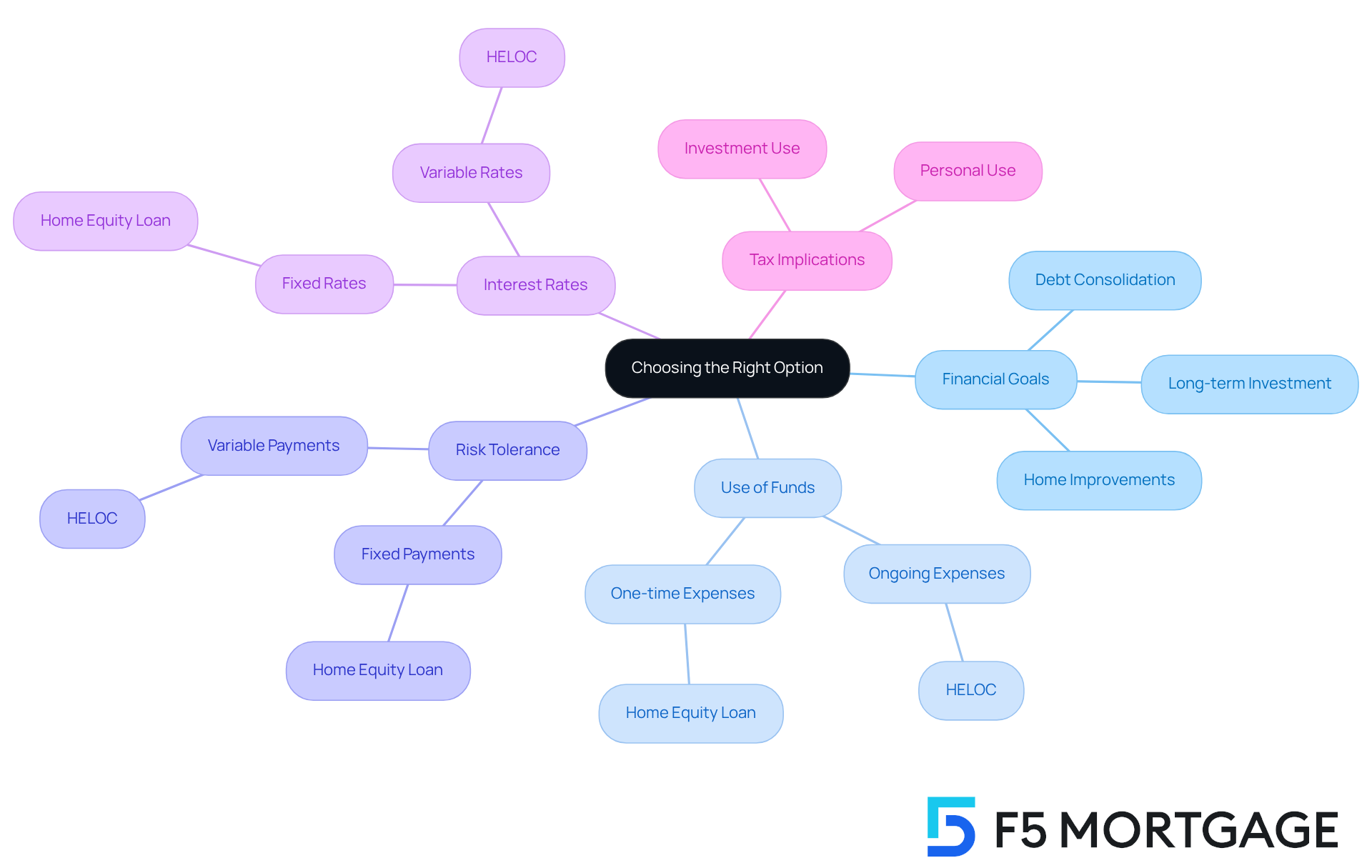

Choosing the Right Option: Factors to Consider

When households face the choice between a property value credit option and the discussion of HELOC vs HELOAN, several important factors come into play: financial goals, the intended use of the funds, and risk tolerance. For families needing a specific amount for a one-time expense, like home improvements or debt consolidation, a home equity option is often the better choice due to its fixed interest rates and predictable monthly payments. On the other hand, families looking for flexibility in borrowing and repayment may find a HELOC more beneficial, as it allows them to draw funds as needed during the draw period, which typically lasts ten years.

Current interest rates and potential tax implications are also crucial considerations. Interest on borrowed funds used for investment purposes may be tax-deductible, significantly impacting the overall cost of borrowing. It’s essential for families to carefully evaluate their ability to manage the fluctuating payments associated with a HELOC vs HELOAN, particularly if interest rates rise, in contrast to the stability offered by a property equity loan.

Real-life scenarios illustrate how households assess their financial goals when choosing between HELOC vs HELOAN. For instance, a family planning a major renovation project might select a HELOC to take advantage of lower initial rates and the ability to borrow only what they need. Conversely, another family may prefer a home equity loan to secure a lump sum for consolidating high-interest debt, ensuring predictable payments that align with their budget.

Consulting with a mortgage broker can provide tailored insights that resonate with individual financial situations, helping families navigate the complexities of these borrowing options effectively. By understanding their unique needs and the current borrowing landscape, families can make informed decisions that support their long-term financial well-being. We’re here to support you every step of the way.

Conclusion

Understanding the differences between Home Equity Loans (HELOAN) and Home Equity Lines of Credit (HELOC) is crucial for families looking to leverage their property value for financial needs. Each option presents unique advantages and challenges that can significantly impact a family’s financial stability and future planning. By grasping these distinctions, families can make informed decisions that align with their specific circumstances and goals.

We know how challenging it can be to navigate these financial products. A HELOAN provides a lump sum with fixed payments, making it ideal for significant one-time expenses. On the other hand, a HELOC offers flexibility with a revolving line of credit, suitable for ongoing needs. It’s important to consider current interest rates, typical fees, and the need to evaluate one’s financial strategy as critical components in choosing the right option. Real-life examples illustrate how different families approach these financial products based on their unique situations, showcasing the importance of tailored financial planning.

Ultimately, the decision between a HELOC and a HELOAN should be guided by a family’s financial objectives, the intended use of funds, and their capacity to manage potential risks. Engaging with financial experts can provide personalized guidance, ensuring that the choice made today supports long-term economic well-being. Families are encouraged to carefully assess their options, as understanding these financial tools can lead to more secure and informed financial futures. We’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan provides a lump sum of cash that you repay over a set period with regular monthly installments, often referred to as a second mortgage. It is beneficial for families needing a substantial amount of money upfront, such as for major renovations or consolidating high-interest debt.

How does a HELOC work?

A HELOC, or Home Equity Line of Credit, operates like a credit card, offering a revolving line of credit that homeowners can withdraw from as needed. It typically has a draw period for withdrawing funds, followed by a repayment period to pay back what was borrowed.

What are the current average rates for HELOCs and home equity loans?

As of 2025, the average rates for HELOCs stand at 8.12%, while residential equity loans average 8.23%. These rates are higher than some unsecured credit options but remain competitive compared to credit cards, which average 20.13%.

What are common reasons families use HELOCs?

Many families utilize HELOCs primarily for funding renovations, with 45% of those likely to borrow citing this as their main reason. Others also use property-backed financing to consolidate debt, benefiting from lower interest rates compared to personal loans.

Why is it important to understand the differences between HELOCs and home equity loans?

Understanding the differences between HELOCs and home equity loans is essential for families to make informed financial decisions. Reflecting on unique needs and financial situations can help choose the option that aligns best with their goals, whether addressing immediate cash needs or planning for long-term financial stability.