Overview

Navigating the home buying process can feel overwhelming, and we know how challenging this can be. The essential role of a mortgage processor is to ease this journey by managing the administrative tasks involved in the loan application process. This includes collecting financial documents, ensuring compliance with regulations, and preparing files for underwriting.

Mortgage processors play a vital role in facilitating smoother transactions. They improve communication between borrowers and lenders, which enhances the overall efficiency and experience of securing a mortgage. By having a dedicated professional by your side, you can feel more confident and supported throughout this important milestone.

We’re here to support you every step of the way, ensuring that your concerns are addressed and your needs are met. With the right guidance, the mortgage process can become a more manageable and positive experience for you and your family.

Introduction

Navigating the home buying process can often feel like traversing a labyrinth of paperwork and regulations. We know how challenging this can be, where even the smallest misstep might lead to significant delays. At the heart of this intricate journey lies the mortgage processor, a critical figure who ensures that the loan application process runs smoothly and efficiently. By expertly managing documentation and facilitating communication between borrowers and lenders, these professionals play an essential role in transforming a potentially overwhelming experience into a streamlined path toward homeownership.

But what exactly distinguishes a mortgage processor from other mortgage professionals? How can their expertise make a difference in securing timely approvals? Understanding these differences can empower you, making the journey toward homeownership feel less daunting. We’re here to support you every step of the way.

Define Mortgage Processor: Key Responsibilities and Functions

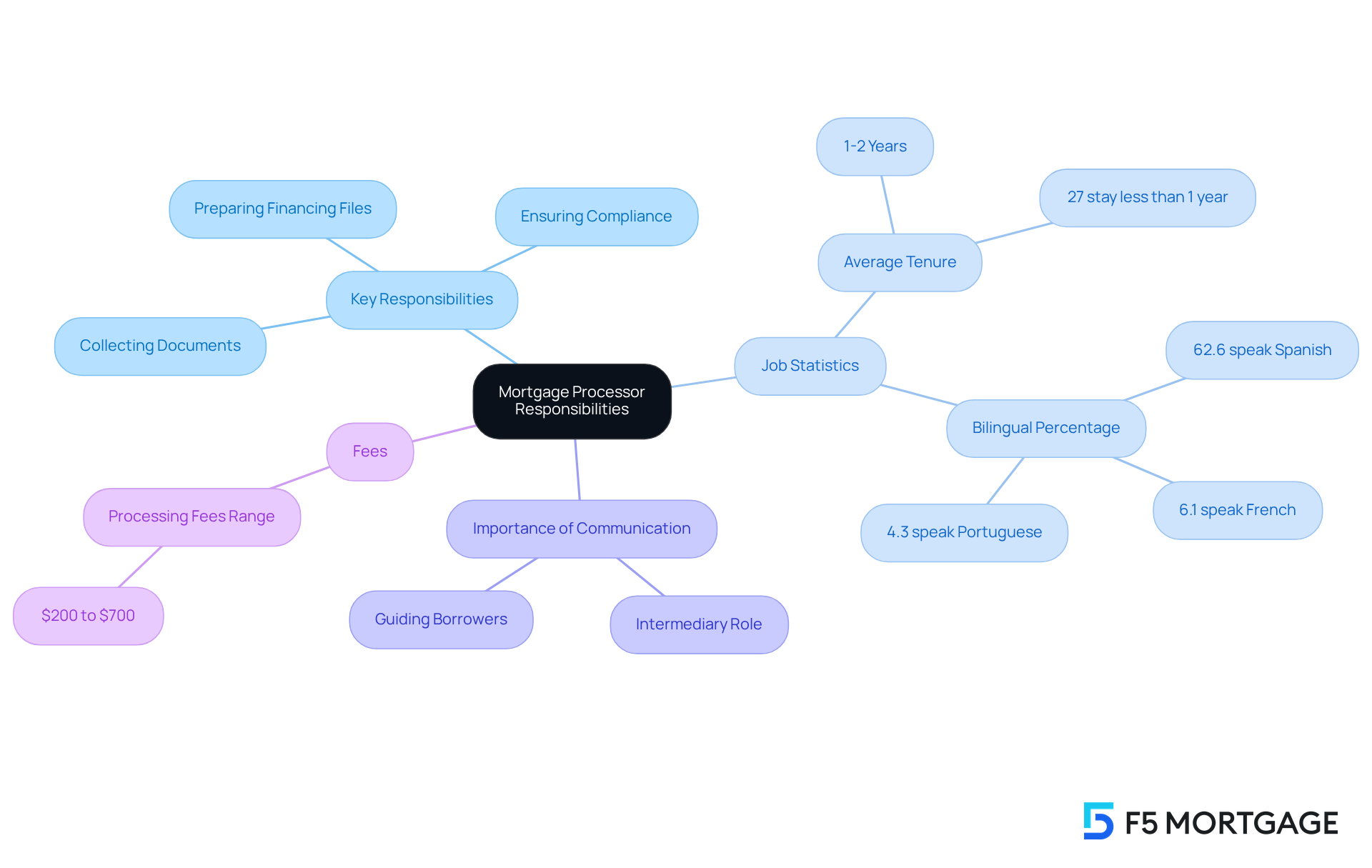

A loan specialist, often referred to as a mortgage processor, is a vital ally in the home purchasing journey, dedicated to overseeing the often complex administrative aspects of the loan application process. The mortgage processor’s primary responsibilities include:

- Collecting and validating essential financial documents

- Ensuring compliance with lending regulations

- Meticulously preparing financing files for underwriting

By serving as a crucial link among borrowers, lenders, and other stakeholders, a mortgage processor makes the loan process significantly smoother, resulting in a more efficient and less stressful experience for clients.

We understand how overwhelming this process can feel. That’s why the expertise of a mortgage processor is so important; they ensure that all necessary documentation is accurate and complete, which is crucial for achieving timely approvals. Statistics reveal that the average loan administrator stays in their role for just 1-2 years, with 27% remaining for less than one year. This highlights the importance of their experience in managing intricate paperwork and enhancing the overall borrower experience.

Moreover, skilled financial specialists, such as a mortgage processor, can identify potential issues early on, improving approval timelines and contributing to a more seamless home purchasing experience. Reliable loan specialists, acting as mortgage processors, are committed to enhancing customer service throughout the often lengthy loan closing process. It’s important to note that loan processing fees can range from $200 to $700 or more, shedding light on the financial aspects of this profession.

Significantly, 62.6% of mortgage specialists are bilingual in Spanish, which is essential for understanding the diverse demographic and communication needs of the role. Mortgage processors play a supportive role by clarifying documentation requirements and guiding borrowers through each step of the process. They serve as mortgage processors, acting as intermediaries between borrowers and lenders to foster better communication and efficiency. Remember, we’re here to support you every step of the way.

Contextualize the Role: Importance of Mortgage Processors in Home Buying

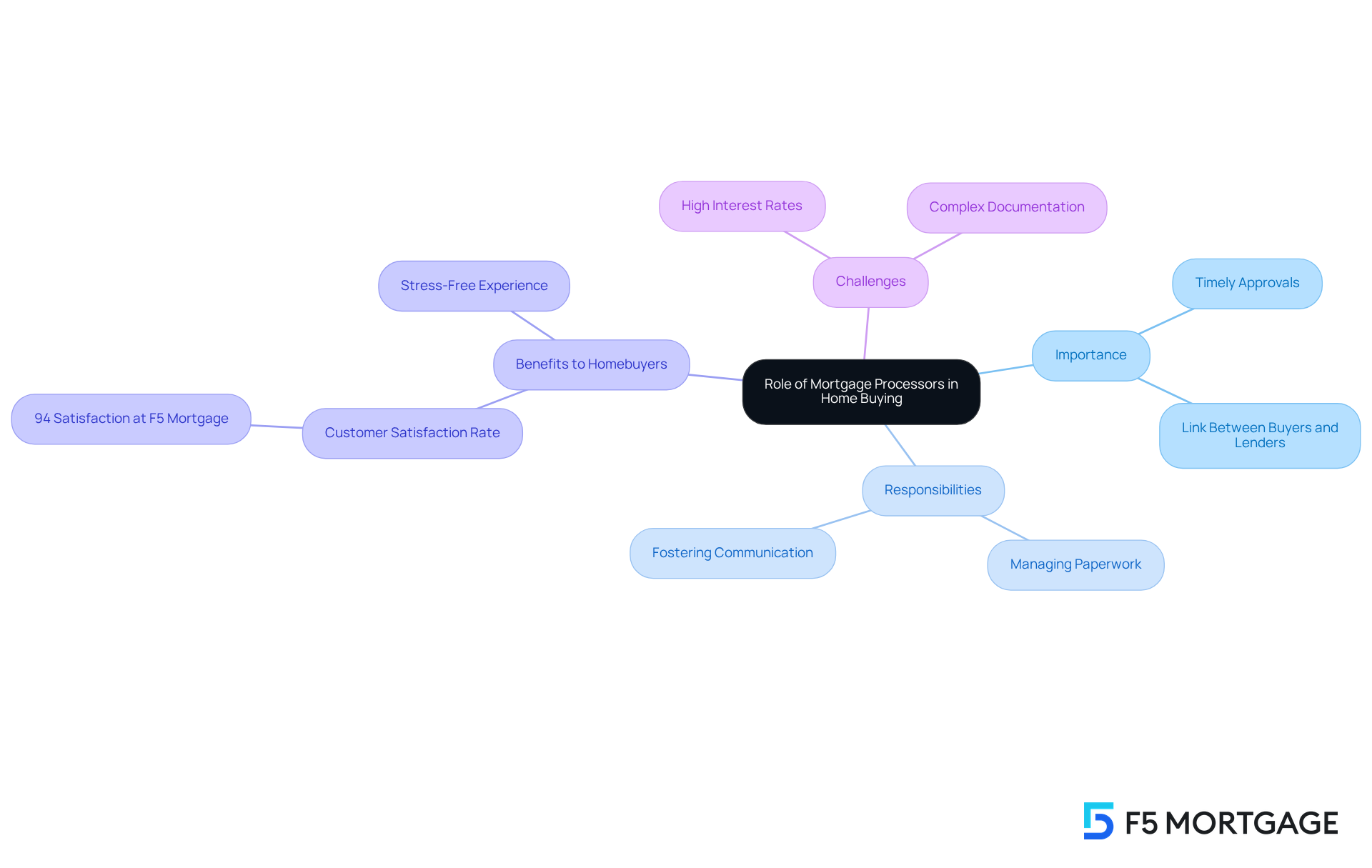

Mortgage specialists play a vital role in your home purchasing journey, acting as the crucial link between you and lenders. In competitive housing markets, their importance grows, as timely approvals can significantly affect the success of your transaction. By expertly managing essential paperwork and fostering communication throughout the financing process, specialists help reduce delays and enhance your overall experience.

We understand how overwhelming this process can be. With a careful focus on specifics and a comprehensive grasp of regulatory standards, mortgage specialists not only simplify the journey but also minimize risks for lenders, ensuring your finances are secure. This dual emphasis on your satisfaction and lender security highlights the essential role that loan facilitators play in the home purchasing ecosystem.

With most loans at F5 closing in under three weeks, the efficiency of the mortgage processor contributes directly to a stress-free experience for you, reinforcing the brokerage’s commitment to exceptional service. More than 1,000 families have benefited from F5 Mortgage, showcasing a remarkable customer satisfaction rate of 94%. This statistic reflects the dedication of their mortgage processor team.

In a competitive market, local lending firms like F5 offer a unique advantage. When you collaborate with lenders who understand the local landscape, you can enhance your offers, making timely closings even more crucial. As noted in a Wall Street Journal article, partnering with local banking professionals or credit specialists can significantly improve your chances of success.

Mortgage specialists are here to support you in overcoming common obstacles faced by homebuyers, such as high interest rates and complex documentation. Together, we can ensure a smoother journey to homeownership, making your dreams a reality.

Detail Daily Tasks: Activities and Responsibilities of Mortgage Processors

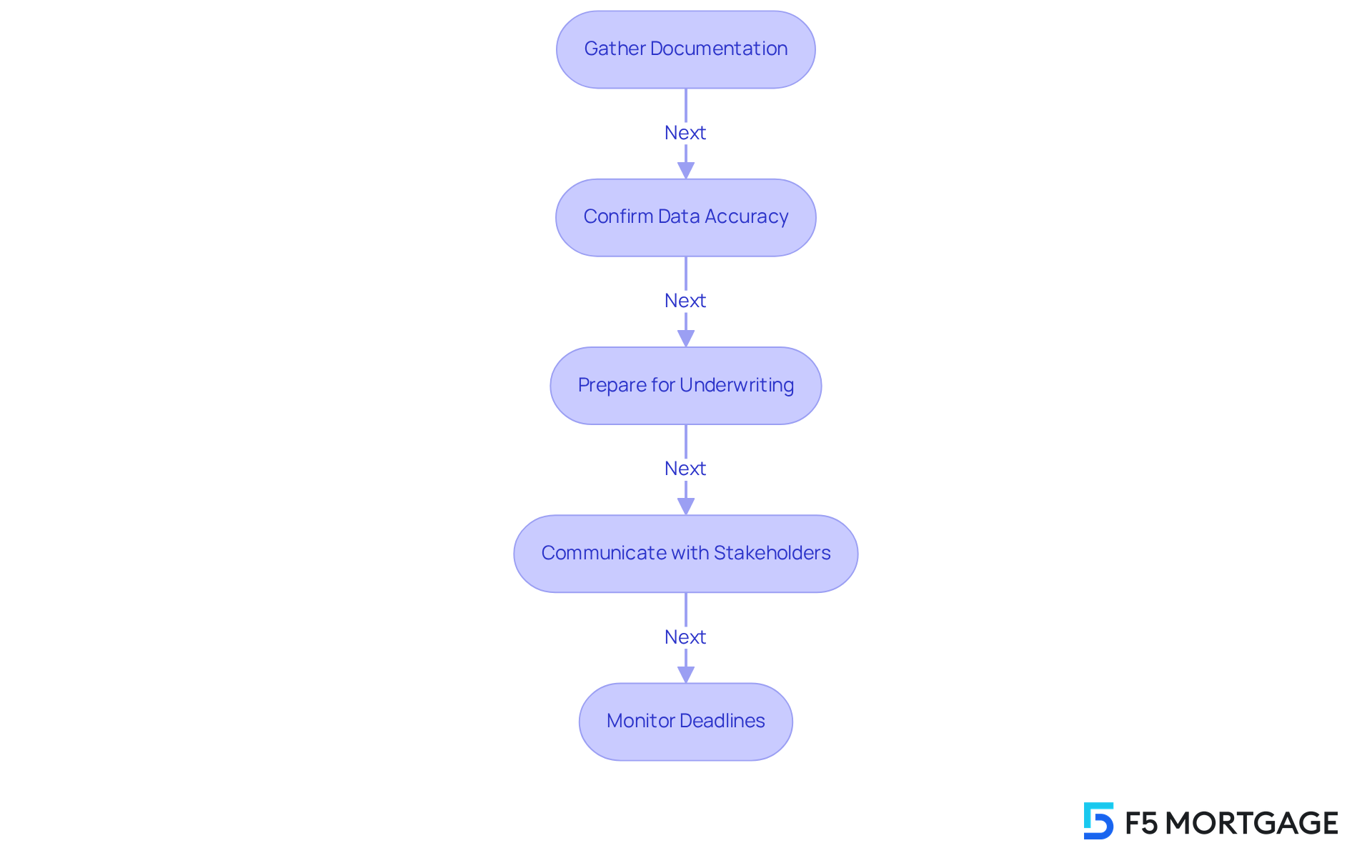

Mortgage processors engage in a variety of essential activities each day to ensure that financing requests progress smoothly. We understand how overwhelming this process can be, and our mortgage processor specialists are dedicated to thoroughly examining financing applications and gathering necessary documentation, including:

- Income statements

- Credit reports

- Asset verifications

Accuracy is crucial; our mortgage processor diligently confirms that all data is complete and precise, often reaching out directly to borrowers to resolve inconsistencies and gather any additional information needed.

As we prepare for underwriting, mortgage processors meticulously arrange financial documents and credit files, ensuring they meet lending standards. This careful preparation allows for a seamless transition to the underwriting stage, which typically lasts about 30 to 45 days. Our coordinators also work closely with mortgage processors, real estate agents, title firms, and other parties involved in the transaction, playing a vital role in scheduling and overseeing the closing phase. This combination of administrative diligence, analytical skills, and effective communication is essential for those in the financing field, enabling them to manage multiple applications efficiently and facilitate timely closings—often in an impressive timeframe of under three weeks.

Moreover, mortgage processors act as intermediaries between borrowers, credit officers, and underwriters, ensuring that everyone stays informed and that the process flows effortlessly. Monitoring deadlines throughout the loan application timeline is another critical responsibility, helping to ensure prompt closure and avoid unnecessary delays. We are here to support you every step of the way, making this journey as smooth as possible.

Differentiate Roles: Mortgage Processors vs. Other Mortgage Professionals

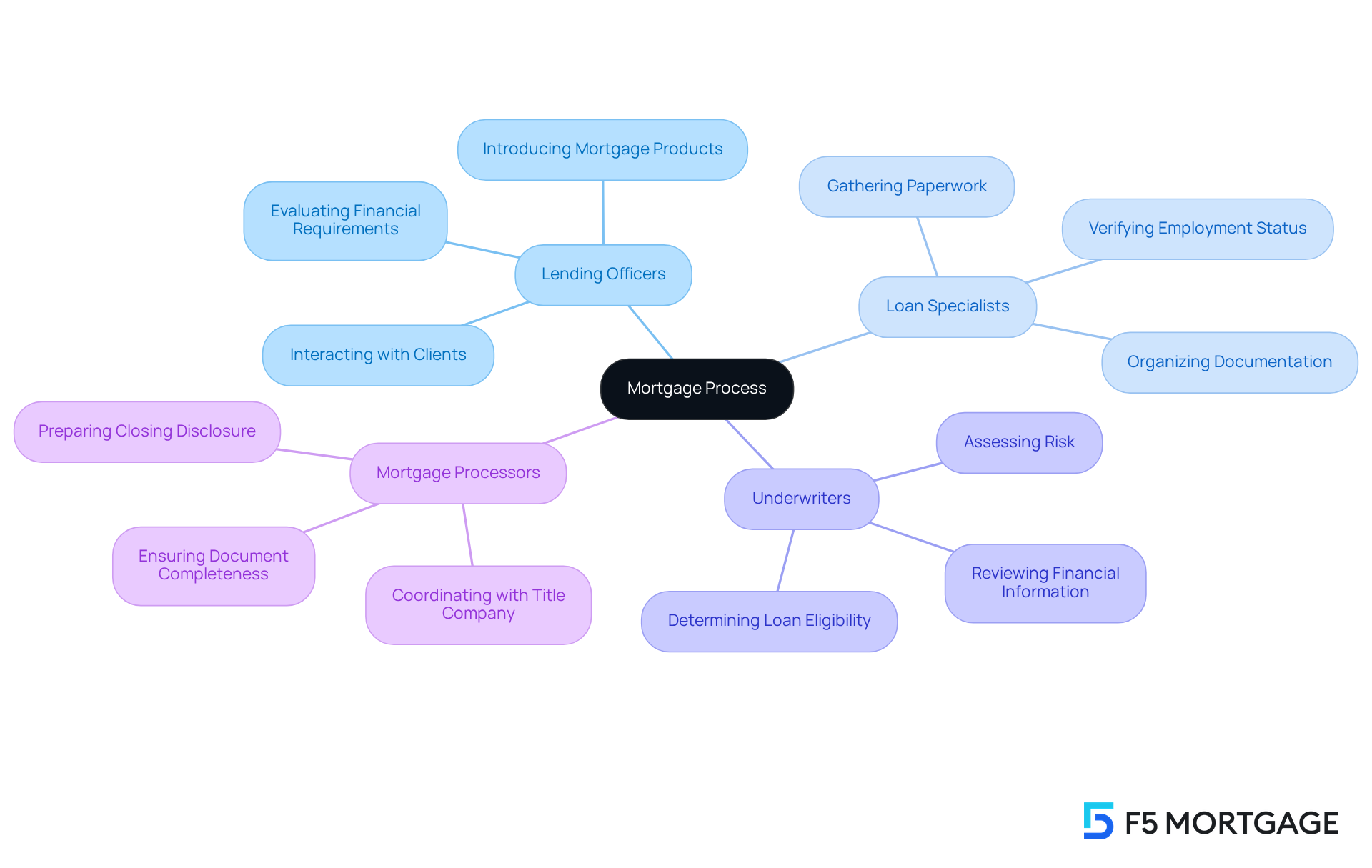

Home financing specialists, credit advisors, and underwriters each play vital roles in the lending process, and we understand how important these roles are for families seeking financial support. Lending officers are primarily responsible for creating financing options and directly interacting with clients. They evaluate financial requirements and suggest suitable credit products, ensuring that families feel heard and understood.

On the other hand, loan specialists handle the administrative aspects, meticulously gathering and organizing all essential paperwork for underwriting. This includes verifying employment status and ensuring that necessary documents, such as tax returns and bank statements, are complete and clear. A capable financial application specialist aims to present a thorough funding request, ideally receiving no more than five stipulations on conditional approval. However, some specialists have faced 30 or more stipulations, highlighting the importance of skilled professionals in this field.

Underwriters assess the risk associated with lending to a borrower based on the detailed information provided by the loan officer. They consider factors like credit scores, income, and debt-to-income ratios to determine loan eligibility. While all three roles are crucial for a successful loan transaction, loan facilitators truly serve as the backbone of the process, ensuring everything runs smoothly.

Collaboration between loan specialists and underwriters is essential. A skilled loan specialist guarantees that all documents are thoroughly reviewed and organized, preventing unnecessary complications and promoting timely closings. Moreover, loan facilitators prepare the Closing Disclosure and coordinate with the title company, a critical step that ensures all required documents are in order before closing. This teamwork not only enhances efficiency but also creates a smoother experience for borrowers, leading to higher customer satisfaction rates.

As Kath Villamayor notes, “In essence, mortgage processors are responsible for collecting all the essential documentation needed as well as reviewing them before they go to the underwriter.” With over 1,000 families helped, F5 Mortgage exemplifies how effective teamwork among mortgage processors can facilitate a seamless home buying experience. We know how challenging this can be, but we’re here to support you every step of the way.

Conclusion

Mortgage processors play an essential role in the home buying journey, acting as a vital bridge between borrowers and lenders. We understand how overwhelming this process can be, and mortgage processors are here to help. Their expertise in managing intricate paperwork and ensuring compliance with lending regulations not only streamlines the loan application process but also enhances your overall experience. By meticulously gathering and validating financial documents, they facilitate timely approvals, making them a crucial ally for anyone navigating the complexities of home financing.

In this article, we’ve highlighted the various responsibilities of mortgage processors, including their daily tasks of collecting income statements, credit reports, and asset verifications. Their ability to identify potential issues early on contributes to smoother transactions and quicker closings, which is especially vital in competitive housing markets. The collaboration between mortgage processors and other mortgage professionals, like loan officers and underwriters, showcases the importance of teamwork in achieving successful outcomes for borrowers.

Ultimately, understanding the vital function of mortgage processors empowers you to make informed decisions during your purchasing journey. As the housing market continues to evolve, recognizing the significance of these specialists can lead to more efficient and less stressful experiences. Engaging with skilled mortgage processors not only enhances communication and transparency but also increases the likelihood of a successful home purchase. Remember, we’re here to support you every step of the way as you turn the dream of homeownership into reality.

Frequently Asked Questions

What is the role of a mortgage processor?

A mortgage processor is a loan specialist who oversees the administrative aspects of the loan application process, ensuring that all necessary documentation is accurate and complete.

What are the key responsibilities of a mortgage processor?

The primary responsibilities include collecting and validating essential financial documents, ensuring compliance with lending regulations, and preparing financing files for underwriting.

How does a mortgage processor contribute to the loan process?

A mortgage processor acts as a crucial link among borrowers, lenders, and other stakeholders, making the loan process smoother and less stressful for clients.

Why is the experience of a mortgage processor important?

The experience of a mortgage processor is essential because they manage intricate paperwork and can identify potential issues early, improving approval timelines and enhancing the overall borrower experience.

What are the typical loan processing fees?

Loan processing fees can range from $200 to $700 or more.

How many mortgage specialists are bilingual, and why is this important?

Approximately 62.6% of mortgage specialists are bilingual in Spanish, which is important for addressing the diverse demographic and communication needs of borrowers.

What support does a mortgage processor provide to borrowers?

A mortgage processor clarifies documentation requirements and guides borrowers through each step of the loan process, fostering better communication and efficiency.