Overview

Navigating the mortgage process can feel overwhelming, but we’re here to support you every step of the way. This article outlines five essential steps for successfully obtaining pre-approval for a home loan:

- Understand the mortgage process itself.

- Prepare your financial documents to demonstrate your readiness.

- Choose the right lender by researching and finding one who understands your needs.

- Submit the application once you’ve selected a lender.

- Leverage the benefits of pre-approval.

Each of these steps is supported by practical advice and insights. We know how challenging this can be, and we emphasize the importance of preparation and informed decision-making. By following these steps, you can enhance your home buying experience and improve your negotiating power in a competitive market.

Introduction

Navigating the path to homeownership can often feel like a daunting journey filled with complex steps and overwhelming choices. We understand how challenging this can be. However, securing a mortgage pre-approval is a crucial milestone that can significantly simplify this process.

This guide outlines the essential steps to achieve pre-approval, empowering you to approach your search with confidence and clarity. But what happens when the excitement of finding the perfect home collides with the intricacies of financing? Understanding how to effectively prepare and leverage pre-approval could be the key to overcoming obstacles and seizing opportunities in today’s competitive real estate market.

We’re here to support you every step of the way.

Understand Mortgage Pre-Approval

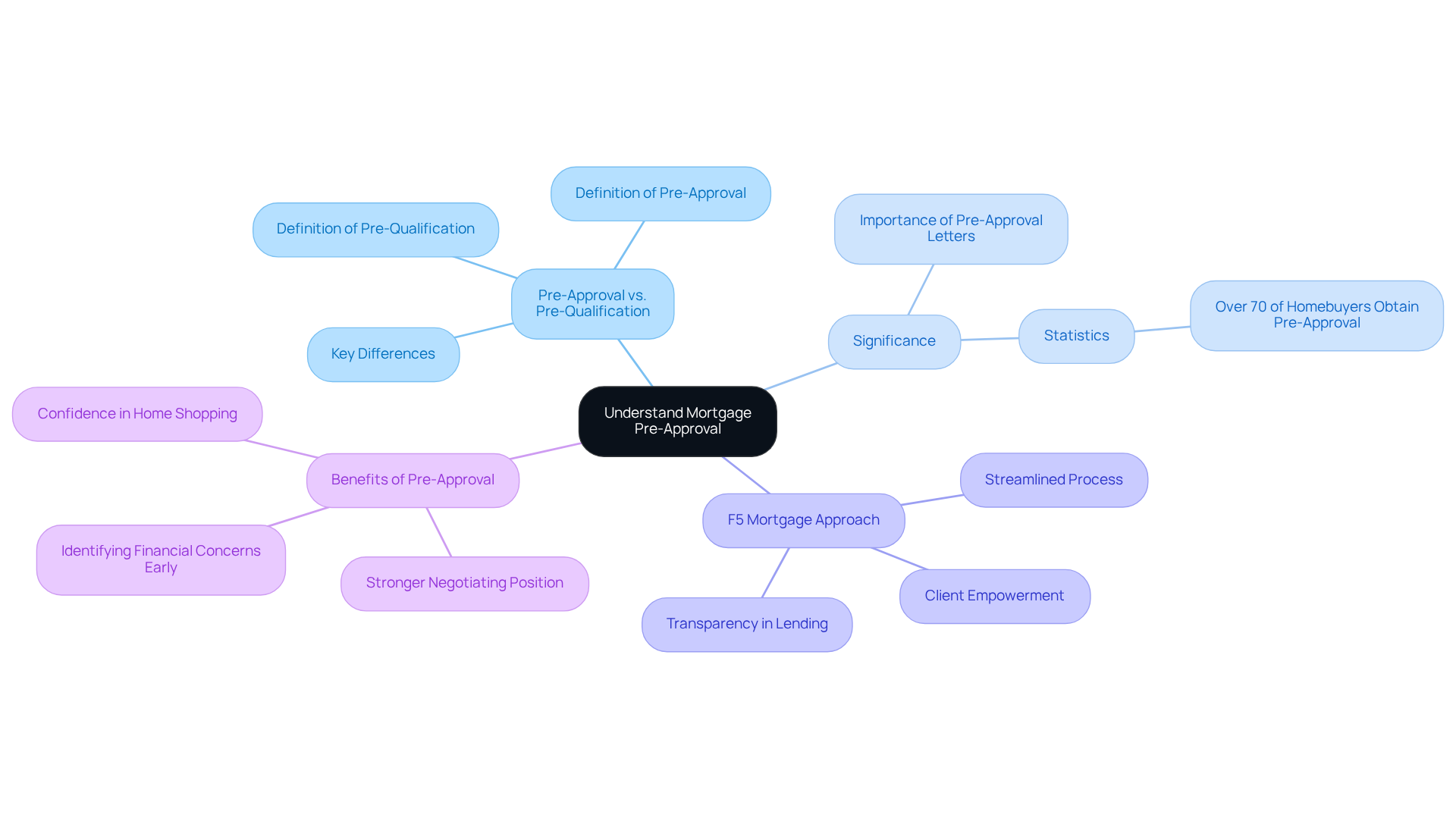

Mortgage pre-qualification is a formal process where F5 Mortgage assesses your financial situation to determine how much they are willing to lend for your home purchase. Unlike pre-qualification, which gives a rough estimate based on self-reported information, the approval process involves a thorough examination of your financial documents, such as income, debts, and credit history. This leads to a letter of intent that outlines the highest loan amount you can obtain, greatly increasing your attractiveness to sellers.

- Pre-Approval vs. Pre-Qualification: Pre-qualification serves as a preliminary step, offering a general idea of potential eligibility, while pre-authorization represents a detailed assessment of your financial standing.

- Significance: A preliminary approval letter indicates to sellers that you are a committed buyer with the financial support needed to present an offer. This can be especially beneficial in competitive markets. In fact, over 70% of homebuyers obtain pre-approval before beginning their house hunt, underscoring its importance in today’s real estate landscape.

We understand that navigating the mortgage process can be overwhelming. Traditional lenders often rely on hard sales tactics and biased information, which can intimidate borrowers and lead to unfavorable terms. In contrast, F5 Financing prioritizes transparency and client empowerment, ensuring you receive the best possible rates without pressure.

Clients can request home purchases or refinancing through F5 Mortgage’s simplified method, guaranteeing approval in less than an hour. This boosts the efficiency of obtaining financing. It’s also advisable to wait until making an offer on a house to decide on a lender and receive official Loan Estimates from potential lenders, ensuring you make an informed choice.

Successful results from prior authorization procedures demonstrate its worth. Buyers who obtain prior authorization often find themselves in a stronger negotiating position, confidently shopping within their budget. This proactive strategy simplifies the home purchasing experience and helps identify possible financial concerns early on, enabling you to tackle them before making significant offers. Ultimately, obtaining a pre approval for home loan is a vital step in showcasing your preparedness to buy a home, making it an essential part of the home purchasing process.

Ready to take the next step? We’re here to support you every step of the way. Request your initial approval with F5 Mortgage today and enjoy a hassle-free mortgage process!

Prepare Your Financial Documents

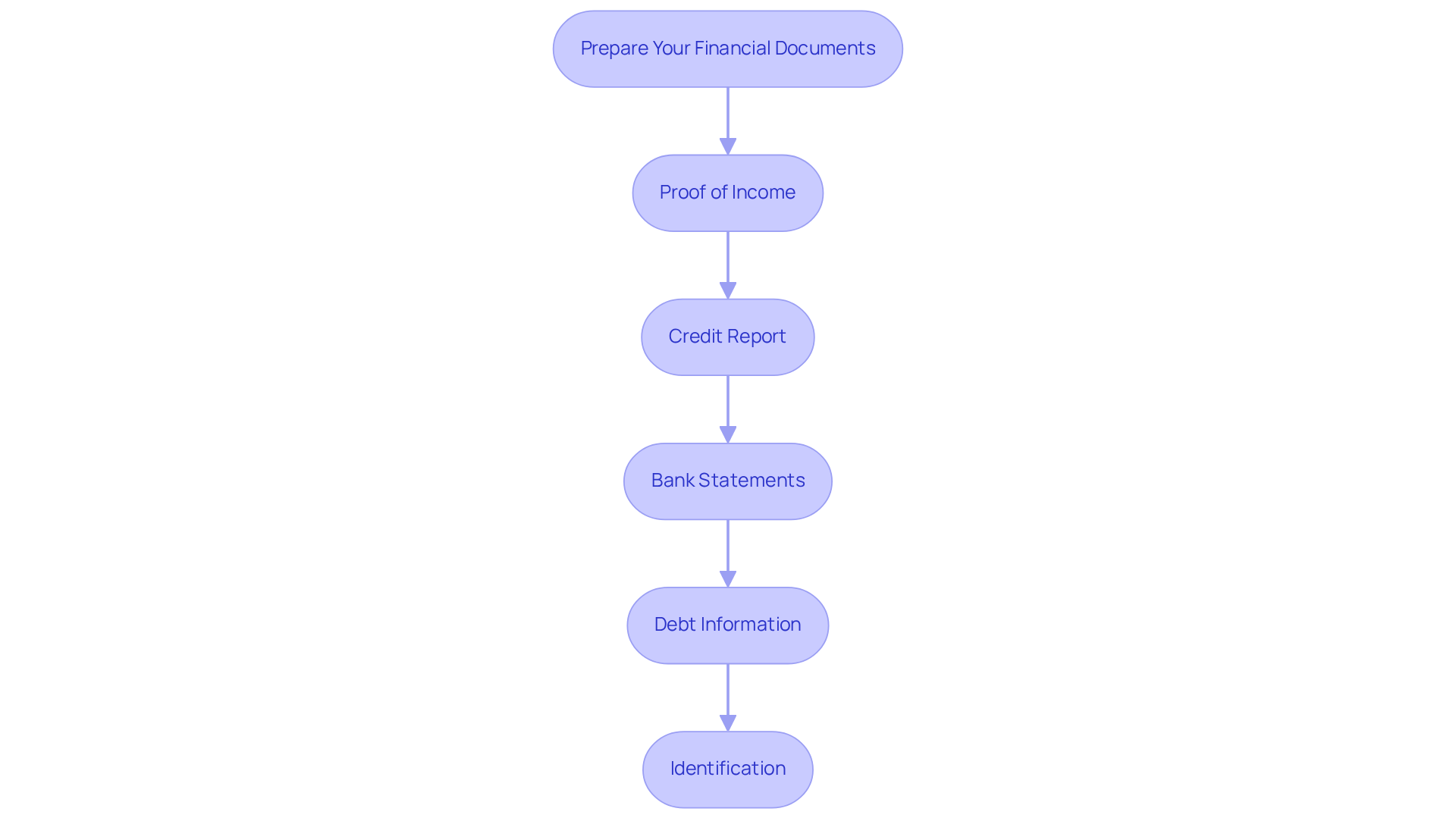

Securing pre approval for home loan can feel daunting, but with the right preparation, you can navigate this process smoothly. Here’s a helpful checklist to guide you:

- Proof of Income: Gather recent pay stubs, W-2 forms from the past two years, and tax returns if you are self-employed.

- Credit Report: Although lenders will obtain your credit report, reviewing it ahead of time can help you spot and fix any errors.

- Bank Statements: Collect statements from the last two to three months to showcase your savings and any significant deposits.

- Debt Information: Make a list of all your current debts, including credit cards, student loans, and other obligations.

- Identification: A government-issued ID, like a driver’s license or passport, is typically required.

Tips for Organizing Your Documents:

- Keep your documents in a dedicated folder for easy access during the application process.

- Ensure all documents are current and precise to prevent delays in obtaining prior authorization.

By following this checklist and organizing your financial documents effectively, you can streamline the pre approval for home loan process. Remember, we understand how challenging this can be, and we’re here to support you every step of the way, enhancing your chances of securing the best mortgage options available.

Choose the Right Lender

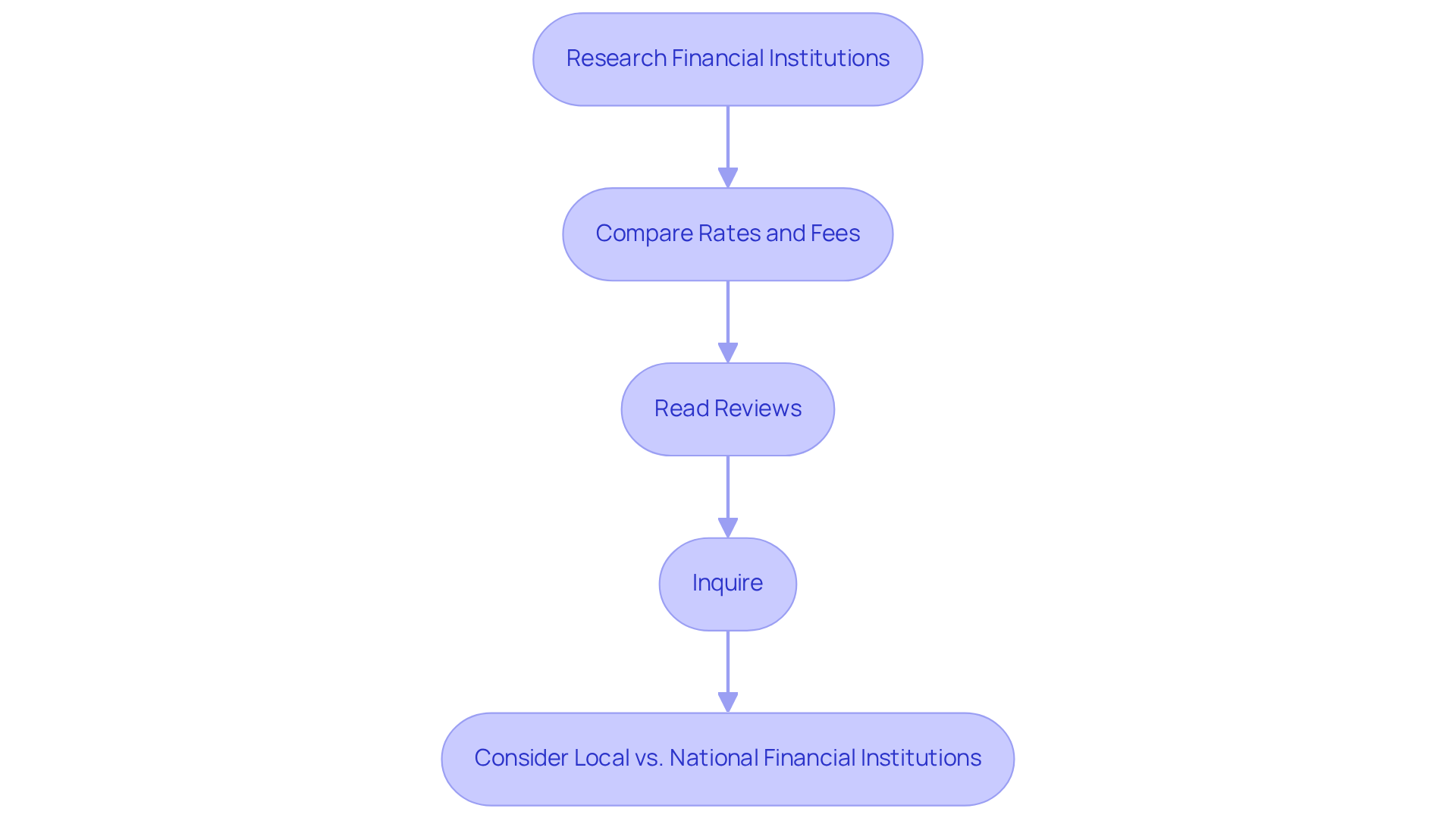

Selecting the right financial institution can significantly shape your mortgage journey, particularly in obtaining pre approval for home loan. We understand how overwhelming the process of obtaining pre approval for home loan can be, and we’re here to support you every step of the way. Here are some steps to help you make an informed decision:

- Research Financial Institutions: Look for entities that specialize in the type of mortgage you need (e.g., FHA, VA, conventional). Specialization can lead to better service and tailored options that truly meet your needs.

- Compare Rates and Fees: Obtain quotes from multiple lenders and compare interest rates, closing costs, and other fees. A thorough comparison can reveal significant savings over the life of your loan. F5 Home Loans leverages advanced technology to ensure ultra-competitive loan rates without the hassle of unwanted hard sales tactics, making it a strong contender in your search.

- Read Reviews: Check online reviews and testimonials to gauge customer satisfaction and service quality. For instance, F5 Mortgage boasts a customer satisfaction rate of 94%, reflecting its commitment to client satisfaction. Clients have praised the team for their exceptional service and personalized mortgage solutions, highlighting the ease of the process and the attention to detail.

- Inquire: Don’t hesitate to ask prospective financial institutions about their loan offerings, processing durations, and any support they provide for first-time buyers. Clear communication can indicate how responsive they will be throughout your mortgage journey, including the process of obtaining pre approval for home loan. F5 Mortgage emphasizes a no-pressure service, ensuring that clients feel supported and informed every step of the way.

- Consider Local vs. National Financial Institutions: Local providers may offer personalized service, while national entities might have more competitive rates. Investigate data on customer satisfaction scores for local versus national financial institutions to assess the advantages of each according to your particular requirements. As an independent broker, F5 Finance works for the client, not the investors, providing a unique advantage in finding the best deal tailored to your needs.

In selecting a financial institution, prioritize clear communication and responsiveness to your inquiries. As F5 Financial states, “We aim to simplify the home purchasing and refinancing process.” An individual or institution with a strong reputation can significantly enhance your pre approval for home loan process. For personalized assistance, reach out to F5 Mortgage today!

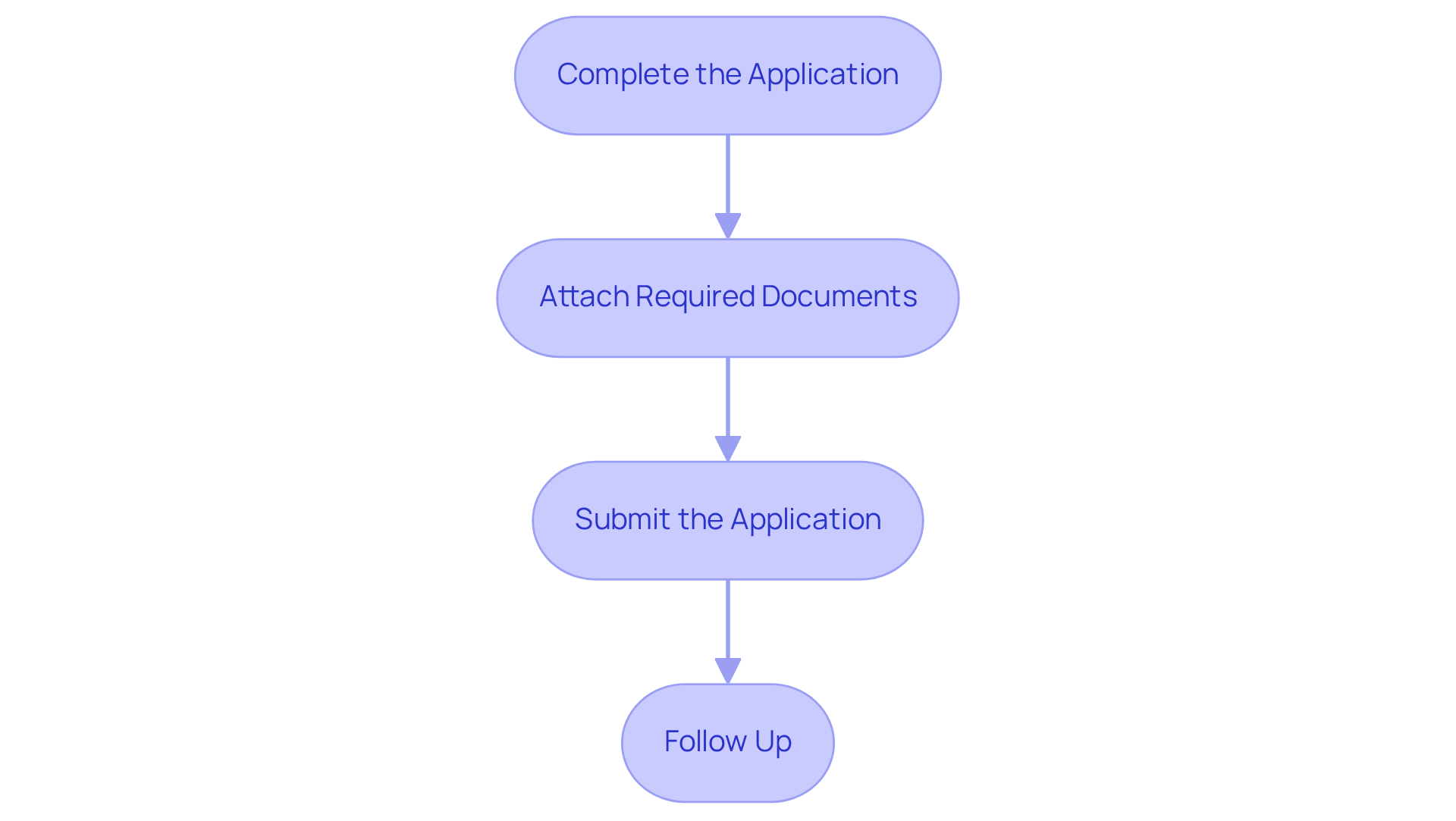

Submit Your Pre-Approval Application

Once you have chosen a financial institution and gathered your documents, it’s time to submit your pre-approval for a home loan application. We know how important this step is, and we’re here to guide you through it.

- Complete the Application: Accurately fill out the financial institution’s application form, detailing your financial situation, including your debt-to-income (DTI) ratio. Ideally, this should be below 43% to help you secure better mortgage rates.

- Attach Required Documents: Include all necessary documents, such as proof of income and identification, that you prepared earlier. Ensuring your financial details are comprehensive can help avoid delays in the approval process.

- Submit the Application: Send your application and documents to the financial institution, either online or in person.

- Follow Up: After submission, confirm with the financial institution that they received your application and inquire about the processing timeline.

What to Expect:

- The lender will review your application and documents, typically taking a few days. During this period, they may reach out for additional information or clarification. It’s important to note that a significant percentage of applications require further documentation, which highlights the importance of thorough initial submissions.

- Successful loan applications often arise from careful preparation and clear communication with the lender. Clients who provide comprehensive financial details and promptly respond to requests for additional information tend to have smoother experiences.

- Be aware that the initial approval process can temporarily reduce your credit score by several points, so it’s essential to monitor your credit health. To enhance your credit score, consider ordering a copy of your credit report to check for errors, paying down existing debts, and using credit wisely.

Pre-approval for home loan letters are typically valid for 60 to 90 days, providing you with a timeframe to act once you receive your pre-approval. F5 Finance can assist you in understanding the validity of these letters and the various loan options available, including refinancing choices such as conventional loans, FHA loans, and VA loans.

- Understanding mortgage approval is crucial; it indicates that the financial institution believes you are a good candidate for a mortgage based on your financial information. This procedure can differ among lenders, and F5 Mortgage can assist in clarifying any questions you might have.

Avoid common pitfalls by ensuring all information is accurate and complete. As noted by industry professionals, one frequent mistake is underestimating the documentation needed, which can delay the process. By being proactive and organized, you can improve your chances of a quick and successful approval.

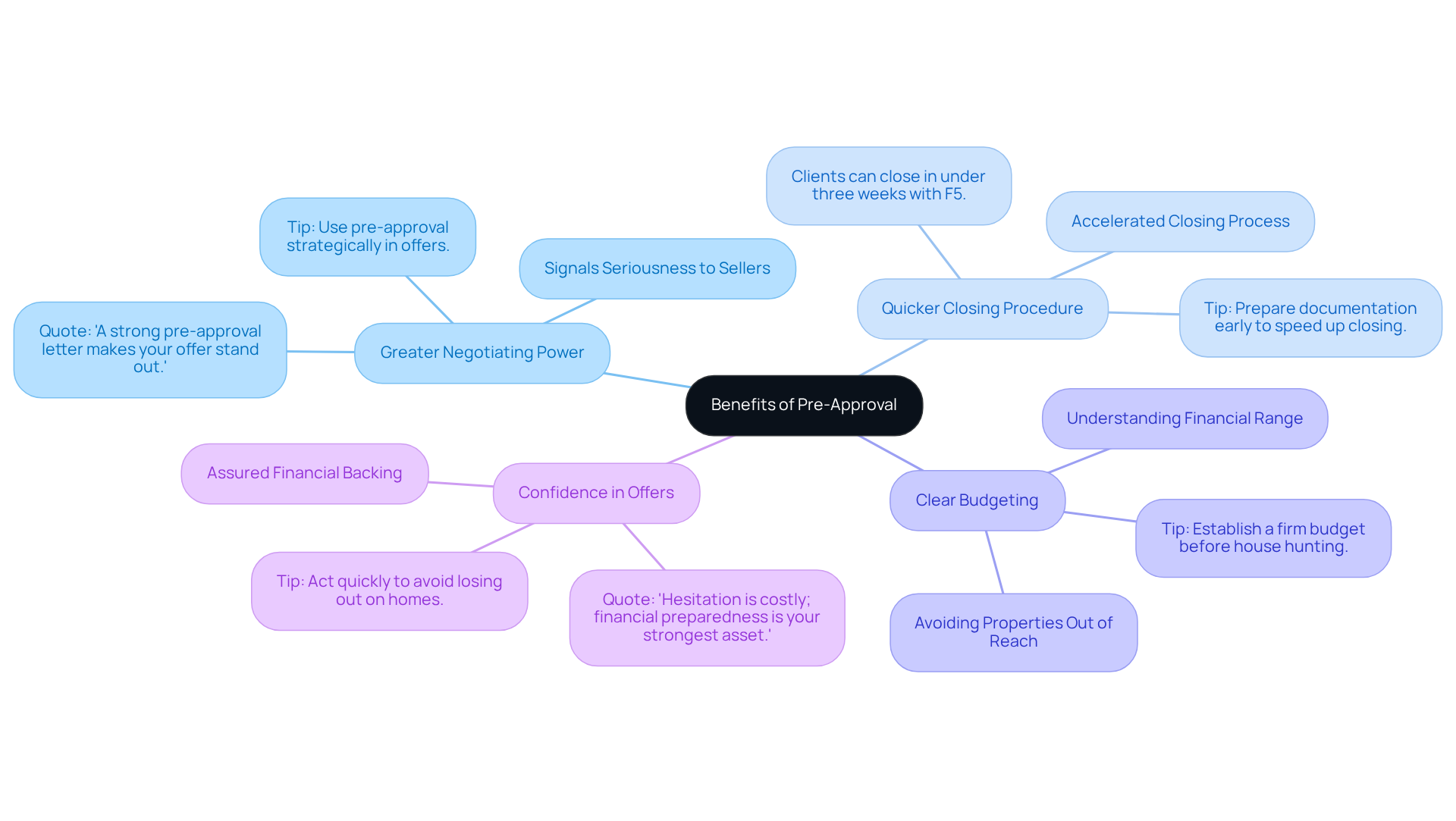

Leverage the Benefits of Pre-Approval

Obtaining a pre-approval for a home loan offers several key advantages that can significantly enhance your home buying experience, especially when working with F5 Mortgage.

Greater Negotiating Power: A letter of approval signals to sellers that you are a committed buyer with the financial means to fulfill your offer. This can make your proposal more appealing in a competitive market, where sellers often receive multiple offers. As Darrin D’Amico mentions, “A robust approval letter makes your offer distinctive and indicates to sellers that you’re a serious competitor.”

Quicker Closing Procedure: With much of the required documentation already finalized during the initial approval phase, the closing process can be accelerated. Many clients find that they can close in under three weeks with F5, enabling them to relocate into their new homes more swiftly. This efficiency can save you valuable time in a fast-moving market.

Clear budgeting is facilitated by pre-approval for a home loan, providing a clear understanding of your budget and allowing you to focus on homes within your financial range. This clarity helps you avoid the frustration of falling in love with properties that may be out of reach, ensuring you make informed decisions.

Confidence in Offers: Equipped with prior approval from F5 Mortgage, you can make offers with assurance, knowing you have the financial support to back your bid. This confidence is crucial in fast-moving markets where hesitation can lead to missed opportunities. Remember, acting quickly is essential to avoid losing out on your dream home.

Tips for Success:

- Strategically use your pre-approval letter when making offers to strengthen your position.

- Maintain a stable financial situation throughout the home buying process to protect your pre-approval status.

- Consider including a personal buyer’s letter with your offer to connect emotionally with the seller, which can further enhance your chances of success. Personalizing your offer can be a game-changer in negotiations, especially in competitive situations.

- Additionally, focus on improving your credit score by checking for errors, paying down existing debts, and using credit wisely to enhance your mortgage opportunities.

Conclusion

Obtaining pre-approval for a home loan is a crucial step in your home buying journey. It provides you with a clear understanding of your financial capabilities and enhances your appeal to sellers. This process empowers you with a solid foundation for your budget and instills confidence when making offers in a competitive market.

We understand how challenging this can be, so let’s break it down. The essential steps include:

- Understanding the difference between pre-approval and pre-qualification

- Preparing the necessary financial documents

- Selecting the right lender

- Submitting a well-organized application

Each of these steps plays a vital role in ensuring a smooth pre-approval experience, ultimately leading to better negotiating power and a more efficient closing process.

In summary, securing pre-approval is not just about obtaining a loan; it’s about positioning yourself as a serious buyer ready to navigate the real estate market with confidence. By following these steps and leveraging the benefits of pre-approval, you can take decisive action towards achieving your dream of homeownership. Embrace this opportunity and take the first step by reaching out to a trusted lender today. We’re here to support you every step of the way in facilitating a seamless mortgage journey.

Frequently Asked Questions

What is mortgage pre-approval?

Mortgage pre-approval is a formal process where a lender, such as F5 Mortgage, assesses your financial situation to determine how much they are willing to lend for your home purchase. It involves a thorough examination of your financial documents, leading to a letter of intent that outlines the highest loan amount you can obtain.

How does pre-approval differ from pre-qualification?

Pre-qualification offers a rough estimate of potential eligibility based on self-reported information, while pre-approval is a detailed assessment of your financial standing and provides a more accurate picture of your borrowing capacity.

Why is obtaining a pre-approval letter important?

A pre-approval letter indicates to sellers that you are a committed buyer with the necessary financial support, which can be particularly beneficial in competitive markets. Over 70% of homebuyers obtain pre-approval before starting their house hunt.

What advantages does F5 Mortgage offer compared to traditional lenders?

F5 Mortgage prioritizes transparency and client empowerment, ensuring borrowers receive the best possible rates without pressure. They also offer a simplified method for obtaining home purchases or refinancing, guaranteeing approval in less than an hour.

What financial documents are needed for mortgage pre-approval?

You will need to gather proof of income (recent pay stubs, W-2 forms, tax returns), a credit report, bank statements from the last two to three months, a list of current debts, and a government-issued identification.

How can I prepare my financial documents effectively?

Keep your documents organized in a dedicated folder for easy access, ensure all documents are current and accurate, and review your credit report for any errors before submission.

What is the benefit of obtaining prior authorization before making an offer on a house?

Obtaining prior authorization strengthens your negotiating position, allows you to confidently shop within your budget, and helps identify potential financial concerns early on, enabling you to address them before making significant offers.

How can I start the pre-approval process with F5 Mortgage?

You can request your initial approval with F5 Mortgage to begin the hassle-free mortgage process and receive support throughout the pre-approval journey.