Overview

A balloon mortgage calculator is a valuable tool for families looking to manage their finances effectively. It allows you to estimate lower initial payments while preparing for a significant lump-sum payment due at the end of the loan term. We know how challenging this can be, and we want to help you navigate these options with confidence.

While these calculators assist in understanding payment structures and future obligations, it’s crucial to consider the associated risks and potential financial pressures. Making informed decisions about balloon loans requires careful thought and planning. Remember, we’re here to support you every step of the way as you explore the best options for your family’s needs.

Introduction

Navigating the world of mortgages can feel overwhelming, especially with options like balloon mortgages that come with their own set of benefits and challenges. We know how challenging this can be, and that’s where a balloon mortgage calculator becomes an invaluable resource. This tool helps families understand the complexities of this financing method, which often features lower initial payments and potentially reduced interest rates.

However, the appeal of lower monthly costs can quickly transform into a financial burden if one is unprepared for the significant payment due at the end of the term. We’re here to support you every step of the way. How can families use this calculator to make informed decisions and steer clear of common pitfalls? Let’s explore this together.

Understand Balloon Mortgages and Their Benefits

A balloon mortgage calculator can help families understand this unique loan arrangement that allows for lower monthly payments for a defined period, typically between five to seven years. This setup can be particularly advantageous for those looking to improve their homes, especially if they plan to utilize a balloon mortgage calculator before the larger payment is due to sell or refinance. We understand how important it is to find a solution that fits your needs, and here are some key benefits to consider:

- Lower Initial Payments: Families can benefit from significantly reduced monthly payments during the initial term, easing cash flow management and making homeownership more attainable.

- Potential for Lower Interest Rates: Balloon loans often come with lower interest rates compared to traditional fixed-rate options, making them an appealing choice for those wishing to minimize borrowing costs.

- Adaptability: This type of loan is perfect for those who anticipate moving or restructuring their finances before the large payment is due, allowing for thoughtful financial planning.

However, it’s essential to recognize the potential risks involved. Families may face financial pressure if they cannot refinance or sell their property before the balloon payment is due, highlighting the importance of using a balloon mortgage calculator to avoid significant challenges. For instance, if a borrower secures a $400,000 adjustable loan at an interest rate of 6.75%, they might pay around $2,594 monthly for nearly five years, only to face a substantial payment of approximately $378,097 at the end of the term. This scenario underscores the importance of careful consideration and preparation when opting for a balloon loan.

Moreover, understanding adjustable-rate loans (ARMs) can provide additional options for families. ARMs typically offer lower initial rates and include interest adjustment limits, which can be beneficial for those planning to pay off their loan quickly or refinance in a few years. If families purchased their homes with less than a 20% down payment, they might also consider refinancing to eliminate private mortgage insurance (PMI), especially in a market with rising home values. This could enhance their financial situation and reduce monthly expenses. Remember, we’re here to support you every step of the way as you navigate these important decisions.

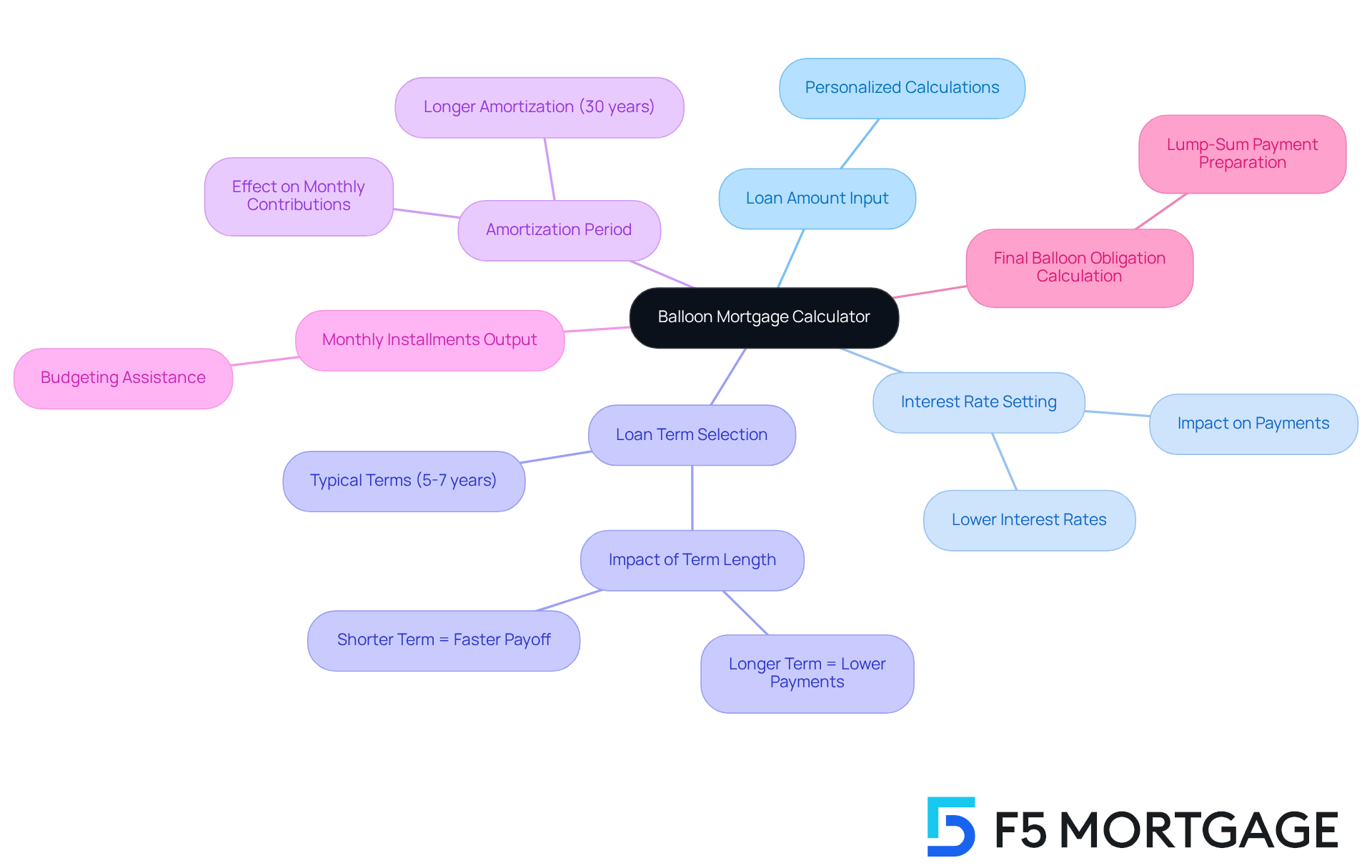

Explore Features of a Balloon Mortgage Calculator

A balloon mortgage calculator for short-term financing is an essential resource for borrowers who want to navigate the complexities of these financial products. This specialized tool, known as a balloon mortgage calculator, helps users estimate their monthly payments and the final balloon amount due at the end of the loan term. Let’s explore some key features that can truly make a difference:

- Loan Amount Input: You can specify the total amount you wish to borrow, allowing for personalized calculations that align with your financial needs.

- Interest Rate Setting: The calculator allows you to set your own annual interest rates, which are crucial in determining your payment amounts. Balloon loans often come with lower interest rates, making them an appealing option for many.

- Loan Term Selection: You have the flexibility to choose the duration of your financing, typically ranging from 5 to 7 years, which aligns with common balloon financing terms. Understanding how changing the loan duration can impact your monthly costs is vital; lengthening the term may lower your expenses, while shortening it can help you pay off your mortgage more quickly.

- Amortization Period: You often have the option to establish a longer amortization period, like 30 years, to see how this affects your monthly contributions.

- Output of Monthly Installments: The calculator provides an estimate of your monthly installments based on your inputs, helping you budget effectively.

- Final Balloon Obligation Calculation: It also computes the lump-sum amount due at the end of the loan term, enabling you to prepare for this significant financial responsibility.

Using a balloon mortgage calculator can greatly enhance your decision-making process. By providing clear insights into payment structures and future obligations, these calculators empower you to make informed choices about your loan options. We know how challenging this can be, especially when considering your debt-to-income (DTI) ratio; a lower DTI can lead to more favorable loan rates.

As you approach the end of your loan period, it’s important to think about the potential need to refinance, sell your home, or transition to a conventional loan at current interest rates. This consideration is particularly relevant for families in California who are looking to optimize home equity and eliminate private mortgage insurance (PMI) through strategic refinancing options available from F5 Mortgage. We’re here to support you every step of the way.

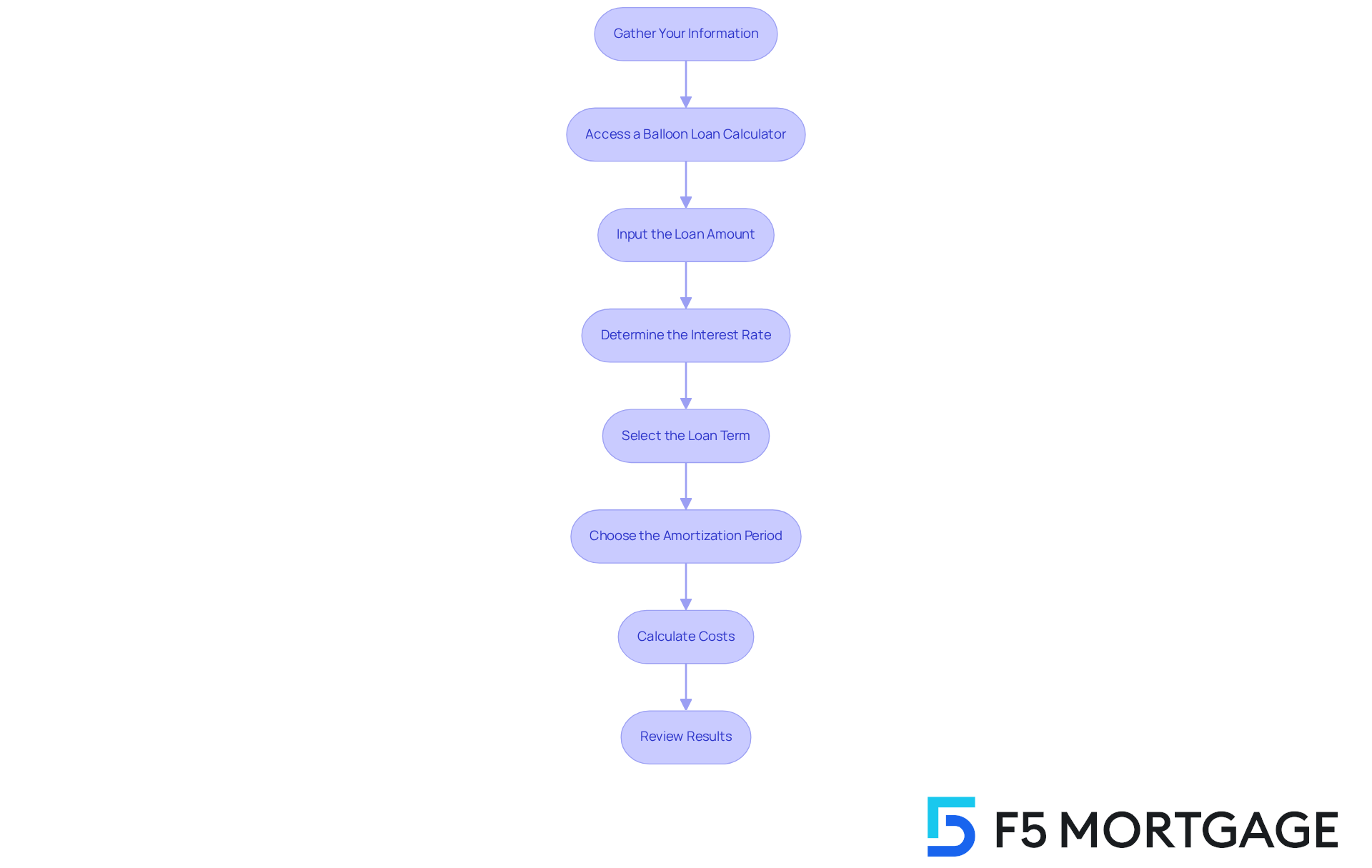

Follow Steps to Calculate Your Balloon Mortgage Payments

Determining your balloon loan payments can feel daunting, but using a balloon mortgage calculator makes it straightforward. Let’s walk through the steps together to ensure you have clarity and confidence:

- Gather Your Information: Start by collecting essential details like the loan amount, interest rate, and your desired loan term. We know how important this information is for your financial planning.

- Access a Balloon Loan Calculator: Find a reliable online calculator on loan websites or from financial institutions. This tool is designed to help you easily navigate your options.

- Input the Loan Amount: Enter the total amount you wish to borrow into the calculator. This is a crucial step in understanding your financial commitment.

- Determine the Interest Rate: Input the annual interest rate for your mortgage. This figure can greatly influence your monthly costs, so it’s vital to get it right.

- Select the Loan Term: Choose the duration of the loan, typically ranging from 5 to 7 years. Aligning this with your financial goals is key to your success.

- Choose the Amortization Period: If relevant, establish the amortization duration (e.g., 30 years). This will show you how it affects your monthly installments and overall payment strategy.

- Calculate Costs: Click the calculate button to see your estimated monthly charges and the final lump sum owed at the end of the term. This is where the numbers start to come together.

- Review Results: Examine the output thoroughly. It’s essential to understand both the monthly charge and the significant final amount required at the conclusion of the term.

Practical examples show that families who assess their mortgage costs effectively can prepare better for the financial implications of their borrowing. For instance, a family with a $100,000 debt at a 3.5% interest rate may find their final large sum due nearing $78,000 at the end of a 10-year period unless they refinance. Financial advisors emphasize the importance of understanding these calculations to avoid potential pitfalls, such as foreclosure, which can arise from being unprepared for the large sum due. As Carolyn Morganbesser wisely notes, “If you possess a seven-year term, you will appreciate a monthly charge based on a 15- or 30-year amortization, but at the conclusion of seven years, your debt is payable.” By utilizing a loan calculator, you can make informed choices and manage your finances effectively. We also recommend saving sufficient funds to cover that large final payment, as it is often more than twice the average monthly installment. Remember, we’re here to support you every step of the way.

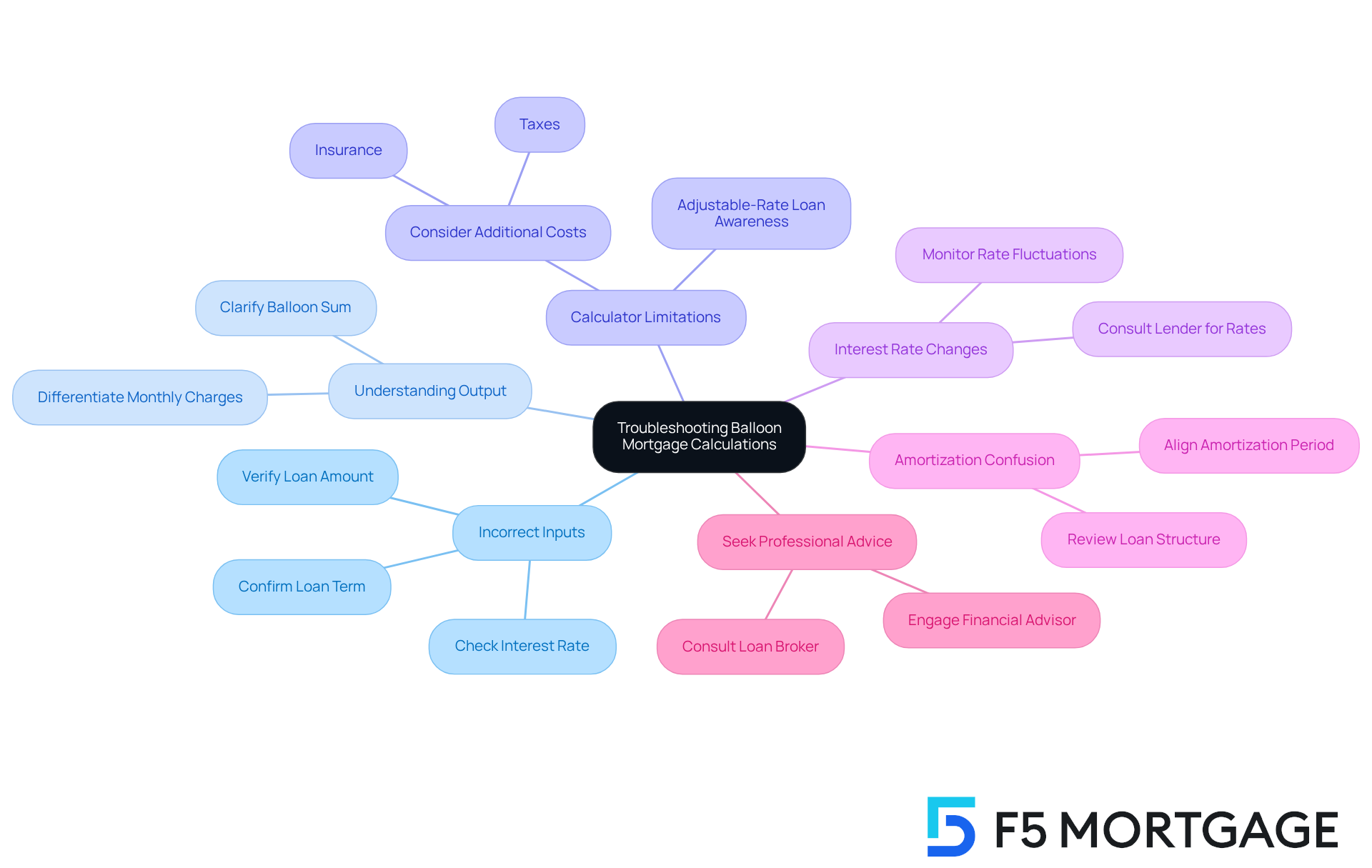

Troubleshoot Common Issues with Balloon Mortgage Calculations

When using a specialized mortgage calculator, we know how challenging it can be to navigate potential issues. Here’s how to troubleshoot them effectively:

- Incorrect Inputs: It’s essential to ensure that all inputs—such as loan amount, interest rate, and loan term—are accurate. Even minor errors can lead to significant discrepancies in your calculations.

- Understanding Output: If the results seem unclear, take a moment to explain the difference between monthly charges and the balloon sum. A well-designed calculator should clearly differentiate these amounts to avoid misunderstandings.

- Calculator Limitations: Be aware that some calculators may not include additional costs like taxes or insurance. This oversight can lead to your total monthly charge being higher than what the calculator shows. Considering that many homeowners encounter considerably increased loan costs due to adjustable-rate loans (ARMs), understanding these constraints is essential.

- Interest Rate Changes: If you’re uncertain about the interest rate, consult your lender for the most accurate figure, as rates can fluctuate frequently. This is crucial, especially in a market where the current 30-year fixed mortgage rate is around 7%.

- Amortization Confusion: An incorrectly set amortization period can skew your monthly payment estimates. Ensure that it aligns with your loan structure to get accurate projections.

- Seek Professional Advice: If doubts remain, consider consulting with a loan broker or financial advisor. Their expertise can help clarify any uncertainties and ensure you’re making informed decisions. Studies suggest that around 10% of ARM holders may find it difficult to fulfill their commitments when their rates change, highlighting the necessity of professional assistance in managing intricate loan calculations.

By addressing these common issues, you can enhance your understanding and confidence in using a balloon mortgage calculator to manage your mortgage effectively. We’re here to support you every step of the way.

Conclusion

Understanding the intricacies of balloon mortgages is essential for families looking to optimize their financial strategies. A balloon mortgage calculator serves as a valuable tool, enabling users to navigate the complexities of these loans. While they offer lower initial payments, careful planning is needed for the significant lump sum due at the end of the term. By leveraging this calculator, borrowers can make informed decisions that align with their financial goals and circumstances.

We know how challenging this can be, and throughout this guide, we provided key insights on the benefits and risks associated with balloon mortgages. We also discussed the features of a balloon mortgage calculator and practical steps for calculating payments. It’s crucial to input accurate data and understand the calculator’s limitations to avoid potential pitfalls. Additionally, the value of consulting professionals when faced with uncertainties was highlighted, reinforcing the need for thorough financial planning.

Ultimately, mastering the use of a balloon mortgage calculator can empower families to take control of their financial futures. By being proactive and informed, individuals can navigate the challenges of balloon loans, ensuring they are well-prepared for the road ahead. Embracing these tools and insights will not only enhance financial literacy but also pave the way for successful homeownership and investment strategies. We’re here to support you every step of the way.

Frequently Asked Questions

What is a balloon mortgage?

A balloon mortgage is a type of loan arrangement that typically allows for lower monthly payments for a defined period, usually between five to seven years, after which a large final payment (the balloon payment) is due.

What are the benefits of a balloon mortgage?

The benefits of a balloon mortgage include lower initial payments, potential for lower interest rates compared to traditional fixed-rate options, and adaptability for those who anticipate moving or restructuring their finances before the large payment is due.

How can a balloon mortgage calculator help families?

A balloon mortgage calculator can help families understand the financial implications of a balloon mortgage, allowing them to plan for the larger payment due at the end of the term and manage their cash flow effectively.

What risks are associated with balloon mortgages?

The primary risk of balloon mortgages is the financial pressure families may face if they cannot refinance or sell their property before the balloon payment is due, which can lead to significant financial challenges.

Can you provide an example of a balloon mortgage scenario?

For instance, if a borrower secures a $400,000 adjustable loan at an interest rate of 6.75%, they might pay around $2,594 monthly for nearly five years, only to face a substantial payment of approximately $378,097 at the end of the term.

What are adjustable-rate loans (ARMs)?

Adjustable-rate loans (ARMs) are loans that typically offer lower initial interest rates and include interest adjustment limits, making them beneficial for those planning to pay off their loan quickly or refinance within a few years.

How can refinancing help families with balloon mortgages?

Families who purchased their homes with less than a 20% down payment might consider refinancing to eliminate private mortgage insurance (PMI), especially in a market with rising home values, which can enhance their financial situation and reduce monthly expenses.