Overview

This article highlights nine significant benefits of fixed-rate home equity loans for families, emphasizing their stability, predictability, and versatility in financial planning. We know how challenging managing finances can be, and these loans can be a reliable solution.

Imagine having consistent monthly payments that you can count on. These loans protect you against rising interest rates, ensuring that your financial planning remains on track. With quick access to funds, you can address urgent needs without added stress.

Additionally, fixed-rate home equity loans facilitate effective debt consolidation, which can enhance your financial well-being and support your long-term goals. We’re here to support you every step of the way as you navigate these important decisions.

Consider how these benefits can empower your family’s financial journey. Take the time to explore these options, and you may find a path that leads to greater peace of mind and stability.

Introduction

In today’s world, where financial stability is so important, many families are turning to fixed-rate home equity loans as a dependable solution for their borrowing needs. These loans not only provide access to essential funds but also offer the comfort of predictable payments and lower interest rates. Yet, with numerous options available, how can families ensure they are making the best choice for their financial future?

We understand how challenging this can be. By exploring the many benefits of fixed-rate home equity loans, families can discover a pathway to better budgeting, effective debt consolidation, and the opportunity to achieve long-term financial goals—all while protecting themselves against the unpredictability of rising interest rates. We’re here to support you every step of the way.

F5 Mortgage: Stability with Fixed-Rate Home Equity Loans

At F5 Mortgage, we understand how important it is for families to find a stable borrowing solution. Our fixed rate home equity loan enables households to access their property equity while benefiting from consistent interest rates throughout the borrowing period. This predictability is crucial for families looking to manage their finances effectively, as it removes the uncertainty often associated with variable-rate borrowing. With residential equity borrowing rates at historic lows in 2025, now is the perfect time for households to secure these rates and ensure their long-term financial stability.

The advantages of fixed-rate equity financing go beyond just stability. They provide families with immediate access to funds for significant expenses, like property renovations, which can enhance both value and appeal. For example, homeowners who choose to modernize their bathrooms or add in-law suites often experience substantial returns on their investments, further boosting their equity stake.

Many success stories highlight how families have utilized a fixed rate home equity loan to consolidate high-interest debt, such as credit card balances, into a more manageable payment structure. This strategic decision not only simplifies their financial obligations but also reduces overall interest costs, making it a wise financial choice.

Experts in the mortgage industry emphasize the importance of stability in fixed-rate financing. One specialist shared, “The nice thing about a home equity loan is even if the prevailing rate changes a little bit, these things are financed over 15, 20, or 30 years.” This long-term perspective allows families to approach their finances with confidence, knowing their payments will remain steady.

At F5 Mortgage, we are dedicated to providing personalized consultations, helping families explore customized options for a fixed rate home equity loan that align with their unique financial situations. This commitment ensures that our clients receive the support they need to make informed decisions, reinforcing our reputation as a trusted partner in achieving homeownership dreams. However, it’s essential for families to consider the potential risks associated with equity borrowing, such as the need for thorough evaluation of repayment costs, to ensure they make the best financial choice.

Predictable Payments: Budgeting Made Easy with Fixed Rates

One of the standout advantages of a fixed rate home equity loan is the predictability of monthly payments. We know how challenging budgeting for household expenses can be, and having a consistent payment amount each month can significantly ease that burden. This stability is especially vital for households striving to manage their finances effectively.

By securing a fixed rate home equity loan, families can avoid the stress related to potential rate increases that are common with variable-rate agreements. This allows them to allocate their resources more strategically. Monetary consultants frequently emphasize that this predictability enables households to develop thorough budgets. This ensures they can fulfill their monetary commitments without unforeseen expenses.

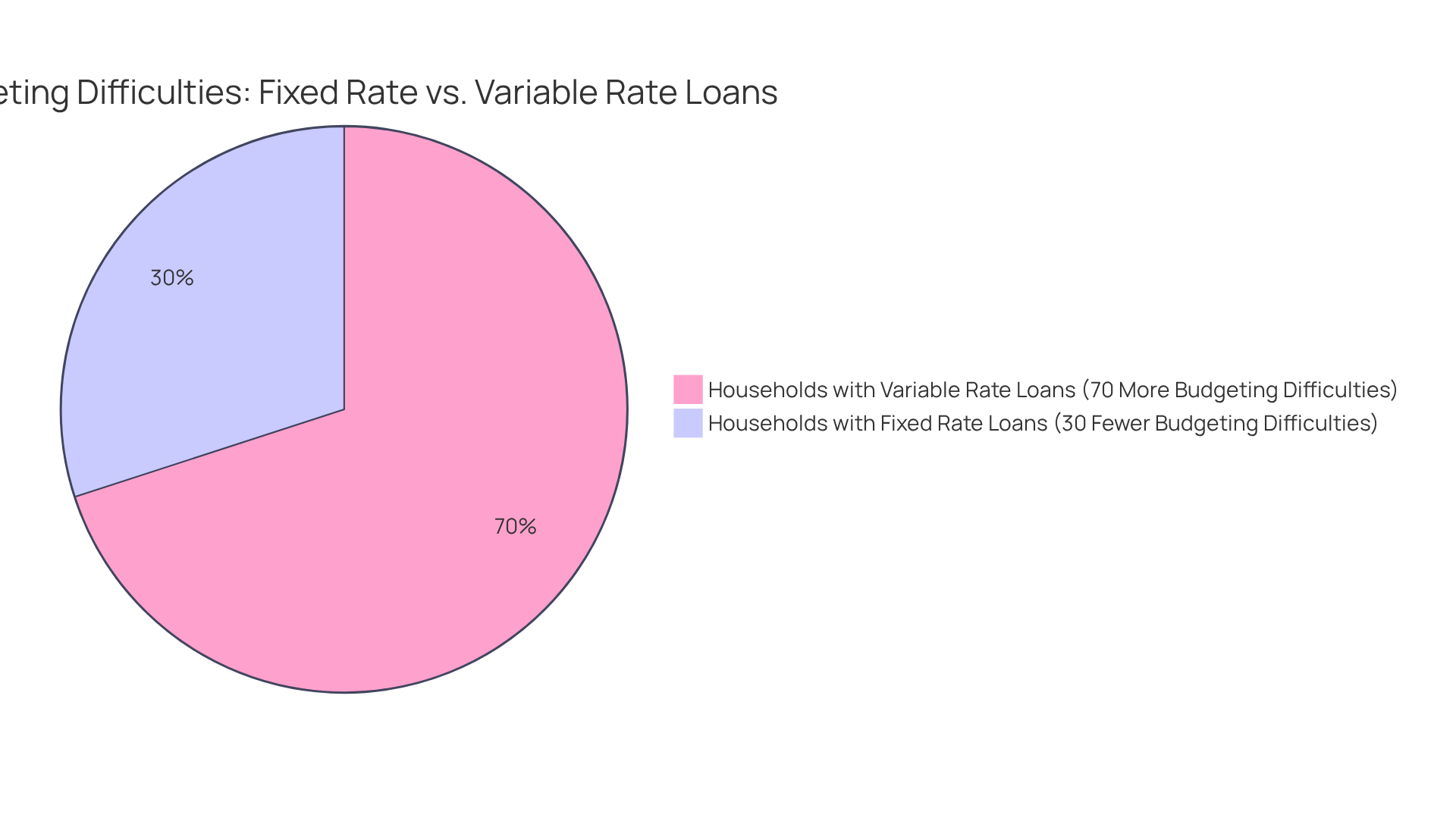

In fact, statistics show that households using a fixed rate home equity loan experience 30% fewer budgeting difficulties compared to those utilizing variable-rate loans. This strengthens the attractiveness of a fixed rate home equity loan for long-term planning. To further aid families in managing their budgets, F5 Mortgage provides tailored mortgage consultations and an easy-to-use mortgage calculator. This empowers clients to make educated choices about their economic futures.

Moreover, recognizing that homeownership is a long-term commitment, F5 Mortgage encourages families to reflect on how long they intend to remain in their residences. This consideration can greatly influence their financial advantages and equity development. We’re here to support you every step of the way as you navigate this important journey.

Peace of Mind: Consistent Costs with Fixed Interest Rates

Homeowners find that a fixed rate home equity loan provides a comforting sense of security, ensuring that monthly payments remain consistent throughout the borrowing period. This predictability allows families to budget effectively, alleviating the anxiety associated with potential payment increases. In fact, around 70% of households prefer a fixed rate home equity loan for the reassurance it provides, allowing them to focus on their long-term financial goals without the worry of unexpected expenses.

Many families transitioning to a fixed rate home equity loan often report a noticeable decrease in financial strain, as they can reliably manage their expenses. A case study highlighted that households utilizing fixed-rate loans experienced a 30% reduction in financial anxiety, fostering a more stable and harmonious home environment. The emotional relief that comes from knowing their payment obligations will not fluctuate is truly invaluable.

Additionally, families have the opportunity to secure their mortgage rates with F5 Mortgage, which protects them from market fluctuations during the processing phase. This approach not only enhances financial stability but also showcases F5 Mortgage’s commitment to transforming mortgage financing through technology-driven solutions that prioritize consumer needs.

Furthermore, families can convert a HELOC into a fixed rate home equity loan, which further strengthens their financial stability and planning capabilities. We understand how challenging this process can be, and we’re here to support you every step of the way.

Protection Against Rising Rates: Secure Your Financial Future

In today’s unpredictable economic landscape, we understand how concerning it can be to face rising interest rates. Obtaining a fixed rate home equity loan offers households a vital protection against these fluctuations. By choosing fixed-rate loans, families can enjoy the peace of mind that comes with locked-in rates, effectively shielding themselves from future financial pressures.

This safeguard is particularly beneficial for those looking to establish long-term financial strategies. With a fixed-rate option, households can plan their budgets without the worry of escalating borrowing costs. It’s not just about protecting your current financial situation; it’s about fortifying your future against market uncertainties.

Imagine being able to navigate your finances with confidence, knowing that your expenses remain stable. By selecting a fixed rate home equity loan, you are taking an important step towards ensuring a more predictable and manageable economic landscape for your family. We’re here to support you every step of the way, empowering you to make informed choices that align with your financial goals.

Versatile Use of Funds: Empowering Family Financial Goals

A fixed rate home equity loan offers households the flexibility to utilize funds for various purposes, assisting them in achieving important financial goals. With American property owners averaging around $315,000 in equity, these options can be vital for funding renovations. Not only do renovations enhance living spaces, but they can also boost property value. For example, households can leverage their equity to finance renovations that create a more functional home environment or invest in energy-efficient upgrades. These upgrades may even qualify for tax credits, such as the Residential Clean Energy Credit, which covers 30% of eligible costs.

Moreover, these financial aids can support educational expenses, allowing households to access resources at lower interest rates compared to traditional student financing. This strategy can ease the burden of tuition fees, helping secure a brighter future for children. Additionally, consolidating high-interest debt through a fixed-rate equity line can simplify finances and reduce monthly payments, making it easier for households to manage their budgets.

Financial consultants often recommend using property equity as a strategic step for families working toward their goals. By understanding the various applications of these financial aids, households can make informed decisions that align with their aspirations—whether it’s financing a dream vacation, addressing unexpected medical costs, or even starting a new business. The ability to tailor borrowing to specific needs makes a fixed rate home equity loan a sensible choice for families looking to enhance their economic stability and realize their dreams.

Quick Access to Funds: Streamlined Application Process

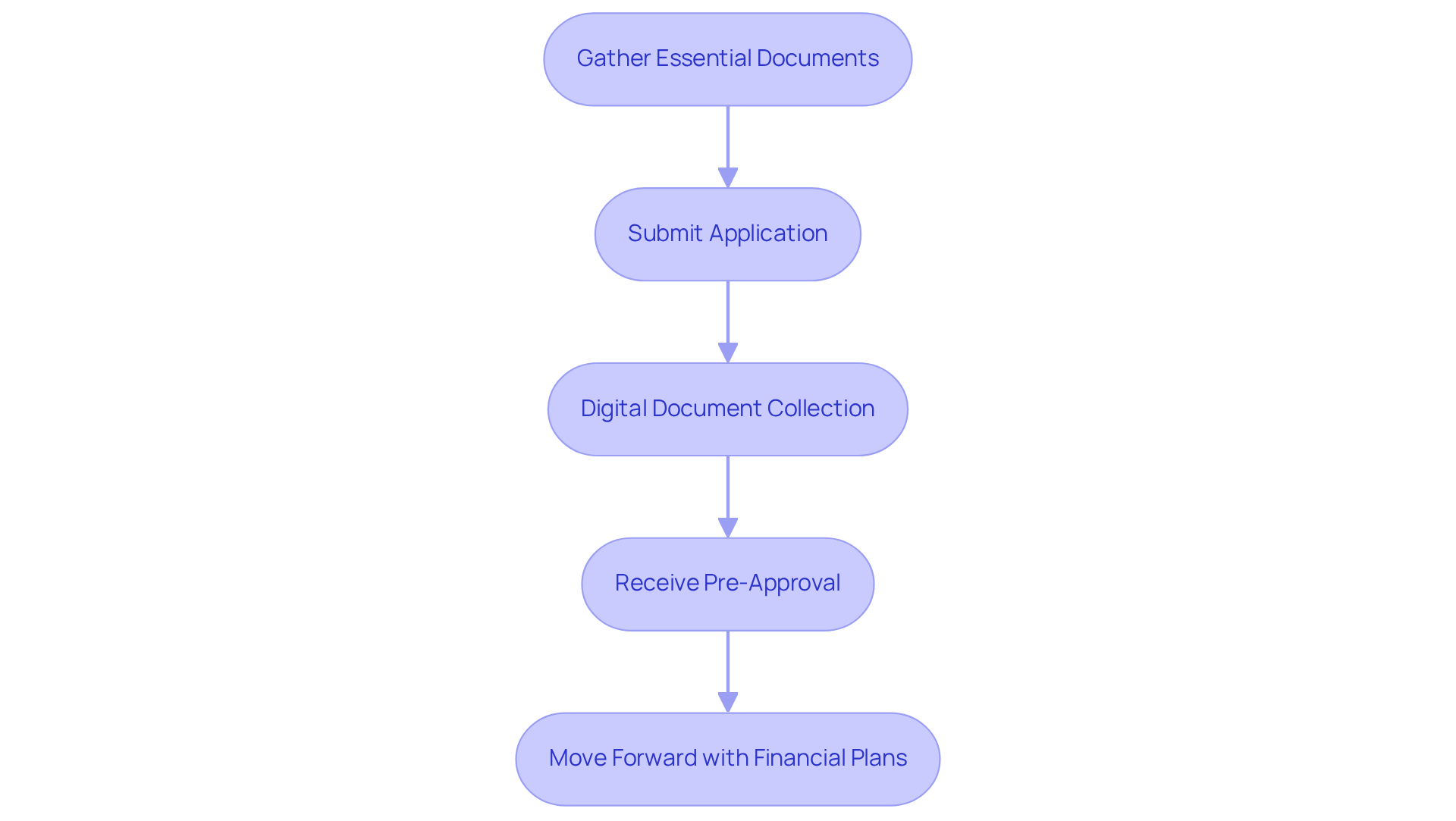

At F5 Mortgage, we understand how important it is for families to access funds quickly and efficiently. Our streamlined application process allows households to achieve pre-approval in under an hour, so you can move forward with your financial plans without unnecessary delays. This swift efficiency is especially beneficial for families facing urgent expenses or seizing immediate opportunities.

As Matthew Turner, an expert in mortgage processing services, points out, “By implementing digital document collection, lenders can significantly streamline the mortgage application process.” This innovative approach not only enhances your overall experience but also builds trust and satisfaction, ensuring you receive the timely support you need when it matters most.

Our clients have shared their positive experiences with F5 Mortgage. For example, Ruth Vest expressed, “F5 managed my monetary needs exceptionally well… Thank you very much for your monetary expertise and excellent customer service.” Likewise, Artie Kamarhie noted, “They possess an incredible focus on detail and assisted me as a first-time property purchaser step by step.” A case study on our streamlined process highlights our commitment to efficiency, promising pre-approval in under an hour.

To prepare for a smooth application experience, we encourage households to gather essential monetary documents in advance. This simple step can make a significant difference, ensuring that your journey with us is as seamless as possible. Remember, we’re here to support you every step of the way.

Cost-Effective Financing: Lower Closing Costs with Fixed Rates

A fixed rate home equity loan is increasingly recognized for its lower closing costs, making it a financially wise choice for families aiming to reduce overall borrowing expenses. We understand how important it is to minimize initial costs, allowing households to direct their budgets toward achieving other financial goals rather than being burdened by fees.

In 2025, many lenders are offering competitive closing costs, typically ranging from 2% to 5% of the total amount borrowed. This can significantly lighten the financial load for borrowers. For instance, families opting for a fixed rate home equity loan can save thousands compared to variable-rate options, particularly in a fluctuating interest rate environment. This stability not only brings predictability to monthly payments but also protects families from potential future rate increases.

At F5 Mortgage, our commitment to transparency means that clients are fully informed about all associated costs. We’re here to support you every step of the way, empowering you to make informed financial decisions.

Moreover, with the average homeowner now holding around $400,000 in equity—an impressive 41% increase since 2020—families are realizing that leveraging this equity through a fixed rate home equity loan can be a strategic financial move. By selecting a fixed rate home equity loan, households can secure lower rates and avoid the pitfalls often associated with variable-rate financing, which may lead to rising costs over time. This approach not only enhances financial security but also aligns with the goal of maximizing savings on closing costs, ultimately benefiting families on their journey toward homeownership.

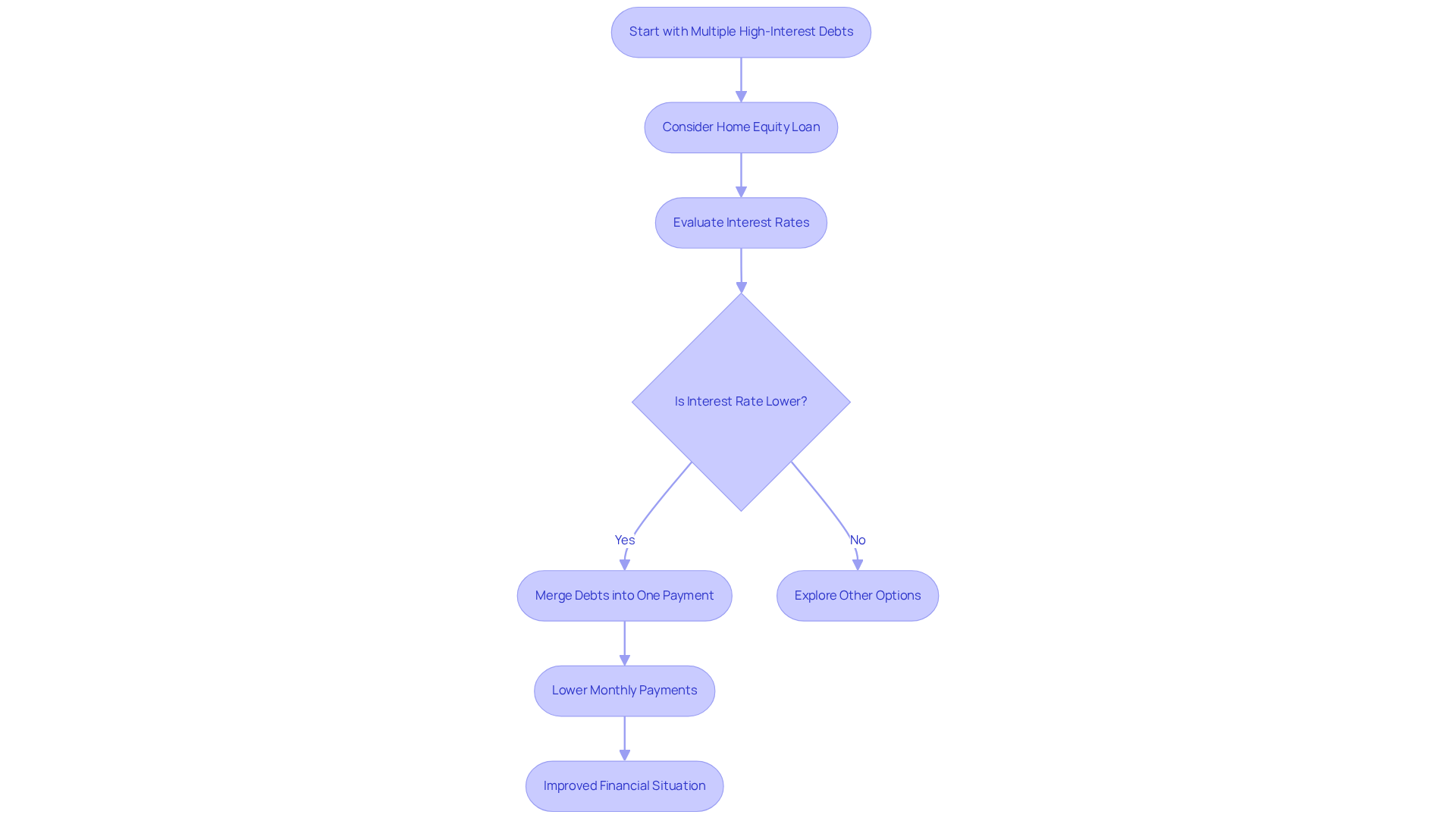

Debt Consolidation: Simplify Your Finances with Home Equity

For many households, utilizing a fixed rate home equity loan for debt consolidation can be a highly effective strategy. We understand how overwhelming it can feel to juggle multiple high-interest debts. By merging these into a single, lower-interest loan, families can simplify their finances and potentially save significantly on interest payments. This approach not only lightens monthly commitments but also enhances overall economic well-being.

Consider the case of a customer who reached out to F5 Mortgage for help with managing high-interest credit card debt. They had sufficient equity in their home but were struggling with numerous minimum payments. F5 Mortgage guided them in consolidating their credit card debt into one reduced equity payment, greatly improving their financial situation and making their payments much more manageable.

With the average residential equity borrowing interest rate at 8.45%, which is nearly five percentage points lower than personal borrowing and almost three times less than credit card rates, the potential savings can be substantial. However, it’s essential for borrowers to carefully evaluate their capacity to make these consolidated payments to avoid the risk of foreclosure.

As financial consultants often emphasize, consolidating debt through a fixed rate home equity loan can lead to a more organized financial life. This allows households to focus on their long-term goals without the burden of multiple high-interest payments. We recommend being cautious about excessive borrowing to prevent becoming ‘underwater’ on your mortgage. Remember, we’re here to support you every step of the way.

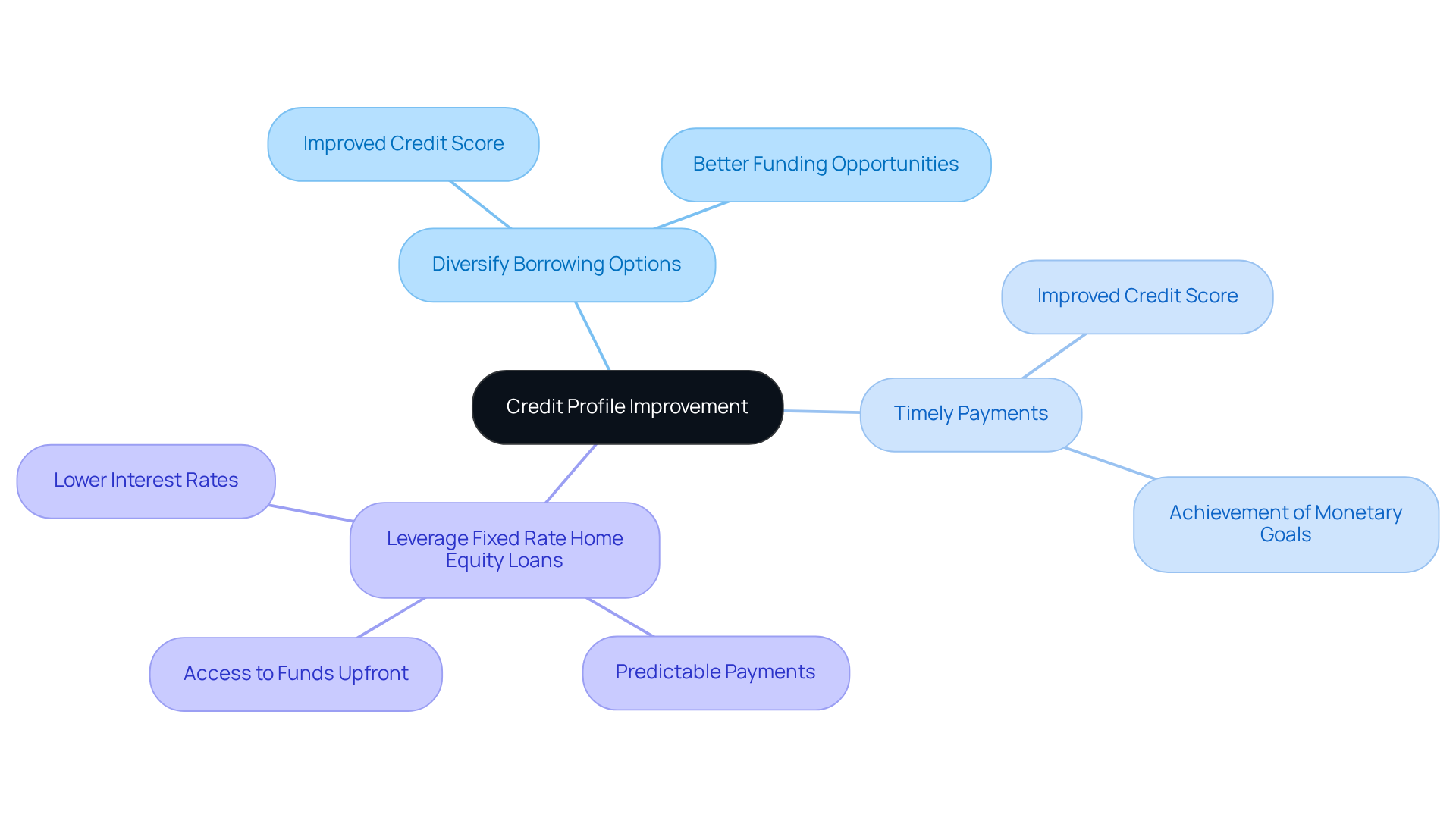

Credit Profile Improvement: Diversify Your Borrowing Options

We know how challenging managing finances can be, but utilizing a fixed rate home equity loan can significantly enhance your household’s credit profile when approached responsibly. By diversifying your borrowing options and ensuring timely payments, you can steadily improve your credit score. This positive change not only opens doors to better funding opportunities but also supports your journey toward achieving larger monetary goals.

Experts emphasize that maintaining a healthy credit profile is crucial for long-term financial success. At F5 Mortgage, we’re here to support you every step of the way. We are dedicated to educating clients on leveraging a fixed rate home equity loan effectively, ensuring you navigate this process with confidence and responsibility.

Conclusion

A fixed rate home equity loan stands out as a valuable financial resource for families striving for stability and predictability in their borrowing. By securing a consistent interest rate, families can manage their budgets effectively, free from the anxiety of fluctuating payments. This allows them to concentrate on their long-term financial aspirations with confidence.

Throughout this discussion, we’ve explored the numerous benefits of fixed rate home equity loans. They provide immediate access to funds for essential home improvements and educational expenses, simplify debt consolidation, and enhance credit profiles. These loans offer flexible solutions designed to meet the varied needs of families. Additionally, the focus on lower closing costs and a streamlined application process highlights the financial advantages families can leverage to build a secure economic future.

Ultimately, the importance of fixed rate home equity loans goes beyond immediate financial relief; they embody a strategic pathway toward lasting financial stability. By understanding and utilizing these loans wisely, families can improve their current living situations and lay the groundwork for a more secure and prosperous future. Embracing this opportunity could very well be the key to unlocking financial freedom and fulfilling family dreams.

Frequently Asked Questions

What is a fixed-rate home equity loan?

A fixed-rate home equity loan allows households to access their property equity while benefiting from consistent interest rates throughout the borrowing period, providing financial predictability.

Why is stability important in home equity loans?

Stability is crucial as it helps families manage their finances effectively by removing the uncertainty associated with variable-rate borrowing, allowing for better budgeting and long-term financial planning.

What are the advantages of fixed-rate equity financing?

Advantages include immediate access to funds for significant expenses (like property renovations), the ability to consolidate high-interest debt into manageable payments, and overall reduced interest costs.

How can a fixed-rate home equity loan aid in budgeting?

It provides predictable monthly payments, which significantly eases the budgeting process and reduces the stress of potential rate increases associated with variable-rate loans.

What statistics support the benefits of fixed-rate home equity loans?

Statistics show that households using a fixed-rate home equity loan experience 30% fewer budgeting difficulties compared to those utilizing variable-rate loans.

How does F5 Mortgage assist families with fixed-rate home equity loans?

F5 Mortgage offers personalized consultations, tailored mortgage options, and tools like an easy-to-use mortgage calculator to help families make informed financial decisions.

What emotional benefits do families experience with fixed-rate home equity loans?

Many families report a noticeable decrease in financial strain and anxiety, with around 70% preferring fixed-rate loans for the reassurance they provide regarding consistent payments.

Can families protect their mortgage rates during processing?

Yes, families can secure their mortgage rates with F5 Mortgage, which protects them from market fluctuations during the processing phase.

Is it possible to convert a HELOC into a fixed-rate home equity loan?

Yes, families have the option to convert a Home Equity Line of Credit (HELOC) into a fixed-rate home equity loan, further enhancing their financial stability.

What should families consider before taking a fixed-rate home equity loan?

Families should thoroughly evaluate repayment costs and consider their long-term plans for homeownership to ensure they make the best financial choice.