Overview

This article offers essential insights into equity loans for families, aiming to illuminate their benefits, mechanics, and important considerations. We understand how challenging financial decisions can be, and we want you to know that equity loans can serve as a valuable resource for various needs, such as home improvements or debt consolidation. However, it’s crucial to recognize the associated risks and requirements for borrowing responsibly. By understanding these aspects, you can make informed choices that align with your family’s financial goals.

Introduction

Understanding the intricacies of home equity can truly be a game-changer for families navigating their financial landscape. We know how challenging this can be. With the potential to unlock significant funds through an equity loan on a house, homeowners can address various needs—from renovations to educational expenses—while leveraging their property’s value. However, the path to accessing these funds is not without its challenges and critical decisions.

What are the essential insights families should consider before diving into the world of equity loans? We’re here to support you every step of the way.

F5 Mortgage: Your Partner for Equity Loan Solutions

At F5 Mortgage, we understand how challenging navigating the complexities of financing can be. That’s why we are committed to assisting households like yours every step of the way. Through personalized consultations, we offer tailored advice that aligns with your unique financial goals.

Our collaborations with leading lenders mean you can access competitive rates and a variety of loan choices. This establishes us as a reliable ally for families looking to efficiently utilize an equity loan on house. We’re here to support you in making informed decisions that positively impact your financial future.

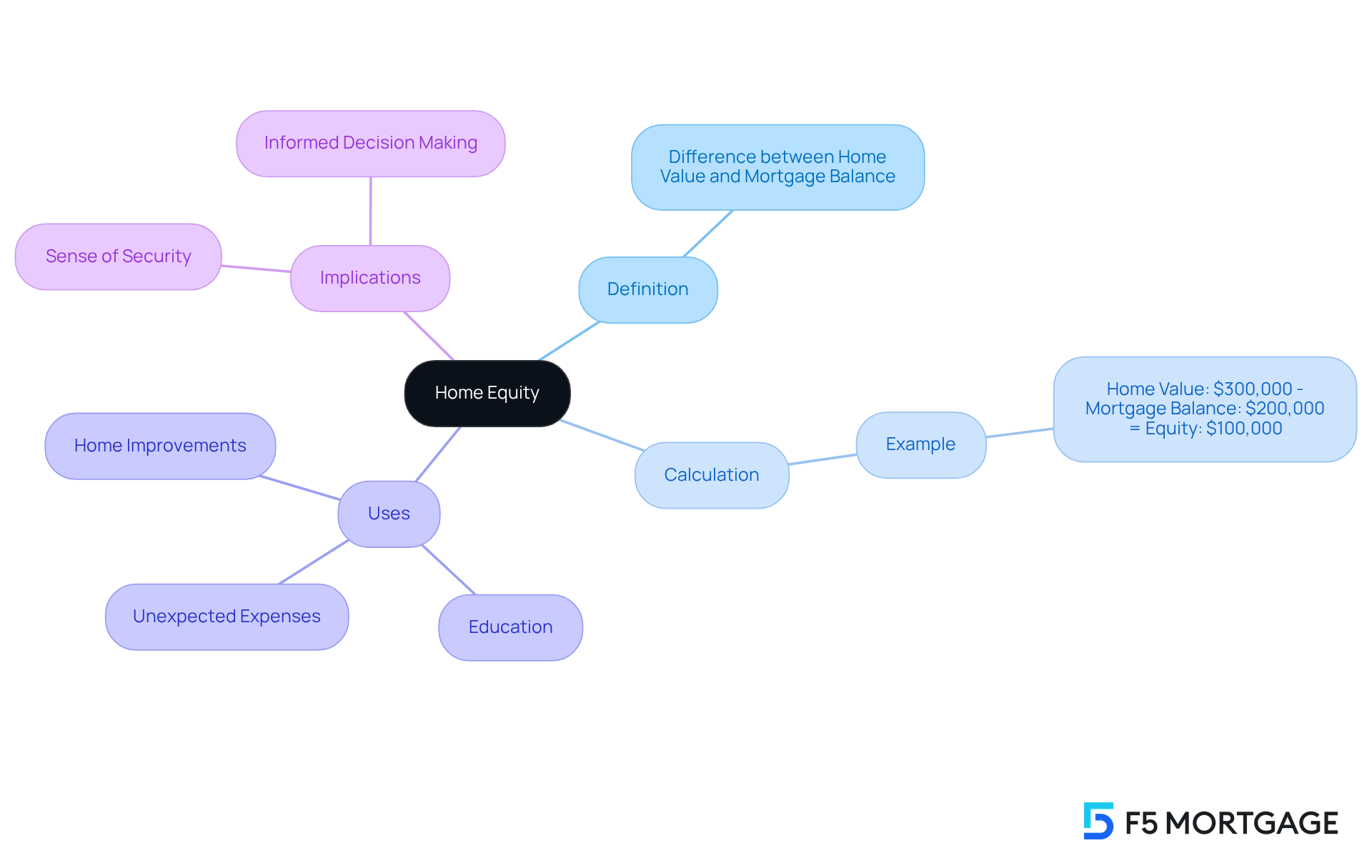

Home Equity Defined: What It Is and How It Works

Understanding the value of your property can be a crucial step in navigating your financial journey. It represents the difference between what your home is currently worth and the outstanding balance on your mortgage. For example, if your home is valued at $300,000 and you owe $200,000, your ownership stake amounts to $100,000.

This ownership is not just a number; it can be a valuable resource. By exploring various financing options, you can access an equity loan on house to fulfill different needs. Whether it’s for home improvements, education, or unexpected expenses, knowing that your property holds value can provide a sense of security.

We know how challenging this can be, but we’re here to support you every step of the way. Understanding your options empowers you to make informed decisions that align with your family’s needs.

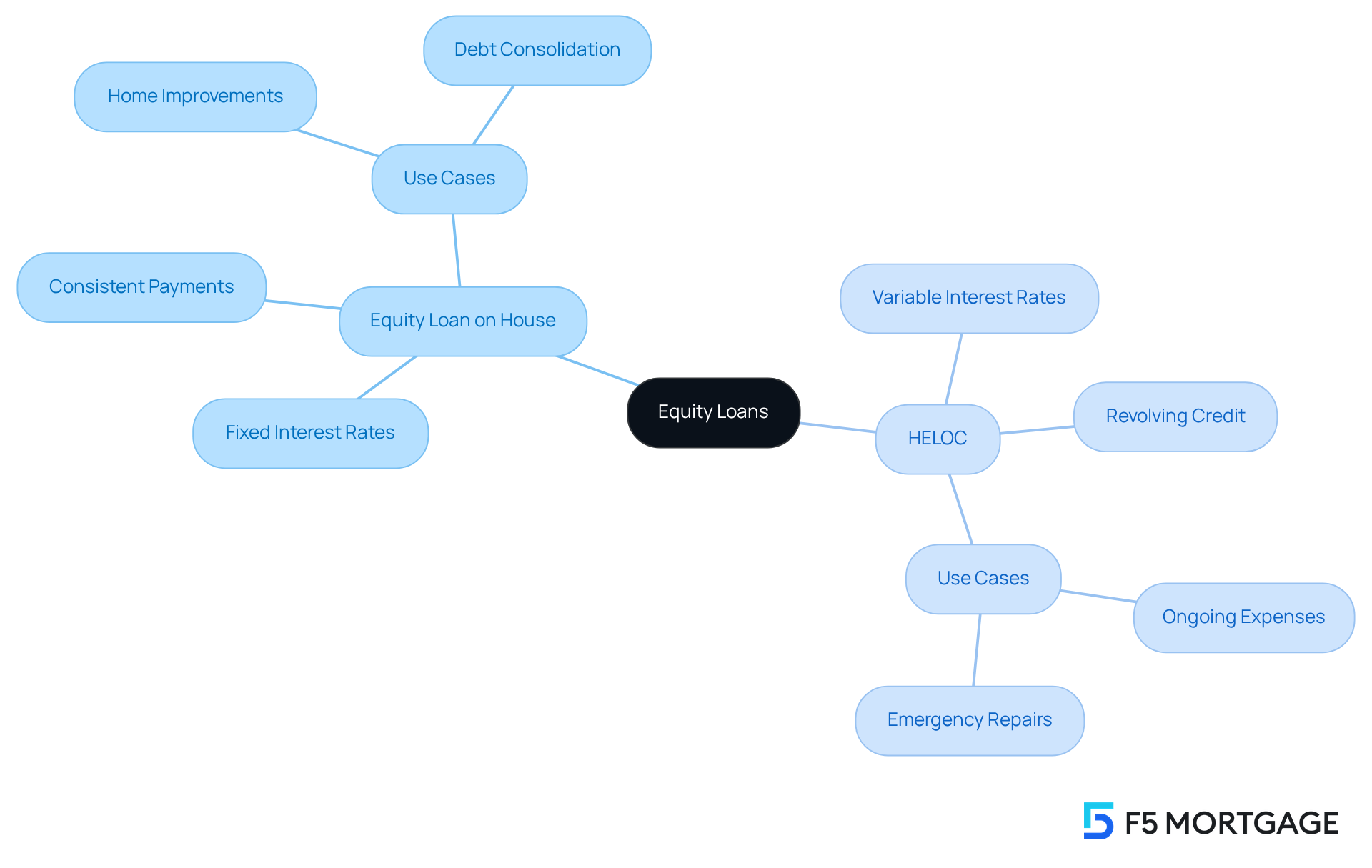

How Equity Loans Work: Key Mechanics Explained

Equity financing typically appears in two main types: equity loan on house and property-backed lines of credit (HELOCs). We understand that navigating these options can be overwhelming, especially when significant costs arise, such as property improvements or debt consolidation. A property-backed financing option provides a lump sum that is repaid over a set period, making it suitable for individuals who need a specific amount to address these challenges. In contrast, a HELOC functions as a revolving line of credit, allowing homeowners to draw funds as needed. This flexibility can be particularly beneficial for ongoing expenses like tuition or emergency repairs. However, it’s important to remember that both options, such as an equity loan on house, utilize your property as collateral, meaning that failure to repay could lead to foreclosure. Lenders generally require a minimum of 20% ownership in your property for a HELOC or similar financing option, a significant factor to consider as you explore your options.

Mortgage professionals emphasize the importance of understanding these mechanics. For instance, a property-backed credit usually offers fixed interest rates and consistent monthly payments, ensuring stability in an unpredictable market. Conversely, HELOCs often come with variable interest rates, which can fluctuate based on market conditions, making them less predictable. As of 2024, the average interest rate on 30-year fixed mortgages reached 6.8%. This has prompted many borrowers to consider an equity loan on house instead of HELOCs due to their stability.

Present trends show an increasing preference for residential value borrowing, specifically equity loan on house options, due to their reliability, particularly as escalating interest rates have made borrowers wary of variable-rate options such as HELOCs. Real-world examples demonstrate this change: families have effectively used an equity loan on house to support major home enhancements or combine high-interest debt, capitalizing on the average homeowner’s asset, which surpasses $274,000. This financial potential underscores the value of consulting with a Home Lending Advisor to navigate these options effectively and align them with your individual financial goals. We know how challenging this can be, and we’re here to support you every step of the way. Moreover, F5 Mortgage takes pride in its quick closing procedure, with most agreements concluding in under three weeks, further boosting the attractiveness of these financing options.

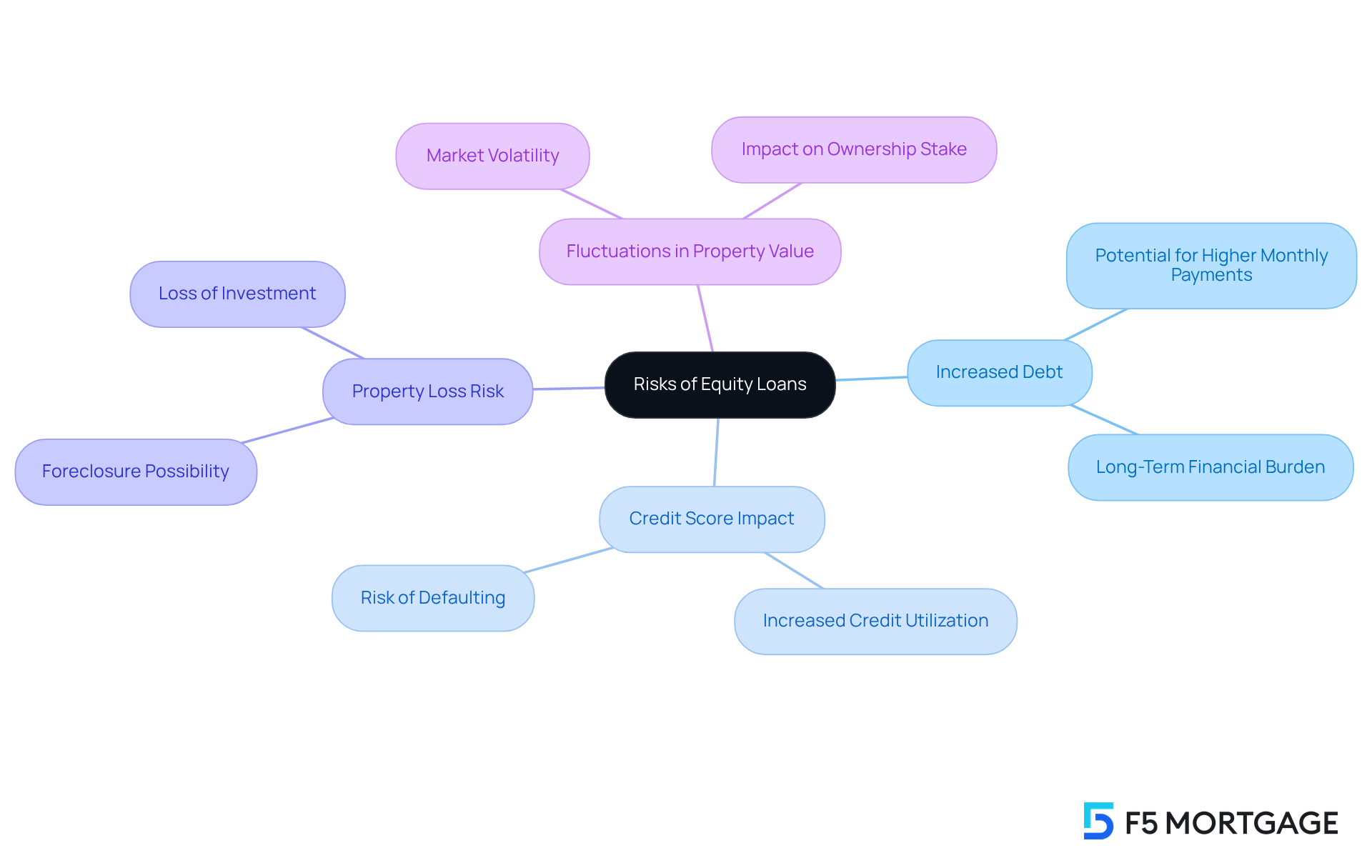

Risks of Equity Loans: What Borrowers Should Consider

Home loans can offer significant financial advantages, but it’s important to recognize the risks involved. We know how challenging this can be, and it’s essential to consider the potential for increased debt. Additionally, think about how borrowing might affect your credit score and the risk of losing your property if you default.

Moreover, fluctuations in property value can impact your ownership stake. This makes it crucial to borrow responsibly. We’re here to support you every step of the way, helping you navigate these important decisions with care and understanding.

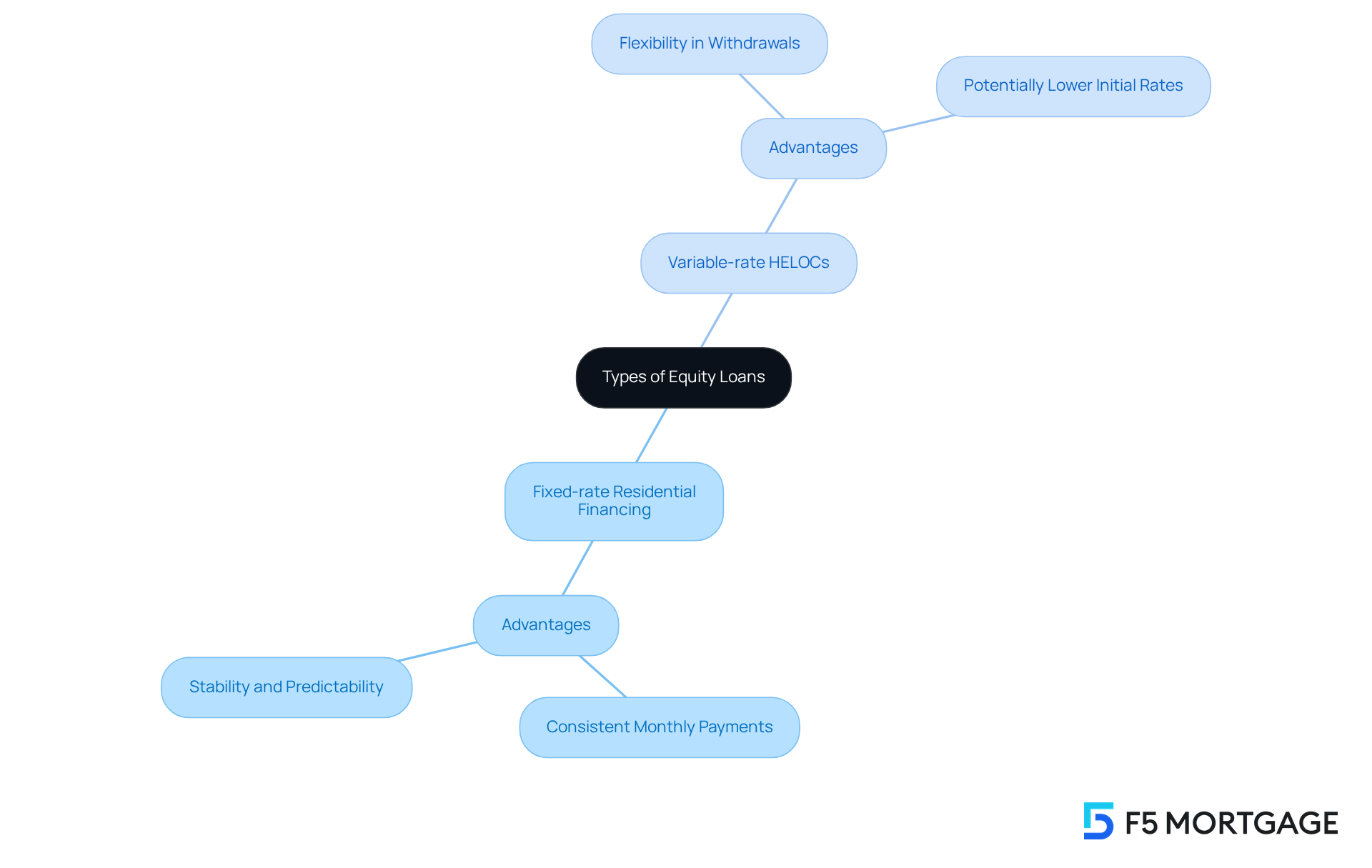

Types of Equity Loans: Exploring Your Options

Navigating the world of financing can feel overwhelming, and we understand how challenging this can be. There are primarily two categories of financing options available:

- Fixed-rate residential financing

- Variable-rate HELOCs

Fixed-rate mortgages offer the comfort of stability with consistent monthly payments, which can provide peace of mind. On the other hand, HELOCs bring flexibility to the table, allowing you to withdraw funds as needed to meet your unique financial needs.

Each option has its own set of advantages, and the choice ultimately hinges on your individual financial circumstances and goals. We’re here to support you every step of the way as you explore these options and find the best fit for your family’s future.

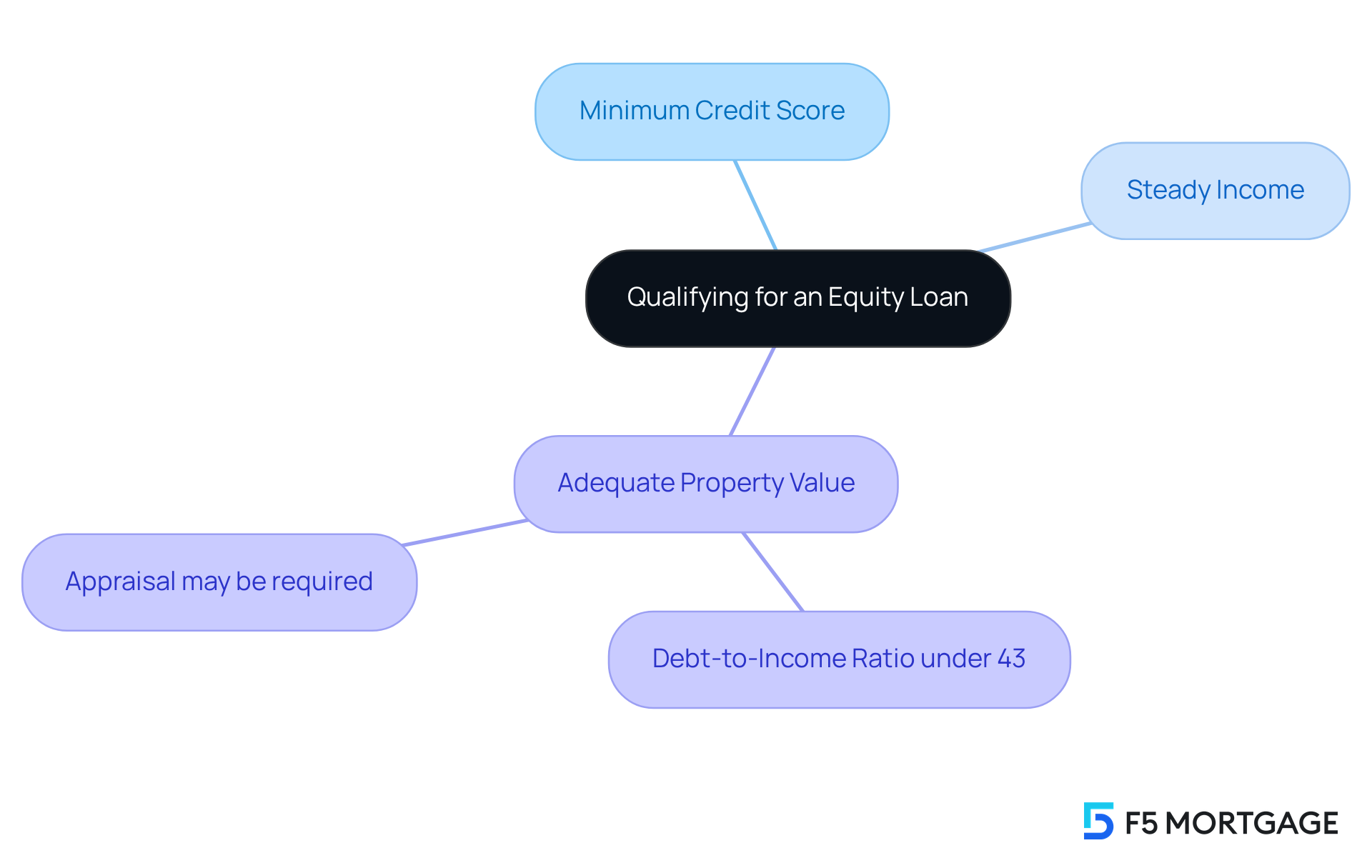

Qualifying for an Equity Loan: Requirements You Need to Meet

We understand that navigating the process of securing a financial advance can feel overwhelming. To help you move forward, it’s essential to know that borrowers typically need:

- A minimum credit score

- A steady income

- Adequate property value

Lenders often look for a debt-to-income ratio under 43%, and they may require an appraisal to determine the current value of your property.

Gathering the necessary documentation, such as tax returns and pay stubs, can make the application process smoother. We’re here to support you every step of the way, ensuring you have the resources you need to achieve your financial goals.

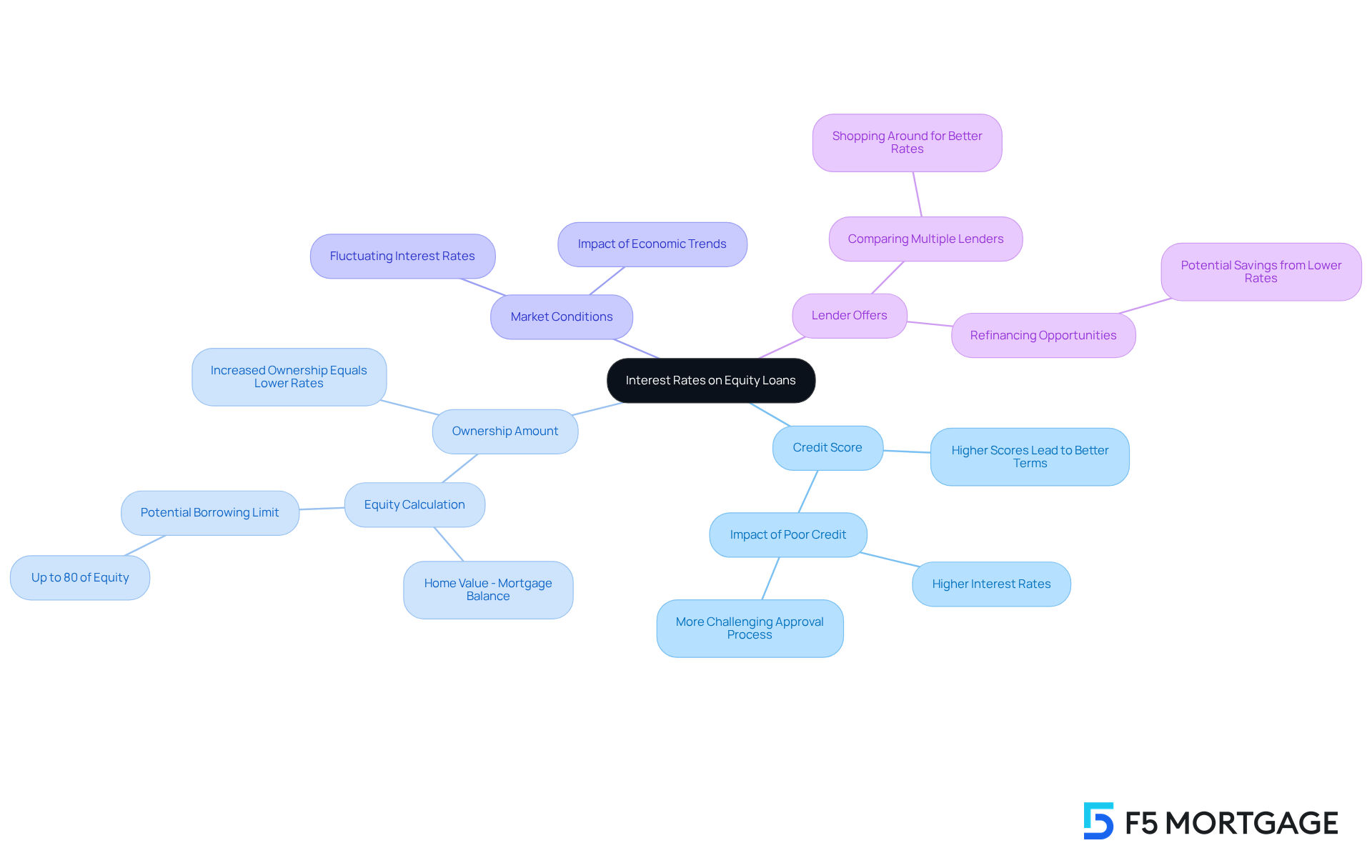

Interest Rates on Equity Loans: What Affects Your Costs

Interest rates on property loans can vary widely, and we understand how overwhelming this can be. Factors such as your credit score, the amount of ownership in your home, and current market conditions all play a role. Typically, those with better credit scores and increased ownership are able to secure lower rates. For instance, if you own a property valued at $300,000 and owe $200,000, you have a $100,000 ownership stake. This could allow you to borrow up to $80,000 at more favorable rates. However, remember that lenders usually permit borrowing up to 80% of the property’s value minus the mortgage balance.

Market trends significantly influence interest rates, and as these rates fluctuate, so too do the offers from lenders. If you’re hoping to secure lower interest rates, consider shopping around and comparing multiple lenders. This proactive approach can lead to meaningful savings. For example, a family that recently refinanced their property financing saw their interest rate drop from 6% to 4.5%, resulting in substantial monthly savings.

Additionally, maintaining a strong credit profile can enhance your borrowing conditions even further. Lenders assess creditworthiness, and those with higher scores often receive better terms. It is possible to acquire property-backed financing with poor credit, but it may be more challenging, and you should be prepared for potentially higher rates. Therefore, keeping track of your credit and addressing any issues before applying for a loan against your property is beneficial. Most creditors will also require a property appraisal to determine the current market value of your home and assess your ownership stake.

By understanding these factors and actively seeking the best offers, you can make informed decisions that align with your financial goals. However, it’s crucial to remain aware of the risks associated with an equity loan on house financing, particularly the possibility of defaulting, as your property serves as collateral. We’re here to support you every step of the way as you navigate this process.

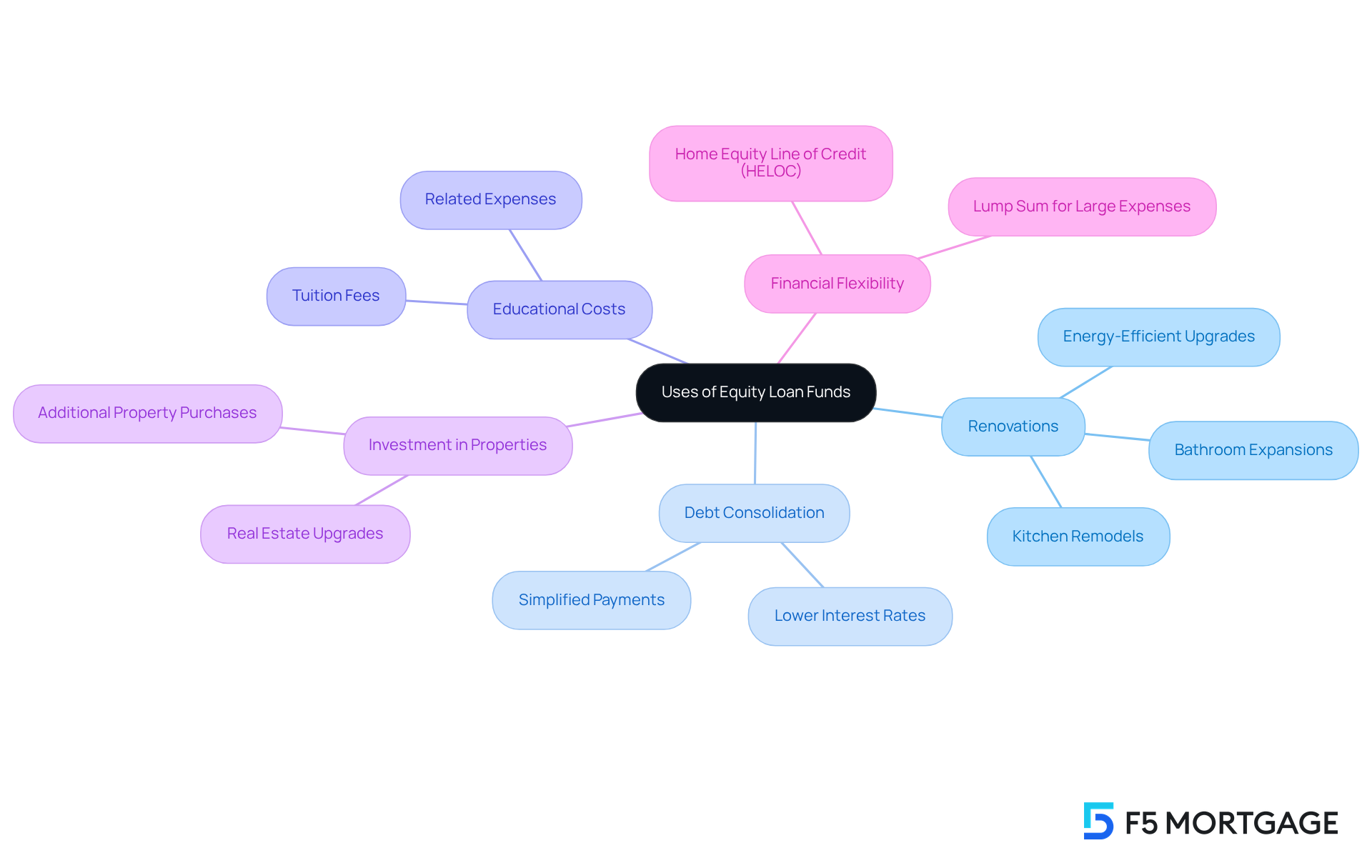

Uses of Equity Loan Funds: Smart Financial Strategies

Equity loan on house funds provide households with a flexible financial resource for various needs, such as renovations, debt consolidation, educational costs, and even investing in additional properties. Many families have successfully utilized these funds to finance significant property upgrades, like kitchen renovations or bathroom expansions. These improvements not only enhance their living spaces but also increase property value. By prioritizing their needs, families can strategically allocate these funds to projects that align with their long-term financial goals.

When considering property renovations, financing options can lead to substantial returns on investment. For example, a family that invests in energy-efficient upgrades may see a decrease in utility costs while simultaneously boosting their property’s market value. Additionally, home value loans often come with lower interest rates compared to credit cards, making them an attractive choice for important life events. They can also simplify debt management by consolidating high-interest debts into one lower-interest option, easing the burden of monthly payments.

For educational expenses, families can use asset financing to cover tuition fees or related costs, providing a stable financial foundation for their children’s future. Furthermore, the flexibility of a Home Equity Line of Credit (HELOC) allows families to access funds as needed for ongoing projects or emergencies, while an equity loan on house provides a lump sum for larger, one-time expenses.

Ultimately, the key to effectively utilizing financing funds lies in understanding personal financial circumstances and objectives. By employing thoughtful financial strategies, families can maximize the benefits of their financing, ensuring that their investments positively impact their overall financial well-being. With F5 Mortgage having assisted over 1,000 households and maintaining a 94% customer satisfaction rate, families can trust the guidance offered to navigate their equity financing options. We know how challenging this can be, and we’re here to support you every step of the way.

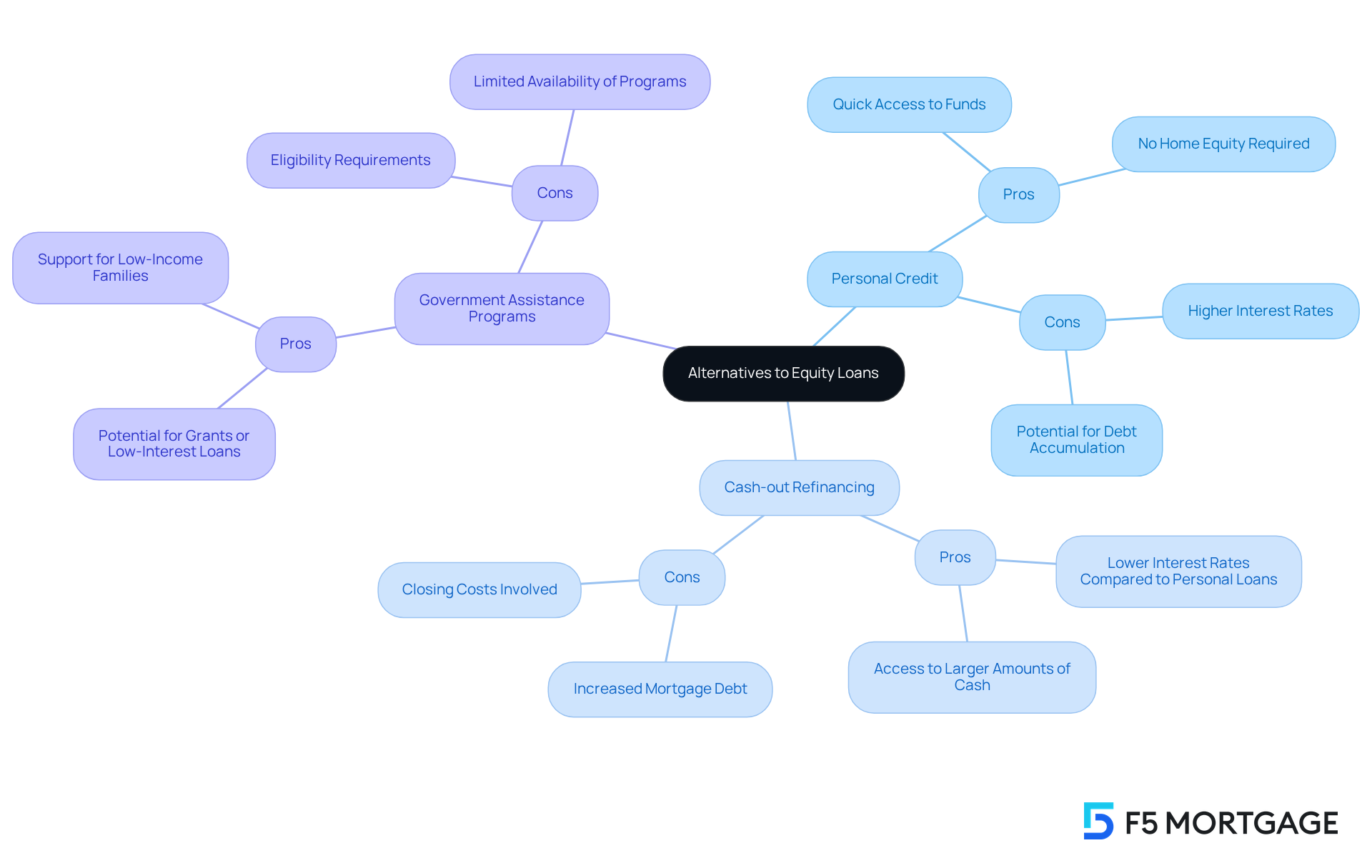

Alternatives to Equity Loans: Other Financing Options

We know how challenging it can be for families seeking funding. You might consider options like:

- Personal credit

- Cash-out refinancing

- Government assistance programs

Each of these choices has its pros and cons. By evaluating them against your personal financial situation, you can find the best path forward for your family.

Consulting with a mortgage broker can be incredibly beneficial. They can provide tailored insights that address your unique needs and concerns. Remember, you’re not alone in this process; we’re here to support you every step of the way.

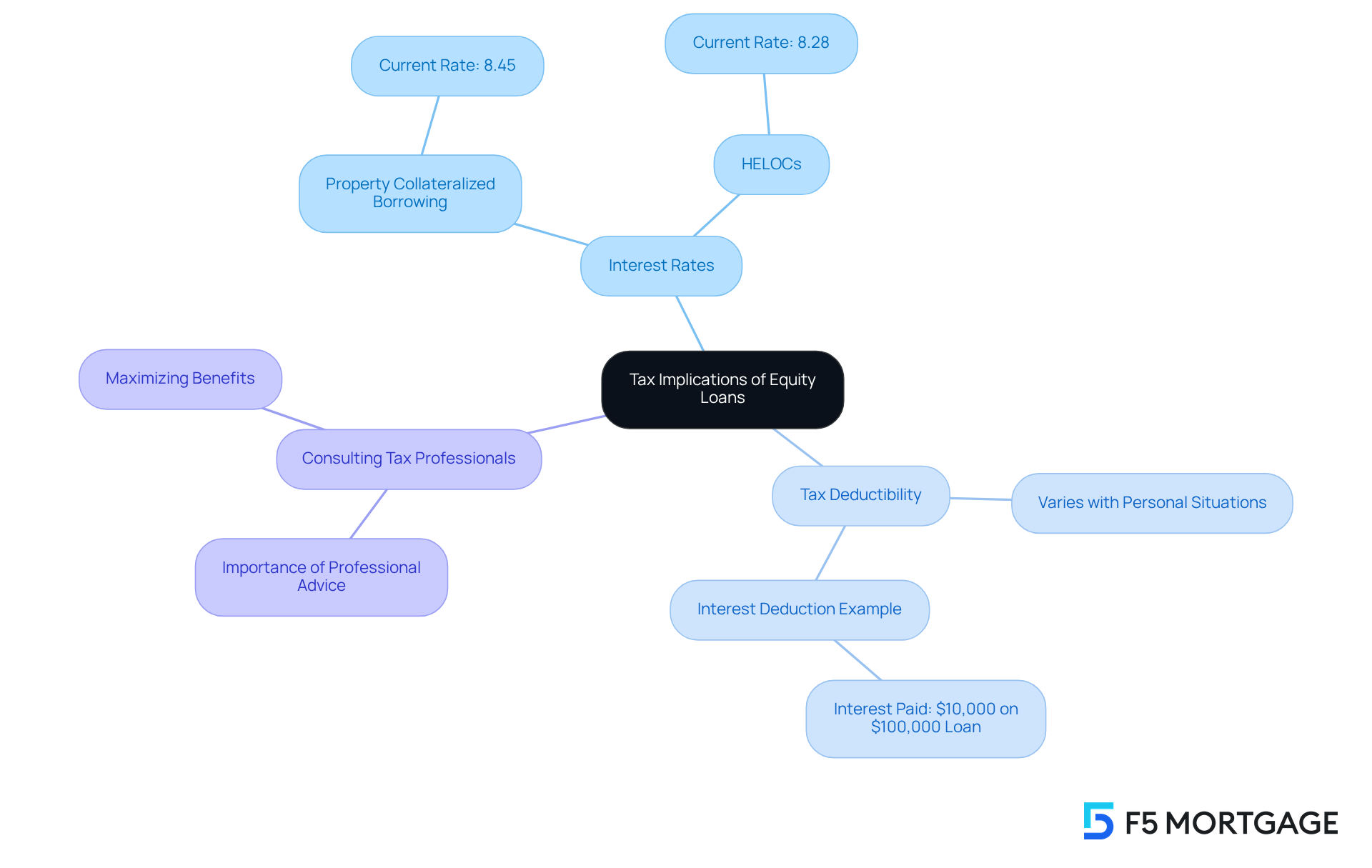

Tax Implications of Equity Loans: What You Should Know

Interest paid on residential credit lines may be tax-deductible if the funds are utilized for property enhancements. However, this can differ depending on personal situations and tax regulations, and we know how challenging this can be to navigate. Currently, the interest rate for property collateralized borrowing stands at 8.45%, while property-backed lines of credit (HELOCs) offer a slightly reduced rate of 8.28%.

Families should seek advice from a tax expert to understand how home financing might affect their tax circumstances and ensure adherence to existing rules. As Matt Richardson, Senior Managing Editor for the Managing Your Money section, wisely states, “Whether you already have a home financing option that you’ve been borrowing from or are considering one for 2025, it’s important to understand the tax implications tied to this particular borrowing product.”

By familiarizing themselves with the qualifications and potential tax advantages associated with HELOCs, households can make more informed choices regarding their borrowing options. Additionally, it is advisable for families to review their specific financial situations with a tax professional. This step can help maximize their benefits and effectively navigate the complexities of an equity loan on house. Remember, we’re here to support you every step of the way.

Conclusion

Understanding equity loans on houses is essential for families looking to leverage their home’s value for financial stability and growth. These loans can serve as a powerful tool, enabling homeowners to access funds for various needs, from renovations to education. By grasping the mechanics and implications of equity loans, families can make informed decisions that align with their financial goals.

Throughout this article, we’ve shared key insights, including:

- The definition of home equity

- The mechanics of different loan types

- The potential risks involved

We know how challenging navigating these options can be, which is why the importance of understanding interest rates, qualifying criteria, and alternative financing options has been emphasized. Each point reinforces the necessity of careful consideration and strategic planning when approaching equity loans.

In conclusion, we encourage families to explore the potential of equity loans while remaining mindful of the associated risks. Consulting with professionals like F5 Mortgage can provide valuable guidance tailored to individual circumstances. By taking proactive steps and making informed choices, families can effectively utilize their home equity to enhance their financial well-being and achieve their long-term goals.

Frequently Asked Questions

What services does F5 Mortgage provide?

F5 Mortgage offers personalized consultations and tailored advice to help households navigate financing complexities, particularly in accessing equity loans.

How is home equity defined?

Home equity is the difference between the current value of your home and the outstanding balance on your mortgage. For example, if your home is worth $300,000 and you owe $200,000, your equity is $100,000.

What are the main types of equity financing options?

The two main types of equity financing are equity loans on houses and property-backed lines of credit (HELOCs).

How does an equity loan work?

An equity loan provides a lump sum that is repaid over a set period, making it suitable for those needing a specific amount for expenses like home improvements or debt consolidation.

What is a HELOC and how does it differ from an equity loan?

A HELOC is a revolving line of credit that allows homeowners to draw funds as needed, offering flexibility for ongoing expenses. In contrast, an equity loan provides a fixed amount upfront.

What are the collateral implications of equity loans and HELOCs?

Both options use your property as collateral, meaning failure to repay could lead to foreclosure.

What ownership percentage do lenders typically require for a HELOC?

Lenders generally require a minimum of 20% ownership in your property to qualify for a HELOC or similar financing options.

What are the interest rate characteristics of equity loans and HELOCs?

Equity loans usually offer fixed interest rates and consistent monthly payments, while HELOCs often have variable interest rates that can fluctuate based on market conditions.

What recent trends are influencing borrower preferences for equity loans?

Increasing interest rates have made borrowers wary of variable-rate options like HELOCs, leading to a growing preference for the stability of equity loans.

How quickly can F5 Mortgage close agreements?

F5 Mortgage typically concludes most agreements in under three weeks, making their financing options attractive.