Overview

This article is here to guide you through the effective use of the extra payment mortgage calculator, helping you maximize your savings on mortgage payments.

We understand how overwhelming the mortgage process can be, and we want to support you every step of the way.

By inputting your loan information accurately, you can uncover significant financial benefits. Imagine saving thousands in interest and shortening your loan terms through simple additional contributions.

This calculator is not just a tool; it’s a key to informed financial decision-making, empowering you to take control of your mortgage journey.

Let’s explore how you can make the most of it together.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially when considering the long-term implications of mortgage payments. We understand how challenging this can be. That’s where the extra payment mortgage calculator comes in as a valuable ally, helping homeowners and potential buyers visualize the significant savings that can be achieved through additional contributions.

But many may wonder: how can seemingly small extra payments lead to substantial financial benefits? This guide will unravel the mysteries of the extra payment mortgage calculator, showing you how it can transform mortgage management and pave the way for a more secure financial future.

We’re here to support you every step of the way.

Understand the Extra Payment Mortgage Calculator

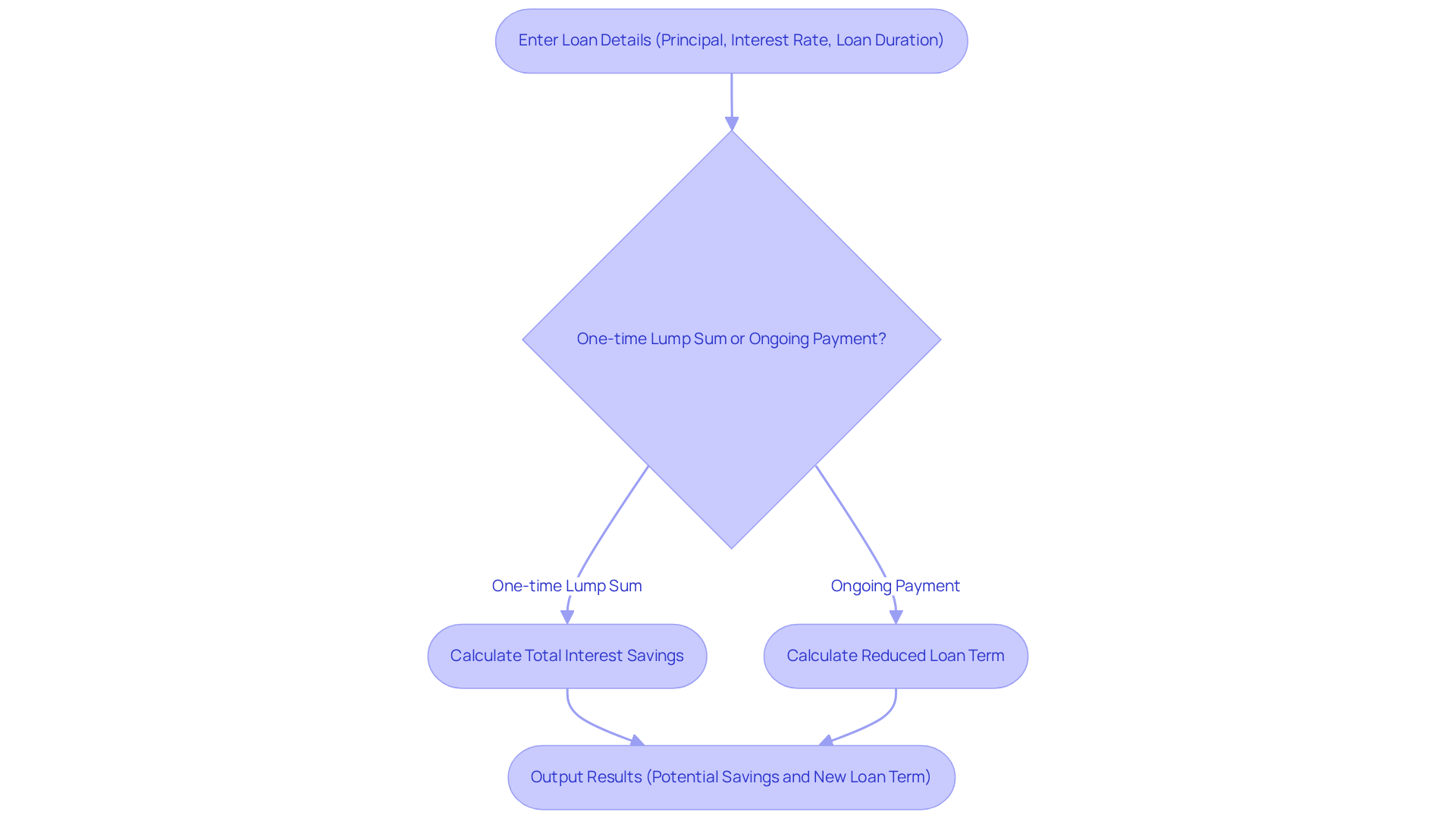

The extra payment mortgage calculator is an invaluable resource for homeowners and potential buyers who are navigating the complexities of their financial journeys. We understand how challenging this can be, and the extra payment mortgage calculator can help you grasp the financial implications of making extra contributions to your mortgage. By entering essential loan details—like the principal amount, interest rate, and loan duration—into the extra payment mortgage calculator, you can discover how additional payments can significantly lower your total borrowing costs and shorten your loan term.

This extra payment mortgage calculator is designed to accommodate both one-time lump-sum contributions and ongoing additional payments, offering a comprehensive view of your potential savings. For instance, if you contribute an extra $100 each month on a $300,000 loan with a 6.75% interest rate, you could save approximately $65,000 in interest and reduce your repayment period by over four years. Understanding how to effectively use the extra payment mortgage calculator is essential for mastering your financial obligations and enhancing your savings over time.

Financial consultants often emphasize the importance of using an extra payment mortgage calculator, noting that even small adjustments in your payment schedule can lead to significant long-term benefits. We’re here to support you every step of the way as you explore these options and make informed decisions for your future.

Step-by-Step Guide to Using the Calculator

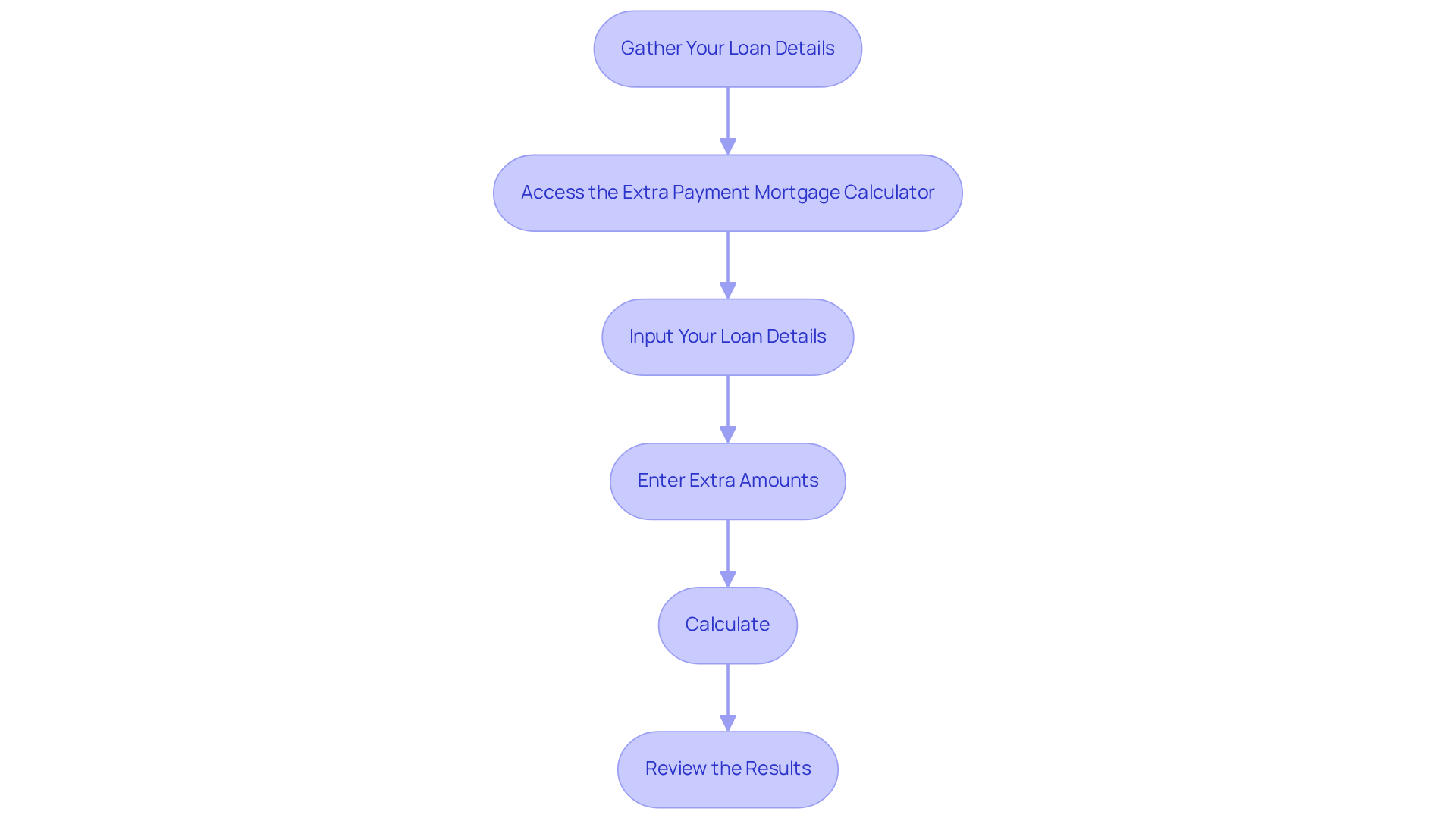

To effectively use the Extra Payment Mortgage Calculator, let’s walk through these steps together:

-

Gather Your Loan Details: First, take a moment to collect important information about your home financing. This includes your loan amount, interest rate, loan duration, and current monthly installment. We know how challenging this can be, but having these details will help you feel more in control.

-

Access the extra payment mortgage calculator: Next, navigate to a trustworthy loan calculator site that provides this additional contribution feature. Finding the right tool is essential for your journey.

-

Input Your Loan Details: Now, enter your loan information into the designated fields. Ensure accuracy to get precise results. Remember, this step is crucial for understanding your potential savings.

-

Enter Extra Amounts: Specify any additional sums you plan to contribute, whether it’s a one-time lump sum or recurring monthly contributions. Every little bit helps, and we’re here to support you every step of the way with our extra payment mortgage calculator.

-

Calculate: Click the ‘Calculate’ button to see the results. The calculator will show how much money you could save and how much earlier you could settle your mortgage. It’s exciting to see the possibilities unfold!

-

Review the Results: Finally, take time to analyze the output. This typically includes a breakdown of your new compensation schedule, total interest saved, and the new payoff date. Feel free to modify the additional amounts as needed to explore various scenarios. You’re making informed decisions that can lead to a brighter financial future.

Explore Savings Potential with Extra Payments

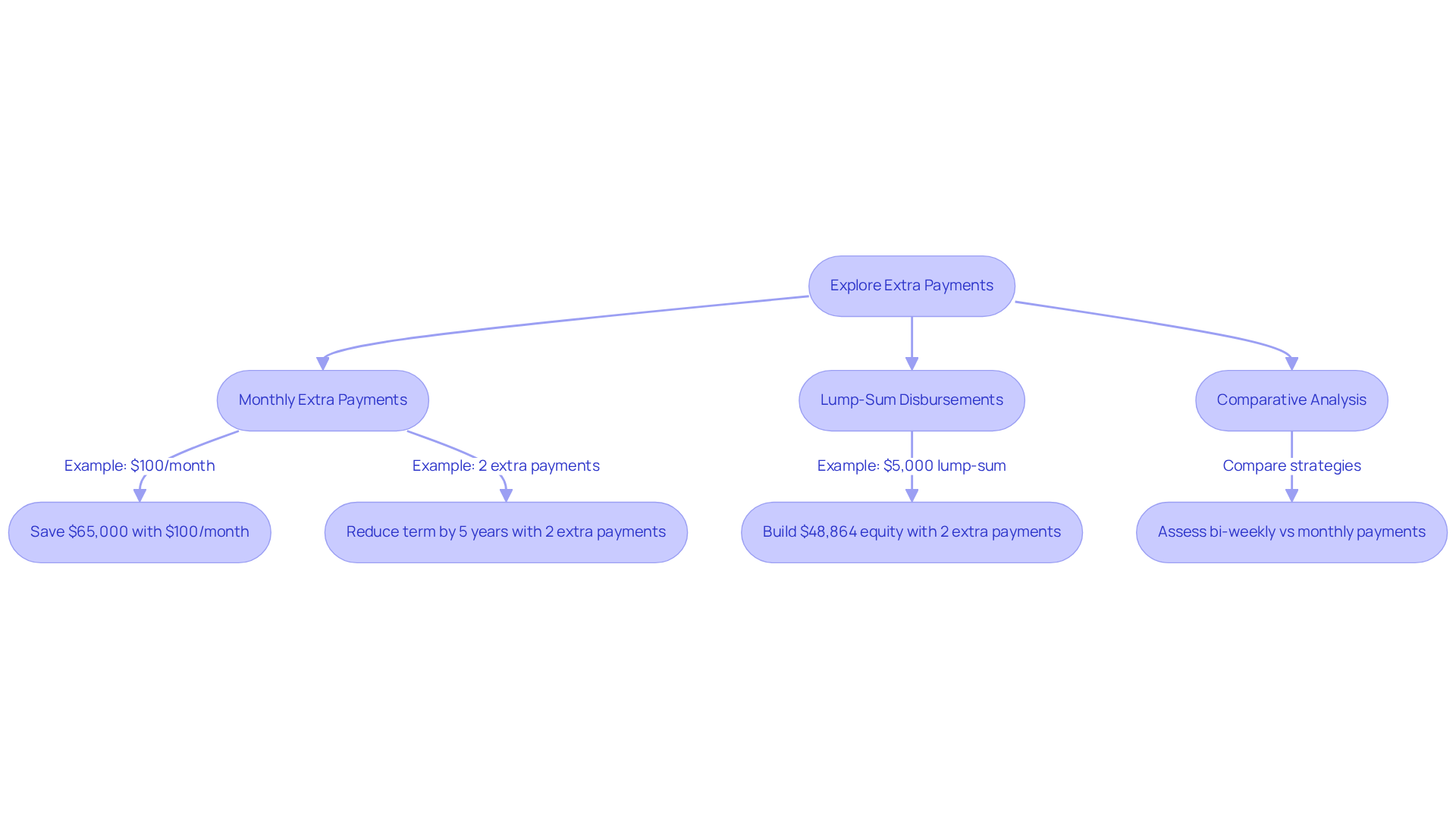

Making additional contributions on your loan can lead to significant savings over time, and utilizing an extra payment mortgage calculator can show you how important that can be for your financial peace of mind. For instance, contributing just $100 to your monthly payment could save you around $65,000 in charges and reduce your repayment duration by more than four years on a $300,000 mortgage at a 6.75% rate. The extra payment mortgage calculator is an invaluable tool that assists you in visualizing these savings by adjusting the extra contribution amounts. Let’s explore some scenarios together:

- Monthly Extra Payments: Committing to an additional $200 each month can greatly reduce your total interest paid and shorten your loan term. For example, making two extra contributions each year can decrease your repayment duration from 30 years to approximately 24 years and 7 months, saving you around $45,922 in costs, which lowers the total charges from about $215,609 to roughly $169,687.

- Lump-Sum Disbursements: A one-time contribution of $5,000 can significantly lower your principal balance, resulting in substantial interest savings. This method can help you build equity faster. Homeowners who contribute two additional installments each year can accumulate about $48,864 in equity during the first five years, compared to around $32,746 without.

- Comparative Analysis: Use the calculator to assess different additional contribution strategies, such as bi-weekly versus monthly supplementary contributions. Bi-weekly payments lead to 13 complete installments each year instead of 12, accelerating your loan settlement and enhancing your savings potential.

Before agreeing to any additional charges, it’s essential to check for any potential prepayment fees that might apply to your loan. Utilizing the extra payment mortgage calculator allows you to make informed decisions that align with your financial goals. Ultimately, this can lead to a more manageable mortgage and a quicker path to homeownership, and we’re here to support you every step of the way.

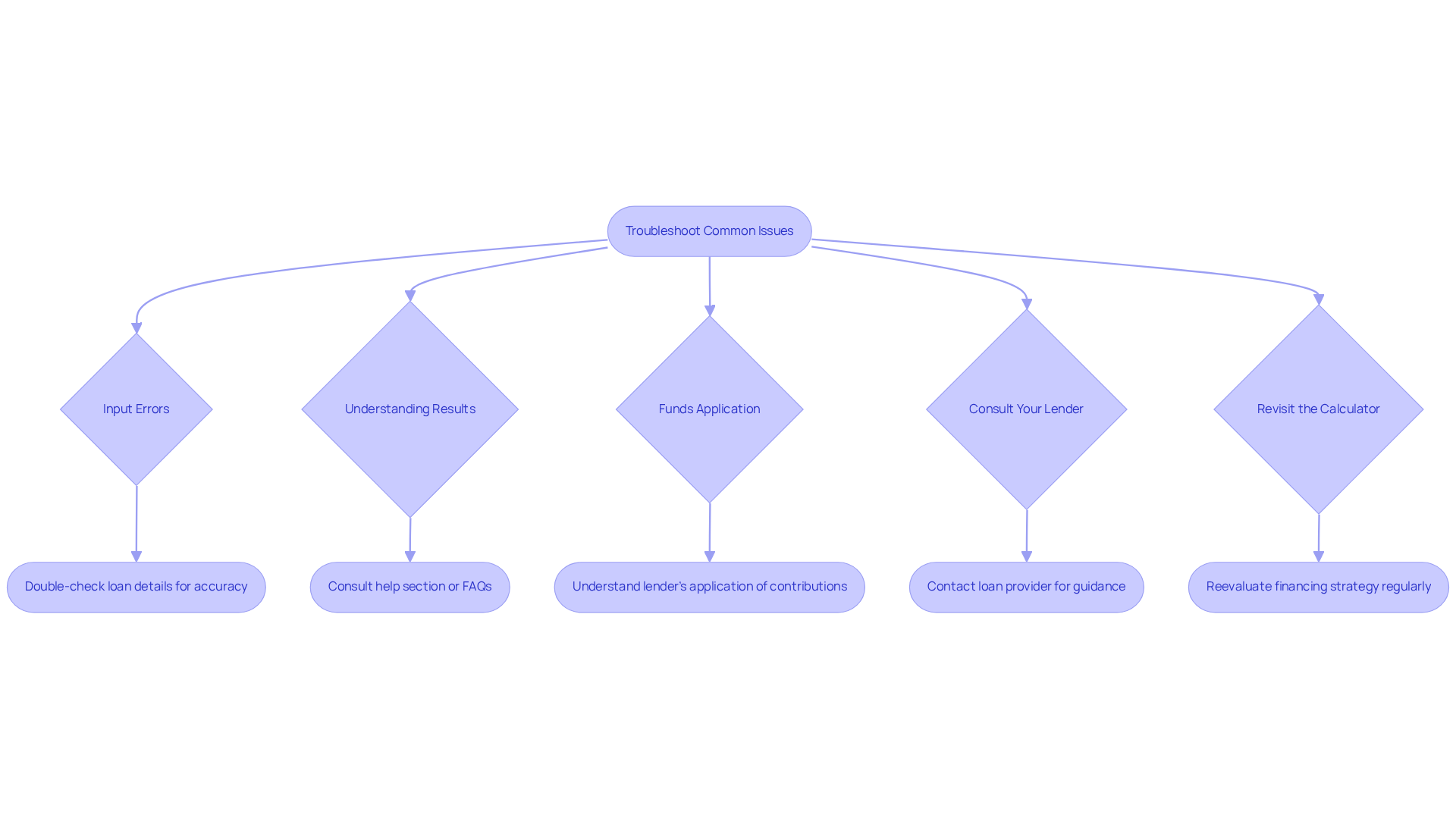

Troubleshoot Common Issues and Considerations

When utilizing the extra payment mortgage calculator, you might encounter some common challenges. We understand how overwhelming this can be, so here are some effective troubleshooting tips to enhance your experience:

- Input Errors: Always double-check your loan details for accuracy. Even minor inaccuracies can lead to misleading results, which may affect your financial planning.

- Understanding Results: If the results seem confusing, don’t hesitate to consult the calculator’s help section or FAQs. These resources often provide valuable insights on how to interpret the data correctly.

- Funds Application: It’s essential to understand how your lender utilizes additional contributions. Some lenders may apply these contributions directly to the principal, while others might assign them to upcoming installments, which can influence your overall savings.

- Consult Your Lender: If you’re unsure about making additional payments or their impact on your loan, we encourage you to contact your loan provider for personalized guidance tailored to your situation.

- Revisit the Calculator: Regularly revisit the calculator as your financial circumstances evolve. This practice allows you to reevaluate your financing strategy and discover new savings opportunities.

Statistics indicate that approximately 30% of users encounter errors while using mortgage calculators. This highlights the importance of accuracy and understanding in the process. As loan consultant Lorraine Jones notes, “An ARM may make sense for homebuyers comfortable with the risk of interest rate increases or those who plan to move or refinance before the fixed rate expires.” By following these tips, you can navigate common pitfalls and make informed decisions that maximize your savings potential with an extra payment mortgage calculator. We’re here to support you every step of the way.

Conclusion

Utilizing the extra payment mortgage calculator is a powerful strategy for homeowners like you who are looking to maximize savings and reduce loan terms. We understand how overwhelming this process can be, but by effectively implementing this tool, you can gain significant insights into the financial benefits of making additional contributions to your mortgage. This approach not only enhances your financial control but also paves the way for a quicker path to homeownership.

Throughout this article, we’ve highlighted key insights, such as the impact of even modest extra payments on total interest savings and loan duration. Imagine making consistent additional contributions that lead to remarkable reductions in interest paid and a shorter repayment timeline. Furthermore, our step-by-step guide serves to demystify the process, ensuring you can confidently navigate the calculator and make informed financial decisions.

In conclusion, embracing the extra payment mortgage calculator is essential for anyone seeking to optimize their mortgage experience. By actively engaging with this tool and exploring various payment strategies, you can unlock substantial savings and enhance your financial well-being. Remember, the journey to financial freedom is within reach—take the first step today and discover how small changes can lead to significant rewards in your mortgage journey.

Frequently Asked Questions

What is the purpose of the extra payment mortgage calculator?

The extra payment mortgage calculator helps homeowners and potential buyers understand the financial implications of making extra contributions to their mortgage, allowing them to see how additional payments can lower total borrowing costs and shorten the loan term.

What information do I need to enter into the extra payment mortgage calculator?

You need to enter essential loan details such as the principal amount, interest rate, and loan duration.

Can the extra payment mortgage calculator accommodate different types of payments?

Yes, the calculator is designed to accommodate both one-time lump-sum contributions and ongoing additional payments.

How can making extra payments impact my mortgage?

Making extra payments can significantly reduce your total interest costs and shorten your repayment period. For example, contributing an extra $100 each month on a $300,000 loan with a 6.75% interest rate could save approximately $65,000 in interest and reduce the repayment period by over four years.

Why do financial consultants recommend using an extra payment mortgage calculator?

Financial consultants emphasize that even small adjustments in your payment schedule can lead to significant long-term benefits, making the calculator a valuable tool for managing financial obligations and enhancing savings.