Overview

This article serves as a compassionate guide for veterans seeking a Certificate of Eligibility (COE) for a VA-backed mortgage. We understand how challenging this process can be, and this document is vital for confirming your eligibility for VA financing. Here, we detail the application process and eligibility criteria, while also highlighting the importance of tracking your application status. Our aim is to empower you with the knowledge needed to navigate your mortgage journey effectively. Remember, we’re here to support you every step of the way.

Introduction

Navigating the complexities of securing a mortgage can be particularly challenging for veterans. We understand how overwhelming this process can feel, especially when it comes to understanding the Certificate of Eligibility (COE). This critical document, issued by the U.S. Department of Veterans Affairs, not only confirms a veteran’s eligibility for VA-backed financing but also streamlines the mortgage application process.

With an increasing number of veterans seeking home loans, grasping the COE’s requirements and application steps is essential. We know how important it is for you to feel confident and informed as you embark on this journey.

How can veterans ensure they meet the eligibility criteria and effectively navigate the application process to secure their dream home? We’re here to support you every step of the way.

Understand the Certificate of Eligibility

The certificate of eligibility (COE) is an essential document issued by the U.S. Department of Veterans Affairs (VA) that confirms a veteran’s eligibility for a VA-supported mortgage. It confirms that you meet the essential service criteria and are eligible for VA benefits. Understanding the certificate of eligibility is crucial, as it not only shows your eligibility but also simplifies the with lenders. Remember, without a certificate of eligibility, you cannot proceed with a VA financing application, making it the first step in your home-buying journey.

The certificate of eligibility includes important information, such as your entitlement amount and details of any prior VA financing used. This information is essential for lenders to evaluate your eligibility and determine the amount for which you qualify. For instance, a servicemember’s credit score of 740 may not meet the requirements for VA financing if their spouse’s debt exceeds their income. This emphasizes the significance of accurate documentation. A real-life scenario illustrates this complexity, showing how marital debt can affect a former service member’s ability to access VA benefit opportunities.

In 2025, we anticipate a substantial number of former service members seeking VA financing, especially as recent legislative changes have expanded eligibility requirements. In fiscal 2024, lenders issued 416,373 VA-backed mortgages totaling over $155 billion, reflecting the growing interest in VA financing. These changes enable more veterans and specific surviving spouses to access VA-backed home financing, particularly in areas affected by disasters. Therefore, having a clear understanding of the certificate of eligibility and its significance will empower you as you navigate the mortgage landscape, ensuring you are well-prepared to secure your home financing. It’s important to note that while the certificate of eligibility verifies your eligibility, it does not guarantee loan approval. Additionally, acquiring a COE can vary in processing time; online submissions usually require just minutes, while postal requests may take 4 to 6 weeks.

Review Eligibility Requirements

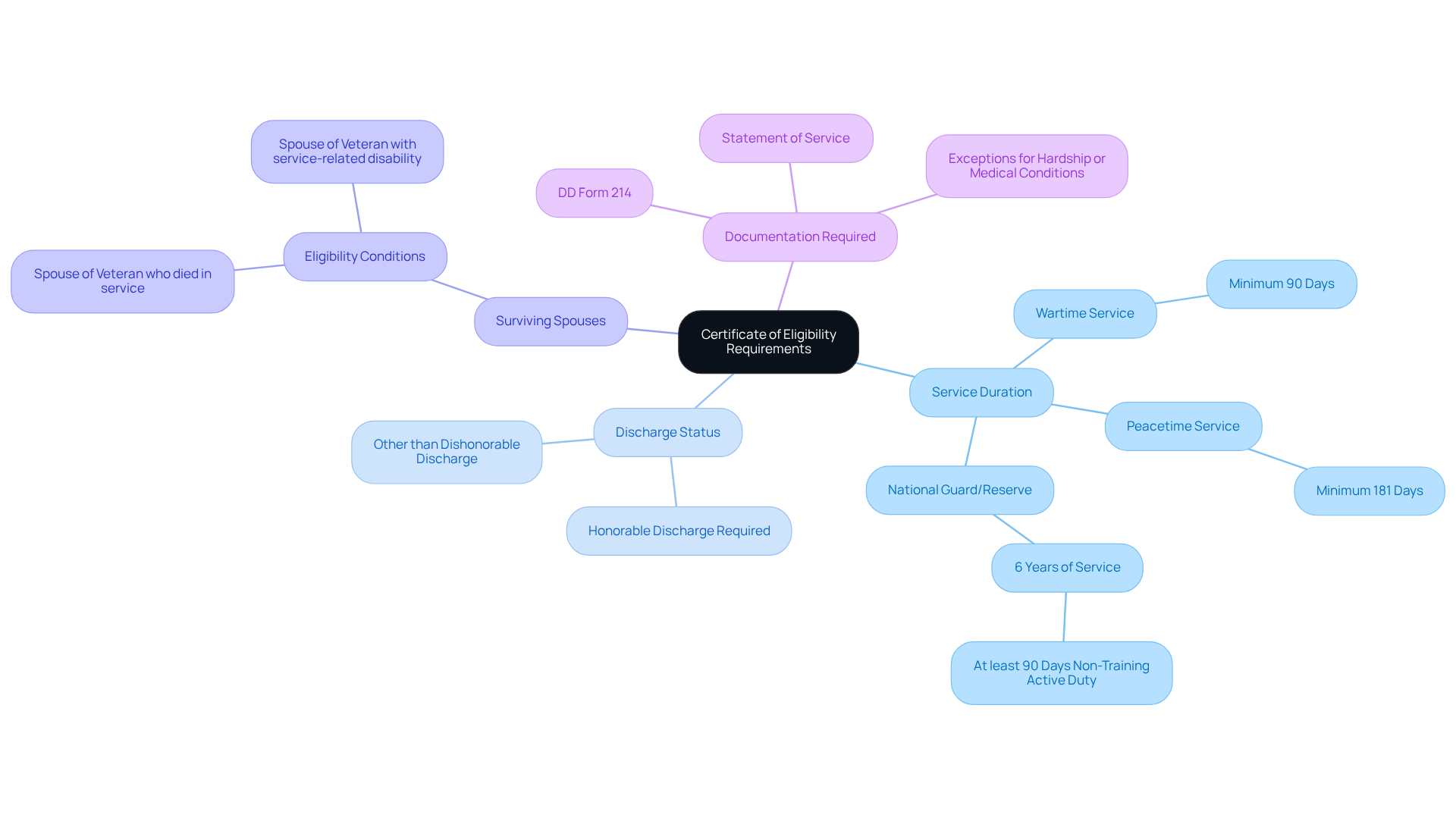

To qualify for a Certificate of Eligibility (COE), applicants must meet specific service requirements established by the VA. We understand that navigating this process can be daunting, so let’s break down the criteria that generally apply:

- Service Duration: Veterans must have served a minimum of 90 days of active duty during wartime or 181 days during peacetime. If you are a member of , you may qualify after six years of service, as long as you have completed at least 90 days of non-training active-duty service.

- Discharge Status: It’s essential to have received an honorable discharge or a discharge under conditions other than dishonorable. This aspect is crucial, as the type of discharge can significantly impact your eligibility.

- Surviving Spouses: If you are a surviving spouse of a veteran who died in service or due to a service-related disability, you may also be eligible for a certificate of eligibility, but specific conditions must be met.

Collecting the required documentation is vital for a successful submission. This includes your DD Form 214 (Certificate of Release or Discharge from Active Duty) or a statement of service from your commanding officer. Remember, service members discharged for hardship or medical conditions may still qualify for a certificate of eligibility, which is an important exception to consider.

We know how challenging this can be, but grasping these requirements beforehand will assist you in evaluating your eligibility and organizing the necessary documentation for your certificate of eligibility request. The enrollment procedure can take as long as 6 weeks, so being well-prepared can greatly improve your likelihood of approval. With over 94% of veterans with honorable discharges successfully obtaining their COE, consulting with a lender or using the eBenefits portal can further simplify your process. We’re here to support you every step of the way.

Complete the Application Process

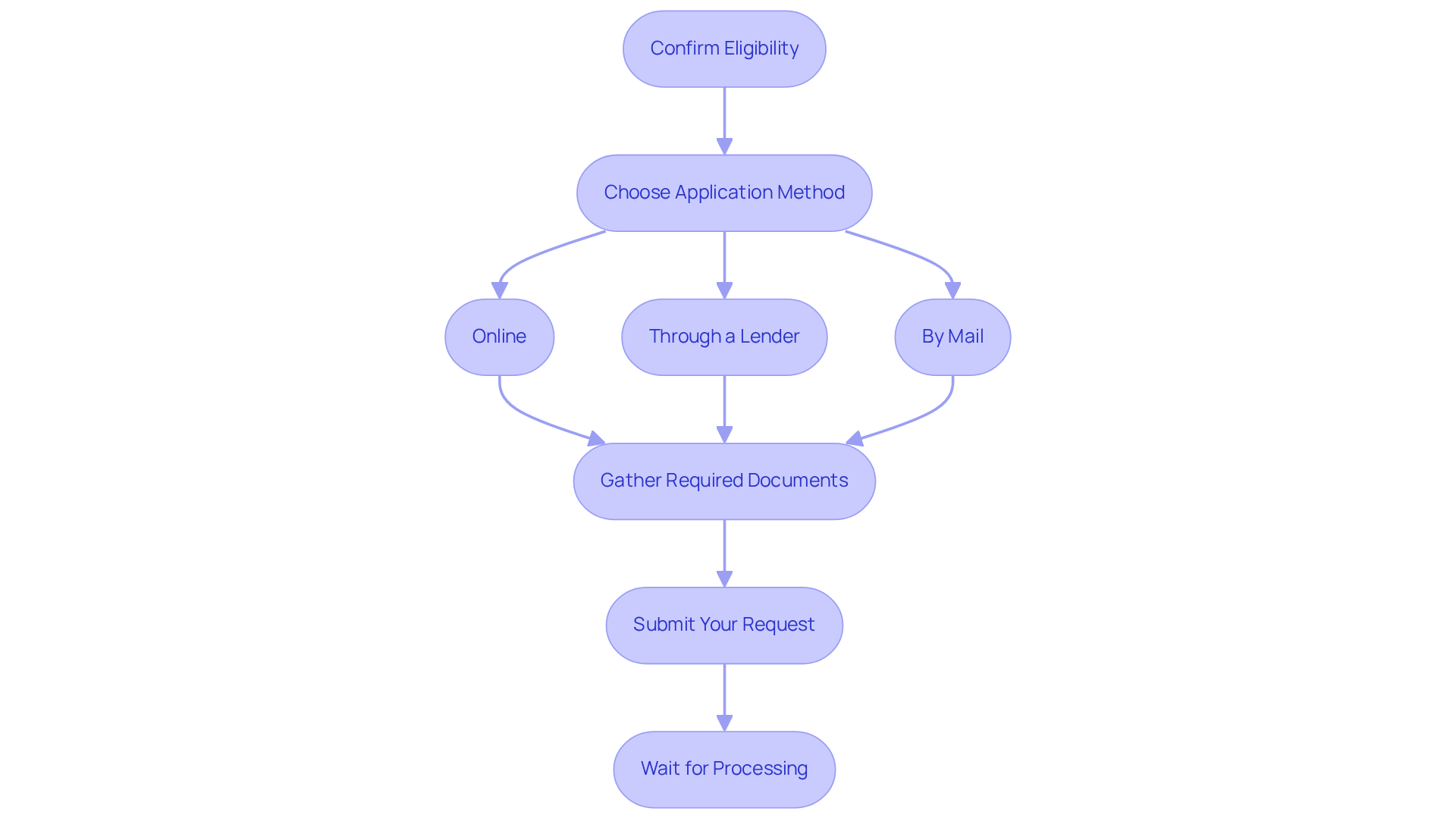

Once you have confirmed your eligibility, you can take the next step in your journey by applying for your certificate of eligibility (COE). We understand that navigating this process can be overwhelming, so here are the steps to guide you:

-

Choose Your Application Method: There are three ways to apply for your COE, and we want to help you find the best option for you:

- Online: The quickest method is through the VA’s eBenefits portal. Simply create an account or log in to request your certificate of eligibility directly. Processing typically takes just minutes, making it a convenient choice.

- Through a Lender: are ready to assist you in obtaining your certificate of eligibility. This method is often the fastest, as lenders have access to the VA’s Web LGY system, allowing for expedited requests.

- By Mail: If you prefer a traditional approach, you can apply by mail. Download and complete VA Form 26-1880 (Request for a certificate of eligibility) and send it to your regional loan center together with the required documentation. Just keep in mind that mailed requests can take 4 to 6 weeks to process.

-

Gather Required Documents: It’s essential to have all necessary documents ready, including proof of service (DD Form 214 for veterans or a statement of service for active-duty members) and any other supporting documentation. Double-checking these documents can help avoid delays in processing. We know how challenging this can be, and understanding the eligibility requirements for refinancing can be beneficial. For instance, a minimum credit score of 620 is often required, along with a stable income and sufficient equity in your home.

-

Submit Your Request: When you’re ready, follow the instructions for your chosen method, ensuring all information is precise and thorough to avoid delays. If you’re applying through a lender, they can assist in verifying your documents and submitting the request on your behalf, providing you with peace of mind.

-

Wait for Processing: After submitting your request, the VA will handle it from there. Online requests are typically processed quickly, while mailed requests may take longer. If you encounter any issues, such as missing records or system errors, don’t hesitate to reach out to your lender for assistance. Remember, you’re not alone in this process.

To enhance your mortgage opportunities, it’s also wise to improve your credit score. Check your credit report for errors, pay down existing debts, and make timely payments. Ordering a copy of your credit report can help you identify any discrepancies that need addressing.

By following these steps, you can effectively finalize your request for the certificate of eligibility, which will open the path for your VA benefits. Additionally, consider exploring specific refinancing options available for VA loans, such as the VA Interest Rate Reduction Refinance Loan (IRRRL) and . Understanding the importance of appraisal in the refinancing process can also empower you on your journey.

Track Your Application Status

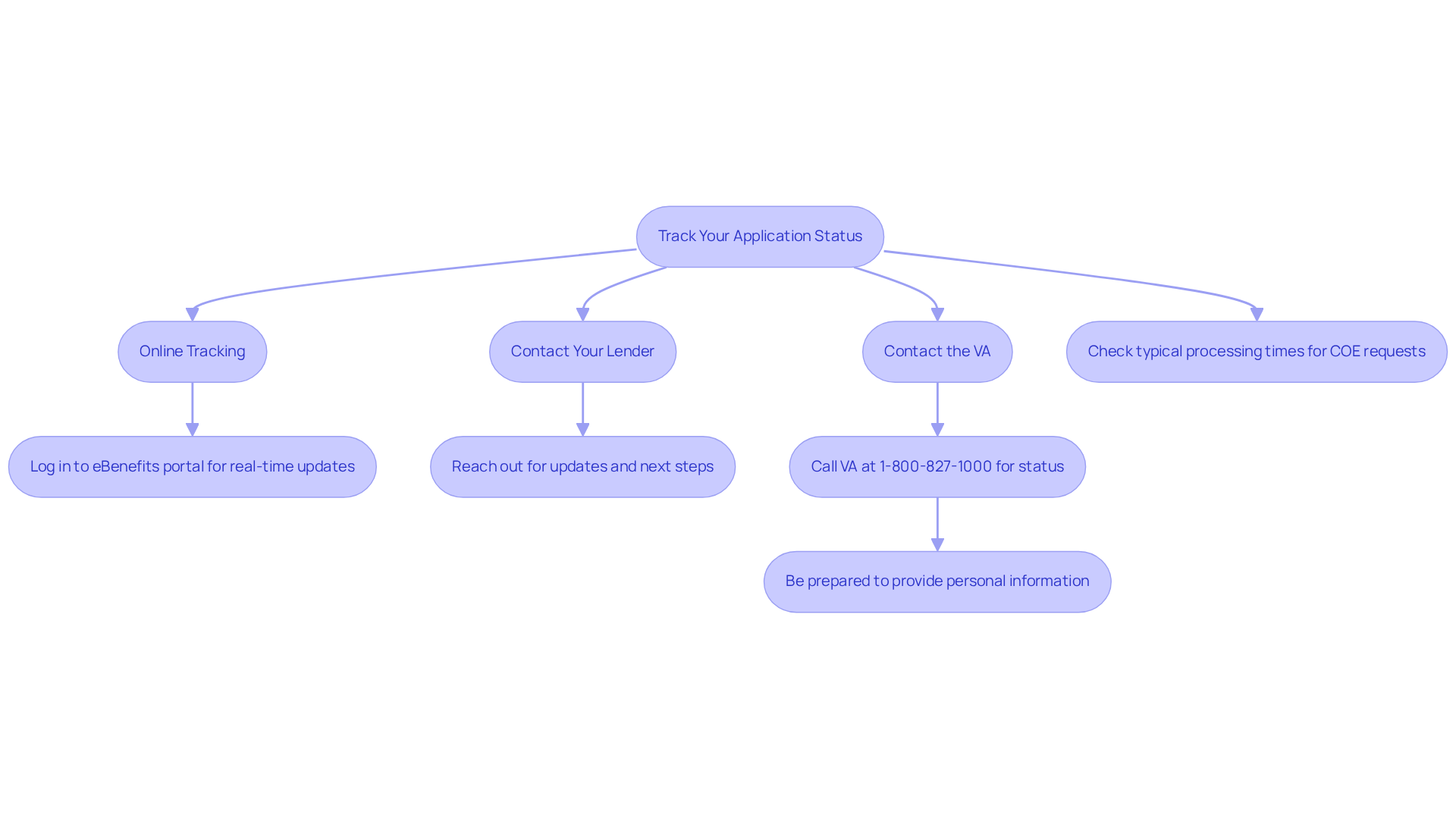

After submitting your request for the certificate of eligibility, it’s essential to monitor its status. Staying informed about updates or potential concerns can make a significant difference in your experience. Here are some effective methods to help you keep track:

- Online Tracking: If you applied through the VA’s eBenefits portal, simply log in to verify your status. This method offers real-time updates, making it the most efficient option available.

- Contact Your Lender: For those who submitted requests through a VA-approved lender, reaching out to them can provide you with updates on your certificate of eligibility inquiry and outline any necessary next steps.

- Contact the VA: If your submission was mailed, you can inquire about its status by calling the VA at 1-800-827-1000. Be prepared to provide personal information for verification.

- Check Processing Times: Understanding typical processing times for COE requests can be beneficial. Online submissions are often handled within minutes, while mailed inquiries may take several weeks.

Actively monitoring your status not only ensures a smoother process but also prepares you for the next steps in securing your VA-backed home loan. We know how challenging this can be, and statistics show that . For example, 81% of Veterans submitting supplemental claims obtain some degree of financial assistance from the VA. Moreover, many veterans have successfully managed their certificate of eligibility status by staying involved, leading to better outcomes.

By not tracking your application, you risk potential delays or missed opportunities. This underscores the importance of being proactive in this process. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the Certificate of Eligibility (COE) is fundamental for veterans seeking to secure a VA-backed mortgage. This essential document not only confirms eligibility for VA benefits but also streamlines the mortgage application process, making it the first crucial step in the home-buying journey. Without a COE, pursuing VA financing becomes impossible, underscoring its importance in accessing valuable home loan opportunities.

The article delves into the key steps required to obtain a COE. We know how challenging this can be, so it’s important to understand eligibility requirements, complete the application process, and track the status of your application. Accurate documentation is significant, and recent legislative changes have broadened access to VA financing for veterans and surviving spouses. By following the outlined procedures and staying informed, applicants can significantly enhance their chances of successfully securing their COE and, subsequently, their VA loan.

Ultimately, the journey towards homeownership through a VA-backed mortgage begins with a clear understanding of the Certificate of Eligibility. As more veterans seek to take advantage of these benefits, being proactive in gathering necessary documentation and monitoring application status will prove invaluable. Empowerment through knowledge and preparation not only facilitates a smoother application process but also opens doors to the financial advantages that come with VA loans. Embrace the opportunity to secure your home financing by prioritizing your COE application today.

Frequently Asked Questions

What is a certificate of eligibility (COE)?

The certificate of eligibility (COE) is a document issued by the U.S. Department of Veterans Affairs (VA) that confirms a veteran’s eligibility for a VA-supported mortgage and verifies that they meet essential service criteria for VA benefits.

Why is the certificate of eligibility important?

The COE is crucial because it not only confirms your eligibility for VA benefits but also simplifies the mortgage request process with lenders. Without it, you cannot proceed with a VA financing application.

What information does the certificate of eligibility contain?

The COE includes important information such as your entitlement amount and details of any prior VA financing used, which are essential for lenders to evaluate your eligibility and determine the loan amount you qualify for.

Can marital debt affect my eligibility for VA financing?

Yes, marital debt can impact a former service member’s ability to access VA benefit opportunities, as lenders consider both the servicemember’s and their spouse’s financial situations during the eligibility evaluation.

How many VA-backed mortgages were issued in fiscal 2024?

In fiscal 2024, lenders issued 416,373 VA-backed mortgages totaling over $155 billion, indicating a growing interest in VA financing.

Are there any upcoming changes to VA financing eligibility?

Yes, recent legislative changes have expanded eligibility requirements, allowing more veterans and specific surviving spouses to access VA-backed home financing, especially in disaster-affected areas.

Does having a certificate of eligibility guarantee loan approval?

No, while the COE verifies your eligibility, it does not guarantee loan approval.

How long does it take to acquire a certificate of eligibility?

The processing time for acquiring a COE can vary; online submissions typically take just minutes, while postal requests may take 4 to 6 weeks.