Overview

Navigating FHA loan credit score requirements can feel overwhelming, but we’re here to support you every step of the way. To make homeownership more accessible:

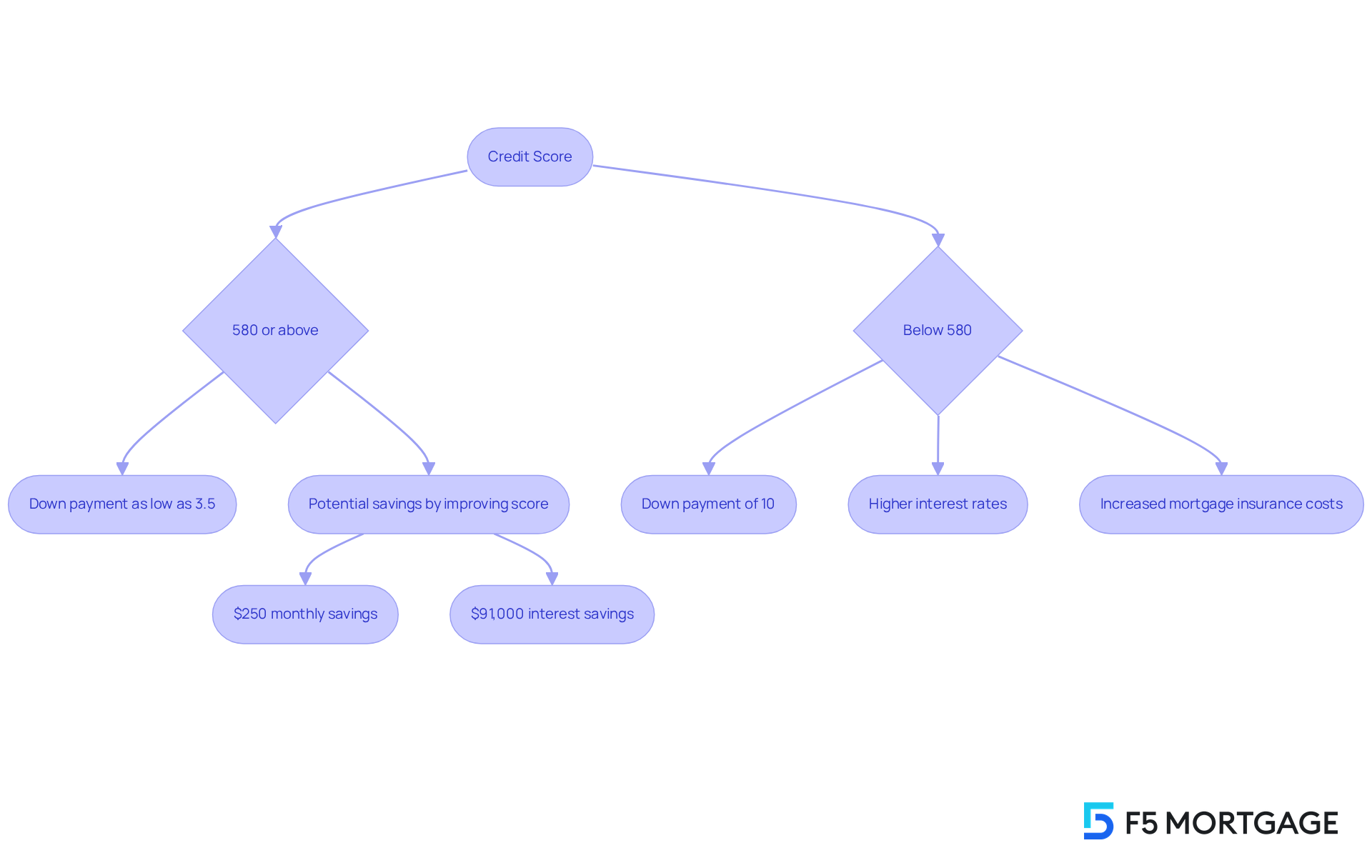

- A minimum credit score of 580 is needed for a 3.5% down payment.

- If your score falls between 500 and 579, a 10% down payment is required.

Improving your credit score can significantly enhance your loan terms. We know how challenging this can be, but taking steps to boost your score can lead to lower down payments and interest rates. This, in turn, reduces the overall cost of homeownership, making your dream of owning a home more achievable.

Take action today by exploring ways to improve your credit score. Every little bit helps, and we believe in your ability to create a brighter financial future.

Introduction

Navigating the complex world of home financing can feel overwhelming, especially for those of you with less-than-perfect credit. We understand how challenging this can be. FHA loans, backed by the Federal Housing Administration, offer a beacon of hope for low- to moderate-income families striving for homeownership. With flexible credit score requirements and lower down payment options, these loans can make a significant difference.

However, grasping the intricacies of credit score requirements is essential. These factors can greatly influence your loan terms and overall affordability. What challenges might you face in optimizing your credit scores to secure the best possible FHA loan terms? We’re here to support you every step of the way as you navigate this journey.

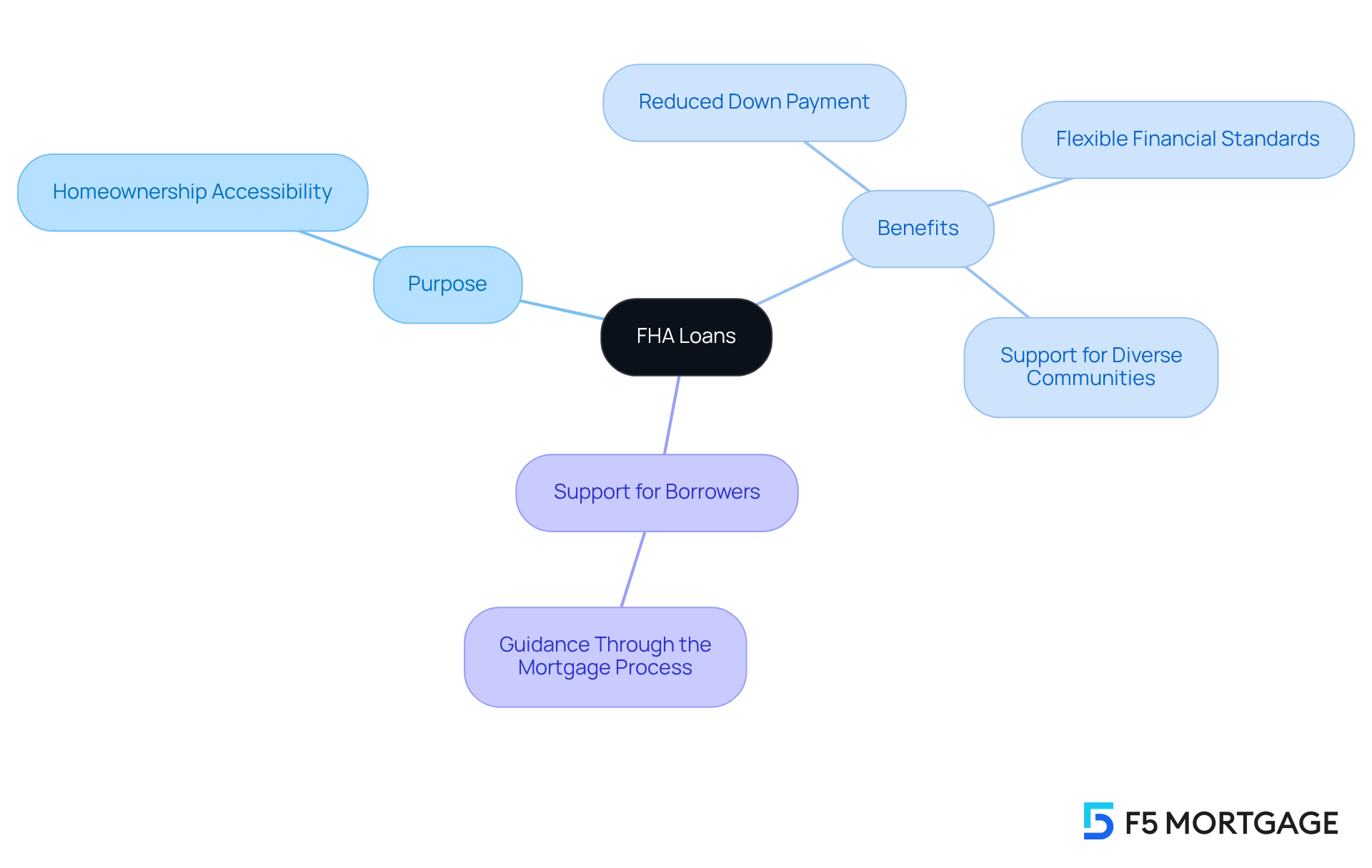

Define FHA Loans and Their Purpose

FHA mortgages are more than just financing options; they are a lifeline for low- to moderate-income families striving for homeownership. Insured by the Federal Housing Administration, these mortgages aim to ease the journey toward owning a home. With benefits like reduced down payment requirements and flexible financial standards, FHA financing opens doors that might otherwise remain closed.

We understand how daunting the path to homeownership can feel, especially for first-time buyers who may not have substantial savings or perfect credit. FHA financing is designed to lower these barriers, making it possible for a broader range of borrowers to achieve their dreams. By supporting families in this way, FHA financing plays a vital role in fostering homeownership across diverse communities.

If you’re considering taking this important step, remember that you’re not alone. We’re here to support you every step of the way, guiding you through the mortgage process with compassion and expertise. Together, we can navigate the challenges and help you find the right path to your new home.

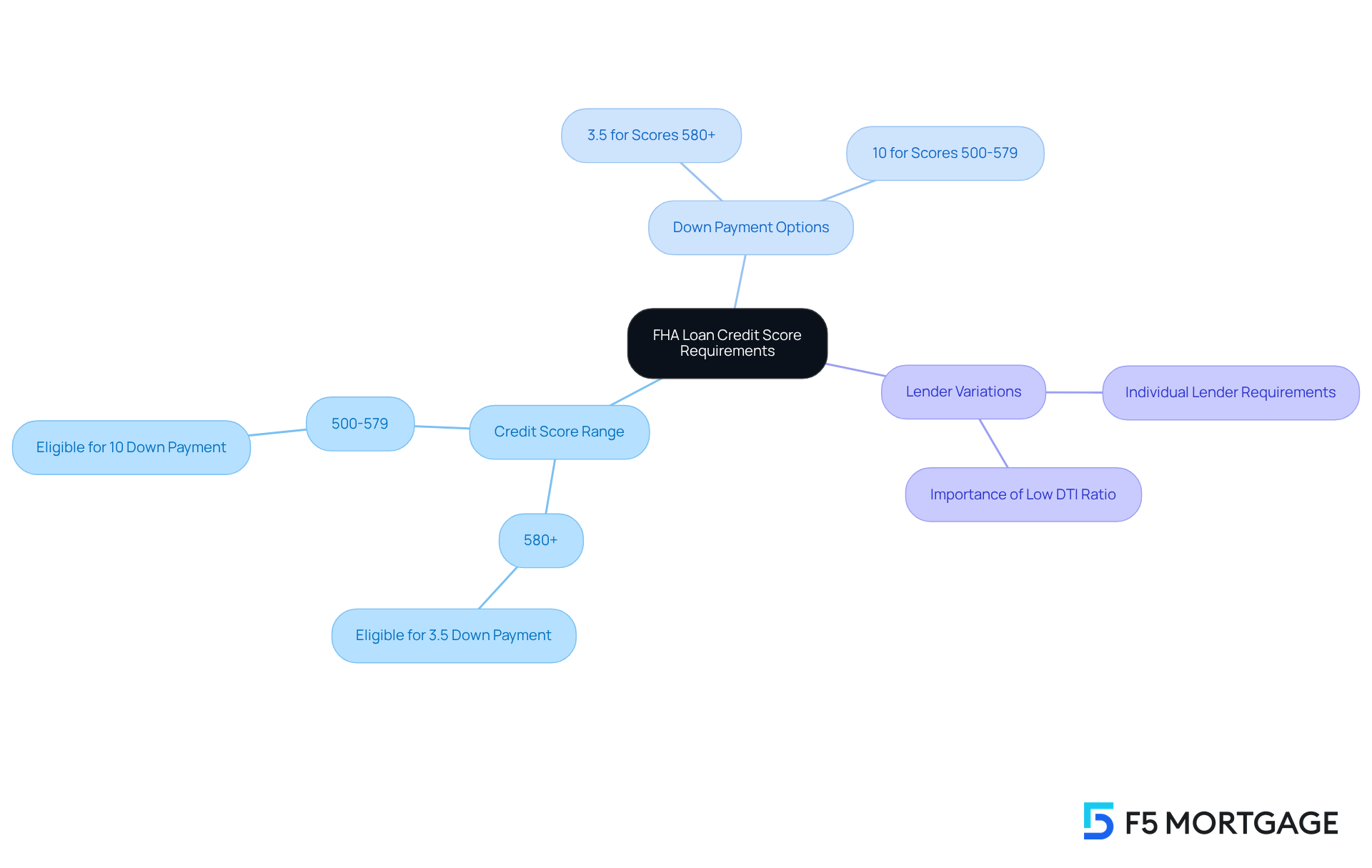

Outline FHA Loan Credit Score Requirements

We understand that navigating the mortgage process can feel overwhelming. To be eligible for an FHA mortgage, it’s essential to know that applicants generally require a minimum FHA loan credit score of 580 to take advantage of the low down payment option of just 3.5%. If your rating falls between 500 and 579, don’t lose hope; you may still qualify, but you’ll need to provide a larger down payment of at least 10%.

It’s important to remember that individual lenders may have their own requirements. Striving for a higher FHA loan credit score can significantly enhance your chances of approval and lead to better financing conditions. We know how challenging this can be, but maintaining a low debt-to-income (DTI) ratio is crucial for your eligibility.

By focusing on these factors, you can empower yourself in the mortgage process. We’re here to support you every step of the way as you work towards securing the home you desire.

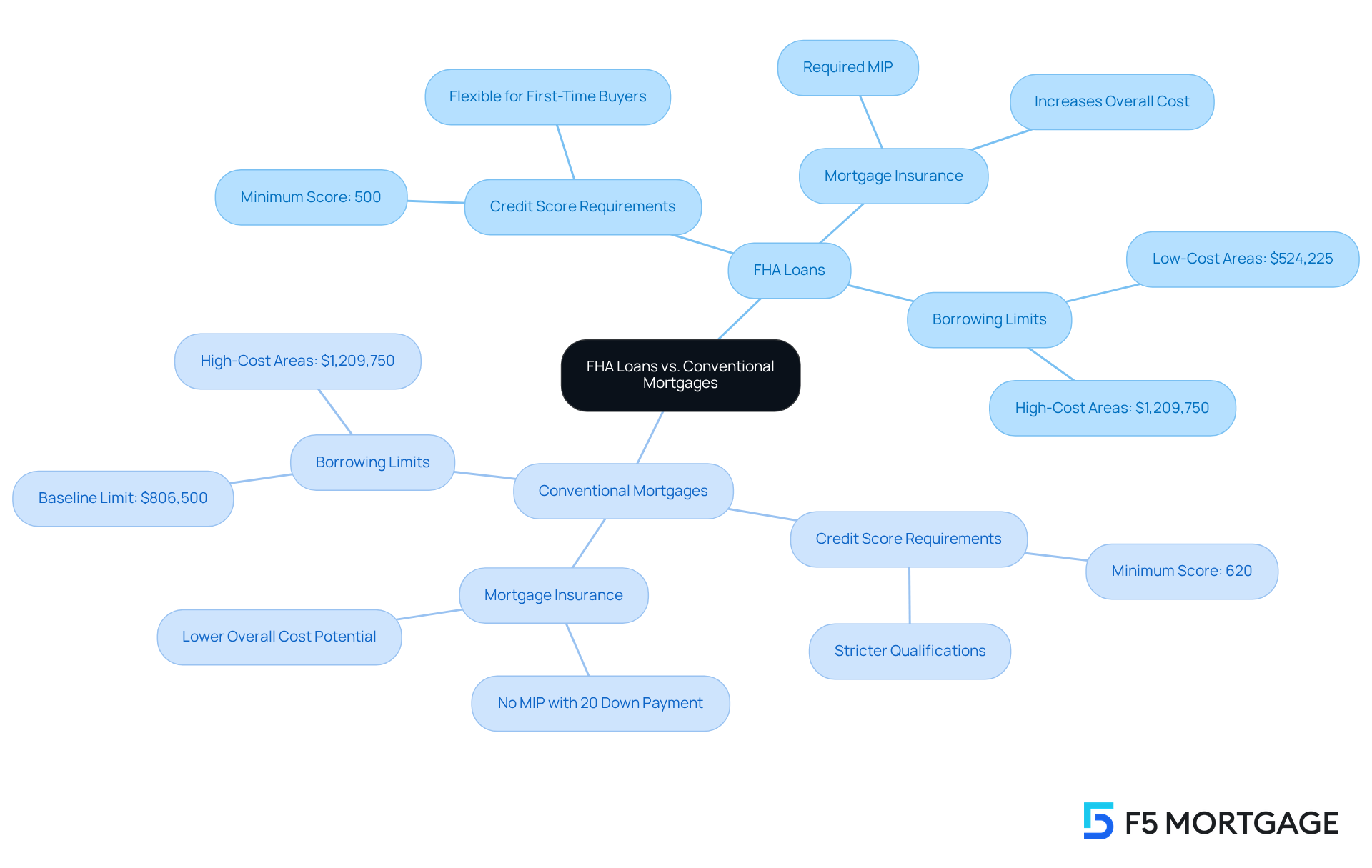

Compare FHA Loans to Conventional Mortgages

FHA financing is designed to be more attainable for borrowers, offering flexible qualifications that can ease the path to homeownership. While traditional mortgages often require a minimum credit score of 620, FHA loan credit score options can accept scores as low as 500. This flexibility makes FHA loans a suitable choice for individuals with imperfect credit histories, especially first-time homebuyers or those facing unique financial situations.

However, it’s important to consider mortgage insurance. FHA financing requires mortgage insurance premiums (MIP), which can increase the overall expense of the loan. In contrast, traditional financing may not necessitate MIP if the borrower can provide a down payment of at least 20%. Understanding this distinction is crucial, as it can significantly impact the total cost of borrowing. We know how challenging it can be to navigate these options, so weighing them carefully is essential.

As of 2025, the FHA borrowing limit for single-unit properties is set at $524,225 in low-cost regions and $1,209,750 in high-cost regions. For comparison, the conventional borrowing limit is $806,500 in baseline regions and also $1,209,750 in high-cost areas. Many borrowers with lower credit ratings have successfully obtained FHA financing, demonstrating that a favorable FHA loan credit score can enable homeownership when traditional routes may not be available.

Comprehending these distinctions is vital as you explore your financing options. We’re here to support you every step of the way, helping you choose the type of credit that best fits your financial situation and homeownership goals.

Examine the Impact of Credit Scores on FHA Loan Terms

Credit ratings play a crucial role in determining the terms of FHA loans, and we know how challenging the FHA loan credit score can be for many families. If your rating is over 580, you can take advantage of down payment options as low as 3.5%. However, if your rating falls below this threshold, especially between 500 and 579, you may face a larger down payment requirement of 10%. This can significantly increase the initial cost of homeownership, which is understandably a concern.

Additionally, lower credit ratings often lead to higher interest rates and increased mortgage insurance costs, raising the overall expense of financing your home. Imagine this: improving your credit score could potentially lower your monthly payments by more than $250. Over the life of a $300,000 mortgage, this could result in savings exceeding $91,000 in interest—an incredible benefit for your family.

It’s important to note that FHA financing also requires both upfront and annual mortgage insurance premiums, which further affects your total costs. Therefore, we encourage you to take steps to enhance your credit profile in order to improve your FHA loan credit score before applying for an FHA loan. By doing so, you can secure more favorable financing terms and lower long-term costs.

Understanding these dynamics is essential for making informed decisions in the home buying process. We’re here to support you every step of the way as you navigate this journey.

Conclusion

FHA loans represent a vital pathway to homeownership for countless families, especially those with limited financial resources or less-than-perfect credit histories. By offering more accessible financing options, these loans help individuals overcome traditional barriers, making the dream of owning a home a reality. It’s essential for potential borrowers to understand the credit score requirements and how they influence loan terms, as this knowledge can empower them to leverage the benefits of FHA financing.

Throughout this article, we’ve highlighted key points such as the minimum credit score needed for FHA loans, which is generally 580 for favorable terms. Maintaining a low debt-to-income ratio is also crucial. When compared to conventional mortgages, FHA loans offer greater flexibility for those with lower credit scores, although it’s important to be aware of potential costs associated with mortgage insurance. Additionally, we’ve underscored the significant impact of credit scores on loan terms, showing how improvements can lead to substantial long-term savings.

Ultimately, the journey to homeownership can feel daunting. However, understanding FHA loan credit score requirements and their implications empowers prospective buyers to make informed decisions. By taking proactive steps to enhance one’s credit profile, individuals can unlock better financing options and lower costs. With the right knowledge and support, achieving homeownership is within reach for many. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What are FHA loans?

FHA loans are mortgages insured by the Federal Housing Administration designed to assist low- to moderate-income families in achieving homeownership.

What is the purpose of FHA loans?

The purpose of FHA loans is to ease the journey toward owning a home by providing financing options with reduced down payment requirements and flexible financial standards.

Who can benefit from FHA loans?

FHA loans are particularly beneficial for first-time homebuyers and those who may not have substantial savings or perfect credit, making homeownership more accessible.

How do FHA loans support families?

FHA loans lower barriers to homeownership, allowing a broader range of borrowers to achieve their dreams and fostering homeownership across diverse communities.

What kind of support is available for potential FHA loan borrowers?

Support is available to guide potential borrowers through the mortgage process with compassion and expertise, helping them navigate challenges and find the right path to homeownership.