Overview

We know how challenging navigating the housing market can be. The FHA flip rule is designed to protect you, the homebuyer, by ensuring that properties must be owned for at least 90 days before they can be sold to buyers using FHA loans. This rule helps to guard against inflated prices and potential fraud, offering you peace of mind in your home-buying journey.

Understanding this rule and its implications is crucial. If a property is resold within specific timeframes, it may require additional appraisals. This ensures that you can make informed decisions, empowering you to navigate the complexities of the housing market effectively.

We’re here to support you every step of the way, helping you understand these regulations and what they mean for you. By being aware of the FHA flip rule, you can approach your home purchase with confidence and clarity.

Introduction

Navigating the intricacies of the FHA flip rule can feel overwhelming for potential homebuyers, especially as the housing market continues to evolve. We understand how challenging this can be. This regulation, which requires a minimum 90-day holding period before a property can be sold to FHA loan buyers, is designed to protect consumers from inflated prices and fraudulent practices. However, with recent updates and exceptions to these rules, how can you effectively find your way through this complex landscape?

In this article, we will explore seven key insights about the FHA flip rule. Our goal is to equip you with the knowledge necessary to make informed decisions and seize opportunities in a competitive market. We’re here to support you every step of the way.

F5 Mortgage: Your Guide to FHA Flip Rule Compliance

At F5 Mortgage, we understand how daunting the FHA flip rule may appear. This crucial regulation, referred to as the FHA flip rule, impacts your home buying and refinancing decisions, requiring assets to be owned for at least 90 days before being sold to buyers using FHA loans. The FHA flip rule is designed to protect homebuyers from potential fraud and inflated asset values. As we look ahead to 2025, recent updates to FHA regulations highlight the need for compliance, especially as the housing market continues to change.

Navigating the mortgage approval process is essential, and we’re here to help you feel confident every step of the way. An approval signifies that a lender has reviewed your financial information and believes you are a suitable candidate for a mortgage. It also provides an estimate of your loan amount, interest rate, and potential monthly payments. At F5 Mortgage, we ensure that you are well-informed about your mortgage options while adhering to FHA regulations, making the transaction process smoother for you.

Through our personalized consultations, we equip you with the knowledge necessary to navigate these regulations with confidence. For example, we share case studies that illustrate how clients have successfully managed the 90-day holding period in accordance with the FHA flip rule and the required documentation for appraisals. Our mortgage brokers emphasize the importance of understanding the FHA flip rule, as it can greatly affect your financing options and opportunities for homeownership.

What sets F5 Mortgage apart is our commitment to providing tailored support. We strive to ensure you are well-informed about your mortgage options while staying compliant with FHA regulations. This dedication not only enhances your overall home buying experience but also empowers you to make informed decisions in a complex market. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Understanding the FHA Flip Rule: Key Definitions and Concepts

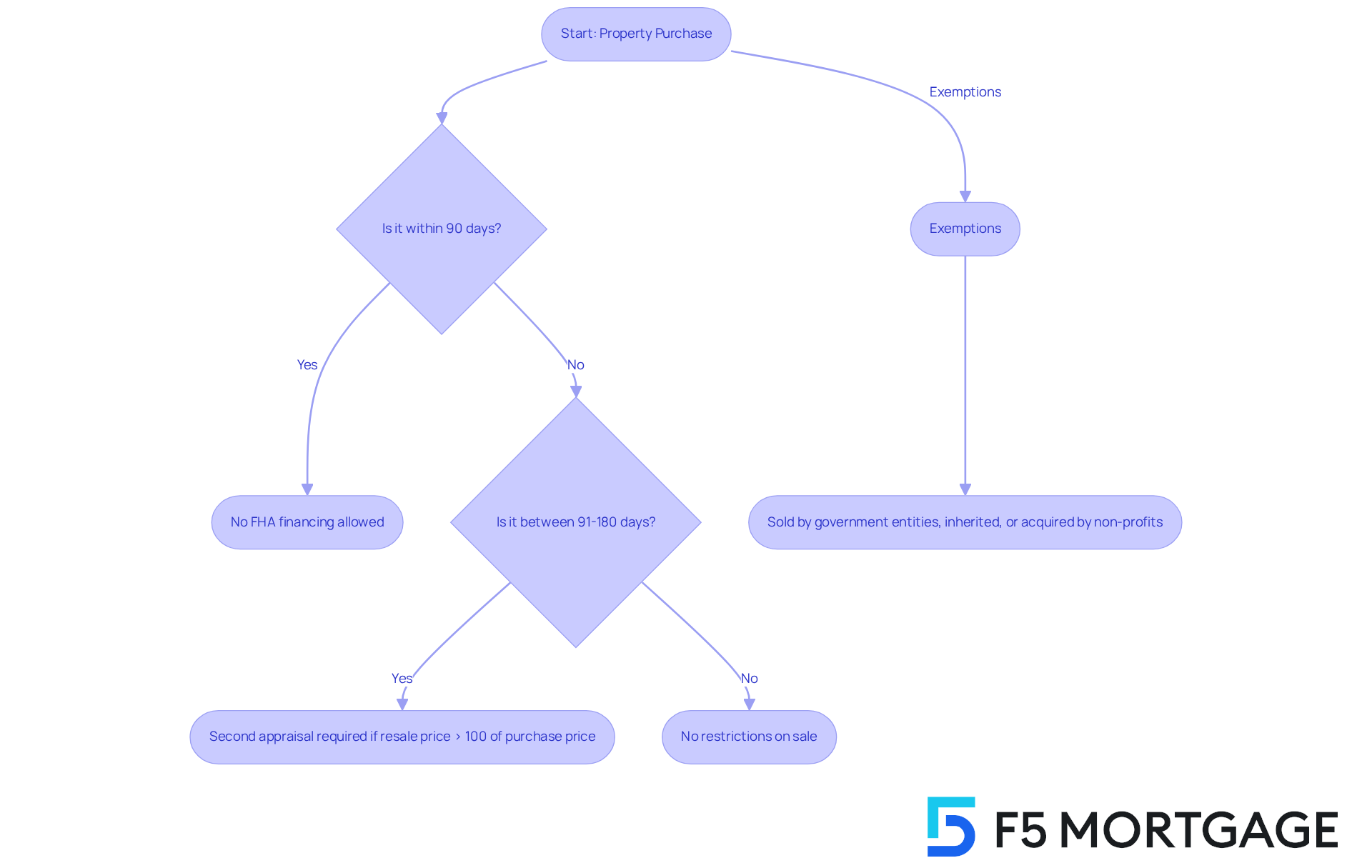

The fha flip rule is designed to protect you from the challenges of flipping real estate, which involves buying and quickly reselling a property for profit. At the heart of this regulation is a 90-day waiting period. During this time, a property must be owned before it can be sold to someone using an FHA loan. This rule is essential for safeguarding you from inflated prices and potential fraud. For example, if an investor buys a property for $120,000 and lists it for $250,000 just 45 days later, the FHA won’t allow financing for that resale until the full 90 days have passed.

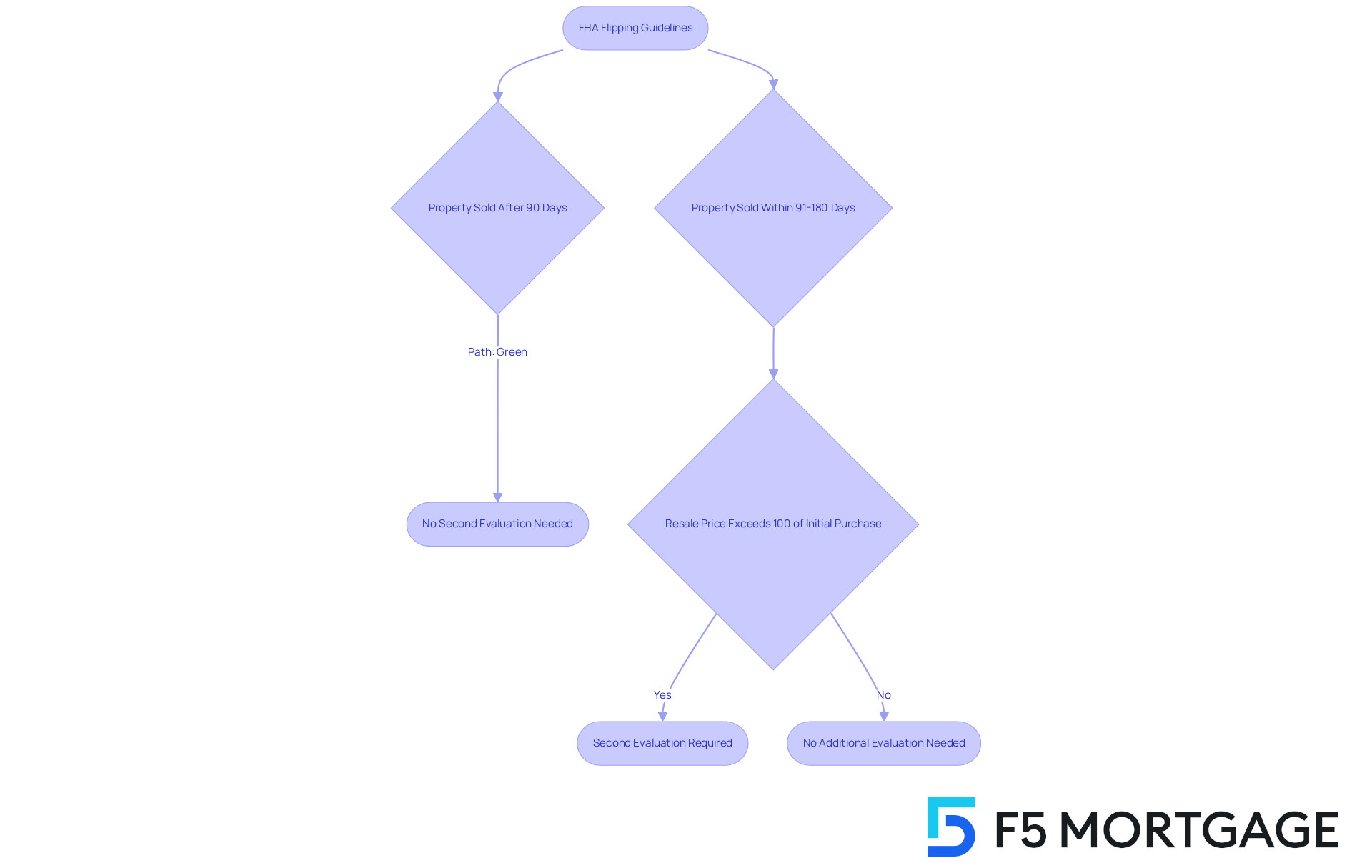

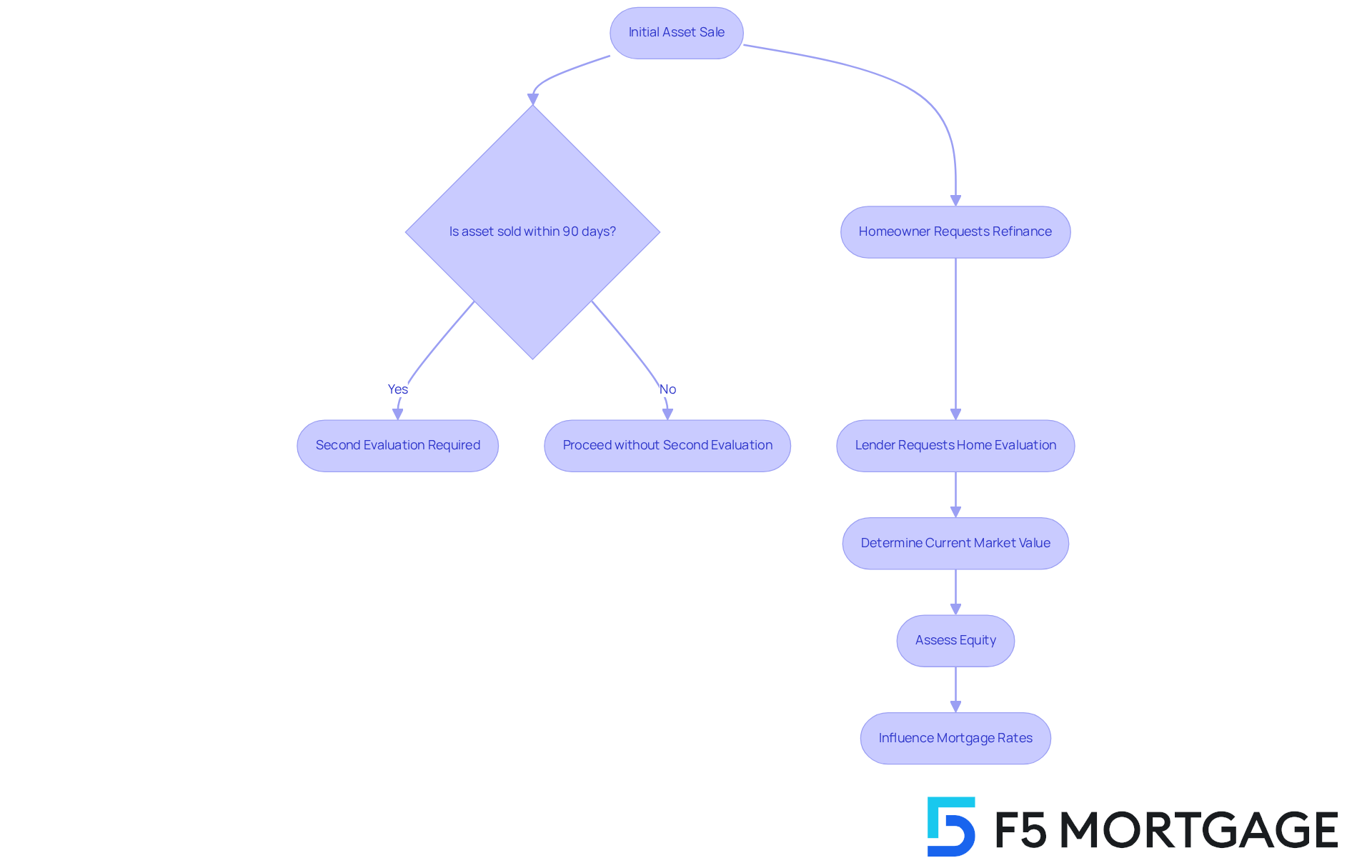

Understanding the fha flip rule is crucial for both buyers and real estate professionals. After the 90-day period, properties can be sold without restrictions, giving you more freedom in pricing. However, if a property is resold between 91 and 180 days after purchase, additional scrutiny is applied. This includes the requirement for a second appraisal if the resale price exceeds the original purchase price by 100% or more. This ensures that the selling price accurately reflects the property’s true market value, promoting stability in the housing market. Your lender will request a home appraisal to determine the current market value of your property, revealing how much equity you have, which can ultimately influence your mortgage rates.

There are also certain exemptions within the fha flip rule. Properties sold by government entities, inherited properties, and those acquired by non-profit organizations are not subject to the 90-day waiting period. This flexibility allows for smoother transactions in specific situations, making it easier for both buyers and sellers to navigate FHA requirements.

In summary, the fha flip rule is a vital aspect of the home buying process, especially for those interested in real estate that has been recently acquired. By understanding these guidelines and the role of appraisals in determining property value and equity, you can make informed decisions and avoid potential pitfalls in your real estate transactions. To effectively navigate these rules, consider reaching out to a knowledgeable lender or real estate professional who can guide you through the appraisal process and FHA requirements. We know how challenging this can be, and we’re here to support you every step of the way.

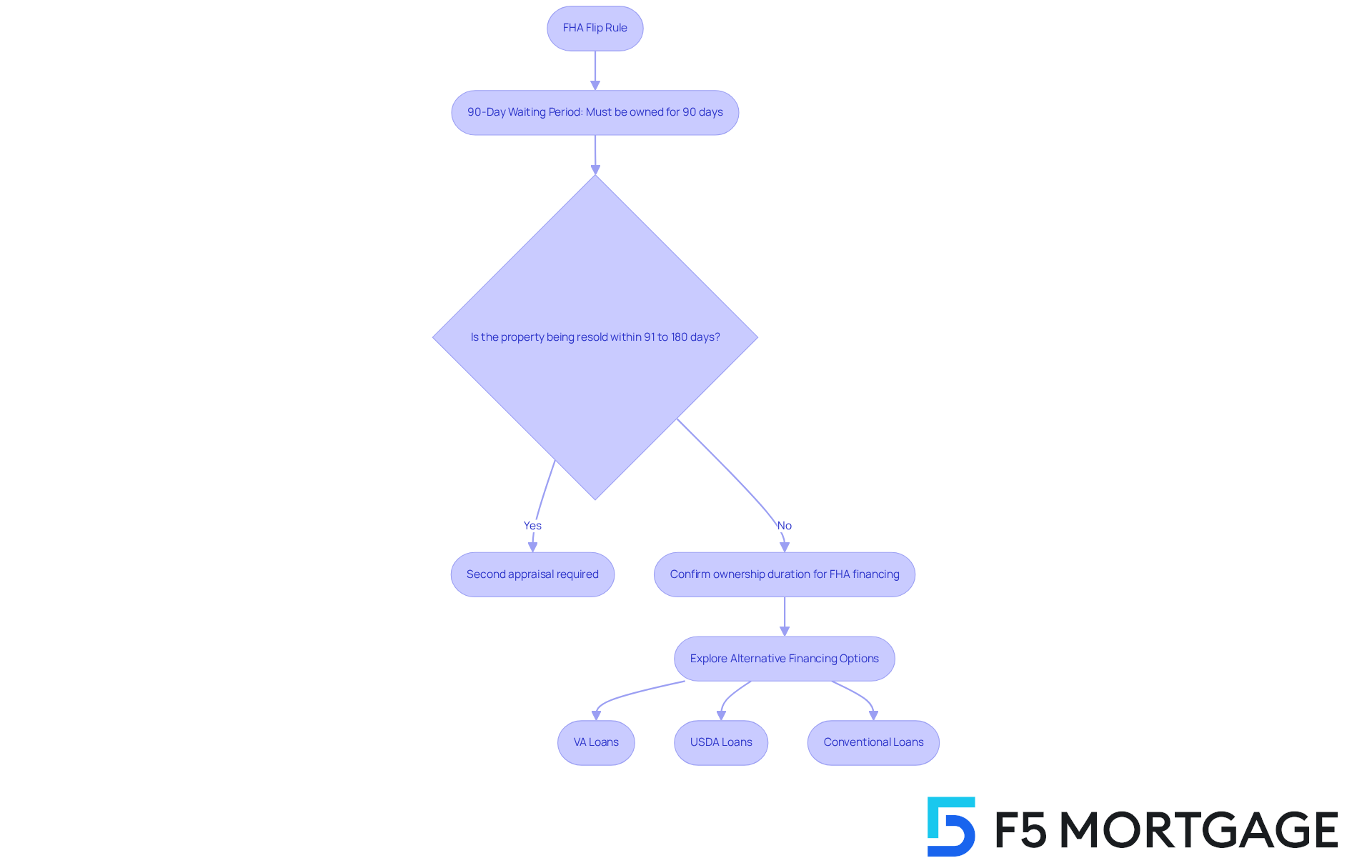

The 90-Day Waiting Period: What Homebuyers Need to Know

Navigating the FHA flip rule can feel daunting for families eager to find their dream home. Under this rule, assets must be owned for at least 90 days before they can be sold to buyers using FHA loans. This regulation is designed to mitigate risks associated with rapid reselling and to comply with the FHA flip rule, ensuring that properties meet specific standards before financing. Since January 1, 2015, the FHA flip rule has been strictly enforced, indicating that if a property was purchased less than 90 days ago, FHA financing is generally not an option. This can significantly affect homebuyers, particularly those interested in recently renovated homes.

The implications of the 90-day rule are significant. If a property is resold within 91 to 180 days of ownership, it faces additional scrutiny. Should the resale price equal or exceed the original purchase price, a second appraisal is necessary to verify the increased value. This evaluation must be conducted by a different appraiser, ensuring that the valuation is both justified and not inflated.

Mortgage experts stress the importance of confirming how long an asset has been owned before pursuing FHA financing. As specialists point out, “The 90-day waiting period does not mean that buyers must wait 90 days to finalize an FHA loan; the agreement cannot be drafted prior to 90 days.” Understanding this distinction is crucial for homebuyers, as it allows them to effectively plan their purchasing strategies.

If you find yourself facing challenges due to the FHA flip rule, be aware that alternative financing options are available. Consider exploring:

- VA loans

- USDA loans

- Conventional loans

Though the latter may have stricter requirements. Being aware of these alternatives is essential for navigating the complexities of home buying in today’s market.

In summary, the FHA Flip Rule plays a vital role in shaping the landscape for homebuyers, particularly concerning financing options and property eligibility. By staying informed about these regulations and seeking guidance from mortgage professionals, you can navigate your homeownership journey with confidence. We know how challenging this can be, and we’re here to support you every step of the way.

Exceptions to the FHA Flip Rule: Navigating Unique Situations

The fha flip rule offers specific exceptions that can truly benefit homebuyers, especially in unique situations. For instance, properties obtained through foreclosure are exempt from the usual restrictions, allowing purchasers to seize these opportunities without the typical waiting period. Additionally, homes that have undergone significant renovations may also qualify for exceptions under the fha flip rule, as long as these enhancements greatly boost the property’s value and livability.

Consider this: in today’s market, homes upgraded to meet contemporary standards often attract individuals looking for move-in-ready options. This is particularly relevant given that the serious delinquency rate for FHA loans was reported at 3.63%. This statistic highlights a substantial number of distressed assets that could be revitalized through thoughtful renovations.

Real estate professionals stress the importance of consulting with a knowledgeable mortgage broker to effectively navigate the fha flip rule. They can provide valuable insights on how these regulations apply to specific properties, ensuring that you are well-informed about your choices. Understanding these nuances empowers you to make strategic decisions in a competitive market. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

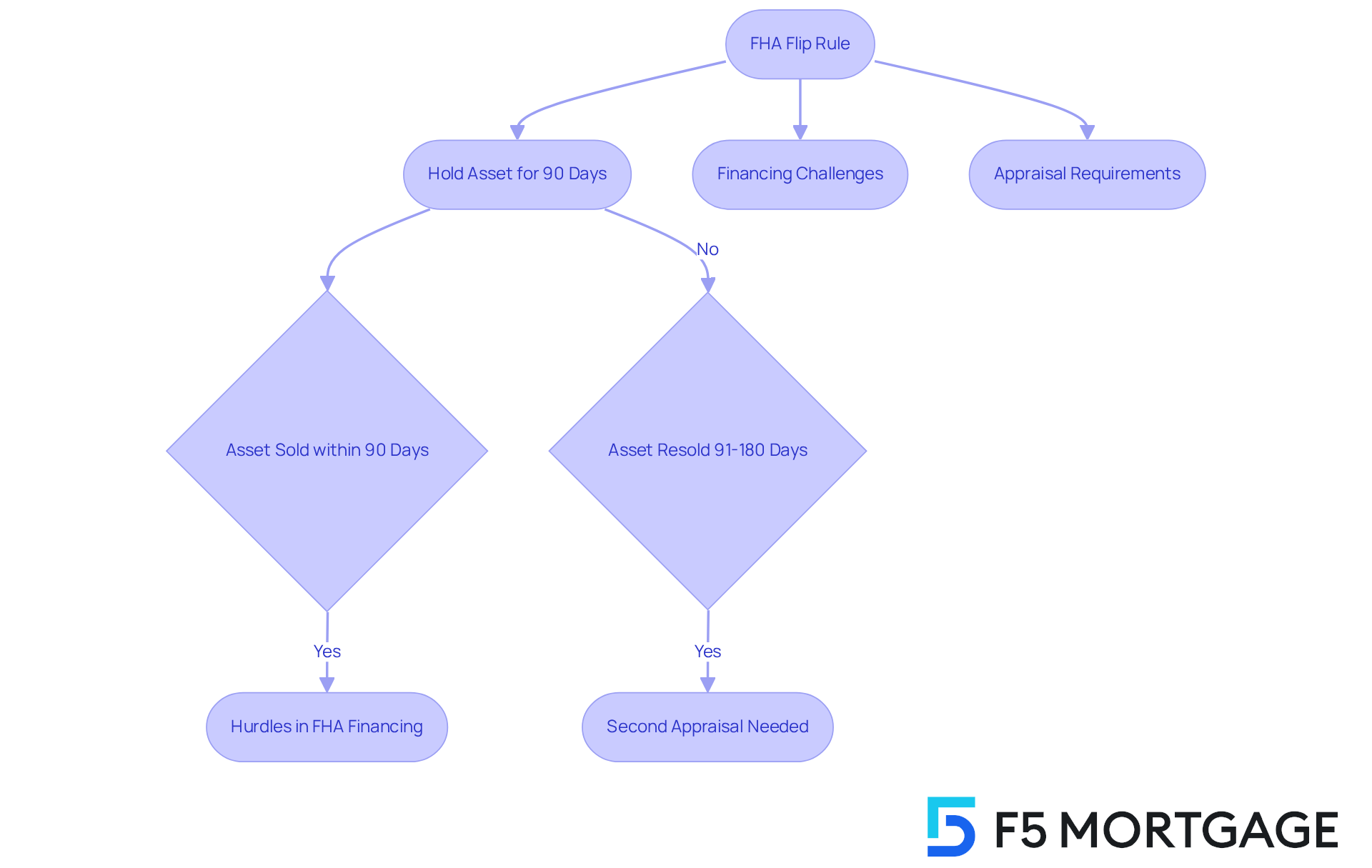

Implications of the FHA Flip Rule: Financing and Appraisal Considerations

The FHA flip rule can significantly affect financing options and appraisal requirements for homebuyers. We understand how challenging this can be, especially when assets sold within 90 days of acquisition often face hurdles in securing FHA financing. According to the FHA flip rule, an owner must hold an asset for at least 90 days before it can be transferred to buyers using an FHA loan. This stipulation is crucial for maintaining the integrity of the FHA program and preventing potential abuses related to the FHA flip rule in real estate flipping.

When it comes to evaluations, additional scrutiny is often required for recently traded assets. If an asset is resold within 91 to 180 days and the resale price is 100% or more above the original purchase price, a second appraisal is mandatory. This ensures that the asset’s value is justified and aligns with the purchase price, protecting both lenders and buyers from inflated valuations.

Appraisers must adhere to strict guidelines when assessing assets under the FHA flip rule. They are tasked with documenting the condition of the asset and any improvements made since the original acquisition. This can be challenging if the renovations are extensive or not thoroughly documented. Additionally, lenders may request an inspection to confirm the asset is in good condition, as a home needing significant repairs might not qualify for refinance loans. For instance, consider a real estate asset purchased for $200,000 and renovated within 60 days. If the new sales agreement is finalized before the 90-day threshold, this could complicate the financing process.

Understanding these evaluation and inspection criteria is vital for buyers considering homes that have undergone recent renovations. By being aware of the FHA’s regulations and the potential need for additional appraisals, homebuyers can navigate the complexities of the mortgage process with greater confidence. We’re here to support you every step of the way as you make informed decisions about your financing options.

Common Misconceptions About the FHA Flip Rule: Debunking Myths

Many homebuyers face challenges when it comes to understanding the FHA flip rule. It’s common to think this rule applies to all properties or that it can be easily bypassed. However, this rule is specifically designed for FHA loans and has strict guidelines that must be followed. For instance, properties sold within 90 days of purchase are generally not eligible for FHA financing, which can significantly impact potential buyers.

If a property is sold between 91 and 180 days after purchase at a price that is 100% or more above the original cost, a second appraisal is required. This step is crucial to ensure fair valuation and protect buyers from inflated prices or potential fraud. It reinforces the integrity of the FHA loan program, which is designed to support families in their home-buying journey.

Despite these important regulations, many homebuyers remain unaware of the specifics of the FHA flip rule. Surveys show that a large percentage of potential clients lack knowledge about these critical guidelines. Understanding these nuances is vital for successfully navigating the home buying process. We know how challenging this can be, and we’re here to support you every step of the way.

To gain clarity on the FHA flip rule and its implications, homebuyers should consult knowledgeable real estate professionals who are familiar with the FHA flip rule. Additionally, comparing rates, costs, and terms from various lenders, such as F5 Mortgage, can help ensure that you receive competitive rates and personalized service tailored to your needs.

FHA Flipping Guidelines: Essential Information for Homebuyers

Homebuyers, we know how challenging navigating the FHA flip rule can be, especially with the 90-day ownership stipulation. According to the FHA flip rule, sellers must hold a residence for a minimum of 90 days before selling it to an FHA borrower. It’s essential to understand this guideline, as it helps prevent rapid resales in line with the FHA flip rule that could artificially inflate real estate values.

According to the FHA flip rule, if a property is sold again within 91 to 180 days, a second evaluation is necessary if the resale price exceeds 100% of the initial purchase amount. This extra evaluation acts as a safeguard, ensuring that you, as a purchaser, do not overpay for properties that may have been quickly flipped according to the FHA flip rule.

Statistics show that properties resold within this timeframe often face increased scrutiny due to the FHA flip rule. Lenders must document the seller’s ownership duration and the valuation history of the asset. For instance, if a property is sold for significantly more than its original cost, the FHA flip rule mandates a second evaluation to confirm its fair market value. This process is crucial for maintaining market stability and protecting consumers from speculative practices.

Additionally, we encourage homebuyers to compare lenders while considering the FHA flip rule to find the best rates and terms that fit your needs. Working with F5 Mortgage can provide competitive rates and personalized service, making your mortgage journey smoother.

Case studies highlight the importance of these guidelines. In one scenario, a homebuyer purchasing a property for $200,000 from an investor who bought it for $100,000 within the 91 to 180-day window triggered the need for a second appraisal due to the substantial profit margin. This requirement ensures that you are not overpaying because of inflated resale values.

Mortgage professionals stress the importance of understanding the FHA flip rule. As one expert noted, ‘The FHA flip rule prevents all quick resales using FHA loans,’ underscoring their role in protecting buyers from predatory practices. By staying informed about the FHA flip rule and the importance of inspections, you can navigate the complexities of the mortgage process with greater confidence and security. We’re here to support you every step of the way.

Impact of the FHA Flip Rule on Property Values and Market Trends

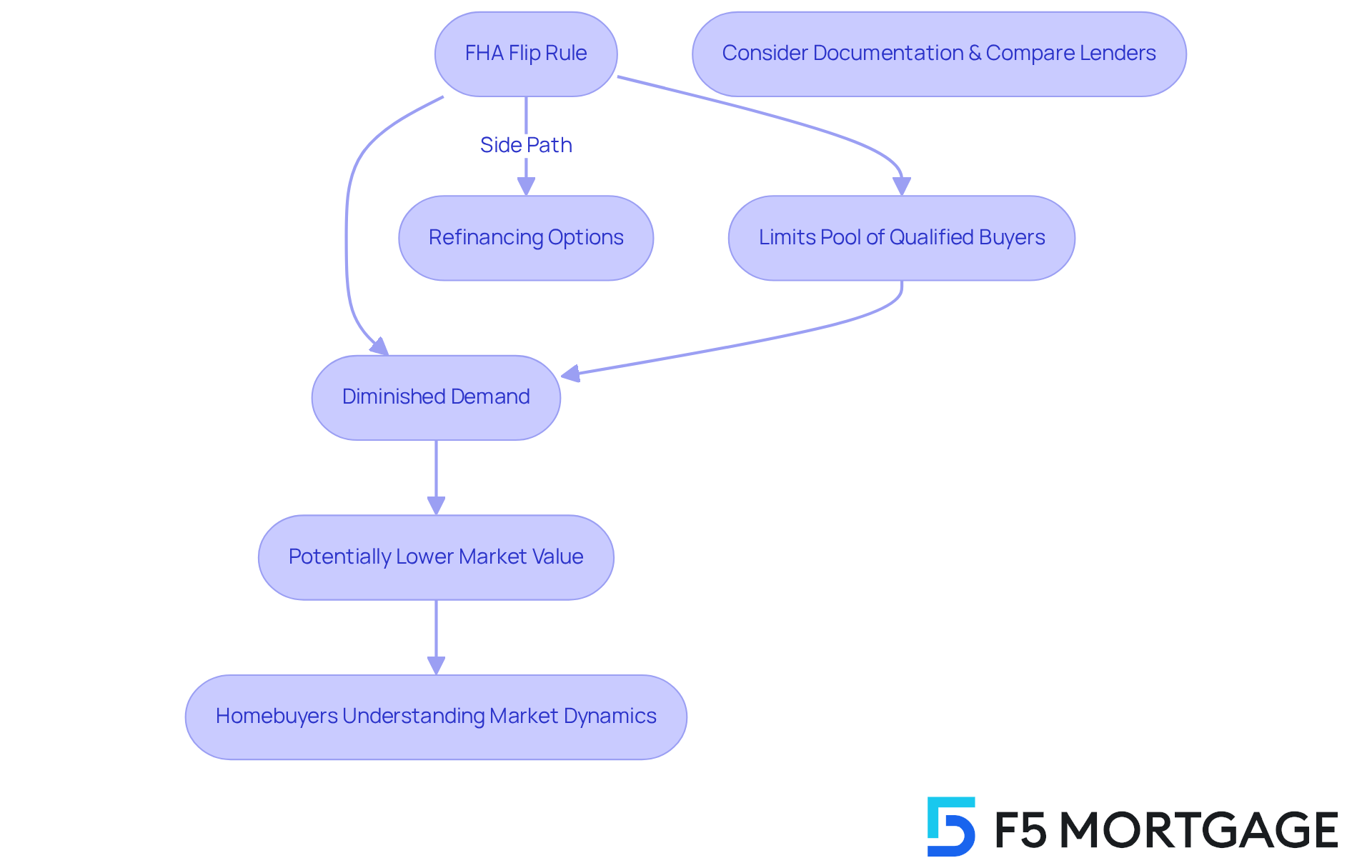

The fha flip rule significantly impacts real estate values by limiting the pool of qualified buyers for homes that have been recently flipped. This restriction can diminish demand for these properties, potentially lowering their market value. As the real estate market steadily recovers, with builders reporting record profits and home prices on the rise, it’s essential for homebuyers to understand these dynamics.

For example, in the first quarter of 2024, 67,817 homes were flipped, reflecting a strong market for renovations. However, the FHA flip rule complicates transactions due to its 90-day ownership requirement before resale. Homes must be owned for at least 90 days before they can be sold to FHA buyers. The fha flip rule is designed to protect buyers from inflated prices and speculative practices, ensuring market stability.

We understand how challenging navigating these regulations can be, so it’s important to consider the fha flip rule carefully when evaluating flipped real estate, as it can affect both availability and pricing in today’s market.

Additionally, when exploring refinancing options, completing your application with the necessary documentation—such as Social Security numbers, bank statements, tax returns, and pay stubs—is crucial. Comparing lenders is vital too; working with F5 Mortgage can offer you competitive rates and personalized service tailored to your unique needs.

We’re here to support you every step of the way.

The Role of Appraisals in FHA Flip Rule Transactions

Appraisals are essential in FHA Flip Rule transactions, and we understand how critical it is to comprehend them. If an asset is sold again within 90 days, a second evaluation may be necessary to verify its worth. This ensures that purchasers are not overpaying for assets that have been rapidly flipped, in compliance with the FHA Flip Rule, thus protecting your investment.

In the context of refinancing, lenders will request a home evaluation to ascertain the current market value of your asset. This evaluation identifies how much equity you possess, which directly influences your mortgage rates. Understanding this process is vital for homeowners looking to refinance, as it can significantly impact your eligibility and the terms of your new loan.

We’re here to support you every step of the way as you navigate these important decisions. Knowing how appraisals work can empower you to make informed choices about your home and finances.

Best Practices for Homebuyers Navigating the FHA Flip Rule

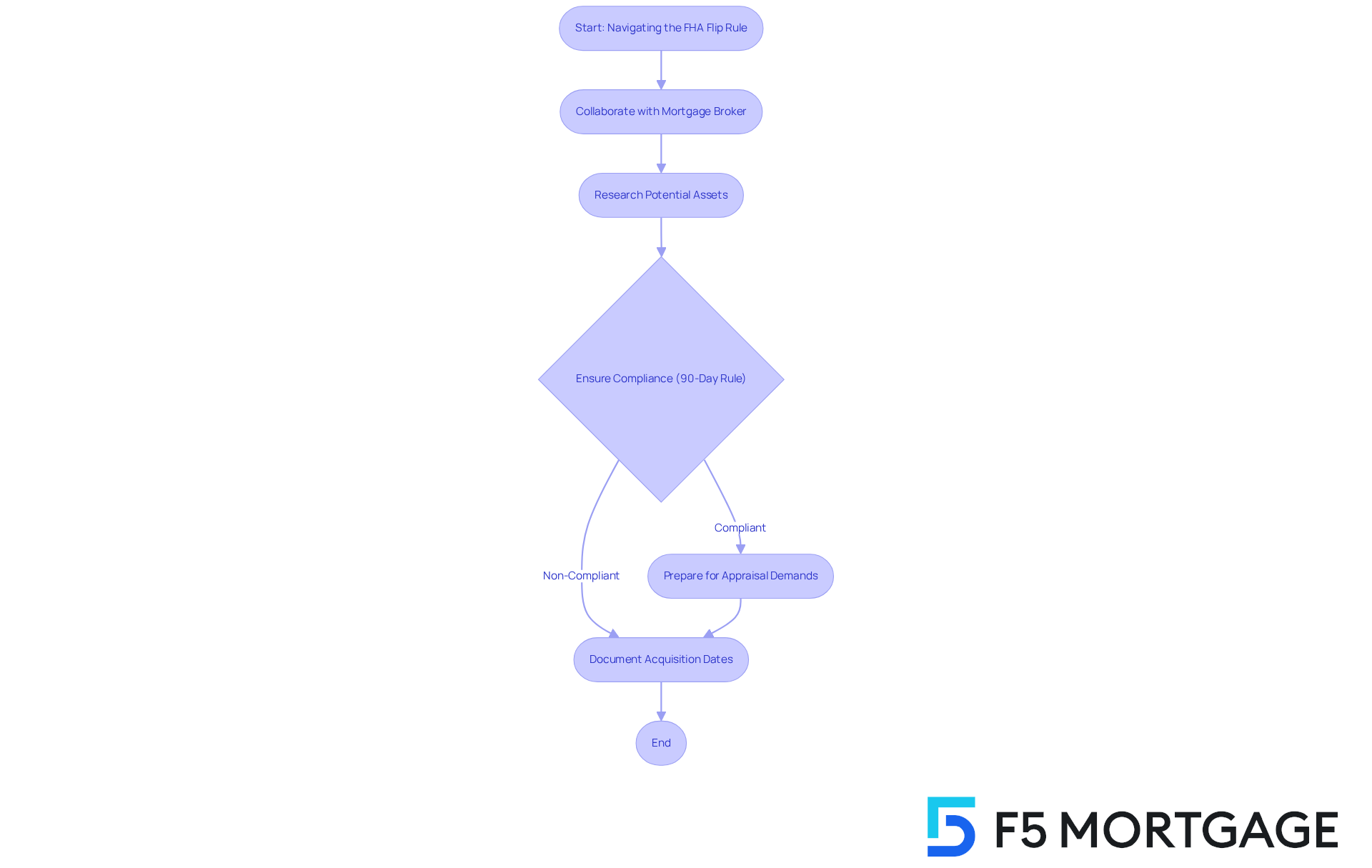

Navigating the FHA flip rule can feel overwhelming; however, you don’t have to do it alone. At F5 Mortgage, we understand how challenging this can be, and we’re here to support you every step of the way. Collaborating closely with your mortgage broker can provide you with essential guidance on compliance and the intricacies of the rule. Our dedicated team, including your loan officer and Account Manager, is committed to helping you find your perfect home and getting your offer accepted.

One key strategy is to perform comprehensive research on potential assets. It’s important to ensure compliance with the FHA flip rule, which mandates that sellers retain an asset for at least 90 days before it can be transferred to a purchaser using an FHA-insured mortgage. Additionally, be prepared for potential appraisal demands, especially for assets sold within 91 to 180 days of acquisition. Substantial price increases may necessitate a second appraisal to validate the new worth.

The FHA flip rule is implemented to protect home purchasers from potentially deceptive or inflated real estate values. This makes it essential for buyers to remain informed and proactive. Documenting property acquisition dates and any improvements made is crucial for compliance. By engaging with knowledgeable mortgage brokers at F5 Mortgage, you can enhance compliance rates and facilitate a smoother homebuying experience. Ultimately, this empowers you to make informed decisions in the FHA loan landscape.

Conclusion

Understanding the FHA flip rule is essential for homebuyers who may feel overwhelmed by the complexities of the housing market. This regulation, which mandates a 90-day waiting period before reselling a property to FHA loan buyers, is designed to protect consumers from inflated prices and potential fraud. By familiarizing yourself with the intricacies of this rule, you can make informed decisions that align with your homeownership goals.

Throughout this article, we’ve discussed key insights into the FHA flip rule, including:

- The importance of the 90-day ownership requirement

- The implications for financing and appraisals

- The exceptions that may apply in unique situations

We know how challenging this can be, which is why thorough research and collaboration with knowledgeable mortgage professionals are vital to ensure compliance with these regulations. Understanding these elements is crucial for successfully navigating the home buying process.

In conclusion, the FHA flip rule plays a significant role in shaping the real estate landscape, impacting both property values and buyer opportunities. As the market evolves, staying informed about these regulations is vital for making strategic decisions. We encourage you to seek guidance from experienced lenders and real estate professionals to effectively navigate these complexities and secure your dream home. Embracing this knowledge not only enhances your homebuying experience but also empowers you to make confident choices in a competitive market.

Frequently Asked Questions

What is the FHA flip rule?

The FHA flip rule requires that a property must be owned for at least 90 days before it can be sold to buyers using FHA loans. This regulation is designed to protect homebuyers from potential fraud and inflated asset values.

Why was the FHA flip rule established?

The FHA flip rule was established to safeguard homebuyers from the risks associated with flipping real estate, which can involve buying and quickly reselling properties at inflated prices.

What happens if a property is sold before the 90-day waiting period?

If a property is sold before the 90-day waiting period, FHA financing is generally not an option. The property must be owned for at least 90 days to qualify for FHA loans.

Are there any exceptions to the 90-day waiting period?

Yes, certain exemptions exist within the FHA flip rule. Properties sold by government entities, inherited properties, and those acquired by non-profit organizations are not subject to the 90-day waiting period.

What are the implications of reselling a property between 91 and 180 days after purchase?

If a property is resold between 91 and 180 days after purchase, it faces additional scrutiny. A second appraisal is required if the resale price exceeds the original purchase price by 100% or more, ensuring that the selling price reflects the property’s true market value.

What should homebuyers know about the mortgage approval process related to the FHA flip rule?

Homebuyers should understand that while the 90-day waiting period must be observed, it does not mean they have to wait 90 days to finalize an FHA loan. However, the agreement cannot be drafted prior to the 90 days.

What alternative financing options are available if the FHA flip rule poses challenges?

If the FHA flip rule presents challenges, homebuyers can explore alternative financing options such as VA loans, USDA loans, and conventional loans, although conventional loans may have stricter requirements.

How can F5 Mortgage assist homebuyers with the FHA flip rule?

F5 Mortgage provides personalized consultations to help homebuyers understand the FHA flip rule and navigate the mortgage approval process, ensuring compliance with FHA regulations and enhancing the home buying experience.