Overview

The article titled “7 Key Insights on First Lien HELOC for Home Upgrades” highlights the benefits and considerations of using a first lien Home Equity Line of Credit (HELOC) for enhancing your home. We understand how important it is to make your living space comfortable and inviting. First lien HELOCs offer homeowners flexible access to their home equity, which can be a game-changer when planning renovations.

Not only do these options come with lower interest rates compared to traditional loans, but they may also provide potential tax benefits. This makes them an attractive choice for funding your home upgrades while managing expenses effectively. We know how challenging this can be, and we’re here to support you every step of the way in making informed decisions about your home improvements.

Introduction

Homeowners are increasingly exploring innovative financing options to enhance their properties, and we understand how important this decision can be. First lien Home Equity Lines of Credit (HELOCs) are emerging as a popular choice, offering a flexible financial tool that not only allows access to home equity but also presents unique benefits. Whether you’re looking to fund renovations, consolidate debt, or manage unexpected expenses, a HELOC could be a valuable resource.

However, as the landscape of home financing evolves, it’s essential to navigate the complexities and risks associated with this option. We know how challenging this can be, and that’s why it’s crucial to gather key insights. What can help you make informed decisions about leveraging a first lien HELOC for your home upgrades? Let’s explore this together and empower you on your journey.

F5 Mortgage: Your Partner for First Lien HELOC Solutions

At F5 Mortgage LLC, we understand how challenging the mortgage process can be for families looking to refinance or acquire properties. As a leading independent mortgage brokerage, we focus on first lien HELOC options that cater to your unique financial needs. Our commitment to client satisfaction drives us to utilize our extensive network of over two dozen top lenders, ensuring you receive customized loan options tailored just for you.

In 2025, the mortgage brokerage industry is experiencing a significant shift towards personalized services, with customer satisfaction rates soaring. At F5 Mortgage, we exemplify this trend by prioritizing your specific needs. Our focus on providing customized solutions has led us to successfully implement first lien HELOCs, enabling property owners like you to efficiently access your equity with flexibility.

As more property owners tap into their equity—evidenced by a record $11.5 trillion of available property equity—we’re here to support you through this opportunity. Our dedication to client education and support, combined with a streamlined application process and the personal touch of our dedicated loan officers, positions us as your trusted partner in navigating the evolving landscape of home financing. With a customer satisfaction rate of 94%, we not only meet but exceed the expectations of families looking to enhance their living situations through strategic financial solutions. We’re here for you every step of the way.

Understanding First Lien HELOC: Definition and Functionality

A first priority Home Equity Line of Credit (HELOC) is a flexible financial product that combines the features of a traditional mortgage with a revolving line of credit. As the main loan on the property, it takes priority over any other claims, allowing property owners to easily access their equity. We know how important it is for families to have financial options, and with a HELOC, borrowers can access funds as needed. This makes it an ideal solution for various financial needs, including property enhancements, debt consolidation, or covering substantial expenses.

In 2025, the popularity of first lien HELOCs is on the rise, propelled by record amounts of home equity—approximately $11.5 trillion accessible to residents of the U.S. With the typical property owner holding around $212,000 in tappable equity, many are seizing the opportunity to leverage this valuable asset through first lien HELOCs. Recent trends indicate that the monthly payment for withdrawing $50,000 via a HELOC has decreased by over $100 since early 2024, making it an increasingly attractive option for families looking to manage their finances effectively.

It is important to note that most HELOCs currently available are second-lien loans, which require an existing mortgage. However, first lien HELOC options provide a unique opportunity for homeowners looking to maximize their equity. F5 Mortgage offers competitive rates and user-friendly technology to simplify the refinancing process, ensuring that families can access their home equity efficiently and with confidence.

When considering refinancing, it is crucial to understand the associated costs. In California, closing costs for refinancing typically range from 2% to 5% of the loan amount. For example, if your new loan amount is $300,000, you can expect to pay between $6,000 and $15,000 in closing costs. These costs include:

- Application fees

- Origination fees

- Credit report fees

- Appraisal fees

- Title search and insurance

- More

Calculating your break-even point can help you determine how long it will take to recoup these costs through savings in monthly payments or interest rates.

Expert opinions highlight the potential for further increases in HELOC withdrawals, especially if the Federal Reserve lowers borrowing costs. As borrowing becomes more affordable, property owners are likely to explore these options more actively. Additionally, the interest on HELOCs may be tax-deductible in many cases, adding to their appeal and making them a smart choice.

Overall, first lien HELOCs serve as a strategic financial resource for property owners who aim to enhance their living environments or manage expenses efficiently. We’re here to support you every step of the way, particularly when taking into account the detailed analysis of refinancing costs offered by F5 Mortgage.

First Lien HELOC vs. Traditional Mortgage: Key Differences

Understanding the essential differences between a first priority home equity line of credit (HELOC) and a conventional mortgage can be a crucial step for homeowners like you. A traditional mortgage provides a lump sum upfront, which is repaid through fixed monthly installments over a set term. In contrast, a first position HELOC allows you to borrow against your equity as needed, offering flexible repayment options that can adapt to your changing financial situation. This flexibility is particularly beneficial for those anticipating variable expenses, such as renovations or unexpected repairs.

Moreover, first position HELOCs typically feature variable interest rates that can fluctuate based on market conditions, while traditional mortgages generally maintain fixed rates. As we look toward 2025, interest rates for first position HELOCs are trending lower, often making them a more appealing option compared to conventional mortgage rates. For instance, if you have a credit score of 740 or above, you may find rates that are considerably lower than those linked to fixed-rate mortgages, potentially resulting in significant savings over time.

Real-life examples demonstrate this trend: many homeowners have chosen a first lien HELOC to finance home upgrades, leveraging their existing equity while enjoying the flexibility of drawing funds as needed. Experts emphasize that this option is especially suitable for financially stable property owners who can manage the variable payments associated with HELOCs. By understanding these differences, you can make informed decisions that align with your financial goals and needs. We know how challenging this can be, and we’re here to support you every step of the way.

Advantages of First Lien HELOC: Why Choose This Option?

Considering upgrades or renovations? A first lien HELOC can offer numerous advantages for homeowners like you.

Flexibility is one of the standout features of a first lien HELOC. You can draw funds as needed, making it particularly suitable for home renovations or unexpected expenses. This flexibility empowers you to manage your finances effectively, especially when costs fluctuate.

Another significant benefit is lower interest rates. Generally, first lien HELOCs provide lower rates compared to personal loans or credit cards. For instance, average home equity line of credit rates currently hover around 8.26%, with rates ranging from 4.99% to 12.00%. This is a considerable saving over typical credit card rates.

You might also appreciate the potential tax benefits. The interest paid on a first lien HELOC may be tax-deductible if the funds are used for home improvements, in line with IRS regulations. However, it’s important to remember that the IRS limits interest deductions at $750,000 for combined mortgage and home equity loans. This can lead to significant savings, especially for those of you investing in major renovations.

Streamlined debt management is another advantage. By consolidating high-interest debts into a first lien HELOC, you can simplify your financial responsibilities and potentially reduce your overall interest expenses. As Jose Garcia, president and CEO of Northwest Community Credit Union, wisely points out, “If you’re paying off high-interest credit cards, you can save a significant amount in interest and streamline your monthly bills.” This not only helps with managing monthly payments but also enhances your cash flow, allowing for better financial planning.

Real-world examples show these benefits in action: homeowners who have utilized a first lien HELOC for renovations often report increased property values and improved living conditions. Financial experts emphasize that this option can be particularly beneficial for those with stable incomes and significant home equity, enabling you to leverage your assets effectively. Strategically using a first lien HELOC can lead to accelerated mortgage repayment and greater financial stability.

However, we know how challenging this can be, so it’s essential to be aware of potential risks. Variable interest rates can complicate budgeting, and payments may increase after the draw period ends. We’re here to support you every step of the way as you navigate these options.

Disadvantages of First Lien HELOC: What to Consider

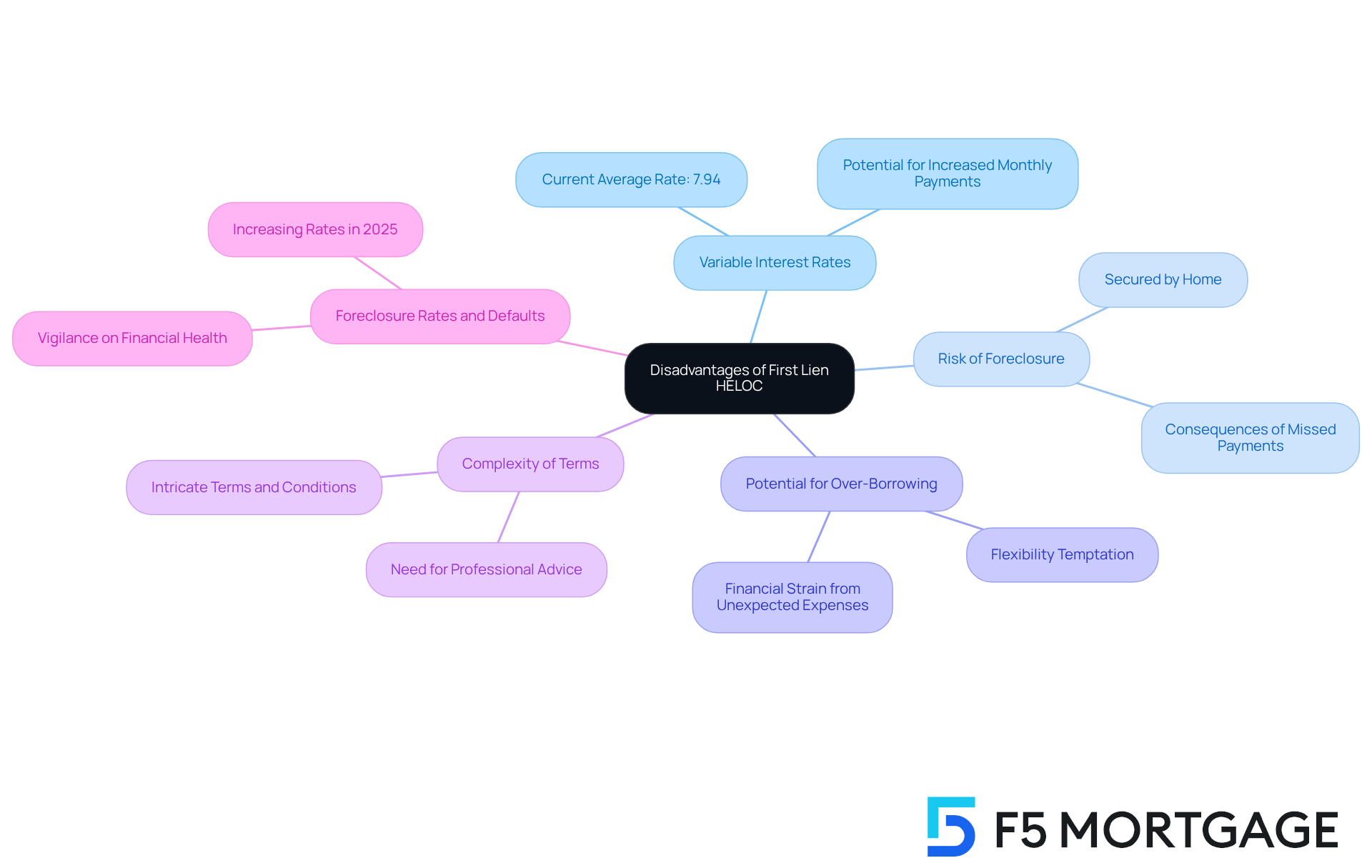

While first lien helocs offer several advantages, it’s important to recognize the notable risks that come along with first lien helocs. We understand how challenging this can be, and being informed is key to making the right choices.

Many first lien HELOCs come with variable interest rates that can change over time. Currently, the average interest rate for HELOCs is 7.94%. This variability may lead to increased monthly payments, making budgeting more difficult for homeowners.

-

Risk of Foreclosure: Because these lines of credit are secured by your home, failing to meet payment obligations could lead to foreclosure. This risk underscores the importance of maintaining a solid repayment plan, especially considering the rising foreclosure rates linked to home equity line of credit defaults in 2025.

-

Potential for Over-Borrowing: The flexibility of a home equity line of credit can sometimes tempt borrowers to take on more debt than they can comfortably handle. This can lead to financial strain, particularly if unexpected expenses arise. As Chelsea Beck, an SEO content specialist, notes, ‘A first lien heloc can be a flexible and powerful means to utilize your property’s equity, but it also entails distinct risks and responsibilities.’

-

Complexity of Terms: The terms and conditions of first-lien HELOCs can be quite intricate. We know how overwhelming this can feel, so seeking professional advice can help you fully understand your obligations and the implications of your borrowing decisions.

-

Foreclosure Rates and Defaults: In 2025, increasing foreclosure rates related to home equity line defaults have raised concerns. It’s essential for borrowers to stay vigilant about their financial health and repayment capabilities. For example, a borrower who heavily utilizes their home equity line of credit may find themselves in a precarious situation if market conditions worsen.

Understanding these risks is crucial for property owners considering a first lien HELOC. It empowers you to make informed decisions that align with your long-term financial goals. We’re here to support you every step of the way, and seeking guidance from a financial advisor before proceeding with a home equity line of credit can provide invaluable insights tailored to your unique situation.

Requirements for First Lien HELOC: What You Need to Know

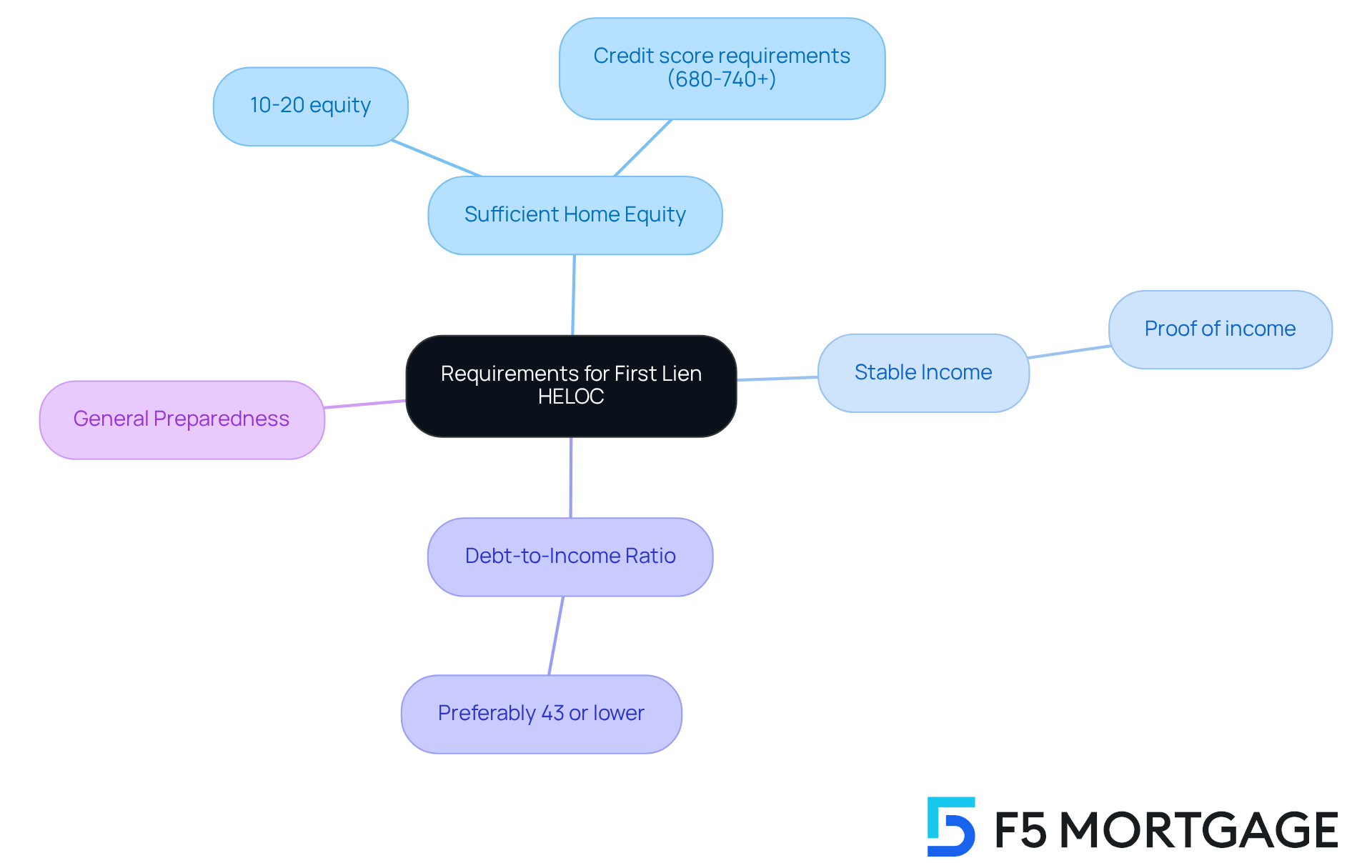

Potential borrowers should be aware of several key requirements involved in qualifying for a first lien HELOC.

-

Sufficient Home Equity: We understand how important your home equity is. Most lenders require homeowners to have at least 10-20% equity in their property. This equity is vital as it dictates the amount accessible for borrowing, with numerous lenders permitting access to up to 80-90% of the property’s equity. A minimum credit score of 680 is generally required to qualify for a first lien HELOC. However, we know that borrowers with higher scores often secure more favorable interest rates. It’s beneficial to aim for a score of 740 or above for the best terms.

-

Stable Income: Demonstrating a consistent income is essential. Lenders require proof of stable earnings to ensure borrowers can manage their loan repayments.

-

Debt-to-Income Ratio: Lenders generally prefer a debt-to-income (DTI) ratio of 43% or lower. This ratio is calculated by dividing total monthly debt payments by gross monthly income. Maintaining a lower DTI can significantly enhance your chances of approval.

Comprehending these necessities is crucial for property owners seeking to utilize their residential equity through a first lien HELOC. In a market where interest rates may vary, being well-prepared can lead to successful financing for residential upgrades. With record levels of property equity and rising line of credit withdrawals, we’re here to support you every step of the way.

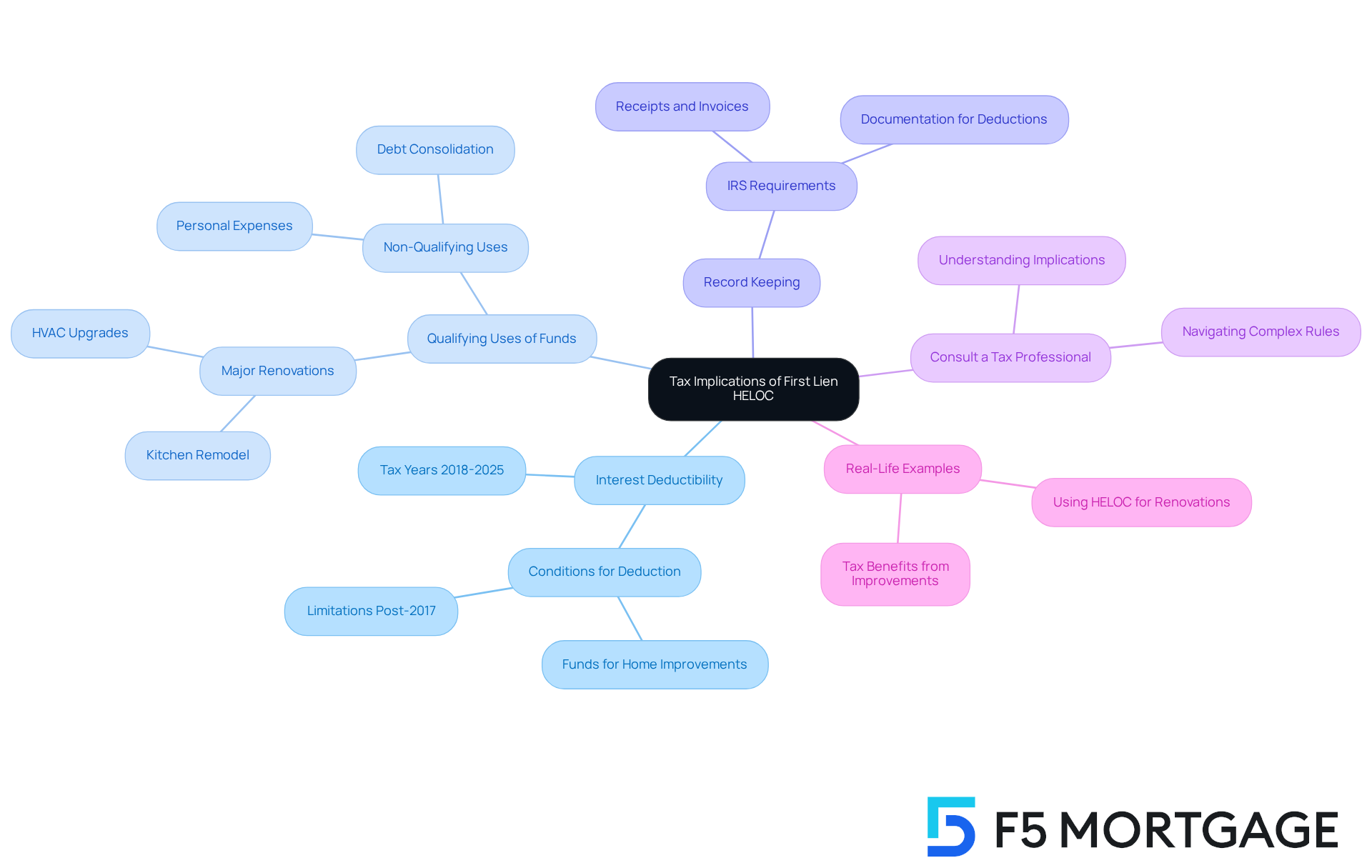

Tax Implications of First Lien HELOC: What You Should Know

Understanding the tax implications of a first mortgage equity line of credit is crucial for property owners looking to tap into their equity. For the tax years 2018 through 2025, interest paid on a first lien HELOC can be tax-deductible, provided that the funds are used to buy, build, or significantly improve the home. This includes major renovations, like adding a new room or upgrading essential systems such as HVAC, which may qualify for deductions. It’s important for property owners to keep detailed records, including receipts and invoices for significant improvements, to meet IRS requirements.

We recommend consulting a tax professional to navigate the specific requirements and limitations tied to these deductions. Financial experts point out that while the deductibility of home equity line of credit interest can offer substantial savings, the rules have tightened since the Tax Cuts and Jobs Act of 2017. For example, homeowners must ensure that the funds are not used for personal expenses or debt consolidation, as these do not qualify for tax benefits. As Hannah Friedman noted, “the deductibility of HELOCs was greatly restricted starting with the 2018 tax year, making it more challenging to determine whether you can deduct the interest on the loan.”

Real-life examples show the advantages of using a home equity line of credit for renovations. Homeowners who used a first lien HELOC to fund a kitchen renovation found that they not only increased their property’s value but also benefited from tax deductions on the interest paid on the loan. This strategic use of a line of credit can lead to significant financial advantages, making it a valuable resource for those looking to improve their homes. Additionally, property owners should remember that the total cap for deducting interest on home equity loans is $750,000 for loans taken out after December 15, 2017, which is an important consideration when planning renovations.

Common Uses for First Lien HELOC: Maximizing Your Home Equity

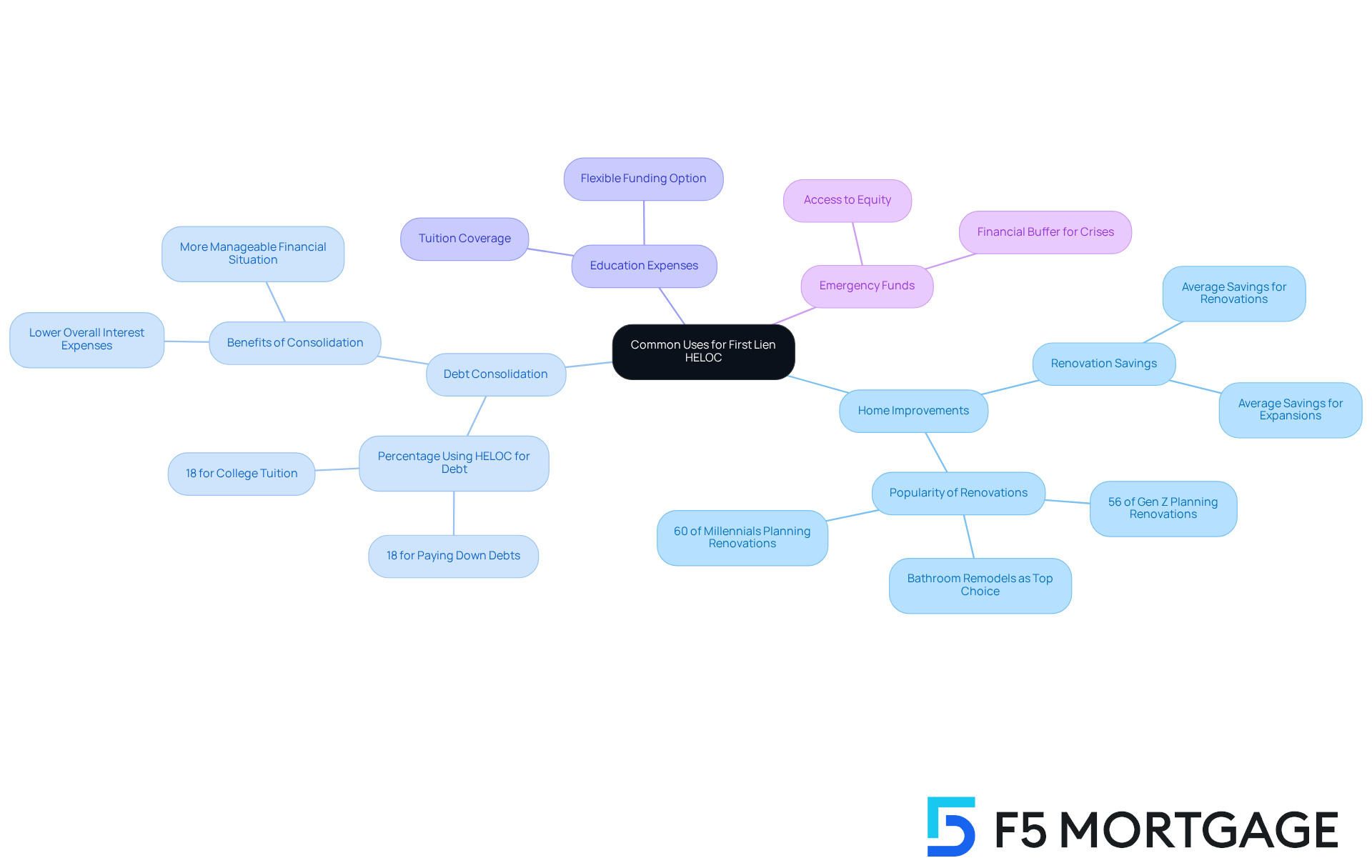

Homeowners can leverage a first lien HELOC for a variety of strategic financial purposes, including:

- Home Improvements: Many homeowners utilize HELOCs to fund renovations or upgrades, significantly increasing their property value. We understand the importance of enhancing your living space, and in fact, over half of property owners cite renovations as their primary reason for considering a first lien HELOC. Kitchen and bathroom remodels are particularly popular. Renovating an existing home is generally cheaper than buying a new one, with an average savings of $49,000 for renovations and $79,000 for expansions.

- Debt Consolidation: First lien HELOCs can be an effective tool for paying off high-interest debts, such as credit cards. By consolidating these debts, property owners can lower their overall interest expenses, making their financial situation more manageable. Approximately 18 percent of surveyed property owners indicated they would use a first lien HELOC to pay down debts or college tuition.

- Education Expenses: A first lien HELOC can also serve as a means to cover tuition or other educational costs for family members, providing a flexible funding option for those pursuing higher education.

- Emergency Funds: Property owners can tap into a first lien HELOC to access their equity, establishing a financial buffer for unanticipated costs or crises and ensuring they are ready for unexpected situations.

As property owners increasingly prioritize renovations, the trend of utilizing first lien HELOCs for home improvement projects is expected to expand. A recent survey revealed that 60% of millennial property owners and 56% of Gen Z property owners have renovation plans for this year. Financial advisors suggest that property owners thoroughly evaluate their equity and think about the long-term effects of utilizing a first lien HELOC to enhance their investment efficiently. As Mike Kinane, SVP of consumer lending at TD Bank, states, ‘First lien HELOCs provide property owners with greater flexibility when making important purchasing choices.’ Additionally, we encourage homeowners to speak with a mortgage professional to identify the purpose and potential impact of using their equity. We’re here to support you every step of the way.

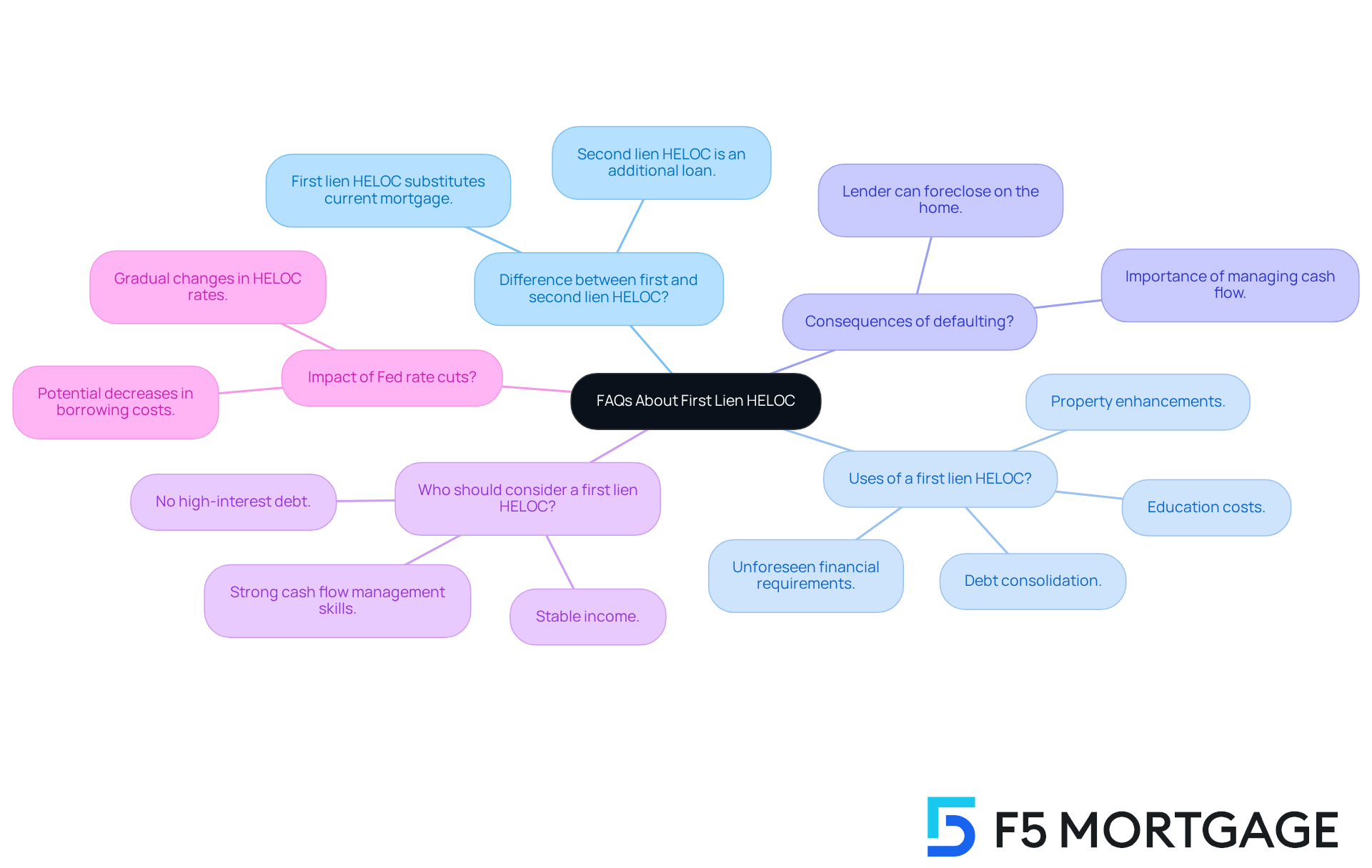

FAQs About First Lien HELOC: Answers to Common Questions

Here are some frequently asked questions about first lien HELOCs:

-

What is the difference between a first lien HELOC and a second lien HELOC? A first lien HELOC serves as a substitute for your current mortgage, effectively becoming the main loan secured by your residence. In contrast, a second mortgage equity line is an extra loan that stands behind your primary mortgage. This allows you to borrow against your property equity without changing your first mortgage, which can be a helpful option for many families.

-

Can I use a first mortgage line of credit for anything? Yes, the funds from a first mortgage equity line of credit can be used for various purposes. Whether it’s for property enhancements, debt consolidation, education costs, or even unforeseen financial requirements, this flexibility can significantly ease your financial management.

-

What occurs if I default on my primary home equity line of credit? If you fail to meet obligations on a primary secured line of credit, the lender has the right to foreclose on your home, as the line of credit is backed by the property. We know how challenging this can be, which underscores the importance of understanding your repayment obligations and managing your cash flow effectively to avoid potential pitfalls.

-

Who are suitable candidates for a first lien HELOC? Ideal candidates for a first lien HELOC typically have stable income, strong cash flow management skills, and no high-interest debt. This combination makes them well-suited for this type of loan, and we’re here to support you every step of the way.

-

How do Fed rate cuts influence home equity line of credit rates? Homeowners should consider that potential Fed rate cuts could affect home equity line rates. This may lead to gradual decreases in borrowing costs over time, which is a significant element to consider when assessing the timing of borrowing against property equity.

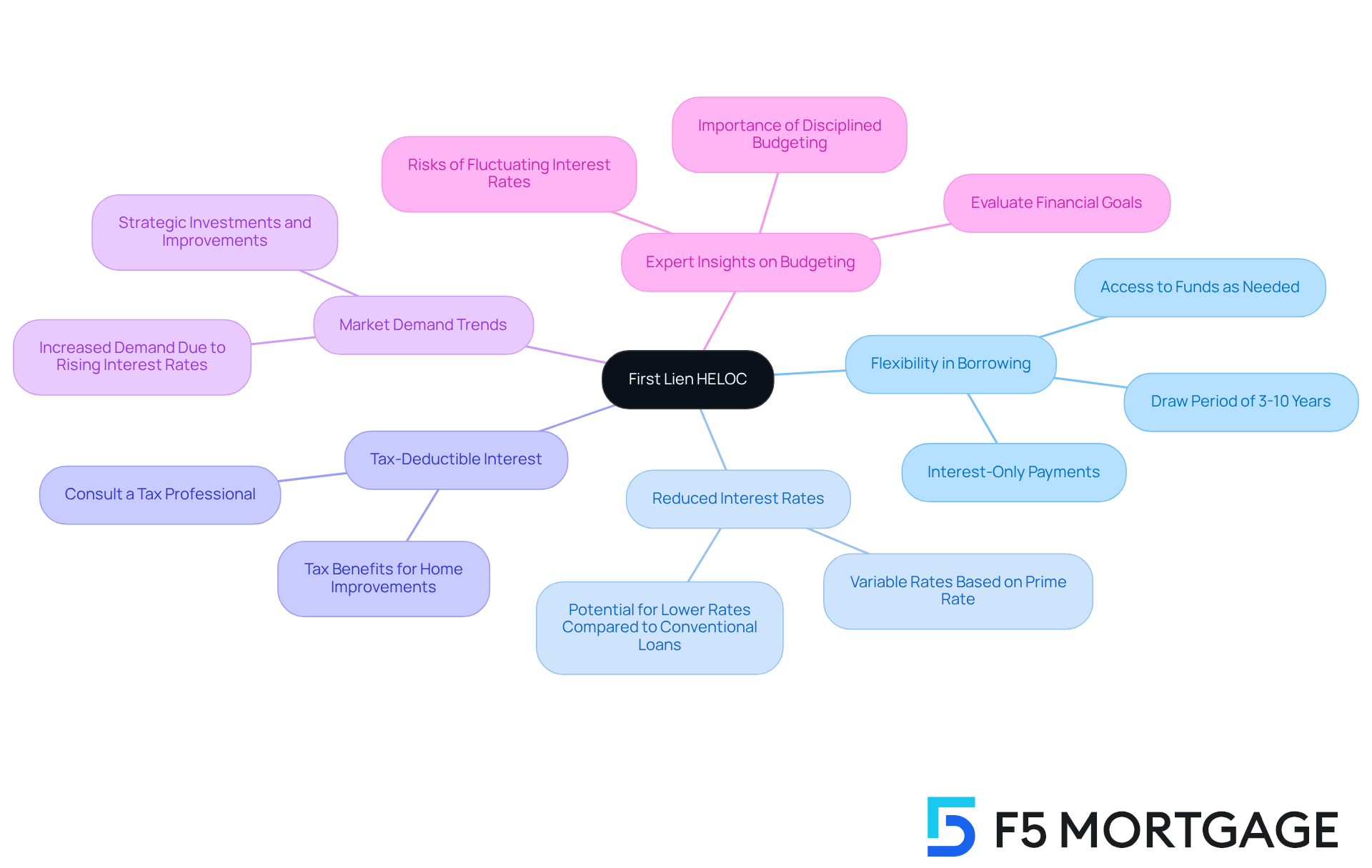

Key Takeaways on First Lien HELOC: Essential Facts Recap

A first lien HELOC serves as a flexible financial tool, enabling property owners to tap into their equity while acting as the primary loan on their asset. Here are some essential takeaways to consider:

- Flexibility in Borrowing and Repayment: Homeowners can draw funds as needed during the draw period, which typically lasts between three to ten years. This allows for interest-only payments, helping to ease short-term financial pressures.

- Compared to conventional loans, a first lien HELOC often provides the potential for reduced interest rates. This makes them an appealing choice for those looking to fund property enhancements or consolidate debt.

- The interest on a first lien HELOC may be tax-deductible if used for significant home improvements, offering additional financial advantages. We encourage homeowners to consult a tax professional to understand their specific situation better.

- As we look ahead to 2025, the first lien HELOC market is experiencing increased demand due to rising interest rates. This trend encourages property owners to seek flexible financing alternatives that enable strategic investments and improvements.

- Expert insights from financial specialists emphasize the importance of disciplined budgeting when utilizing a first lien HELOC. They recommend that property owners carefully evaluate their financial goals and ensure that the benefits outweigh potential risks, such as fluctuating interest rates and the possibility of balloon payments after the draw period.

In conclusion, a first lien HELOC can serve as a powerful tool for homeowners aiming to enhance their properties. However, it’s crucial to approach it with careful planning and financial awareness. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

A first lien HELOC represents a valuable financial opportunity for homeowners, allowing them to leverage their home equity while enjoying the flexibility of a line of credit. This innovative financing option not only serves as the primary loan on the property but also enables property owners to fund renovations, consolidate debt, or cover unexpected expenses. It’s a strategic choice for enhancing living spaces and improving quality of life.

We understand how important it is to make informed decisions about your finances. Throughout this discussion, key insights have emerged regarding the functionality, advantages, and potential risks associated with first lien HELOCs. Homeowners can benefit from lower interest rates compared to traditional mortgages, tax-deductible interest when used for home improvements, and the ability to draw funds as needed. However, it’s essential to remain aware of the associated risks, such as fluctuating interest rates and the possibility of foreclosure if payments are missed. Understanding the requirements for qualification and the implications of using a first lien HELOC is crucial for making informed financial decisions.

As homeowners increasingly seek to tap into their property equity, first lien HELOCs stand out as a flexible and advantageous solution for funding home upgrades and managing finances. We know how challenging this can be, and it’s imperative for property owners to approach this financial tool with careful planning and a solid understanding of their financial landscape. Engaging with a trusted mortgage partner like F5 Mortgage can provide invaluable guidance, ensuring that homeowners make the most of their equity while navigating the complexities of the mortgage landscape effectively. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage LLC is an independent mortgage brokerage that specializes in first lien Home Equity Line of Credit (HELOC) solutions, focusing on personalized services to meet the unique financial needs of families looking to refinance or acquire properties.

What is a first lien HELOC?

A first lien HELOC is a flexible financial product that allows property owners to access their equity as needed. It combines features of a traditional mortgage with a revolving line of credit and takes priority over other claims on the property.

Why is the popularity of first lien HELOCs increasing?

The popularity of first lien HELOCs is rising due to record amounts of home equity available, with approximately $11.5 trillion accessible in the U.S. Many homeowners are leveraging their equity, as the monthly payment for withdrawing funds through HELOCs has decreased.

What are the typical closing costs associated with refinancing in California?

In California, closing costs for refinancing typically range from 2% to 5% of the loan amount. For a $300,000 loan, this could amount to between $6,000 and $15,000, covering fees such as application, origination, credit report, appraisal, and title search.

How does a first lien HELOC differ from a traditional mortgage?

Unlike a traditional mortgage that provides a lump sum with fixed monthly payments, a first lien HELOC allows borrowing against equity as needed with flexible repayment options. HELOCs typically have variable interest rates, while traditional mortgages generally have fixed rates.

What are the benefits of choosing a first lien HELOC?

Benefits include access to funds as needed, flexibility in repayment, and potentially lower interest rates compared to traditional mortgages, especially for borrowers with good credit scores.

Can the interest on a HELOC be tax-deductible?

Yes, in many cases, the interest on HELOCs may be tax-deductible, adding to their appeal for homeowners looking to manage expenses efficiently.

How does F5 Mortgage ensure client satisfaction?

F5 Mortgage prioritizes client satisfaction by offering customized loan options, a streamlined application process, and the support of dedicated loan officers, achieving a customer satisfaction rate of 94%.