Overview

Securing a Home Equity Line of Credit (HELOC) can feel daunting, especially for those with bad credit. We understand how challenging this can be, but there are steps you can take to improve your chances:

- Gather the necessary documentation.

- Evaluate your property equity to understand your financial standing.

- Select lenders who are willing to accommodate lower credit scores.

It’s essential to grasp the application process. By improving your creditworthiness through effective debt management, you can enhance your approval chances. Remember, proactive steps and thorough preparation are crucial for success. We’re here to support you every step of the way as you navigate this journey.

Introduction

Navigating the world of home equity lines of credit (HELOC) can feel overwhelming, especially for those facing credit challenges. We understand how difficult this situation can be. However, grasping the fundamentals and benefits of a HELOC can open doors to vital financial resources for homeowners in need. This guide aims to walk you through practical steps and strategies to secure a HELOC, even when credit issues arise.

What key actions can transform this daunting process into a manageable journey toward financial stability? We’re here to support you every step of the way.

Understand HELOC Basics and Benefits for Bad Credit

A Home Equity Line of Financing is a revolving borrowing line backed by the equity in your residence. For homeowners who may be feeling the weight of poor credit, a HELOC with bad credit can provide essential access to funds for various needs, such as home enhancements, debt consolidation, or unexpected expenses.

Benefits of a HELOC for Bad Credit:

- Flexible Access to Funds: Unlike a conventional loan, a home equity line of credit allows you to borrow only what you need, when you need it. This flexibility can be a lifeline when managing your finances.

- Lower Interest Rates: A HELOC with bad credit typically features lower interest rates compared to unsecured loans, making it a more affordable option for many families.

- Potential Tax Deductions: Depending on how you use the funds, the interest paid on a home equity line of credit may be tax-deductible, providing you with additional financial relief.

- Improving Credit Score: By responsibly using a home equity line of credit, you can enhance your credit score over time, demonstrating your ability to manage debt effectively.

We understand how challenging navigating these financial options can be, but grasping these fundamentals will empower you to make informed choices as you embark on the . Remember, we’re here to support you every step of the way.

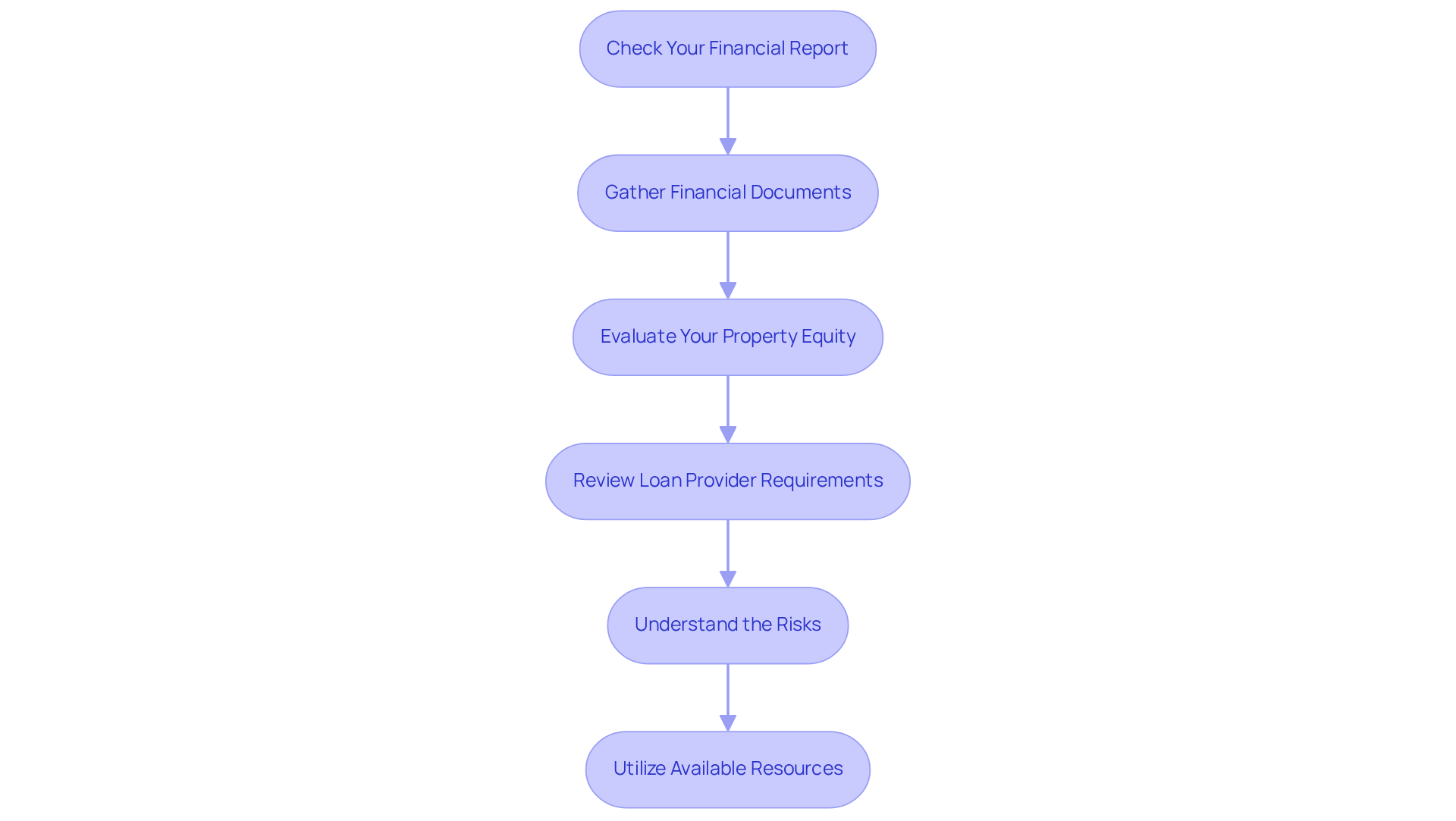

Gather Required Documentation and Check Eligibility

Before applying for a Home Equity Line of Credit, we know how crucial it is to gather the necessary documentation and assess your eligibility. Let’s walk through these steps together to prepare effectively:

Check Your Financial Report: Start by obtaining a copy of your financial report to evaluate your standing. Look for any errors that can be disputed; correcting inaccuracies can improve your score. As Tim Maxwell, a personal finance writer, emphasizes, “Reviewing your financial report before applying for a HELOC is crucial to comprehend your financial standing and rectify any errors that could impede your approval.”

Gather Financial Documents: It’s essential to prepare the following documents:

- Proof of income (like pay stubs or tax returns)

- Homeownership documents (including your deed and mortgage statement)

- Debt information (credit card statements and details of other loans)

- Identification (driver’s license and Social Security number)

Evaluate : To determine your property equity, subtract your mortgage balance from your home’s current market value. Most financial institutions typically require at least 15-20% equity to qualify for a HELOC. Additionally, the lender will order a home appraisal to assess your property’s current market value, which will help identify how much equity you have and influence your rates.

Review Loan Provider Requirements: Different financial institutions have unique criteria for applicants who are interested in a HELOC with bad credit. It’s worth investigating lenders that offer HELOC with bad credit for individuals with unfavorable financial backgrounds, as some may be more flexible in their requirements. Did you know that approximately 30% of lenders accept applicants with ? Exploring your options is essential. Moreover, maintaining a low debt-to-income (DTI) ratio is vital, as a DTI exceeding 43% could hinder your chances of securing a home equity line of credit. A better DTI can lead to more competitive mortgage rates, so assessing your financial situation carefully is important.

Understand the Risks: It’s important to be aware that while a home equity line of credit can provide access to funds, you must continue making payments on your original mortgage. This dual obligation can create financial strain if not managed properly.

Utilize Available Resources: F5 Mortgage offers valuable resources, including a comprehensive home buyer’s guide and refinancing guides, to support you throughout your mortgage journey. By following these steps, you can effectively prepare for your home equity line of credit application and increase your chances of approval. Remember, we’re here to support you every step of the way.

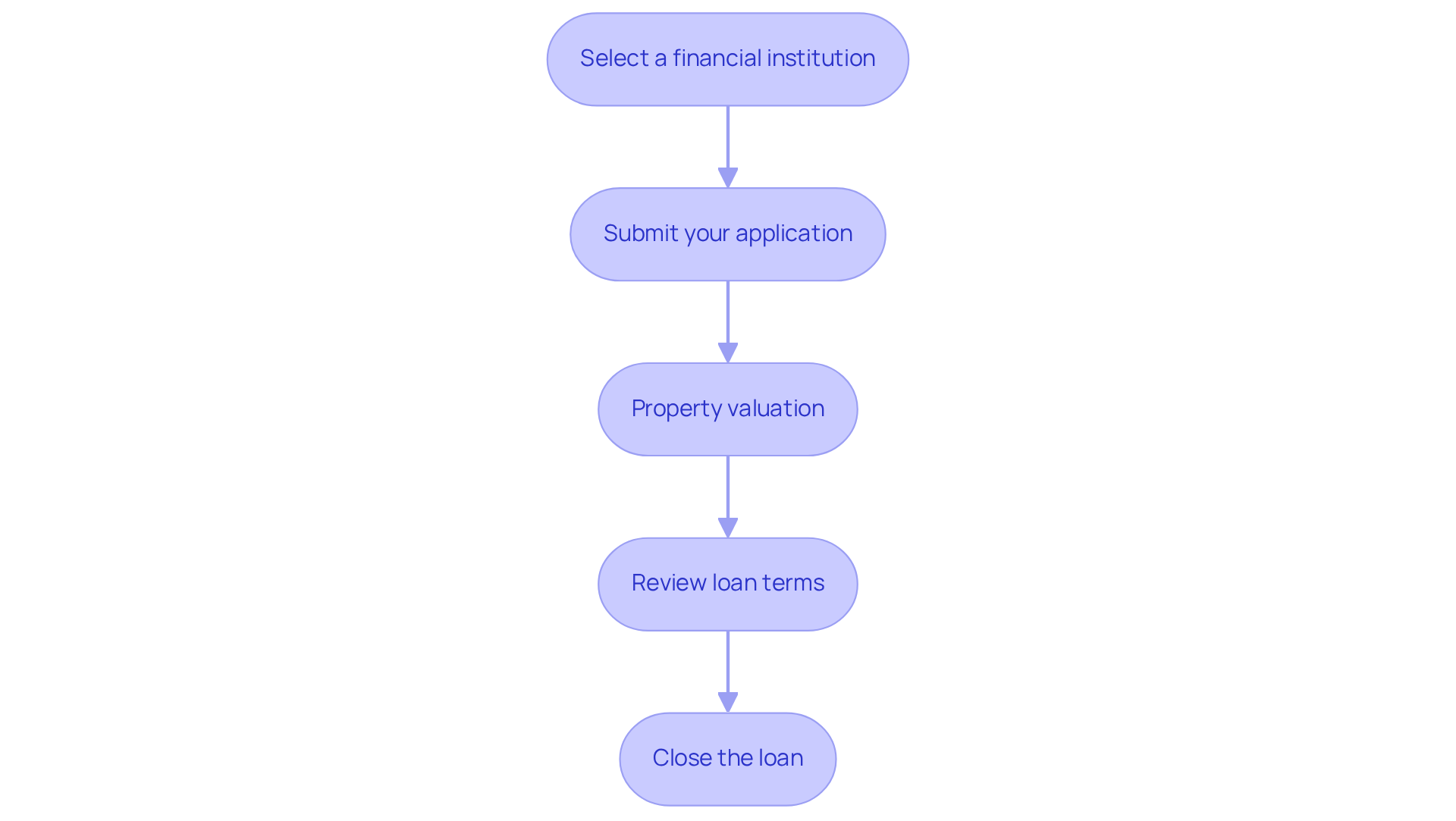

Follow the Step-by-Step Application Process for a HELOC

Applying for a HELOC with bad credit can feel daunting, especially. But don’t worry; we’re here to support you every step of the way. Follow these essential steps to navigate the process more effectively:

- Select a financial institution: Start by researching organizations that cater to individuals with challenging financial histories. Look for customer reviews and compare the terms they offer, especially focusing on interest rates and fees. Some lenders may accept , which can be a relief for those with lower credit scores.

- Submit your application: Take a moment to fill out the application form with accurate information and attach all required documentation, such as proof of income and property ownership. Completing a home equity line of credit application can be quick—often taking just about 15 minutes online—but it does require thorough documentation of your finances and a new property appraisal.

- Property valuation: Expect the financial institution to require a property appraisal to assess its current market value. This step is crucial, as it helps determine how much you can borrow. Most lenders allow borrowing up to 80 or 85 percent of your property’s value, meaning you’ll need to have more than 15 to 20 percent equity. To improve your chances, consider requesting a copy of your financial report to check for errors or discrepancies. Additionally, paying down existing debts can lower your debt-to-income (DTI) ratio, ideally keeping it below 43% for better mortgage rates.

- Review loan terms: Once you receive approval, take the time to carefully review the loan terms, including interest rates, repayment options, and any associated fees. Remember, closing costs for home equity lines can range from 2% to 5% of your maximum borrowing limit, so understanding these details is vital for making an informed decision.

- Close the loan: If you feel comfortable with the terms, proceed to the closing phase. This is where you’ll sign the final paperwork and gain access to your funds. Typically, the approval process for a home equity line of credit takes between two to six weeks, depending on the efficiency of the financial institution and the complexity of the appraisal.

By following these steps, you can approach the application process for a HELOC with bad credit with confidence, even if you face credit challenges. As Peter Warden wisely notes, “The home equity line of credit process functions similarly to the mortgage process: You’ll receive rate quotes, select a lender, provide financial documents, and wait for an appraisal.” This understanding can help you feel more prepared as you embark on your home equity line of credit journey.

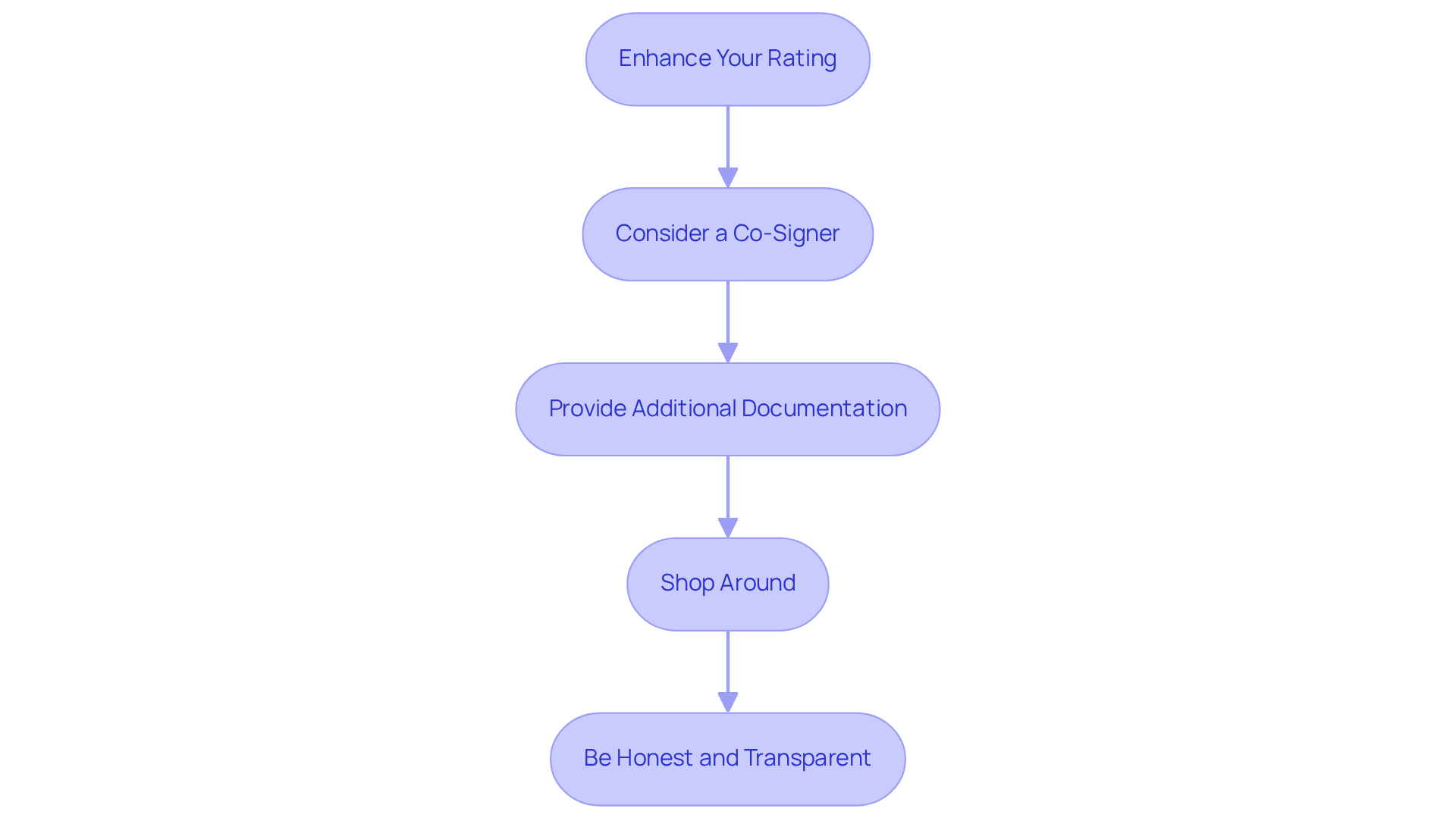

Overcome Common Challenges and Improve Approval Chances

Applying for a HELOC with bad credit may seem daunting, but there are strategies to enhance your chances of approval. We understand how challenging this can be, and we’re here to support you every step of the way.

Enhance Your Rating: Start by taking proactive steps to boost your score before applying. Paying down debts and making timely payments can make a significant difference.

Consider a Co-Signer: If possible, think about seeking a co-signer with stronger financial standing. This can greatly enhance your application and provide you with additional support.

Provide Additional Documentation: Don’t hesitate to offer explanations for any negative marks on your credit report. Whether it’s due to job loss or medical expenses, sharing your story can better.

Shop Around: Remember, it’s important not to settle for the first offer you receive. Take the time to compare various financial institutions to find the best terms and conditions that suit your needs.

Be Honest and Transparent: Lastly, clearly communicate your financial situation to the lender. Honesty can build trust and may lead to more favorable terms. We believe that with the right approach, you can navigate this process successfully.

Conclusion

Navigating the process of securing a Home Equity Line of Credit (HELOC) with bad credit can be daunting, but know that it is entirely achievable with the right approach. By understanding the fundamentals of HELOCs and recognizing their potential benefits—like flexible access to funds and lower interest rates—you empower yourself to make informed financial decisions. This guide has outlined essential steps and considerations to enhance your chances of approval, even if you are facing credit challenges.

Key insights discussed include:

- The importance of gathering necessary documentation

- Evaluating property equity

- Understanding lender requirements

Proactive measures such as:

- Improving credit scores

- Considering co-signers

- Providing clear explanations for credit issues

can significantly increase your chances of approval. Additionally, shopping around for the best terms and being transparent with lenders can further strengthen your application.

Ultimately, the journey to securing a HELOC with bad credit is not just about overcoming obstacles; it is an opportunity for financial growth and stability. With careful preparation and a strategic approach, you can access the funds you need while also working towards improving your credit standing. Taking these steps can lead to a brighter financial future, reinforcing the significance of persistence and informed decision-making in the face of adversity.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a revolving borrowing line backed by the equity in your residence, allowing homeowners to access funds for various needs.

How can a HELOC benefit homeowners with bad credit?

A HELOC can provide essential access to funds for homeowners with bad credit, helping with home enhancements, debt consolidation, or unexpected expenses.

What are the main benefits of a HELOC for those with bad credit?

The main benefits include flexible access to funds, lower interest rates compared to unsecured loans, potential tax deductions on interest paid, and the opportunity to improve credit scores through responsible use.

How does a HELOC offer flexible access to funds?

Unlike conventional loans, a HELOC allows you to borrow only what you need, when you need it, providing financial flexibility.

Are the interest rates on a HELOC with bad credit higher than other loan types?

No, a HELOC with bad credit typically features lower interest rates compared to unsecured loans, making it a more affordable option.

Can the interest paid on a HELOC be tax-deductible?

Yes, depending on how you use the funds, the interest paid on a HELOC may be tax-deductible.

How can using a HELOC responsibly improve my credit score?

By responsibly managing a home equity line of credit, you can enhance your credit score over time, demonstrating effective debt management.

What should I keep in mind when applying for a HELOC?

Understanding the fundamentals of HELOCs will empower you to make informed choices during the application process, and support is available to help you navigate your options.