Overview

This article serves as a caring guide for families looking to estimate their mortgage payments. We understand how overwhelming this process can be, and we’re here to support you every step of the way. It emphasizes the importance of grasping the components of PITI—Principal, Interest, Taxes, and Insurance—so you can feel more confident in your financial decisions.

We delve into the calculation process, highlighting common challenges families face. By illustrating real-life scenarios, we aim to make this content relatable and engaging. Our practical advice is designed to empower you, ensuring that you can navigate the complexities of homeownership with ease.

Ultimately, we want you to feel informed and prepared as you embark on this journey. Understanding your mortgage payments is a crucial step, and we’re here to help you make sense of it all.

Introduction

Understanding the intricacies of mortgage payments can feel overwhelming for families embarking on the journey of homeownership. We know how challenging this can be. This guide breaks down the essential components—principal, interest, taxes, and insurance—providing families with the tools needed to estimate their mortgage payments accurately.

However, as interest rates fluctuate and additional costs often go overlooked, how can families ensure they are fully prepared for this significant financial commitment?

Exploring these questions will empower families to navigate the complexities of mortgage payment estimation with confidence. We’re here to support you every step of the way.

Understand Mortgage Payments and Their Components

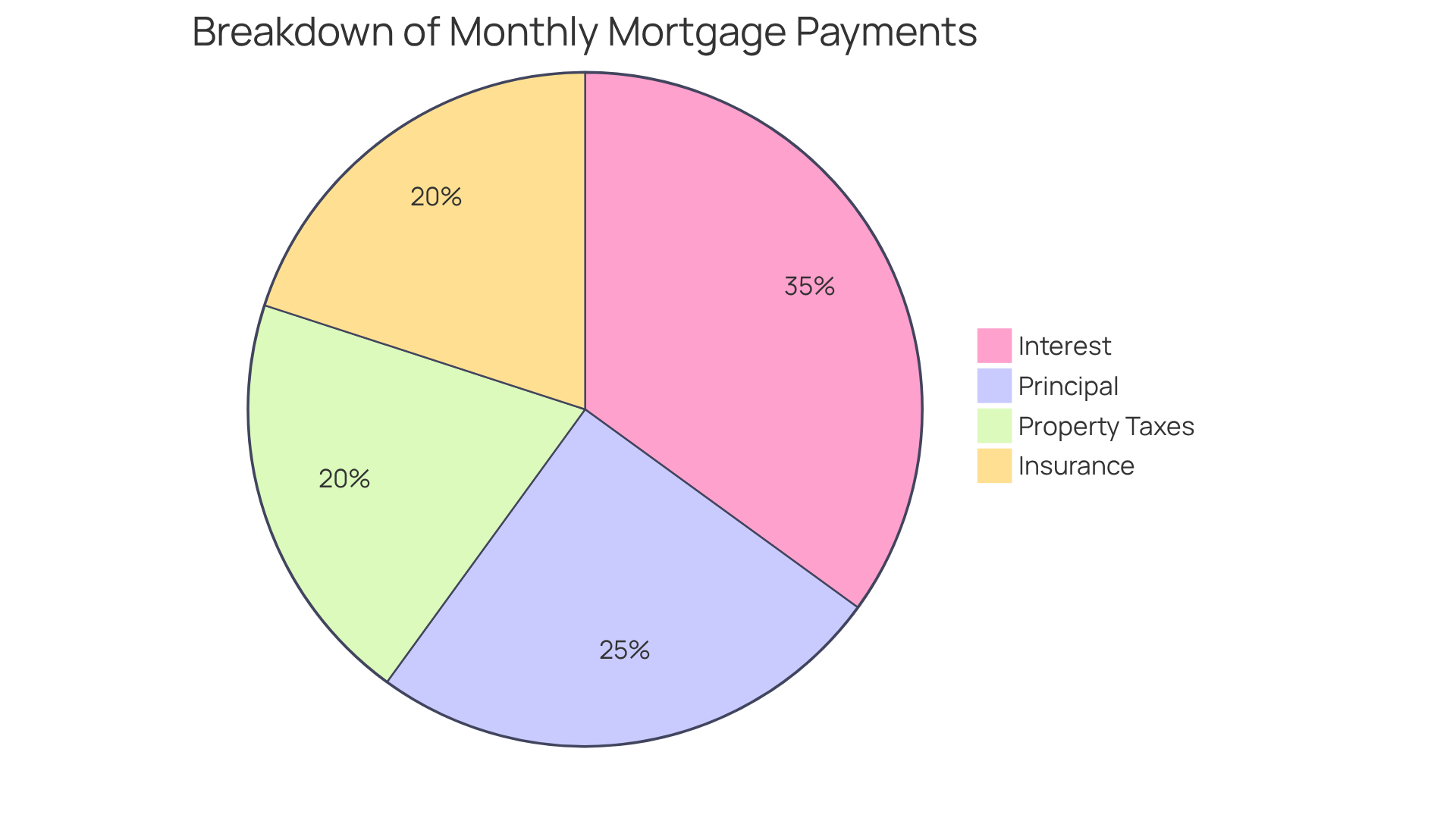

Understanding how to estimate mortgage payment can feel overwhelming, but we’re here to support you every step of the way. Mortgage payments typically consist of four key components, known as PITI, which are essential for families to grasp as they navigate homeownership.

-

Principal: This is the amount you borrow to purchase your home. With each regular installment, you chip away at the principal, gradually building your home equity.

-

Interest: This represents the cost of borrowing the principal amount, expressed as a percentage. The interest rate is crucial in determining your overall monthly cost. Currently, rates range from 6.875% to 7.125%. Even a small increase can significantly impact your monthly payments. For instance, the average payment reached a record high of $2,070 in August 2025, marking a 20% increase since 2020. To shield yourself from potential market fluctuations, consider locking in your mortgage rate with F5 Mortgage once your application is approved.

-

Property Taxes: These are typically included in your monthly payments and are based on your home’s assessed value. Funds for property taxes are often held in an escrow account until they are due, ensuring timely payment and avoiding penalties.

-

Insurance: Homeowners insurance protects your property from damages. If your down payment is less than 20%, you may need private mortgage insurance (PMI), which can add to your monthly costs. PMI can be canceled once your loan balance drops to 78% of the original property value, but you must request this in writing and demonstrate a solid repayment history, offering potential savings.

Grasping these elements is crucial for families to effectively estimate mortgage payment and prepare for additional expenses associated with homeownership. Financial advisors stress that a thorough understanding of PITI can empower families to make informed decisions, ensuring they feel ready for the responsibilities that come with owning a home.

Calculate Your Mortgage Payment Step-by-Step

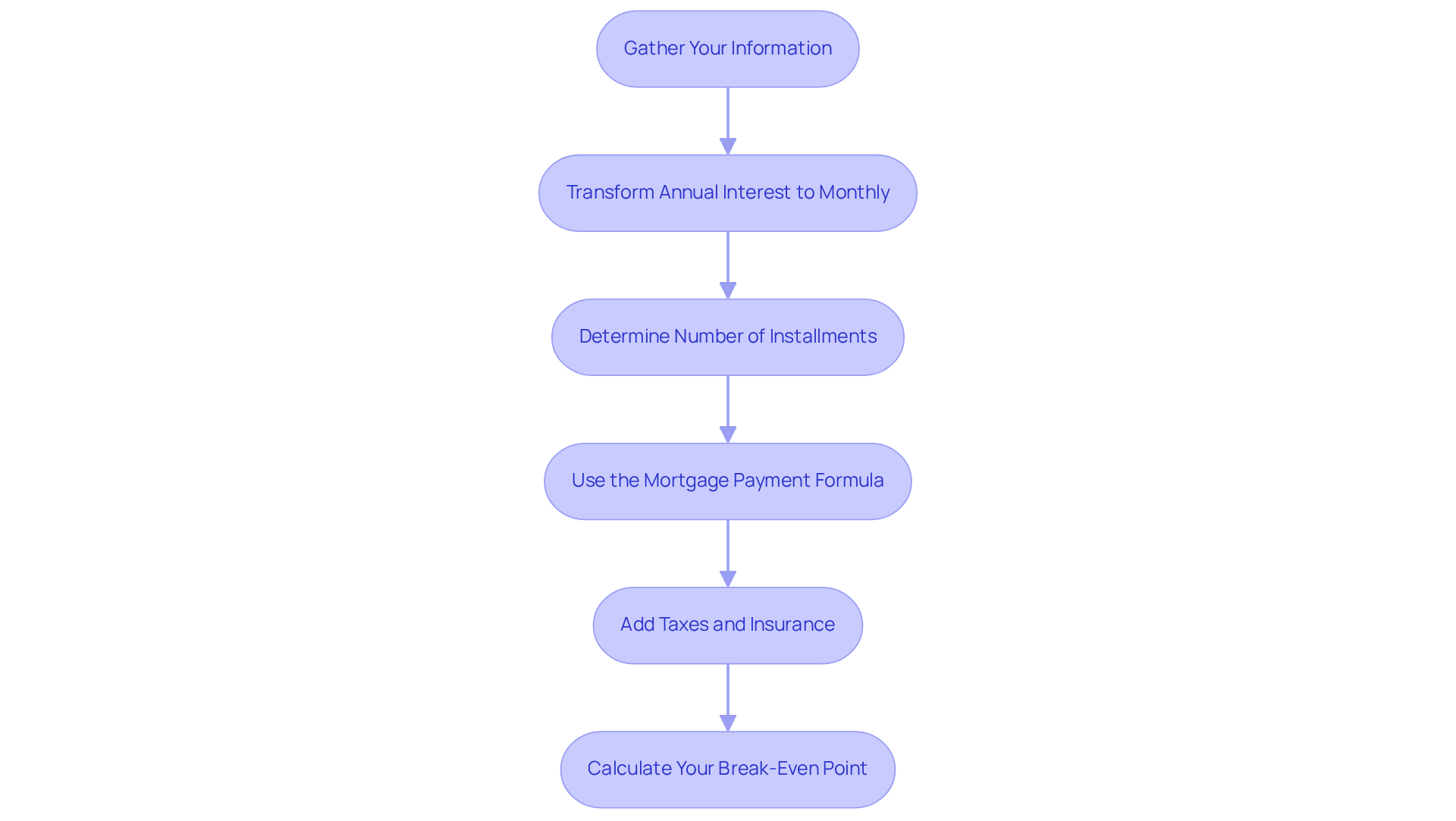

Calculating your estimated mortgage payment can feel overwhelming, but we’re here to support you every step of the way. Follow these simple steps to gain clarity on your financial commitments:

-

Gather Your Information: Start by collecting essential details such as the loan amount (principal), interest percentage, loan term (in years), and any additional costs like taxes and insurance. We know how challenging this can be, but having this information at hand will make the process smoother.

-

Transform the annual interest figure into a monthly value by dividing it by 12. For instance, if your interest rate is 4%, the monthly rate would be 0.04 / 12 = 0.00333. This small step can make a big difference in your calculations.

-

Determine the Number of Installments: Calculate the overall count of installments by multiplying the loan term in years by 12. For a 30-year mortgage, this leads to 30 x 12 = 360 installments. Knowing this helps you visualize your long-term commitment.

-

Use the Mortgage Payment Formula: The formula to compute your monthly payment (M) is:

M = P × (r(1 + r)^n) / ((1 + r)^n - 1)Where:

- P = principal loan amount

- r = monthly interest rate

- n = number of payments

For example, with a $300,000 loan at 4% interest for 30 years:

- P = 300,000

- r = 0.00333

- n = 360

Plugging these values into the formula yields:

M = 300,000 × (0.00333(1 + 0.00333)^360) / ((1 + 0.00333)^360 - 1) ≈ $1,432.25This calculation is key to estimating your mortgage payment and understanding your monthly obligations.

-

Add Taxes and Insurance: To obtain a comprehensive view of your regular costs, factor in estimated property taxes and insurance. Split these yearly expenses by 12 and include them in your monthly charge. For example, if your yearly property tax is $3,600 and insurance is $1,200, your expenses would be $300 and $100, respectively. Thus, to estimate your mortgage payment, your overall charge each month would be $1,432.25 + $300 + $100 = $1,832.25. This total helps you budget more effectively.

-

Calculate Your Break-Even Point: Understanding your break-even point is crucial, especially if you are considering refinancing. To compute it, first ascertain your refinancing expenses, which encompass all closing fees and charges related to refinancing. Next, calculate your monthly savings by subtracting your new payment from your current payment. Ultimately, divide your refinancing expenses by your recurring savings to determine how many months it will take to reach equilibrium. For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months ($4,000 / $100 = 40 months). You need to stay in your home long enough to reach this break-even point for refinancing to make sense.

Grasping these computations is essential, particularly since mortgage installments on a $450,000 loan can vary from $2,261.26 to $3,010.72 each month, based on the loan duration and interest levels. With present figures averaging approximately 6.95% for 30-year fixed loans, families ought to evaluate their financial circumstances thoroughly before agreeing to a mortgage. Additionally, as mortgage rates may decrease further, now could be an advantageous time to explore home buying options. It is also crucial to investigate and assess all potential expenses before borrowing, as extra charges beyond principal and interest, such as homeowners insurance and taxes, can greatly affect total regular disbursements. Furthermore, understanding the implications of different mortgage term lengths can help families make informed decisions about their financial commitments.

Address Common Challenges in Mortgage Payment Estimation

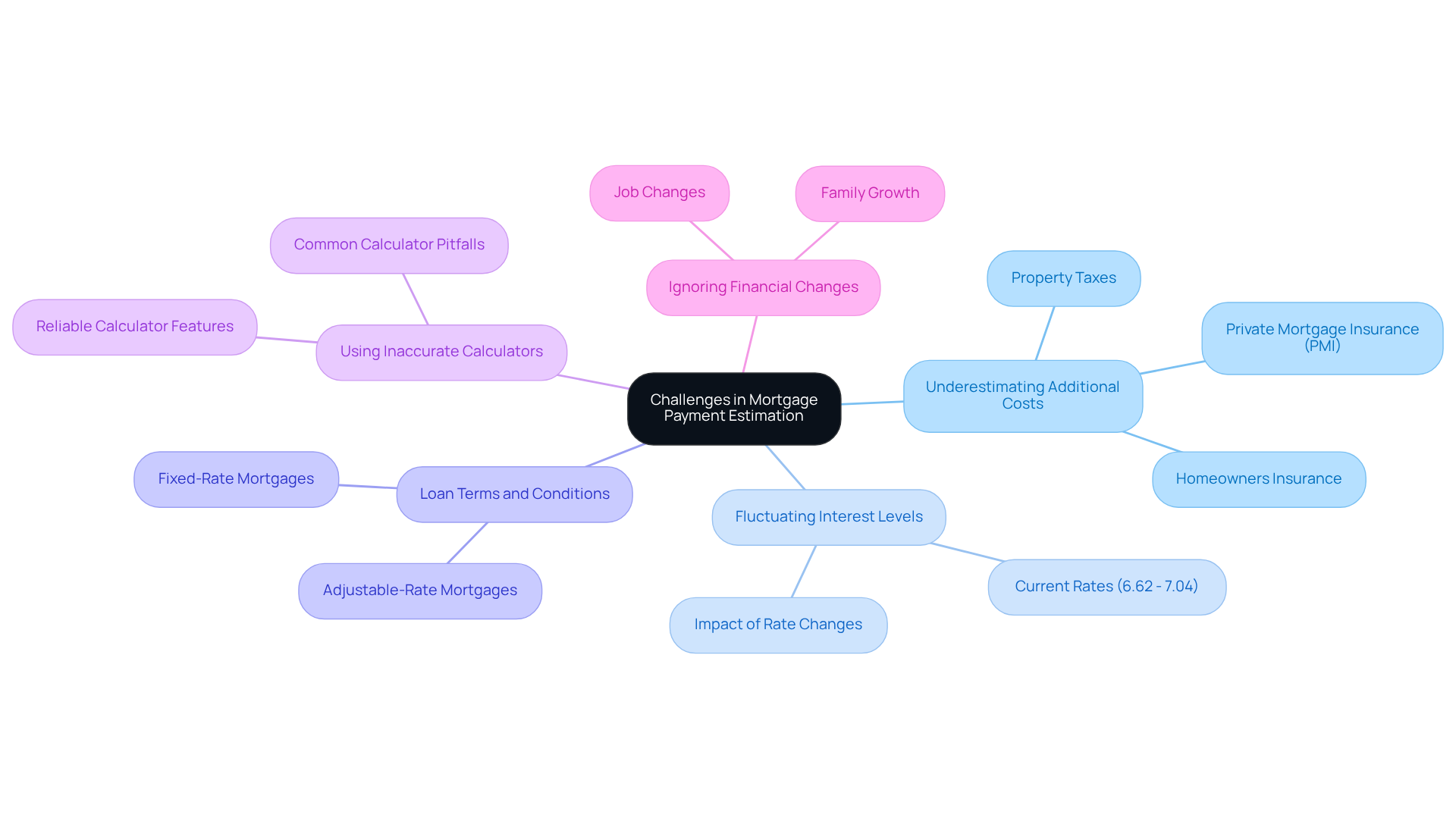

For families, estimating mortgage payment can be challenging, and if these challenges are not addressed, they may lead to financial strain. We understand how overwhelming this can be, and we want to help you navigate through it. Here are some key considerations:

- Underestimating Additional Costs: Many families focus solely on principal and interest, often overlooking essential expenses like property taxes, homeowners insurance, and private mortgage insurance (PMI). These costs can add up significantly, so it’s crucial to include them in your calculations. By doing so, you can avoid unexpected financial burdens.

- Fluctuating Interest Levels: With current interest rates ranging from 6.62% to 7.04%, it’s important to recognize that these figures can change, affecting your monthly payments. Using the most up-to-date information for your estimates is essential. By considering potential future changes, you can prepare for possible increases in your mortgage expenses. At F5 Mortgage, we leverage technology to help you lock in competitive rates, ensuring you can make informed decisions without the pressure of hard sales tactics.

- Loan Terms and Conditions: The type of loan you choose—whether a fixed-rate or adjustable-rate mortgage—can greatly influence your payments. Understanding the specific terms and conditions of your loan is vital for making informed decisions that align with your long-term financial goals. F5 Mortgage provides clear, unbiased information to guide you through these options.

- Using Inaccurate Calculators: Not all mortgage calculators give a complete picture of costs. It’s essential to use reliable calculators that account for taxes, insurance, and PMI to achieve a more accurate estimate of your monthly expenses. F5 Mortgage offers resources that ensure you have a comprehensive view of your potential costs.

- Ignoring Financial Changes: Life events, such as job changes or family growth, can significantly affect your financial situation. Regularly reassessing your mortgage cost estimates in light of these changes helps you stay aligned with your current financial reality. With F5 Mortgage’s personalized service, you can receive ongoing support as your needs evolve.

By recognizing and proactively addressing these challenges, families can navigate the estimate mortgage payment process more effectively. We’re here to support you every step of the way. Engage with F5 Mortgage to take advantage of our innovative approach and ensure a stress-free experience in your home financing journey.

Conclusion

Estimating mortgage payments is a vital skill for families embarking on the journey of homeownership. By breaking down the components of mortgage payments—principal, interest, property taxes, and insurance—families can gain clarity on their financial obligations. This knowledge not only empowers them to make informed decisions but also prepares them for the responsibilities that come with owning a home.

In this guide, we’ve outlined essential steps for calculating mortgage payments, from gathering necessary information to using the mortgage payment formula. We also address common challenges families face, such as underestimating additional costs and the impact of fluctuating interest rates. Recognizing these factors is crucial for avoiding unexpected financial burdens and ensures a more accurate estimation of monthly payments.

Ultimately, navigating the mortgage payment estimation process requires diligence and awareness. We encourage families to engage with reliable resources and professionals, like F5 Mortgage, to ensure they are well-equipped to make informed financial decisions. By understanding the intricacies of mortgage payments and addressing potential challenges, families can confidently embark on their homeownership journey, paving the way for a secure and fulfilling future.

Frequently Asked Questions

What are the key components of a mortgage payment?

The key components of a mortgage payment are Principal, Interest, Property Taxes, and Insurance, collectively known as PITI.

What does the principal component of a mortgage payment refer to?

The principal is the amount you borrow to purchase your home. With each regular payment, you reduce the principal, which helps build your home equity.

How does interest affect mortgage payments?

Interest represents the cost of borrowing the principal amount, expressed as a percentage. The interest rate significantly influences your overall monthly payment. Current rates range from 6.875% to 7.125%, and even small increases can lead to significant changes in monthly costs.

What are property taxes in relation to mortgage payments?

Property taxes are typically included in your monthly mortgage payments and are based on the assessed value of your home. Funds for property taxes are usually held in an escrow account until they are due to ensure timely payment.

What role does insurance play in mortgage payments?

Homeowners insurance protects your property from damages. If your down payment is less than 20%, you may also need to pay for private mortgage insurance (PMI), which adds to your monthly costs. PMI can be canceled once your loan balance drops to 78% of the original property value, but you must request this cancellation in writing.

Why is it important to understand the components of mortgage payments?

Understanding the components of mortgage payments is crucial for families to effectively estimate their monthly payments and prepare for additional expenses associated with homeownership. A thorough grasp of PITI empowers families to make informed decisions about their financial responsibilities.