Overview

The Downpayment Toward Equity Act is designed to empower first-time homebuyers like you by providing grants of up to $25,000. We know how challenging the financial burden of purchasing a home can be, and this act aims to alleviate that stress, making homeownership more accessible. By reducing initial expenses, families can build equity more quickly, paving the way for a brighter future.

Additionally, the act offers various assistance programs to ensure that more households can qualify for homeownership opportunities. Imagine being able to step into your dream home sooner than you thought possible! We’re here to support you every step of the way, guiding you through the mortgage process and addressing your needs and concerns. Together, we can make homeownership a reality for you and your family.

Introduction

The journey to homeownership can often feel overwhelming, filled with financial hurdles that leave potential buyers uncertain about their future. We understand how challenging this can be, and that’s why the Downpayment Toward Equity Act stands out as a beacon of hope. This initiative offers substantial assistance to first-time homebuyers, providing grants of up to $25,000 to help ease the burden of down payments.

As this initiative gains traction, it’s natural to have questions about its accessibility and eligibility. What does this mean for families striving for a stable future? We’re here to support you every step of the way as you explore how this can turn your homeownership dreams into reality.

F5 Mortgage: Your Partner for Down Payment Assistance Programs

At F5 Financing LLC, we understand how daunting the journey to homeownership can be. That’s why we are committed to being a supportive partner for clients seeking the downpayment toward equity act. Through tailored consultations, we help households explore their options, ensuring they feel empowered every step of the way.

By leveraging a network of over two dozen top lenders, we offer solutions designed to meet diverse financial situations. We know how challenging this can be, and our streamlined application process reflects our dedication to client satisfaction—promising pre-approval in under an hour. Additionally, we provide comprehensive resources to educate clients about their choices, so they can make informed decisions with confidence.

With recent initiatives aimed at simplifying down payment support, including the that proposes up to $25,000 in aid for first-generation homebuyers, we anticipate a substantial impact on homeownership rates by 2025. Our strategy not only improves accessibility but also fosters informed decision-making, ultimately creating a pathway to homeownership for countless families. Together, we can navigate this journey and turn your dreams into reality.

Understanding the Downpayment Toward Equity Act: Key Provisions and Benefits

The Downpayment Toward Equity Act aims to empower first-time homebuyers by offering significant financial assistance for down payments. This important legislation proposes grants of up to $25,000, significantly alleviating the financial burden of purchasing a home. By reducing initial expenses, the act enhances accessibility to homeownership, allowing families to build equity more quickly and potentially lower their monthly mortgage payments.

Key benefits of the Downpayment Toward Equity Act include:

- Reduced Financial Barriers: These grants can cover a significant portion of the down payment, making it easier for families to enter the housing market. Additionally, F5 offers low down payment loan solutions, with options as low as 3% down and even 0% down for certain choices, further easing the path to homeownership.

- Increased Equity: By facilitating home purchases, the act helps households build equity sooner, contributing to long-term financial stability. With the support of F5 Financing, families can explore various that align with their financial situations.

- Lower Monthly Payments: A reduced down payment requirement may lead to lower monthly mortgage payments, easing financial strain. F5 Mortgage’s expertise can assist families in selecting the best loan options to maximize their financial benefits.

However, we know how challenging this process can be. It’s important to note that the Downpayment Toward Equity Act is still pending and faces challenges under the new administration. Recent changes have broadened eligibility criteria, allowing more households to benefit from this initiative. Potential homeowners earning less than 120% of the area median income can qualify, with allowances for high-cost markets where income limits may reach up to 180%.

To seek down payment support in Ohio, households should follow these steps:

- Investigate available options.

- Gather necessary documents like proof of income and tax returns.

- Collaborate with a knowledgeable lender like F5 Financing.

- Formally submit their application.

Current down payment assistance initiatives for first-time homebuyers in Ohio include YourChoice!, Grant for Grads, and Ohio Heroes, providing alternative options for families eager to achieve homeownership. Partnering with F5 Mortgage can help navigate these programs effectively.

Practical examples illustrate the impact of the Downpayment Toward Equity Act: families who have taken advantage of it report smoother transitions into homeownership, with many expressing relief at the financial assistance provided. As the Downpayment Toward Equity Act remains a vital resource for families, housing policy experts highlight its potential to significantly enhance homeownership opportunities for those who may not have had the chance otherwise.

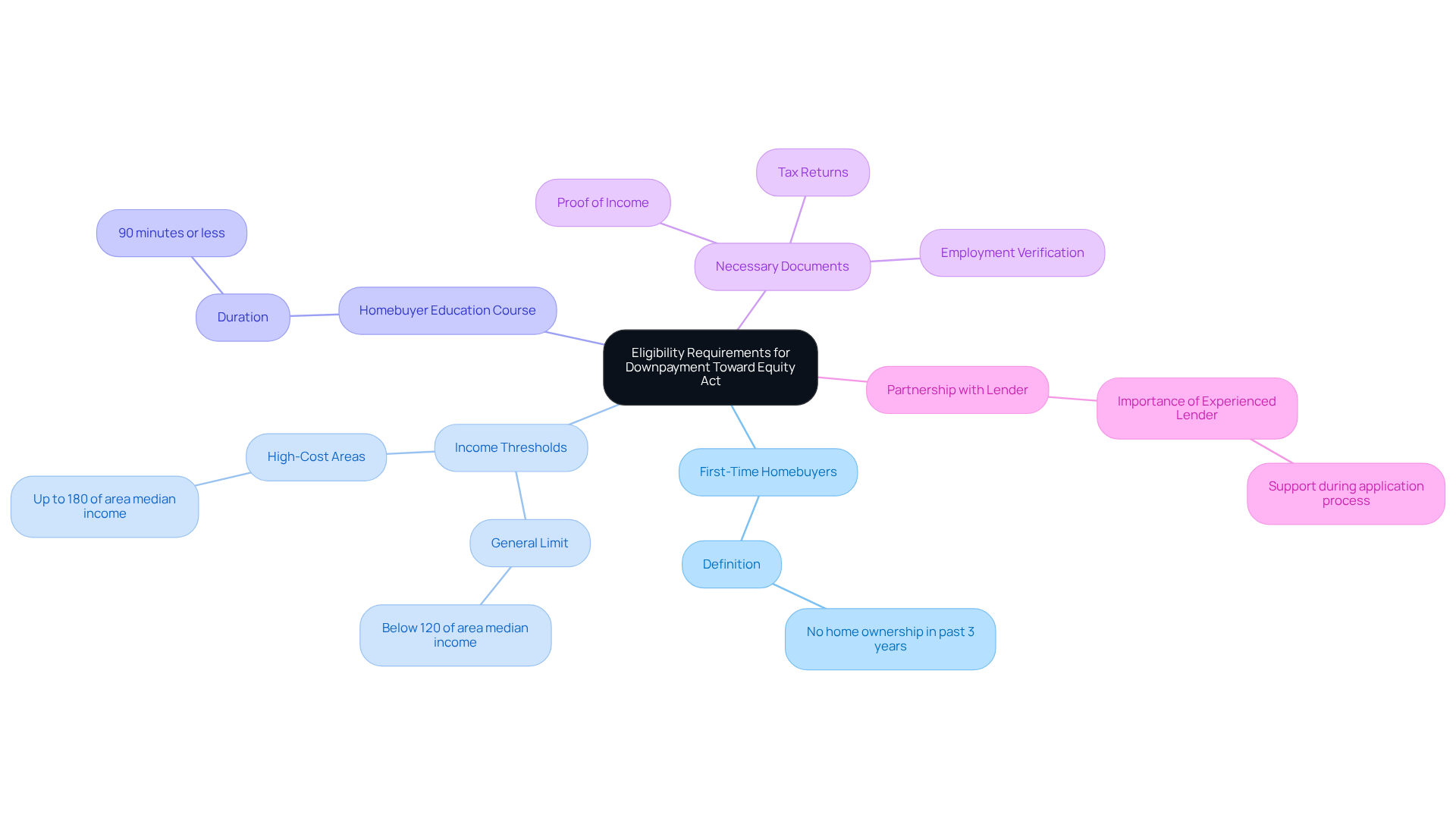

Eligibility Requirements for the Downpayment Toward Equity Act

We understand that navigating eligibility criteria can be daunting to qualify for assistance under the . First and foremost, applicants must be first-time homebuyers—individuals who haven’t owned a home in the past three years. Income thresholds are also crucial; for many initiatives, your household income should be below 120% of the area median income. However, if you’re in a high-cost real estate market, you may qualify with incomes up to 180% of the area median income. Additionally, it’s important to note that homes must be acquired within specific regions that align with the initiative’s goals.

Beyond these financial considerations, prospective buyers often need to complete a HUD-approved homebuyer education course, typically taking 90 minutes or less. This course provides essential knowledge about homeownership responsibilities, ensuring you feel well-prepared for the journey ahead.

To give yourself the best chance at qualifying for down payment assistance in Ohio, it’s vital to explore available options. Gather all necessary documents, such as:

- Proof of income

- Tax returns

- Employment verification

and submit your application formally. Partnering with an experienced lender like F5 can provide invaluable support during this process. For instance, households with a combined income of $75,000 looking to purchase in a high-cost area may find they qualify for the program, especially if they meet the other criteria.

Mortgage specialists emphasize the importance of understanding these criteria, as they can significantly impact your ability to obtain financing and manage the home purchasing process smoothly. By familiarizing yourself with the stipulations of the downpayment toward equity act, you can better position your family to access the available financial support, including potential grants of up to $25,000 for first-time buyers. Remember, we’re here to support you every step of the way.

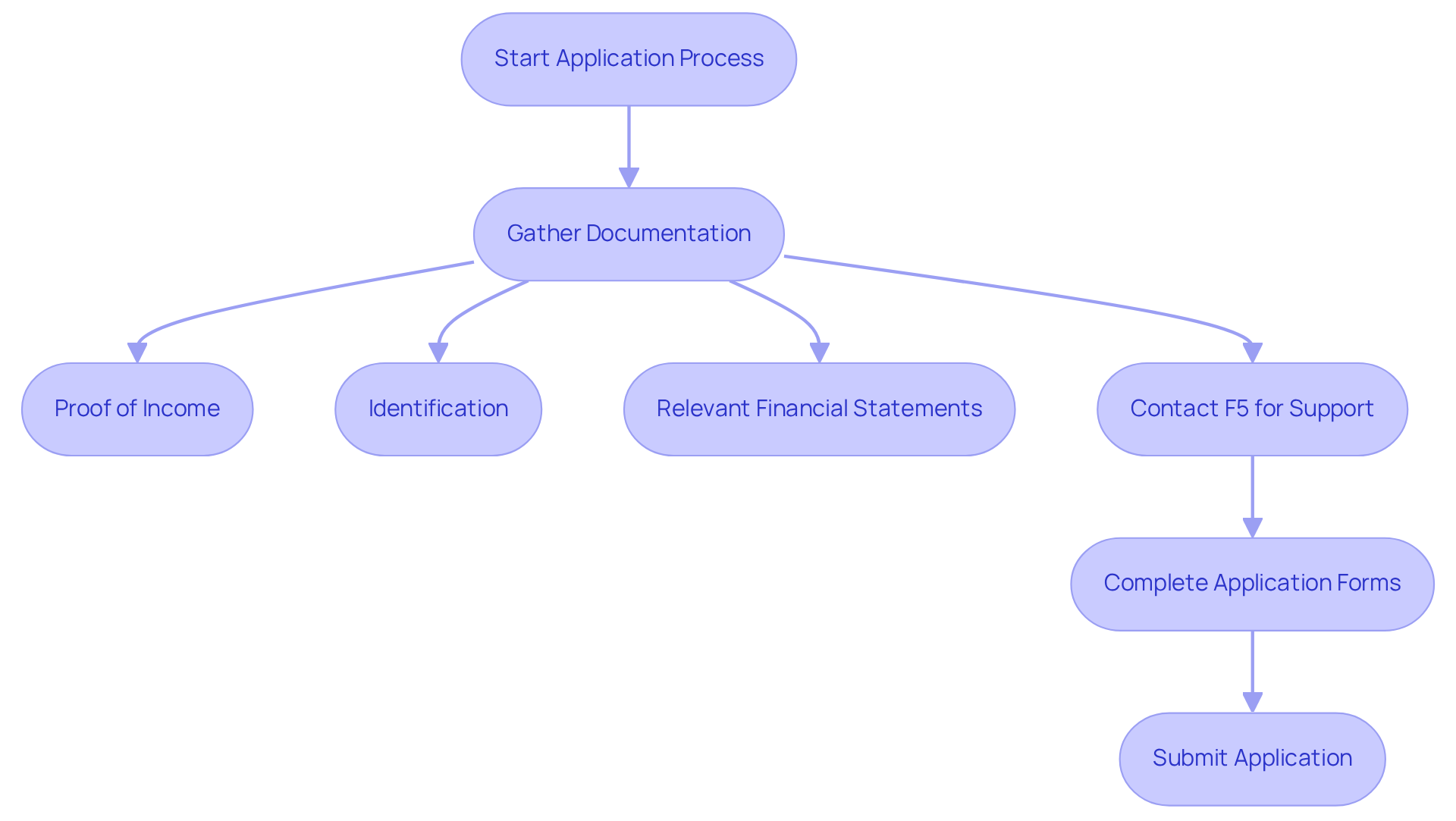

How to Apply for the Downpayment Toward Equity Act Assistance

Applying for assistance through the downpayment toward equity act can feel overwhelming. We understand how challenging this process can be, and we’re here to support you every step of the way. To begin, gather essential documentation, such as:

- Proof of income

- Identification

- Relevant financial statements

This preparation is crucial for a smooth application process.

Once you have compiled this information, reaching out to F5 can provide invaluable support. As a trusted independent brokerage, F5 specializes in guiding clients through the application process. They ensure that all required forms are accurately completed and submitted to the appropriate authorities. With their , the application process becomes simpler and more manageable for you.

F5 Home Loans operates Monday to Friday from 8:30 am to 11:00 pm (EST) and Saturday from 8:30 am to 5:00 pm (EST). This flexibility allows you to seek help at your convenience. With a strong history of assisting households in navigating similar programs, F5 Mortgage is dedicated to empowering you on your journey toward homeownership with the downpayment toward equity act. Remember, you are not alone in this process; support is available to help you achieve your dream.

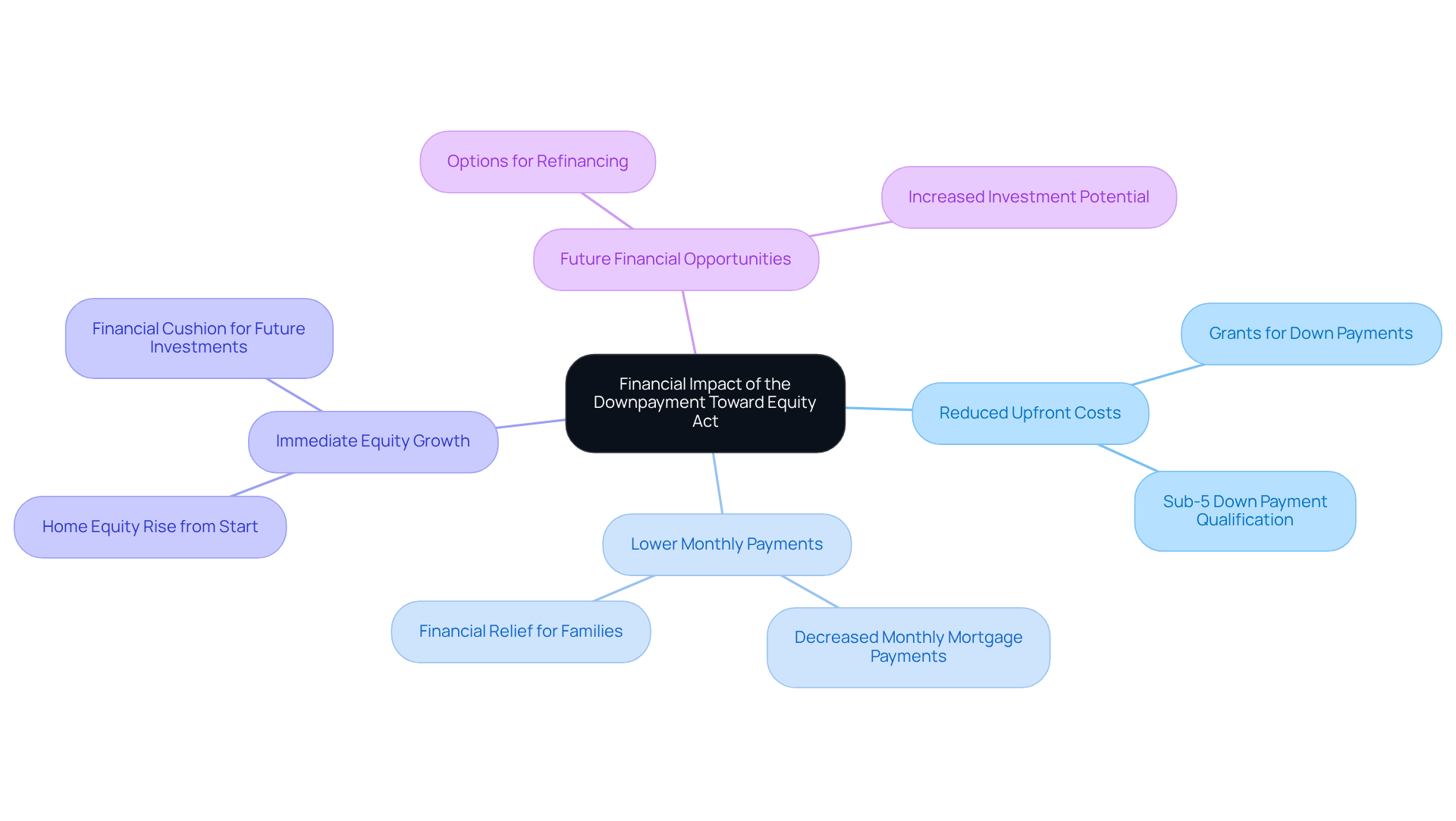

Financial Impact of the Downpayment Toward Equity Act on First-Time Homebuyers

The Downpayment Toward Equity Act represents a significant breakthrough for first-time homebuyers. We understand how daunting the home purchasing process can be, especially with the financial burdens that often accompany it. By providing grants for the downpayment toward equity act, this act significantly reduces the upfront costs, making homeownership much more attainable for families like yours. With this financial support, not only is the initial investment lower, but it can also lead to reduced monthly mortgage payments. Many households have shared their relief at finding their monthly payments significantly decreased, allowing them to manage their finances with greater ease.

Moreover, the downpayment toward equity act promotes immediate equity growth in homes for first-time buyers. We know how important it is to build a secure financial future, and statistics show that those receiving often see their home equity rise right from the start. This equity can act as a financial cushion, offering homeowners more options for future investments or refinancing opportunities. Overall, the Downpayment Toward Equity Act signifies a significant advancement in making homeownership a reality for many families, relieving the financial pressures that can make purchasing a home seem overwhelming. We’re here to support you every step of the way.

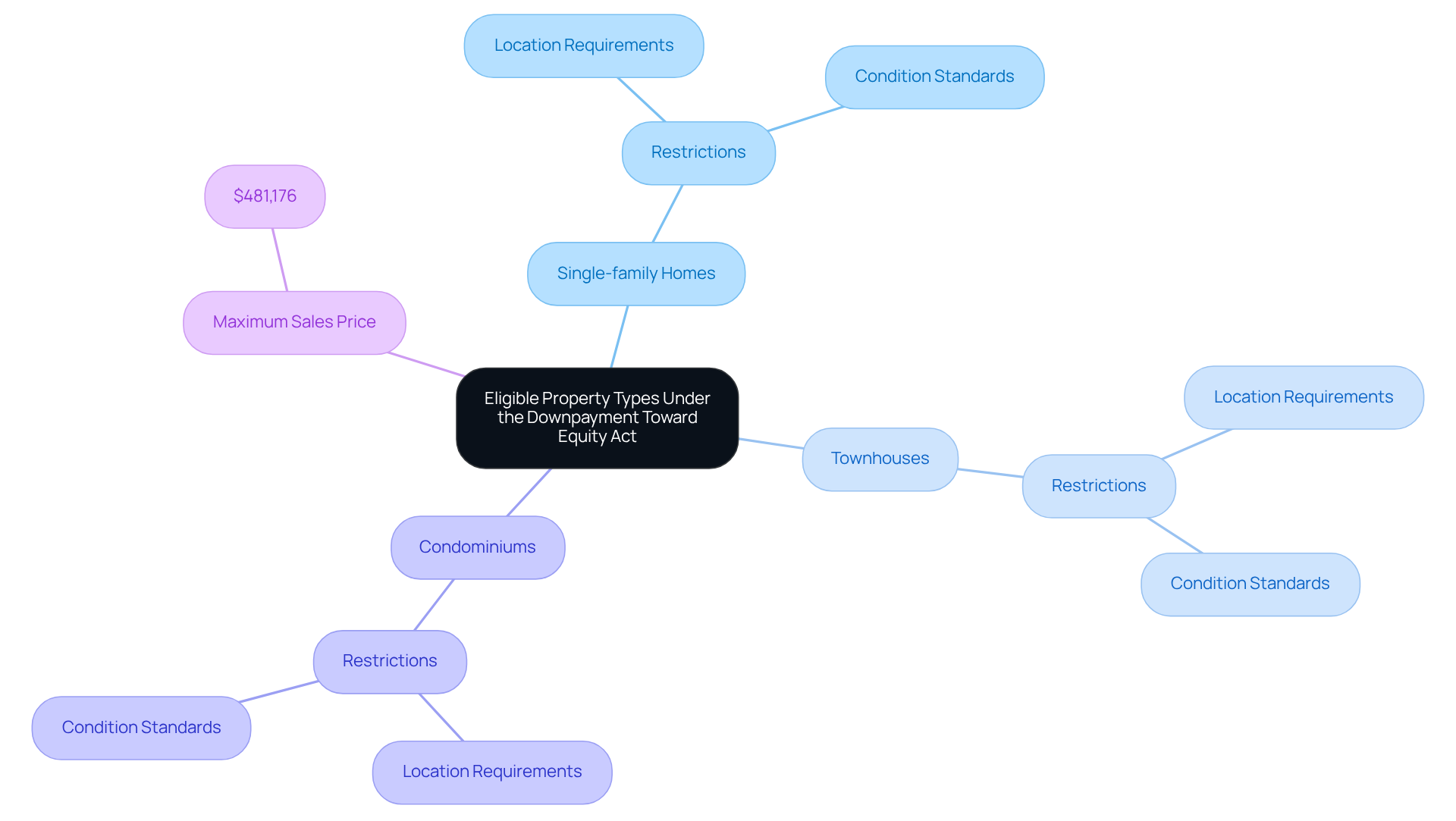

Eligible Property Types Under the Downpayment Toward Equity Act

We understand that finding the right home can be a challenge under the . Eligible property types generally include:

- Single-family homes

- Townhouses

- Condominiums

However, it’s important to note that specific restrictions may apply based on the property’s location and condition. For instance, properties must meet certain standards to qualify for support, and the maximum sales price for eligible properties is capped at $481,176.

To ensure you make the best decision, we encourage you to consult with F5 Mortgage. They can help confirm the eligibility of your desired property type, ensuring it complies with the requirements of the Downpayment Toward Equity Act. This verification process is essential for maximizing the advantages of the support initiative, empowering you and your family to make informed choices when buying your home. Remember, we’re here to support you every step of the way.

Comparing the Downpayment Toward Equity Act with Other Assistance Programs

When considering the downpayment toward equity act alongside other support initiatives, it’s important to recognize several key factors that can impact your journey. These include:

- Funding sources

- Eligibility requirements

- The level of financial aid available

The Downpayment Toward Equity Act stands out by providing direct grants that can significantly lower the upfront costs for homebuyers.

For instance, initiatives like the City of San Antonio Homeownership Incentive Initiative provide up to $15,000 for first-time purchasers, while Atlanta Housing’s initiative offers up to $20,000. This highlights the variety of support available to you. We understand how overwhelming this can feel, and it’s essential for families to thoughtfully evaluate their unique situations, including income thresholds.

Consulting with F5 Financing can help you determine which option aligns best with your financial goals. With over 2,466 currently available—1,518 of which are specifically for first-time buyers—the landscape is rich with opportunities. Specialized support is crucial in making informed decisions, and we encourage households to take the next step by reaching out to F5 Mortgage for personalized assistance. Remember, we’re here to support you every step of the way.

Debunking Myths About the Downpayment Toward Equity Act

Many families may feel discouraged by the misconceptions surrounding the downpayment toward equity act. One common misconception is that this program is only for . In reality, the downpayment toward equity act is designed to support a broader range of first-time homebuyers, making it accessible to many who might not identify as low-income.

Another frequent belief is that the application process is overly complicated. We understand how challenging this can seem. However, with the support of F5 Financing, households can easily navigate the requirements and documentation involved. F5 Mortgage is dedicated to connecting clients with top realtors and securing the best mortgage offers, ensuring that families receive the assistance they need throughout the process.

It’s crucial to address and dispel these misconceptions about the downpayment toward equity act. By doing so, we can encourage more households to explore their options and take advantage of the support available to them. Remember, we’re here to support you every step of the way.

The Role of Housing Counseling in the Downpayment Toward Equity Act

Housing counseling plays a vital role in the Downpayment Toward Equity Act, equipping potential homebuyers with the essential knowledge and skills for successful homeownership. We understand how overwhelming the journey to homeownership can be, and these are designed to help households evaluate their financial situations, develop effective budgets, and navigate the complexities of the mortgage process. By participating in housing counseling, applicants significantly enhance their opportunities to obtain support and make informed choices about their future.

For instance, studies show that completing homebuyer education courses can lead to improved financial literacy and better mortgage outcomes. Moreover, households that have utilized housing counseling services often report feeling more confident in their ability to manage homeownership responsibilities. Housing counselors emphasize that financial education is not just beneficial; it is crucial for fostering sustainable homeownership and reducing the risk of foreclosure.

By prioritizing these resources, the aim of the Downpayment Toward Equity Act is to create a more informed and empowered base of homeowners. We encourage prospective homebuyers to explore local housing counseling services and educational resources to maximize their chances of success. Additionally, F5 Lending offers assistance with various down payment aid options available in California, including the Golden State Finance Authority’s Open Doors initiative, which provides up to 7% of the primary loan amount toward closing costs. This assistance is especially advantageous for first-time homebuyers and individuals with low-to-moderate incomes, ensuring that households have access to essential resources to realize their homeownership dreams.

Eligibility for these programs may vary, and we encourage households to consult with F5 Mortgage to understand the specific criteria that apply. Remember, we’re here to support you every step of the way.

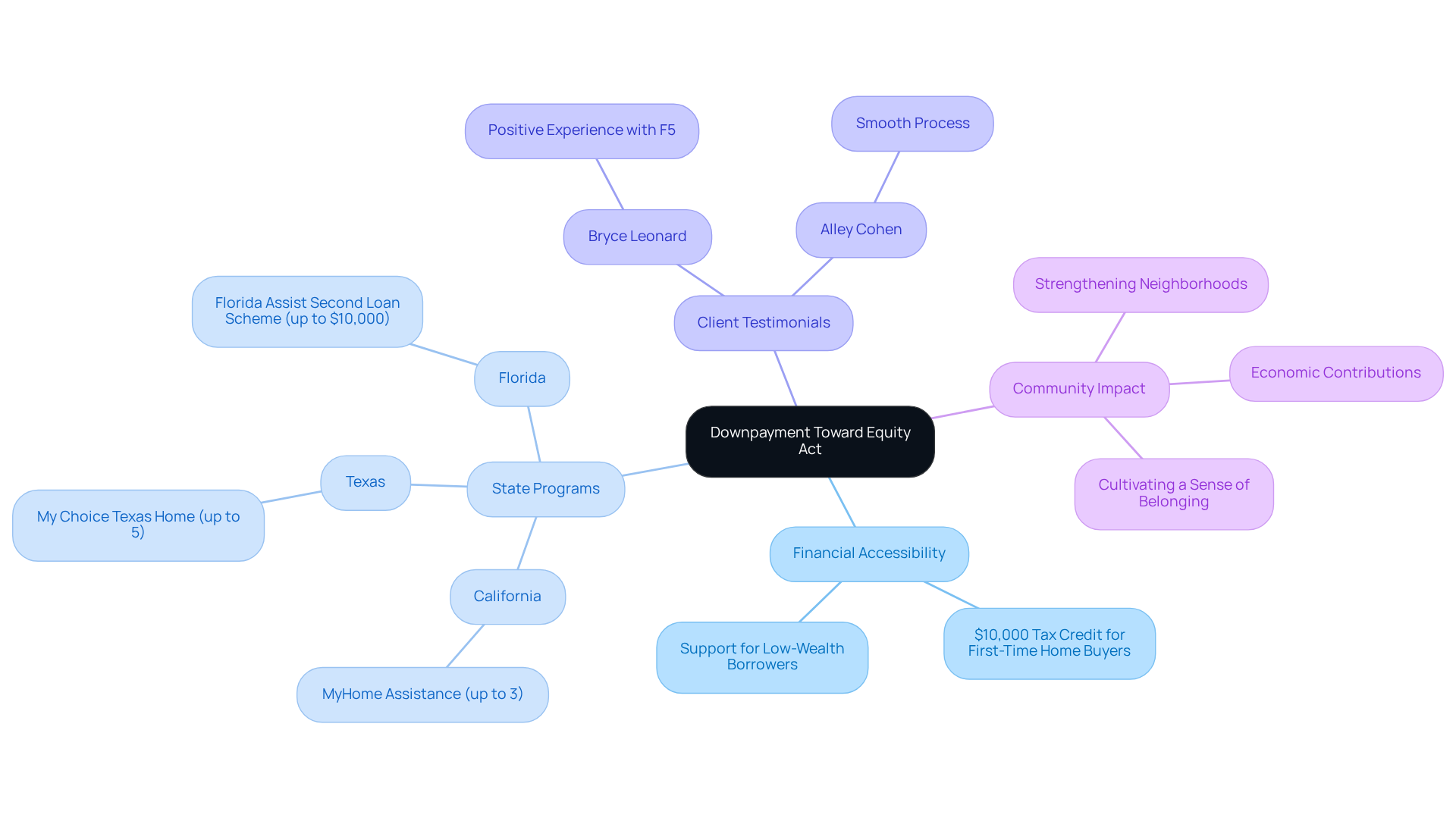

Key Benefits of the Downpayment Toward Equity Act for Homebuyers

The Downpayment Toward Equity Act plays a crucial role in reducing financial barriers for homebuyers, thus making homeownership more accessible and promoting greater equity. By offering direct support for down payments—such as a suggested $10,000 tax credit for first-time home buyers—the act helps families realize their dreams of owning a home without the burden of significant upfront costs. This initiative not only enhances individual financial stability but also encourages community growth as households make investments in their futures through the downpayment toward equity act. When families secure homes, they contribute to local economies, strengthen neighborhoods, and cultivate a sense of belonging.

At F5 Financing, we are proud to offer various down payment support options in states like California, Texas, and Florida. For instance, the MyHome Assistance initiative from the California Housing Finance Authority can provide up to 3% of the home’s purchase price. In Texas, residents can benefit from the My Choice Texas Home option, which includes a 30-year, low-interest-rate mortgage along with up to 5% for down payment and closing assistance. In Florida, programs like the Florida Assist Second Loan Scheme offer up to $10,000 for initial expenses, making homeownership more achievable.

Testimonials from satisfied clients truly highlight the positive impact of these programs. Bryce Leonard shares, “Awesome work. I appreciated receiving assistance with my loan via F5. Highly recommend to anyone who is looking for true experts.” Alley Cohen adds, “Everything went very smoothly!” Expert opinions, including those from Marvin M. Smith, emphasize the importance of the downpayment toward equity act in achieving long-term financial stability. This support allows households to , including education and healthcare. The act exemplifies how targeted assistance, such as the downpayment toward equity act, can lead to transformative outcomes, with many families successfully attaining homeownership through these programs, including those facilitated by F5 Mortgage, thereby reinforcing the fabric of their communities.

However, we know how challenging this can be for low-wealth borrowers, who often struggle to meet traditional lending requirements. This highlights the critical role of initiatives like the downpayment toward equity act in helping bridge the gap to homeownership. We’re here to support you every step of the way.

Conclusion

The Downpayment Toward Equity Act is a transformative initiative designed to make homeownership more attainable for first-time buyers. By providing substantial financial assistance, including grants up to $25,000, this act alleviates many burdens associated with purchasing a home. Its core mission is to empower families, helping them build equity and secure a stable financial future while fostering community growth.

Throughout the article, we highlight the act’s benefits, such as:

- Reduced financial barriers

- Increased equity

- Lower monthly payments for families

We also emphasize the importance of understanding:

- Eligibility requirements

- The application process

- The role of housing counseling in maximizing the act’s advantages

By dispelling common myths and clarifying misconceptions, the Downpayment Toward Equity Act encourages more households to explore their options and take proactive steps toward homeownership.

Ultimately, the Downpayment Toward Equity Act represents a significant opportunity for many families to achieve their dream of owning a home. By leveraging available resources and support from organizations like F5 Mortgage, potential homebuyers can navigate this journey with confidence. We know how challenging this can be, and it is essential for households to stay informed and actively engage with these initiatives. They not only pave the way for individual financial stability but also contribute to the overall health of communities. Embracing the opportunities presented by the Downpayment Toward Equity Act can lead to lasting positive change for families and neighborhoods alike.

Frequently Asked Questions

What is F5 Financing LLC’s role in down payment assistance?

F5 Financing LLC assists clients seeking down payment support by providing tailored consultations and leveraging a network of over two dozen lenders to offer solutions for diverse financial situations.

What is the Downpayment Toward Equity Act?

The Downpayment Toward Equity Act is legislation aimed at empowering first-time homebuyers by offering grants of up to $25,000 to help alleviate the financial burden of down payments, making homeownership more accessible.

What are the benefits of the Downpayment Toward Equity Act?

Key benefits include reduced financial barriers for homebuyers, increased equity for families, and potentially lower monthly mortgage payments due to reduced down payment requirements.

Who is eligible for assistance under the Downpayment Toward Equity Act?

Eligibility is primarily for first-time homebuyers who have not owned a home in the past three years, with household income limits typically below 120% of the area median income, and up to 180% in high-cost markets.

What steps should households follow to seek down payment support in Ohio?

Households should investigate available options, gather necessary documents (proof of income, tax returns), collaborate with a knowledgeable lender, and formally submit their application.

What current down payment assistance initiatives are available for first-time homebuyers in Ohio?

Current initiatives include YourChoice!, Grant for Grads, and Ohio Heroes, which provide alternative options for families looking to achieve homeownership.

What additional requirement might applicants need to fulfill to qualify for the Downpayment Toward Equity Act?

Applicants may need to complete a HUD-approved homebuyer education course, which typically takes 90 minutes or less, to ensure they understand homeownership responsibilities.

How can partnering with F5 Financing help prospective homebuyers?

Partnering with F5 Financing provides invaluable support in navigating the down payment assistance process, helping families understand eligibility criteria and access available financial support effectively.