Overview

Earnest money is more than just a deposit; it’s a symbol of your commitment in real estate transactions. We understand how important it is for you to feel secure during negotiations with sellers. By grasping key factors like:

- Market conditions

- The property’s price

- Seller expectations

you can determine an earnest money amount that feels right for you.

It’s also crucial to know the conditions under which this deposit can be refunded. Protecting your financial interests is our priority, and we’re here to support you every step of the way. Remember, you’re not alone in navigating these challenges; understanding these aspects can empower you in your journey.

Introduction

Navigating the real estate landscape can be overwhelming, and understanding the intricacies of earnest money is crucial. This essential deposit, often viewed as a buyer’s commitment to a purchase, plays a significant role in the dynamics of a transaction. However, we know how challenging it can be to determine the right amount and grasp the conditions that govern its refundability.

What factors should you consider to ensure you make informed decisions and protect your financial interests? We’re here to support you every step of the way.

Define Earnest Money and Its Purpose in Real Estate

Earnest money, often referred to as a good faith deposit, plays a vital role in real estate transactions. When a purchaser submits earnest money with their offer, it reflects their serious commitment to moving forward with the acquisition. Typically held in an escrow account until the sale is finalized, earnest money can be applied toward the purchaser’s down payment or closing costs.

In most cases, earnest money contributions range from 1% to 3% of the home’s purchase price. For a $400,000 property, this translates to approximately $4,000 to $12,000. By providing earnest money, purchasers not only affirm their intentions but also encourage sellers to take their property off the market, making the transaction process smoother.

In competitive markets, opting for a larger earnest money deposit can further strengthen a buyer’s offer. This not only demonstrates seriousness but may also give them an edge in negotiations. We understand how challenging this can be, and while a deposit isn’t legally required, it is a common practice that can significantly impact the home-buying experience. We’re here to support you every step of the way as you navigate this important journey.

Determine Appropriate Earnest Money Amounts and Influencing Factors

Determining the right amount of earnest money to offer can feel overwhelming, but understanding a few key factors can help ease your concerns:

-

Local Market Conditions: In a competitive seller’s market, it’s common for buyers to present a larger earnest money contribution to make their offer stand out. Typically, initial payments range from 1% to 3% of the home’s sale price. However, in a competitive situation, you might consider increasing the earnest money to enhance your appeal. Conversely, in a buyer’s market, smaller contributions may suffice, reflecting the reduced competition.

-

Property Price: The value of the home plays a significant role in determining your deposit amount. For more expensive properties, larger upfront payments may be necessary, while more affordable homes usually require smaller amounts. For instance, if you’re looking at a $400,000 residence, security deposits might range from $4,000 to $12,000.

-

Seller Expectations: Sellers often have specific expectations regarding deposit funds, shaped by their past experiences or advice from their real estate agents. By understanding these expectations, you can tailor your offer to align with what the seller is looking for, which can be beneficial.

-

Buyer’s Financial Situation: It’s essential to assess your financial capacity when deciding on a deposit amount. Striking a balance between being competitive and staying within your budget is crucial to avoid financial strain. Remember, we know how challenging this can be, and it’s important to feel secure in your decision.

-

Type of Financing: The type of loan you choose can also impact the deposit requirements. For instance, conventional loans may have different expectations compared to FHA or VA loans, which can influence how much you need to offer.

By carefully considering these factors, you can identify an appropriate earnest money deposit amount that demonstrates your commitment while ensuring you remain financially cautious. We’re here to support you every step of the way as you navigate this process.

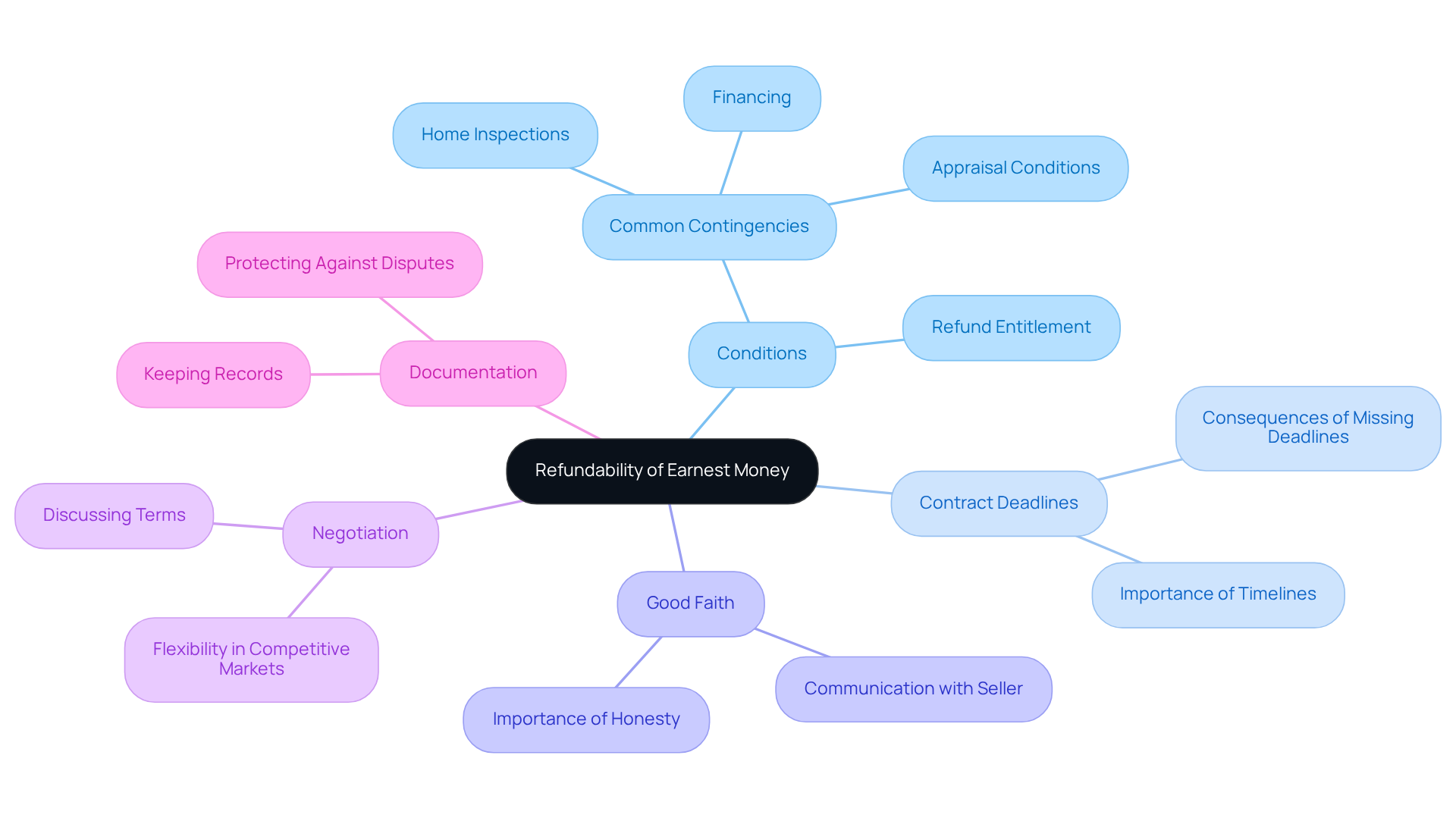

Understand Refundability of Earnest Money and Common Pitfalls

Understanding earnest money is crucial for homebuyers, especially when it comes to protecting your hard-earned funds. We know how challenging this can be, and being aware of potential pitfalls can help you navigate the process with confidence. Here are some essential considerations to keep in mind:

-

Conditions: Most purchase contracts have specific conditions that allow you to back out of the transaction without losing your deposit. Common contingencies include financing, home inspections, and appraisal conditions. If these aren’t met, you’re entitled to a refund, which can provide peace of mind.

-

Contract Deadlines: It’s vital to adhere to the timelines outlined in your purchase agreement. Missing these deadlines can turn your deposit non-refundable, leading to significant financial loss that could have been avoided.

-

Good Faith: Throughout this journey, acting in good faith is essential. Ending the agreement without valid reasons can jeopardize your security funds, so it’s important to communicate openly and honestly.

-

Negotiation: Remember, you have the power to discuss the terms related to your deposit with the seller. This flexibility can be especially beneficial in competitive markets, where every detail counts.

-

Documentation: Keeping detailed records of all communications and agreements regarding your deposit is a smart move. This documentation can protect you in case any disputes arise, ensuring you have a clear reference point.

By grasping these elements, you can effectively navigate the complexities of earnest money, safeguarding your financial interests during the home buying process. In competitive markets, sellers may be less inclined to return earnest money, highlighting the importance of having clear contractual terms and adhering to deadlines. Legal experts often point out that misunderstandings about contract terms lead to disputes, so specificity in agreements is key. We’re here to support you every step of the way.

Conclusion

We understand that navigating the world of real estate can be daunting, and earnest money plays a crucial role in this journey. It symbolizes your serious intent to purchase a property, allowing you to secure your position in a competitive market while building trust with sellers. This trust can be pivotal during negotiations, making it essential for you to grasp the nuances of earnest money, including its purpose, typical amounts, and the conditions that may lead to a refund.

Factors influencing the appropriate amount of earnest money can vary:

- Local market conditions

- Property prices

- Seller expectations

- Your financial situation

It’s important to recognize the potential for refundability and to be aware of common pitfalls, such as contract deadlines and good faith requirements. By carefully navigating these considerations, you can protect your interests and enhance your chances of a successful transaction.

Ultimately, earnest money is more than just a deposit; it’s a strategic tool that can significantly impact your homebuying experience. As the real estate landscape evolves, staying informed about earnest money practices empowers you to make confident decisions. Whether you’re entering a competitive market or negotiating terms, understanding the role of earnest money can lead to a smoother and more secure home-buying journey. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is earnest money in real estate?

Earnest money, often called a good faith deposit, is a sum of money that a purchaser submits with their offer to demonstrate their serious commitment to buying a property.

What is the purpose of earnest money?

The purpose of earnest money is to show the seller that the buyer is serious about the transaction. It also encourages the seller to take the property off the market while the sale is being finalized.

How is earnest money typically handled during a transaction?

Earnest money is usually held in an escrow account until the sale is completed. It can then be applied toward the buyer’s down payment or closing costs.

How much is earnest money usually?

Earnest money contributions typically range from 1% to 3% of the home’s purchase price. For example, on a $400,000 property, this would amount to approximately $4,000 to $12,000.

Can a larger earnest money deposit benefit a buyer?

Yes, in competitive markets, a larger earnest money deposit can strengthen a buyer’s offer, demonstrating seriousness and potentially giving them an advantage in negotiations.

Is a deposit of earnest money legally required?

No, a deposit of earnest money is not legally required, but it is a common practice that can significantly impact the home-buying experience.