Overview

Navigating financial options can be overwhelming, especially when considering a Home Equity Line of Credit (HELOC) versus cash-out refinancing. This article sheds light on the key differences between these two choices, helping you understand which might be best for your unique situation.

A HELOC offers the flexibility to manage ongoing expenses with variable interest rates, making it a suitable option for those who need access to funds over time. On the other hand, cash-out refinancing provides a lump sum with fixed payments, which can be ideal for significant projects or debt consolidation.

We understand how crucial it is to choose the right financial path. By highlighting these differences, we aim to empower you to make informed decisions based on your financial circumstances. Remember, we’re here to support you every step of the way as you explore your options.

Introduction

Homeowners today find themselves at a crucial crossroads when it comes to leveraging their property equity. With two primary options available— a Home Equity Line of Credit (HELOC) and cash-out refinancing—it’s important to understand the unique advantages each offers.

We know how challenging these decisions can be, and recognizing the nuances between these financial tools is essential. As interest rates fluctuate and financial needs change, you may be wondering: which option truly aligns with your financial goals?

This article explores the key differences and suitability of HELOCs versus cash-out refinancing, providing you with the insights needed to navigate your financial journey with confidence.

Define HELOC and Cash-Out Refinance

A Home Equity Line of Credit (HELOC) is a revolving line of credit backed by the equity in your home. This means that as a property owner, you can borrow against your property’s value whenever you need, much like using a credit card. Typically, HELOCs allow you to borrow up to 90% of your home’s equity, making them especially useful for short-term financial needs or projects, such as home renovations. In 2024, the average HELOC balance in the U.S. rose to $45,157. This trend reflects a growing number of homeowners choosing to utilize their equity for various expenses. Interestingly, the average FICO Score among HELOC borrowers is close to 800, suggesting that these loans are often accessed by individuals with strong credit profiles.

On the other hand, a cash-out refinance involves replacing your existing mortgage with a new, larger one. This process allows you to take out the difference in cash, effectively refinancing your property for more than you owe. You receive the surplus as a lump sum payment at closing. Cash-out refinancing generally permits borrowing up to 80% of your property’s equity and is often favored for significant renovations or debt consolidation. Many homeowners appreciate this option, as it typically leads to lower monthly payments compared to maintaining both a mortgage and a HELOC. In 2025, the typical refinance amount was notably large, highlighting its appeal for property owners seeking efficient access to their equity. Additionally, the interest on cash refinances or HELOCs may be tax-deductible if the funds are used for capital home enhancements.

Understanding HELOC vs refinance options is vital for homeowners, as each serves different financial goals and circumstances. We know how challenging it can be to navigate these choices. While HELOCs offer flexibility and are ideal for ongoing expenses, understanding HELOC vs refinance reveals that cash-out refinances provide a lump sum that can be beneficial for larger projects or debt consolidation. It’s essential to weigh the potential risks of borrowing against your property equity alongside the benefits of each option. This careful evaluation can help you determine which choice aligns best with your personal needs. F5 Mortgage is here to support you every step of the way, providing a simplified process for securing these loans and assisting you in exploring the options available to you as a property owner.

Explain How HELOC and Cash-Out Refinance Work

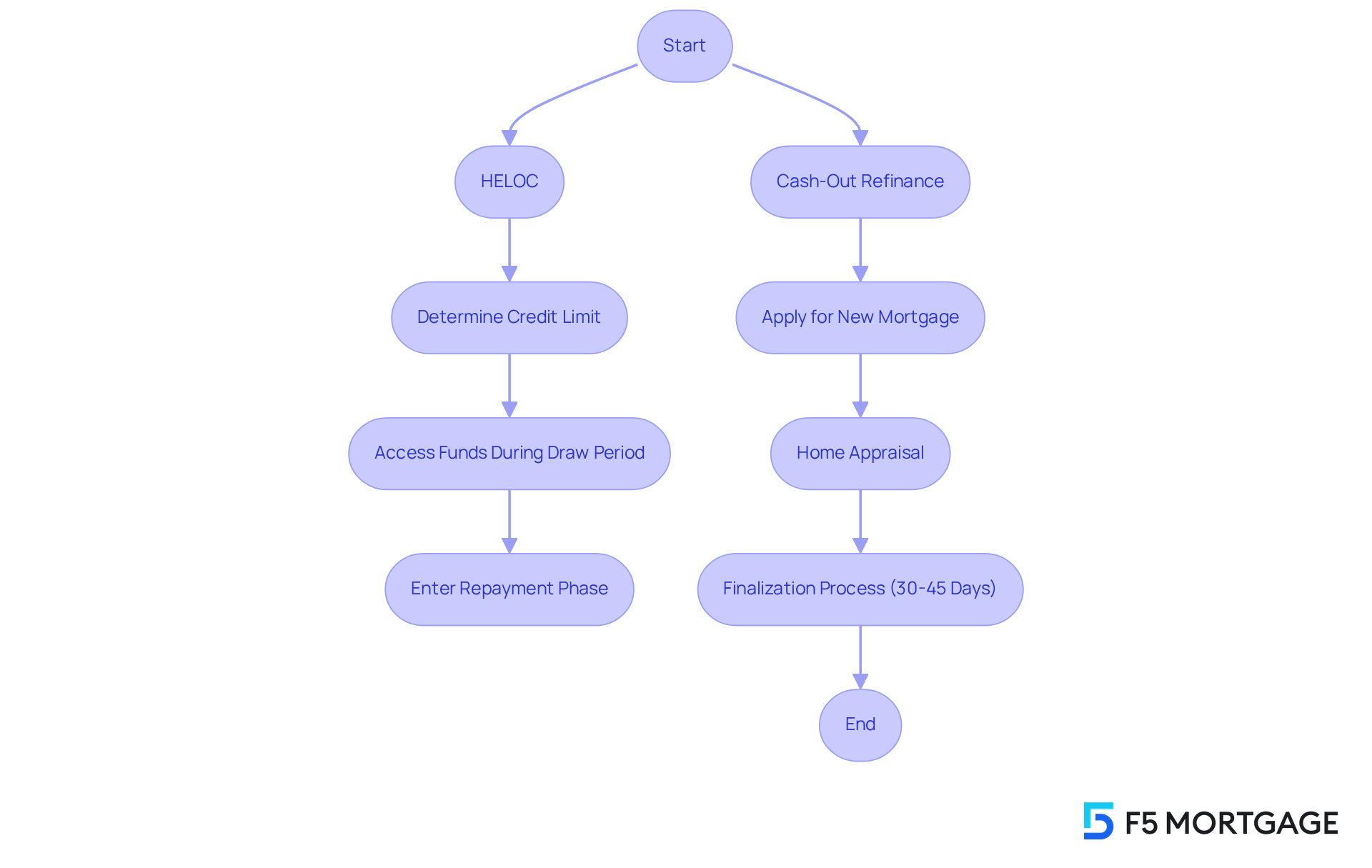

A Home Equity Line of Credit (HELOC) can be a valuable tool for property owners, functioning much like a credit card. It allows you to access a predetermined credit limit based on your home equity, offering flexibility during times when you need it most. You can draw from this line of credit as needed during a specified draw period, typically lasting 5 to 10 years, before entering a repayment phase.

As of Q1 2025, many families will be relieved to know that the average monthly payment for a $50,000 HELOC has dropped from $412 in early 2024 to $311. This decline reflects lower borrowing costs, which can ease financial stress. However, it’s important to understand that the process of withdrawing funds through refinancing differs from a HELOC vs refinance. You would need to apply for a new mortgage that settles your current loan and provides money based on your equity. This often requires a home appraisal and can take around 30 to 45 days to finalize, highlighting the complexities involved in securing a new mortgage.

Interestingly, among those who refinanced in the second quarter, 81% opted for cash-out refinancing. This choice underscores its popularity among property owners looking to leverage their equity by comparing HELOC vs refinance options. Keep in mind that the terms of the new mortgage may differ from your original loan, which could impact your monthly payments and overall financial strategy.

Moreover, over 90% of property owners currently enjoy fixed mortgage rates below 6%. This fact is crucial when evaluating your refinancing options, especially in the context of HELOC vs refinance. We understand how challenging these decisions can be, but comprehending these processes is essential for making informed choices about utilizing your equity effectively. We’re here to support you every step of the way as you navigate these important financial decisions.

Compare Pros and Cons of HELOC and Cash-Out Refinance

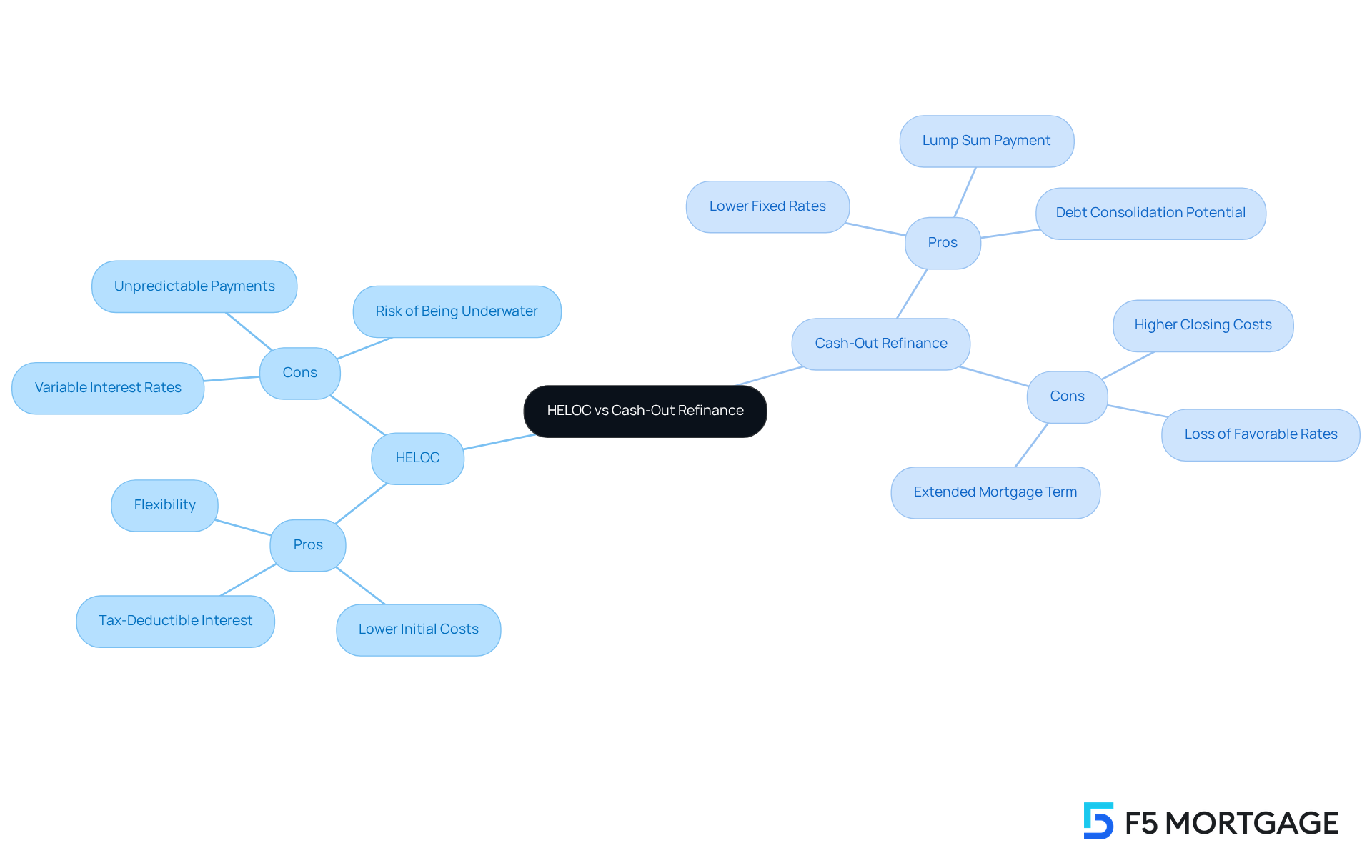

Homeowners often find themselves at a crossroads when evaluating HELOC vs refinance, with each option presenting its own set of benefits and drawbacks. We understand how challenging this decision can be. To qualify for a home equity line of credit, property owners typically need to have built up at least 15% to 20% equity in their home. HELOCs provide flexibility, allowing homeowners to access funds as needed, often with lower initial costs. Additionally, if used for property improvements, the interest on a HELOC may be tax-deductible, making it an attractive option for those looking to fund renovations.

However, it’s important to consider that the variable interest rates tied to HELOCs can lead to unpredictable monthly payments, complicating budgeting. Moreover, if property values decline after borrowing against equity, homeowners risk being underwater on their mortgage, which can be a daunting prospect.

On the other hand, cash refinancing typically offers lower fixed interest rates and a lump sum of money, making it suitable for significant expenses like debt consolidation or major home improvements. This option allows homeowners to replace their current mortgage with a larger one, tapping into their equity in the process. Yet, equity refinancing often comes with higher closing costs, averaging between 2% and 6% of the loan amount, and may reset the mortgage term, potentially extending the repayment period. For homeowners with favorable existing mortgage rates, refinancing for cash might seem less appealing, as it could mean losing those advantageous terms. In 2021, refinance borrowers withdrew an average of $60,214, highlighting the potential financial benefits of this choice.

Consider real-life scenarios: homeowners seeking to fund a significant renovation might opt for refinancing with cash withdrawal to secure a fixed rate, while those needing ongoing access to funds for smaller projects may prefer a home equity line of credit, illustrating the differences in HELOC vs refinance. Financial experts emphasize the importance of assessing personal financial situations when weighing these options, as the right choice can greatly influence long-term financial health. As we approach mid-2025, with cash-out refinance rates exceeding 7%, it’s crucial for property owners to carefully evaluate their options. Remember, we’re here to support you every step of the way as you navigate these decisions.

Assess Suitability for Different Financial Needs

A Home Equity Line of Credit (HELOC) can be a valuable resource for property owners seeking flexible access to funds for ongoing projects or unexpected expenses. This option allows you to borrow as needed, making it particularly suitable for those who can manage variable payments and are comfortable with fluctuating interest rates. However, it’s essential to recognize that HELOCs typically have variable interest rates, which may result in unpredictable monthly payments and budgeting challenges. For instance, homeowners planning multiple renovations over time, with a total estimated cost of around $50,000, can utilize a HELOC to manage these expenses effectively, only paying for the amounts they withdraw during the initial draw period of 5 to 10 years. To qualify for a HELOC, borrowers usually need to have over 15% equity in their property and a debt-to-income ratio below 43%.

On the other hand, cash-out refinancing may be more appropriate for those who require a substantial one-time financial boost, such as for major renovations or debt consolidation. This option allows property owners to replace their current mortgage with a larger one, enabling them to tap into their equity. It can be particularly advantageous for those who can secure a lower interest rate than their existing mortgage, providing a fixed monthly payment structure that simplifies budgeting. However, keep in mind that cash refinancing often incurs higher closing costs compared to a HELOC. Homeowners with stable incomes and a clear plan for utilizing the funds may find refinancing to be a strategic financial choice, especially considering the potential for tax-deductible interest when funds are used for home improvements.

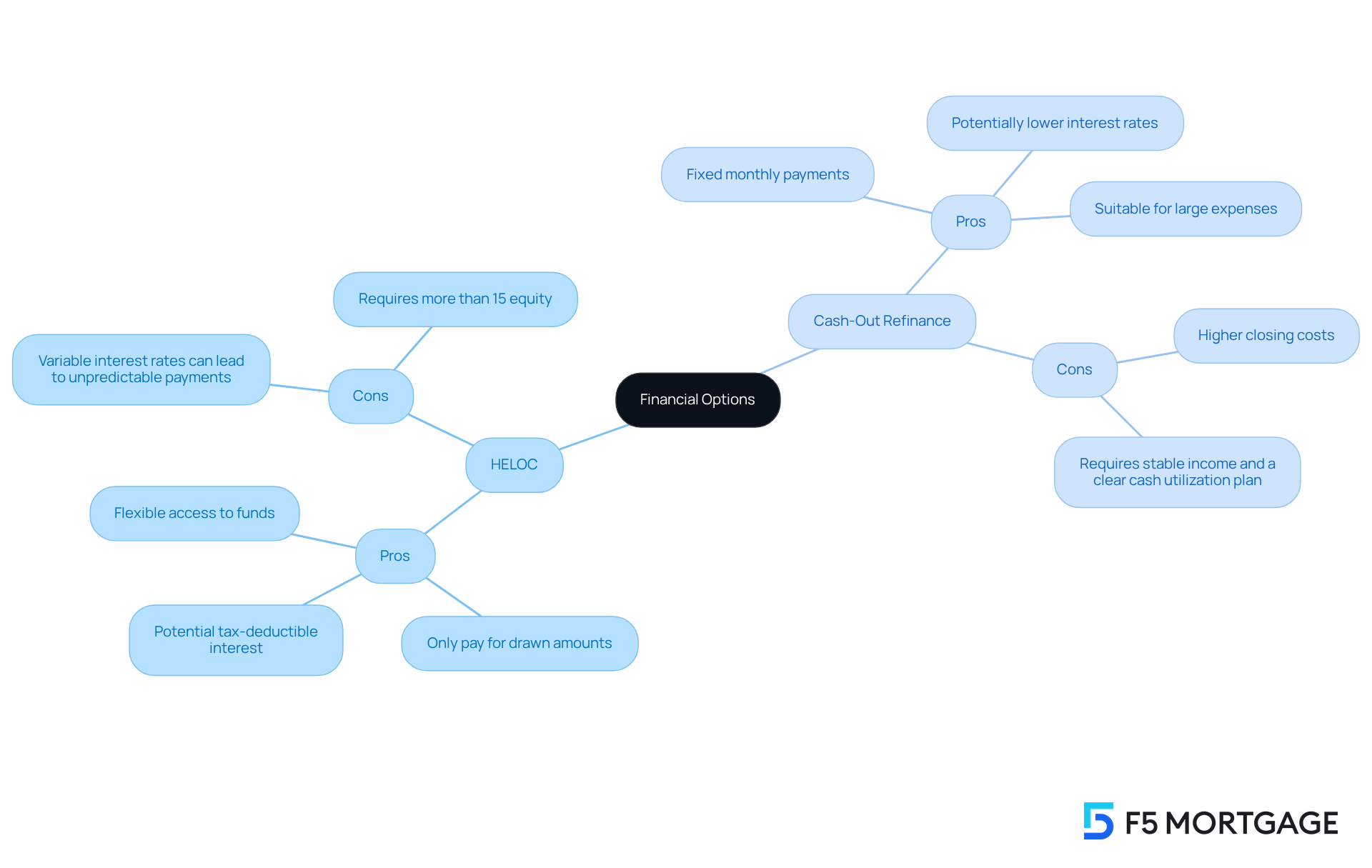

Ultimately, the choice between a home equity line of credit and cash-out refinancing is a matter of heloc vs refinance, which hinges on your personal financial needs and circumstances. We encourage homeowners to thoughtfully evaluate their goals, repayment capabilities, and the nature of their expenses to determine the most suitable option. Here’s a quick summary of the pros and cons to consider:

- HELOC Pros: Flexible access to funds, only pay for drawn amounts, potential tax-deductible interest.

- HELOC Cons: Variable interest rates can lead to unpredictable payments, requires more than 15% equity.

- Cash-Out Refinance Pros: Fixed monthly payments, potentially lower interest rates, suitable for large expenses.

- Cash-Out Refinance Cons: Higher closing costs, requires stable income and a clear cash utilization plan.

We know how challenging these decisions can be, but we’re here to support you every step of the way.

Conclusion

Understanding the distinctions between a Home Equity Line of Credit (HELOC) and cash-out refinancing is crucial for homeowners looking to leverage their property equity effectively. We know how challenging this can be, and each option presents unique features tailored to different financial needs. HELOCs offer flexibility for ongoing expenses, while cash-out refinancing provides a substantial one-time cash influx for larger projects or debt consolidation.

Throughout this article, we’ve shared key insights regarding the operational mechanics of both financing options. HELOCs allow for flexible borrowing against home equity, making them ideal for short-term needs. On the other hand, cash-out refinancing enables homeowners to replace their mortgage with a larger one, accessing a lump sum for significant expenditures. We explored the pros and cons of each option, highlighting factors such as interest rates, payment structures, and qualification requirements that can influence your decision.

Ultimately, the choice between HELOC and cash-out refinancing hinges on your individual financial circumstances and objectives. We encourage you to carefully assess your needs, considering factors like repayment capabilities and the nature of your expenses. By doing so, you can make informed decisions that align with your long-term financial health. With the evolving landscape of mortgage options in 2025, staying informed and seeking professional guidance can empower you to navigate these choices confidently and strategically. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit backed by the equity in your home, allowing property owners to borrow against their home’s value as needed, similar to using a credit card.

How much equity can I borrow with a HELOC?

Typically, HELOCs allow you to borrow up to 90% of your home’s equity.

What are common uses for a HELOC?

HELOCs are especially useful for short-term financial needs or projects, such as home renovations.

What is the average HELOC balance in the U.S. as of 2024?

The average HELOC balance in the U.S. rose to $45,157 in 2024.

What is a cash-out refinance?

A cash-out refinance involves replacing your existing mortgage with a new, larger one, allowing you to take out the difference in cash as a lump sum payment at closing.

How much equity can I borrow with a cash-out refinance?

Cash-out refinancing typically permits borrowing up to 80% of your property’s equity.

When might homeowners prefer a cash-out refinance?

Homeowners may favor cash-out refinancing for significant renovations or debt consolidation, as it often leads to lower monthly payments compared to maintaining both a mortgage and a HELOC.

Can the interest on HELOCs or cash-out refinances be tax-deductible?

Yes, the interest on cash refinances or HELOCs may be tax-deductible if the funds are used for capital home enhancements.

What are the key differences between a HELOC and a cash-out refinance?

HELOCs offer flexibility for ongoing expenses, while cash-out refinances provide a lump sum that is beneficial for larger projects or debt consolidation.

Why is it important to understand HELOCs and cash-out refinancing?

Understanding these options is vital for homeowners as each serves different financial goals and circumstances, helping them make informed borrowing decisions.