Overview

Navigating the mortgage process can feel overwhelming, but a Florida mortgage calculator offers a range of features designed to support you every step of the way. With user-friendly interfaces, monthly payment estimators, and property tax integration, these tools simplify complex calculations that often cause confusion.

Imagine being able to compare different loan types and down payment options effortlessly. This calculator not only helps you understand interest rate variations but also provides amortization schedules that can clarify your long-term financial commitments. You can even save your calculations for future reference, ensuring that you have all the information you need at your fingertips.

Ultimately, these features empower you to make informed financial decisions regarding home purchases and refinancing. By providing essential budgeting tools, the calculator makes it easier to visualize your financial landscape. We know how challenging this can be, but with the right resources, you can approach your mortgage journey with confidence and clarity.

Introduction

Navigating the complexities of home financing can often feel overwhelming, especially for those looking to purchase or refinance a property in Florida. We understand how challenging this can be. That’s where the Florida mortgage calculator steps in as a vital tool, providing a streamlined approach to understanding your financial options and obligations. By exploring its essential features, you will discover how this innovative calculator not only simplifies the mortgage process but also empowers you to make informed decisions.

What challenges might arise when relying on traditional methods? We’re here to support you every step of the way. Leveraging modern technology can truly transform your home-buying experience.

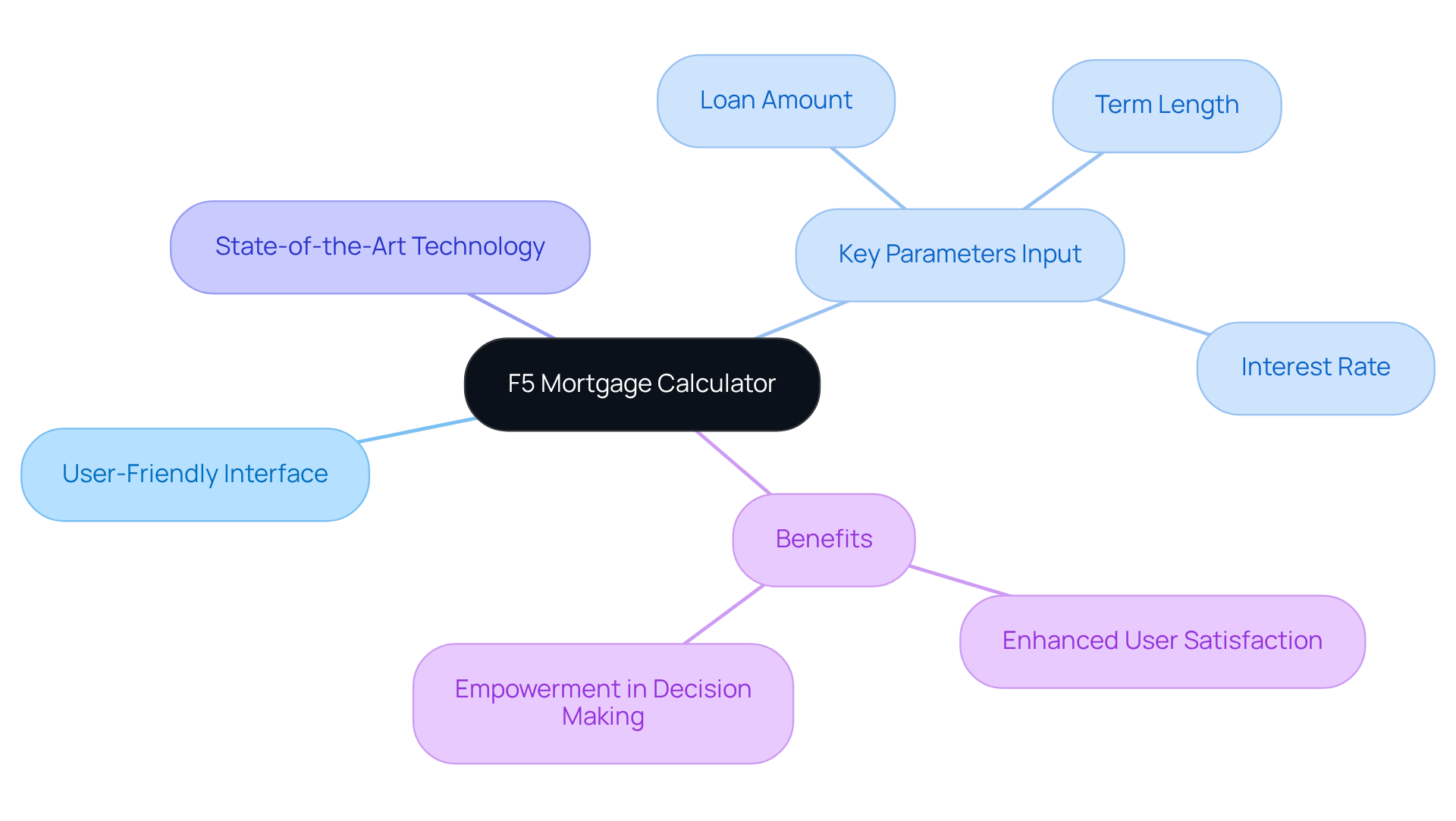

F5 Mortgage Calculator: Streamlined Home Financing Solutions

Navigating the home financing process can be overwhelming, but the Florida mortgage calculator is here to help. With its , it allows you to easily input key parameters like loan amount, interest rate, and term length. This means you can quickly assess your financial options without the stress of complicated calculations.

We understand how important it is for you to feel empowered in making decisions about home purchases or refinancing. This innovative tool not only simplifies these complexities but also enhances your confidence as you explore your lending options. By utilizing state-of-the-art technology, F5 ensures that you can traverse the lending landscape with ease.

Recent statistics show that loan calculators significantly enhance user satisfaction. Many borrowers appreciate the clarity and accessibility these tools provide. As Nicholas Hiersche, President of The Mortgage Calculator, shares, “Our mission has always been to simplify the financing process and make it accessible to everyone.” This dedication to leveraging technology in loan brokerage is crucial, especially in a rapidly changing market where you deserve effective and trustworthy solutions.

We know how challenging this can be, and we’re here to support you every step of the way. The Florida mortgage calculator is designed with your needs in mind, helping you feel informed and prepared as you embark on this important journey.

Monthly Payment Estimator: Understand Your Financial Commitment

Navigating the mortgage process can feel overwhelming, but the Florida mortgage calculator‘s monthly cost estimator function is here to help. By entering the amount borrowed, interest rate, and duration of financing, users can accurately compute their anticipated monthly housing expenses. This tool is essential for prospective homebuyers, as it provides a clear view of financial obligations, allowing families to budget effectively and avoid the stress of overextending their finances.

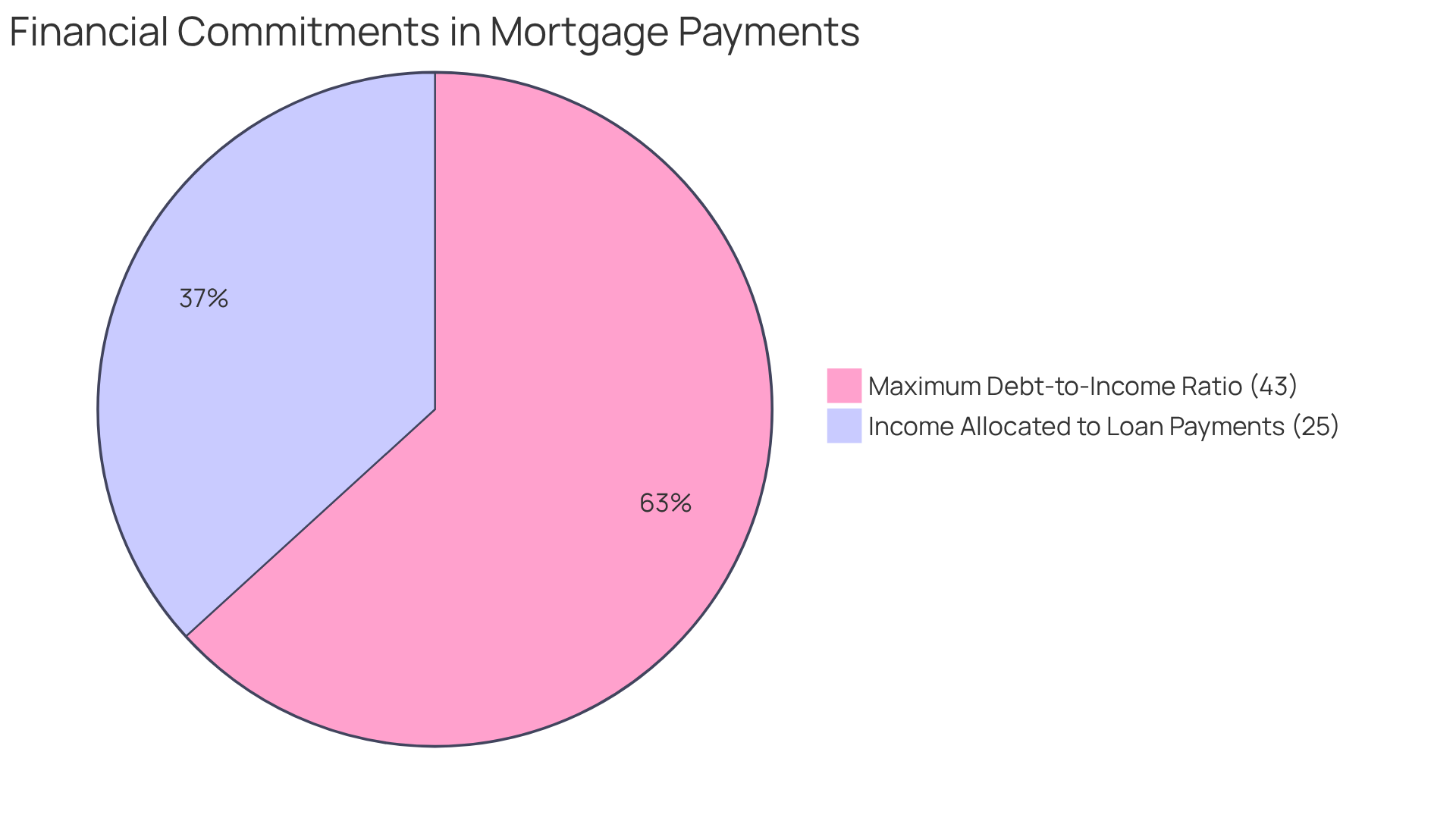

We know how challenging this can be, and financial consultants emphasize the importance of . As Dmitriy Fomichenko wisely advises:

- “You should allocate 25% of your income towards loan payments (including property taxes and insurance).”

Additionally, grasping your Debt-to-Income (DTI) ratio is crucial; generally, a maximum of 43% DTI is necessary for home financing, which can impact the mortgage rates you might qualify for.

By utilizing these financial commitment tools, you can make informed decisions that keep you within your budget while pursuing your dream of homeownership. F5 Finance is here to support you every step of the way, assisting you in navigating these financial evaluations and securing the best loan options available, including various refinancing solutions tailored to meet your unique needs.

Property Tax Integration: Accurate Budgeting for Homebuyers

Navigating the world of homeownership can be overwhelming, especially when using a Florida mortgage calculator to plan for monthly payments. The F5 Loan Calculator offers a thoughtful solution by integrating property tax rates, allowing users to include local taxes in their payment estimates. This feature is crucial for accurate budgeting, as property taxes can add hundreds of dollars to your monthly expenses, significantly impacting your overall financial picture.

We understand how challenging it can be to find a Florida mortgage calculator that accurately reflects your costs. Many conventional calculators often overlook essential expenses like:

- Taxes

- Insurance

- Homeowners association fees

This oversight can leave you with an incomplete understanding of your financial obligations. By providing a more comprehensive assessment of your monthly responsibilities, the Florida mortgage calculator enables you to make informed decisions about your financial future.

This commitment to transparency and accuracy not only enhances your budgeting experience but also contributes to the high customer satisfaction rate that F5 has achieved. Clients feel more confident as they navigate their financing journey, knowing they have the tools to understand their full financial landscape. We’re here to , ensuring that you feel equipped to tackle the challenges of homeownership.

Loan Type Comparison: Evaluate Your Financing Options

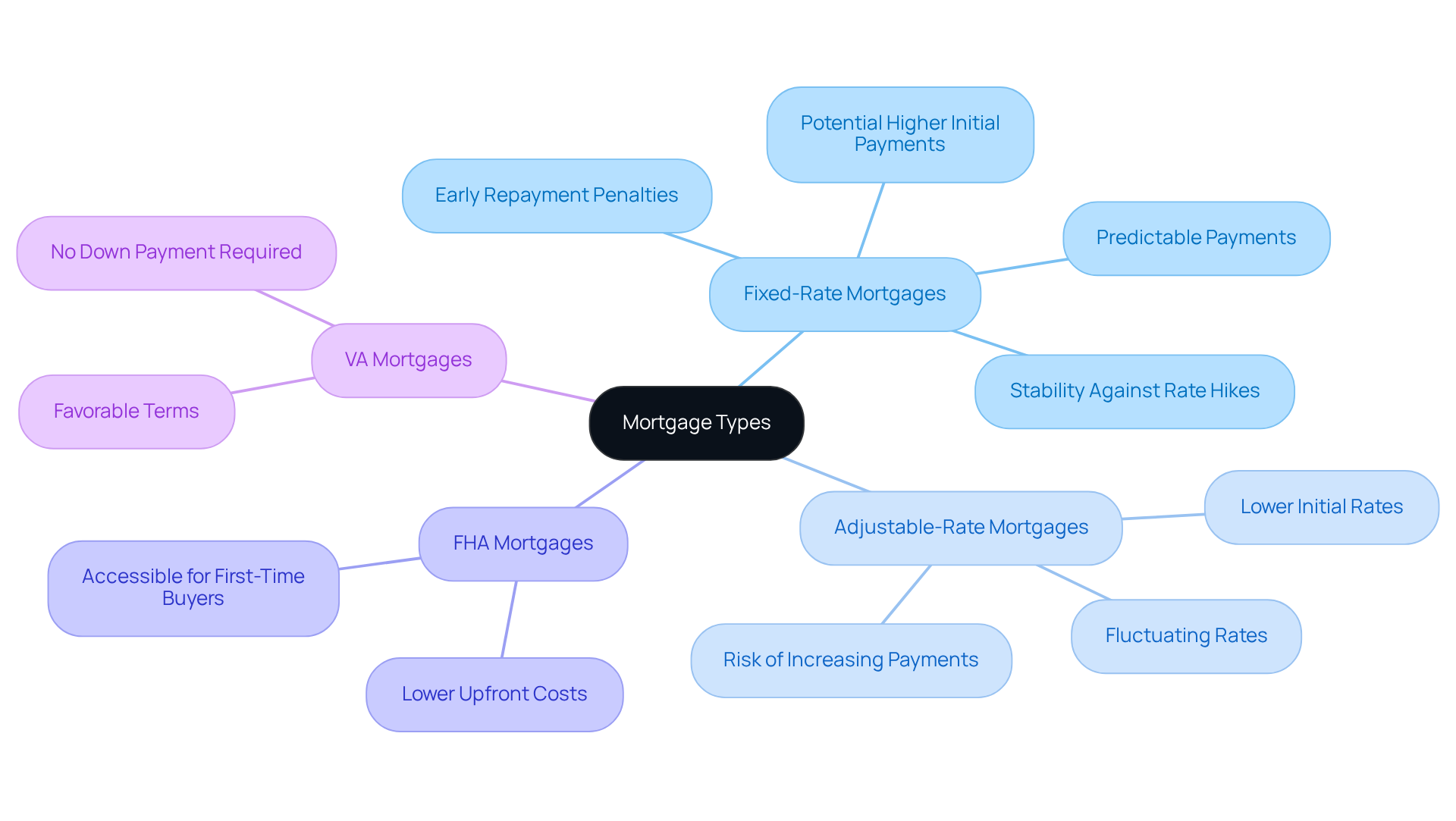

Navigating the world of mortgages can feel overwhelming, but the mortgage type comparison feature of the F5 Mortgage Calculator is here to help. This tool, known as the florida mortgage calculator, allows you to evaluate various mortgage options—fixed-rate, adjustable-rate, FHA, and VA mortgages—so you can find the right fit for your family’s needs.

By weighing the advantages and disadvantages of each financing type, you can discover a solution that aligns with your financial goals and personal circumstances. For instance, fixed-rate mortgages offer stability with predictable monthly payments, while adjustable-rate mortgages may start with lower rates but can fluctuate over time.

As we look ahead to 2025, many home purchasers are leaning toward FHA options, thanks to their lower upfront costs. Meanwhile, veterans continue to favor VA programs for their favorable terms.

This informed decision-making process is crucial for achieving long-term financial stability. We understand how important it is for families to feel confident as they , and we’re here to support you every step of the way.

Down Payment Calculator: Plan Your Savings Strategy

Navigating the journey to homeownership can feel overwhelming, but the down deposit calculator is here to help. This essential tool empowers potential homebuyers by showing them how much they need to save for a down payment based on their desired home price and loan type. It’s not just about numbers; it’s about setting realistic savings goals that can make a significant difference in your overall mortgage costs.

For first-time buyers, the typical deposit is around 8% of the home’s purchase price. This highlights the importance of planning ahead. By utilizing this calculator, you can gain a clearer understanding of how your down payment influences financing terms and monthly payments. This knowledge can lead to more , making your dream home more attainable.

Establishing a clear savings strategy today can pave the way for a smoother home buying experience tomorrow. Remember, we know how challenging this can be, and we’re here to support you every step of the way. Take the first step towards your future by exploring your options with the down deposit calculator.

Interest Rate Comparison: Find the Best Mortgage Rates

We know how challenging navigating mortgage rates can be. The Florida mortgage calculator‘s interest rate comparison feature allows you to evaluate a range of mortgage rates from various lenders. By actively comparing these rates, you can uncover the most competitive choices, potentially saving substantial amounts over the duration of your financing. For example, even a modest difference in interest rates can lead to savings of approximately $72,000 over a 30-year term. This tool not only empowers you to make informed decisions but also equips you with the confidence to with lenders.

As Andrew Dehan, a senior writer in home lending, notes, having multiple loan offers can provide leverage in negotiations. This means you could secure lower rates or reduced fees, making a significant difference in your financial journey. By utilizing the Florida mortgage calculator, you can take proactive steps toward achieving your homeownership goals while maximizing your financial benefits. We’re here to support you every step of the way.

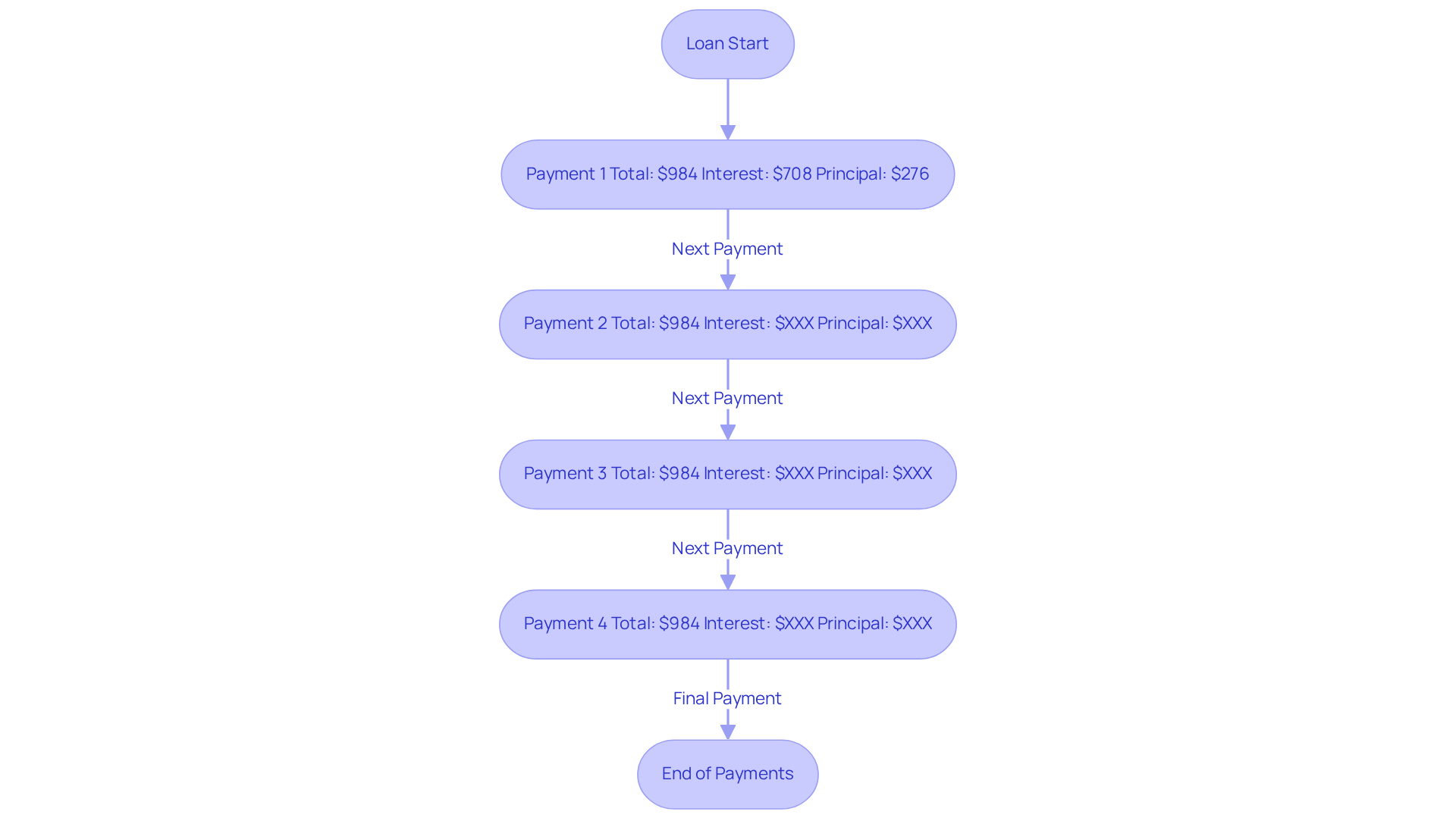

Amortization Schedule: Visualize Your Payment Progression

The amortization schedule functionality provides a detailed analysis of loan installments over time, showing the separation between principal and interest. This visualization is essential for homeowners, as it explains how each installment contributes to decreasing the loan balance and the total expense of borrowing. For instance, in a typical mortgage scenario, the first installment of $984 allocates $708 toward interest and only $276 toward the principal, highlighting the initial focus on interest contributions. We know how challenging this can be, and grasping this progression is crucial for efficient financial management. It enables homeowners to foresee upcoming expenses and plan accordingly.

Tracking the amortization schedule empowers clients to , making it easier to plan for upcoming financial obligations. As Amanda Dixon, a personal finance specialist, points out, ‘Financial advisors possess extensive knowledge about the investing realm,’ which underscores the importance of seeking guidance from experts. This guidance can help incorporate significant home financing into comprehensive financial planning.

Furthermore, an amortization schedule applies not only to fixed-rate loans but also to adjustable-rate products, where estimates may differ due to changing interest rates. Homeowners can utilize these schedules to monitor their progress, ensuring they remain on track to build equity and ultimately own their homes outright. By utilizing tools such as the Florida mortgage calculator, clients can gain insights into their payment progression. This knowledge empowers them to make informed decisions that align with their financial objectives.

Save Calculations: Easy Access for Future Reference

The save calculations feature is designed with you in mind, allowing you to keep your loan calculations for future reference. This invaluable tool is especially beneficial for homebuyers like you, who may want to revisit financial plans or compare different scenarios over time. With your calculations easily accessible, you can adapt your strategies as your financial situation evolves, helping you stay aligned with your .

Utilizing this feature not only enhances your financial planning but also encourages a proactive approach to achieving your homeownership goals. We understand how important it is to stay informed, so consider setting reminders to review your saved calculations periodically. This way, you can be ready to act as market conditions change.

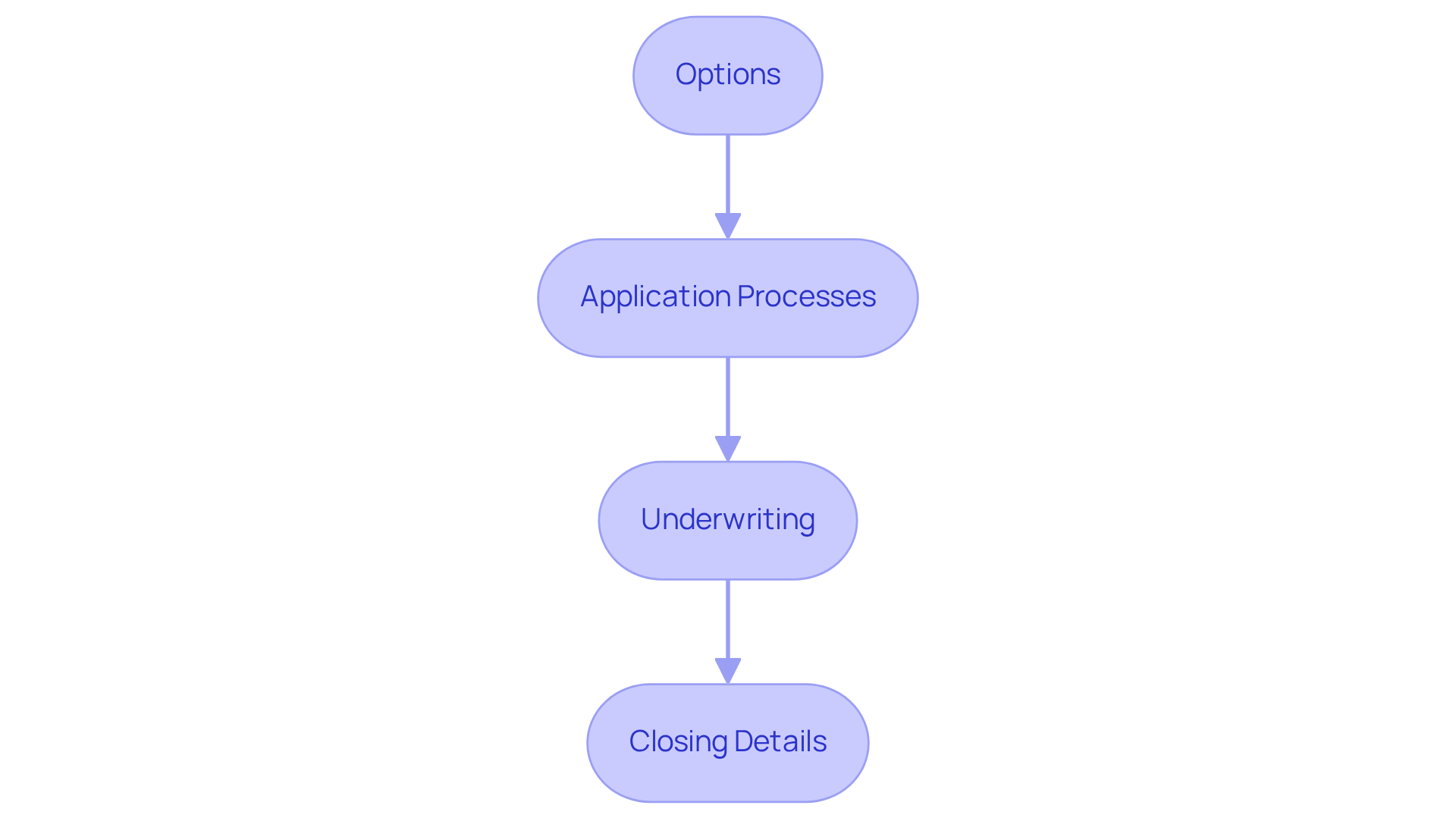

Additionally, F5 Financing offers a comprehensive step-by-step guide to refinancing. This includes:

- Options

- Application processes

- Underwriting

- Closing details

These can help you understand your break-even point and make informed choices. With F5’s technology-driven, consumer-centric approach, you can anticipate competitive rates and exceptional service, empowering you to realize your homeownership dreams with confidence. We’re here to support you every step of the way.

Mobile Compatibility: Access Your Calculator Anytime, Anywhere

The F5 Loan Calculator is thoughtfully designed for mobile compatibility, allowing you to access it anytime and anywhere. In today’s fast-paced world, where 96% of buyers start their home search online, having a mobile-friendly experience is essential for making informed decisions on the go. By providing easy access to loan calculations, F5 empowers you to navigate your financial choices with confidence, enhancing your overall homebuying experience.

This commitment to mobile accessibility reflects the growing trend of digital marketing in real estate and aligns with our dedication to providing a stress-free process for homebuyers. With our extensive network of lenders and a focus on securing , you can leverage the calculator to explore strategic refinancing opportunities that unlock lower rates and flexible terms.

We understand how challenging this journey can be, and our client-centric approach ensures that you are supported throughout. We’re here to help you make the most of available down payment assistance programs, enhancing your home buying opportunities every step of the way.

User-Friendly Interface: Simplifying the Mortgage Calculation Process

Navigating the loan calculation process can feel overwhelming, but the F5 Loan Calculator is here to help. With a user-friendly interface designed just for you, it simplifies everything. You’ll find straightforward instructions and that allow you to effortlessly input your information and receive precise results. This thoughtful design eliminates confusion, making it easier for you to focus on what matters most.

We understand that whether you’re a first-time homebuyer or a seasoned investor, the mortgage journey can be daunting. That’s why our emphasis on usability significantly enhances your overall experience. The F5 Mortgage team is dedicated to empowering you, ensuring you have the necessary tools to make informed decisions. We’re here to support you every step of the way, so you can navigate your mortgage journey with confidence.

Conclusion

The Florida mortgage calculator is more than just a tool; it’s a companion for prospective homebuyers navigating the often complex world of home financing. We understand how overwhelming this process can be, and that’s why this calculator is designed to enhance your experience and empower you to make informed decisions. It simplifies the journey from budgeting to securing a mortgage, providing you with the clarity and confidence needed to explore your options and plan your financial future effectively.

Key functionalities, such as monthly payment estimators, property tax integration, and loan type comparisons, allow you to evaluate your financial commitments comprehensively. The down payment calculator helps you set realistic savings goals, while the interest rate comparison feature ensures you can find the most competitive rates available. Additionally, the amortization schedule offers a visual representation of your payment progression, fostering a better understanding of your financial landscape.

In today’s rapidly changing market, leveraging tools like the Florida mortgage calculator is crucial for maximizing your financial benefits and achieving your homeownership goals. By utilizing these resources, you can navigate your options with ease and confidence, making informed choices that align with your unique circumstances. Embrace the power of technology in your home financing journey, and take proactive steps toward securing your dream home today.

Frequently Asked Questions

What is the F5 Mortgage Calculator?

The F5 Mortgage Calculator is a user-friendly tool designed to simplify the home financing process by allowing users to input key parameters like loan amount, interest rate, and term length to assess their financial options easily.

How does the F5 Mortgage Calculator enhance user confidence?

It simplifies complex calculations related to home purchases and refinancing, empowering users to make informed decisions about their lending options and enhancing their confidence in navigating the financing landscape.

What features does the monthly payment estimator provide?

The monthly payment estimator allows users to enter the amount borrowed, interest rate, and duration of financing to accurately compute their anticipated monthly housing expenses, helping families budget effectively.

What financial advice is provided regarding loan payments?

Financial consultants recommend allocating 25% of your income towards loan payments, including property taxes and insurance, and understanding your Debt-to-Income (DTI) ratio, which should generally not exceed 43% for home financing.

How does the F5 Loan Calculator assist with property taxes?

The F5 Loan Calculator integrates local property tax rates into payment estimates, providing users with a more accurate budgeting tool that reflects their total monthly expenses, including taxes, insurance, and homeowners association fees.

Why is it important to consider property taxes in budgeting?

Property taxes can significantly increase monthly expenses, so including them in budgeting ensures a comprehensive understanding of financial obligations and helps avoid overextending finances.

What commitment does F5 Finance make to its users?

F5 Finance is dedicated to supporting users throughout the home financing process by providing tools and resources to navigate financial evaluations and secure optimal loan options tailored to individual needs.