Overview

Navigating the journey to homeownership can be daunting, especially for first-time buyers and families with limited income. We understand how challenging this can be, and that’s why we want to share nine essential down payment assistance programs available in Florida. These programs are designed to support you on your path to owning a home, offering hope and financial relief in a competitive housing market.

Among these programs, the Florida Housing Homebuyer Program and the Florida Hometown Heroes Program stand out. They provide significant financial assistance, making homeownership more attainable for individuals facing financial hurdles. Imagine being able to secure a home that meets your family’s needs without the overwhelming burden of high upfront costs.

Each program has unique benefits tailored to help you succeed. We’re here to support you every step of the way, ensuring you find the right assistance that aligns with your situation. By exploring these options, you can take confident steps toward achieving your dream of homeownership.

Don’t hesitate to reach out for more information or guidance on how to apply for these programs. Together, we can turn your dream into reality.

Introduction

Navigating the journey to homeownership can often feel like an uphill battle, especially for first-time buyers in Florida. We know how challenging this can be. With rising home prices and complex financing options, many families find themselves searching for effective solutions to overcome financial hurdles.

This article explores nine essential down payment assistance programs available in Florida, highlighting how they can empower aspiring homeowners to achieve their dreams. Imagine if the key to unlocking homeownership lies not just in savings, but in understanding and utilizing these vital resources. We’re here to support you every step of the way.

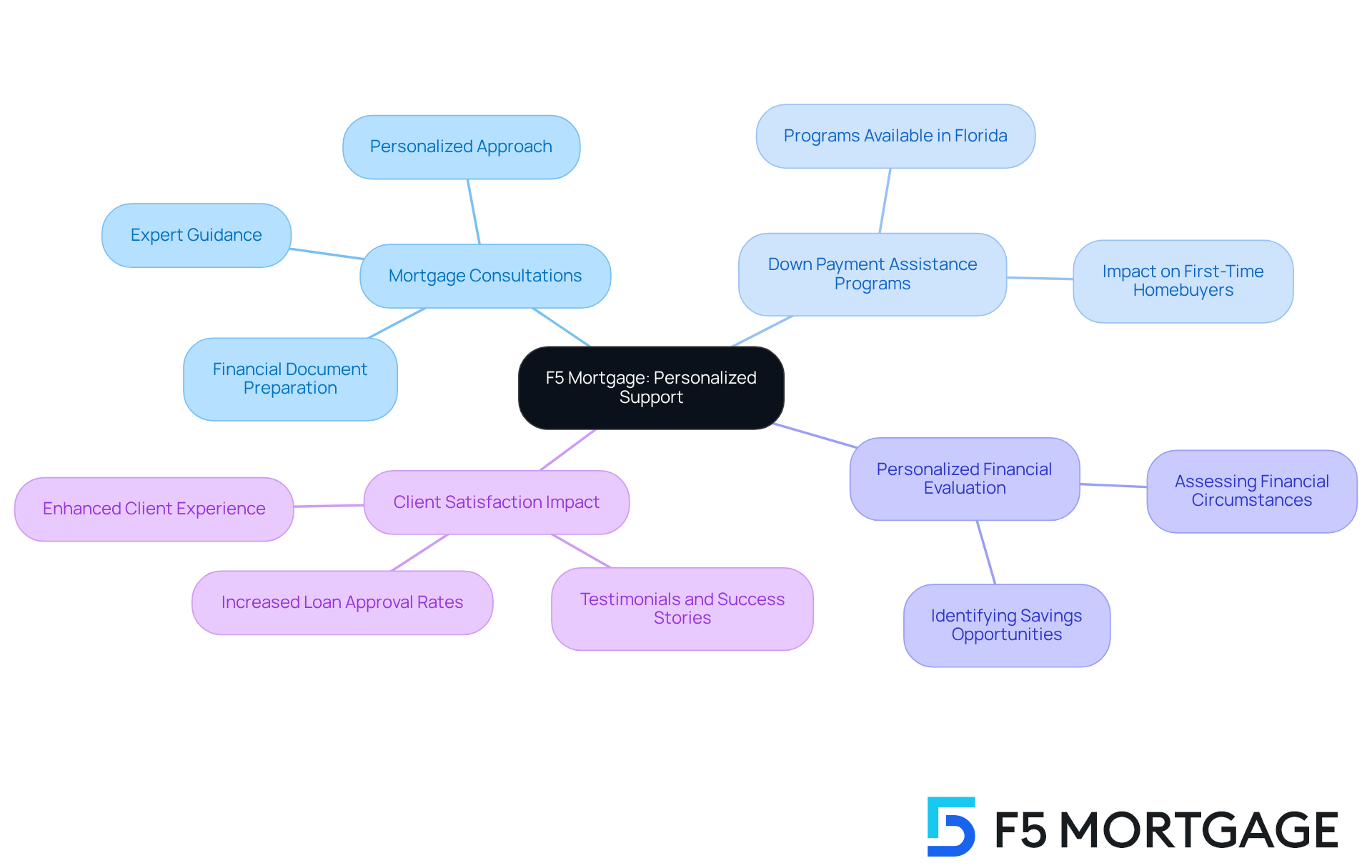

F5 Mortgage: Personalized Mortgage Consultations and Assistance Programs

F5 Mortgage understands that navigating the mortgage process can be challenging for families. We understand how crucial it is to find the right support, such as down payment assistance programs Florida, when purchasing or refinancing a home. That’s why we excel in providing personalized mortgage consultations tailored to your unique needs.

By thoroughly evaluating your personal financial circumstances, we offer support initiatives that align with your specific objectives. This personalized approach not only informs you but also empowers you to make well-informed decisions regarding your mortgage options.

With access to a varied selection of financing options, F5 Mortgage streamlines the often intricate mortgage environment. This allows you to explore your choices with confidence and assurance.

The impact of such customized support is significant. Research indicates that personalized mortgage options and down payment assistance programs Florida can enhance client satisfaction and increase the likelihood of successful loan approvals, particularly for first-time homebuyers. As one mortgage broker noted, ‘Down payment assistance programs Florida are essential in helping families achieve their homeownership dreams.’

At F5 Mortgage, we are committed to being your trusted partner throughout this process, supporting you every step of the way.

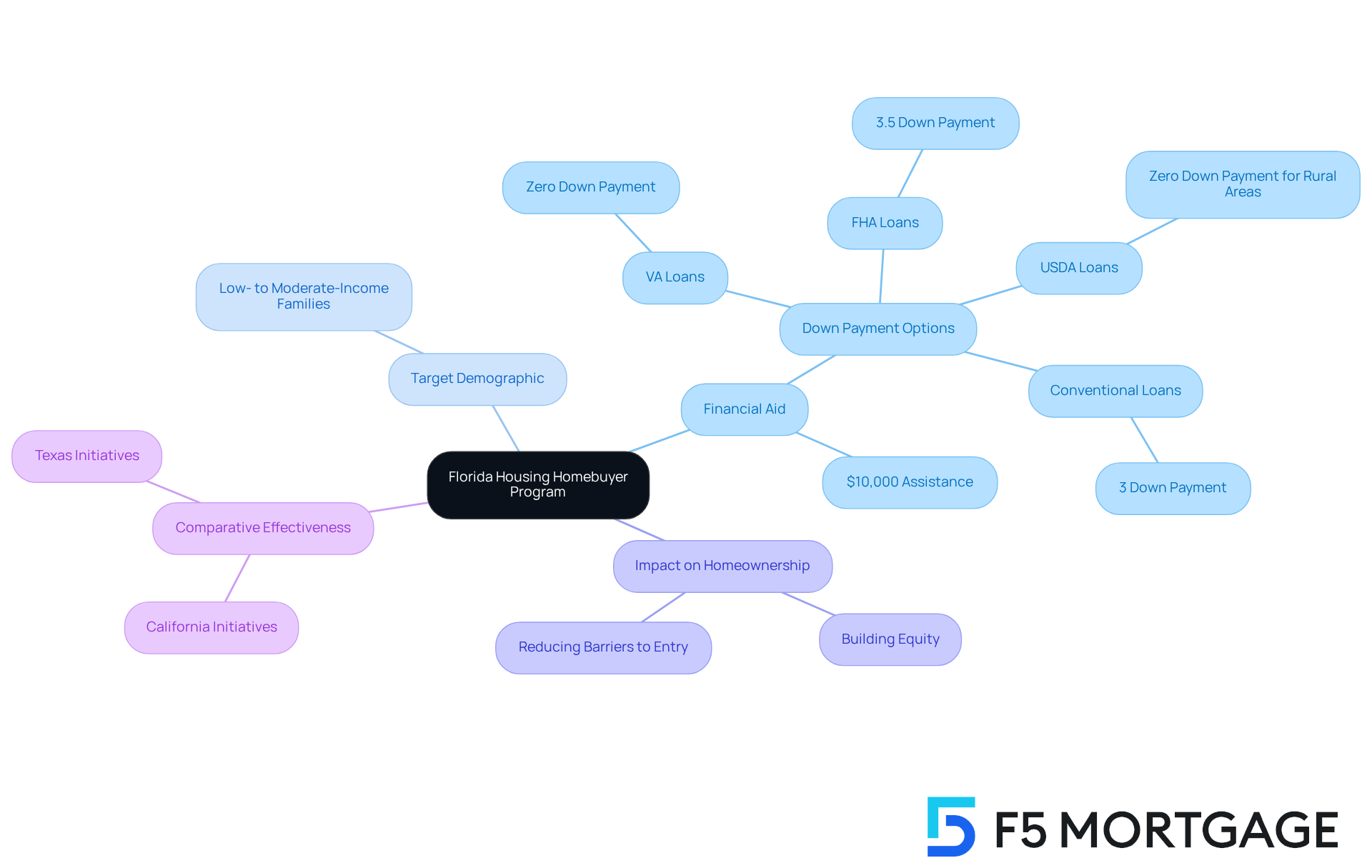

Florida Housing Homebuyer Program: Key Support for First-Time Buyers

The Florida Housing Homebuyer Program is here to support first-time buyers, offering access to affordable mortgage options and crucial down payment assistance. We know how challenging it can be to purchase a home, and that’s why eligible participants can receive up to $10,000. This financial aid significantly eases the burden of homeownership, especially for low- to moderate-income families who are navigating the complexities of the housing market.

In 2024, we anticipate that this initiative will help many first-time homebuyers, underscoring its vital role in fostering homeownership across the state. Experts emphasize that down payment aid options, including FHA loans with their low down payment solutions, are essential in reducing barriers to entry. This support allows families to invest in their futures and build equity.

With the median home prices in Florida’s major cities presenting challenges, down payment assistance programs in Florida are more crucial than ever for those seeking their first home, including the Florida Housing Homebuyer Program. The initiative boasts an impressive average rating of 4.92, reflecting its effectiveness and the satisfaction of its participants. Additionally, findings from similar initiatives in California and Texas highlight the importance of financial aid in promoting homeownership nationwide. We’re here to support you every step of the way on your journey to homeownership.

Florida Hometown Heroes Program: Assistance for Community Heroes

The Florida Hometown Heroes Program is here to lend a helping hand to first-time homebuyers who are essential community workers, such as teachers, healthcare professionals, and law enforcement officers. We understand how challenging it can be to secure a home, and this initiative acknowledges the invaluable contributions of these dedicated individuals by offering vital down payment and closing cost assistance.

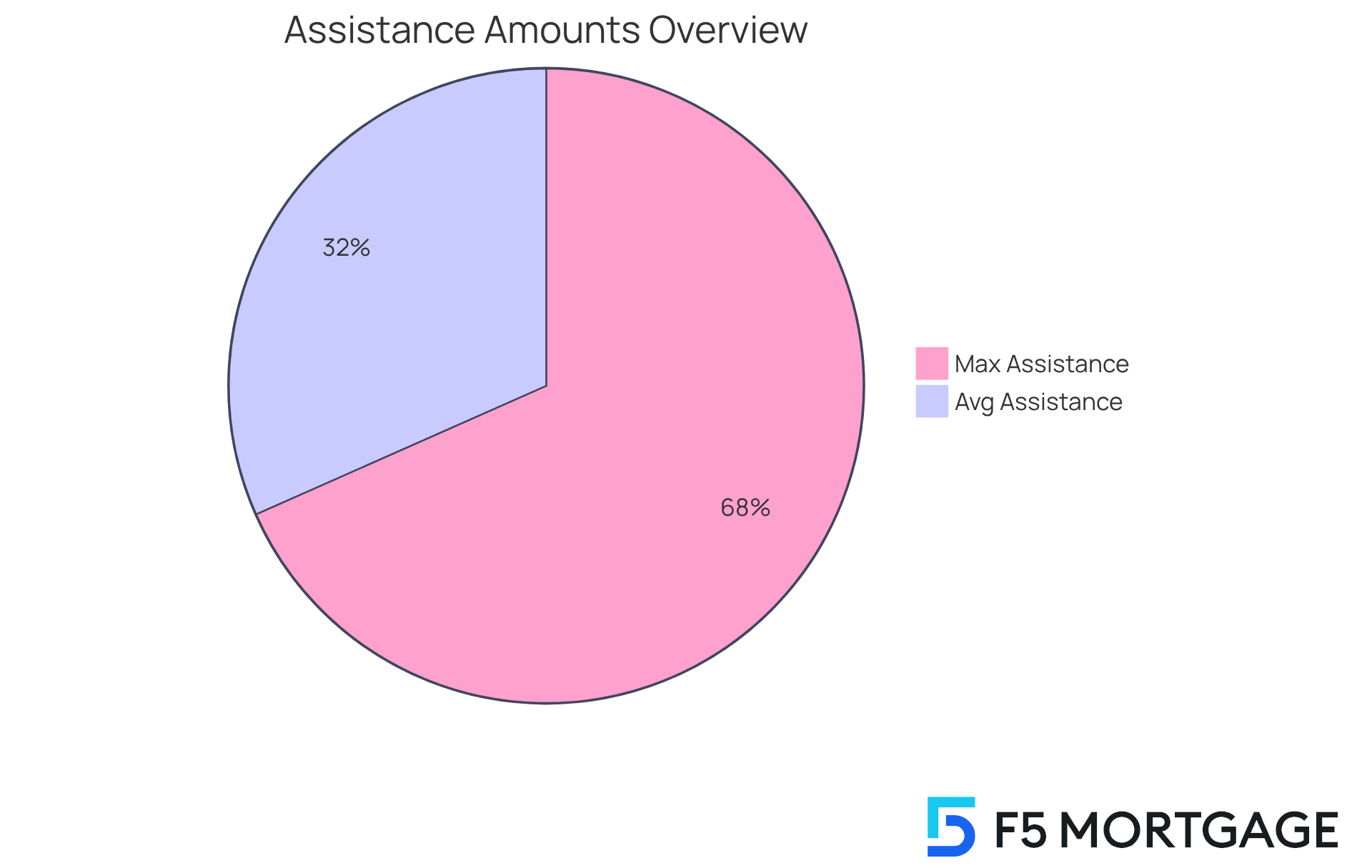

Imagine receiving up to $35,000 in support—this financial assistance can truly be transformative for those looking to establish roots in the communities they serve so diligently. By empowering our community heroes, we are not only helping them achieve homeownership but also positively influencing homeownership rates across Florida. This fosters stability and growth in our local neighborhoods.

With an average assistance amount of approximately $16,198, the program is designed to alleviate the financial burdens associated with purchasing a home. We’re here to support you every step of the way, making this initiative a crucial resource for those dedicated to serving others. Together, we can create a brighter future for our communities.

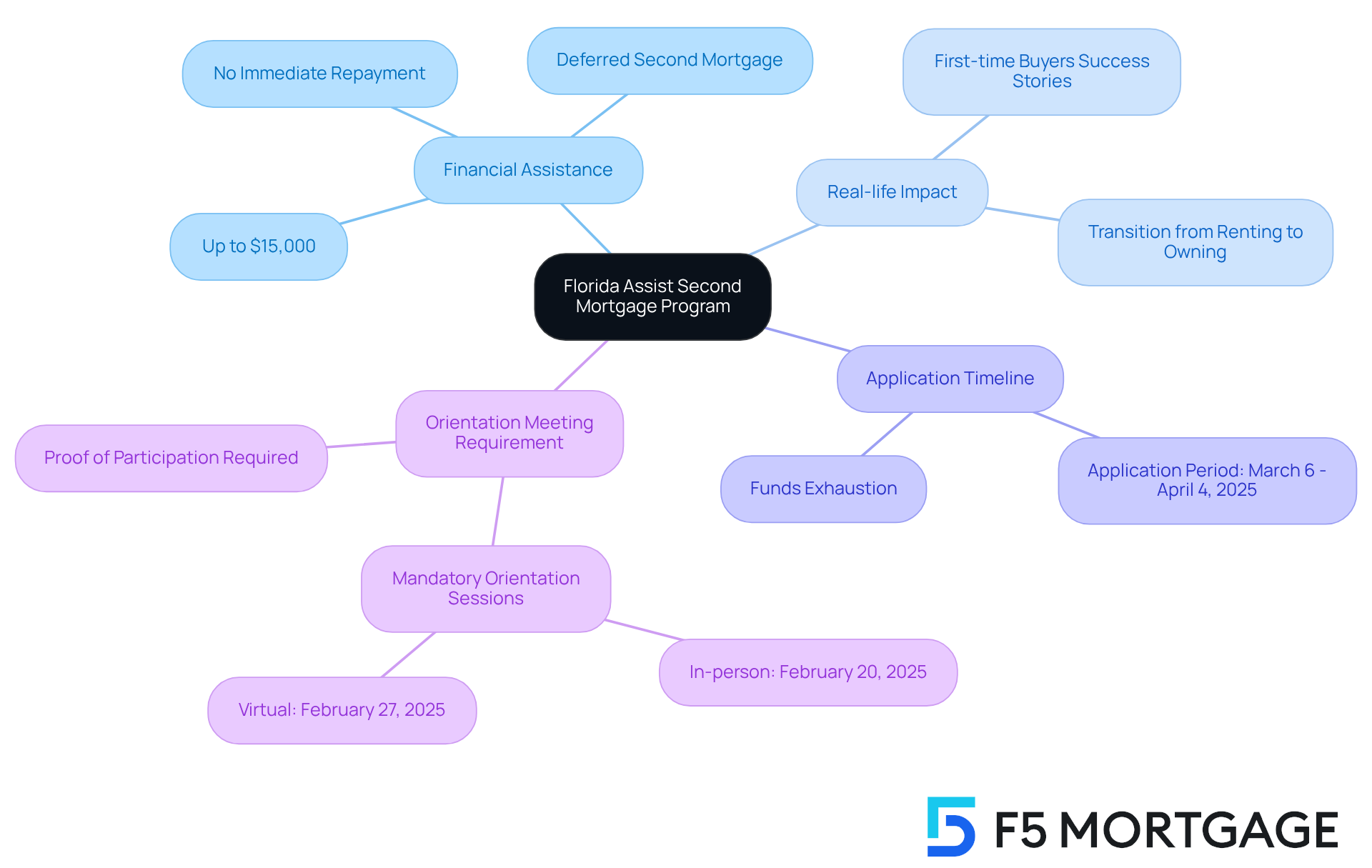

Florida Assist Second Mortgage Program (FL Assist): Additional Financial Support

The Florida Assist Second Mortgage Program (FL Assist) offers crucial financial assistance to homebuyers by covering down payment assistance programs Florida and closing expenses through a deferred second mortgage. We understand how challenging it can be to save for a deposit, and this program can help. Qualified borrowers can obtain up to $15,000—a substantial sum that can ease your financial burden. With this deferred loan arrangement, no payments are necessary until the property is sold or refinanced, providing flexibility for buyers who may encounter financial limitations.

Real-life instances demonstrate the initiative’s impact. Many first-time buyers have successfully utilized FL Assist to secure their properties, enabling them to transition from renting to owning. Financial consultants frequently emphasize the benefits of deferred second mortgages, pointing out that they allow purchasers to invest in their homes without the immediate stress of repayment.

Additionally, it’s important to note that applications for FL Assist will be accepted from March 6, 2025, to April 4, 2025, or until funds are exhausted. Before submitting an application, participation in a compulsory orientation meeting is necessary. This ensures that prospective applicants are well-informed about the requirements. This initiative not only facilitates homeownership but also empowers individuals and families to achieve their dreams of owning a home in Florida with down payment assistance programs Florida. We’re here to support you every step of the way.

HFA Advantage (FL Plus): Competitive Mortgage Options and Assistance

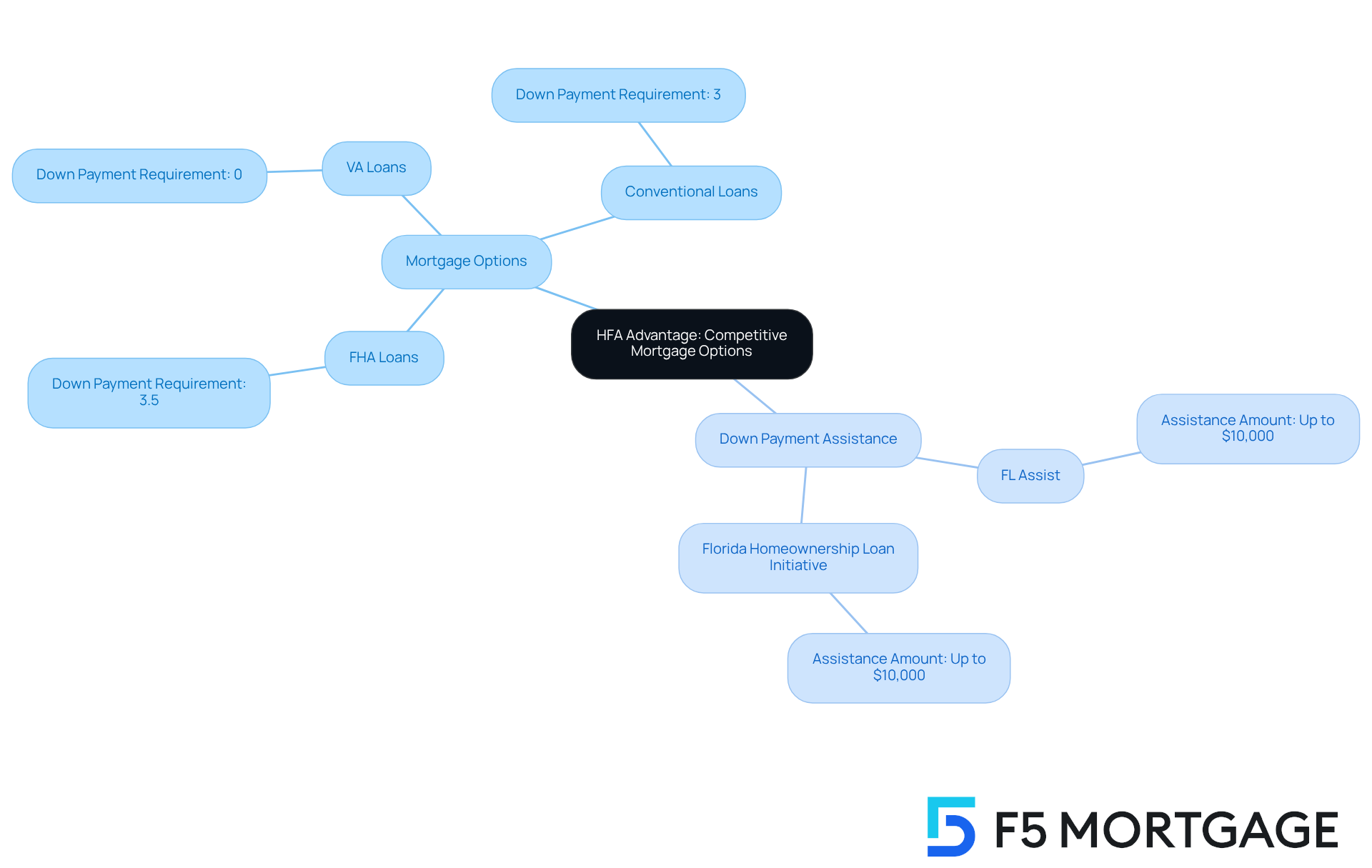

The HFA Advantage initiative offers a wonderful opportunity for first-time homebuyers and individuals looking to refinance their homes. We know how challenging this process can be, and this initiative provides access to competitive mortgage choices that can help ease your financial concerns. With lower interest rates and reduced mortgage insurance expenses, homeownership becomes much more attainable.

Additionally, borrowers can benefit from down payment assistance programs in Florida, which significantly alleviates the financial strain of purchasing a home. Imagine being able to secure a mortgage with options like FHA loans requiring only a 3.5% down payment, VA loans with 0% down, or conventional loans needing as little as 3% down for well-qualified buyers. This flexibility opens doors for many families.

In Florida, down payment assistance programs like FL Assist and the Florida Homeownership Loan Initiative can provide up to $10,000 in assistance, making it easier for low- to moderate-income families to enter the housing market. These resources can be a game-changer for those who may feel overwhelmed by the costs associated with homebuying.

Testimonials from satisfied clients highlight the exceptional service provided by F5 Mortgage. They emphasize how the team is dedicated to helping families navigate these options effectively. We’re here to support you every step of the way, ensuring that you can enhance your home while taking advantage of available financial assistance.

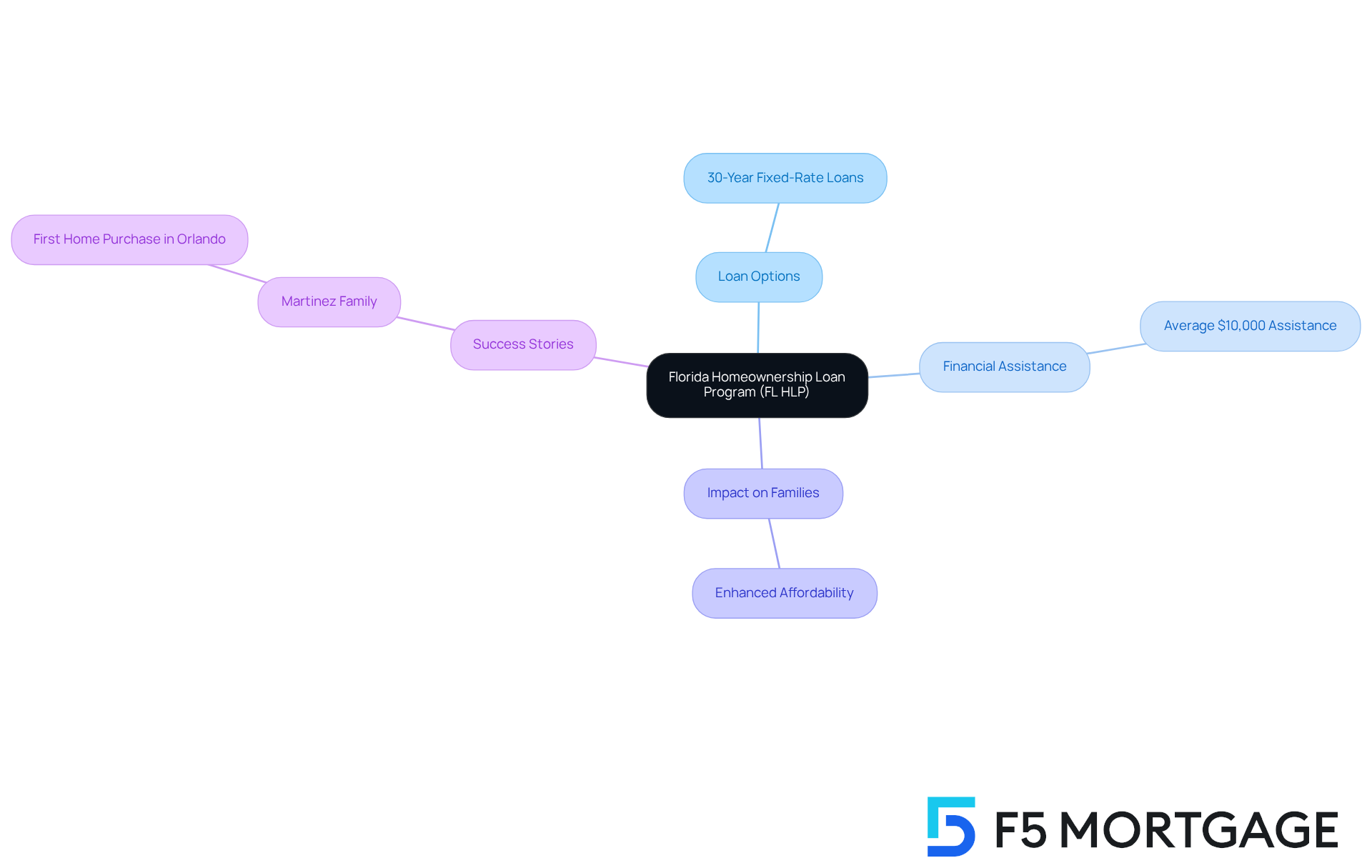

Florida Homeownership Loan Program (FL HLP): Support for Low- to Moderate-Income Families

The Florida Homeownership Loan Program (FL HLP) is a beacon of hope for low- to moderate-income families aspiring to achieve homeownership. This initiative offers 30-year fixed-rate loans paired with financial assistance options, significantly easing the financial burden for families navigating Florida’s competitive housing market. On average, families benefiting from FL HLP receive around $10,000 in down payment assistance programs Florida, which can dramatically enhance affordability.

We understand how challenging it can be to secure sufficient financing, especially for first-time homebuyers. Housing advocates emphasize the importance of initiatives like FL HLP, which are vital for families facing these hurdles. Feedback from satisfied customers of F5 Mortgage reveals heartfelt appreciation for the support they received, highlighting how these services have transformed their home purchasing experience.

Real-life stories illustrate the profound impact of this initiative. For instance, families who once struggled to save for a down payment have successfully purchased homes thanks to down payment assistance programs Florida offered by FL HLP. Take the Martinez family, who had been renting for years; they were able to buy their first home in Orlando after receiving help through the program. This initiative not only empowers families but also fosters greater stability in Florida’s housing market, ensuring that more individuals can realize their dreams of homeownership.

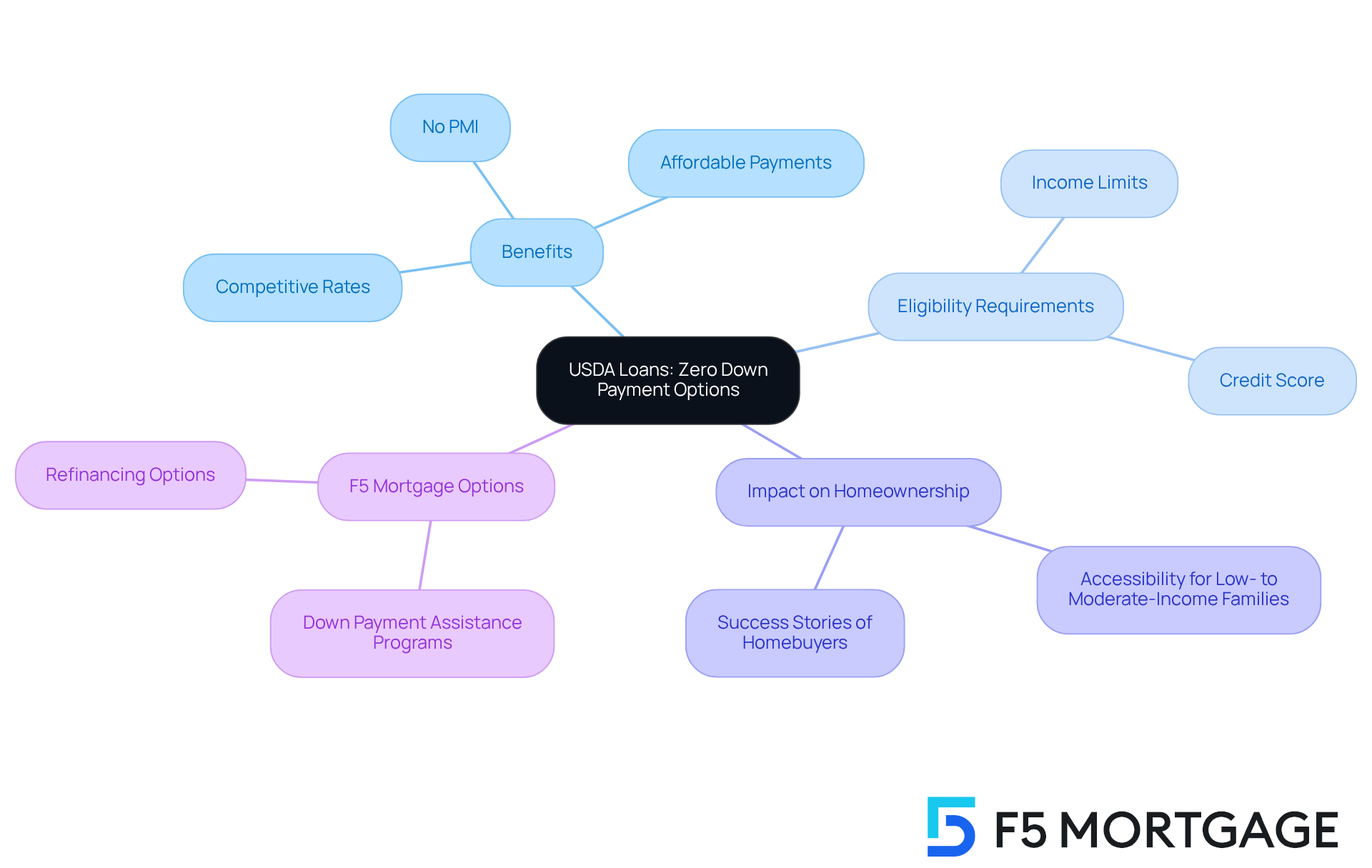

USDA Loans: Zero Down Payment Options for Rural Homebuyers

USDA financing presents a remarkable opportunity for qualified rural buyers to secure a property with zero down payment. Specifically designed for low- to moderate-income families, these financial products offer competitive interest rates and flexible credit requirements, making them accessible to many buyers. We understand how challenging homeownership can be, and the USDA initiative actively encourages families to establish their homes in rural areas, away from the hustle of city life.

One of the significant advantages of USDA financing is that it eliminates the need for private mortgage insurance (PMI). This greatly reduces monthly payments, improving affordability for families. To qualify for a USDA mortgage, applicants must meet specific income limits and credit score requirements, ensuring that the program effectively serves those who need it most.

Recent data indicates that thousands of rural homebuyers have successfully utilized USDA financing, showcasing its popularity and effectiveness in facilitating homeownership. Families have shared their success stories, realizing their dreams of owning a home without the burden of an initial cost. This demonstrates the transformative impact of these financial choices on their lives. As financial expert Dan Green notes, USDA financing is a viable solution for many, providing a pathway to homeownership that is both attainable and sustainable.

F5 Mortgage plays a vital role in this journey by offering a variety of options, including down payment assistance programs in Florida like FHA, VA, and conventional alternatives. This ensures that families have access to customized choices that cater to their unique needs. Furthermore, F5 Mortgage provides refinancing options for all mortgage categories, allowing borrowers to adjust terms or tap into home equity, further enhancing their financial flexibility. We’re here to support you every step of the way.

FHA Loans: Flexible Financing for First-Time Homebuyers

FHA mortgages are a favored choice for first-time homebuyers, and it’s easy to see why. With a minimum down payment requirement of just 3.5%, these financial options are designed to be accessible for those who may not have significant savings. In today’s housing market, where the median single-family home price has soared over 50% from $170,000 in 2019 to $255,000 in 2024, this low barrier to entry is particularly beneficial.

Moreover, FHA financing accommodates lower credit scores, making them an appealing option for individuals with less-than-perfect credit histories. We understand that many first-time buyers face challenges in securing financing, and this inclusivity is crucial. Additionally, FHA mortgages typically offer competitive interest rates, further enhancing their attractiveness for new homebuyers.

Real-life examples truly illustrate the impact of these flexible financing options. Families utilizing FHA financing have reported smoother transitions into homeownership, thanks to manageable down payment requirements and supportive lending terms. Testimonials from satisfied clients highlight the exceptional service provided by F5 Mortgage, with many expressing gratitude for the assistance they received during the financing process. As mortgage experts emphasize, these financial products not only pave the way to homeownership but also empower buyers to invest in their futures with confidence.

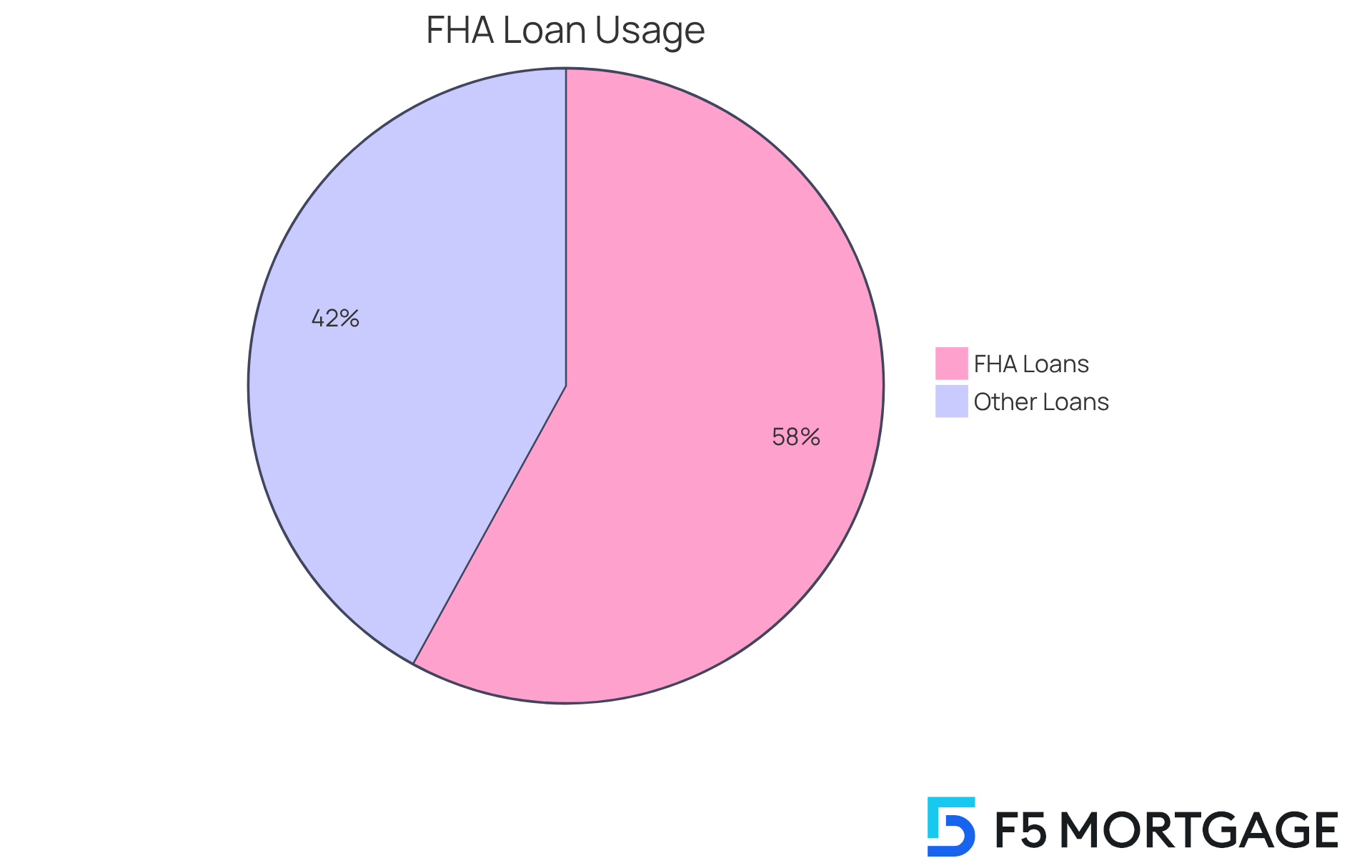

Significantly, first-time home purchasers represented a record 58% of agency purchase financing in Q1 2025, underscoring the growing importance of FHA mortgages in the current market. Furthermore, F5 Mortgage provides various down payment assistance programs in Florida, as well as in states like California and Texas, enhancing purchasing opportunities for families looking to upgrade their homes. We know how challenging this can be, and we’re here to support you every step of the way.

VA Home Loans: Benefits for Veterans and Active-Duty Military

Navigating home financing can feel overwhelming, especially for our veterans and active-duty military members. At F5 Mortgage, we understand how challenging this can be. That’s why we want to share the unique advantages offered through VA home financing. With no upfront costs and attractive interest rates, this program is designed to ease your financial burdens.

Supported by the U.S. Department of Veterans Affairs, VA loans allow lenders to provide favorable conditions to qualified borrowers. This means you can access loans without the need for private mortgage insurance (PMI), significantly lowering your monthly expenses. We recognize that every dollar counts, and this initiative is here to assist you in achieving your dream of homeownership.

We’re committed to supporting you every step of the way. By connecting you with top realtors, we ensure that you secure the best mortgage deals available. Let us help you turn your homeownership dreams into reality. Together, we can navigate this journey with confidence and care.

Florida Down Payment Assistance Programs: Diverse Options for Homebuyers

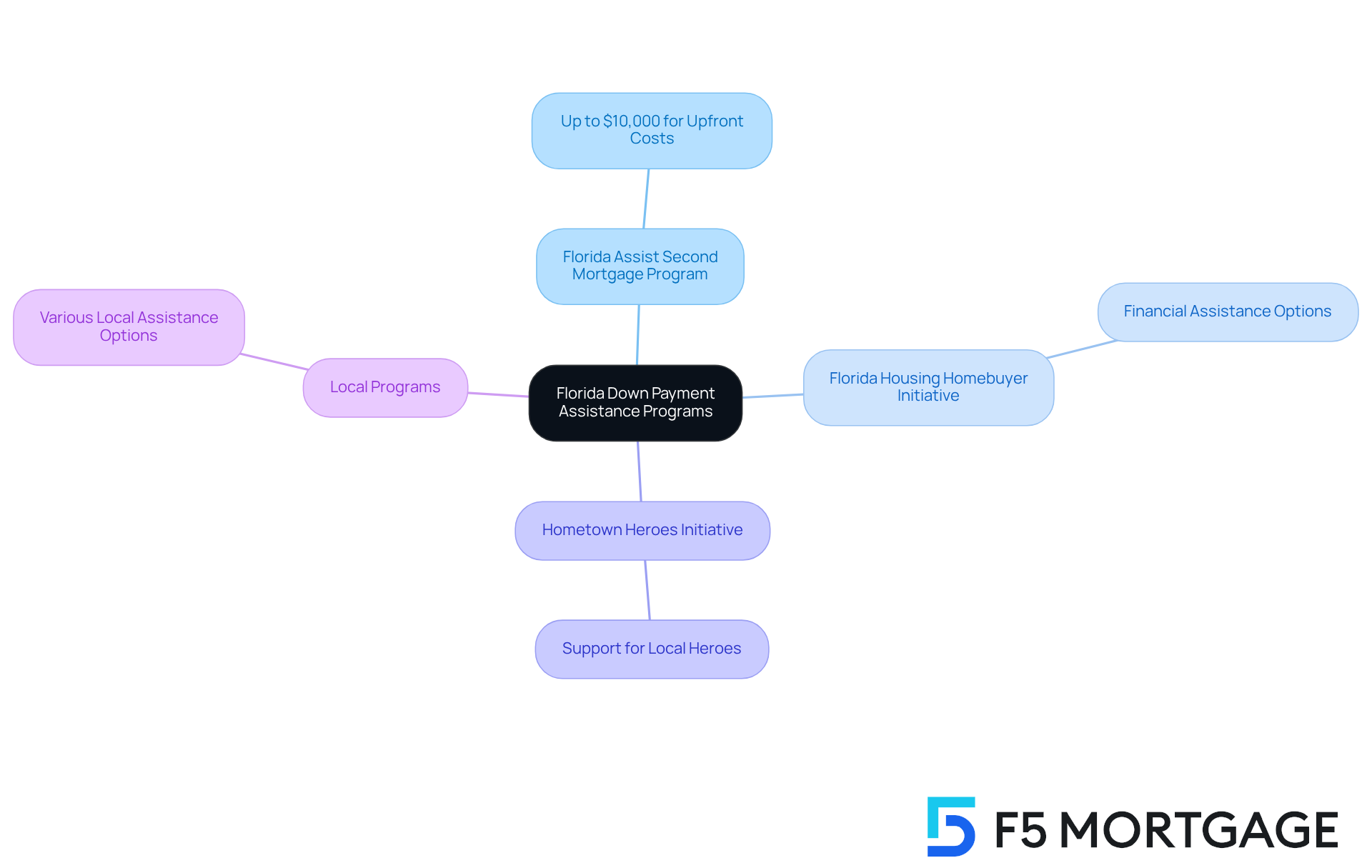

Navigating the journey to homeownership can be challenging, especially when faced with financial hurdles. In Florida, down payment assistance programs provide numerous support options designed to help you overcome these obstacles. One standout resource is the Florida Assist Second Mortgage Program, which offers up to $10,000 to cover upfront costs. This program can be a game-changer for many aspiring homeowners.

In addition to this, Florida offers initiatives like:

- Florida Housing Homebuyer initiative

- Hometown Heroes initiative

There are also various local programs that provide financial assistance for down payment and closing costs. By exploring these diverse options, you can make informed decisions that align with your financial situation.

At F5 Mortgage, we understand how important it is to find the right support. Our commitment to helping clients navigate these opportunities is reflected in the many success stories from satisfied customers who have benefited from these programs. Whether you choose state-sponsored initiatives or local efforts, down payment assistance programs in Florida offer abundant possibilities for those looking to achieve their dream of homeownership.

Remember, we know how challenging this can be, but we’re here to support you every step of the way.

Conclusion

Navigating the path to homeownership in Florida can feel overwhelming, especially with the rising costs associated with purchasing a home. However, there is hope. A variety of down payment assistance programs available in the state can provide the support many aspiring homeowners need. Programs like the Florida Housing Homebuyer Program, Hometown Heroes Program, and FL Assist are designed to alleviate the financial burdens faced by first-time buyers and those in need of assistance.

Several key programs stand out in providing crucial financial support. For instance, the Florida Assist Second Mortgage Program offers up to $15,000, while USDA loans enable zero down payment options for rural homebuyers. Each program is tailored to meet specific needs, whether it’s supporting low- to moderate-income families or honoring community heroes like teachers and first responders. Services like F5 Mortgage emphasize the importance of personalized mortgage consultations, guiding families through these complex options with care.

The significance of these down payment assistance programs cannot be overstated. They empower individuals and families to realize their homeownership dreams, contributing positively to the overall stability and growth of Florida’s housing market. By taking advantage of these resources, prospective buyers can transform their aspirations into reality, paving the way for a brighter future for themselves and their communities. Exploring these options and seeking expert guidance is a crucial step toward a successful homebuying journey. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage provide for families navigating the mortgage process?

F5 Mortgage offers personalized mortgage consultations and access to down payment assistance programs tailored to the unique needs of families, helping them make informed decisions regarding their mortgage options.

How does F5 Mortgage approach personalized mortgage support?

F5 Mortgage evaluates personal financial circumstances to offer support initiatives that align with specific objectives, enhancing client satisfaction and increasing the likelihood of successful loan approvals, especially for first-time homebuyers.

What is the Florida Housing Homebuyer Program?

The Florida Housing Homebuyer Program supports first-time buyers by providing access to affordable mortgage options and down payment assistance, offering eligible participants up to $10,000 to ease the burden of homeownership.

Who is eligible for the Florida Housing Homebuyer Program?

The program is designed for first-time homebuyers, particularly low- to moderate-income families facing challenges in purchasing a home.

What is the significance of down payment assistance programs in Florida?

Down payment assistance programs, including the Florida Housing Homebuyer Program, are crucial for reducing barriers to homeownership, allowing families to invest in their futures and build equity, particularly in the context of rising median home prices.

What is the Florida Hometown Heroes Program?

The Florida Hometown Heroes Program provides assistance to first-time homebuyers who are essential community workers, such as teachers, healthcare professionals, and law enforcement officers, by offering down payment and closing cost assistance.

How much financial assistance can participants receive from the Florida Hometown Heroes Program?

Participants can receive up to $35,000 in financial assistance, with an average assistance amount of approximately $16,198, which helps alleviate the financial burdens of purchasing a home.

What impact does the Florida Hometown Heroes Program have on communities?

By supporting community heroes in achieving homeownership, the program positively influences homeownership rates and fosters stability and growth in local neighborhoods.