Overview

Navigating the path to homeownership can be daunting for first-time buyers in Nevada, but there are various financial assistance programs available to help you along the way. We understand how challenging this can be, especially in a market with high property prices. That’s why it’s essential to explore local market conditions and support initiatives that provide down payment assistance.

One of the first steps in your journey is obtaining pre-approval for a mortgage. This not only strengthens your position as a buyer but also gives you a clearer picture of what you can afford. We’re here to support you every step of the way, ensuring you make informed decisions despite the challenges you may face.

By taking advantage of these resources, you can empower yourself to overcome obstacles and achieve your dream of homeownership. Remember, you are not alone in this process; there are many tools and programs designed to assist you. Let’s navigate this journey together.

Introduction

Navigating the path to homeownership in Nevada can feel overwhelming, especially for first-time buyers facing a competitive market where median prices exceed the national average. We understand how challenging this can be. Yet, amidst these hurdles, there are numerous opportunities available, including various financial assistance programs designed to alleviate the burden of down payments and closing costs.

As you consider your options, one pressing question remains: how can you effectively leverage these resources and strategies to turn your dream of owning a home into a reality in such a demanding landscape?

We’re here to support you every step of the way.

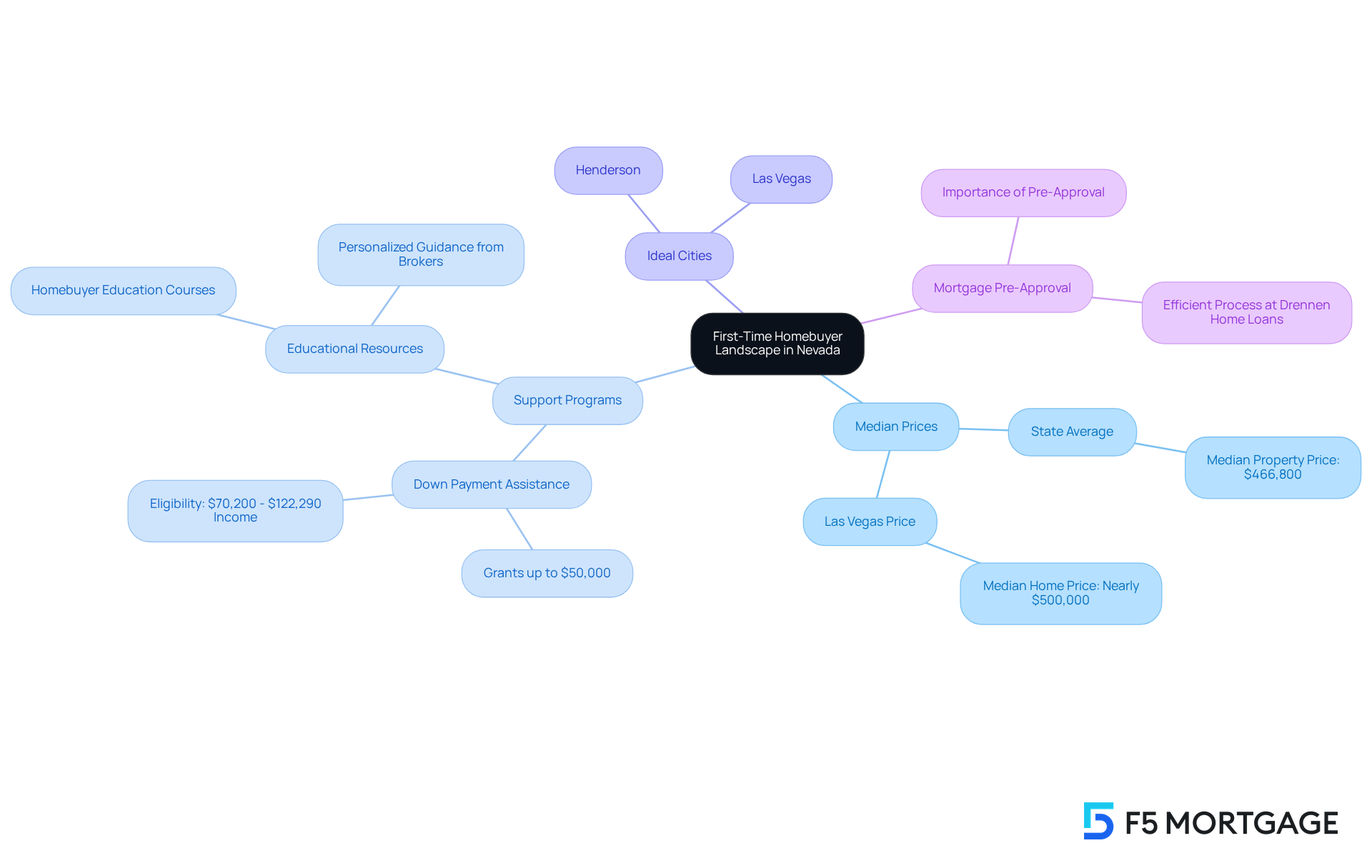

Understand the First-Time Homebuyer Landscape in Nevada

For a first time home buyer in Nevada, navigating the housing market can feel daunting, but there are both challenges and opportunities to consider. As of 2025, the median property price in Nevada is around $466,800, which exceeds the national average. This may seem intimidating, especially for those with limited savings. In Las Vegas, the situation is even more complex, with median home prices nearing $500,000.

However, there is hope! Various programs and grants exist to support the first time home buyer in Nevada, offering down payment assistance of up to $50,000 and educational resources that clarify the purchasing process. To qualify for these grants, applicants should earn between $70,200 and $122,290 per year. Understanding local market conditions—like inventory levels and average days on the market—is essential for making informed decisions.

Moreover, knowing which cities are ideal for a first time home buyer in Nevada, such as Henderson and Las Vegas, can help narrow down choices and enhance the home-buying experience. It’s crucial for serious buyers to obtain pre-approval for a mortgage, as this step can significantly simplify the buying process.

We know how challenging this can be, but with the right guidance and resources, aspiring homeowners can effectively navigate these challenges. Together, we can take significant steps toward achieving your homeownership goals.

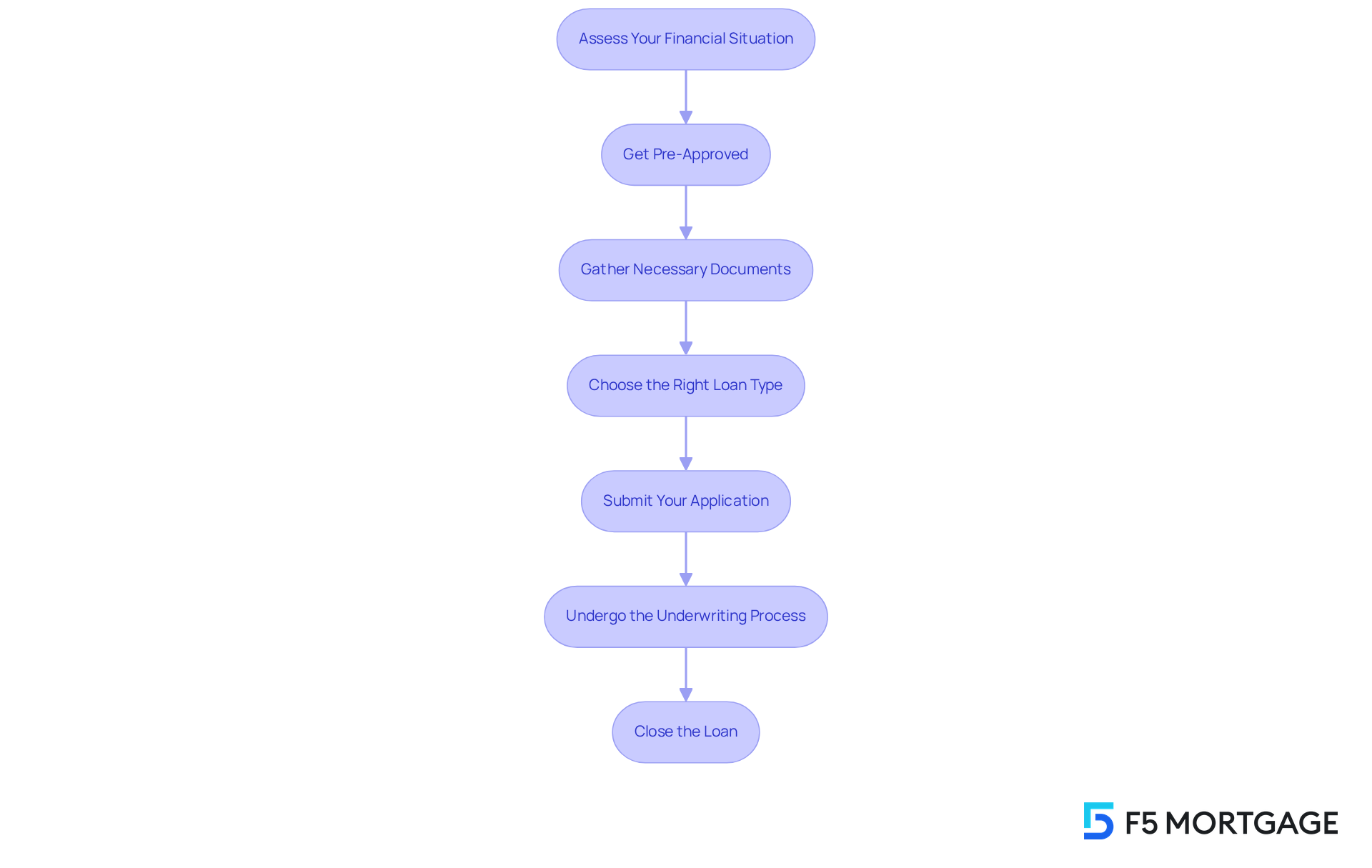

Follow the Step-by-Step Mortgage Application Process

Successfully navigating the mortgage application process can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into several key steps that can help you feel more confident:

- Assess Your Financial Situation: Start by reviewing your credit score, income, and savings. Understanding your financial standing is crucial in determining what you can afford.

- Get Pre-Approved: Securing pre-approval from lenders is a vital step. Not only does it clarify your budget, but it also enhances your offers, making you a more competitive purchaser in today’s market. As local mortgage banker Darin Hahn wisely points out, “Being pre-approved signals to sellers that you are serious, improving your chances in a competitive environment.”

- Gather Necessary Documents: Prepare essential documentation, like tax returns, pay stubs, and bank statements. Having these ready can streamline your application process and alleviate some stress.

- Choose the Right Loan Type: Take the time to explore various loan options, such as FHA, VA, and conventional loans. Finding the best fit for your financial situation and homeownership goals is key.

- Submit Your Application: When you’re ready, complete the mortgage application with your chosen lender. Ensure that all information is accurate and comprehensive to avoid delays.

- Undergo the Underwriting Process: Be prepared for the lender to verify your financial details and assess the property. This step is critical in securing your mortgage, and understanding it can help ease your concerns.

- Close the Loan: Once approved, carefully review the closing disclosure, sign the necessary documents, and finalize your mortgage. This is an exciting step toward achieving your dream of homeownership.

With the average time to get pre-approved for a mortgage in 2025 being relatively swift, first time home buyers in Nevada can expect a more streamlined experience. Many families have successfully navigated this process, turning their homeownership dreams into reality. Remember, obtaining pre-approval not only clarifies your budget but also signals to sellers that you are a serious client, enhancing your chances in a competitive market.

However, it’s important to be aware of potential challenges, such as high-interest rates and complicated paperwork. We know how challenging this can be, but with the right support and guidance, you can navigate these hurdles effectively.

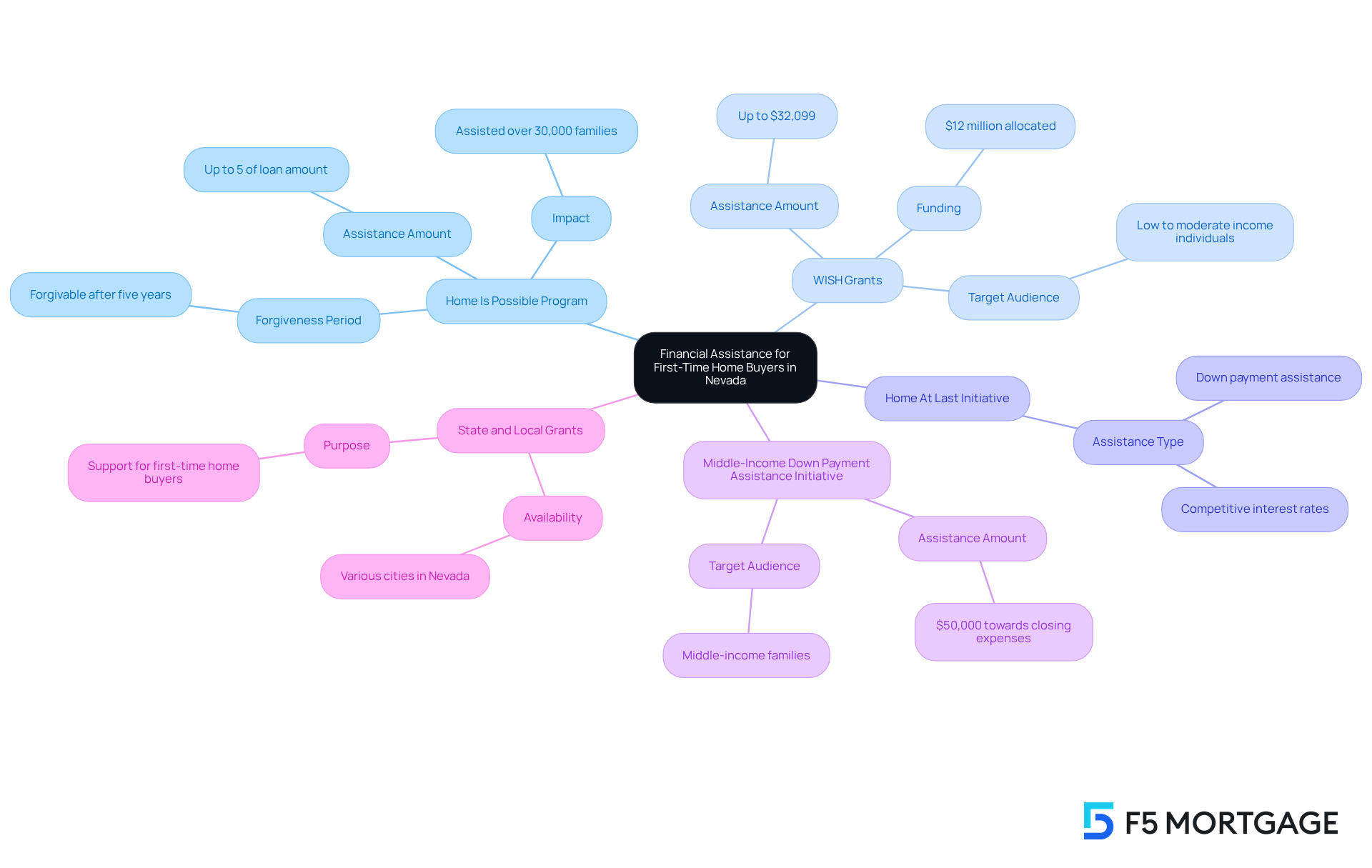

Explore Financial Assistance and Down Payment Options

First time home buyer Nevada, we understand how challenging this journey can be. Thankfully, there are a variety of financial assistance programs designed to ease your path to homeownership:

-

Home Is Possible Program: This initiative offers up to 5% of the loan amount for down payment assistance, becoming forgivable after five years. Since its launch in 2014, it has successfully assisted over 30,000 families in achieving property ownership, showcasing its effectiveness in facilitating housing purchases.

-

WISH Grants: Aimed at individuals with low to moderate incomes, this program provides matching grants of up to $32,099 to help with down payment and closing expenses. This significantly alleviates the financial strain of acquiring a home, with $12 million allocated to enhance its reach and impact.

-

Home At Last Initiative: Not only does this initiative offer down payment assistance, but it also provides competitive interest rates, making homeownership more affordable for qualified individuals.

-

Middle-Income Down Payment Assistance Initiative: Offering $50,000 towards closing expenses and down payment support, this initiative is a valuable resource for families looking to enhance their living situations.

-

State and Local Grants: Various cities throughout Nevada provide additional grants and support initiatives specifically designed for first time home buyer Nevada. Exploring these options can help you secure the necessary funds to make property acquisitions more manageable.

As Jeff Newbury, Senior Vice President of Mortgage Lending, expressed, “These initiatives offer a distinct chance for working families and individuals who contribute to our community. The support is a grant that doesn’t require repayment and isn’t a lien on the property.”

As you progress on your journey, we encourage you to contemplate these programs. They can enhance your financial assistance and help turn your aspiration of owning a property in Nevada into reality.

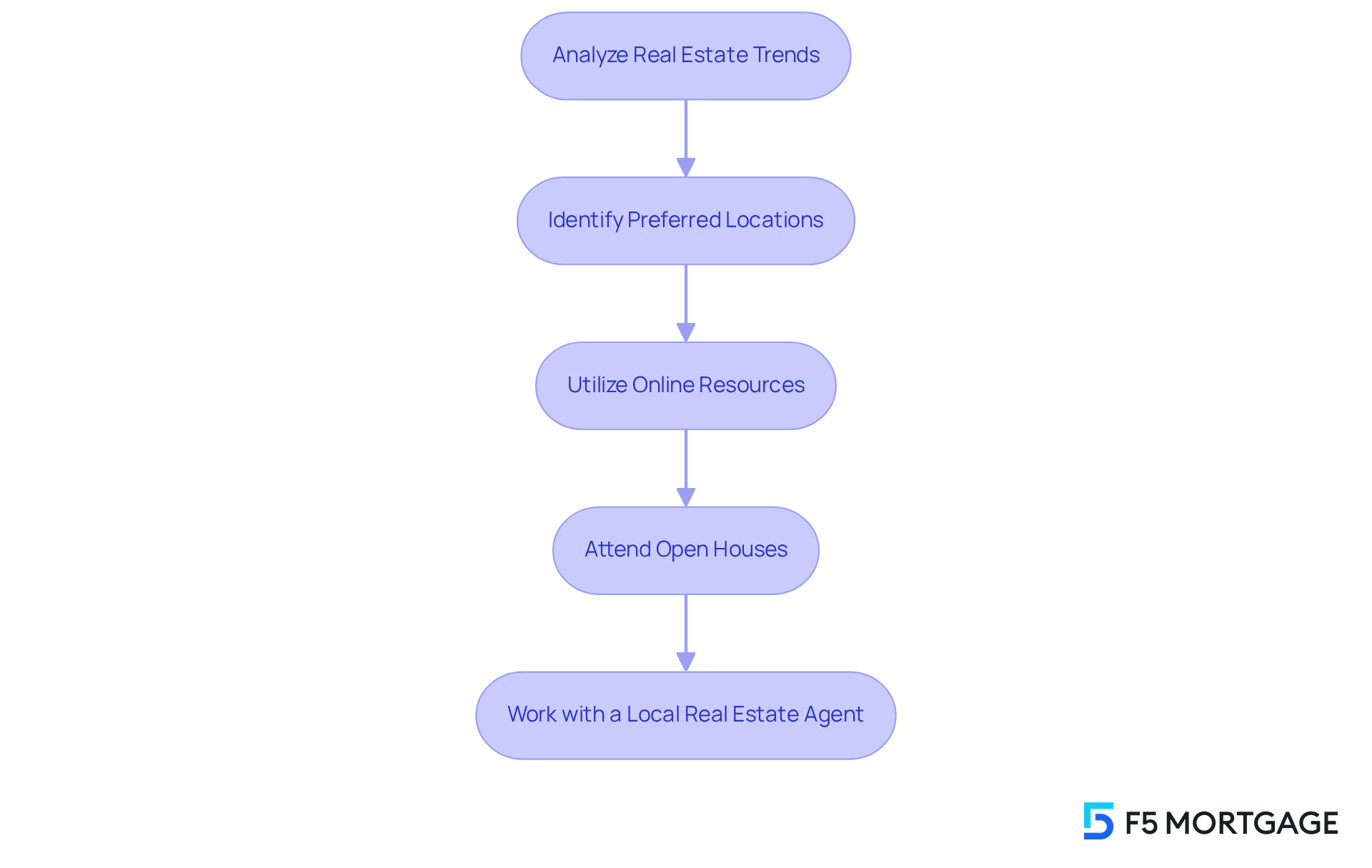

Research the Nevada Housing Market and Start Your Home Search

To effectively research the Nevada housing market, we know how challenging this can be, so consider these supportive strategies:

-

Analyze Real Estate Trends: Monitoring median property prices, inventory levels, and average days on the listings can help you understand the competitiveness of various neighborhoods. For instance, did you know that Las Vegas has seen a remarkable 77.6% increase in housing inventory year-over-year? Meanwhile, the overall housing inventory in the West has increased by 38.3%. This broader context can help you gauge the competitive landscape and make informed choices.

-

Identify Preferred Locations: Evaluating essential factors such as school districts, local amenities, and commute times can help you pinpoint neighborhoods that align with your lifestyle. Areas with strong community features often provide better long-term value. It’s crucial to consider how these aspects fit into your daily life and family needs.

-

Utilize Online Resources: Leverage platforms like Zillow and Realtor.com for comprehensive insights into available properties and current market conditions. These tools can help you track new listings and price changes effectively, making your search easier.

-

Attend Open Houses: Participating in open houses offers a firsthand experience of homes and neighborhoods. This allows you to assess the ambiance and suitability of potential purchases, helping you feel more connected to your choices.

-

Work with a Local Real Estate Agent: Collaborating with a knowledgeable agent can provide personalized guidance tailored to your needs. For example, Robert Little, an Associate at REMAX Advantage Henderson, noted that buyer demand in Las Vegas has cooled due to higher interest rates. Their expertise in the local area can streamline the home-buying process and assist you in handling any difficulties.

By employing these strategies, first time home buyers in Nevada can confidently approach the housing market. Remember, we’re here to support you every step of the way as you make informed decisions in your home search.

Conclusion

Navigating the path to homeownership as a first-time buyer in Nevada can feel overwhelming, but it also brings exciting opportunities. With median home prices exceeding national averages and a competitive market, understanding this landscape is essential for your journey. We know how challenging this can be, but there are various assistance programs and resources available to help ease the financial burden, making homeownership more attainable for many aspiring buyers.

Key insights from this guide emphasize the importance of pre-approval in the mortgage application process. There are numerous financial assistance programs to explore, and conducting thorough research on the housing market is crucial. By assessing your personal financial situation, exploring different loan options, and leveraging local resources, you can successfully navigate the complexities of purchasing a home in Nevada.

Ultimately, the journey to homeownership is not just about securing a property; it is about building a foundation for your future. By taking informed steps and utilizing available resources, first-time homebuyers can transform their dreams into reality. Embrace the opportunities ahead and take action—your new home in Nevada awaits! We’re here to support you every step of the way.

Frequently Asked Questions

What is the median property price in Nevada for first-time homebuyers as of 2025?

The median property price in Nevada is around $466,800, which exceeds the national average.

How do median home prices in Las Vegas compare to the rest of Nevada?

In Las Vegas, median home prices are nearing $500,000, making the housing market more complex for first-time homebuyers.

What assistance is available for first-time homebuyers in Nevada?

Various programs and grants offer down payment assistance of up to $50,000 and educational resources to help clarify the purchasing process.

What are the income qualifications for the grants available to first-time homebuyers in Nevada?

Applicants should earn between $70,200 and $122,290 per year to qualify for these grants.

Why is it important to understand local market conditions when buying a home in Nevada?

Understanding local market conditions, such as inventory levels and average days on the market, is essential for making informed decisions as a buyer.

Which cities in Nevada are ideal for first-time homebuyers?

Henderson and Las Vegas are identified as ideal cities for first-time homebuyers in Nevada.

What is a crucial step for serious buyers in the home-buying process?

Obtaining pre-approval for a mortgage is crucial, as it can significantly simplify the buying process.