Overview

Affording a $400,000 home can feel daunting, but understanding the financial requirements can empower you. Typically, an individual needs an annual income between $100,000 and $125,000, especially when considering a standard mortgage setup with a 30-year term and a 20% down payment. We know how challenging this can be, but keeping housing expenses within 28% of your total income is a crucial guideline to follow.

It’s essential to consider various factors that influence mortgage affordability. Your credit score, debt-to-income ratio, and the size of your down payment all play significant roles in determining what you can afford. By being informed about these elements, you can make more confident decisions in your home-buying journey. Remember, we’re here to support you every step of the way.

Introduction

Navigating the path to homeownership can often feel like a daunting journey. We understand how challenging this can be, especially when considering the financial implications of purchasing a $400,000 home. Knowing the income requirements is crucial; potential buyers typically need to earn between $100,000 and $125,000 annually to meet lender expectations. However, various factors, such as credit scores, debt-to-income ratios, and down payments, influence affordability.

This raises an important question: how can one effectively calculate the necessary income to secure a mortgage? This guide delves into essential steps and considerations that empower future homeowners. We’re here to support you every step of the way as you make informed financial decisions on your journey to owning your dream home.

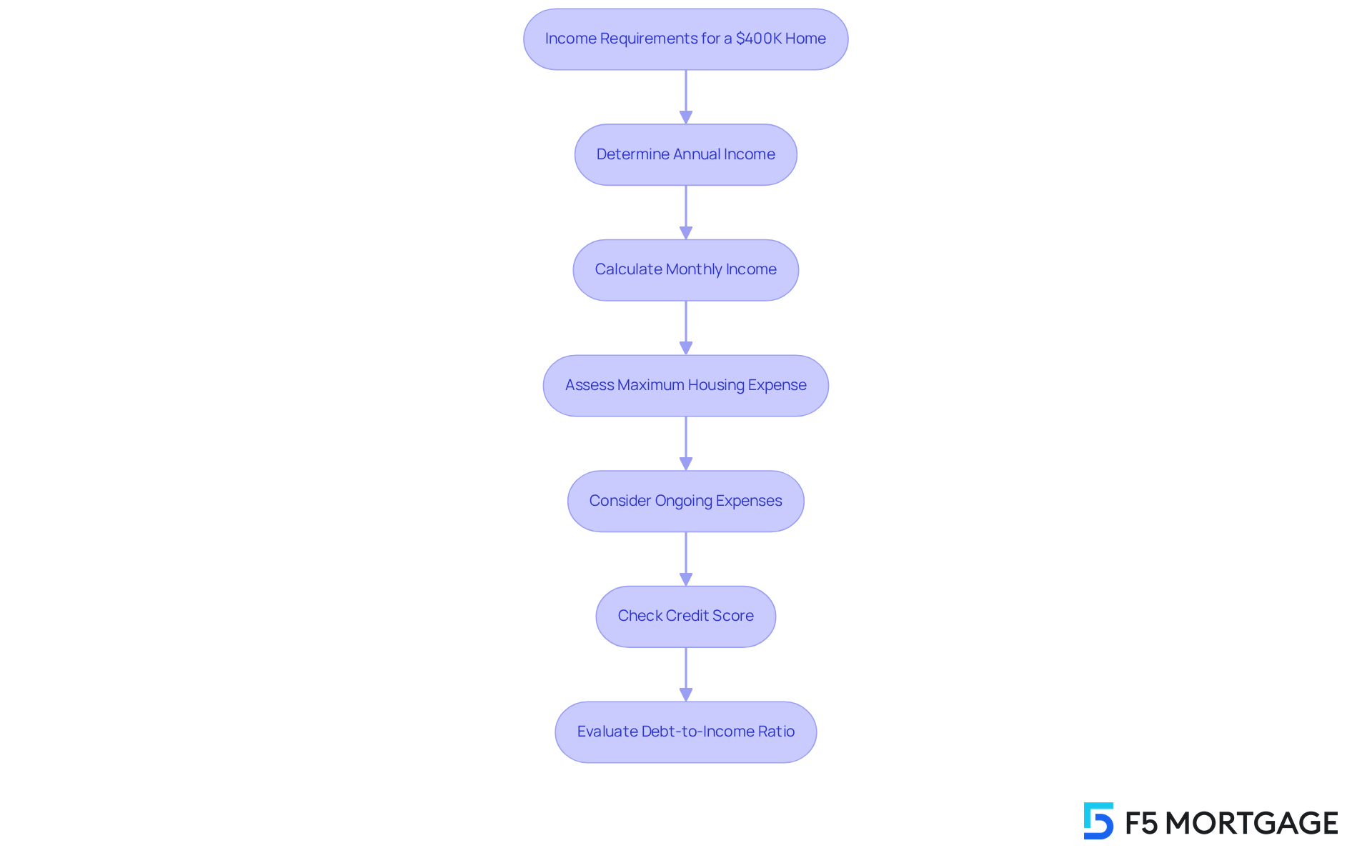

Understand Income Requirements for a $400K Home

We understand how challenging it can be to navigate the journey of homeownership. When considering how much income for a 400k house, you typically need an annual income between $100,000 and $125,000, especially with a standard 30-year fixed mortgage and a 20% down payment. Lenders generally recommend that your housing expenses should not exceed 28% of your total monthly income. For example, if your monthly income is around $8,333, your maximum housing expense should be about $2,333. This amount includes principal, interest, taxes, and insurance (PITI).

It’s essential to remember that ongoing expenses, such as property taxes and homeowners insurance, can significantly impact your overall financial obligations. Therefore, it’s crucial to factor these into your budget. A good to excellent credit score, typically 740 or above, is vital for securing favorable loan rates and conditions. Moreover, maintaining a debt-to-income ratio (DTI) of 43% or lower can enhance your chances of obtaining a home loan.

Understanding these figures is key to evaluating how much income for a 400k house aligns with your homeownership dreams. We’re here to support you every step of the way as you explore your options.

Identify Key Factors Affecting Mortgage Affordability

Several key factors influence mortgage affordability, and understanding them can make a significant difference in your journey to homeownership.

-

Credit Score: We know how challenging it can be to navigate credit scores. An elevated credit score can lead to better interest rates, which ultimately lowers your monthly expenses. For the best rates, aim for a score above 740. Recent data shows that a FICO score of 800 can secure a mortgage rate around 6.644%. It’s important to note that with an FHA mortgage, a credit score as low as 500 might still allow you to purchase a $250,000 home with a 10% deposit. This highlights the necessity of understanding how credit scores affect various financing options.

-

Debt-to-Income Ratio (DTI): Your DTI is another crucial factor. Lenders typically prefer a DTI of 36% or lower, which compares your monthly debt payments to your gross monthly income. If your DTI exceeds 41%, your financing options may be limited, especially for traditional loans. However, some financing types, like FHA options, may allow a DTI of up to 50% for borrowers with strong credit profiles. Freddie Mac and Fannie Mae also permit DTI ratios as high as 50% for those with credit scores of 620 or above, which can enhance your chances of loan approval.

-

Down Payment: A larger initial contribution can significantly ease your financial burden. It reduces the amount you need to borrow and may eliminate private mortgage insurance (PMI), lowering your regular expenses. For instance, understanding how much income for a 400k house is necessary can show you that a 20% deposit on a $400,000 house can save you thousands over the life of the loan.

-

Interest Rates: Current market rates play a pivotal role in determining your monthly payment. As of July 2025, the average 30-year mortgage rate hovers around 6.72%. Experts speculate that rates could potentially reach 8% or higher, making it essential to time your application wisely. Even a small increase in rates can have a substantial impact on what you can afford.

-

Loan Category: Lastly, the type of loan you choose can greatly influence your total expenses. Different financing categories, such as FHA, VA, and conventional options, come with varying requirements and benefits. For example, VA loans often provide lower rates and no down payment for eligible veterans, while FHA loans may be more accessible for first-time buyers with lower credit scores.

Understanding these factors empowers you to make informed decisions as you plan to purchase a home. Additionally, focusing on reducing your DTI ratio by paying down existing debts can further strengthen your loan application. We’re here to support you every step of the way.

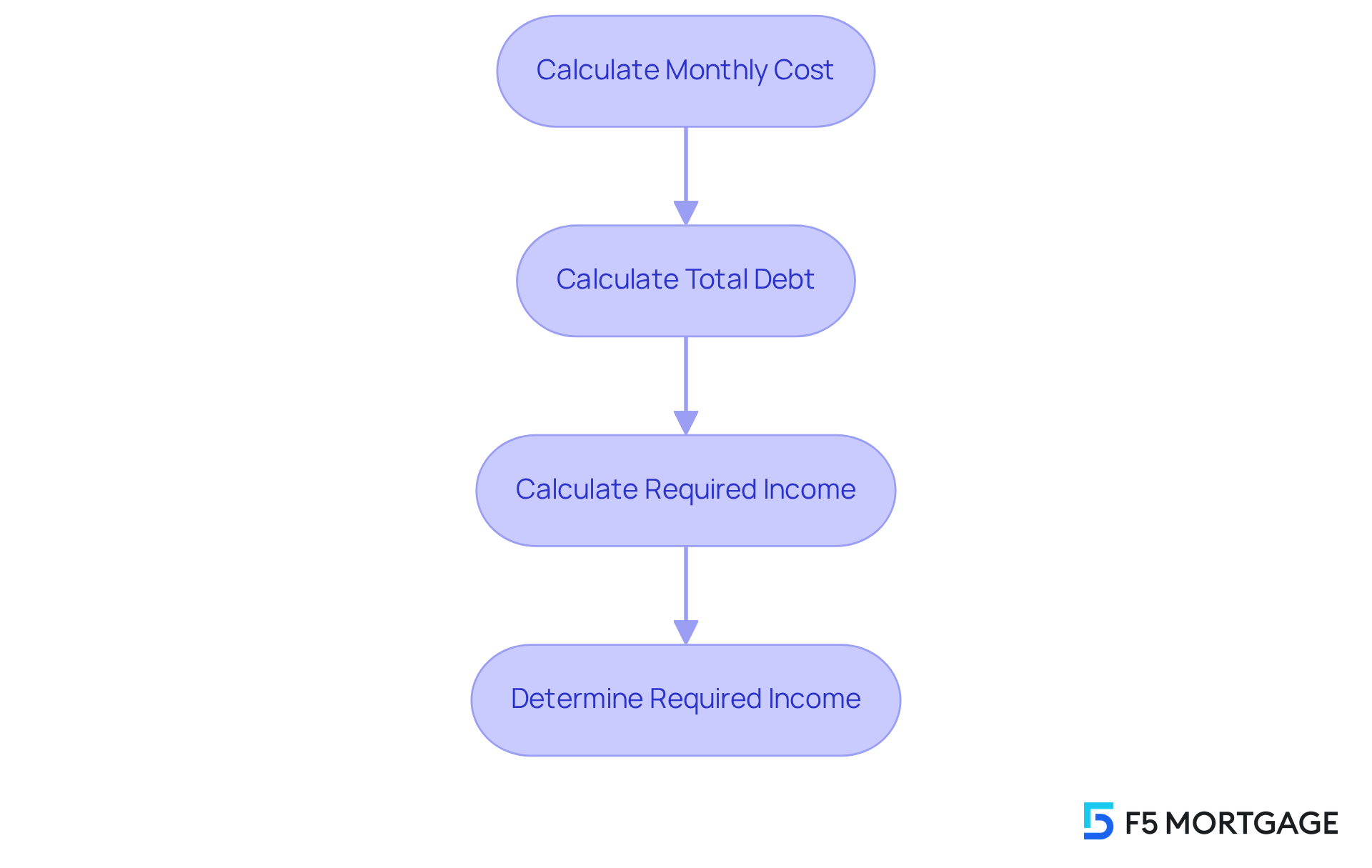

Calculate Your Required Income for a $400K Mortgage

Understanding the financial commitment of a $400,000 mortgage can feel overwhelming, but we’re here to support you every step of the way. To help you navigate this process, let’s break it down into manageable steps:

-

Calculate Monthly Cost: Start by using a home financing calculator. This tool can help you estimate your monthly payment based on the amount borrowed, interest rate, and term length. For example, if you secure a 6% interest rate over 30 years, your monthly payment might be around $2,400.

-

Calculate Total Debt: Next, consider any other recurring debts you may have, like car loans or credit cards. If you have an additional $500 in monthly obligations, your total monthly debt would then be $2,900.

-

Calculate Required Income: Finally, to determine the income you’ll need, divide your total monthly debt by the acceptable debt-to-income (DTI) ratio, which is often around 36%.

- Required Income = Total Monthly Debt / DTI Ratio

- Required Income = $2,900 / 0.36 = $8,055 (monthly) or roughly $96,660 annually.

This calculation is essential for understanding how much income for a 400k house is necessary to comfortably afford it. We know how challenging this can be, but taking these steps can empower you to make informed decisions.

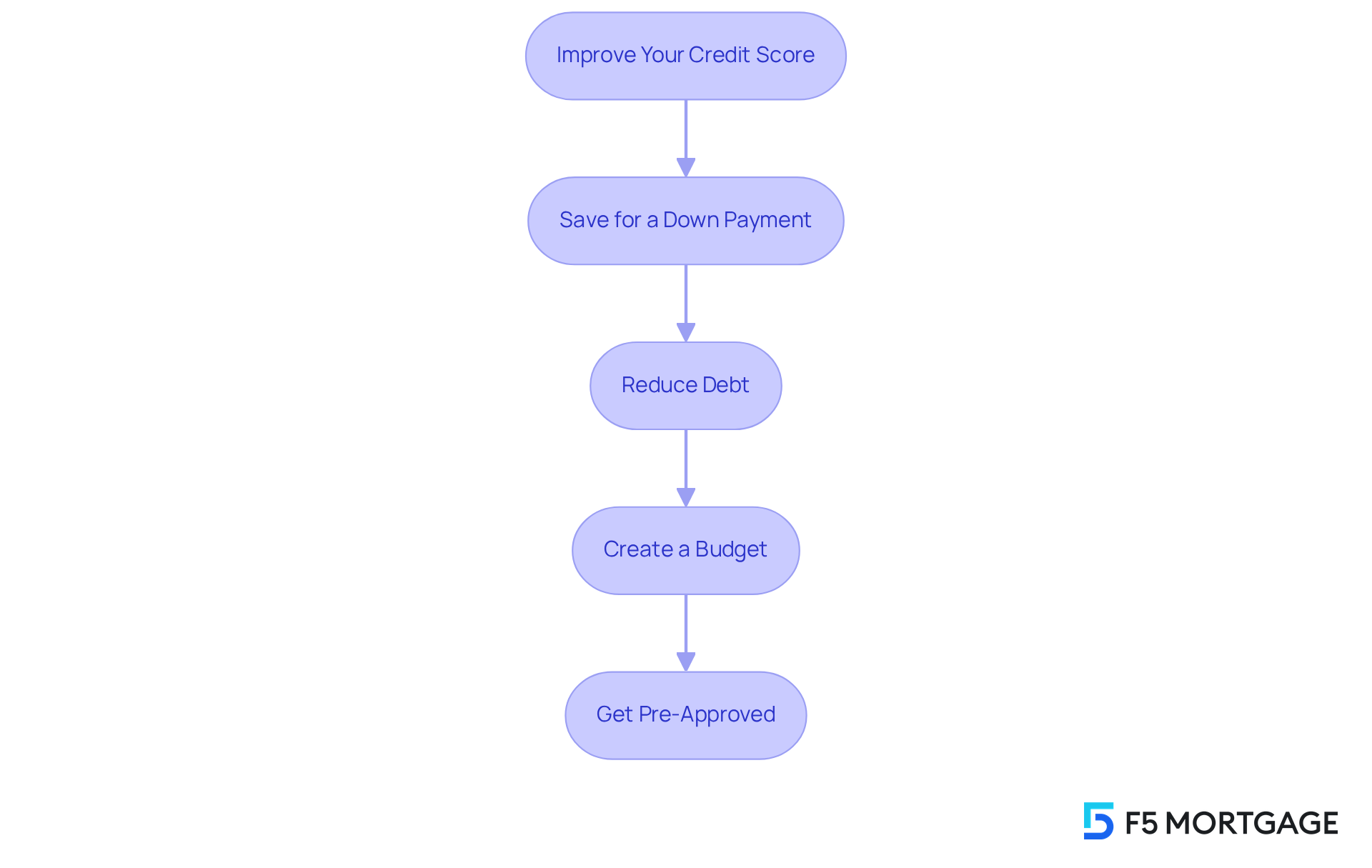

Enhance Financial Readiness for Home Buying

To enhance your financial readiness for home buying, we know how essential it is to take thoughtful steps. Here are some ways you can prepare:

-

Improve Your Credit Score: Paying down existing debts, making payments on time, and avoiding new credit inquiries can significantly boost your score. Every small effort counts!

-

Save for a Down Payment: Aim for at least 20% of the home price to avoid PMI. Setting a savings goal and creating a budget can help you reach this milestone, making homeownership more attainable.

-

Reduce Debt: Lowering your debt-to-income ratio by paying off high-interest debts can enhance your loan eligibility. This step can bring you closer to your dream home.

-

Create a Budget: Outlining your monthly expenses and income is crucial. Understanding how much income for a 400k house you can allocate toward housing costs will empower you in your home buying journey.

-

Get Pre-Approved: Before you start searching for a home, obtaining pre-approval for financing is a smart move. It helps you understand your budget and shows sellers that you are a serious purchaser.

By taking these steps, you can position yourself as a strong candidate for mortgage approval. Remember, we’re here to support you every step of the way, making the home buying process smoother and more manageable.

Conclusion

Understanding the income requirements for purchasing a $400,000 home is essential for prospective buyers like you, who are aiming for successful homeownership. We know how challenging this can be, but by grasping the financial landscape—including necessary income levels, credit scores, debt-to-income ratios, and down payment considerations—you can better prepare for your mortgage journey.

Throughout this article, we’ve emphasized key factors that can make a difference. Maintaining a credit score above 740, managing a debt-to-income ratio of 36% or lower, and making a substantial down payment are essential steps to enhance your mortgage affordability. Additionally, calculating your monthly costs and understanding the impact of current interest rates are crucial, as these elements directly affect your overall financial readiness.

Ultimately, taking proactive measures—such as improving your credit score, saving for a down payment, and getting pre-approved for financing—can significantly empower you as a potential homeowner. By following these guidelines and understanding the necessary income for a $400,000 mortgage, you can navigate the complexities of home buying with confidence. The journey to homeownership is within reach, and with careful planning and informed decisions, achieving that dream home is entirely possible.

Frequently Asked Questions

What annual income is typically needed to afford a $400,000 home?

To afford a $400,000 home, you typically need an annual income between $100,000 and $125,000, especially with a standard 30-year fixed mortgage and a 20% down payment.

What percentage of my income should go towards housing expenses?

Lenders generally recommend that your housing expenses should not exceed 28% of your total monthly income.

How much can I afford to spend on housing expenses if my monthly income is $8,333?

If your monthly income is around $8,333, your maximum housing expense should be about $2,333, which includes principal, interest, taxes, and insurance (PITI).

What ongoing expenses should I consider when budgeting for a home?

Ongoing expenses such as property taxes and homeowners insurance can significantly impact your overall financial obligations, so it’s crucial to factor these into your budget.

What credit score is needed to secure favorable loan rates?

A good to excellent credit score, typically 740 or above, is vital for securing favorable loan rates and conditions.

What is the recommended debt-to-income ratio for obtaining a home loan?

Maintaining a debt-to-income ratio (DTI) of 43% or lower can enhance your chances of obtaining a home loan.

Why is it important to understand income requirements for a $400,000 home?

Understanding these figures is key to evaluating how much income for a $400,000 house aligns with your homeownership dreams.