Overview

The main focus of this article is to explore options for obtaining low home equity loan rates that can help families upgrade their homes. We know how challenging this can be, and we’re here to support you every step of the way. It highlights various lenders, including F5 Mortgage, that offer competitive rates and personalized services. By leveraging home equity for renovations, families can create the spaces they’ve always dreamed of. However, it’s important to be mindful of potential risks, such as negative equity, as you navigate this process.

Introduction

Did you know that nearly half of all mortgaged properties are classified as ‘equity rich’? This statistic not only captures attention but also highlights a significant opportunity for homeowners. We understand how challenging it can be to navigate financial needs, and leveraging your property value for renovations could be a wonderful solution. With the rise of low home equity loan rates, families can access funds for upgrades that enhance their living spaces and contribute to long-term wealth accumulation.

However, as the market fluctuates, the challenge lies in navigating the myriad of options available. How can you ensure that you secure the best rates and terms for your unique circumstances? We’re here to support you every step of the way as you explore these possibilities.

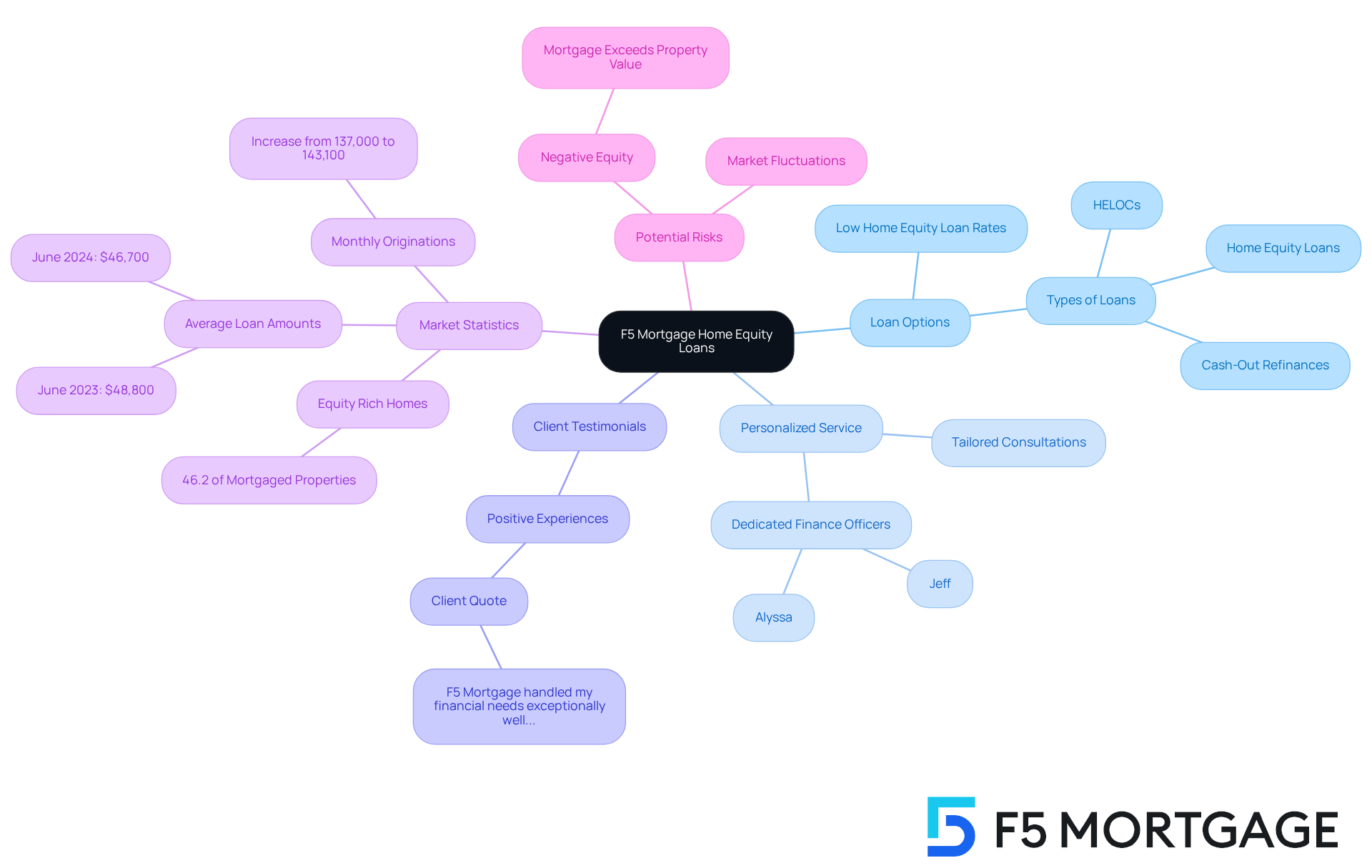

F5 Mortgage: Unlock Competitive Home Equity Loan Rates with Personalized Service

At F5 Mortgage, we offer a comprehensive selection of equity loan options, including low home equity loan rates, designed to meet the unique needs of families. We understand how important it is for you to find the right financial solutions. That’s why we focus on personalized consultations, allowing you to explore competitive rates and terms, such as low home equity loan rates, that align with your financial goals. With partnerships with over two dozen leading lenders, we provide access to the best deals available, including low home equity loan rates, empowering you to confidently enhance your home.

Did you know that 46.2% of mortgaged properties are classified as ‘equity rich’? This means their remaining debt is less than half the property’s value. For families looking to tap into their property value for renovations or other financial needs, low home equity loan rates provide a significant opportunity. In 2025, the typical residential collateral borrowing origination figure was around $46,700, reflecting a slight revival in collateral borrowing as homeowners seek alternatives to cash-out refinancing.

We recognize that tailored assistance is essential for securing financing options with low home equity loan rates. Our dedicated finance officers, such as Jeff and Alyssa, prioritize understanding your unique financial situation. They work diligently to craft solutions that best suit your needs, ensuring a smoother borrowing experience.

Many families have successfully used low home equity loan rates along with competitive property loan rates to finance substantial renovations, enhancing both their home’s value and livability. By leveraging their property value, homeowners can embark on renovations that not only improve their living environment but also contribute to long-term wealth accumulation. Our satisfied clients often share their positive experiences: “F5 Mortgage handled my financial needs exceptionally well… The experience I had was fantastic compared to all of the other mortgage brokers I had spoken with throughout that process.”

However, it’s important for families to be aware of potential risks, such as negative equity, where the mortgage owed exceeds the property’s worth, particularly in fluctuating markets. By thoughtfully utilizing their property value, homeowners can undertake renovations that bolster their financial future. We know how challenging this can be, and we’re here to support you every step of the way.

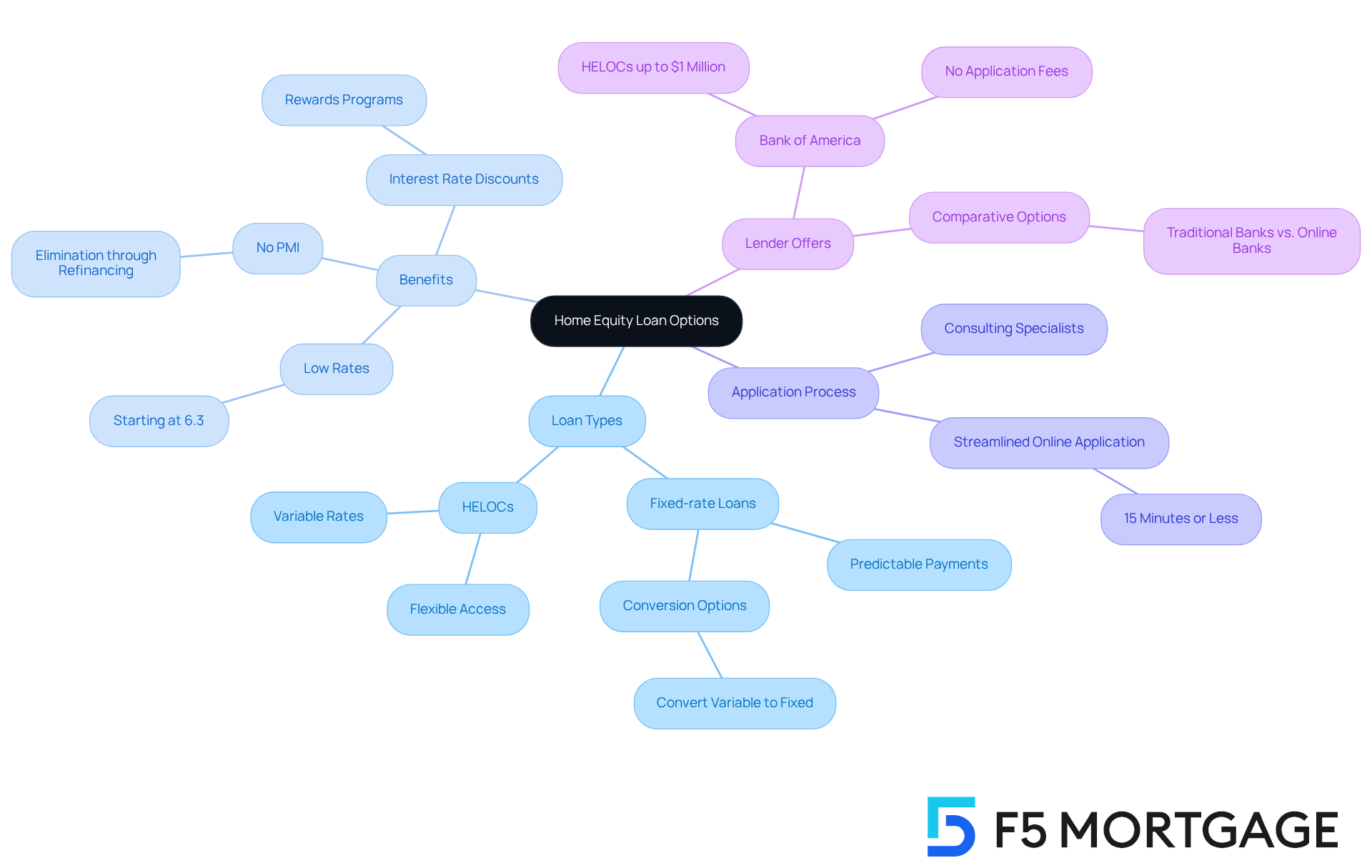

Bank of America: Explore Flexible Home Equity Loan Options and Competitive Rates

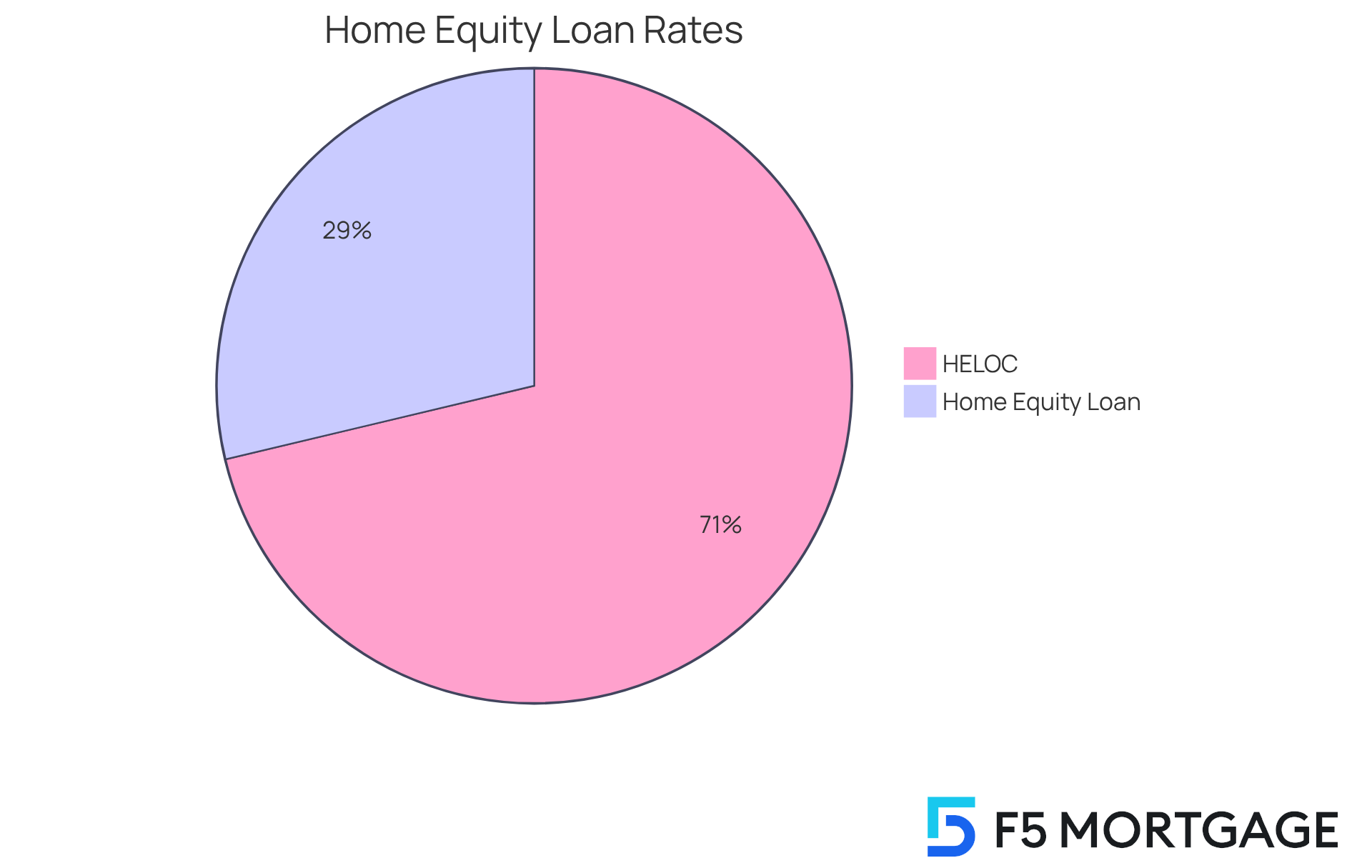

Property value loans offer a variety of options, including fixed-rate loans and property value lines of credit (HELOCs). These choices can be quite appealing for homeowners eager to tap into their property’s value. With low home equity loan rates starting at 6.3% and flexible terms, these loans are essential for those looking to access their home equity for renovations or other financial needs. Many lenders even allow borrowers to convert part or all of a variable-interest balance to a fixed rate without incurring conversion fees, making it easier for those who prefer predictable payments.

In California, homeowners who purchased their homes with less than a 20% down payment might have the opportunity to eliminate private mortgage insurance (PMI) through refinancing. Given the area’s significant property appreciation rates, calculating a new loan-to-value (LTV) ratio based on the increased value of their home could enable borrowers to secure a more favorable mortgage without PMI, ultimately lowering their monthly payments.

The online application process for these loans is typically streamlined, allowing clients to access funds quickly and efficiently. This ease of access is particularly beneficial for homeowners looking to finance important upgrades. Many utilize their HELOCs for renovations, emergency expenses, or educational costs due to low home equity loan rates. Surveys indicate that a considerable number of current HELOC users would consider using their assets for property enhancements, highlighting a strong trend towards leveraging residential value to increase overall worth.

Additionally, some lenders offer interest rate reductions for qualifying clients who participate in rewards programs, making property-backed products even more affordable. With minimum lines of credit often starting around $25,000 and the potential to secure substantial amounts, homeowners can find tailored solutions to meet their specific financial situations.

For families considering property enhancements, it is advisable to explore various lenders and their offerings to find the best fit for your financial needs. Consulting with a mortgage specialist can provide valuable insights into the most suitable options available, including strategies for enhancing property value through rate-and-term refinancing and cash-out alternatives. We know how challenging this can be, and we’re here to support you every step of the way.

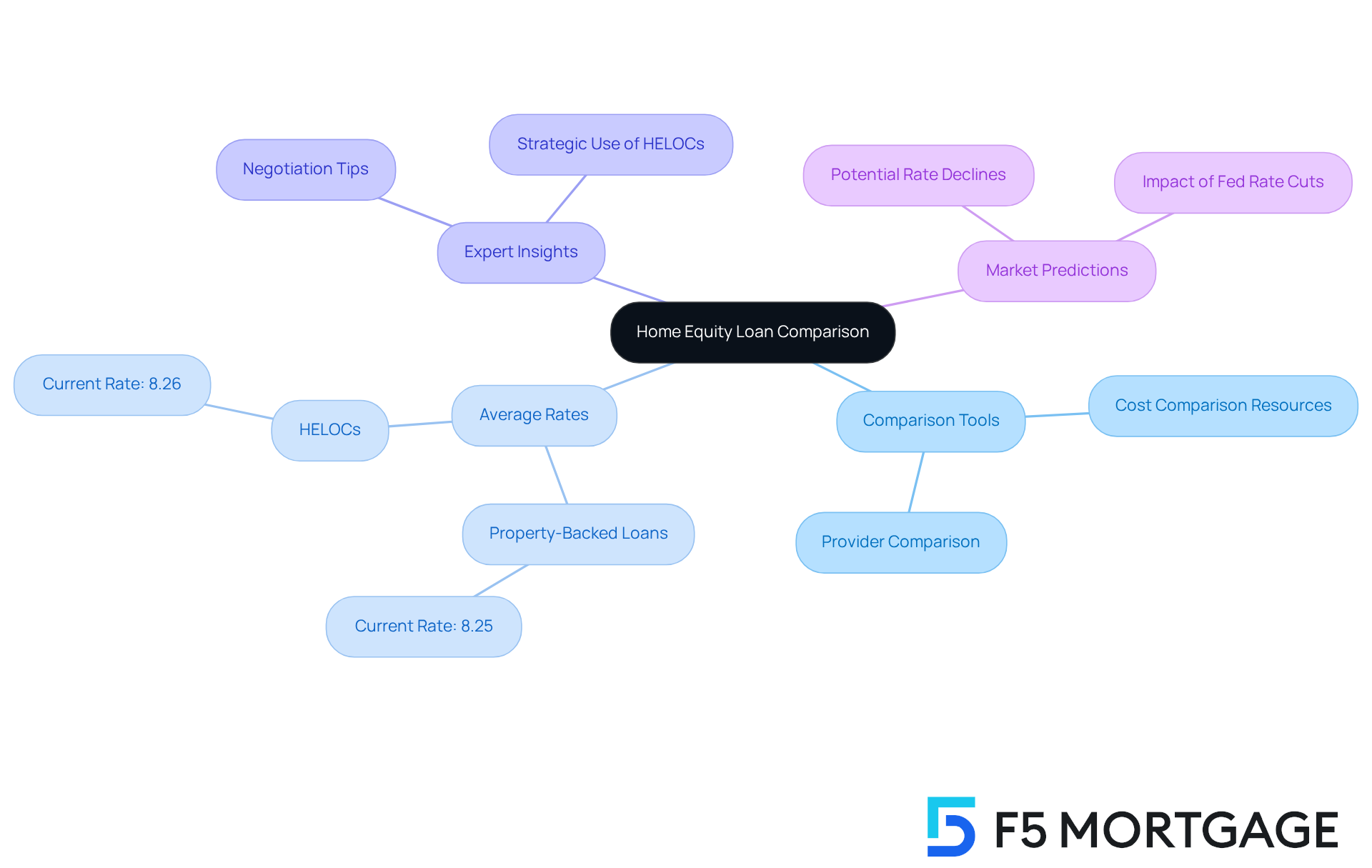

Bankrate: Utilize Comprehensive Tools to Compare Home Equity Loan Rates

At Bankrate, we understand how overwhelming it can be to navigate the mortgage financing landscape. That’s why we offer a collection of thorough tools designed to assist property owners in comparing costs from various providers. By utilizing these resources, you can identify the most advantageous prices and terms available in the market, empowering you to make informed decisions that suit your needs.

Currently, the average percentages stand at 8.25% for property-backed loans and 8.26% for HELOCs. This context is crucial for borrowers seeking clarity in their options. Financial experts emphasize that using comparison tools not only enhances transparency but also empowers you to negotiate better terms. Our goal is to help you secure the most favorable financing options tailored to your unique situation.

At F5 Mortgage, we collaborate with over twenty leading lenders to find the best offer for you, whether that means the most competitive prices or the quickest closing times. As Chris Carter, Sales Manager at Univest Home Loans, wisely notes, ‘Now is a great time to obtain a line of credit against property.’ This strategic approach can lead to significant savings—potentially totaling almost $5,000 over a 20-year financing period if interest rates decline by just a quarter-point.

Moreover, predictions suggest that property values might drop in 2025, creating an opportune moment for families looking to enhance their homes. We know how challenging this can be, and we’re here to support you every step of the way. Take action today to explore your options and secure the best financing for your future.

Century Credit Union: Access Tailored Home Equity Loans for Better Rates

At F5 Mortgage, we understand how challenging it can be to navigate property financing. That’s why we focus on offering customized solutions that cater to the unique financial circumstances of families looking to enhance their homes. With competitive rates and tailored service, you can discover options such as low home equity loan rates that truly meet your needs, allowing you to access the value in your home for upgrades or renovations.

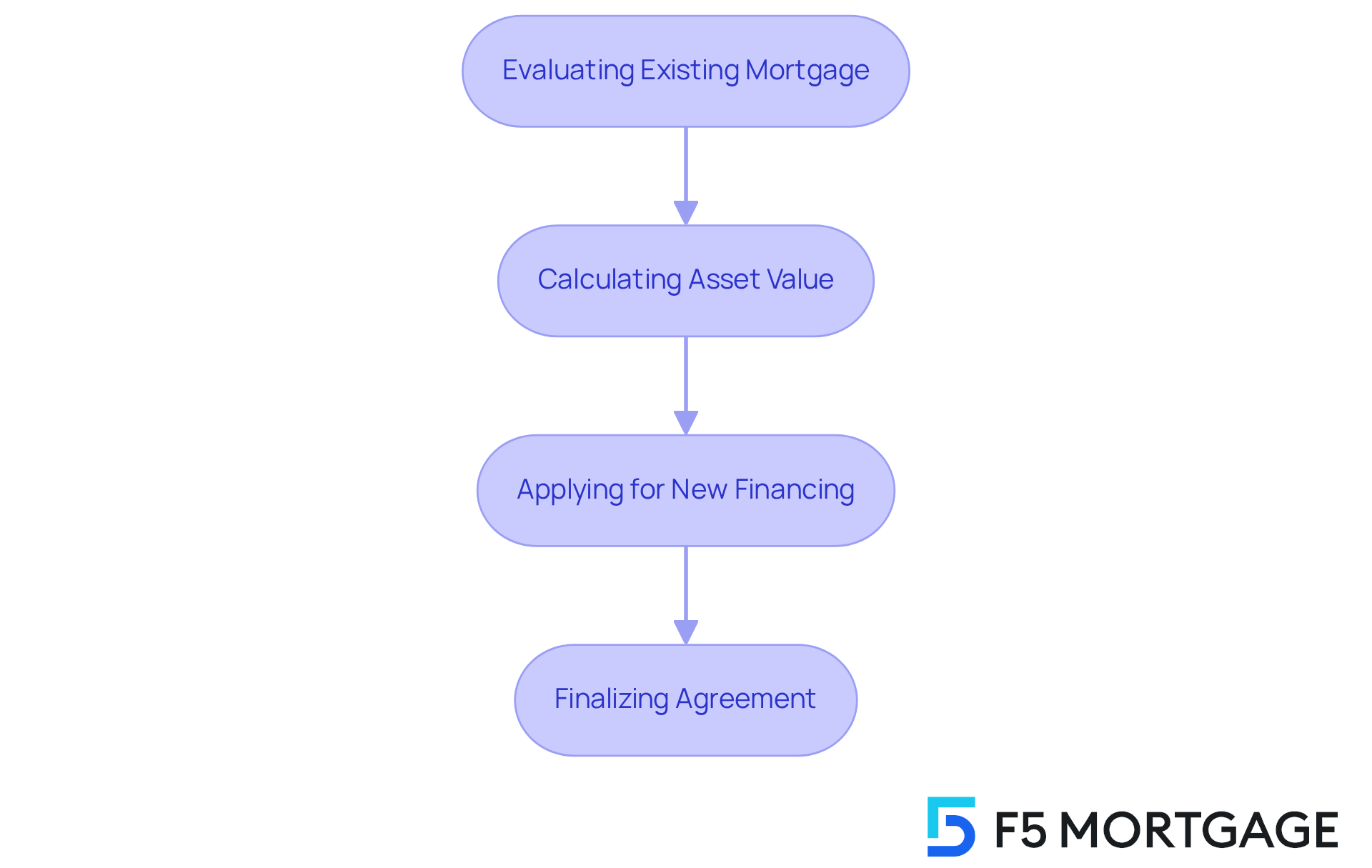

The refinancing process in California typically involves several key stages:

- Evaluating your existing mortgage

- Calculating your asset value

- Applying for a new financing option

- Finalizing the agreement

We know how important it is to understand the associated costs—such as application fees, appraisal fees, and closing costs—to ensure a smooth refinancing experience.

Our clients have consistently praised our team for their exceptional service and expertise. For instance, Ruth Vest noted how seamlessly her refinancing process unfolded, thanks to the careful assistance from our financing specialists. Similarly, first-time homebuyer Marqis Lamar expressed his gratitude for the educational and patient guidance he received throughout the journey.

At F5 Mortgage, we’re here to support you every step of the way, dedicated to helping you maximize your property value while ensuring a smooth experience. Let us assist you in turning your home into the space you’ve always dreamed of.

Rocket Mortgage: Secure Your Home Equity Loan with a Streamlined Process

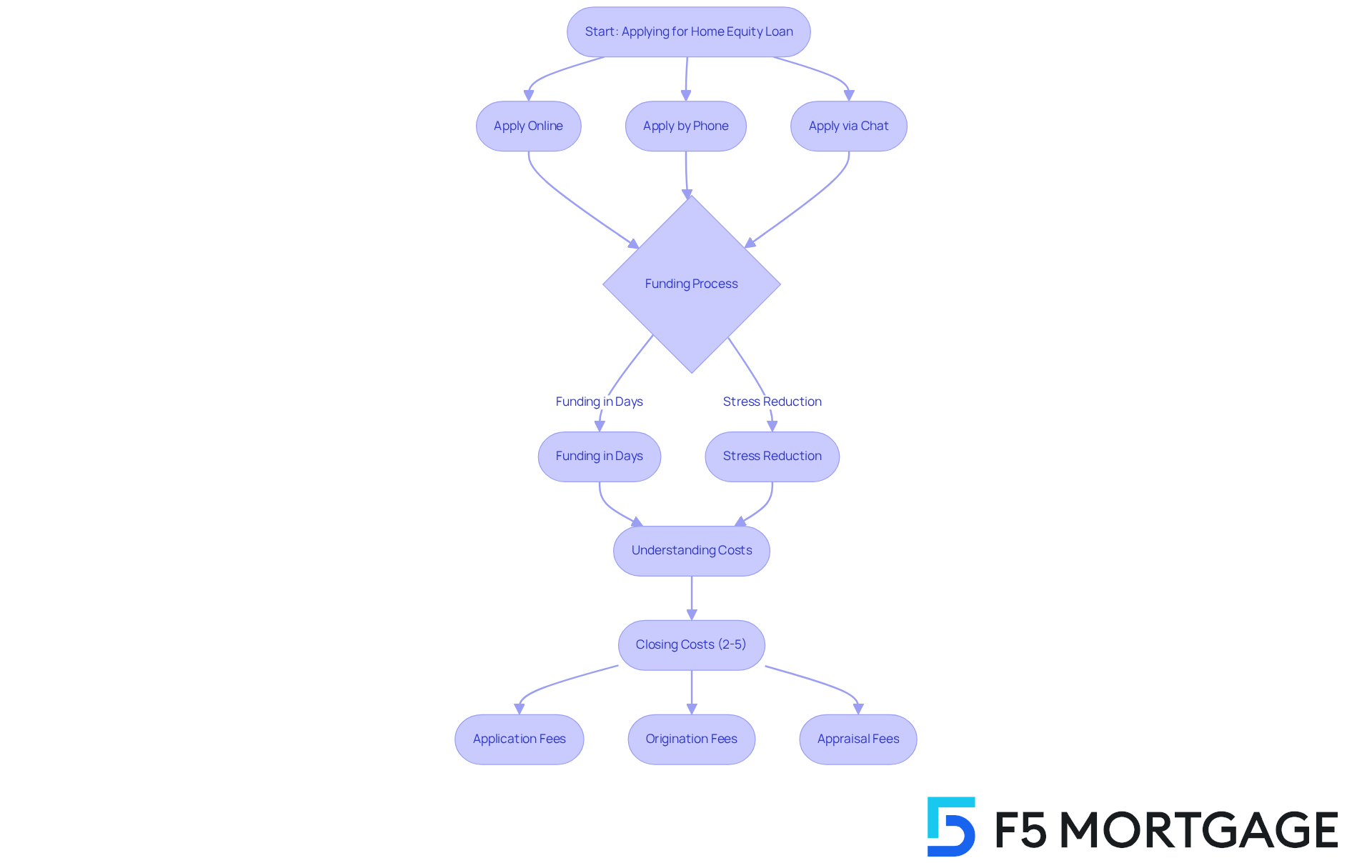

At F5 Mortgage, we understand how important home equity financing can be for families. Our application process is designed to be highly efficient, allowing you to apply online, by phone, or through chat. This flexibility means you can choose the method that best suits your needs, making it a wonderful option for those who appreciate personalized financial solutions.

Imagine having a conversation with our financing specialists who can help you tailor an agreement that aligns perfectly with your goals. We know how challenging this can be, and we’re here to support you every step of the way. Plus, the typical time to secure home financing has significantly decreased. Many clients report successful funding in just a few days. This swift turnaround alleviates the stress often associated with traditional financing processes, enabling you to access your equity when you need it most.

Understanding the costs associated with refinancing is crucial for families considering this option. In California, closing costs for mortgage refinancing typically range from 2% to 5% of the borrowed amount. For example, if your new loan amount is $300,000, you might expect to pay between $6,000 and $15,000 in closing costs. These expenses can include:

- Application fees

- Origination fees

- Appraisal fees

- And more

Determining your break-even point can help you figure out how long it will take to recover these costs through savings in monthly payments or interest. For families looking to enhance their homes, leveraging property value can provide significant financial benefits, particularly when taking advantage of low home equity loan rates during times of declining mortgage costs. We’re here to guide you through this process and help you make informed decisions for your financial future.

Community America: Discover Unique Home Equity Loan Products for Your Needs

At F5 Mortgage, we understand how challenging it can be to navigate home equity loan options. That’s why we offer a range of innovative products tailored to meet the diverse needs of families looking to upgrade their homes. With competitive prices and personalized service, we’re here to help you discover solutions that align perfectly with your financial goals.

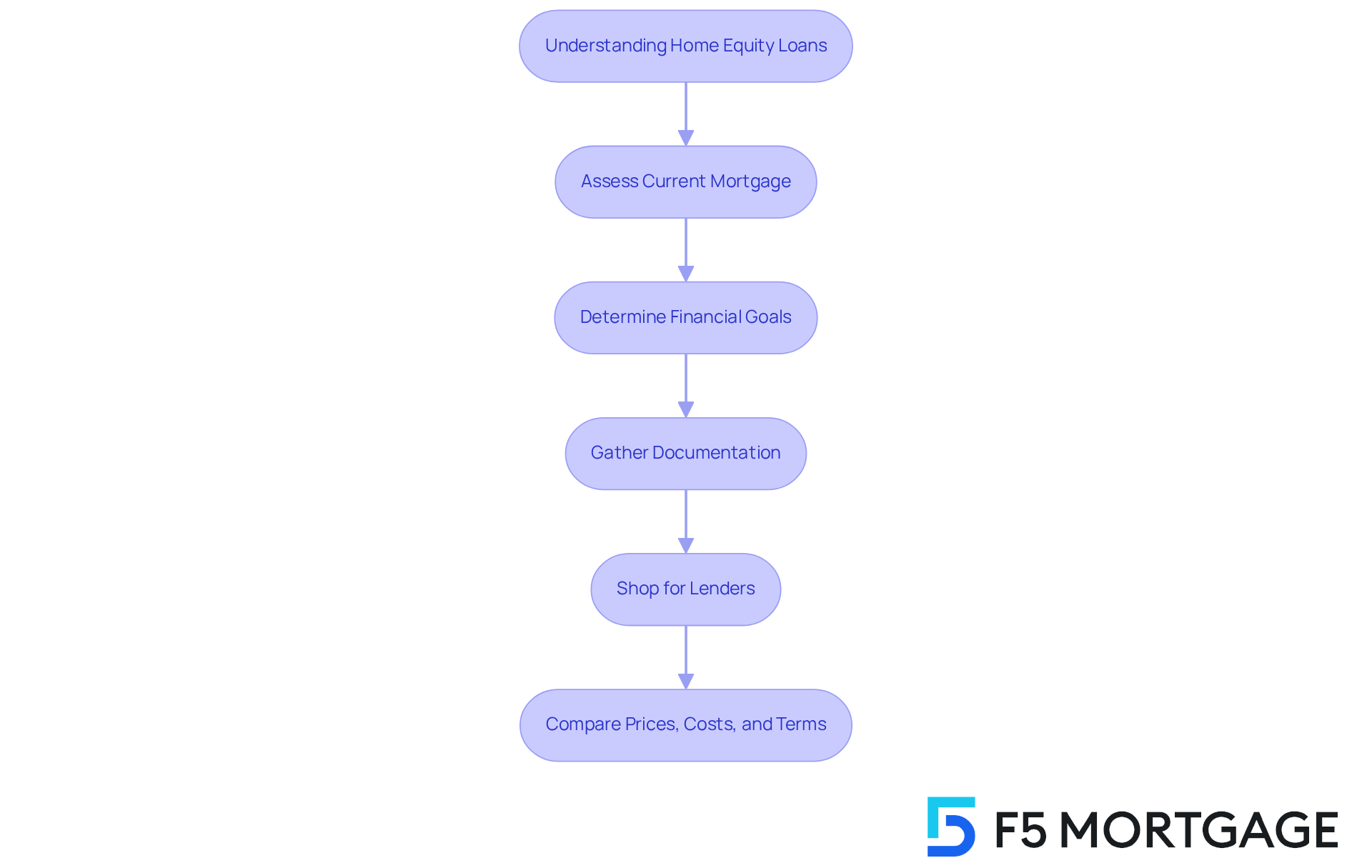

If you’re considering refinancing in California, it’s essential to understand the steps involved. Start by assessing your current mortgage and determining your financial goals. Gather the necessary documentation, and then it’s time to shop for lenders. Comparing prices, costs, and terms is crucial to ensure your individual needs are met. At F5 Mortgage, we pride ourselves on our competitive pricing and tailored service, making this process smoother for you.

Whether you’re looking to refurbish your home or combine existing debt, these financial products can be utilized effectively. The appeal of home equity loans lies not only in their affordability—home collateral financing typically offers low home equity loan rates compared to personal loans or credit cards—but also in their straightforward structure. This enables predictable monthly payments that remain consistent throughout the financing period.

As homeowners increasingly seek to tap into their equity, which now averages around $203,000, F5 Mortgage provides unique options that cater to both immediate financial needs and long-term aspirations. However, we know it’s important to consider potential risks, such as the possibility of negative equity if property prices decline. Ensuring you have a well-rounded understanding of these financial products is vital, and we’re here to support you every step of the way.

Allegacy: Find Flexible Home Equity Loan Options for Lower Rates

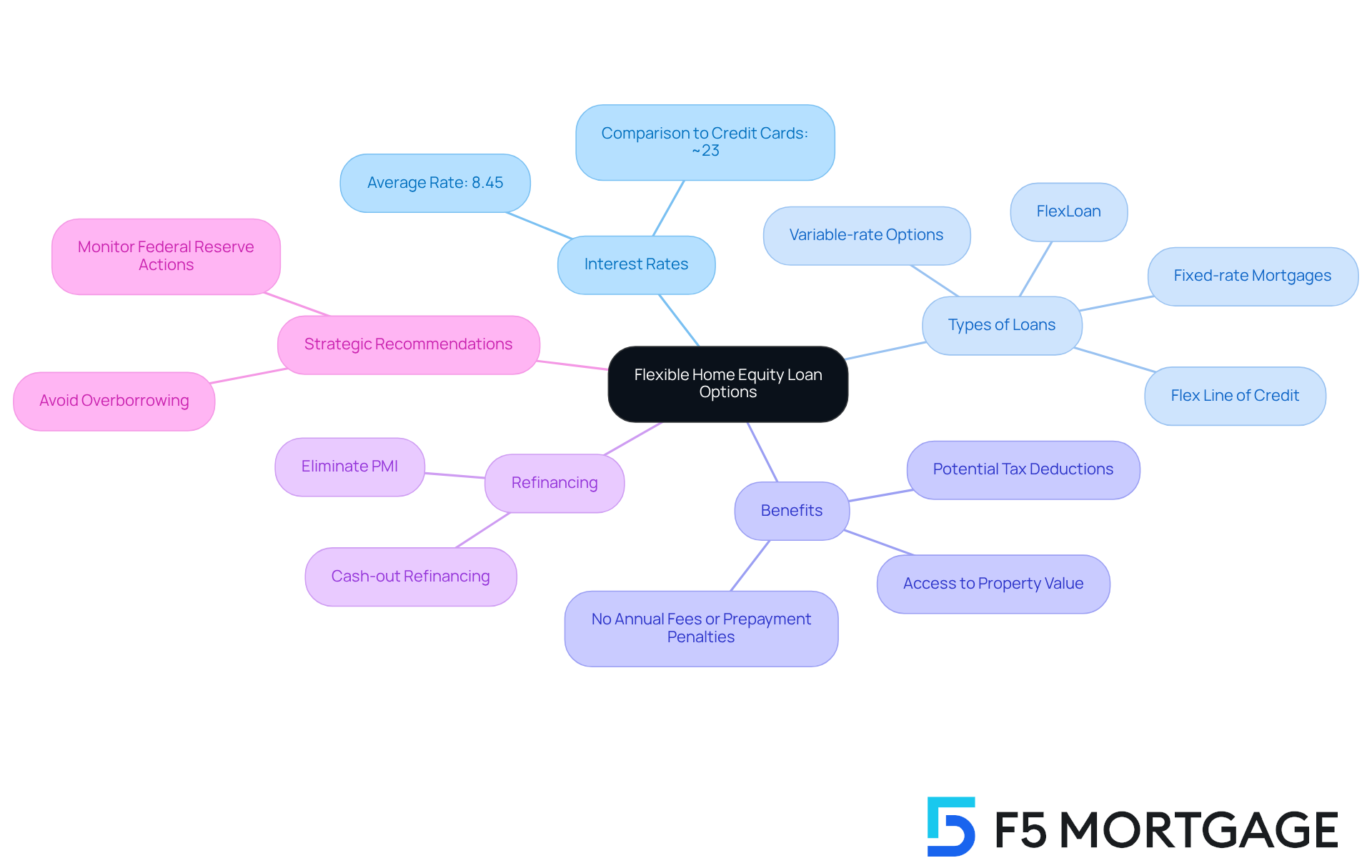

At F5 Mortgage, we understand how important it is for families to enhance their homes. We offer a variety of adaptable financing options specifically designed to meet your unique needs. With an average interest rate of just 8.45%, our financial products are significantly more affordable than the median credit card interest rate of nearly 23%. This competitive pricing allows you to access your property value for various purposes, such as renovations, debt consolidation, or significant one-time expenses, thanks to low home equity loan rates. We offer financing options up to $350,000, with a maximum value-to-loan ratio of 90% for primary residences.

One of the key advantages of F5 Mortgage’s home equity products is their flexibility. You can choose from fixed-rate mortgages, which provide predictable monthly payments, or variable-rate options that offer greater flexibility. For instance, our FlexLoan and Flex Line of Credit allow you to secure fixed terms on segments of your variable-interest products, creating a customized borrowing experience that aligns with your financial goals.

In addition to equity loans, if you purchased your home with a down payment of less than 20%, you might want to consider refinancing your current mortgage to eliminate private mortgage insurance (PMI). With property values appreciating significantly in California, refinancing can help you achieve a lower loan-to-value (LTV) ratio, potentially removing PMI expenses. If you’re facing significant costs, such as medical bills or education expenses, cash-out refinancing could be beneficial, allowing you to access additional funds while securing a lower interest rate on your new mortgage.

Many families have successfully enhanced their properties using F5 Mortgage options, leading to improved living environments and higher property values. Financial consultants often recommend utilizing property value for improvements, noting that it can be a strategic decision to invest in your real estate while benefiting from low home equity loan rates compared to personal financing. However, we know how challenging it can be to navigate these options, so it’s essential to avoid overextending against your property value to prevent potential financial pitfalls.

As the Federal Reserve continues to adjust interest rates, now is a favorable time for homeowners to explore options for securing low home equity loan rates. F5 Mortgage is dedicated to providing tailored service, ensuring that you receive the support you need to navigate the borrowing process with ease. We’re here to help you make property value loans and refinancing an attractive option for improving your family’s home.

Midland States Bank: Explore Competitive Home Equity Loan Features

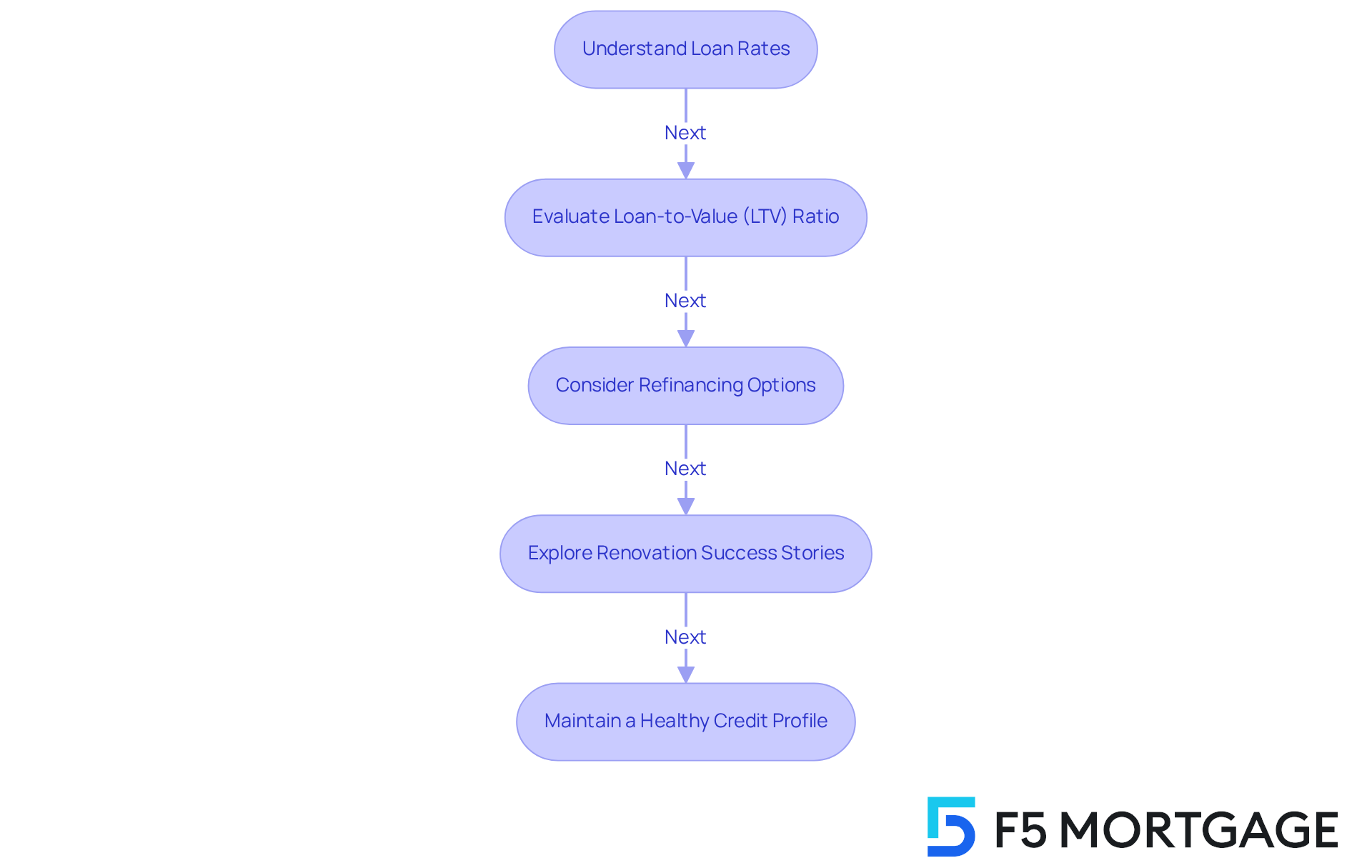

At F5 Mortgage, we understand how daunting the mortgage landscape can be, which is why we strive to offer features that truly support your property financing journey. With attractive low home equity loan rates and flexible repayment options, we aim to make your experience as smooth as possible. Currently, average rates for five-year property financing are just above 8%, but we believe you can find options that align with your financial goals. Experts suggest that securing low home equity loan rates, specifically below 8.25% for a 10-year term or 8.20% for a 15-year term, can lead to significant long-term savings, empowering you to make informed decisions.

Additionally, we know that borrowing less can enhance your terms by lowering your loan-to-value (LTV) ratio, which is crucial for effectively accessing home equity. If your LTV ratio is below 70%, you’re likely to receive some of the most appealing offers available, particularly low home equity loan rates, making it beneficial to keep your LTV low.

F5 Mortgage also offers refinancing options that allow homeowners like you to adjust your financing terms. This can help reduce monthly payments or eliminate private mortgage insurance (PMI) for those who initially put down less than 20%. Given the rising property values in California, many homeowners find it easier to achieve favorable LTV ratios, further enhancing their refinancing opportunities.

Consider the success stories of families who have used F5 Mortgage property value loans for renovations. For instance, one household transformed their kitchen, significantly increasing their home’s value and improving their living space. With the flexibility to access funds as needed, homeowners can embark on projects that elevate their living environments while managing their budgets effectively. Moreover, a 20-point increase in your credit score can lower your interest rates by 0.5%, underscoring the importance of maintaining a healthy credit profile.

As the market evolves, F5 Mortgage continuously adapts, ensuring you can confidently leverage your property value for enhancements and upgrades. To explore personalized options that cater to your financial needs, we invite you to consult with F5 Mortgage. We’re here to support you every step of the way.

Columbia Credit Union: Access Competitive Home Equity Loans for Home Upgrades

At F5 Mortgage, we understand how important it is for homeowners to access their property’s value for essential upgrades and renovations. Our competitive home value loans, featuring low home equity loan rates, come with attractive interest rates and a commitment to personalized service, allowing you to discover solutions tailored to your financial goals.

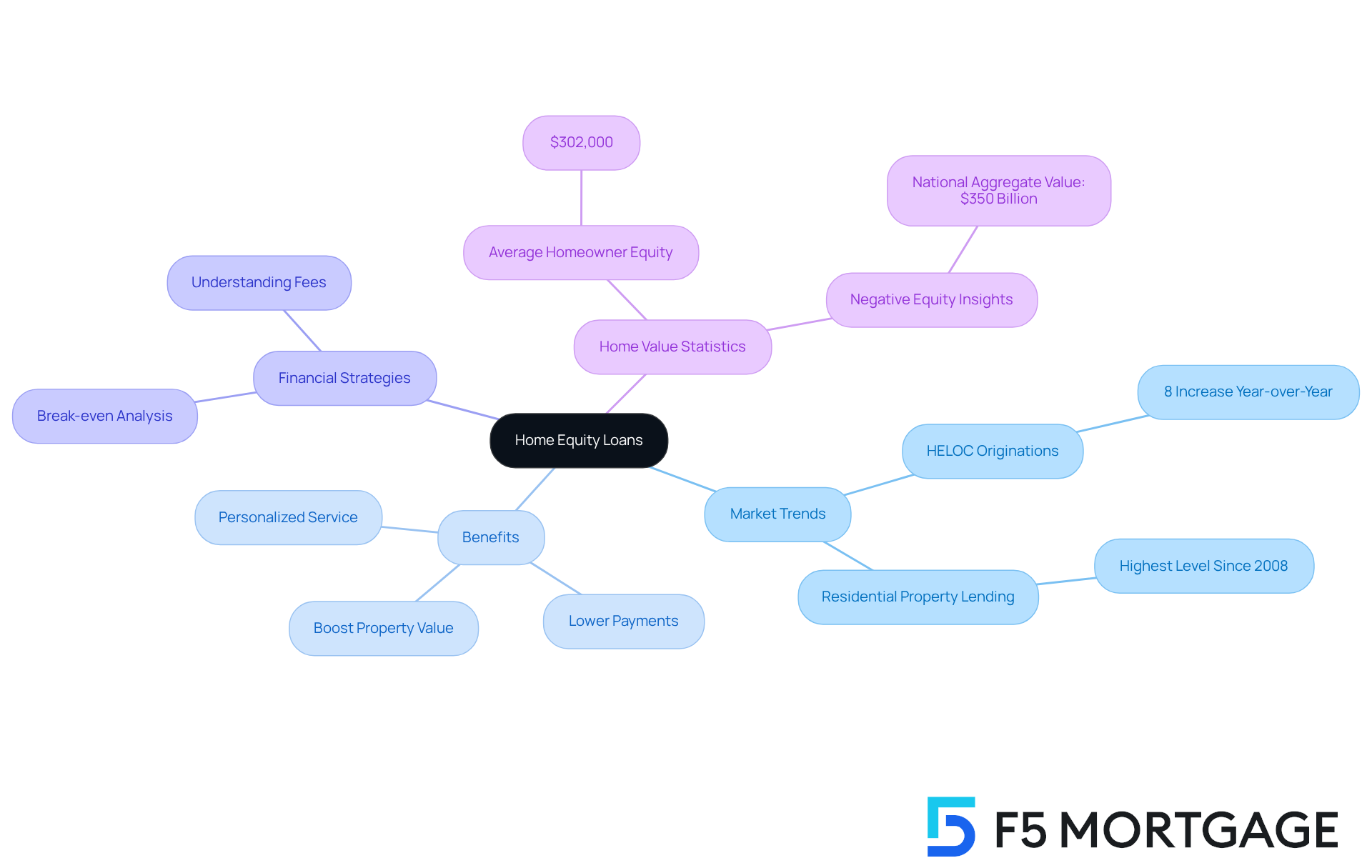

Navigating the refinancing process in California can feel daunting, but it’s crucial for families looking to lower their payments or efficiently access their assets. Did you know that residential property lending has reached its highest level since early 2008? HELOC originations have climbed by 8% compared to last year, indicating a growing trend among property owners eager to utilize their assets for enhancements. In fact, the typical mortgage-holding property owner has around $302,000 in value, presenting a significant opportunity for financing improvements.

Financial advisors emphasize that using property-backed loans for renovations, especially with low home equity loan rates, not only boosts property value but also enhances living conditions. This makes it a strategic investment for families looking to upgrade their homes. We know how challenging this can be, so understanding the detailed breakdown of fees and conducting a break-even analysis is essential for making informed decisions.

Home assessments are also vital in determining property value and ownership stake, significantly influencing mortgage costs. At F5 Mortgage, we pride ourselves on offering flexible financing options and personalized support, ensuring your family can achieve its improvement goals effectively and affordably, especially with our low home equity loan rates. We’re here to support you every step of the way.

Empower Federal Credit Union: Benefit from Personalized Service and Competitive Home Equity Loan Rates

At F5 Mortgage, we understand how important it is to find the right support for your property financing needs. That’s why we offer tailored services along with competitive rates, which include low home equity loan rates currently among the lowest available. With low home equity loan rates at an Annual Percentage Rate (APR) of 7.25% for property loans, you can benefit from reduced interest costs, allowing you to allocate more funds towards renovations and improvements. Our commitment to client satisfaction means that families receive the guidance they need throughout the lending process, enhancing your overall experience.

For those considering a Home Equity Line of Credit (HELOC), we offer a maximum APR of 17.99%, with a margin of -0.25% over the Prime Rate, effective December 23, 2024. This makes it an attractive option for individuals looking to tap into their property value by taking advantage of low home equity loan rates. At F5 Mortgage, we not only provide competitive rates but also essential tools and education to empower you in making informed financial decisions. Our dedication to personalized service significantly enhances your satisfaction with property value financing, helping families confidently achieve their renovation goals.

If you’re a family exploring home equity loans, we invite you to consult with F5 Mortgage. Together, we can explore the best options tailored to your unique financial needs.

Conclusion

Exploring low home equity loan rates offers a wonderful opportunity for families eager to enhance their living spaces while tapping into the equity of their homes. With various options available from lenders like F5 Mortgage, homeowners can access competitive rates and personalized services that align with their financial aspirations. This approach not only facilitates necessary renovations but also helps in building long-term wealth.

In this evolving landscape, several key players stand out in the home equity loan market, including:

- Bank of America

- Bankrate

- Century Credit Union

Each of these institutions brings unique features and benefits to the table. From streamlined application processes to personalized consultations, they cater to diverse financial needs. However, it’s crucial for homeowners to understand potential risks, such as negative equity, to make informed decisions while navigating the complexities of property financing.

Now is the perfect time for homeowners to explore their options as the home equity loan landscape continues to evolve. By taking advantage of low home equity loan rates, families can invest in their homes, improve their living environments, and secure their financial futures. Whether you’re considering renovations, debt consolidation, or other financial needs, consulting with a knowledgeable lender can empower you to make strategic choices that enhance your property value and overall well-being. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer for home equity loans?

F5 Mortgage offers a comprehensive selection of equity loan options, including low home equity loan rates, personalized consultations, and access to competitive rates and terms from over two dozen leading lenders.

What is the significance of being ‘equity rich’?

An ‘equity rich’ property means that the remaining debt is less than half the property’s value, allowing homeowners to tap into their property value for renovations or other financial needs.

How much was the typical residential collateral borrowing origination figure in 2025?

The typical residential collateral borrowing origination figure in 2025 was around $46,700.

What role do finance officers play at F5 Mortgage?

Finance officers at F5 Mortgage prioritize understanding each client’s unique financial situation and work to craft tailored solutions that ensure a smoother borrowing experience.

How can homeowners benefit from low home equity loan rates?

Homeowners can use low home equity loan rates to finance substantial renovations, enhancing their home’s value and livability while contributing to long-term wealth accumulation.

What are some potential risks associated with home equity loans?

One potential risk is negative equity, where the mortgage owed exceeds the property’s worth, especially in fluctuating markets.

What options does Bank of America provide for home equity loans?

Bank of America offers flexible options including fixed-rate loans and property value lines of credit (HELOCs), starting at low home equity loan rates of 6.3%.

How can homeowners in California eliminate private mortgage insurance (PMI)?

Homeowners who purchased with less than a 20% down payment may eliminate PMI through refinancing by calculating a new loan-to-value (LTV) ratio based on their home’s increased value.

What is the typical online application process for home equity loans?

The online application process is typically streamlined for quick and efficient access to funds, which is beneficial for homeowners seeking to finance upgrades.

How can homeowners utilize HELOCs?

Homeowners often use HELOCs for renovations, emergency expenses, or educational costs due to low home equity loan rates.

What tools does Bankrate provide for comparing home equity loan rates?

Bankrate offers comprehensive tools to assist property owners in comparing costs from various providers, helping them identify the most advantageous prices and terms.

What are the current average percentages for property-backed loans and HELOCs?

The current average percentages are 8.25% for property-backed loans and 8.26% for HELOCs.

How can using comparison tools benefit borrowers?

Using comparison tools enhances transparency and empowers borrowers to negotiate better terms for their loans.

What predictions are made regarding property values in 2025?

Predictions suggest that property values might drop in 2025, creating opportunities for families looking to enhance their homes.