Overview

This article is dedicated to helping you effectively use a mobile home loan calculator to estimate your monthly payments and make informed borrowing decisions. We understand how challenging this process can be, and it’s important to grasp key financial terms along the way. We’re here to support you every step of the way.

In this guide, you’ll find a step-by-step approach to using the calculator, enriched with real-life examples that demonstrate its effectiveness. These examples aim to show you how the calculator can simplify the complexities of mobile home financing, making it easier for you to navigate your options.

By following this guide, you can empower yourself with the knowledge needed to make confident financial decisions. Remember, understanding your finances is the first step towards achieving your dreams of homeownership.

Introduction

Mobile home loan calculators are essential tools for anyone looking to borrow, allowing you to estimate your monthly payments and grasp your financial commitments more clearly. We know how challenging this can be, and by mastering these calculators, you can make informed decisions that truly reflect your unique financial situation. This knowledge ultimately leads to a more confident home-buying experience.

Yet, navigating the complexities of various loan options can feel overwhelming. Understanding how interest rates and down payments impact your choices raises critical questions. How can you effectively utilize these calculators to ensure the best financial outcome? We’re here to support you every step of the way as you explore these important decisions.

Understand Mobile Home Loan Calculators

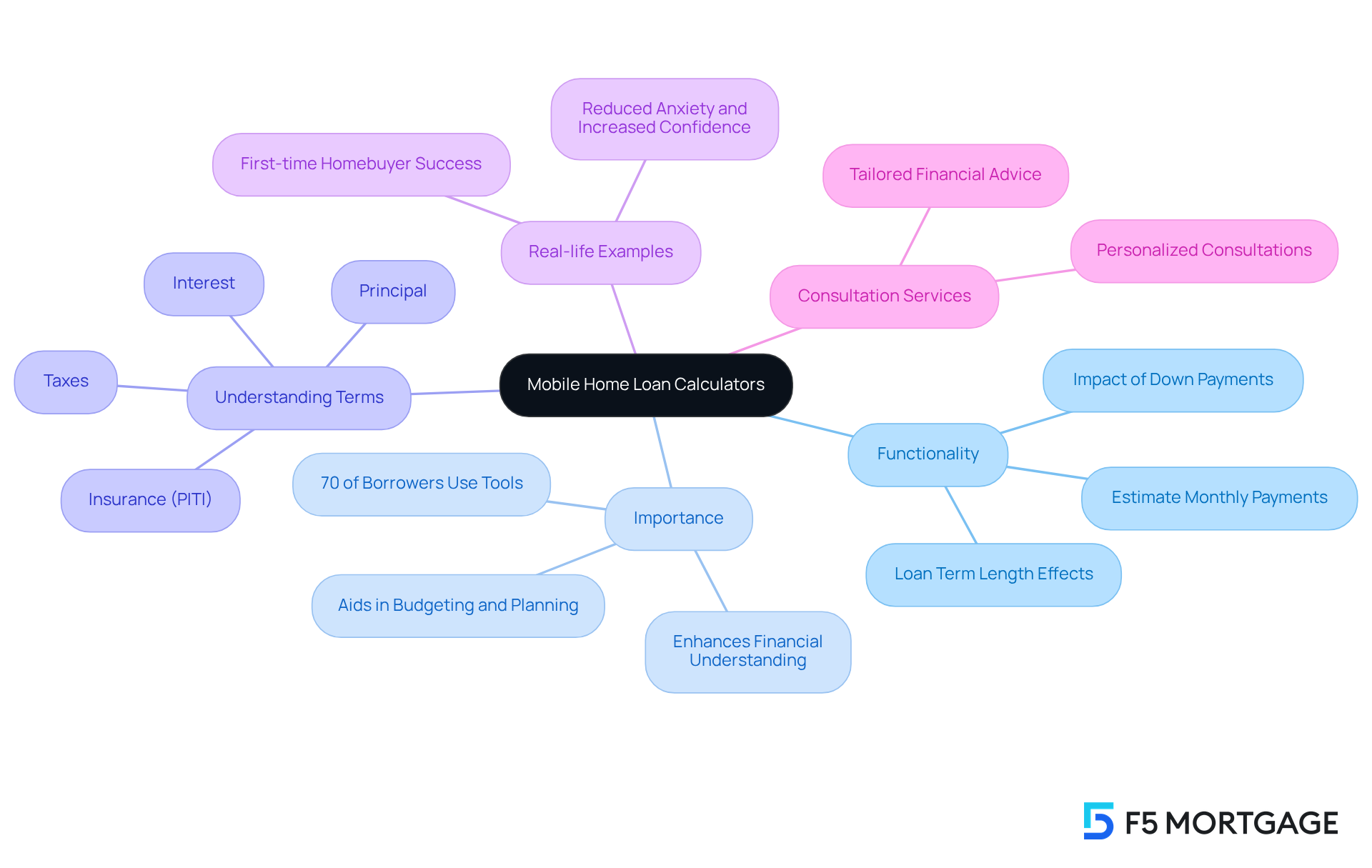

Mobile home loan calculators serve as invaluable resources for potential borrowers, allowing them to estimate their monthly payment amounts based on key factors such as the amount borrowed, interest rate, and term length. These tools also illustrate how varying down payment amounts can impact monthly payments and the total cost of the loan. By mastering these devices, you can make informed choices about your loan options, ensuring they align with your financial situation.

Understanding essential terms like principal, interest, taxes, and insurance (PITI) is vital for accurately interpreting the results. In 2025, approximately 70% of borrowers reported using online loan estimation tools, highlighting their growing importance in the decision-making process. Financial consultants emphasize that leveraging these tools can significantly enhance a borrower’s understanding of their financial responsibilities, aiding in better planning and budgeting. As one financial advisor noted, “Utilizing a mortgage estimation tool can clarify the figures and help borrowers envision their financial future.”

Real-life examples showcase the effectiveness of mobile home financing tools. For instance, a first-time homebuyer used a tool to explore various financing options and ultimately chose a plan that fit comfortably within their budget. This empowered approach not only reduced anxiety but also built confidence in their financial decisions. Moreover, F5 Mortgage addresses common challenges faced by homebuyers, such as high-interest rates and complicated documentation, making the use of these tools even more crucial in navigating the lending landscape.

By utilizing a mobile home loan calculator, borrowers can navigate the complexities of mobile home financing with greater ease and understanding. Additionally, with F5 Mortgage’s personalized consultations and accessible financing tool, clients receive tailored advice that aligns with their unique financial circumstances. We know how challenging this can be, and we’re here to support you every step of the way.

Step-by-Step Instructions for Using the Calculator

-

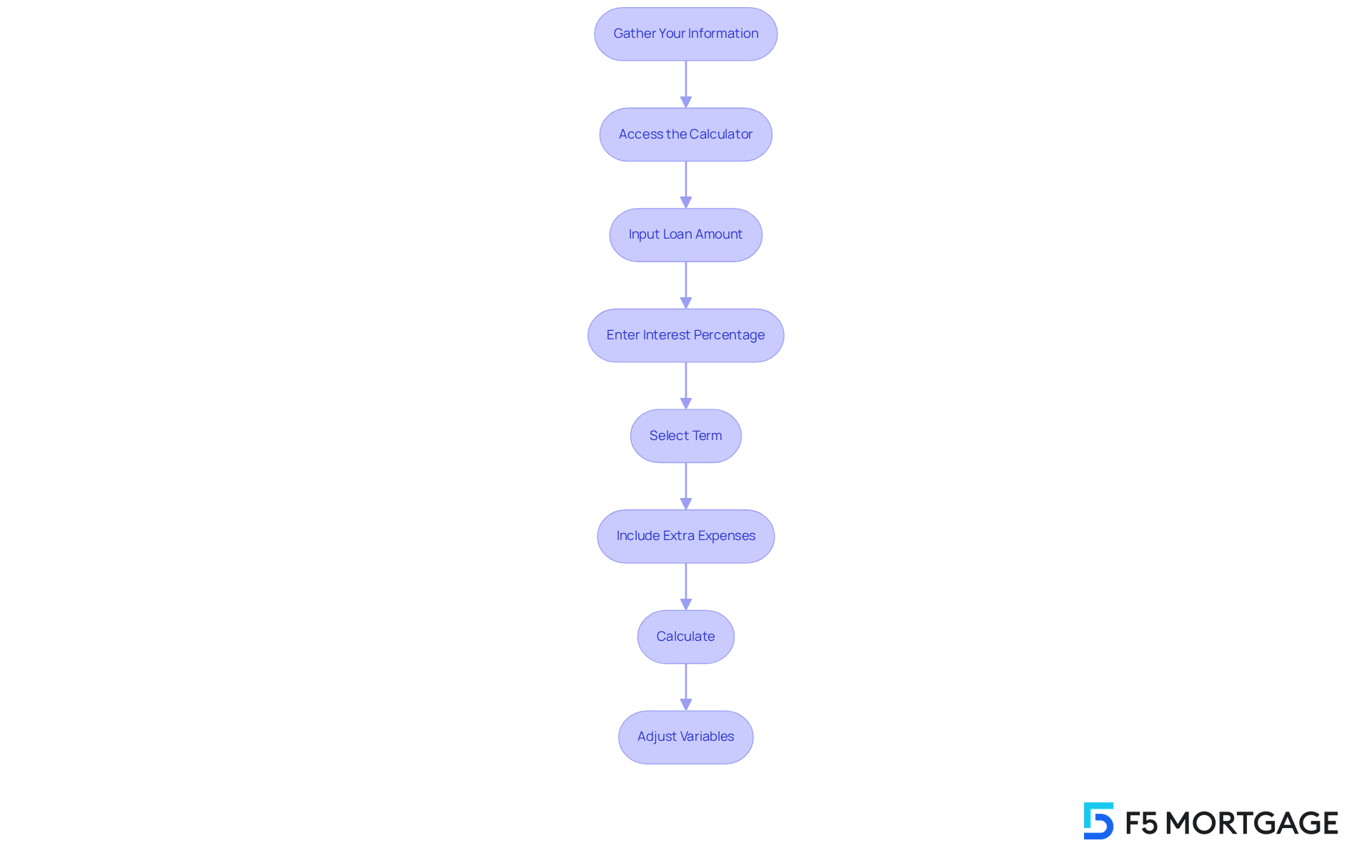

Gather Your Information: We understand how important it is to have all the details before using the device. Start by collecting the necessary information: the amount you wish to borrow, the interest rate (you can use an estimated rate based on current market conditions, which in 2025 starts around 6.75%), and the term (in years).

-

Access the mobile home loan calculator: Next, navigate to a reliable mobile home loan estimator online or through a mortgage brokerage app. We recommend F5 Mortgage, which offers a user-friendly mobile home loan calculator that simplifies this process for you.

-

Input Loan Amount: Enter the total amount you plan to borrow. This is typically the purchase price of the mobile home minus any down payment you might have.

-

Enter Interest Percentage: Now, input the interest percentage you anticipate receiving. If you’re uncertain, it’s always wise to verify current rates or consult with your loan broker for estimates.

-

Select Term: Choose the duration of the financing, which is commonly 15 or 30 years. This choice can significantly impact your monthly payments.

-

Include Extra Expenses: If possible, consider adding property taxes, homeowner’s insurance, and any private mortgage insurance (PMI) that may be relevant to your situation.

-

Calculate: Click the calculate button to see your estimated monthly payment. Take a moment to review the breakdown of principal and interest, as well as any additional costs you included. This transparency is essential for understanding your financial commitment.

-

Adjust Variables: Don’t hesitate to experiment with different borrowing amounts, interest percentages, and terms. This will help you see how these factors influence your monthly payment and allow you to find what fits your budget best. For instance, many families have successfully used calculators to find manageable payments by adjusting their loan amounts and terms.

Best Practices: Remember, keeping credit card balances below 30% of their limit can help you secure better loan rates. Additionally, we recommend acquiring a minimum of three loan estimates to evaluate your choices efficiently. As finance expert Peter Warden mentions, this approach can provide clarity and confidence in your decision-making process.

Troubleshoot Common Issues and FAQs

-

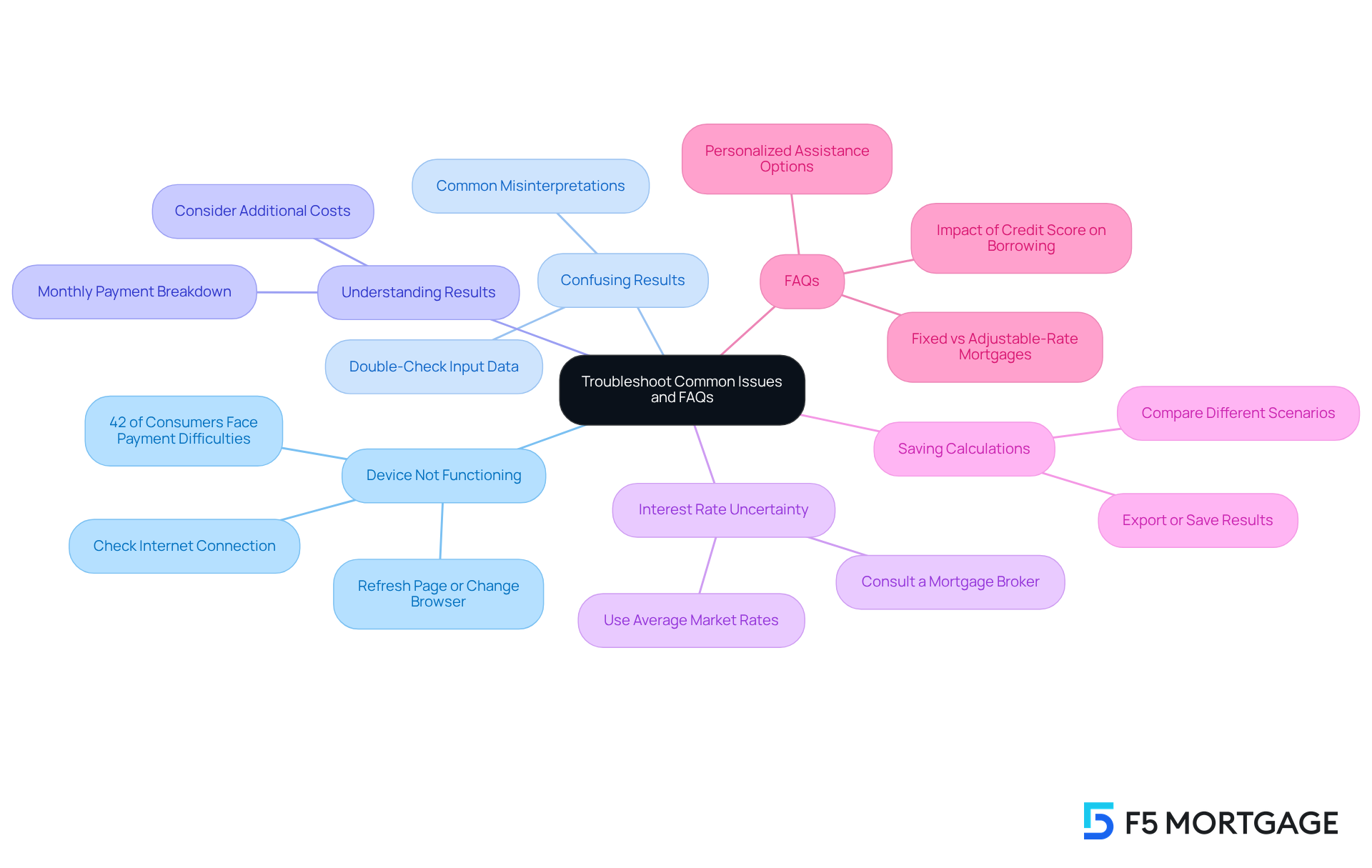

Device Not Functioning: If your device is struggling to load or operate, we understand how frustrating that can be. Please ensure you have a stable internet connection. A simple refresh of the page or trying a different browser might do the trick. It’s worth noting that 42% of loan consumers have faced difficulties maintaining certain debt payments, which can include issues with the mobile home loan calculator.

-

Confusing Results: If the results appear confusing, take a moment to double-check the information you entered. Make sure that the loan amount, interest percentage, and loan term are accurate. Many users misinterpret results due to incorrect data entry, leading to unnecessary confusion. We’re here to help clarify things for you.

-

Understanding Results: If you’re unsure about how to interpret the results, remember that the monthly payment includes both principal and interest. Additional costs, such as taxes and insurance, can vary based on your location and specific circumstances. A common challenge many users face is not accounting for these extra costs when using a mobile home loan calculator, which can unexpectedly strain finances.

-

What If I Don’t Know My Interest Rate? If you’re uncertain about the interest amount, consider using an average figure based on current market trends. Alternatively, consulting with a mortgage broker can provide you with a more precise estimate. Experts recommend using a mobile home loan calculator and checking multiple sources to gain a clearer understanding of prevailing rates.

-

Can I Save My Calculations?: Many calculators offer the option to save your results or send them to your email. Look for features that allow you to export or save your calculations for future reference. This can be especially beneficial for families wanting to compare different scenarios before making important decisions.

-

FAQs:

- What is the difference between fixed and adjustable-rate mortgages?

Fixed-rate mortgages maintain a constant interest rate, while adjustable-rate mortgages can fluctuate over time. - How does my credit score influence my borrowing?

Generally, a higher credit score leads to better interest rates and loan terms. - What should I do if I need more help?

If you need personalized assistance, consider reaching out to a mortgage broker, like F5 Mortgage, who can guide you through the process.

- What is the difference between fixed and adjustable-rate mortgages?

Incorporating these insights can significantly enhance your understanding and use of mortgage calculators. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Mastering the mobile home loan calculator is a vital step for potential borrowers who want to make informed financial decisions. This powerful tool can help you gain clarity on your loan options, understand the implications of different borrowing amounts, interest rates, and terms, and ultimately choose a financing plan that aligns with your financial goals.

In this guide, we’ve outlined essential steps, from gathering the necessary information to troubleshooting common issues. It’s important to know your financial situation, experiment with different variables, and understand the breakdown of monthly payments. Real-life examples illustrate how borrowers can confidently navigate their choices, reinforcing the value of these calculators in simplifying the lending process.

In a landscape where financial literacy is crucial, leveraging a mobile home loan calculator can empower you to take control of your financial future. By understanding how to effectively use these tools, you can avoid unnecessary stress and make well-informed decisions. Embracing this knowledge not only enhances budgeting and planning but also fosters a sense of confidence in navigating the complexities of mobile home financing.

We know how challenging this can be, and we’re here to support you every step of the way. Take this opportunity to master the calculator and feel empowered in your financial journey.

Frequently Asked Questions

What is the purpose of mobile home loan calculators?

Mobile home loan calculators help potential borrowers estimate their monthly payments based on factors like the amount borrowed, interest rate, and term length. They also show how different down payment amounts affect monthly payments and the total loan cost.

Why is it important to understand terms like principal, interest, taxes, and insurance (PITI)?

Understanding these essential terms is vital for accurately interpreting the results from loan calculators, which aids borrowers in making informed financial decisions.

How prevalent is the use of online loan estimation tools among borrowers?

In 2025, approximately 70% of borrowers reported using online loan estimation tools, indicating their growing importance in the decision-making process.

How can mobile home loan calculators enhance a borrower’s understanding of financial responsibilities?

By using these tools, borrowers can better plan and budget, gaining clarity on their financial future and responsibilities associated with the loan.

Can you provide an example of how a mobile home loan calculator has helped a borrower?

A first-time homebuyer used a loan calculator to explore various financing options, ultimately choosing a plan that fit comfortably within their budget, which reduced anxiety and built confidence in their financial decisions.

What challenges do homebuyers face that make using loan calculators important?

Homebuyers often encounter challenges such as high-interest rates and complicated documentation, making the use of loan calculators crucial for navigating the lending landscape.

How does F5 Mortgage assist clients in using mobile home loan calculators?

F5 Mortgage offers personalized consultations and an accessible financing tool, providing tailored advice that aligns with clients’ unique financial circumstances.