Overview

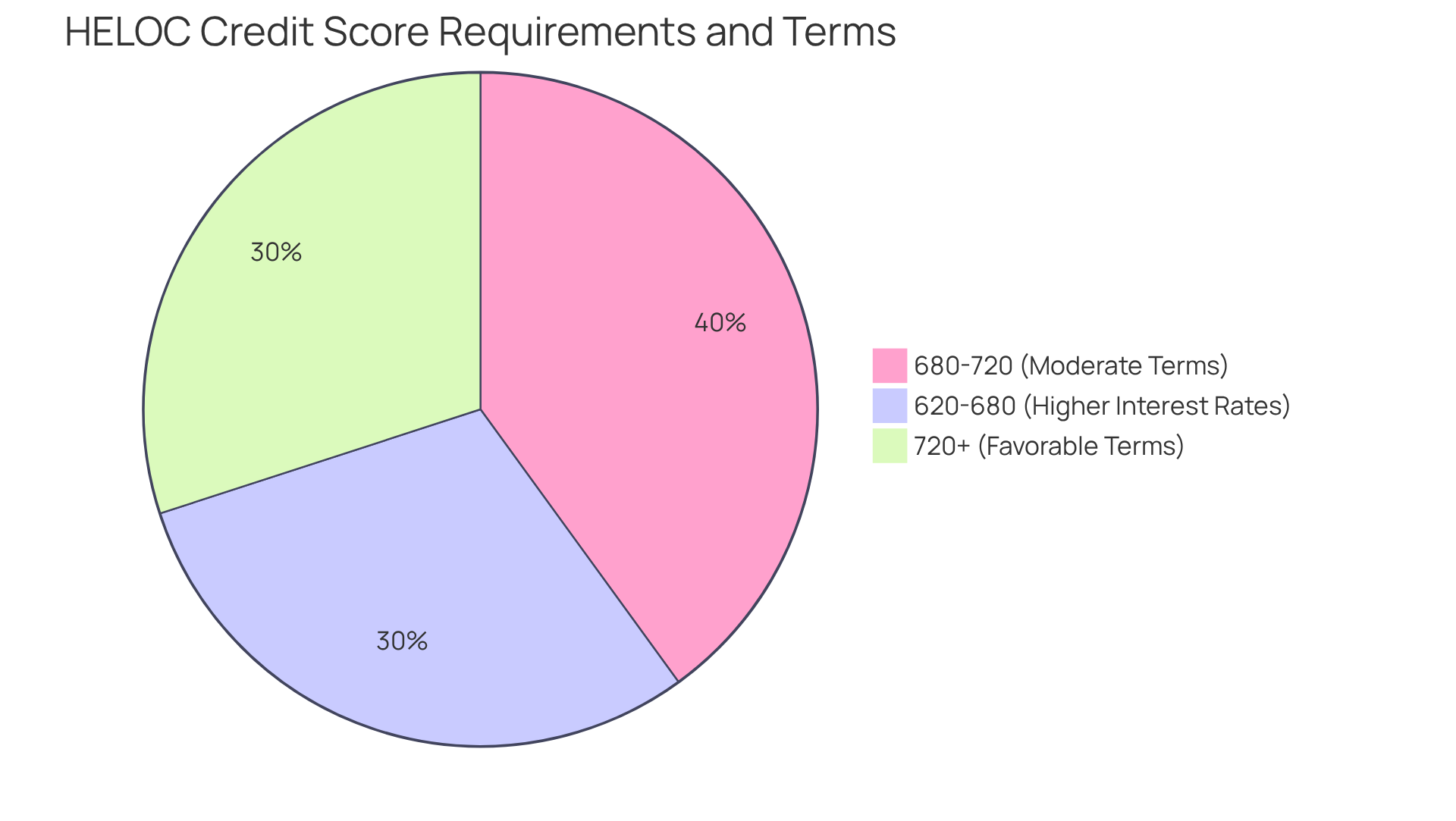

Navigating the world of HELOC credit score requirements can feel overwhelming, but we’re here to support you every step of the way. Typically, a minimum credit score of 620 to 680 is needed, and if you have a score of 720 or higher, you may find even better terms available. This is important because lenders look at your credit score alongside other key factors, such as your home equity and debt-to-income ratios, to determine your eligibility and the conditions of your loan. Understanding this process can empower you to make informed decisions about your financial future.

Introduction

We understand that navigating the complexities of home financing can be daunting, especially when unexpected expenses arise. A Home Equity Line of Credit (HELOC) can offer you a flexible solution, allowing you to tap into your property’s value for various financial needs. However, we know that the approval process can be challenging, particularly with the stringent credit score requirements that vary among lenders.

What are the key factors that determine your eligibility for a HELOC? How can you enhance your chances of securing favorable terms? Let’s explore these questions together, empowering you to make informed decisions every step of the way.

Define HELOC and Its Importance in Home Financing

We understand how challenging managing finances can be, especially when unexpected costs arise. A Home Equity Line of Credit (HELOC) is a revolving line of credit that’s backed by the value of your home. This means you can borrow against the worth of your property, giving you access to funds for various purposes—whether it’s for renovations, debt consolidation, or those unplanned expenses that can catch us off guard.

What makes a HELOC truly significant in property financing is its flexibility. Unlike a conventional loan, you can access funds as needed, up to a predetermined limit, and you only incur interest on the amount you actually use. This adaptability makes HELOCs an appealing choice for homeowners who want to manage their finances effectively while leveraging their home’s value.

We’re here to support you every step of the way as you consider your options. By understanding your needs and the potential of a HELOC, you can take control of your financial journey with confidence.

Outline Credit Score Requirements for HELOC Approval

We understand how challenging it can be to navigate the world of home equity lines of credit (HELOCs). To qualify, most lenders typically have HELOC credit score requirements that include a minimum credit rating ranging from 620 to 680. However, if you’re aiming for better interest rates and terms, you should consider the HELOC credit score requirements, which often prefer a rating of 720 or higher.

According to reliable sources like Experian and Bankrate, the HELOC credit score requirements indicate that borrowers with a FICO rating of at least 680 tend to receive more favorable terms. It’s important to note that while some lenders may accept lower ratings, these approvals usually come with higher interest rates and less advantageous terms, particularly due to the HELOC credit score requirements.

Moreover, the approval process can vary significantly among lenders, which can affect the terms and conditions offered. We’re here to support you every step of the way as you explore your options and find the best solution for your financial needs.

Examine Additional Eligibility Criteria Beyond Credit Scores

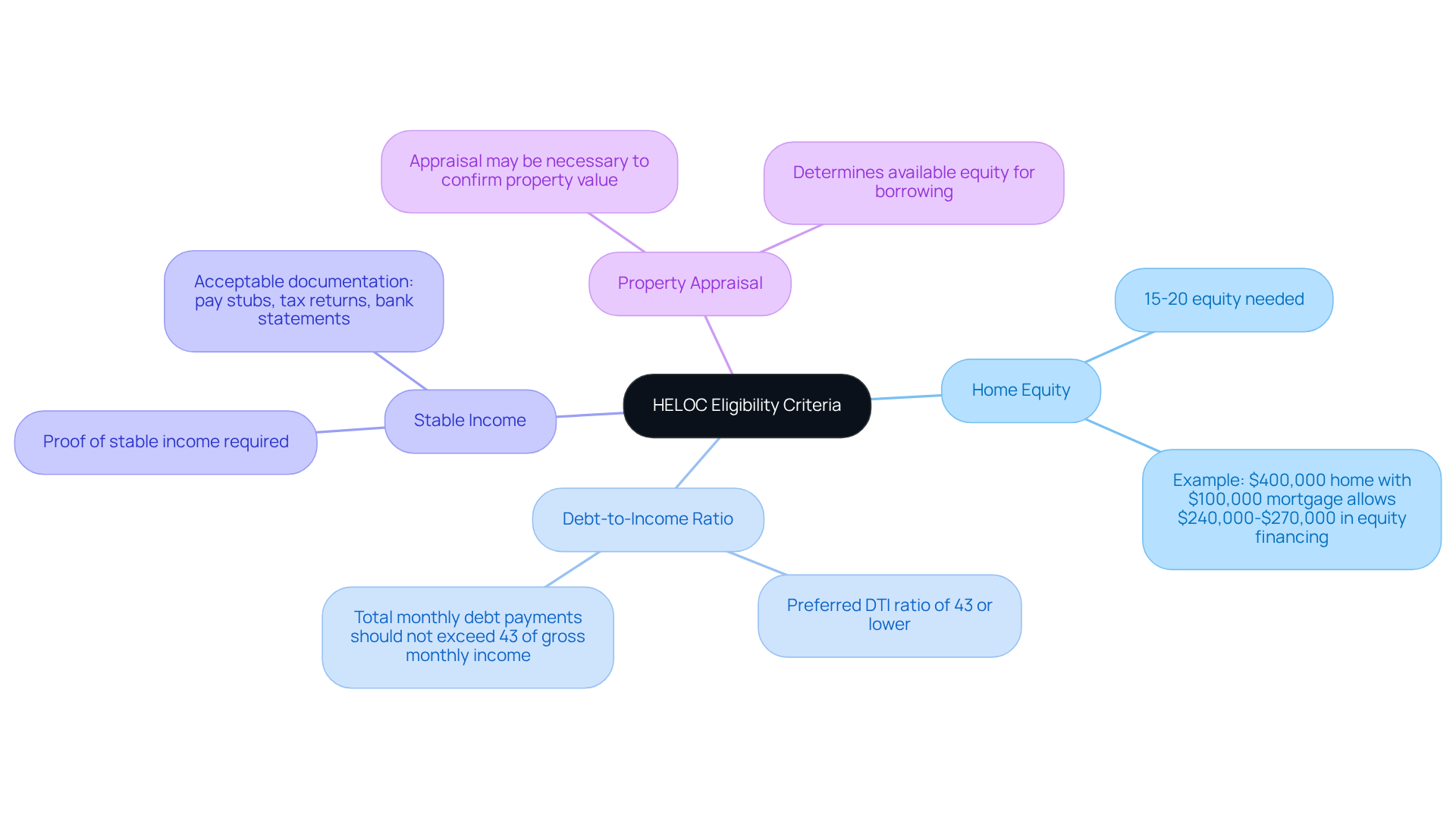

When considering a Home Equity Line of Credit (HELOC), it’s essential to understand the HELOC credit score requirements, as lenders look at several key factors beyond just credit scores.

-

Home Equity: To qualify, borrowers typically need at least 15-20% equity in their home. This means that the outstanding mortgage balance should be significantly lower than the property’s current market value. For instance, on a property valued at $400,000 with a $100,000 mortgage, homeowners could access between $240,000 and $270,000 in equity financing.

-

Debt-to-Income (DTI) Ratio: Most lenders prefer a DTI ratio of 43% or lower. This indicates that total monthly debt payments should not exceed 43% of gross monthly income. Keeping a low DTI is crucial for improving your chances of approval.

-

Stable Income: Proof of stable income is vital. Lenders want to ensure that borrowers can manage HELOC repayments. Acceptable documentation typically includes recent pay stubs, tax returns, and bank statements.

-

Property Appraisal: An appraisal may be necessary to confirm the property’s current value and the available equity. This step is essential for determining how much can be borrowed against the property.

Understanding these elements can significantly enhance your chances of obtaining a line of credit with favorable conditions by meeting the HELOC credit score requirements, allowing you to utilize your property equity effectively. At F5 Mortgage, we pride ourselves on a fast and efficient closing process, with most loans closing in less than three weeks. We also boast a customer satisfaction rate of 94%. With our commitment to a stress-free experience and no-pressure guidance, we ensure that you feel supported throughout the entire process.

Additionally, consider the potential tax benefits associated with home equity loans, which can further enhance the financial advantages of acquiring a home equity line of credit. We know how challenging this can be, and we’re here to support you every step of the way.

Implement Strategies to Improve Your Credit Score for HELOCs

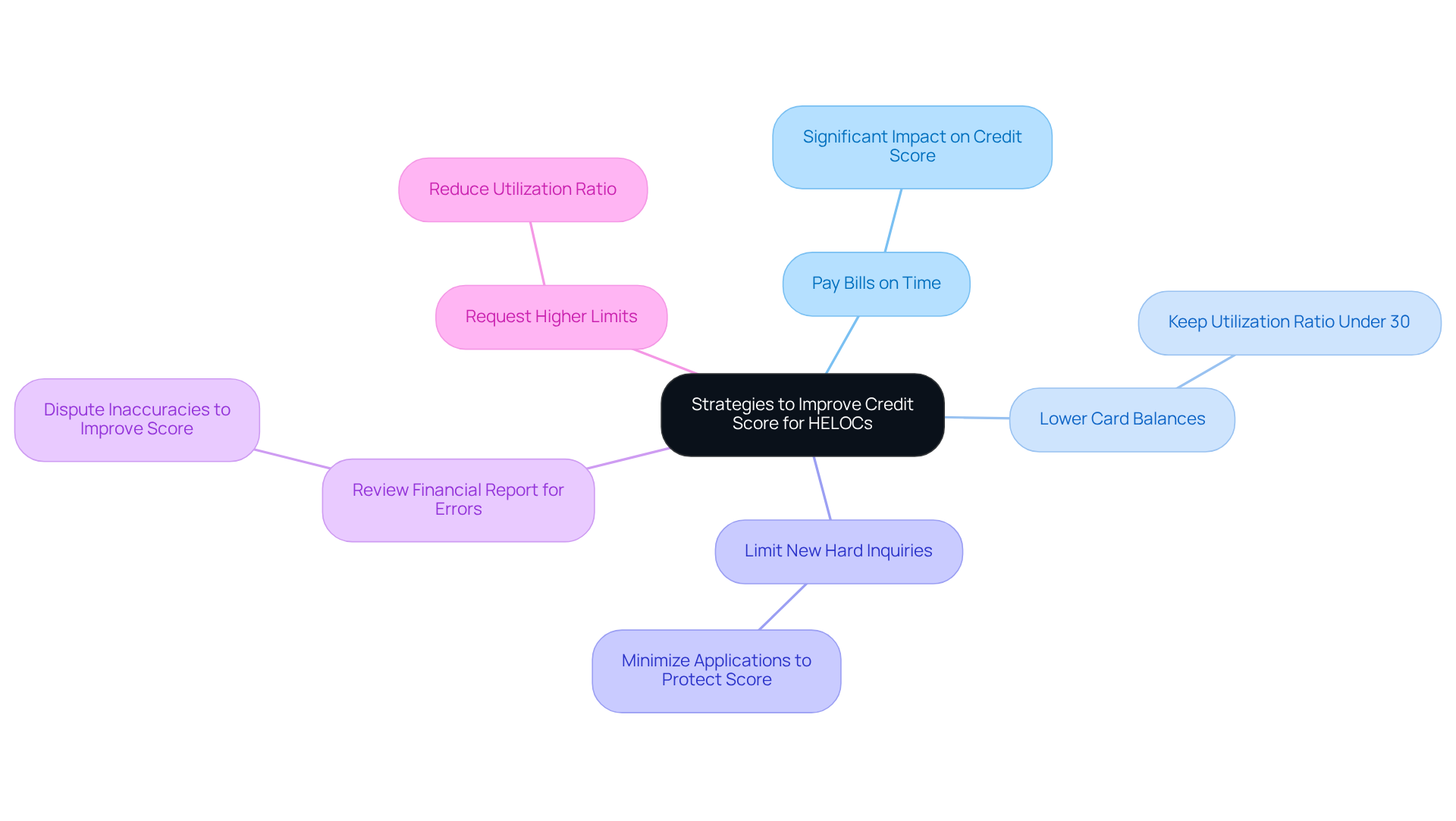

Improving your financial rating is essential for meeting the HELOC credit score requirements to qualify for a Home Equity Line of Credit (HELOC) with advantageous terms. We understand how challenging this can be, and we’re here to support you every step of the way. Here are some effective strategies to consider:

- Pay Bills on Time: Timely payments are one of the most significant factors influencing your credit score. Regular timely payments can enhance your rating considerably, making it an essential focus area for prospective borrowers.

- Lower Card Balances: Strive to keep your utilization ratio under 30%. Reducing outstanding debt not only enhances your rating but also shows responsible financial management.

- Limit New Hard Inquiries: Each new application for a loan results in a hard inquiry, which can temporarily decrease your score. To safeguard your financial reputation, limit the number of new applications.

- Review Your Financial Report for Errors: Regularly checking your financial report for inaccuracies is crucial. Dispute any errors you find, as correcting them can positively impact your score.

- Request Higher Limits: If possible, inquire about increasing the limits on your current accounts. This can reduce your utilization ratio, further improving your financial profile.

Expert insights highlight that proactive financial management is essential for unlocking economic opportunities. For example, Matt Richardson, a senior managing editor, suggests that many would gain from examining their financial health before proceeding to search for lenders and estimating repayment expenses.

By applying these strategies, you can enhance your financial profile and improve your likelihood of meeting the HELOC credit score requirements to secure a home equity line of financing with more favorable conditions. Real-life instances demonstrate that individuals who actively oversee their ratings often qualify for more advantageous lending rates, underscoring the significance of proactive financial management. As of early July 2025, the average HELOC rate is around 6.64%, highlighting the need for improved credit scores to access better terms.

Conclusion

A Home Equity Line of Credit (HELOC) can be a valuable financial tool for homeowners, enabling them to tap into the equity of their properties for various needs. We understand how crucial it is to grasp the credit score requirements and additional eligibility criteria to secure favorable terms and interest rates. By improving credit scores and meeting lender expectations, you can unlock the financial flexibility that HELOCs offer.

Throughout this discussion, we’ve highlighted key factors influencing HELOC approval:

- Maintaining a strong credit score

- Ensuring sufficient home equity

- Managing a low debt-to-income ratio

Strategies like timely bill payments, reducing credit card balances, and regularly reviewing your credit reports can significantly enhance your credit profile. These steps not only improve your chances of approval but also pave the way for better financial outcomes.

Being proactive in your financial management is vital. By taking control of your credit scores and understanding the nuances of HELOC eligibility, you can open doors to funding opportunities that enhance your financial stability. Engaging with these practices and staying informed about the evolving landscape of HELOCs ensures you are well-equipped to make decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit that is backed by the value of your home, allowing you to borrow against your property’s worth.

What can a HELOC be used for?

A HELOC can be used for various purposes, including home renovations, debt consolidation, and covering unplanned expenses.

How does a HELOC differ from a conventional loan?

Unlike a conventional loan, a HELOC offers flexibility in accessing funds as needed, up to a predetermined limit, and you only incur interest on the amount you actually use.

Why is a HELOC significant in property financing?

A HELOC is significant because it provides homeowners with a flexible financial tool to manage their finances effectively while leveraging the value of their home.