Overview

Navigating the mortgage process can be overwhelming, and many homebuyers wonder what key factors influence their Debt Service Coverage Ratio (DSCR) rates. We understand how challenging this can be. Several significant elements come into play, including:

- Income stability

- Property type

- Market conditions

- Financing conditions

Each of these factors plays a crucial role in shaping a homebuyer’s ability to secure favorable mortgage terms.

Income stability is vital; it reflects your capacity to meet mortgage obligations consistently. Additionally, the type of property you are considering can impact your financial strategy. Market conditions also fluctuate, affecting overall affordability and options available to you. Finally, financing conditions can vary, influencing the terms of your mortgage.

By understanding these factors, you can better navigate your financial decisions and feel more empowered in your homebuying journey. We’re here to support you every step of the way, helping you secure the best possible outcomes for your future.

Introduction

Navigating the mortgage landscape can be overwhelming for homebuyers, and understanding the intricacies of Debt Service Coverage Ratio (DSCR) rates is crucial. These rates hold the power to significantly influence loan eligibility and financing terms. They can either open doors to homeownership or present daunting challenges.

We know how challenging this can be, and you may wonder: what are the key factors that can sway these rates? How can you strategically position yourself to secure favorable outcomes? This article delves into eight critical elements that shape DSCR rates. By exploring these insights, we aim to empower you to make informed financial decisions and feel more confident in your journey toward homeownership.

F5 Mortgage: Personalized Solutions for Understanding DSCR Rates

At F5 Mortgage, we understand how overwhelming the mortgage process can be. That’s why we excel in providing tailored consultations that clarify the complexities of Debt Service Coverage Ratio metrics for our clients. By leveraging an extensive network of lenders, we craft customized solutions that meet your unique financial circumstances.

This personalized approach empowers homebuyers like you with the knowledge needed to navigate mortgage options confidently. Imagine feeling fully equipped to make informed decisions about your financial future. Our focus on individualized service ensures that you are well-prepared to understand how your debt service coverage ratio affects DSCR rates, leading to more strategic financial choices.

We know how essential it is to feel supported during this journey. With F5 Mortgage, you’re not just another client; you’re part of a caring community that is here to support you every step of the way.

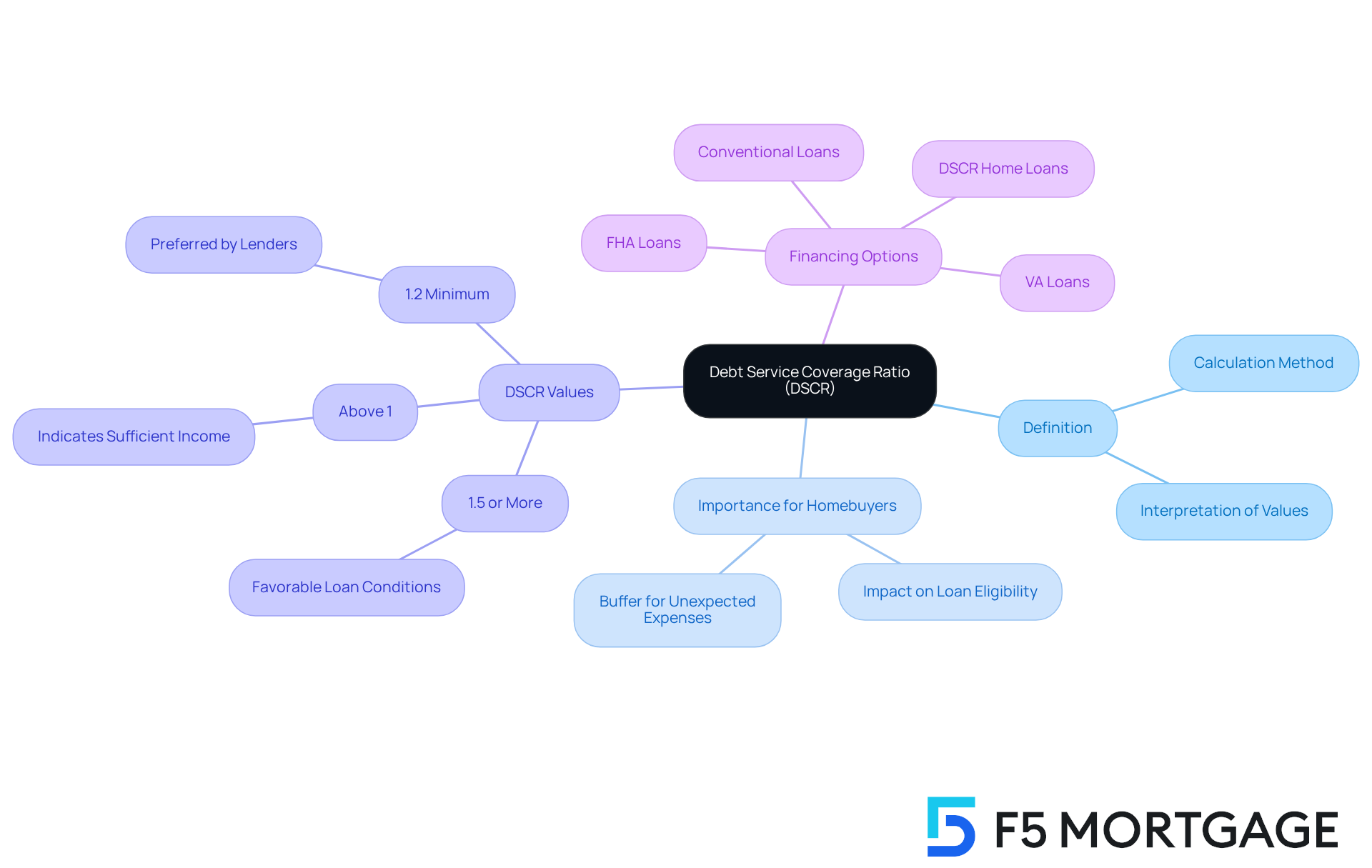

Debt Service Coverage Ratio (DSCR): What Homebuyers Need to Know

Understanding the DSCR rates is essential for anyone navigating the mortgage landscape. This vital financial measure evaluates a borrower’s ability to meet their debt obligations by analyzing DSCR rates. The calculation involves dividing the net operating revenue of a property by the total debt service to determine the DSCR rates. If the DSCR rates exceed 1, it indicates that the property generates enough income to cover its debt. However, DSCR rates below 1 may signal potential challenges in meeting payment responsibilities.

For homebuyers, grasping their DSCR rates can significantly impact loan eligibility. Typically, lenders prefer a minimum DSCR rates of 1.2, which means the property should generate at least 20% more earnings than the debt service. This requirement provides borrowers with a cushion to manage unexpected expenses or income fluctuations.

Statistics reveal that a higher debt service coverage ratio, or DSCR rates, correlates with better mortgage approval rates. Individuals boasting a ratio of 1.5 or more often enjoy favorable loan conditions, such as lower interest rates and reduced down payment requirements. Conversely, those with a ratio below 1.2 may face challenges in securing financing or might encounter higher DSCR rates because of perceived risks.

Real-life examples illustrate how the debt service coverage ratio influences mortgage applications. Investors looking to expand their portfolios frequently utilize this financing method, allowing them to qualify based on property earnings rather than personal financial conditions. This flexibility is especially advantageous for those with complex income streams or multiple properties, enabling continued investment growth without straining personal debt-to-income ratios. Additionally, financing options like VA and FHA mortgages may also consider the debt service coverage ratio in their qualification processes, making them relevant choices for families looking to enhance their homes.

At F5 Mortgage, we understand that the mortgage financing experience can be overwhelming. That’s why we’re committed to leveraging technology to offer competitive rates and a stress-free service. Our no-pressure approach ensures you receive clear and unbiased information about your mortgage approval, empowering you to make informed decisions. In summary, the DSCR rates play a crucial role in the mortgage application process, influencing both eligibility and financing terms. We know how challenging this can be, so we encourage homebuyers to assess their DSCR rates and consider reaching out to a loan consultant at F5 Mortgage for guidance as they navigate the mortgage landscape.

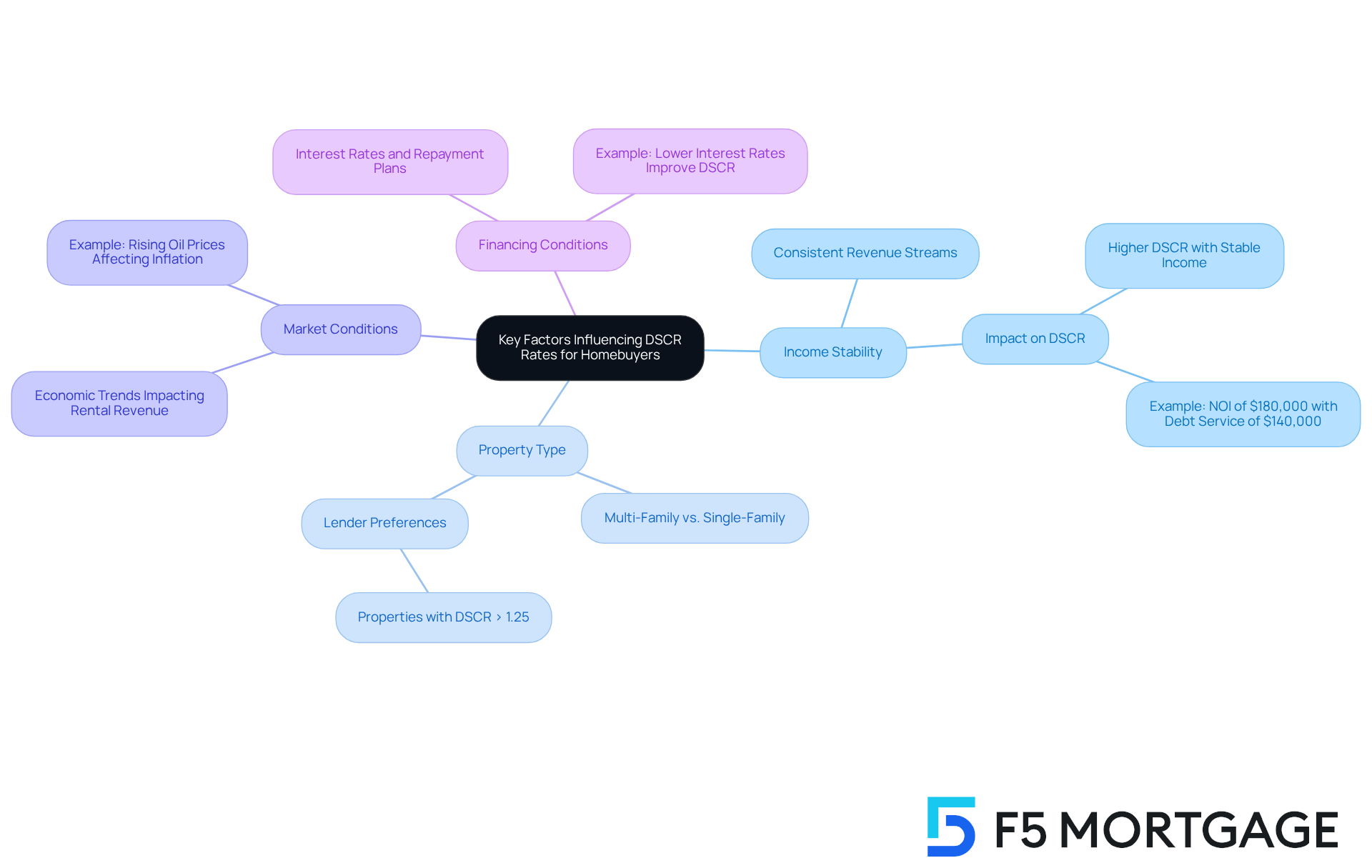

Key Factors Influencing DSCR Rates for Homebuyers

Several key factors significantly influence the dscr rates for homebuyers, and understanding these factors can help you navigate the mortgage process with confidence.

-

Income Stability: We know how crucial consistent income sources are for enhancing the Debt Service Coverage Ratio (DSCR). A reliable revenue stream not only facilitates timely debt payments but also reassures lenders of your capability to handle financial obligations, which is reflected in your dscr rates. For instance, properties with consistent rental revenue often demonstrate greater DSCR rates, indicating a stronger ability to meet debt responsibilities. As industry specialists highlight, ‘Dscr rates above 1.0 signify that a rental property generates sufficient revenue to meet its debt commitments.’

-

Property Type: The category of property can significantly influence your earning potential and, as a result, the debt service coverage ratio. Multi-family units frequently produce more steady rental revenue than single-family houses, which leads to more advantageous dscr rates. Lenders generally favor properties that demonstrate robust income-generating capabilities, which can enhance your chances of loan approval. Properties with dscr rates of 1.25 or greater are often considered optimal by lenders, indicating a 25% excess in earnings after addressing debt obligations.

-

Market Conditions: Economic trends can greatly impact rental revenue and property values. In a flourishing market, heightened demand for rental properties can lead to increased rents, which positively influences the dscr rates. Conversely, economic declines can diminish rental income, which decreases dscr rates and raises perceived risk for lenders. For example, rising oil costs might lead to inflation, prompting the Federal Reserve to consider adjustments that can further affect mortgage prices.

-

Financing Conditions: The framework of your financing, including interest rates and repayment plans, can affect monthly payments and overall debt service coverage ratio. Favorable financing conditions can ease the financial strain on borrowers, allowing for improved dscr rates. For example, a borrower with lower interest rates may find it easier to maintain DSCR rates above the minimum threshold required by lenders, typically set at 1.20.

Understanding these factors empowers you as a homebuyer to strategically position yourself when applying for loans. To improve your odds of obtaining advantageous financing terms, consider sustaining a steady revenue, selecting properties with significant earning potential, and staying informed about market conditions. We’re here to support you every step of the way.

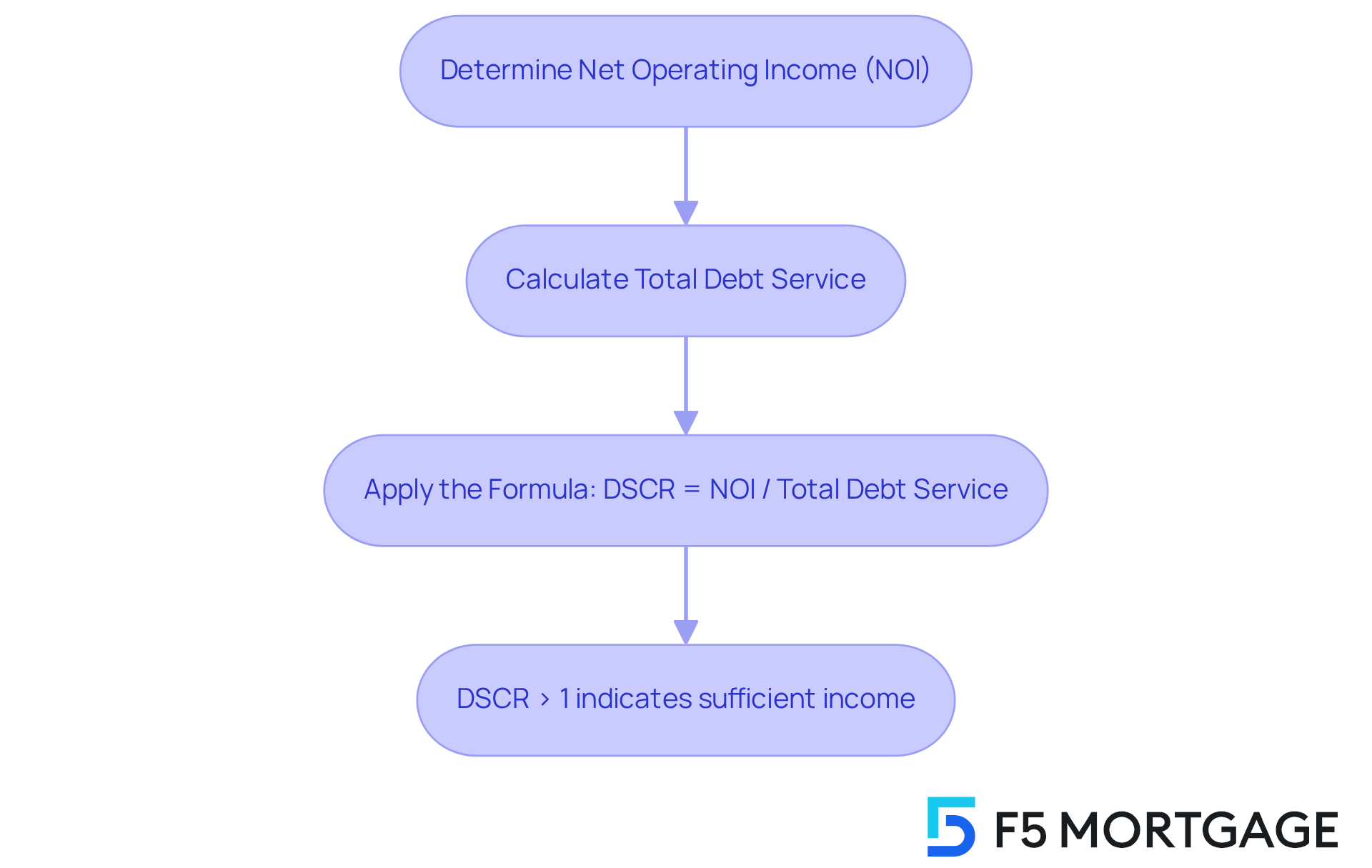

How to Calculate Your Debt Service Coverage Ratio (DSCR)

Understanding your Debt Service Coverage Ratio (DSCR) is vital for your financial well-being as a homebuyer. Let’s explore how to calculate it together:

-

Determine Net Operating Income (NOI): Start by figuring out your total revenue from the property. This includes all rental income, minus operating expenses like maintenance, property management fees, and taxes.

-

Calculate Total Debt Service: Next, add up all your debt obligations. This encompasses your mortgage payments and any other loans tied to the property.

-

Apply the Formula: Now, use the formula: Debt Service Coverage Ratio = NOI / Total Debt Service. If your DSCR rates exceed 1, it indicates that your income is sufficient to cover your debt responsibilities, which is a reassuring sign for lenders.

Comprehending your debt service coverage ratio is crucial, as it reflects your ability to manage debt effectively. Financial consultants emphasize the importance of understanding your NOI and total debt service, as these figures are key to securing favorable financing conditions. A well-calculated DSCR can significantly enhance your chances of obtaining financing, particularly in competitive markets like California and Florida, where strong rental demand is making these DSCR rates more appealing.

Additionally, grasping your Debt-to-Income (DTI) ratio is equally important. Typically, a maximum DTI ratio of 43% is necessary for home financing. A better DTI can lead to more competitive mortgage rates, so it’s essential for homebuyers to understand how these financial metrics work together to improve their financing options. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

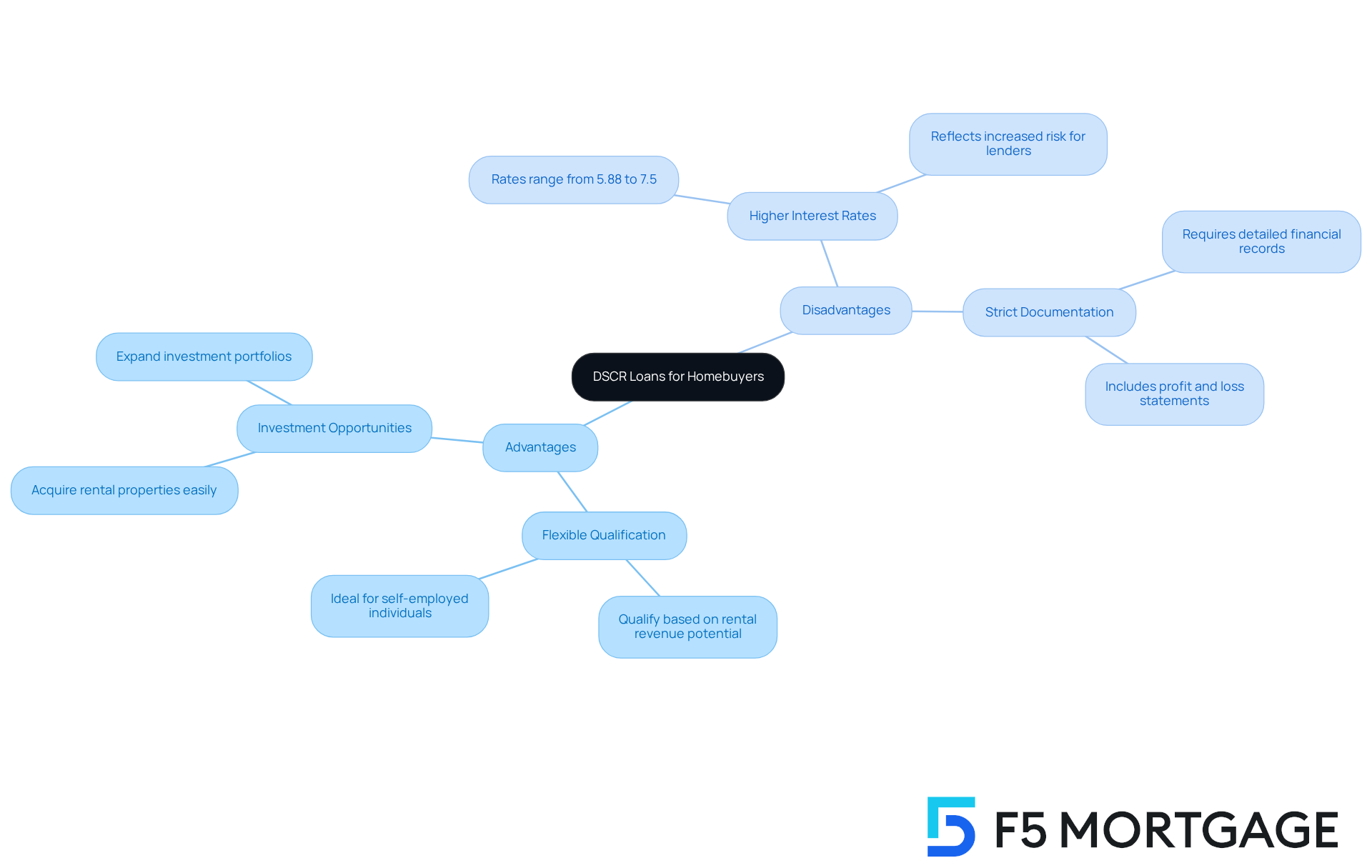

Pros and Cons of DSCR Loans for Homebuyers

The advantages of DSCR loans can be truly significant, especially for those navigating unique financial situations.

- Flexible Qualification: We understand how challenging it can be to secure funding, especially for self-employed individuals or those with non-traditional income. DSCR loans simplify the approval process, allowing borrowers to qualify based on the rental revenue potential of their properties rather than their personal earnings. This flexibility is particularly beneficial for anyone with variable income.

- Investment Opportunities: These financial products are perfect for acquiring rental properties, empowering investors to expand their portfolios without the stringent income verification typically required by conventional financing.

However, it’s essential to consider some notable drawbacks:

- Higher Interest Rates: It’s important to be aware that DSCR loans often come with higher interest rates compared to traditional loans. This reflects the increased risk that lenders take by focusing on property performance. Currently, the dscr rates for debt service coverage ratio financing range from 5.88% to 7.5%, while those for other financing types span from 10.25% to 12%. This comparison highlights the potential cost-efficiency of such financing options for certain borrowers.

- Strict Documentation: The application process does require detailed financial records, including profit and loss statements and rent rolls. We know this can be cumbersome for some borrowers, but this thorough documentation is crucial for demonstrating the property’s cash flow and ensuring it meets lender requirements.

Furthermore, maintaining dscr rates of 1.3 or above can significantly enhance your chances of securing reduced interest costs and greater funding amounts. It’s vital for prospective borrowers to understand how their property’s financial sustainability can influence their borrowing conditions.

By thoughtfully assessing these factors, homebuyers can determine if a debt service coverage ratio loan aligns with their financial objectives and investment plans. Remember, we’re here to support you every step of the way as you navigate these important decisions.

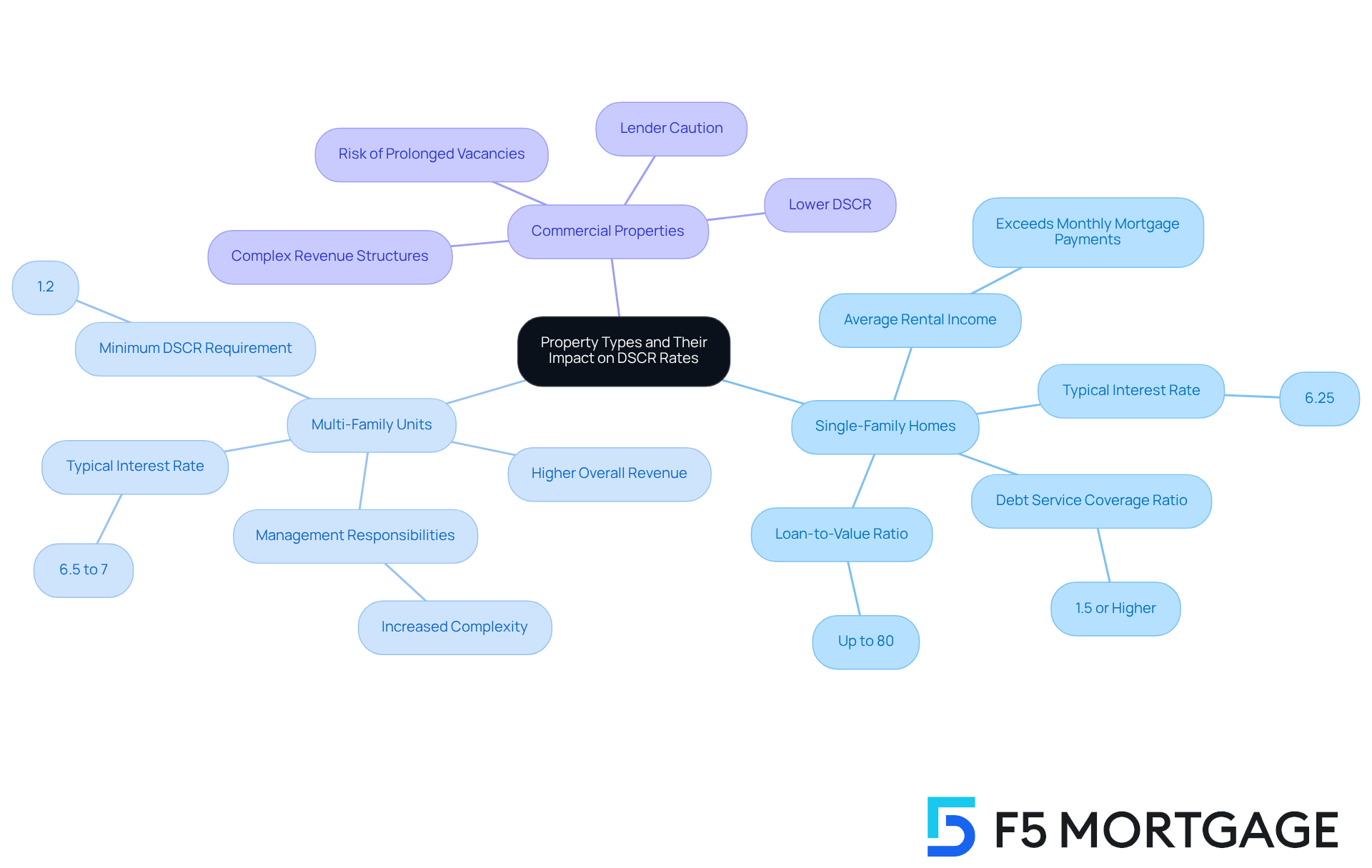

Property Types and Their Impact on DSCR Rates

The type of property you choose can significantly influence the DSCR rates, which are crucial for real estate investors. Understanding how different property types affect these calculations can help you make informed decisions.

-

Single-Family Homes: These properties usually provide stable rental income, contributing to a favorable DSCR. With average rental income often exceeding monthly mortgage payments, single-family homes can achieve a debt service coverage ratio of 1.5 or higher, indicating strong financial stability. The typical debt service coverage ratio interest rate for single-family rental properties is around 6.25%. This stability makes them appealing to lenders, who typically favor these less risky investments. Furthermore, the loan-to-value ratio for DSCR loans often reaches up to 80%, enhancing your financing options for these properties.

-

Multi-Family Units: While multi-family properties can generate higher overall revenue, they also come with increased management responsibilities and the potential for vacancies. The rental income for multi-family units can be significantly greater, but managing multiple tenants can impact the debt service coverage ratio. The usual loan interest rate for multifamily properties ranges from 6.5% to 7%. It’s essential for investors to ensure that net operating revenue sufficiently covers debt obligations to maintain a favorable ratio, ideally meeting the minimum DSCR requirement of 1.2 for advantageous financing.

-

Commercial Properties: These often present complex revenue structures, complicating DSCR calculations. Variations in rental income and the risk of prolonged vacancies can lead to a lower debt service coverage ratio, making lenders more cautious. Investors should be ready for the challenges involved in assessing the earning potential of commercial properties.

Understanding these distinctions is vital for homebuyers and investors as they evaluate potential investments. We know how challenging this can be, and as highlighted by industry experts, a reliable rental revenue stream is essential for achieving favorable DSCR rates. This, in turn, impacts your financing choices and conditions. We’re here to support you every step of the way as you navigate these important decisions.

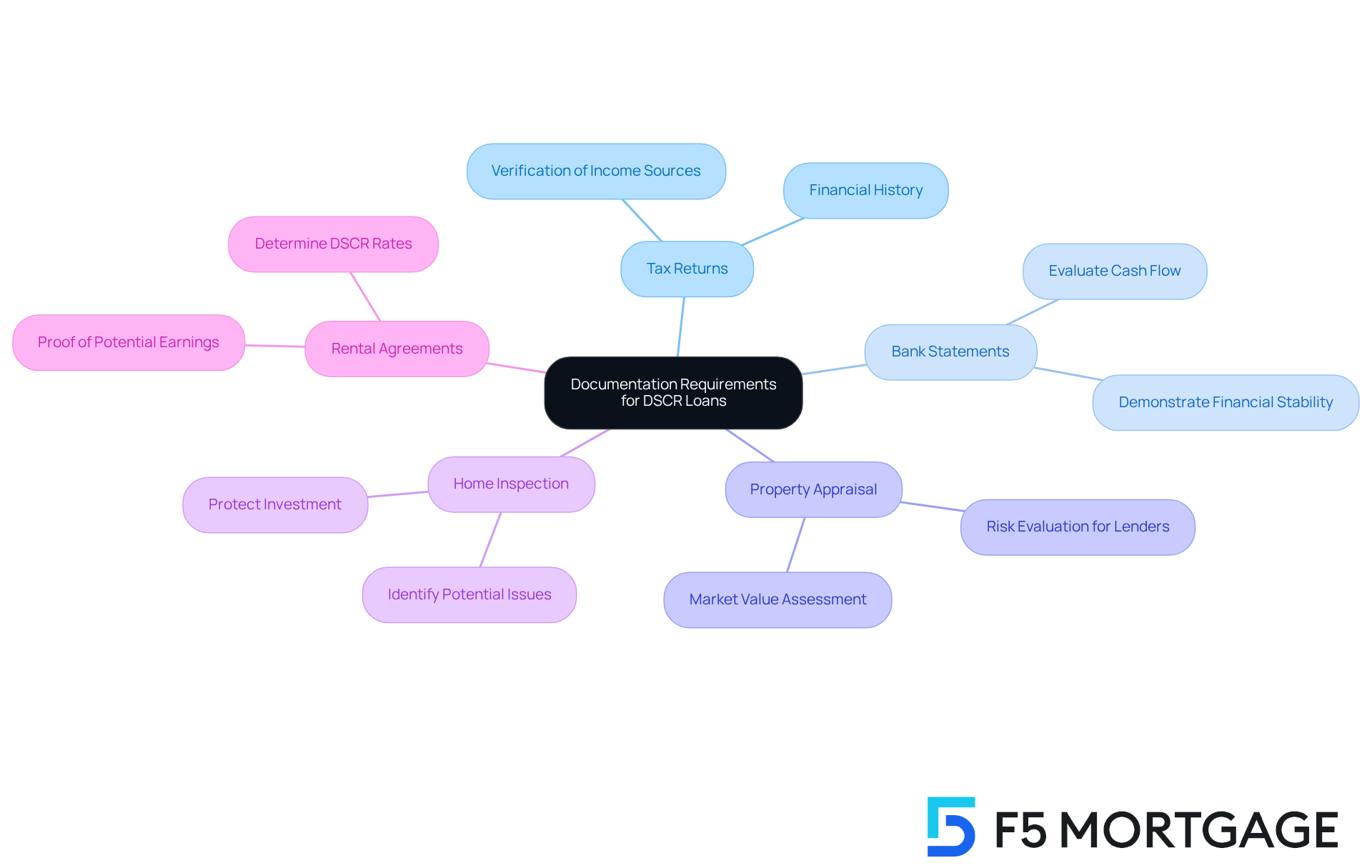

Documentation Requirements for DSCR Loans

When seeking a debt service coverage ratio financing option, we understand how overwhelming this process can feel. To ensure a seamless approval journey, homebuyers should gather several essential documents. These include:

- Tax Returns: While DSCR loans typically do not require proof of income through tax returns or pay stubs, having tax returns can still bolster your application. They provide additional verification of your income sources and financial history, which can be reassuring for lenders.

- Bank Statements: These documents are crucial for demonstrating your financial stability and liquidity. They showcase your ability to manage expenses and maintain reserves. Lenders usually look for at least two months of bank statements to evaluate your cash flow.

- Property Appraisal: An appraisal is vital for evaluating your property’s market value, which directly influences the financing amount and conditions. This assessment helps lenders gauge the risk associated with your borrowing. The appraisal process is independent, ensuring both you and the lender are protected from overpaying for the property. If the appraised value is lower than expected, it can impact the loan process, so it’s essential to be prepared for this possibility.

- Home Inspection: Although not mandatory for obtaining a mortgage, a home inspection is a critical step in protecting your investment. It allows you to identify potential issues with the property before finalizing the purchase. Home inspections typically cost between $200 and $500, and attending the inspection can provide valuable insights into the home’s condition and necessary repairs. Be sure to ask questions during the inspection to understand any red flags.

Rental agreements, if applicable, serve as proof of potential earnings from the property, which is essential for determining the DSCR rates. This ratio, known as DSCR rates, indicates your ability to cover debt obligations with rental income.

Having these documents organized and readily accessible can significantly speed up the approval process, often reducing the average time to finalize financing to under three weeks due to simplified documentation requirements. Moreover, detailed documentation enhances your chances of securing favorable financing conditions, as creditors gain greater trust in your financial profile. Recent changes in the documentation for DSCR rates application have further simplified requirements, making it easier for borrowers to qualify.

Mortgage brokers emphasize that complete and accurate documentation is critical; missing or incomplete documents can lead to delays or even denial of your loan application. To ensure all necessary documentation is prepared, we encourage you to consult with a mortgage broker. We’re here to support you every step of the way.

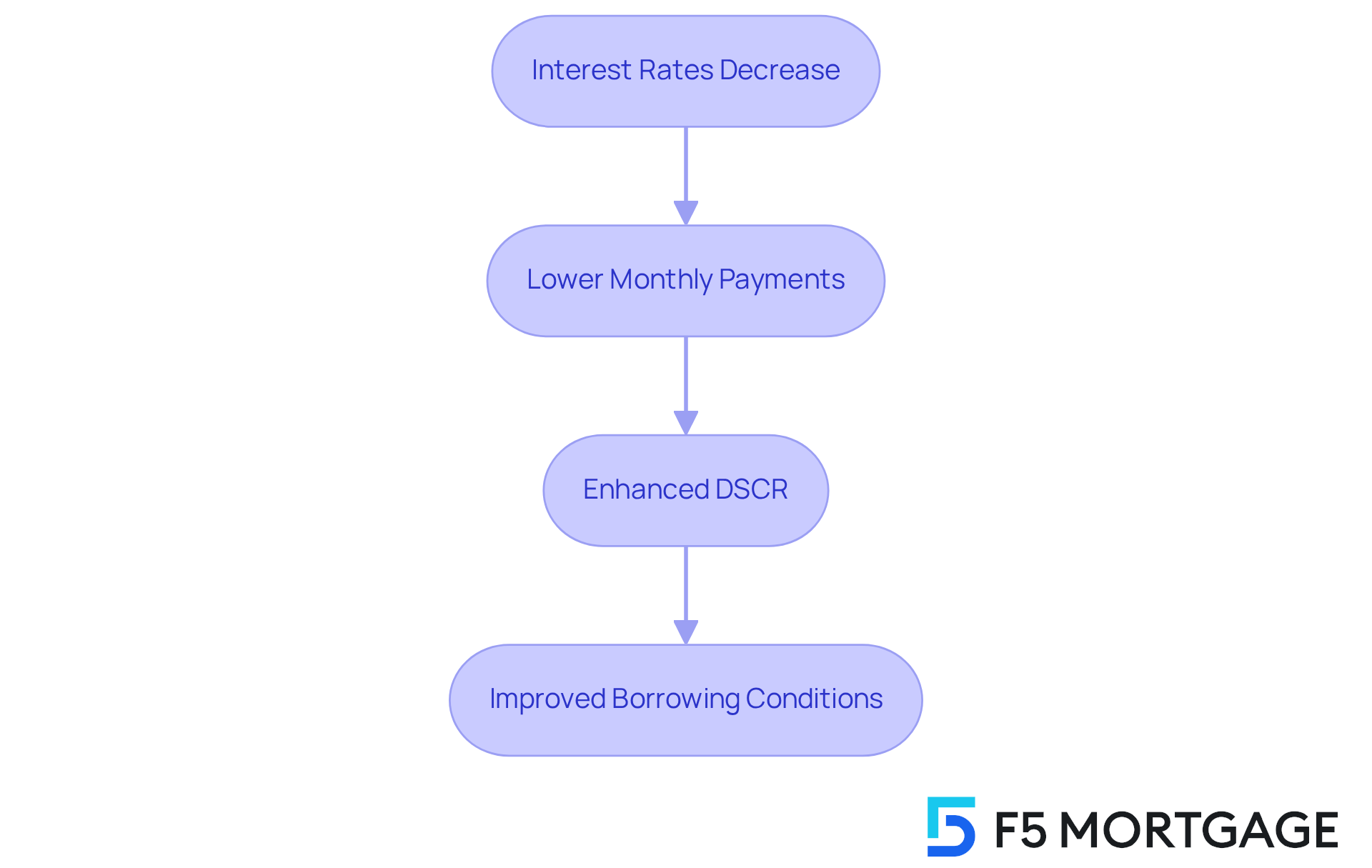

The Impact of Interest Rates on DSCR for Homebuyers

Interest levels play a crucial role in influencing a homebuyer’s DSCR rates. We understand how challenging it can be when borrowing costs increase; monthly debt service payments rise, potentially leading to lower DSCR rates. For instance, imagine a borrower purchasing a $400,000 home with a 20% down payment. If interest rates drop significantly, their monthly payment could decrease from roughly $2,240 to about $2,000. This reduction can enhance the DSCR, making it easier for borrowers to meet their financial obligations.

Current trends show that mortgage rates have recently decreased to approximately 6.4%, down from a high of 7.52% in late April. This change is expected to boost demand in the housing market, as lower costs improve affordability for homebuyers. Economists suggest that as DSCR rates decline, the DSCR can improve, allowing borrowers to qualify for better loan conditions.

Moreover, the Mortgage Bankers Association indicates that reduced mortgage costs could lead to an increase in home purchases and refinancing efforts, reversing the trend of declining mortgage applications. Mark Palim, Chief Economist at Fannie Mae, notes that this recent decline is likely to provide a slight uplift to home sales this year. This highlights the importance of tracking interest trends closely.

In summary, we encourage homebuyers to stay alert regarding interest changes. These fluctuations directly impact monthly debt obligations and the overall DSCR rates. By securing favorable rates, you can significantly strengthen your financial standing and improve your borrowing conditions. We’re here to support you every step of the way.

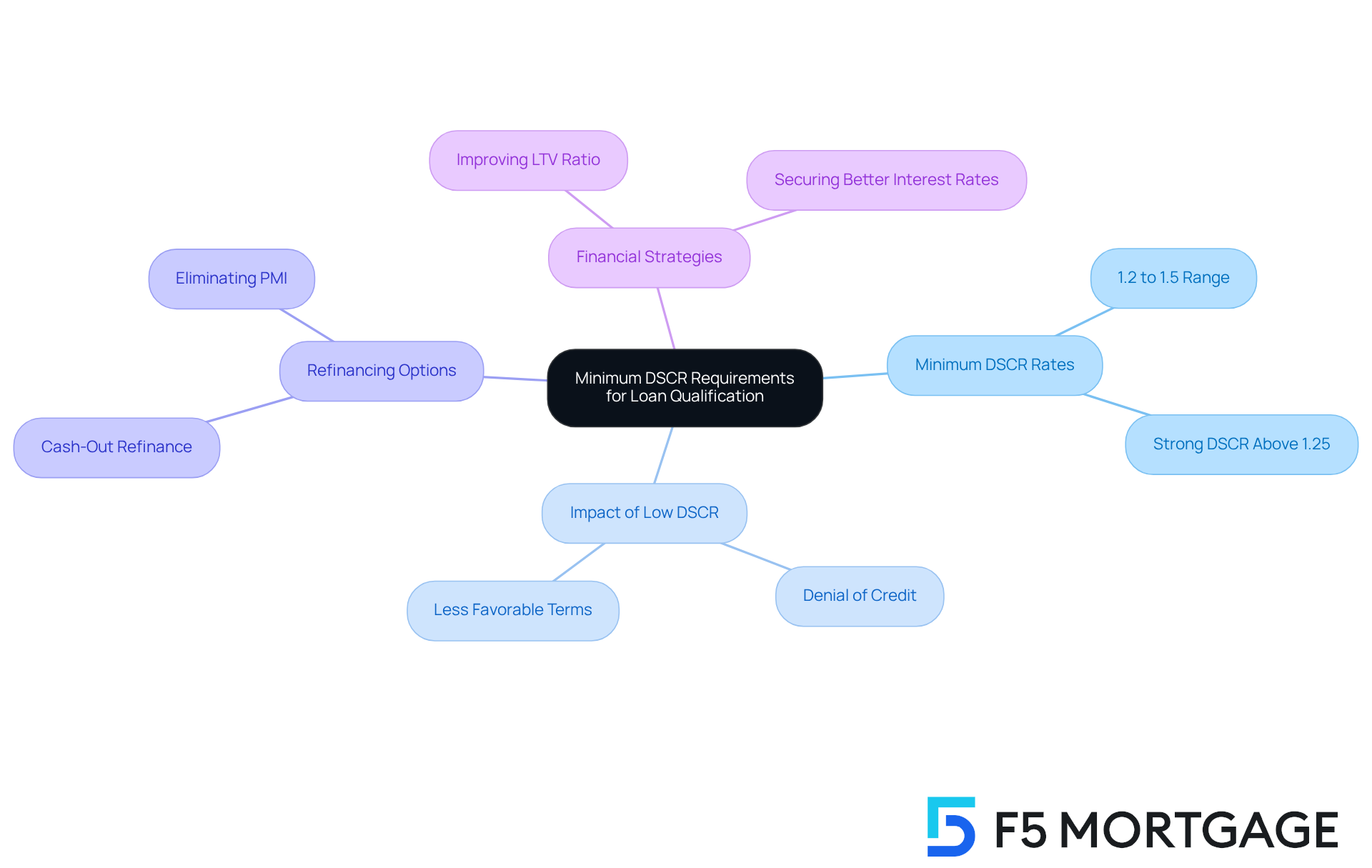

Minimum DSCR Requirements for Loan Qualification

Navigating the world of mortgages can feel overwhelming, especially when it comes to understanding dscr rates. Most creditors typically require a minimum dscr rates of 1.2 to 1.5 for qualification. This requirement can vary based on the type of property and the creditor’s guidelines. If your dscr rates fall below this range, it may lead to denial of credit or less favorable terms. That’s why it’s essential for homebuyers to aim for dscr rates above the minimum requirement, as this can significantly enhance your chances of securing financing.

If you purchased your home with a conventional mortgage and put down less than 20%, refinancing could be a beneficial option. This process may allow you to eliminate private mortgage insurance (PMI), which can ease your financial burden. Given the rising home appreciation levels in California, you can reassess your loan-to-value (LTV) ratio based on your home’s increased value. This adjustment could potentially improve your overall financial situation.

If you find yourself facing considerable costs, a cash-out refinance might be the solution you need. This option can provide you with a larger mortgage at a lower LTV ratio. However, it’s crucial to ensure that you secure a more economical interest rate on your new home financing. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

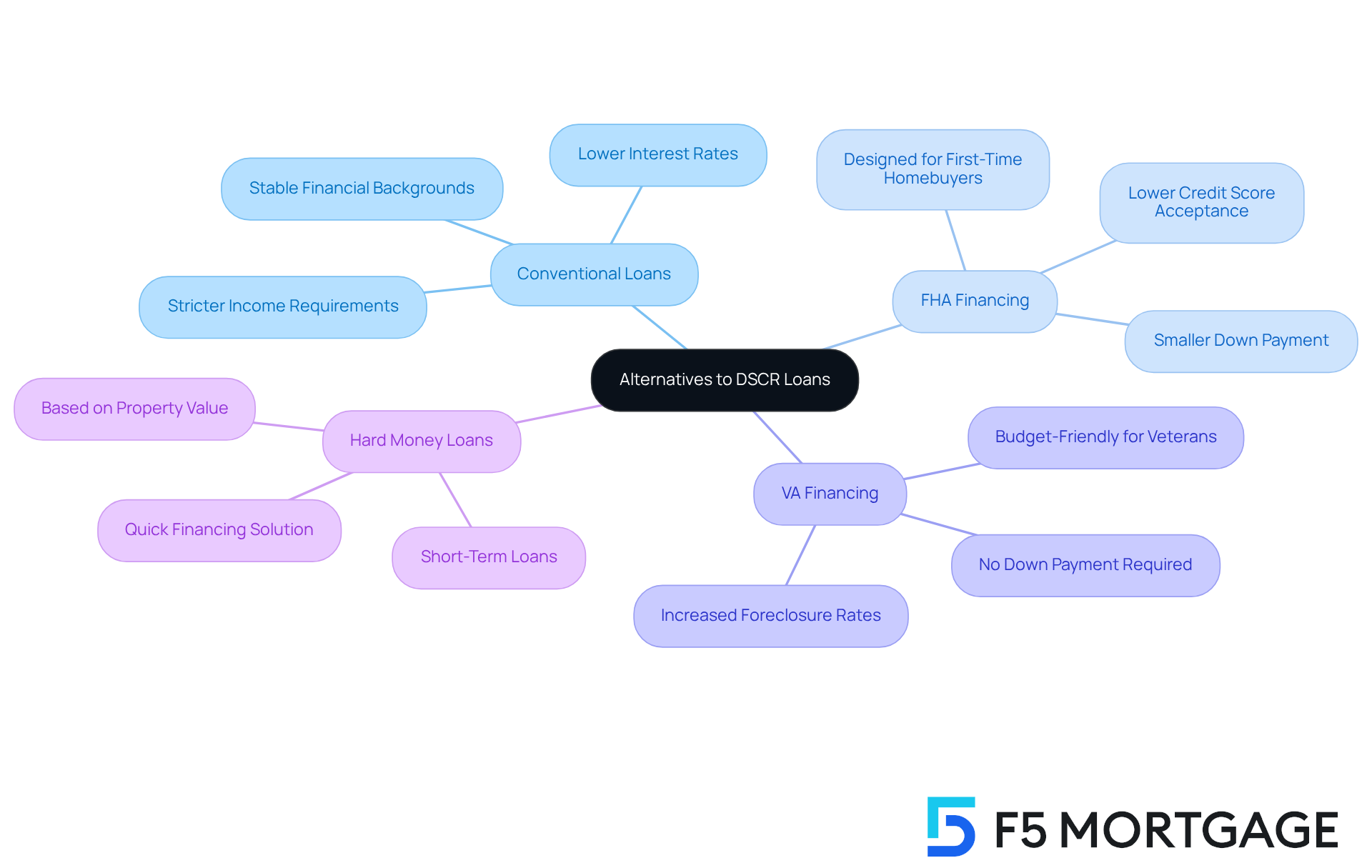

Alternatives to DSCR Loans for Homebuyers

If you’re a homebuyer exploring alternatives to dscr rates, we understand how overwhelming this process can feel. Fortunately, there are several viable options available to help you find the right fit for your needs:

- Conventional Loans: While these loans may come with stricter income requirements, they often offer lower interest rates. This can make them an appealing choice for those with stable financial backgrounds.

- FHA Financing: Specifically designed for first-time homebuyers, FHA financing accommodates lower credit scores and requires a smaller down payment. This approach broadens access to homeownership, making it more achievable for many families.

- VA Financing: For our veterans, VA financing frequently provides the wonderful benefit of no down payment. This makes it a budget-friendly option for those who have served in the military and are looking to buy a home.

- Hard Money Loans: These short-term loans are based on the property’s value rather than the borrower’s creditworthiness. They offer a quick financing solution for those in immediate need of capital.

By exploring these alternatives, you can identify a financing solution that best meets your individual needs and circumstances. Remember, we’re here to support you every step of the way as you navigate this important decision.

Conclusion

Understanding the nuances of Debt Service Coverage Ratio (DSCR) rates is crucial for homebuyers who want to navigate the mortgage landscape effectively. We know how challenging this can be, and this article highlights the various factors that influence DSCR rates, emphasizing the importance of:

- Income stability

- Property type

- Market conditions

- Financing conditions

By grasping these elements, homebuyers can better position themselves for successful loan applications and favorable financing terms.

Key insights from the article reveal that a minimum DSCR rate of 1.2 is typically required for loan qualification, with higher ratios leading to better loan conditions. Factors such as:

- Consistent income streams

- The type of property being financed

- Current economic trends

All play significant roles in determining an individual’s DSCR rates. Additionally, understanding documentation requirements and the impact of interest rates can further empower homebuyers to make informed decisions.

Ultimately, staying informed about these dynamics is essential for anyone looking to secure a mortgage. By actively assessing personal financial situations, engaging with knowledgeable professionals, and exploring various financing options, homebuyers can enhance their chances of achieving their homeownership goals. Embracing this knowledge not only facilitates a smoother mortgage process but also lays the groundwork for a more secure financial future. We’re here to support you every step of the way.

Frequently Asked Questions

What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) is a financial measure that evaluates a borrower’s ability to meet their debt obligations by dividing the net operating revenue of a property by the total debt service. A DSCR above 1 indicates that the property generates enough income to cover its debt.

Why is understanding DSCR rates important for homebuyers?

Understanding DSCR rates is crucial for homebuyers as it significantly impacts loan eligibility. Lenders typically prefer a minimum DSCR of 1.2, meaning the property should generate at least 20% more earnings than the debt service, providing a cushion for unexpected expenses.

How does a higher DSCR affect mortgage approval?

A higher DSCR correlates with better mortgage approval rates. Individuals with a DSCR of 1.5 or more often enjoy favorable loan conditions, such as lower interest rates and reduced down payment requirements, while those with a ratio below 1.2 may face challenges in securing financing.

What factors influence DSCR rates for homebuyers?

Key factors influencing DSCR rates include income stability, property type, market conditions, and financing conditions. Consistent income sources, multi-family properties, favorable market trends, and better financing terms all contribute to higher DSCR rates.

How can income stability affect DSCR rates?

Consistent income sources enhance DSCR by facilitating timely debt payments and reassuring lenders of a borrower’s financial capability. Properties with steady rental revenue typically demonstrate greater DSCR rates.

Does the type of property impact DSCR rates?

Yes, the type of property can significantly influence earning potential. Multi-family units often produce more stable rental revenue than single-family homes, leading to more favorable DSCR rates, which lenders prefer.

How do market conditions affect DSCR rates?

Economic trends can impact rental revenue and property values. In a strong market, increased demand for rental properties can raise rents, positively influencing DSCR rates. Conversely, economic downturns can decrease rental income and lower DSCR rates.

What role do financing conditions play in determining DSCR rates?

The terms of financing, including interest rates and repayment plans, can affect monthly payments and overall DSCR. Favorable financing conditions can ease financial strain, allowing borrowers to maintain DSCR rates above the minimum required by lenders.

How can homebuyers improve their DSCR rates?

Homebuyers can improve their DSCR rates by sustaining a steady revenue stream, selecting properties with significant earning potential, and staying informed about market conditions. This strategic positioning can enhance their chances of obtaining advantageous financing terms.

How does F5 Mortgage assist homebuyers with DSCR understanding?

F5 Mortgage provides tailored consultations to clarify DSCR metrics, leveraging a network of lenders to craft customized solutions. Their personalized approach ensures homebuyers are equipped to understand how their DSCR affects mortgage options and financing decisions.