Overview

This article highlights nine essential down payment assistance programs available in Arizona, designed to support first-time homebuyers and low- to moderate-income families on their journey to homeownership. We understand how challenging this process can be, and these initiatives, such as the HOME+PLUS program and the Home in Five Advantage, provide vital financial support for down payments and closing costs. By reducing barriers to homeownership, these programs not only help families secure their dream homes but also promote stability within the community. We’re here to support you every step of the way as you explore these valuable resources.

Introduction

In the landscape of homeownership, down payment assistance programs act as vital lifelines for aspiring buyers. We understand how daunting the housing market can be, especially in Arizona. These initiatives not only ease the financial burden of upfront costs but also empower families to realize their dreams of owning a home.

However, with so many options available, how can potential buyers navigate the maze of programs to find the right support for their unique situations? This article delves into nine essential down payment assistance programs in Arizona. We’ll highlight their benefits, eligibility requirements, and the transformative impact they can have on your journey to homeownership. We’re here to support you every step of the way.

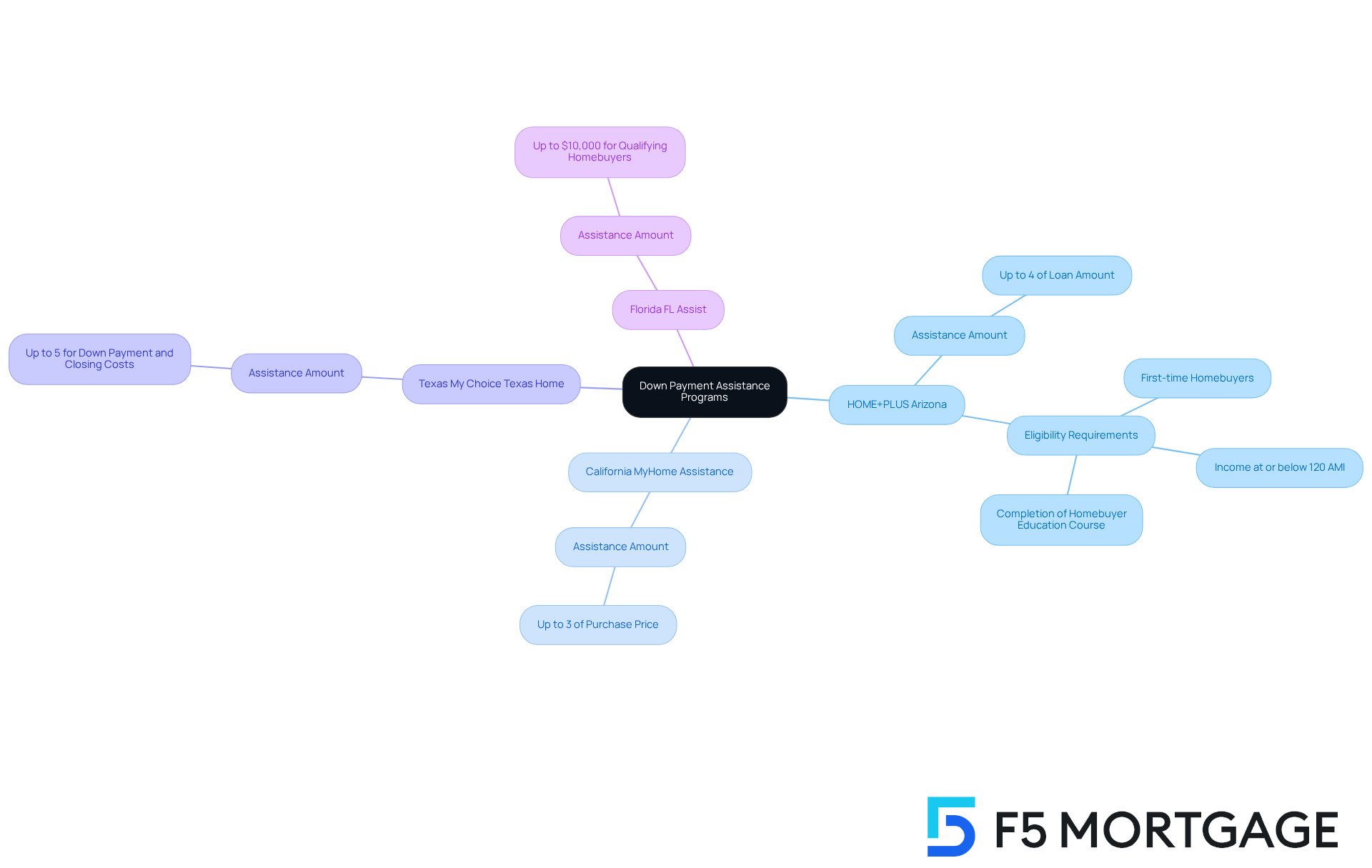

F5 Mortgage: HOME+PLUS Down Payment Assistance Program

The HOME+PLUS down payment assistance Arizona program is designed to support eligible homebuyers by providing up to 4% of the loan amount to help cover down payments and closing costs. This initiative is particularly focused on first-time homebuyers with incomes at or below 120% of the Area Median Income (AMI). By significantly reducing the obstacles to homeownership, it opens doors for many families. To qualify, applicants are required to complete a homebuyer education course, ensuring they are equipped with essential knowledge about the mortgage process.

Success stories highlight the effectiveness of this initiative. For instance, first-time homebuyer Maria Magdalena Contreras transitioned from renting for eight years to owning her home, thanks to the support offered by the HOME+PLUS initiative. This program not only facilitates access to homeownership but also empowers buyers with the knowledge they need to make informed financial choices. Ultimately, down payment assistance Arizona contributes to a more stable housing environment in the state.

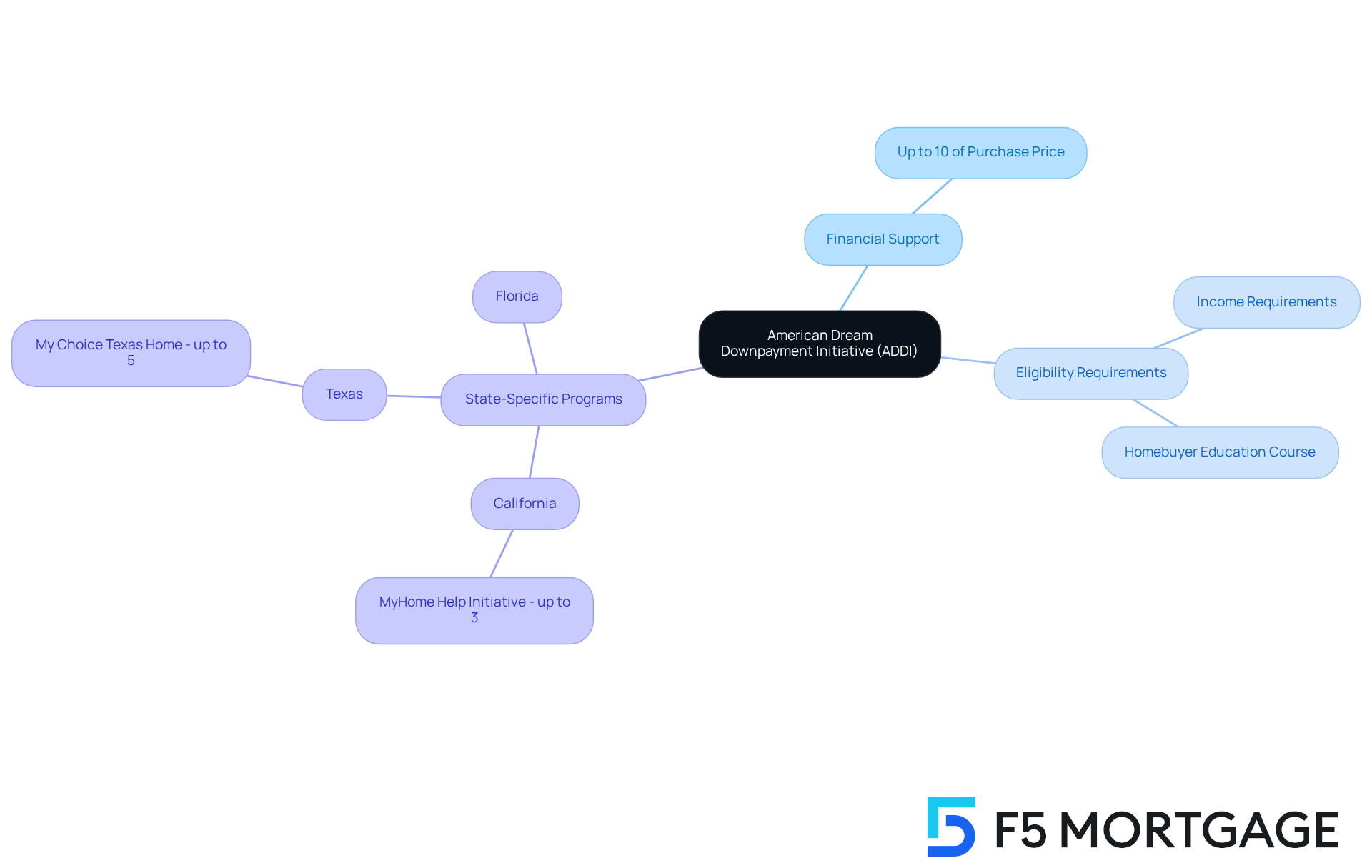

In addition to the HOME+PLUS initiative, F5 Mortgage offers various down payment support efforts in states such as California, Texas, and Florida. For example:

- California’s MyHome Assistance initiative provides up to 3% of the home’s purchase price.

- Texas’s My Choice Texas Home scheme offers up to 5% for down payment and closing assistance.

- In Florida, initiatives like FL Assist provide up to $10,000 for qualifying homebuyers.

These programs exemplify F5 Mortgage’s commitment to enhancing home buying opportunities for families.

Governor Katie Hobbs expressed, “Through Arizona Is Home and the initiative for down payment assistance Arizona, we’ve turned the dream of owning a home into a reality for hundreds of Arizonans, and now even more Arizonans will have that same opportunity.” This client-focused strategy, combined with outstanding customer satisfaction, underscores F5 Mortgage’s dedication to assisting families in their journey to homeownership. We know how challenging this can be, and we’re here to support you every step of the way.

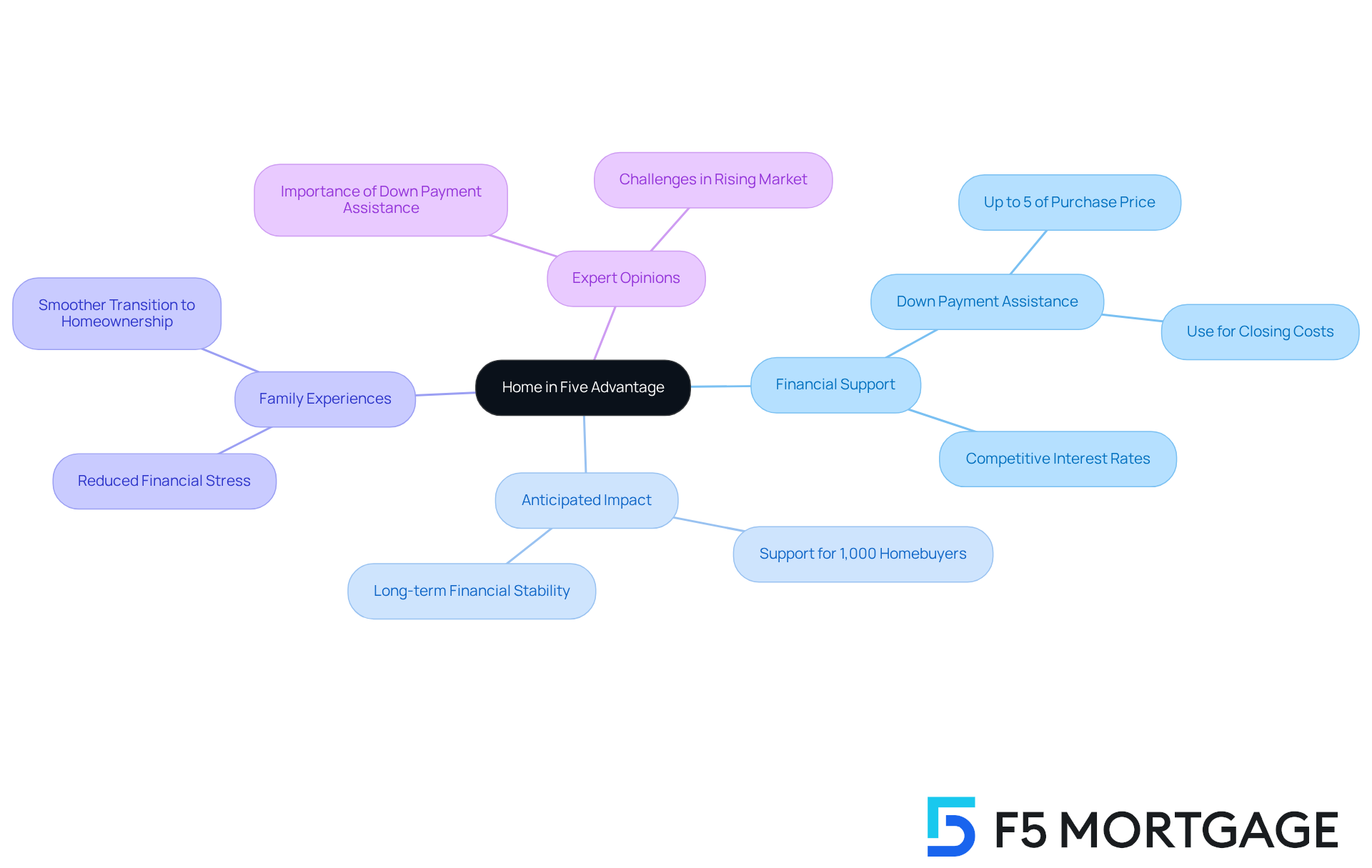

Home in Five Advantage: Financial Support for First-Time Buyers

The Home in Five Advantage initiative provides down payment assistance Arizona for first-time homebuyers in Maricopa County, offering up to 5% of the purchase price. This financial help can be used for both down payments and closing costs, making it easier for those who struggle to save for these initial expenses. Alongside this support, the initiative provides a competitive interest rate on the first mortgage, making homeownership more attainable and affordable for new buyers.

In 2025, we anticipate this initiative will have a significant impact on local families, with many already benefiting from its resources. Families who have participated in the Home in Five program have shared their experiences of reduced financial stress and a smoother transition into homeownership. Financial experts emphasize that down payment assistance Arizona programs are crucial in overcoming the challenges faced by first-time buyers, especially in a market where home prices continue to rise.

With the expansion of the Arizona Is Home initiative, which includes the Home in Five Advantage, the state is committed to assisting around 1,000 homebuyers. This reflects a growing dedication to making homeownership possible for working families. This initiative not only eases the burden of upfront costs but also promotes long-term financial stability for those involved. We know how challenging this journey can be, and we’re here to support you every step of the way.

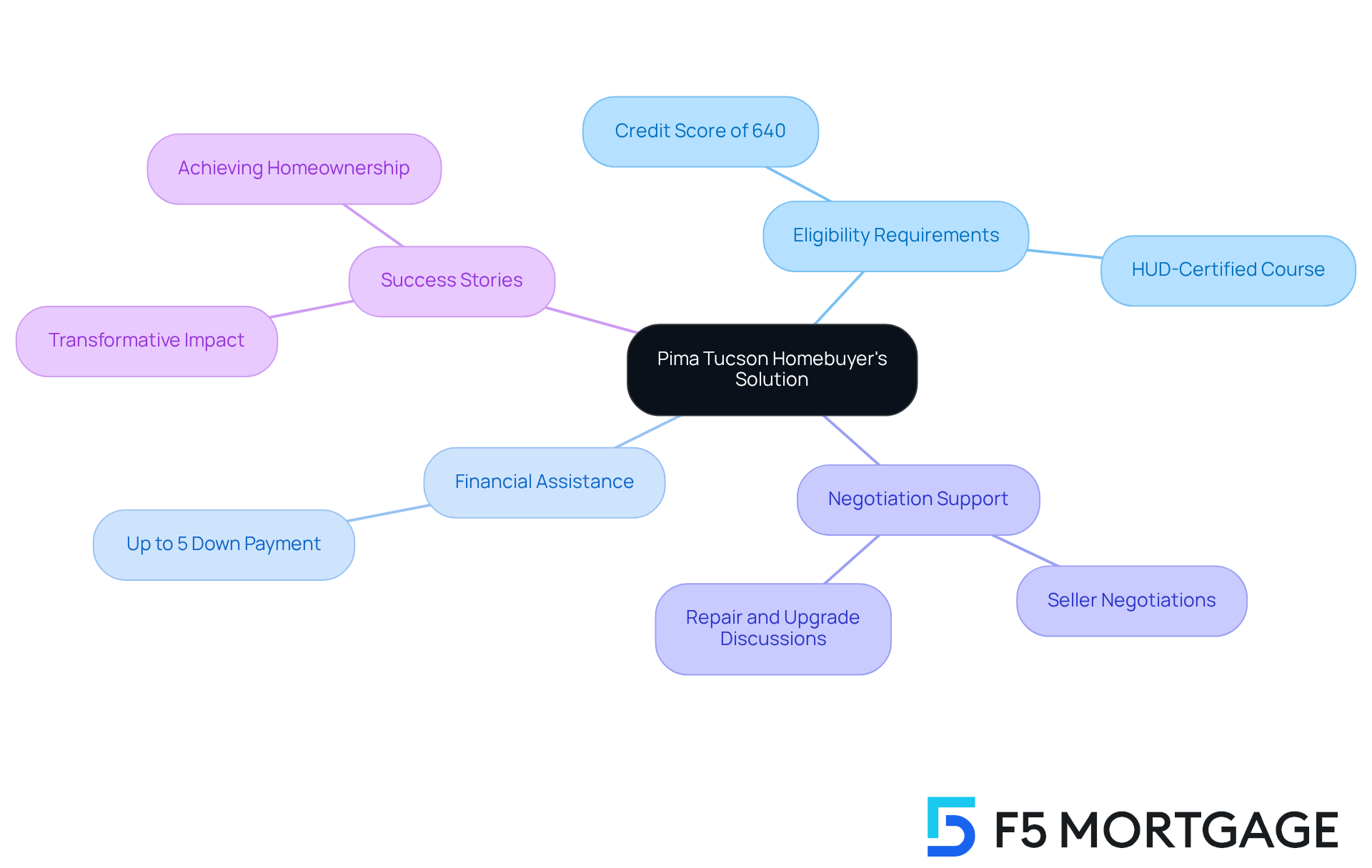

Pima Tucson Homebuyer’s Solution: Localized Assistance for New Buyers

The Pima Tucson Homebuyer’s Solution is a vital financial assistance program designed with you in mind. If you’re an eligible homebuyer in Pima County, including Tucson, this initiative can provide down payment assistance in Arizona of up to 5% of your home purchase price to help cover down payment and closing costs. This makes it an attractive option for both first-time and repeat buyers.

We understand how challenging the homebuying process can be. To qualify, you’ll need:

- A minimum credit score of 640

- To complete a HUD-certified homebuyer education course

This step ensures you’re well-prepared for the responsibilities of homeownership.

As you navigate this journey, remember that negotiating with sellers about repairs and upgrades is common. These negotiations can significantly influence the overall purchase price. At F5 Mortgage, we’re here to support you every step of the way, connecting you with top realtors who can help you navigate these discussions effectively.

Success stories from participants highlight the transformative impact of this support. Families have reached their dream of homeownership, even amidst the complexities of the real estate market. We know how important this journey is for you, and we’re committed to helping you achieve your aspirations.

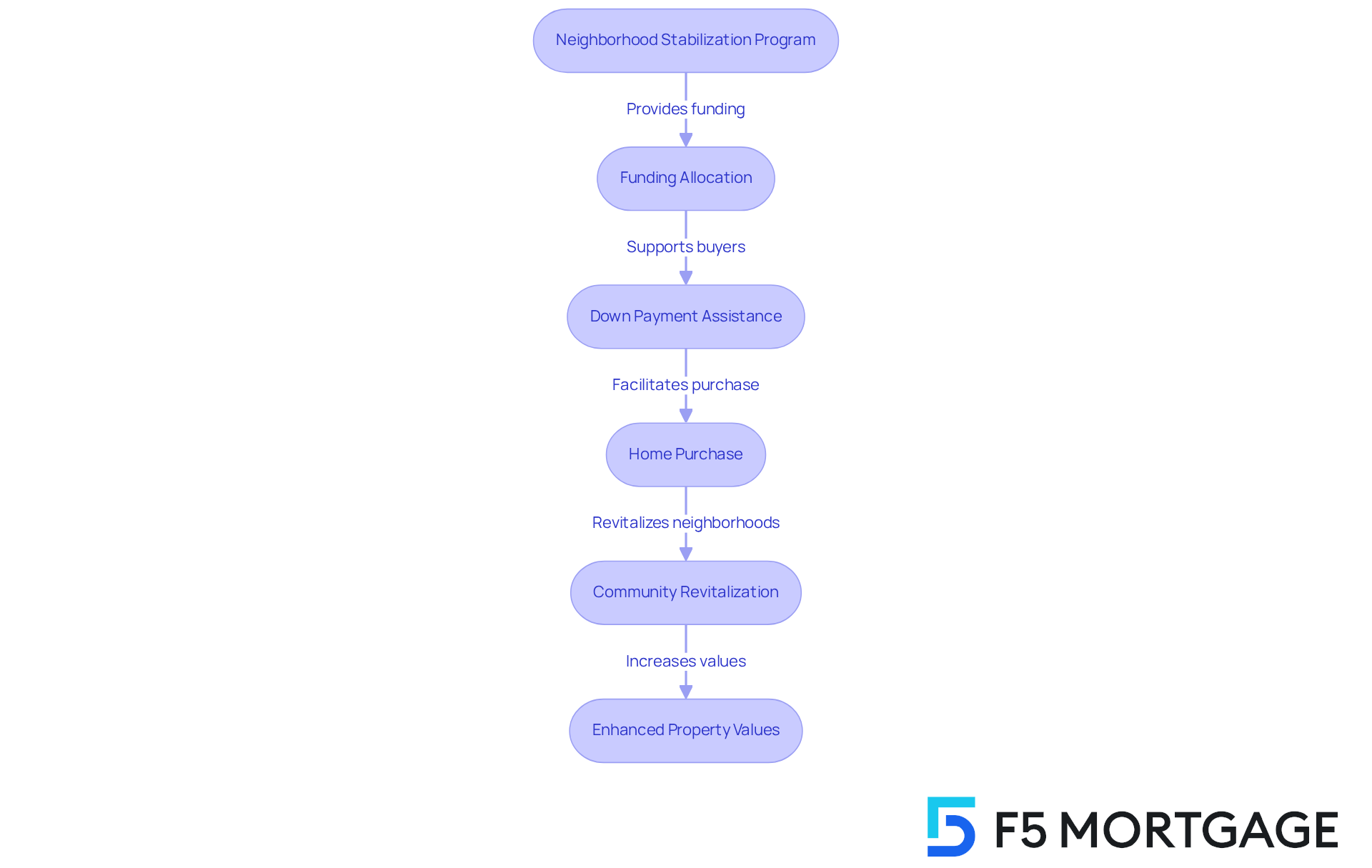

Neighborhood Stabilization Program: Community Revitalization Support

The Neighborhood Stabilization Program (NSP) plays a vital role in revitalizing communities by providing funding to help homebuyers acquire foreclosed or abandoned properties in targeted neighborhoods. We know how challenging it can be to face the consequences of vacant homes, which often lead to declining property values and increased crime rates. By facilitating the purchase of these properties, NSP aims to stabilize communities and foster a sense of belonging among residents.

Eligible buyers can access down payment assistance Arizona for financial assistance with down payments and closing costs, significantly lowering the barriers to homeownership. For instance, the initiative offers soft-second mortgages, which can ease the financial burden on new homeowners. In Arizona, NSP has successfully allocated funds to various municipalities, which includes down payment assistance Arizona, contributing to the rehabilitation of neighborhoods and enhancing community aesthetics.

Statistics underscore the program’s effectiveness: over $3.92 billion has been allocated nationwide to acquire, rehabilitate, demolish, and redevelop foreclosed and abandoned residential properties. In Arizona alone, NSP has facilitated the purchase of numerous homes, leading to revitalization efforts that have transformed neighborhoods into vibrant communities.

Community leaders have commended the NSP for its positive influence on property ownership and neighborhood stability. As one local official noted, “Revitalizing neighborhoods through homeownership not only provides families with a place to live but also strengthens the community fabric.”

Success stories abound, with many families benefiting from NSP support, resulting in enhanced living conditions and higher property values. By investing in homes that contribute to community recovery, NSP not only helps individual buyers with down payment assistance in Arizona but also fosters a collective resurgence in neighborhoods across the state. We’re here to support you every step of the way as you explore the possibilities of homeownership.

American Dream Downpayment Initiative (ADDI): Federal Support for Homeownership

The American Dream Downpayment Initiative (ADDI) provides down payment assistance Arizona to support low-income first-time homebuyers like you. It offers financial support of up to 10% of the purchase price, which can cover initial costs and closing expenses. We understand how daunting the journey to homeownership can be, and this initiative, featuring down payment assistance Arizona, is designed to help families overcome those financial hurdles.

To qualify, participants need to meet specific income requirements and complete a homebuyer education course. This step is crucial, as it equips you with the knowledge you need for this important investment. Additionally, FHA loans from F5 Mortgage provide low initial costs and flexible credit criteria, making them an excellent choice for first-time buyers.

In states like California, Texas, and Florida, there are various options for down payment assistance Arizona that enhance FHA loans. For instance:

- The MyHome Help Initiative in California can provide up to 3% of the home’s purchase price.

- The My Choice Texas Home initiative offers up to 5% for down payment and closing assistance.

These resources work together to empower families to achieve their dream of homeownership. We know how challenging this can be, but with the right support, you can take the steps needed to make your dream a reality.

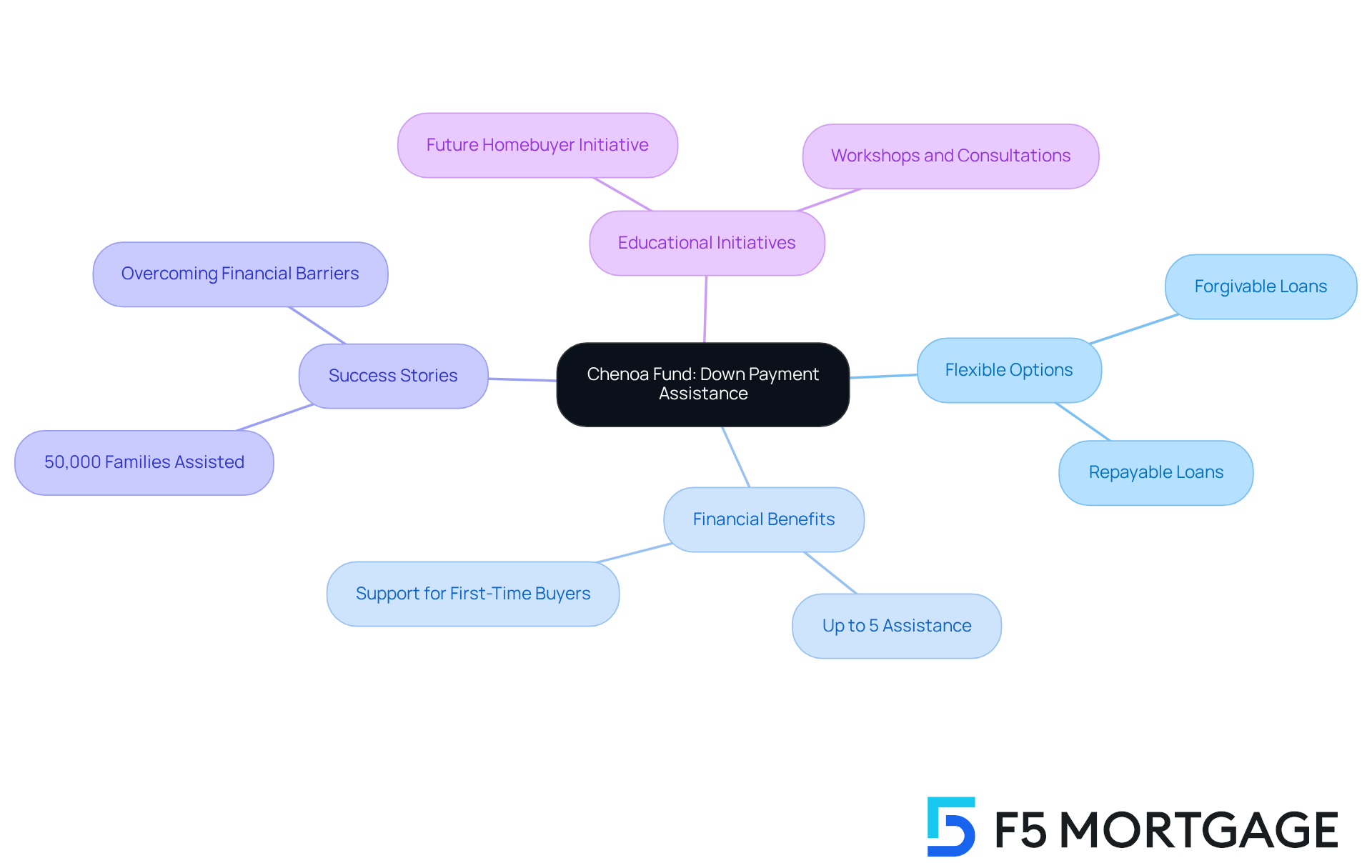

Chenoa Fund: Flexible Down Payment Assistance Options

The Chenoa Fund offers a compassionate down payment assistance initiative through a second mortgage, providing homebuyers with both forgivable and repayable options. We understand how daunting initial expenses can be, and qualified purchasers can receive up to 5% of the purchase price, significantly easing the financial burden of homeownership. This initiative is especially beneficial for those who may not have substantial savings yet meet mortgage qualifications. The flexibility of the Chenoa Fund has become a vital resource for many aspiring homeowners, helping them overcome financial barriers with confidence.

Success stories are plentiful, with numerous families realizing their dreams of homeownership thanks to the support of the Chenoa Fund. Many first-time buyers have shared how this program was instrumental in overcoming financial hurdles, allowing them to secure their homes without the stress of hefty upfront costs. As the need for flexible down payment assistance in Arizona continues to rise, the Chenoa Fund shines as a crucial ally for homebuyers in Arizona and beyond, ready to support you every step of the way.

WISH Program: Targeted Assistance for Low- to Moderate-Income Families

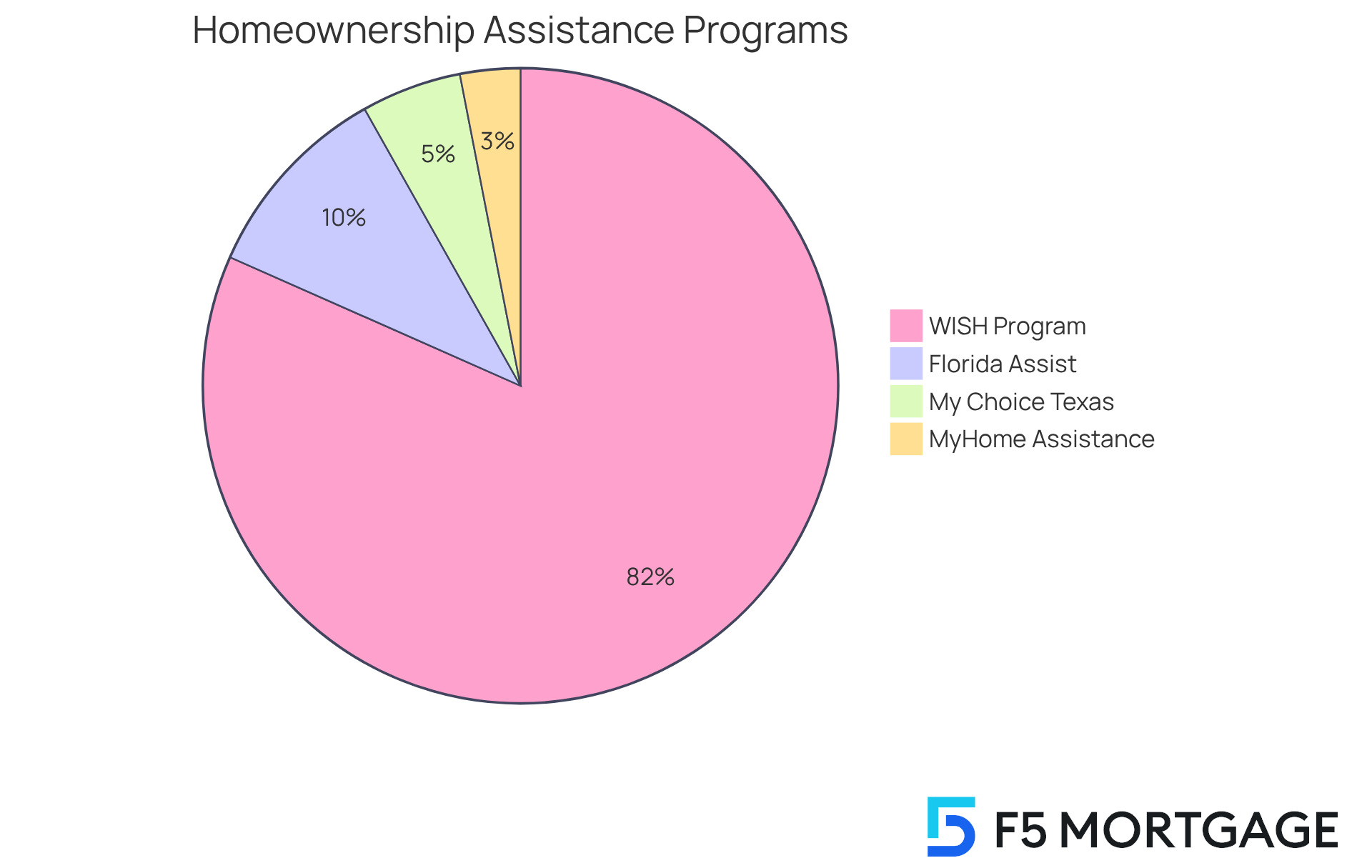

The WISH (Workforce Initiative Subsidy for Homeownership) Program is designed to support low- to moderate-income families by providing down payment assistance in Arizona through matching grants. For every dollar you contribute as a homebuyer, this initiative matches it with up to $4. This significant support can help you overcome financial obstacles and realize your dream of homeownership.

Moreover, F5 Mortgage provides FHA loans, which come with low initial costs, making them especially advantageous for first-time homebuyers. In California, the MyHome Assistance initiative offers up to 3% of the home’s purchase cost, while Texas’s My Choice Texas Home scheme provides a 30-year, low-interest mortgage with up to 5% for down payment and closing support.

In Florida, initiatives like the Florida Assist Second Mortgage Program offer up to $10,000 to cover initial expenses. These resources, such as down payment assistance Arizona, are designed to facilitate your journey toward owning a home, helping families like yours improve their living conditions. We know how challenging this can be, but we’re here to support you every step of the way.

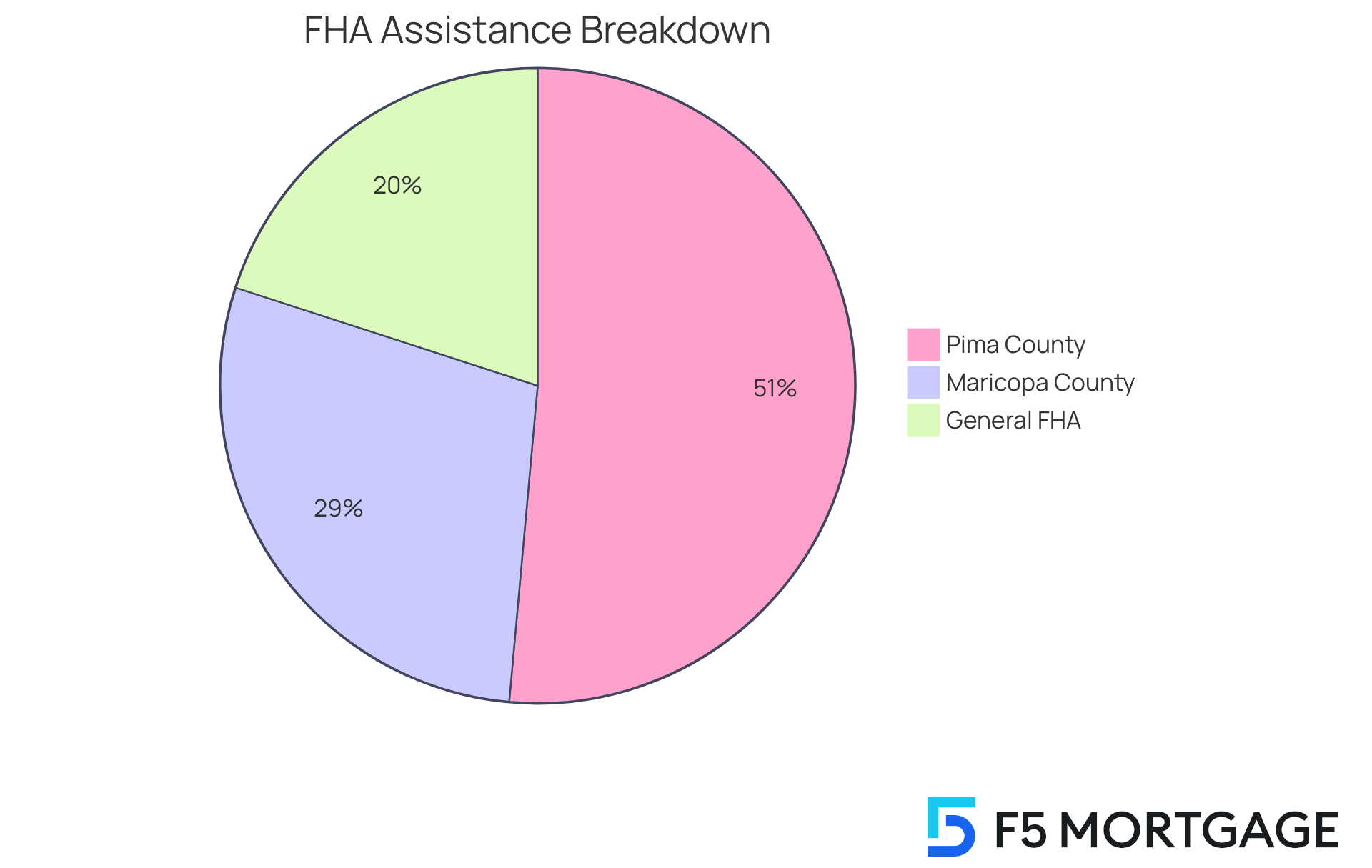

FHA Loan Program: Government-Backed Down Payment Assistance

The FHA Loan Program is thoughtfully designed to assist first-time homebuyers by offering significantly reduced upfront costs, often as low as 3.5% of the purchase price. We understand how challenging this journey can be, especially for individuals with limited savings or lower credit scores. This government-backed initiative opens doors to homeownership that might otherwise remain closed.

Moreover, FHA loans can be seamlessly combined with various down payment assistance Arizona programs available, enhancing their appeal for buyers eager to enter the housing market. For instance, first-time home purchasers in Maricopa County can receive between 3% and 7% of the home’s purchase price in support, while those in Pima County may qualify for up to $9,000.

These programs not only alleviate the financial burden of initial expenses but also empower families to realize their dreams of homeownership, contributing to community stability and growth. At F5 Mortgage, we take pride in offering a diverse range of loan options, including FHA loans, ensuring our clients have access to the best financial solutions tailored to their needs.

As one satisfied client shared, ‘The team at F5 Mortgage made the process so smooth and easy, I couldn’t have asked for better support!’ Success stories like this abound, with many families benefiting from the FHA Loan Program and related support. This illustrates the essential role these initiatives play in making homeownership a reality for those who might struggle to secure financing through conventional means. We’re here to support you every step of the way.

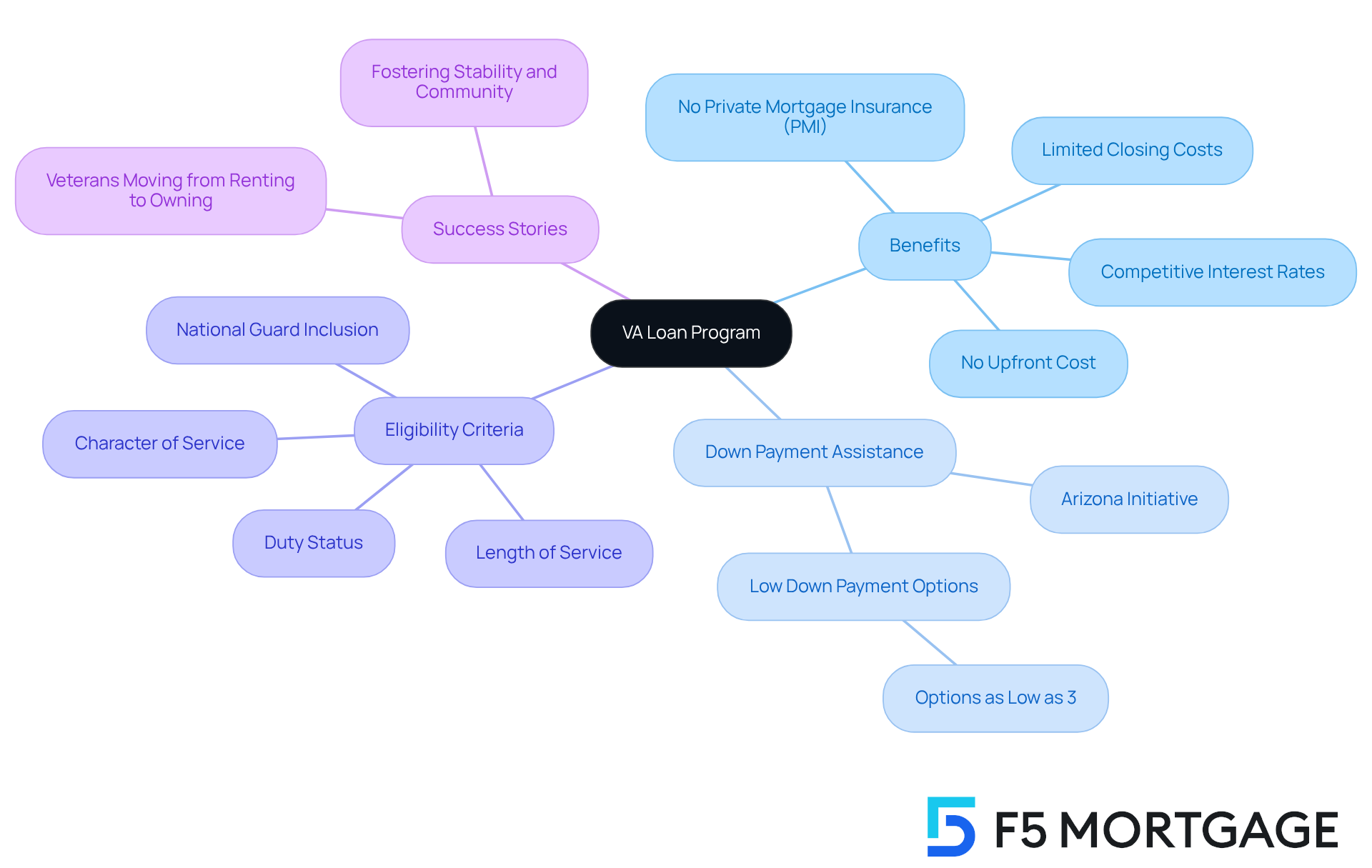

VA Loan Program: Down Payment Assistance for Veterans

The VA Loan Program offers significant benefits for qualifying veterans, allowing them to buy a home without an upfront cost and without the burden of private mortgage insurance (PMI). We understand how challenging it can be to attain property ownership, especially for veterans and active-duty military personnel, and that’s where down payment assistance Arizona can help. This initiative is designed to ease that financial strain and provide down payment assistance in Arizona, making homeownership more accessible.

VA loans typically feature competitive interest rates and flexible credit requirements, making them an excellent choice for those who qualify. At F5 Mortgage, we recognize the importance of down payment assistance Arizona in making home financing more accessible. That’s why we provide various low down payment options, including choices that require as little as 3% down.

Our Home Loan Specialists are dedicated to helping veterans discover these opportunities, ensuring that financial limitations do not hinder their journey to homeownership. Many of our clients have shared heartwarming success stories, illustrating how the VA Loan Program has enabled them to move from renting to owning, fostering a sense of stability and community.

Eligibility for VA loans is determined by factors such as:

- Length of service

- Duty status

- Character of service

Recent updates now include National Guard members with at least 90 days of active service. This expansion of eligibility criteria has further increased homeownership rates among veterans, demonstrating our commitment to supporting those who have served. We’re here to support you every step of the way in achieving your homeownership dreams.

Conclusion

In Arizona, the landscape of homeownership is becoming increasingly accessible, thanks to a variety of down payment assistance programs designed to support first-time buyers and families striving for stability. These initiatives not only provide financial aid but also empower individuals with the knowledge and skills necessary to navigate the complexities of purchasing a home. Programs such as HOME+PLUS, Home in Five Advantage, and the Neighborhood Stabilization Program highlight the state’s commitment to fostering an inclusive housing market.

As we explore these down payment assistance options, it’s clear how they significantly lower the barriers to homeownership. For instance, the HOME+PLUS program offers substantial financial support, while the Chenoa Fund provides flexible options tailored to meet the diverse needs of Arizona’s residents. Success stories from participants underscore the transformative impact these programs have on families, allowing them to transition from renting to owning and enhancing community stability.

We know how challenging the journey to homeownership can be, and the importance of down payment assistance programs in Arizona cannot be overstated. They serve as vital tools for individuals and families seeking to achieve the dream of homeownership, fostering a sense of belonging and community. For those considering this significant step, exploring these resources can be the first step toward a brighter, more secure future. Engaging with these programs not only benefits individuals but also contributes to the overall health and vitality of Arizona’s neighborhoods.

Frequently Asked Questions

What is the HOME+PLUS Down Payment Assistance Program?

The HOME+PLUS program provides up to 4% of the loan amount to eligible homebuyers in Arizona to help cover down payments and closing costs, particularly targeting first-time homebuyers with incomes at or below 120% of the Area Median Income (AMI).

What are the eligibility requirements for the HOME+PLUS program?

Applicants must complete a homebuyer education course and meet income requirements, specifically having an income at or below 120% of the Area Median Income (AMI).

Can you provide an example of a success story from the HOME+PLUS program?

Maria Magdalena Contreras, a first-time homebuyer, transitioned from renting for eight years to owning her home through the support of the HOME+PLUS initiative.

What other down payment assistance programs does F5 Mortgage offer in different states?

F5 Mortgage offers various programs, including California’s MyHome Assistance (up to 3% of the purchase price), Texas’s My Choice Texas Home (up to 5%), and Florida’s FL Assist (up to $10,000 for qualifying homebuyers).

What is the Home in Five Advantage initiative?

The Home in Five Advantage initiative provides down payment assistance of up to 5% of the purchase price for first-time homebuyers in Maricopa County, covering both down payments and closing costs while offering competitive mortgage interest rates.

How does the Home in Five Advantage initiative impact families?

Families participating in the Home in Five program report reduced financial stress and a smoother transition into homeownership, making homeownership more attainable and affordable.

What are the eligibility criteria for the Pima Tucson Homebuyer’s Solution?

To qualify, applicants must have a minimum credit score of 640 and complete a HUD-certified homebuyer education course.

What assistance does the Pima Tucson Homebuyer’s Solution provide?

This program offers up to 5% of the home purchase price in down payment assistance, helping both first-time and repeat buyers with down payments and closing costs.

How does F5 Mortgage support buyers in the homebuying process?

F5 Mortgage connects buyers with top realtors to assist with negotiations regarding repairs and upgrades, ensuring they navigate the homebuying process effectively.