Overview

Loan assumption is a process that allows you to take over a seller’s existing mortgage. This can lead to significant savings, especially in a rising interest rate environment. We understand how challenging navigating these options can be, and we’re here to support you every step of the way.

In this article, we’ll outline the steps involved in loan assumption. You’ll discover the benefits, such as lower interest rates and quicker transactions. These advantages can make a real difference for families looking to ease their financial burdens.

However, it’s important to be aware of potential risks. Understanding lender requirements and the necessary documentation is crucial for a successful transfer. We want you to feel empowered and informed, ensuring that you can make the best decisions for your family’s future.

Introduction

Navigating the complexities of mortgage financing can often feel daunting, especially when interest rates fluctuate unpredictably. We understand how challenging this can be. Loan assumption presents a unique opportunity for buyers to take over an existing mortgage, potentially securing a lower interest rate and significant savings. However, this process is not without its intricacies and risks.

How can you effectively navigate the loan assumption landscape while maximizing benefits and minimizing pitfalls? This article delves into the essential steps, advantages, and potential challenges of loan assumption. We’re here to support you every step of the way, providing a comprehensive guide for both buyers and sellers looking to make informed decisions in today’s real estate market.

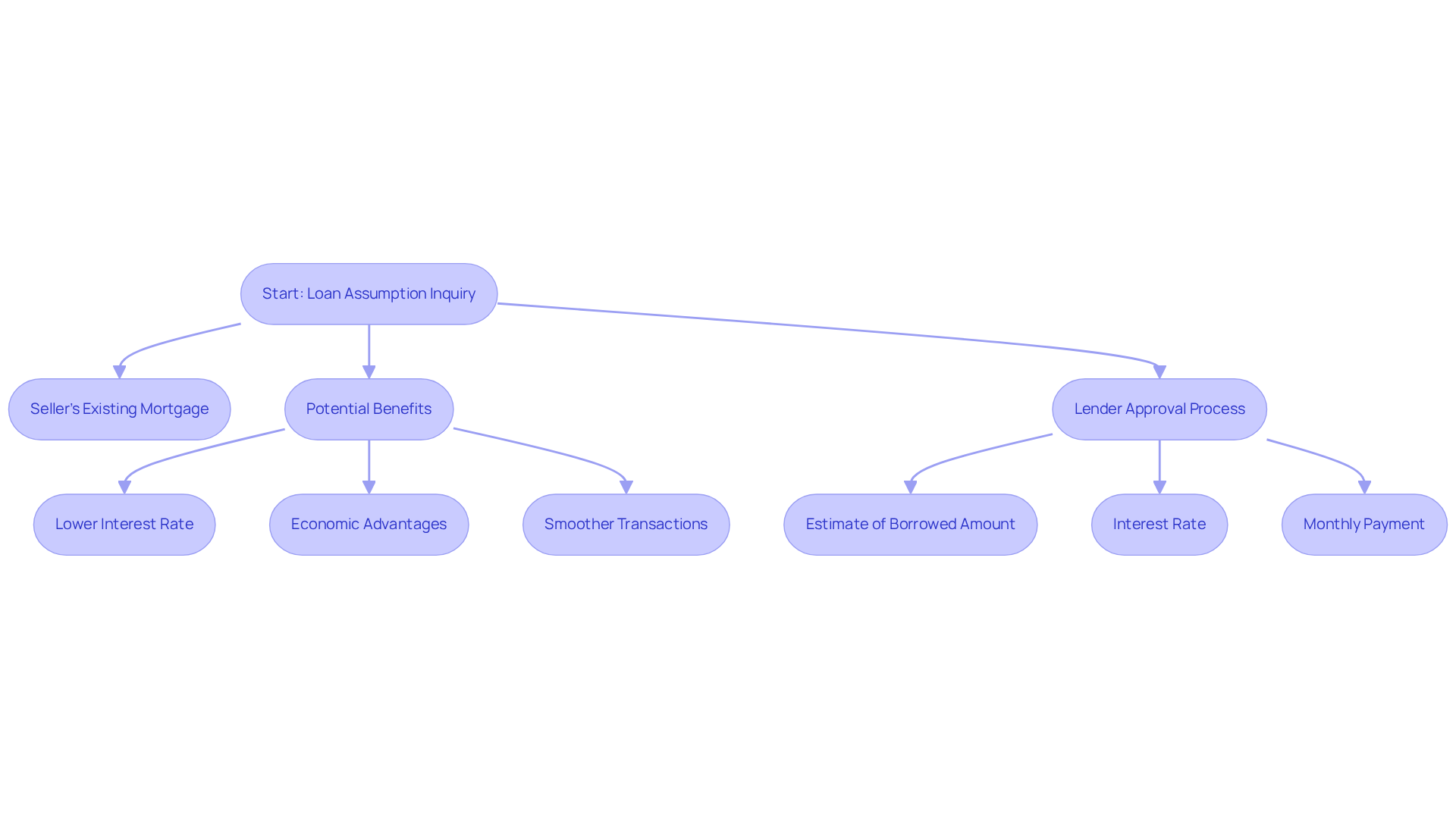

Define Loan Assumption and Its Importance

is a process that allows a purchaser to take over the seller’s existing mortgage, including its conditions, , and outstanding balance. This can be particularly beneficial in a rising interest rate environment. By inheriting a potentially lower rate than what is currently available on the market, the purchaser can find significant savings.

Understanding how to take over a mortgage is essential for both purchasers and vendors. It can lead to and provide . For instance, if a seller has a low-rate mortgage, a purchaser can benefit from a loan assumption, potentially saving thousands over the life of the loan.

Moreover, receiving an endorsement from the lender can indicate that the purchaser is a strong candidate for the mortgage, simplifying the loan assumption process. This approval typically includes an estimate of the borrowed amount, the interest rate, and the monthly payment.

It’s important to recognize that the approval process can vary among lenders. This variability can make the property more appealing to purchasers, especially when interest rates are high. We know how challenging navigating these options can be, but we’re here to .

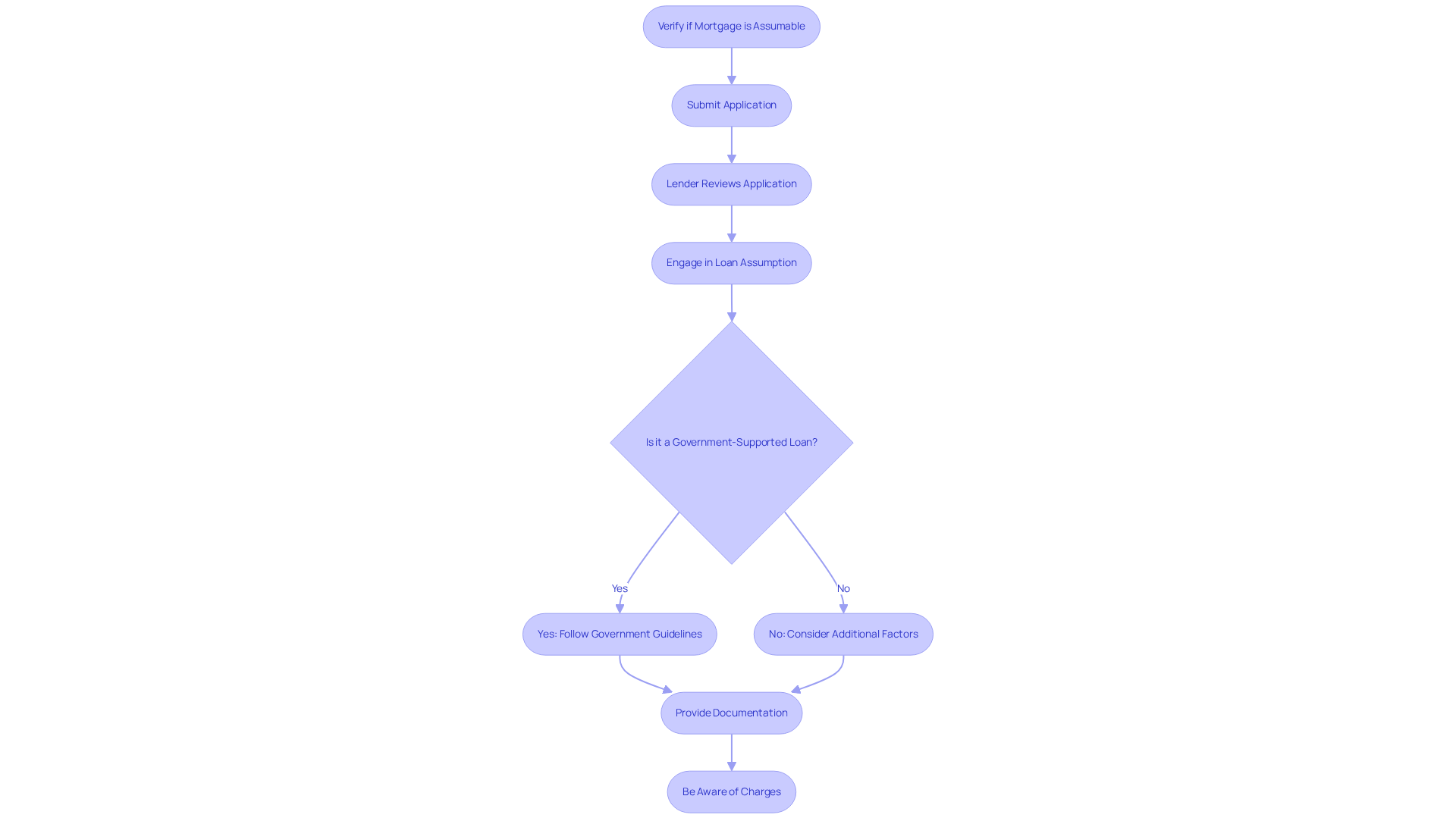

Explain How Loan Assumption Works

Navigating the process can feel overwhelming, but we are here to support you throughout every step of the loan assumption. The first step is to verify that the existing mortgage is assumable, which you can do by consulting with the lender. Once you’ve confirmed the loan assumption, you can proceed to submit your application. The lender will review it to assess your creditworthiness and .

Upon approval, you’ll engage in a loan assumption, taking over the payments and obligations tied to the mortgage. It’s important to understand that not all financial agreements are transferable. However, government-supported options, like , often have specific rules regarding loan assumption that make transitions smoother.

For instance, FHA mortgages issued before December 1, 1986, are ‘,’ meaning there are no restrictions on new takeovers. Additionally, starting in October 2024, 84% of VA homeowners will benefit from , making these mortgages particularly attractive for transfer.

As the seller, you may need to provide , such as:

- The payoff statement

- Current payment history

- Any relevant disclosures about the financing status

Be aware that different charges may apply during the transfer process. For example:

- typically range from 2% to 6% of the home’s sale price

- A is 0.5 percent of the balance

Understanding these steps and associated expenses can empower you to navigate the complexities of with confidence.

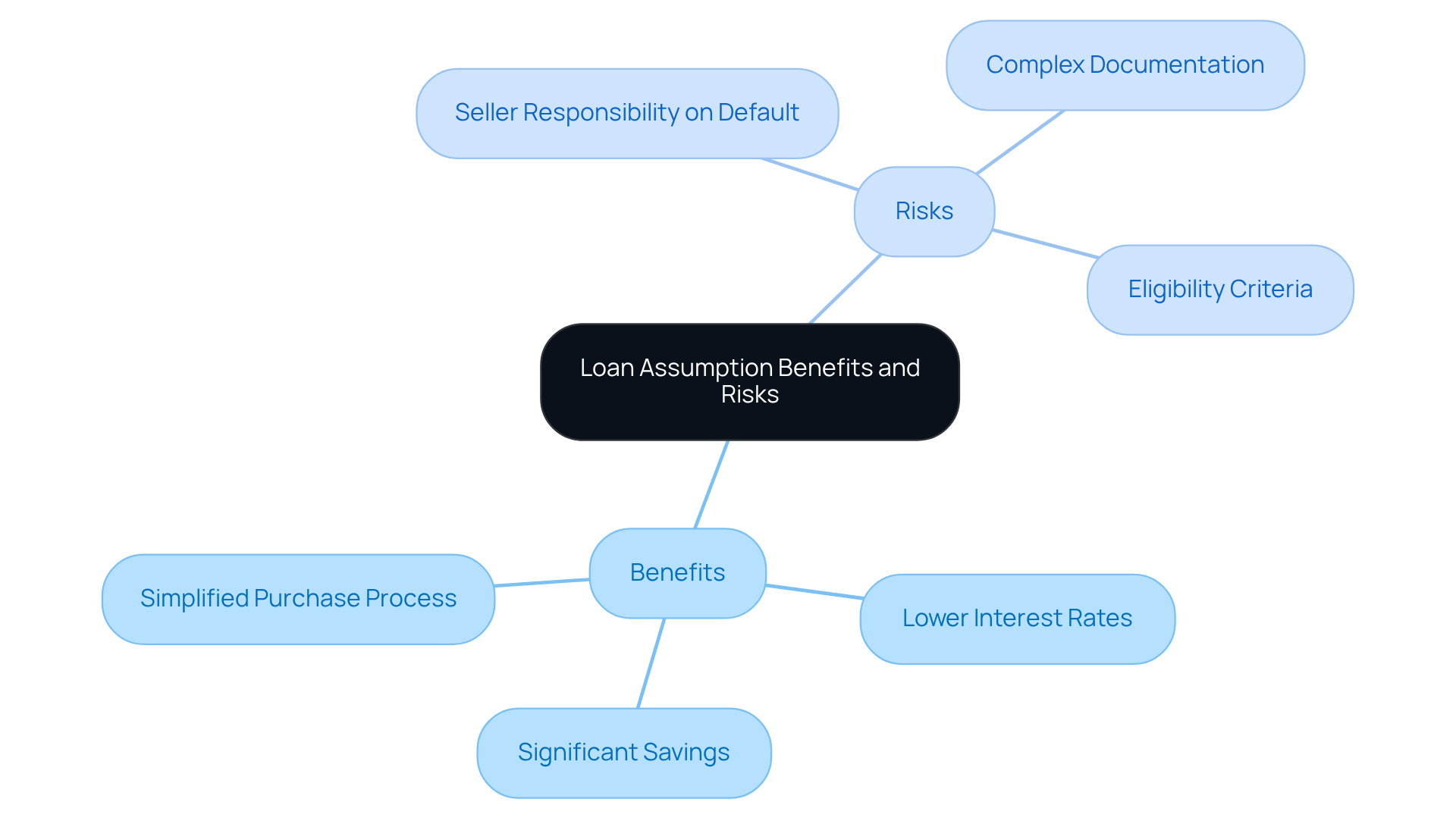

Discuss Benefits and Risks of Loan Assumption

Navigating the world of mortgages can be challenging, and we understand how overwhelming it may feel. One option to consider is , which offers several advantages that can ease your journey. Imagine taking on a mortgage with than what’s currently available in the market. This can lead to over time, allowing you to allocate your finances more effectively.

Additionally, the process of loan assumption can simplify the . You may find that closing can happen more quickly since you might avoid the lengthy steps involved in securing a new mortgage. However, it’s essential to be aware of the . If the buyer defaults, the seller could still be held responsible for the debt, which may affect their credit.

Moreover, the loan assumption process can be intricate. Lenders often require and may impose transfer fees. It’s crucial for buyers to ensure they meet the lender’s eligibility criteria to prevent any complications. We know how important it is to feel secure in your decisions, and we’re here to support you every step of the way as you explore your options.

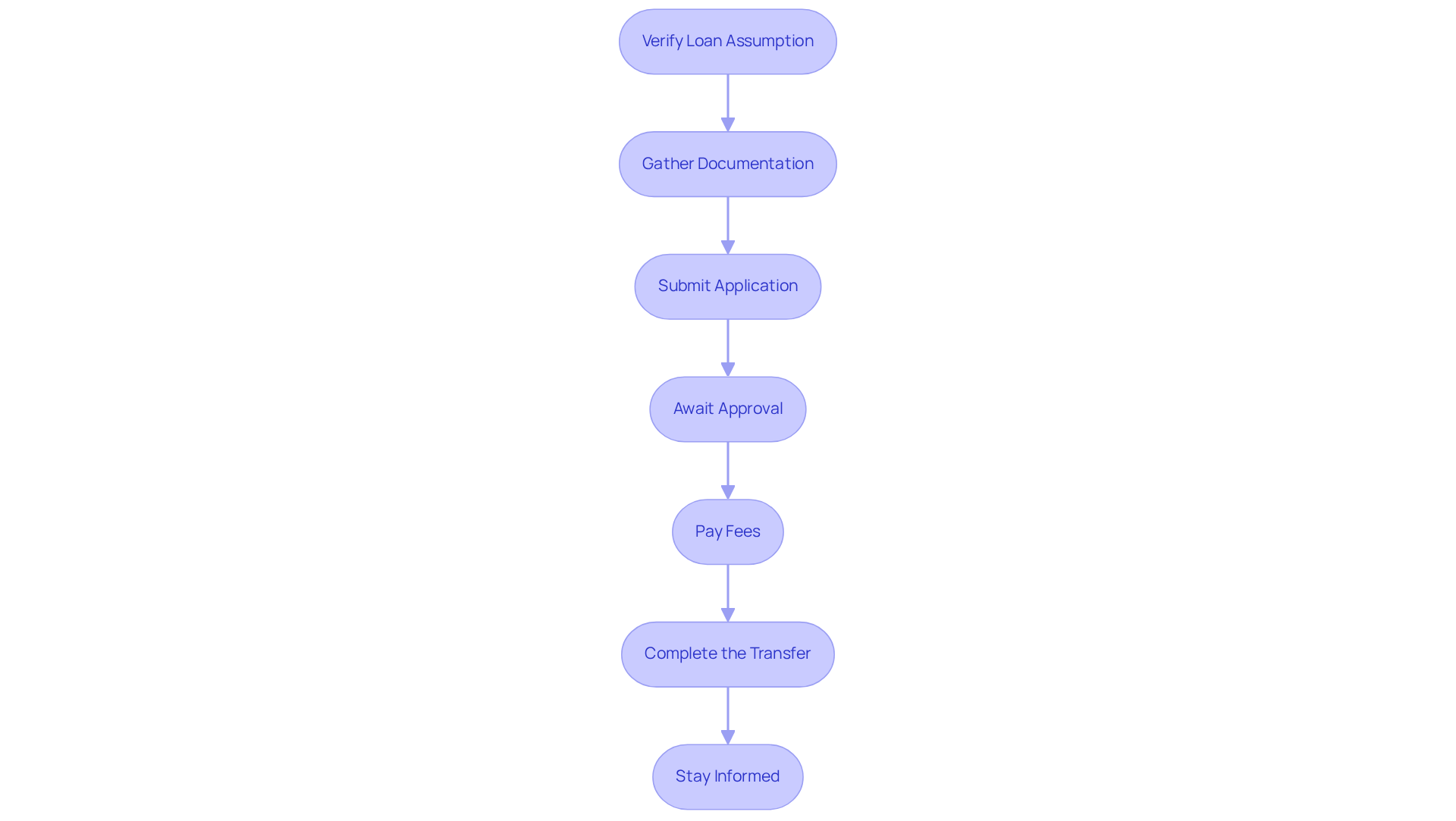

Outline Steps to Assume a Loan Successfully

Taking on a debt can feel overwhelming, but we’re here to support you every step of the way. To help you navigate this process, follow these important steps:

- Verify : First, confirm with the seller and lender that the . This is crucial, as not all credits qualify for transfer.

- Gather Documentation: Next, collect , including proof of income, credit history, and any other information the lender may require. Common documentation includes tax returns, bank statements, and employment verification.

- Submit Application: Once you have your documents ready, apply for the financing transfer with the lender, supplying all requested documentation. Ensure that your application is complete to avoid any delays.

- Await Approval: After submission, the lender will review your application and may ask for additional information or clarification. This process can take longer than conventional credit approvals, often spanning from 45 to 90 days.

- Pay Fees: Be prepared to cover any , which can vary from 0.5% to 1% of the borrowing amount. For , to $500, or $125 for straightforward transfers.

- Complete the Transfer: Once approved, finalize the takeover by signing the and taking over the loan payments. This step is essential to ensure that you are legally responsible for the mortgage.

- Stay Informed: Keep in touch with the lender to ensure all terms are being met and to address any issues that may arise during the assumption process. Regular communication can help prevent misunderstandings and ensure a smooth transition.

Remember, homes with loan assumption features currently boast rates as low as 2%, making this an attractive option for many buyers. While loan assumption can provide benefits like and reduced closing costs, we know how challenging it can be to navigate potential risks, such as the loss of . We’re here to guide you through this journey.

Conclusion

Mastering the loan assumption process can truly transform the experience for both buyers and sellers in the real estate market. By allowing purchasers to take over an existing mortgage, this approach not only offers potential financial savings through lower interest rates but also simplifies the transaction process. We understand how navigating these intricacies can be challenging, and grasping the details of loan assumption is essential for maximizing its benefits while minimizing associated risks.

In this article, we highlighted key steps such as:

- Verifying the assumability of the loan

- Gathering necessary documentation

- Navigating the application process

The benefits, including quicker closings and lower payments, were contrasted with potential risks like seller liability in case of buyer default and the complexities of lender requirements. Each of these factors plays a crucial role in determining whether loan assumption is the right choice for your unique situation.

In conclusion, embracing the loan assumption process can lead to significant advantages in today’s fluctuating interest rate environment. As you evaluate your options, understanding the mechanics of loan assumption—along with its benefits and risks—becomes increasingly important. Remember, with the right guidance and knowledge, navigating this process can open doors to more favorable financial opportunities in real estate. We’re here to support you every step of the way.

Frequently Asked Questions

What is loan assumption?

Loan assumption is a process where a purchaser takes over the seller’s existing mortgage, including its conditions, interest rate, and outstanding balance.

Why is loan assumption important?

Loan assumption is important because it can be beneficial in a rising interest rate environment, allowing purchasers to inherit a potentially lower mortgage rate than what is currently available, resulting in significant savings.

How can loan assumption benefit purchasers?

Purchasers can benefit from loan assumption by potentially saving thousands over the life of the loan if they take over a seller’s low-rate mortgage.

What role does lender endorsement play in loan assumption?

An endorsement from the lender indicates that the purchaser is a strong candidate for the mortgage, which can simplify the loan assumption process.

What does the lender’s approval typically include?

The lender’s approval typically includes an estimate of the borrowed amount, the interest rate, and the monthly payment.

Does the approval process for loan assumption vary?

Yes, the approval process can vary among lenders, which can affect how appealing the property is to purchasers, especially in high interest rate environments.