Overview

In this article, we understand how important it is for you to improve your credit score, especially when it comes to securing approval for a Home Equity Line of Credit (HELOC). We know how challenging this can be, and we’re here to support you every step of the way.

To help you on this journey, we outline nine effective strategies that can make a significant difference. These include:

- Managing your credit utilization

- Making timely payments

- Regularly checking your credit reports for errors

- Seeking professional advice

Each of these steps contributes to building a stronger financial profile, ultimately increasing your chances of loan approval.

By taking action on these strategies, you can empower yourself and move closer to achieving your financial goals.

Introduction

Navigating the path to securing a Home Equity Line of Credit (HELOC) can feel overwhelming, especially when considering the critical role of credit scores. We understand how challenging this can be, and enhancing this vital financial metric is not just beneficial; it’s essential for approval. In this article, we present nine actionable strategies that can significantly improve your credit scores, empowering you to unlock the potential of your home equity.

With challenges like high debt levels and the complexities of credit utilization, how can you effectively position yourself for success in today’s competitive lending landscape? We’re here to support you every step of the way.

F5 Mortgage: Personalized Consultations to Boost Your Credit Score

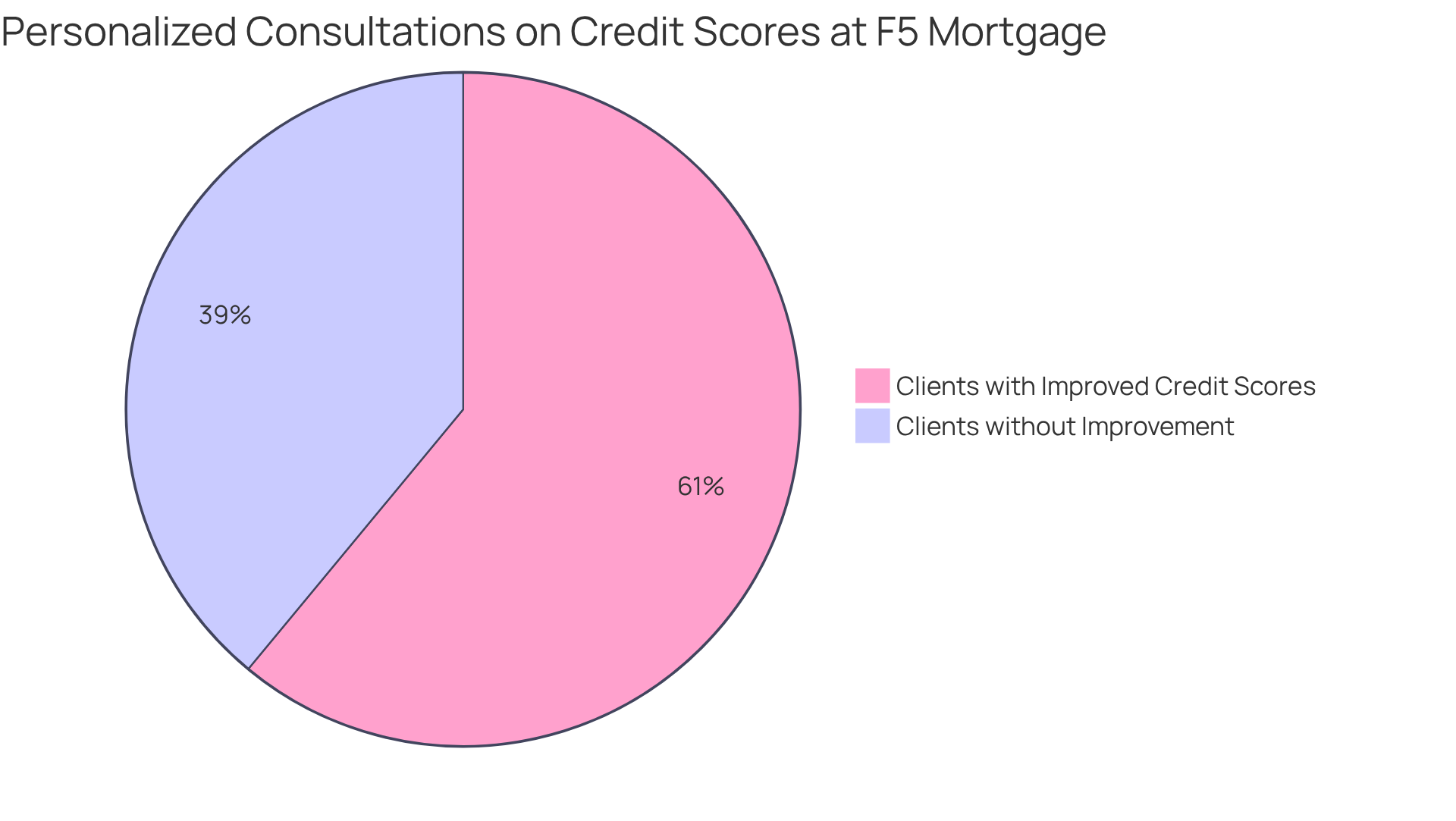

At F5 Mortgage, we understand how challenging navigating your financial circumstances can be. That’s why we provide personalized consultations that delve into your unique situation. By thoroughly assessing your financial history and current monetary status, our brokerage develops tailored strategies designed to improve your credit score for a HELOC loan.

This customized approach not only equips you with actionable insights but also significantly boosts your chances of securing a HELOC loan, as it takes your credit score for HELOC loan into account. In fact, 61% of our clients have reported enhancements in their financial ratings following these consultations, which underscores the effectiveness of personalized guidance.

Financial advisors stress the importance of customized financial strategies. As Schulz mentions, “They want to know you can manage your business before they trust you with a large sum of money.” This highlights the necessity of addressing individual needs and circumstances, ultimately leading to more favorable loan outcomes. We’re here to support you every step of the way, ensuring that your unique needs are met.

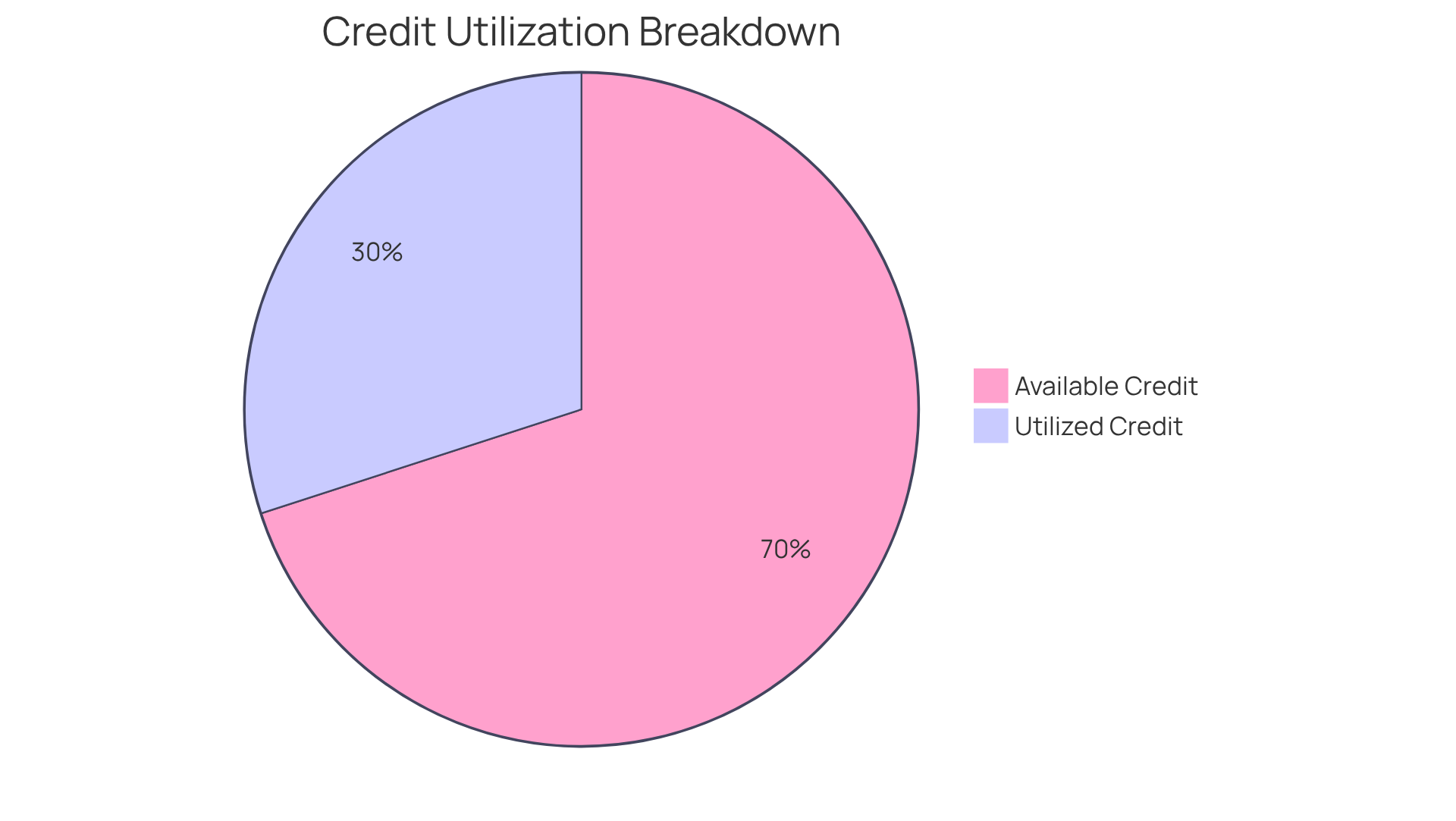

Manage Your Credit Utilization Ratio Effectively

To enhance your score, we understand how important it is to keep your utilization ratio below 30%. This means that if you have a limit of $10,000, it’s best not to carry a balance exceeding $3,000. By reducing current balances and avoiding maxing out your cards, you can significantly improve your financial profile. This not only makes you a more appealing candidate by improving your credit score for HELOC loan but also brings you one step closer to achieving your financial goals. We’re here to support you every step of the way as you navigate these important decisions.

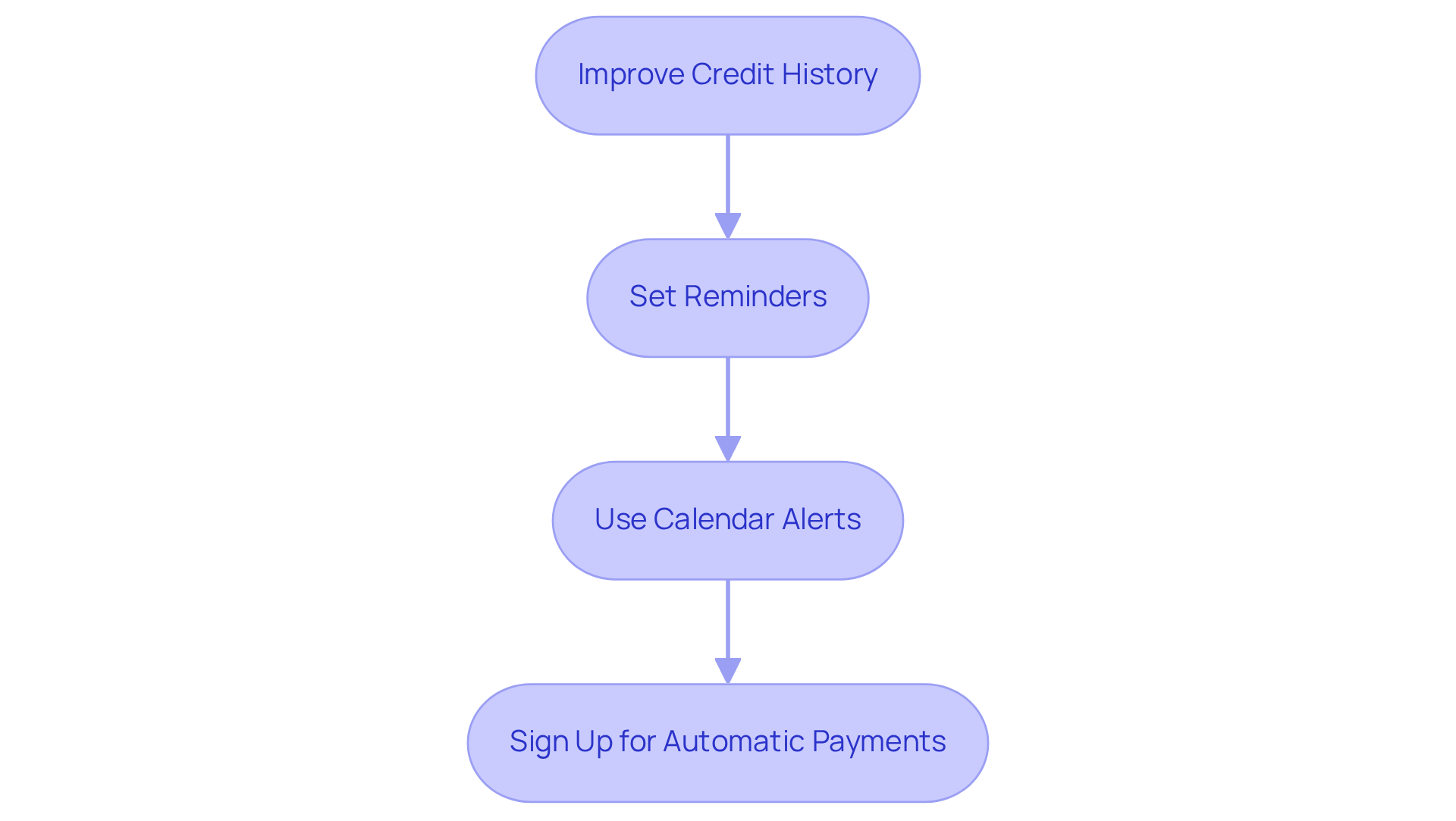

Make Timely Payments to Enhance Your Credit History

We understand how challenging it can be to manage your finances effectively. Creating a routine of making prompt contributions is essential for enhancing your financial standing. To help you stay on track, consider:

- Setting reminders

- Using calendar alerts to ensure you never miss a due date

Additionally, think about signing up for automatic payments for your regular bills. This will not only ensure a steady payment history but also significantly benefit your financial reputation over time. Remember, we’re here to support you every step of the way as you work towards a more secure financial future.

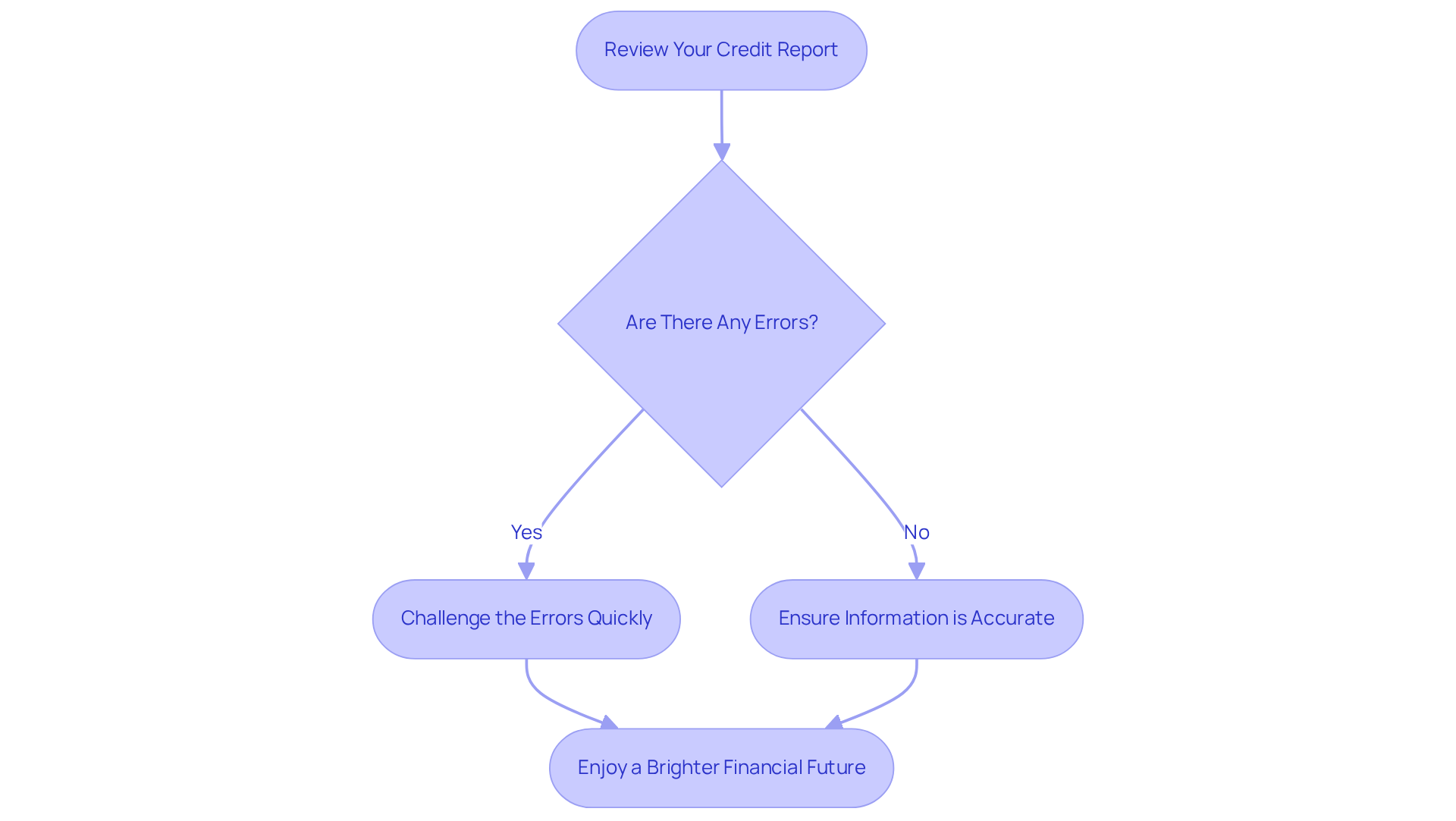

Regularly Check Your Credit Report for Errors

We know how challenging it can be to navigate your financial landscape. Consistently examining your financial report is crucial; it allows you to identify and contest any mistakes that might be lowering your score. Remember, you are entitled to one free report each year from each of the three major bureaus. This is an opportunity you shouldn’t miss—ensure that all the information is accurate.

If you discover any inconsistencies, it’s important to challenge them quickly. Taking this action can significantly enhance your financial standing, empowering you to make informed decisions. We’re here to support you every step of the way as you work towards a brighter financial future.

Reduce Outstanding Debts to Improve Your Credit Score

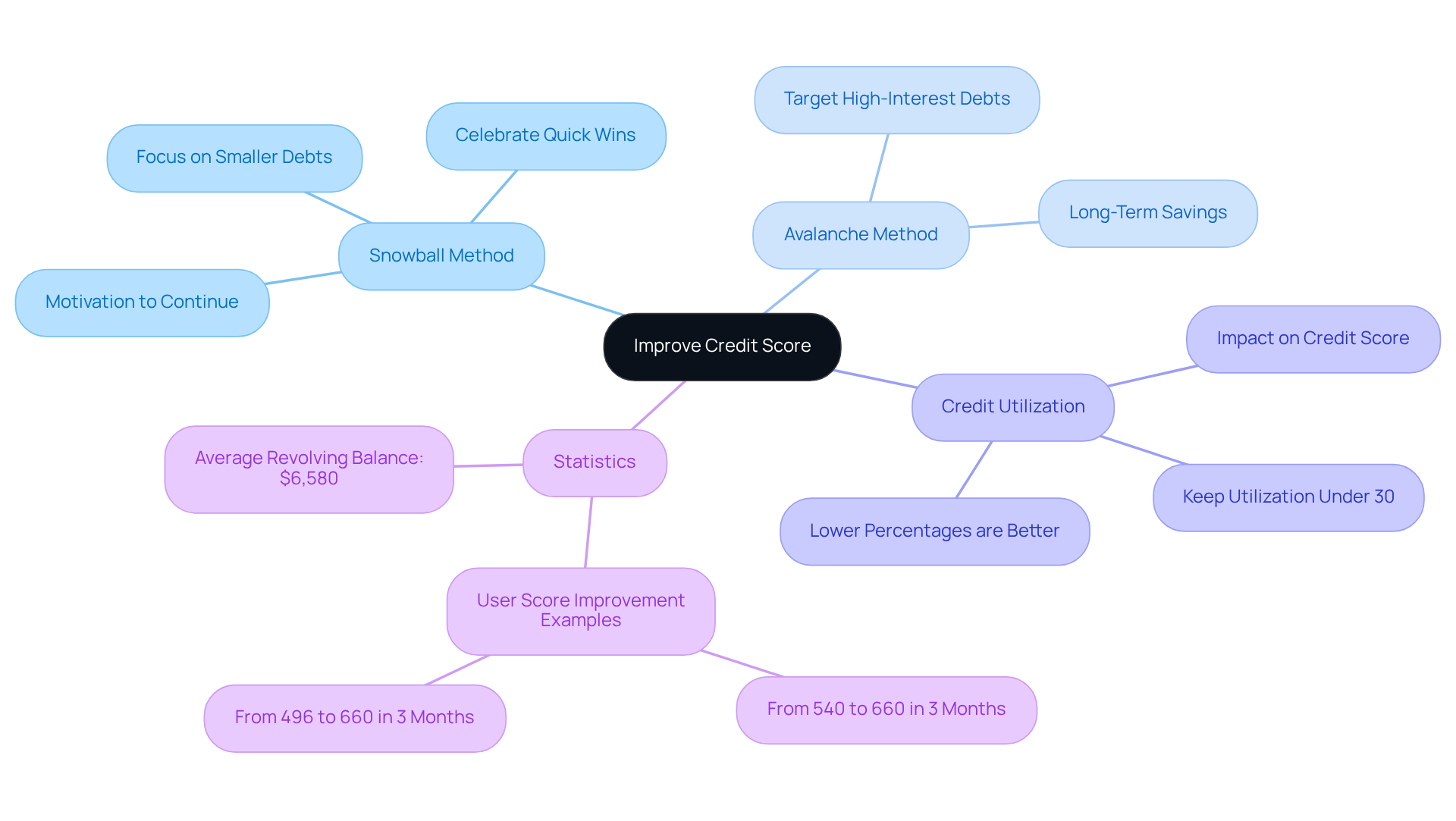

Improving your credit score for HELOC loan approval can feel daunting, but focusing on lowering your remaining balances—especially those with high interest rates like credit cards—can significantly boost your chances. We know how challenging this can be, but implementing organized repayment strategies, such as the snowball and avalanche methods, can make a real difference.

The snowball approach encourages you to tackle smaller debts first, allowing you to celebrate quick wins that motivate you to keep going. Conversely, the avalanche strategy targets high-interest liabilities, which may save you more money in the long run. As your debt decreases, your borrowing utilization ratio improves—an essential factor in your credit scoring.

Typically, utilization of available funds is the second-largest element in your rating. Keeping your utilization under 30% is advisable, with even lower percentages being more beneficial. For instance, many individuals who effectively reduced their card balances have seen substantial improvements in their credit scores. One user reported a rise from 540 to 660 within just three months after settling collections, showcasing the powerful impact of thoughtful financial management.

Statistics reveal that the average revolving charge card balance is currently $6,580, highlighting the importance of managing high balances. By methodically lowering your liabilities, you not only enhance your financial profile but also improve your credit score for a HELOC loan approval. Financial advisors emphasize that timely payments and strategic debt reduction are vital for maintaining good financial health, ultimately leading to better borrowing opportunities.

Moreover, those with the highest credit ratings often have utilization in the single digits, reinforcing the benefits of sound debt management. Remember, we’re here to support you every step of the way as you work towards a brighter financial future.

Build a Diverse Credit Mix for Better Scores

To enhance your score, we understand how important it is to consider diversifying your financial mix. This can include a blend of charge cards, installment loans, and retail accounts. However, it’s essential to only take on new borrowing if you can manage it responsibly. A comprehensive financial profile can lead to improved ratings and a better credit score for HELOC loan acceptance. Remember, we’re here to support you every step of the way.

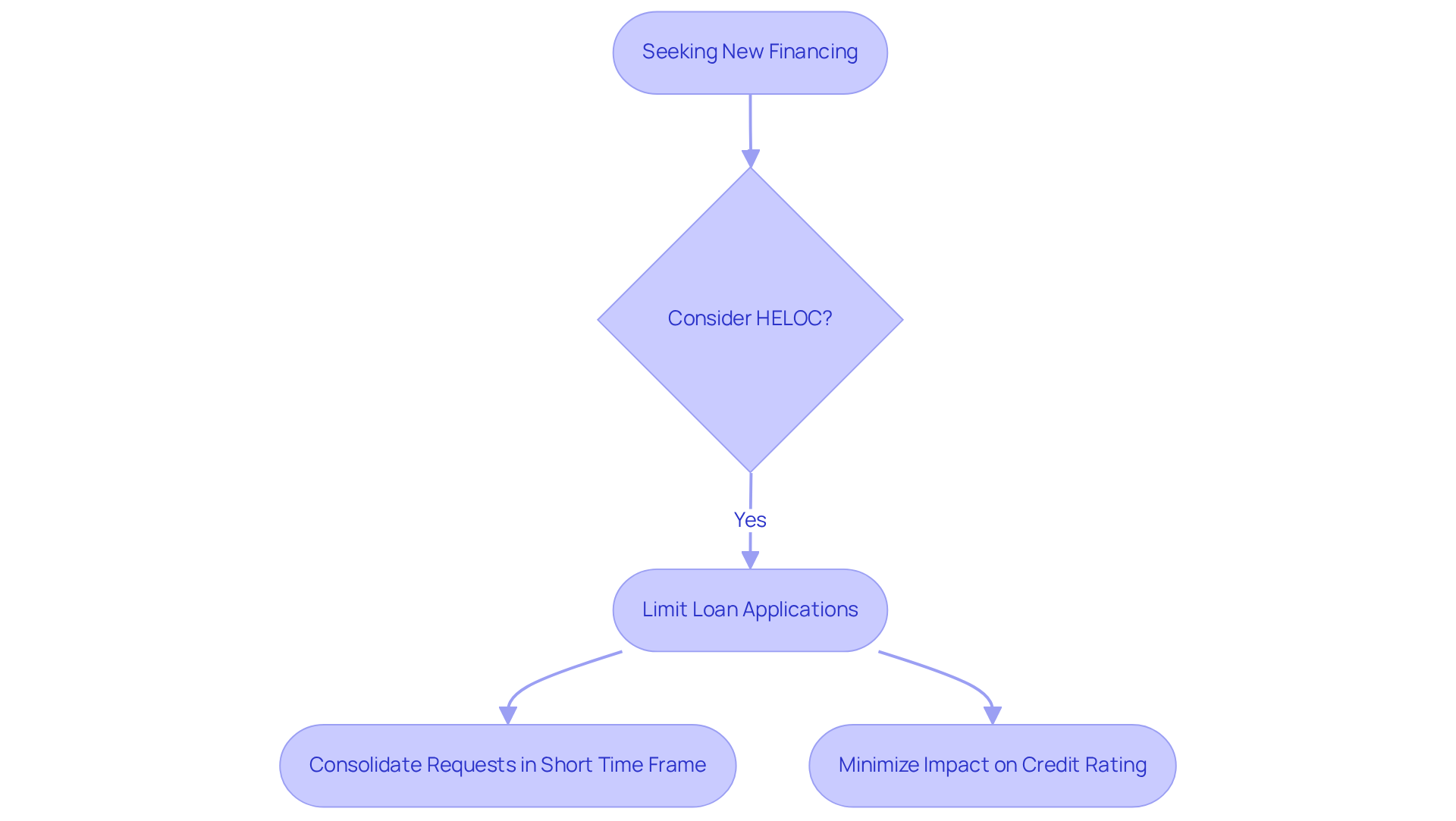

Limit Hard Inquiries to Protect Your Credit Score

We understand that seeking new financing can be a daunting experience. Each time you request it, a hard inquiry is created, which can slightly reduce your credit rating. To protect your rating, it’s wise to limit the number of loan applications you submit. If you’re considering a Home Equity Line of Credit (HELOC), it’s important to keep in mind your credit score for HELOC loan when consolidating your requests within a short time frame. This approach can help minimize the impact of multiple inquiries on your financial rating. Remember, we’re here to support you every step of the way.

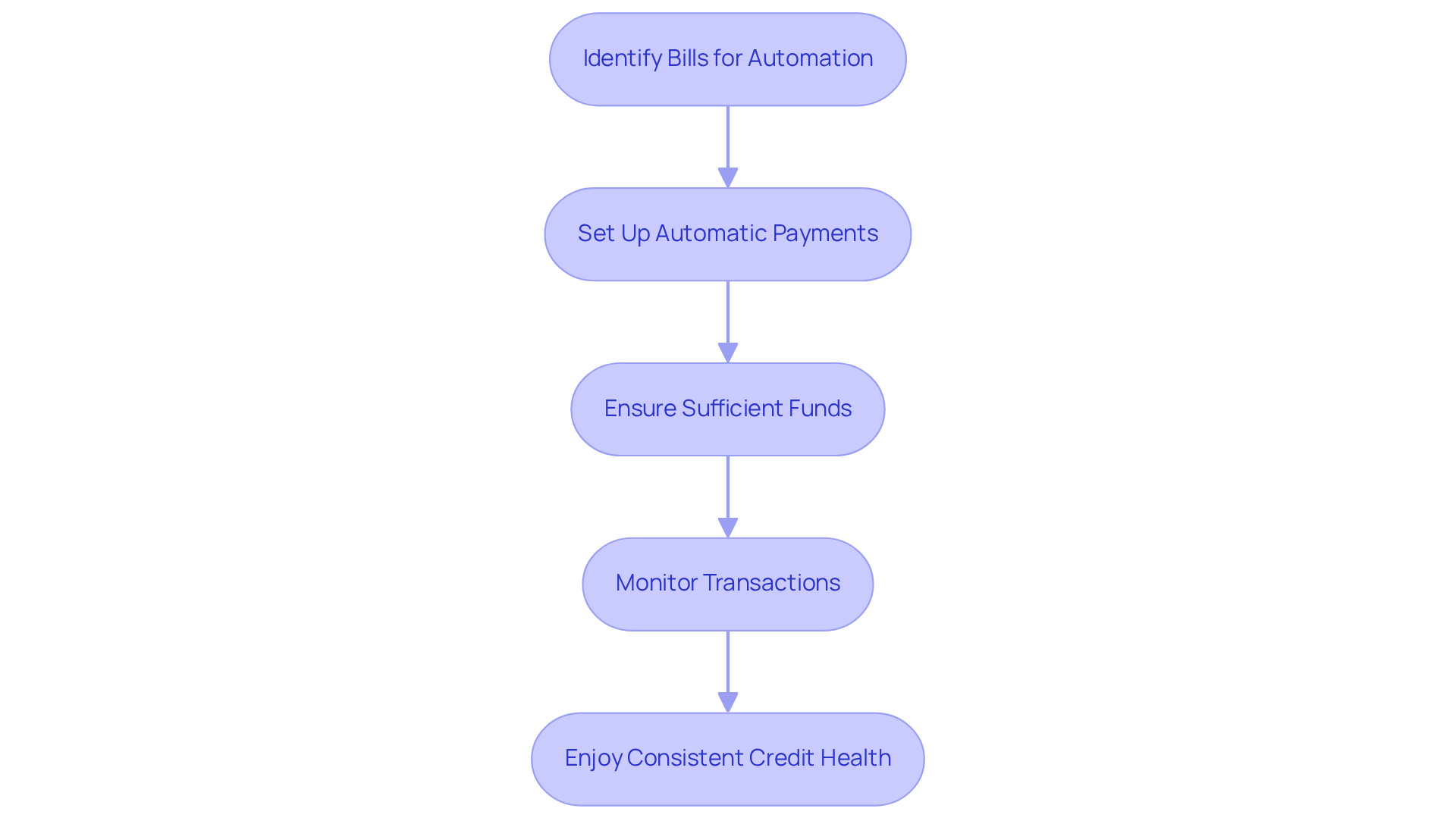

Set Up Automatic Payments for Consistent Credit Health

Setting up automatic transactions for your bills is a proactive way to enhance your financial well-being. We understand how challenging it can be to keep track of due dates, and by automating these transactions, you can significantly reduce the risk of delays that could negatively impact your credit score for heloc loan. It’s essential to establish these automatic payments to process before the due date, helping you avoid late fees and ensuring prompt bill settlements.

Additionally, it’s crucial to ensure that your bank account has sufficient funds to cover these payments. This simple step can help you avoid overdraft fees, which can add unnecessary stress to your financial situation. By taking these measures, you are not just maintaining a positive financial history; you are also supporting your overall money management journey. Remember, we’re here to support you every step of the way as you take control of your finances.

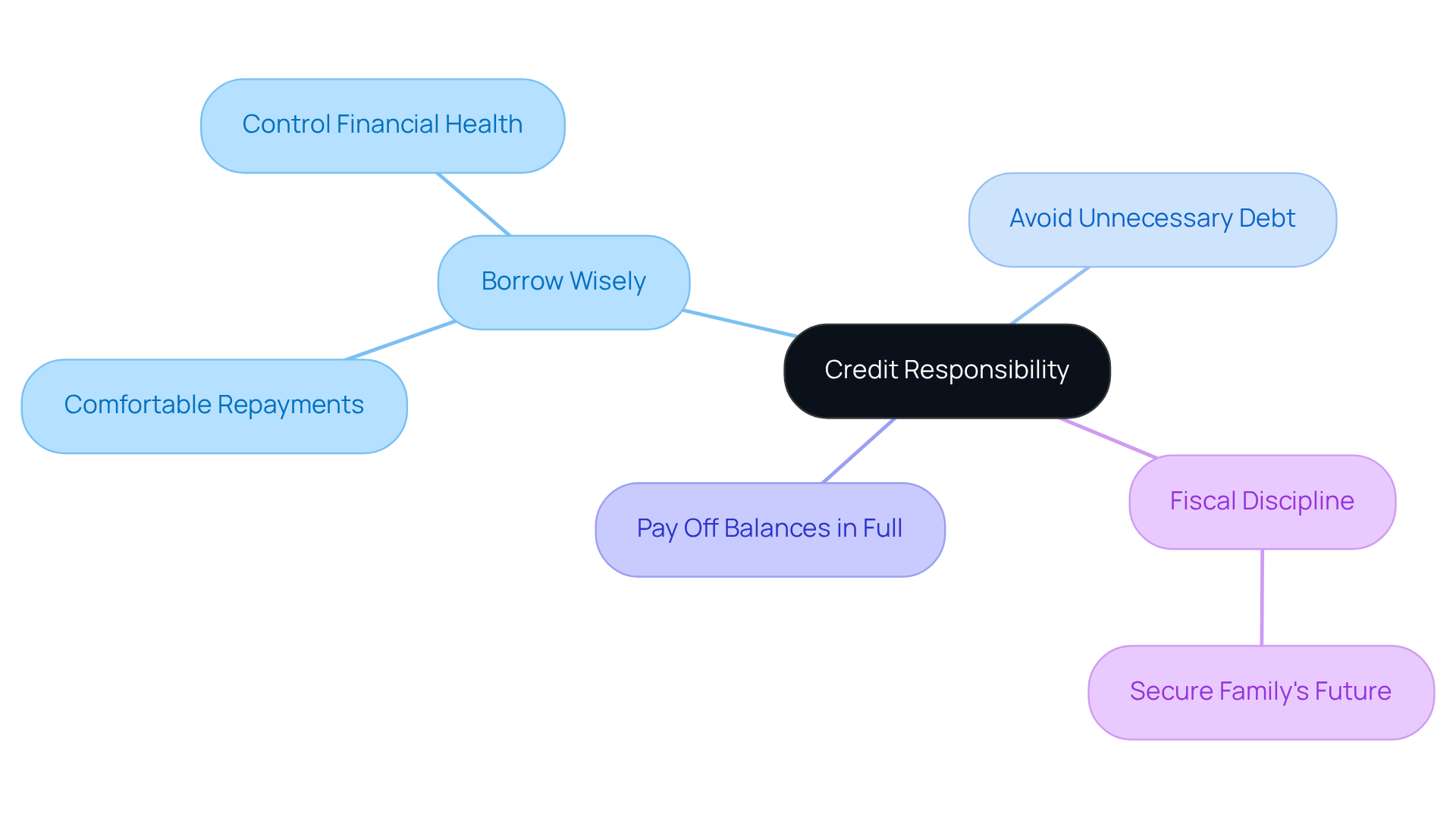

Use Credit Responsibly to Enhance Your Score

We know how challenging managing finances can be, and using financial resources responsibly is essential. This means borrowing only what you can comfortably repay. By avoiding unnecessary debt and striving to pay off your balances in full each month, you can take control of your financial health.

This responsible behavior not only helps maintain a good financial rating but also fosters fiscal discipline. Such discipline is crucial when you’re aiming to improve your credit score for a HELOC loan. Remember, every step you take towards financial responsibility is a step towards securing your family’s future.

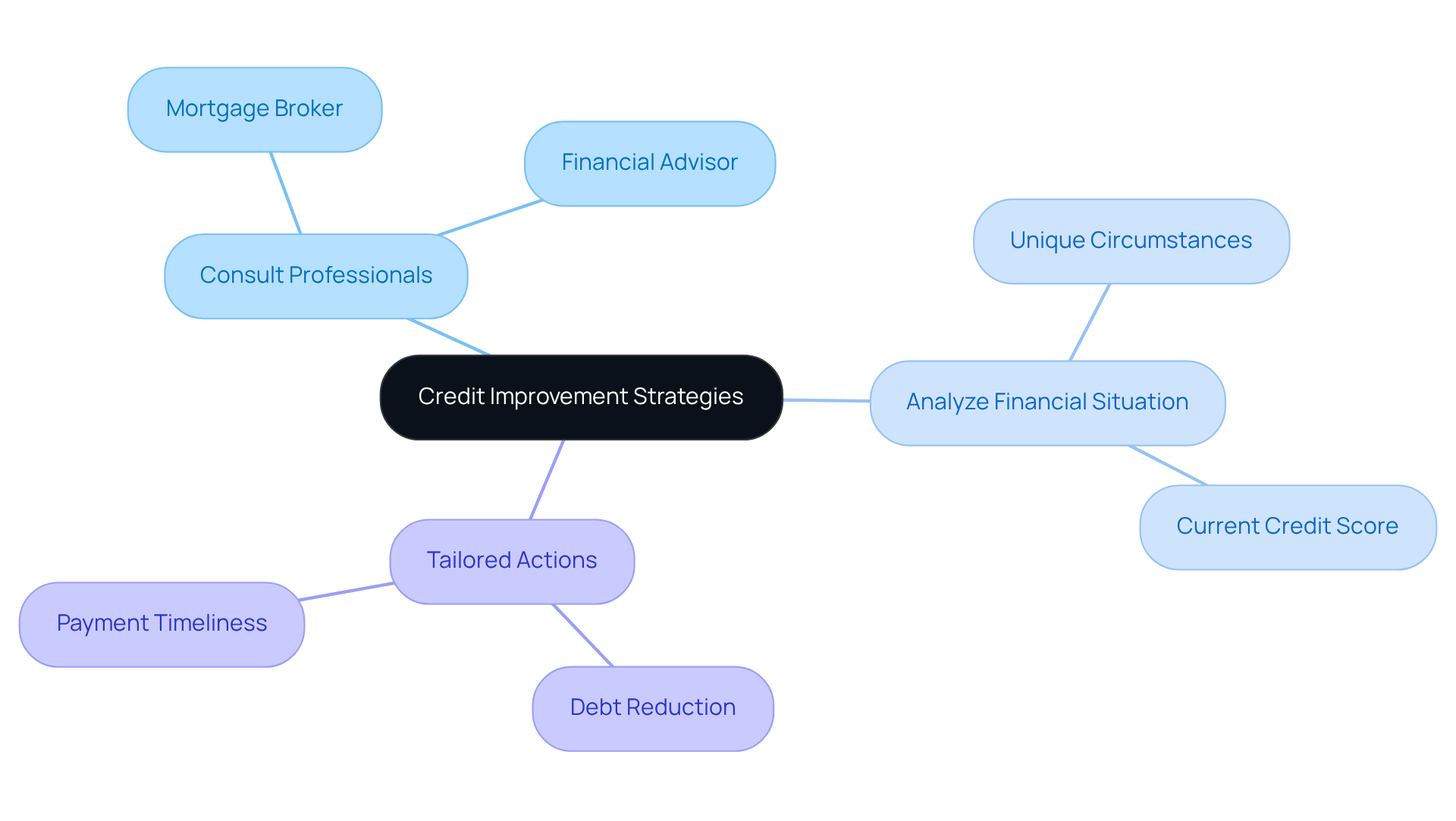

Seek Professional Advice for Tailored Credit Improvement Strategies

We understand how challenging it can be to navigate the complexities of improving your credit score. Consulting with a mortgage broker or financial advisor can be a vital step in this journey. These caring professionals can analyze your unique financial situation and recommend specific, tailored actions to enhance your creditworthiness. By doing so, they can significantly increase your chances of HELOC loan approval, which is closely linked to your credit score for a HELOC loan, empowering you to achieve your financial goals. Remember, we’re here to support you every step of the way.

Conclusion

Improving your credit score is essential for securing a Home Equity Line of Credit (HELOC) loan, and the strategies outlined here provide a comprehensive roadmap to achieve that goal. We know how challenging this can be, but by focusing on personalized financial consultations, effective credit utilization, timely payments, and proactive debt management, you can significantly enhance your creditworthiness and increase your chances of loan approval.

Key strategies include:

- Managing your credit utilization ratios to stay below 30%

- Making timely payments to build a solid credit history

- Regularly checking your credit reports for errors

- Reducing outstanding debts through organized repayment methods

- Diversifying your credit types

- Limiting hard inquiries

Each of these approaches plays a crucial role in painting a positive financial picture that lenders are more likely to trust.

Ultimately, taking control of your credit score is not just about numbers; it’s about paving the way for a secure financial future. Seeking professional advice can provide tailored strategies that align with your individual circumstances, empowering you to make informed decisions. By implementing these strategies and remaining committed to financial responsibility, you can unlock the doors to greater lending opportunities and achieve your financial aspirations.

Frequently Asked Questions

What services does F5 Mortgage provide to help improve credit scores?

F5 Mortgage offers personalized consultations that assess your financial history and current monetary status to develop tailored strategies aimed at improving your credit score for a HELOC loan.

How effective are the consultations provided by F5 Mortgage?

The consultations have proven effective, with 61% of clients reporting enhancements in their financial ratings after receiving personalized guidance.

Why is it important to have a customized financial strategy?

Customized financial strategies address individual needs and circumstances, which can lead to more favorable loan outcomes, as financial advisors prefer to see that clients can manage their finances before trusting them with large sums of money.

What is a credit utilization ratio, and why is it important?

A credit utilization ratio is the percentage of your credit limit that you are using. It is important to keep this ratio below 30% to enhance your credit score and improve your chances of securing a HELOC loan.

How can I manage my credit utilization ratio effectively?

To manage your credit utilization ratio, reduce current balances and avoid maxing out your credit cards. For example, if your credit limit is $10,000, aim to keep your balance below $3,000.

What steps can I take to ensure timely payments on my bills?

To make timely payments, consider setting reminders, using calendar alerts, and signing up for automatic payments for regular bills to maintain a steady payment history.

How does making timely payments benefit my financial reputation?

Consistently making timely payments helps enhance your credit history, which significantly benefits your financial reputation over time.