Overview

Zero down home loans are vital for families eager to embrace homeownership. They offer a unique opportunity to secure financing without the burden of a down payment, making it significantly easier for first-time buyers and families to take this important step.

We understand how challenging this can be, and this article aims to guide you through the various loan options available, eligibility requirements, and the benefits of down payment assistance programs.

Together, these elements create a smoother path to homeownership, helping you feel more confident and supported in your journey.

Introduction

Navigating the path to homeownership can indeed feel overwhelming, especially for first-time buyers who are facing financial challenges. We understand how daunting this journey can be. Zero down home loans offer a transformative opportunity, enabling individuals and families to bypass the traditional down payment hurdle and concentrate on securing their dream property.

However, despite these advantages, misconceptions and eligibility requirements can lead to confusion. What essential insights do potential buyers need to grasp in order to effectively leverage these financing options? We’re here to support you every step of the way.

F5 Mortgage: Competitive Zero Down Home Loan Options

At F5 Mortgage, we understand how daunting the can be, especially for first-time buyers and families looking to improve their living situation. That’s why we offer a variety of designed to meet your needs. Our offerings include:

- VA financing

- USDA financing

- Specialized programs that offer zero down home loans for financing 100% of your property acquisition

To make homeownership even more attainable, we provide access to in California. We know how challenging this can be, and we’re here to support you every step of the way. By leveraging user-friendly technology, we , ensuring a stress-free experience for our clients. Our technology streamlines applications and offers clear guidance throughout the entire process.

Furthermore, by partnering with over two dozen top lenders, we guarantee that you receive the most available in the market. This commitment to makes homeownership more achievable than ever. Let us help you take the next step toward your dream home.

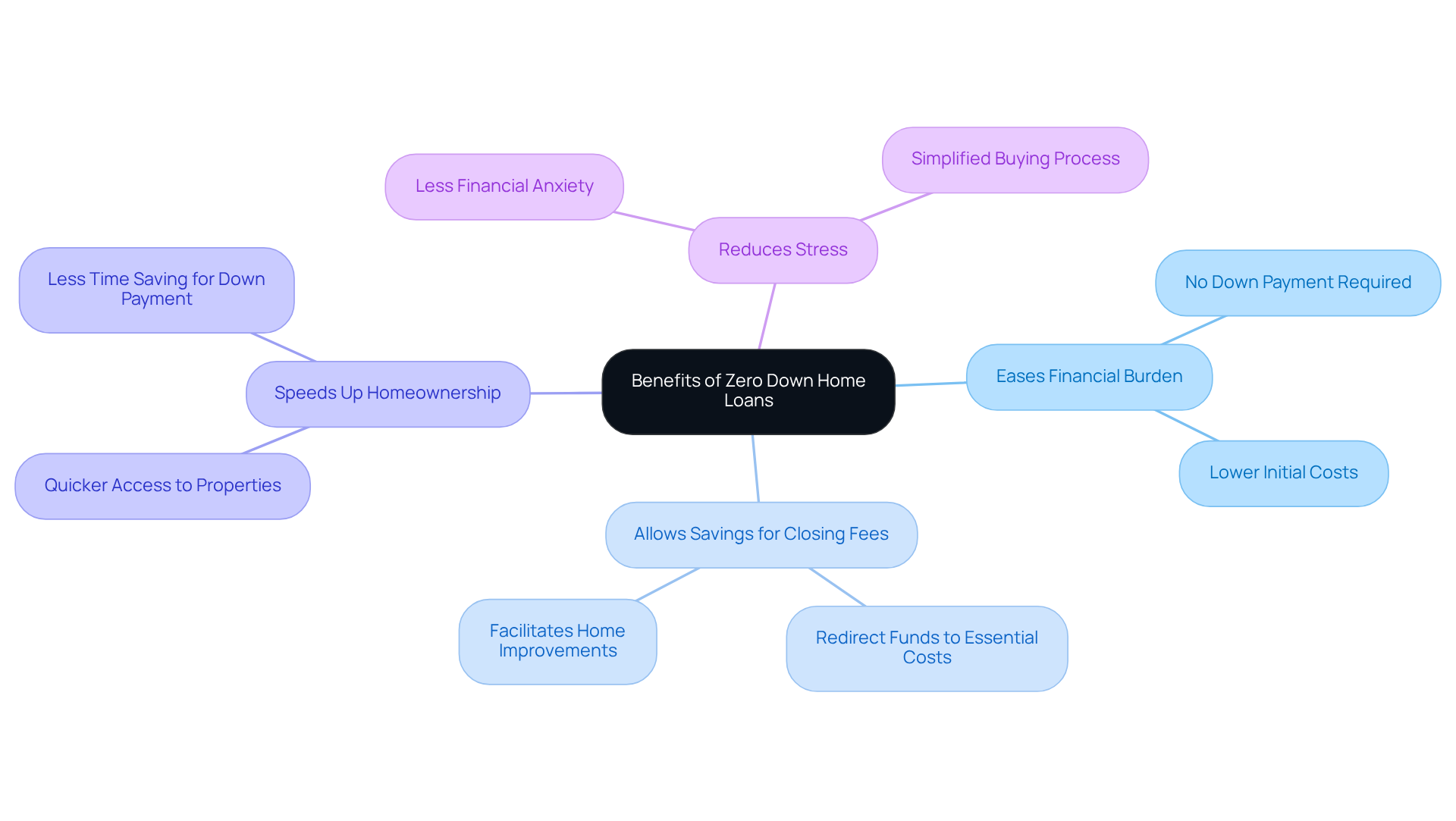

Benefits of Zero Down Home Loans for First-Time Buyers

provide a world of possibilities for . We understand how daunting the can be, and removing this barrier allows you to focus on what truly matters. Instead of worrying about a , you can direct your savings towards or home improvements.

This financial support not only eases the burden but also speeds up your journey to . Imagine being able to secure your dream home more quickly with zero down home loans, eliminating the stress of saving for a down payment. We’re here to support you every step of the way, making the path to your new residence smoother and more accessible.

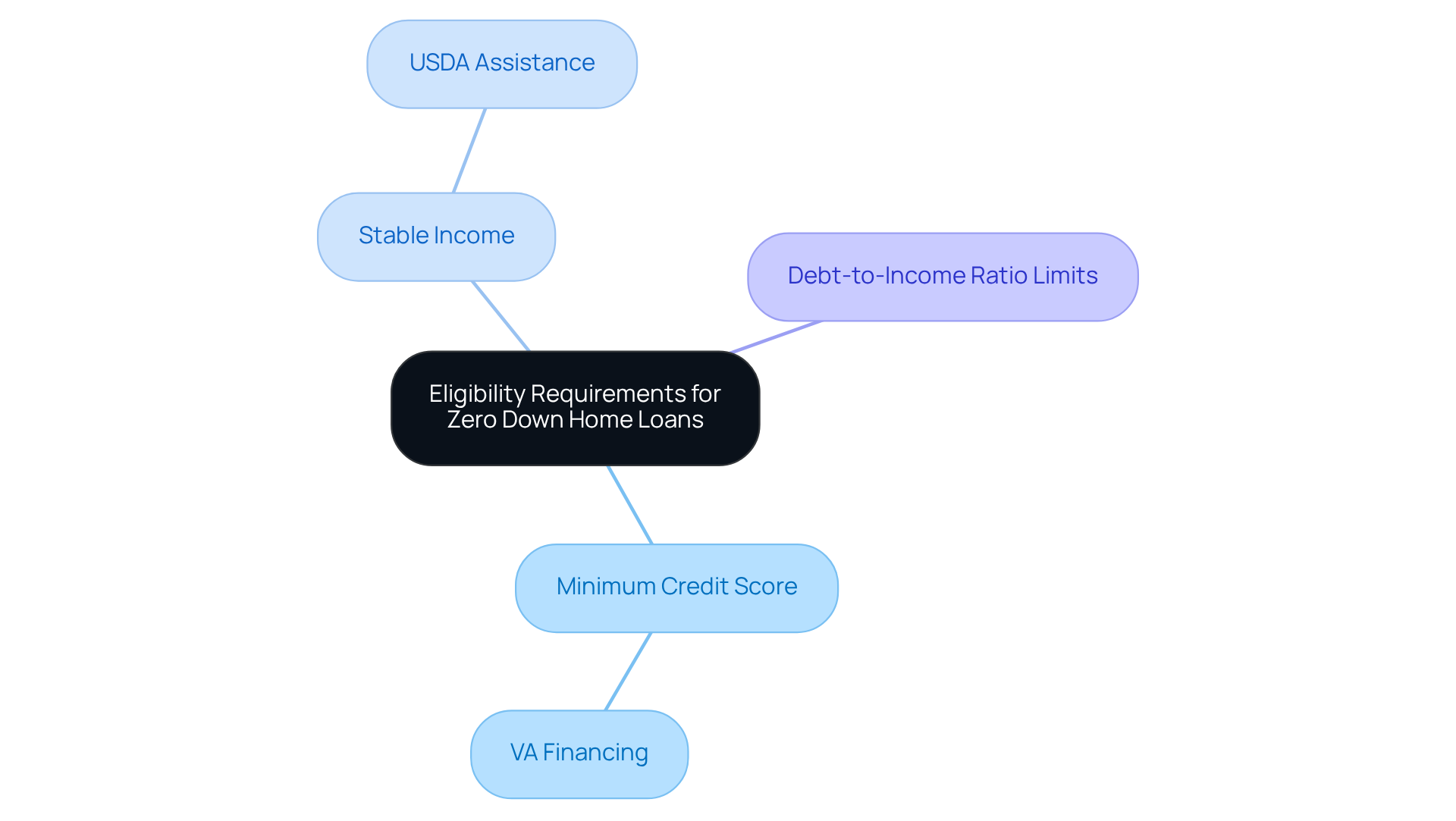

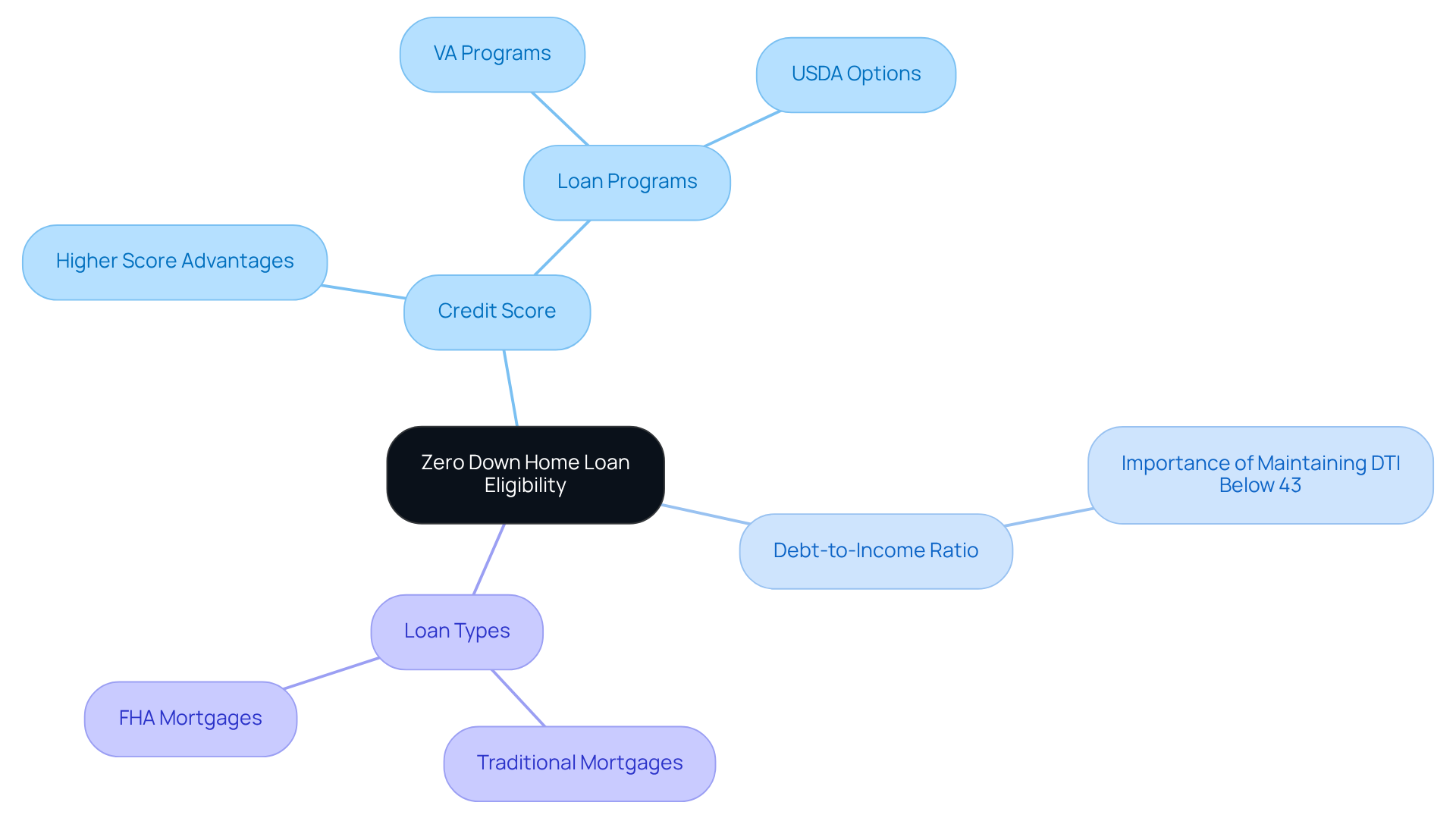

Eligibility Requirements for Zero Down Home Loans

Navigating the world of home financing can be daunting, but we’re here to help you every step of the way. To qualify for , it’s important to understand the specific that may apply. This often includes:

- Having a minimum credit score

- Demonstrating

- Meeting debt-to-income ratio limits

For instance, requires service eligibility, while USDA assistance is designed for low to moderate-income purchasers in rural areas.

At , we offer a diverse range of financing programs, including both standard and unconventional options. Even if you’ve faced rejection from another lender, remember that there are still choices available to you. Understanding these requirements and the variety of is essential for potential borrowers like you to effectively navigate your funding opportunities. We’re committed to you need to make informed decisions.

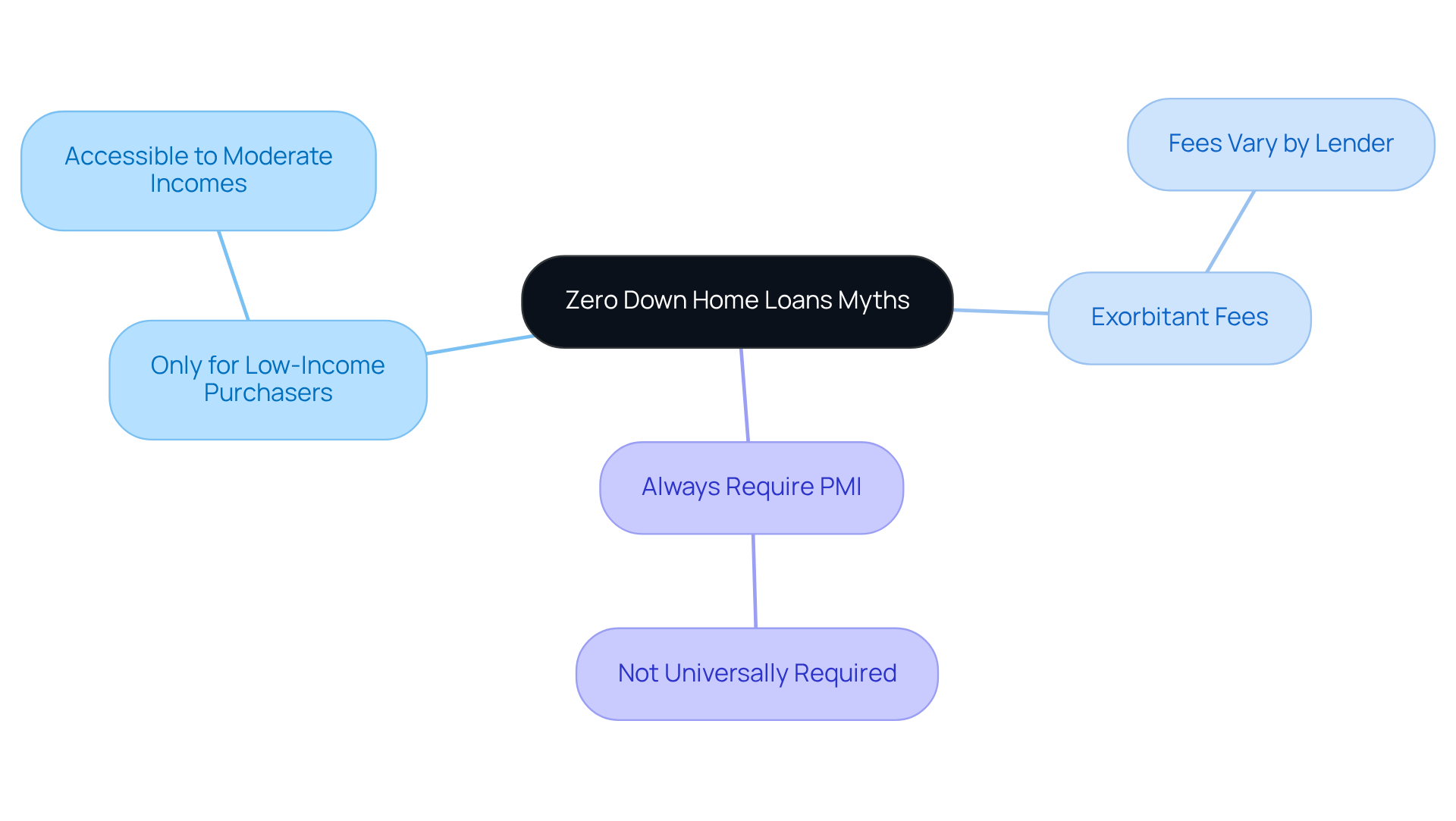

Common Myths About Zero Down Home Loans Debunked

Many myths surround financing. You might have heard that these options are only for or that they come with exorbitant fees. We understand how confusing this can be. In reality, zero down home loans can be accessible to a , including those with moderate incomes.

It’s important to know that while some may require (PMI), this is not universally the case. By comprehending the facts, you can that best suit your needs. We’re here to in navigating this process.

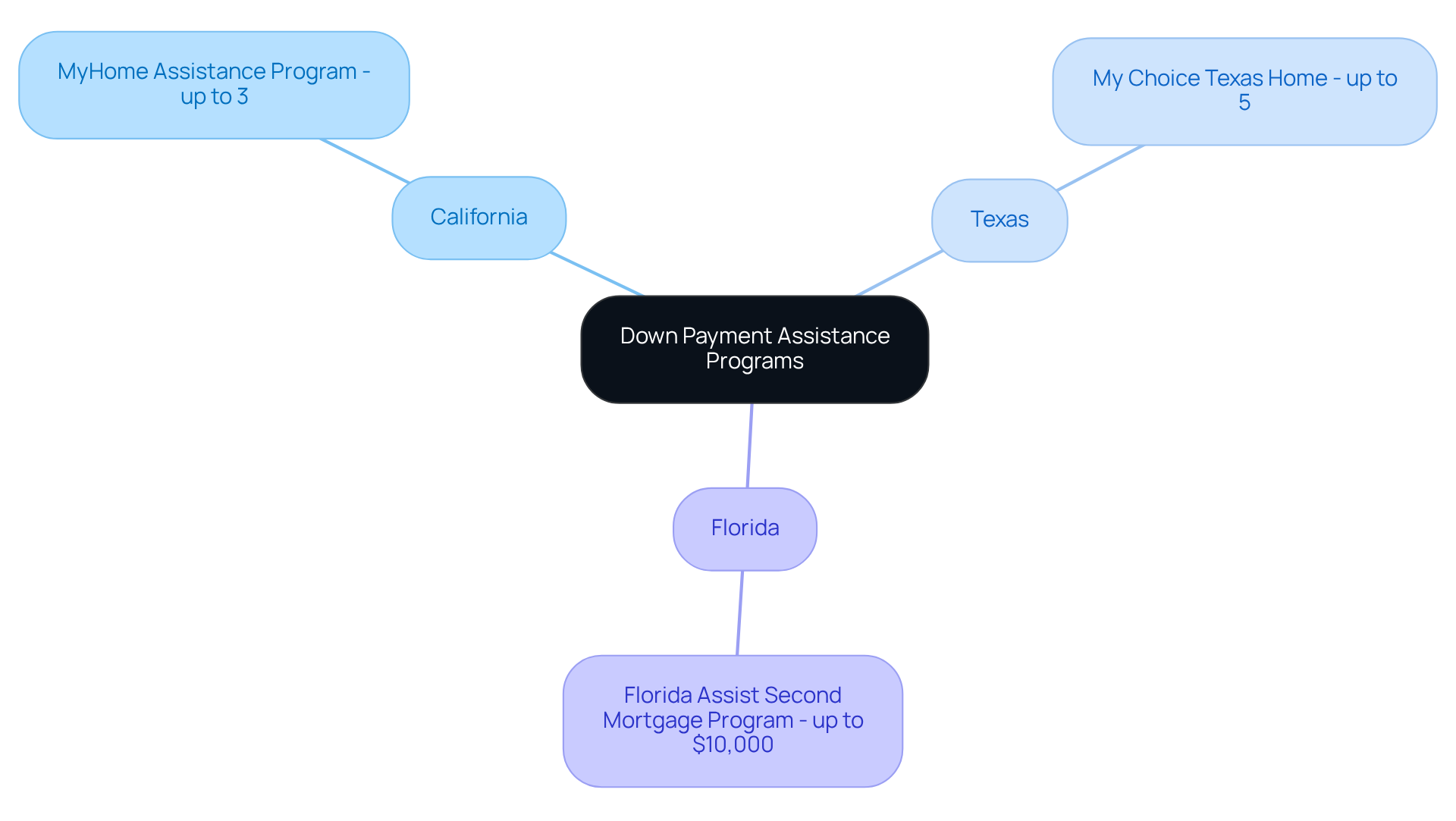

Down Payment Assistance Programs Supporting Zero Down Loans

Buying a home can feel overwhelming, especially when it comes to the . Fortunately, several are here to help you. These programs support buyers pursuing by providing grants or low-interest loans to cover closing costs and other expenses.

In California, for instance, the MyHome Assistance Program from the California Housing Finance Authority (CalHFA) offers up to 3% of the property’s purchase price. This can make a significant difference as you navigate the . Similarly, in Texas, the My Choice Texas Home program from the Texas Department of Housing and Community Affairs (TDHCA) provides a 30-year, low-interest-rate mortgage along with up to 5% for down payment and closing assistance.

Florida also has several options available, including the Florida Assist Second Mortgage Program, which offers up to $10,000 for upfront costs. These assistance programs are designed to ease the transition into like yours.

We know how challenging this can be, but you don’t have to face it alone. For more information on how these programs can benefit you, consider . We’re here to support you every step of the way.

How Credit Scores Affect Zero Down Home Loan Eligibility

Navigating the world of home financing can feel overwhelming, especially when it comes to credit scores. We understand how challenging this can be, but it’s important to know that your in your eligibility for . Generally, a higher credit score increases your chances of approval and can lead to more favorable financing terms. For instance, while VA programs may allow for lower credit scores, USDA options typically require a score of at least 640.

Equally important is your . Most lenders look for a maximum DTI of 43% for home loans. A healthier DTI can open the door to , making it crucial for buyers to assess their financial situation thoroughly. We encourage you to regularly review your credit reports and take proactive steps to improve your scores before applying for a mortgage. This preparation can significantly influence your and the overall mortgage approval process.

In Colorado, you have various refinancing choices. Traditional mortgages often come with stricter eligibility requirements, while are generally more accessible for individuals with lower credit scores. Understanding these options can empower you to make informed decisions. Remember, we’re here to support you every step of the way as you embark on this journey towards homeownership.

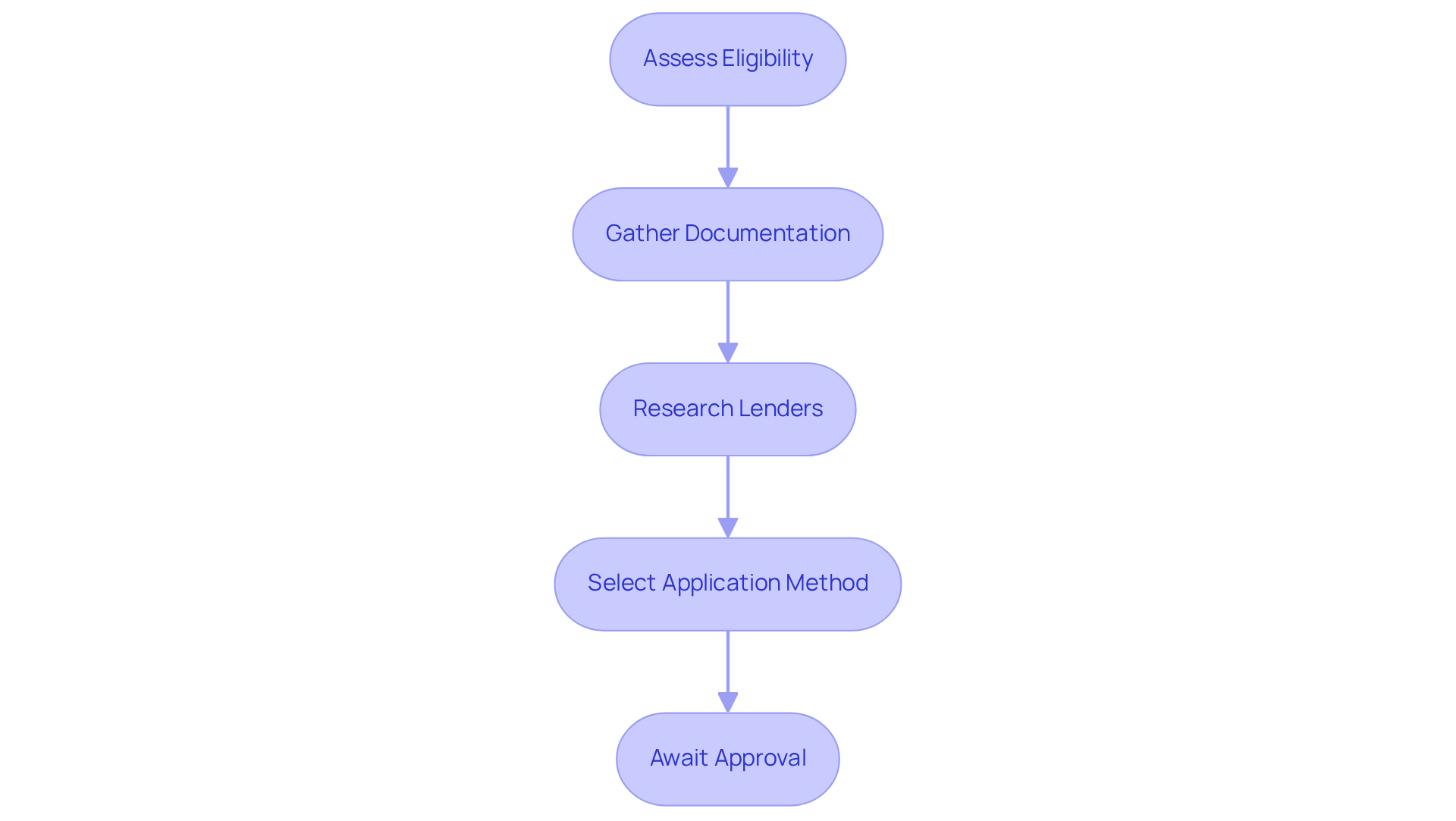

Steps to Apply for Zero Down Home Loans

We know how challenging it can be to navigate the world of housing financing. Applying for involves several key steps that can seem overwhelming at first.

- Assess your eligibility by reviewing your credit scores and income.

- Gather the necessary documentation, including proof of income and employment.

- Research lenders and financing alternatives. Remember, can make all the difference.

- Select your preferred method to —whether online, by phone, or through chat.

Our financing experts are here to help you complete your application and find that fit your needs.

After you submit your application, you’ll await approval and may need to provide any additional information requested by the lender. By utilizing these convenient application options, you can streamline the process and enhance your chances of obtaining zero down home loans. We’re here to support you every step of the way. Reach out to F5 Mortgage today to get started!

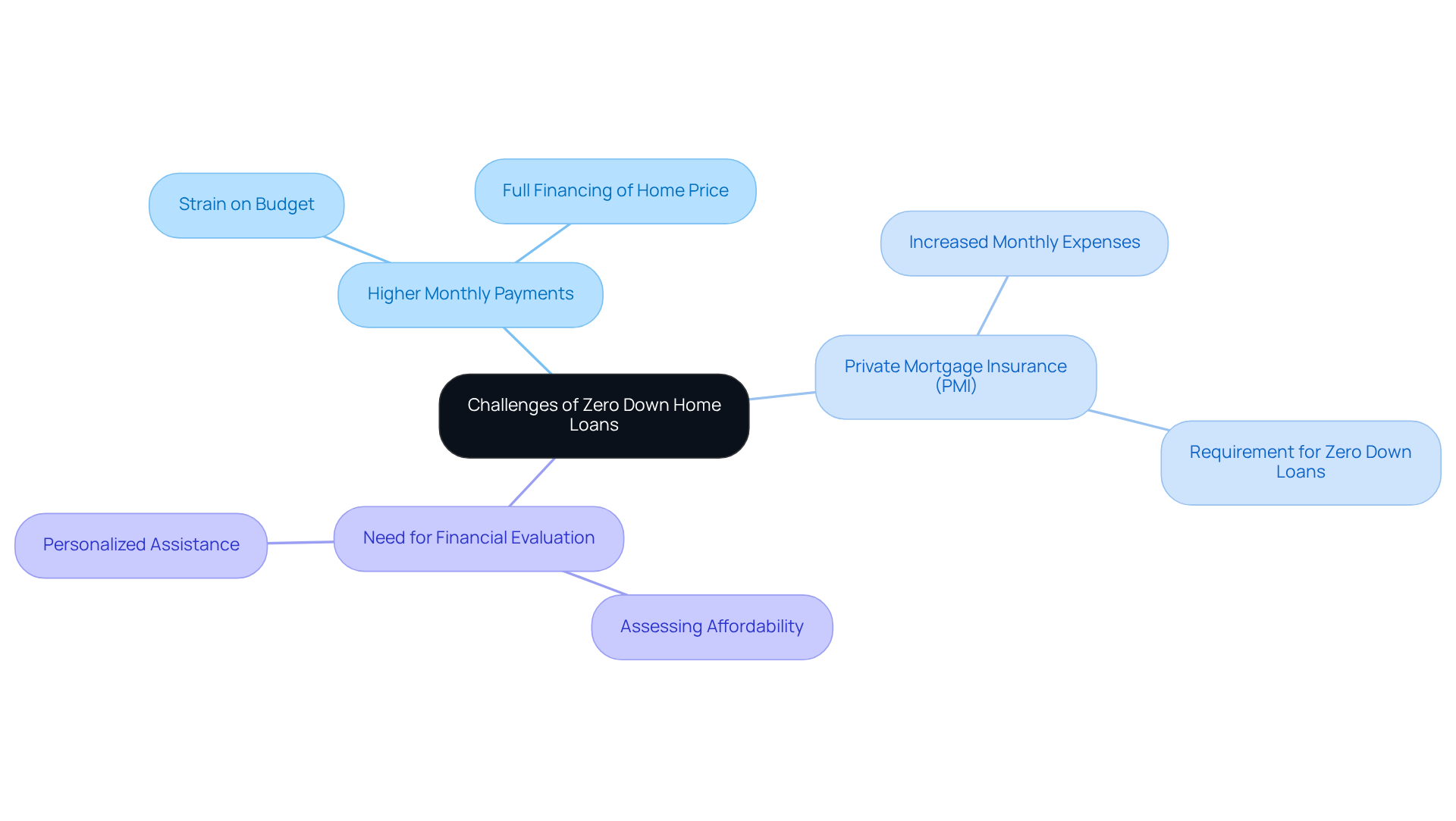

Challenges of Zero Down Home Loans to Consider

While offer many benefits, we know how challenging it can be to navigate the associated hurdles. Borrowers often face higher monthly payments due to financing the entire home price, which can strain budgets. Additionally, these credits frequently necessitate , adding to monthly expenses. At F5 Mortgage, we are here to support you every step of the way, providing to help you .

Our technology-driven approach ensures that you receive without the pressure of hard sales tactics. We aim to refresh the mortgage process by offering and better rate comparisons. It’s essential to consider whether you can comfortably manage these expenses before proceeding. We invite you to reach out to us today to and discover the most suitable financing for your needs.

Zero Down Home Loans vs. Traditional Loans: Key Differences

Navigating the world of mortgages can feel overwhelming, especially when considering the differences between and . One of the most significant hurdles for many potential buyers is the requirement for a with conventional loans. This can be a their dream home.

In contrast, zero down home loans enable buyers to cover the full purchase price of a home without needing an upfront payment. This can be a . Furthermore, Ohio offers a variety of , such as:

- YourChoice!

- Grant for Grads

- Ohio Heroes

These programs provide , .

It’s important to understand that these assistance programs may come with different terms—some may require repayment or forgiveness over time, while others are grants that do not need to be paid back. However, conventional financing often offers lower interest rates and, if you can make a 20% down payment, you can avoid private mortgage insurance (PMI).

When considering your options, we know how challenging this can be. It’s , long-term goals, and the potential costs associated with each type of financing. Remember, we’re here to every step of the way as you make this important decision.

Why Partnering with a Mortgage Broker Matters for Zero Down Loans

Navigating the world of can feel overwhelming, especially when considering options. At , we understand how challenging this can be, which is why we are dedicated to making the process as smooth as possible. Our advanced, user-friendly technology, including an intuitive online application platform and real-time financing tracking, simplifies your journey, allowing you to feel guided rather than pressured.

Mortgage brokers play a vital role in this process. They have access to a wide variety of lenders and financial products, enabling them to find the best choices tailored to your personal needs. Imagine having someone by your side, providing valuable guidance throughout the , helping you navigate complex paperwork, and ensuring you understand all your options. This support can be especially beneficial for who may be unfamiliar with .

At F5 Mortgage, we’re here to support you every step of the way. With our commitment to in under three weeks, we strive to streamline your journey to homeownership. Our goal is to make this experience as stress-free as possible by minimizing delays and maintaining clear communication at every step. Let us help you turn your dream of homeownership into a reality.

Conclusion

Zero down home loans represent a transformative opportunity for aspiring homeowners, especially first-time buyers, to overcome the significant barrier of substantial down payments. By removing this financial hurdle, these loans open doors for many families to achieve their dream of homeownership without the stress of saving for a hefty upfront cost.

Throughout this article, we’ve shared essential insights about the various types of zero down home loans available, including VA and USDA financing, alongside specialized programs tailored to individual needs. We’ve highlighted key eligibility requirements, debunked common myths, and emphasized the importance of down payment assistance programs, ensuring that potential buyers are well-informed. Additionally, understanding the impact of credit scores and the application process has been a focal point, equipping you with the knowledge needed to navigate your options effectively.

In conclusion, we know how overwhelming the journey to homeownership can feel, but zero down home loans offer a viable path forward. By leveraging available resources, understanding eligibility criteria, and seeking guidance from mortgage professionals, you can confidently embark on your home-buying journey. Embracing these opportunities not only enhances your financial stability but also contributes to the broader goal of making homeownership accessible to all.

Frequently Asked Questions

What types of zero down home loans does F5 Mortgage offer?

F5 Mortgage offers VA financing, USDA financing, and specialized programs that provide zero down home loans for financing 100% of your property acquisition.

How does F5 Mortgage assist with down payment challenges?

F5 Mortgage provides access to down payment assistance programs in California to help make homeownership more attainable for clients.

What technology does F5 Mortgage use to simplify the mortgage process?

F5 Mortgage leverages user-friendly technology to streamline applications and provide clear guidance throughout the mortgage process, ensuring a stress-free experience for clients.

How does F5 Mortgage ensure competitive rates for home loans?

F5 Mortgage partners with over two dozen top lenders to guarantee that clients receive the most competitive rates and terms available in the market.

What are the benefits of zero down home loans for first-time buyers?

Zero down home loans remove the barrier of a hefty deposit, allowing first-time buyers to focus their savings on essential costs like closing fees or home improvements, and speeding up their journey to homeownership.

What are the eligibility requirements for zero down home loans?

Eligibility requirements often include having a minimum credit score, demonstrating stable income, and meeting debt-to-income ratio limits. Specific programs like VA financing and USDA assistance have additional criteria related to service eligibility and income levels.

What should potential borrowers do if they have been rejected by another lender?

Potential borrowers should understand that there are still financing options available to them, even if they have faced rejection from another lender. F5 Mortgage offers a diverse range of financing programs to assist these individuals.