Overview

No appraisal HELOCs offer families a fast and cost-effective way to access home equity, alleviating the stress often associated with traditional appraisals. We understand how challenging financial situations can be, and this option allows for quicker fund access—often within days—while eliminating appraisal fees. For homeowners needing immediate financial support, this can be an appealing choice.

However, it’s important to be aware of potential risks, such as:

- Higher default rates

- Stricter eligibility criteria

We’re here to support you every step of the way as you navigate these options.

Introduction

No appraisal HELOCs are transforming the landscape of home financing, providing families with a streamlined way to access their home equity without the hassle of traditional appraisals. We know how challenging this can be, and these innovative financial solutions promise not only speed and convenience but also the potential for significant savings. This makes them an attractive option for homeowners looking to upgrade or renovate their living spaces.

However, as enticing as these benefits may be, they raise important questions about the risks and limitations involved. How can families navigate this new terrain while ensuring they make informed financial decisions? We’re here to support you every step of the way, empowering you to explore your options with confidence.

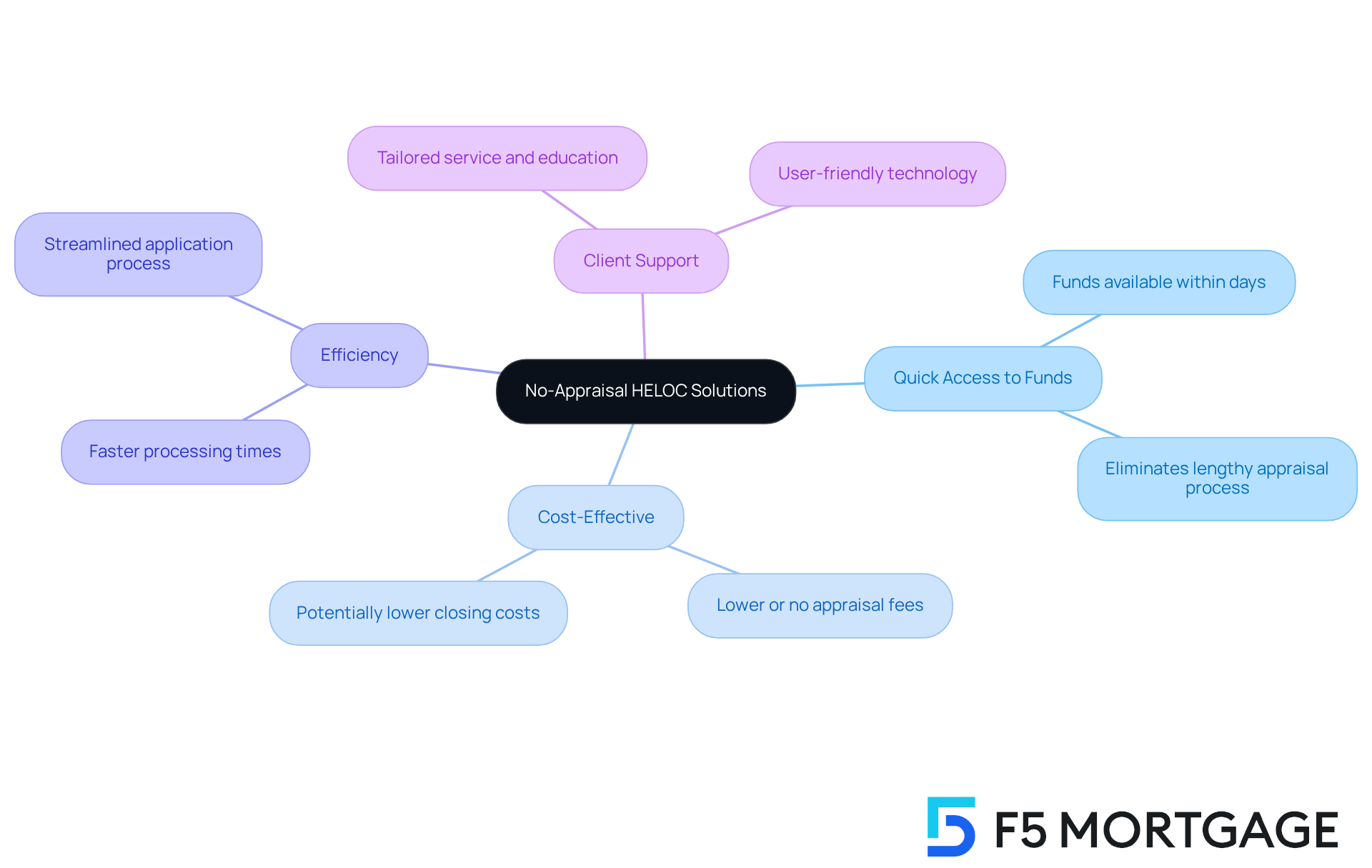

F5 Mortgage: Your Partner for No-Appraisal HELOC Solutions

At F5 Mortgage LLC, we understand how overwhelming the can be. As a leading independent mortgage brokerage, we focus on options for , making it easier for they need. In 2025, a growing number of mortgage brokers are following this trend by providing to prioritize efficiency and accessibility for homeowners like you.

Imagine being able to access funds quickly—often within days—through a no appraisal HELOC, eliminating the that can take one to two weeks. This expedited approach not only saves valuable time but also reduces costs, offering an attractive option for families in need of . We know how challenging this can be, and we’re here to support you every step of the way.

Moreover, our commitment to your satisfaction means you can navigate your financing options with confidence and ease. By leveraging and a client-focused strategy, F5 Mortgage empowers you to make informed decisions about your property value. We strive to be your trustworthy ally in realizing your through a no appraisal HELOC, avoiding the complications of traditional appraisals.

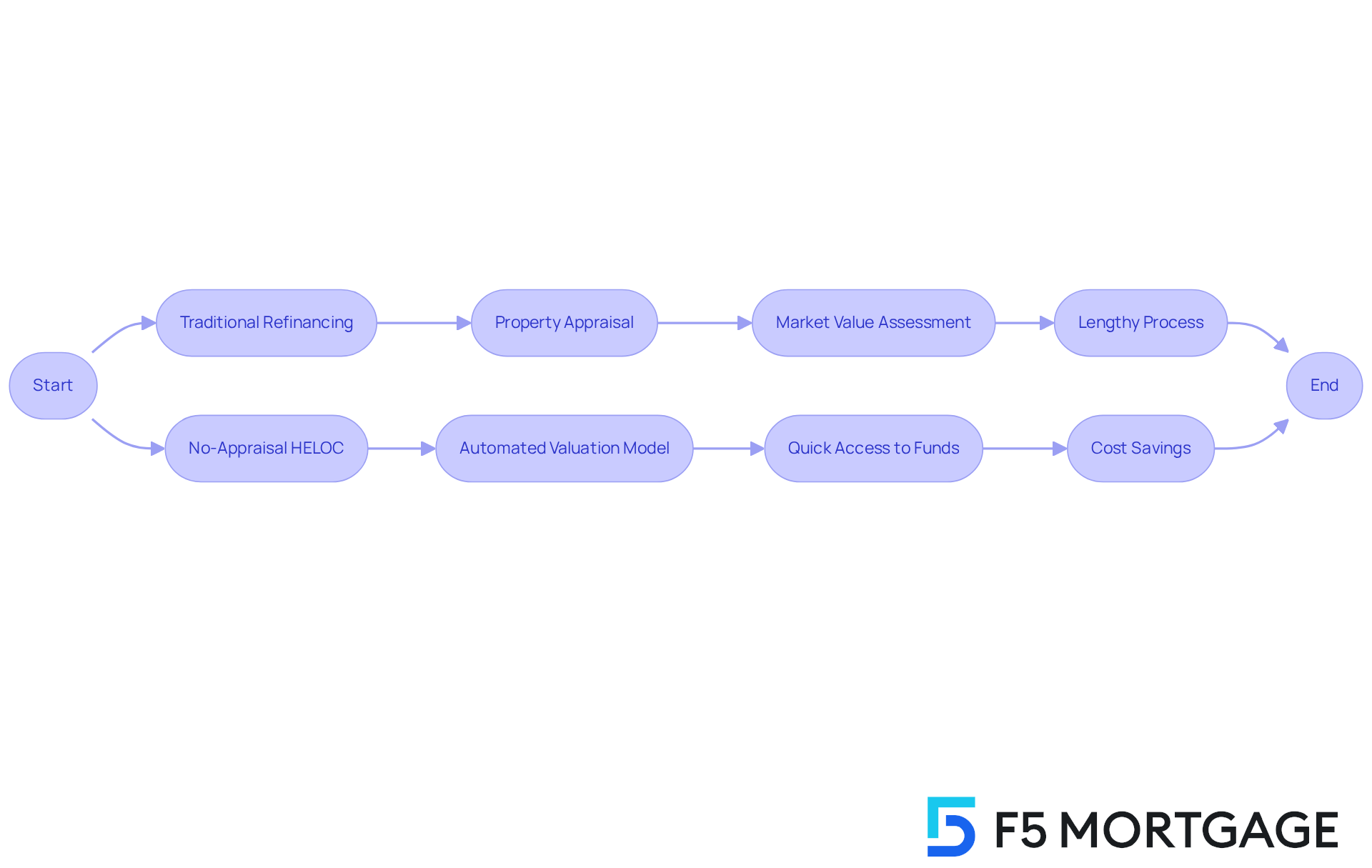

Understanding No-Appraisal HELOCs: What They Are and How They Work

allows homeowners to tap into their home’s worth without the stress of a formal assessment. We understand how challenging it can be to navigate , and this streamlined process is designed to alleviate some of that burden. Instead of relying on traditional property evaluations, lenders can use (AVMs) or current asset calculations. This not only saves time but also reduces costs, making it an appealing option for families who need quick access to funds.

Understanding the is essential for effectively . While to determine the current market value of your property, no appraisal HELOC simplifies this process. By utilizing , homeowners can maximize the benefits of refinancing, especially in an environment of declining mortgage rates. We’re here to support you every step of the way as you explore your options.

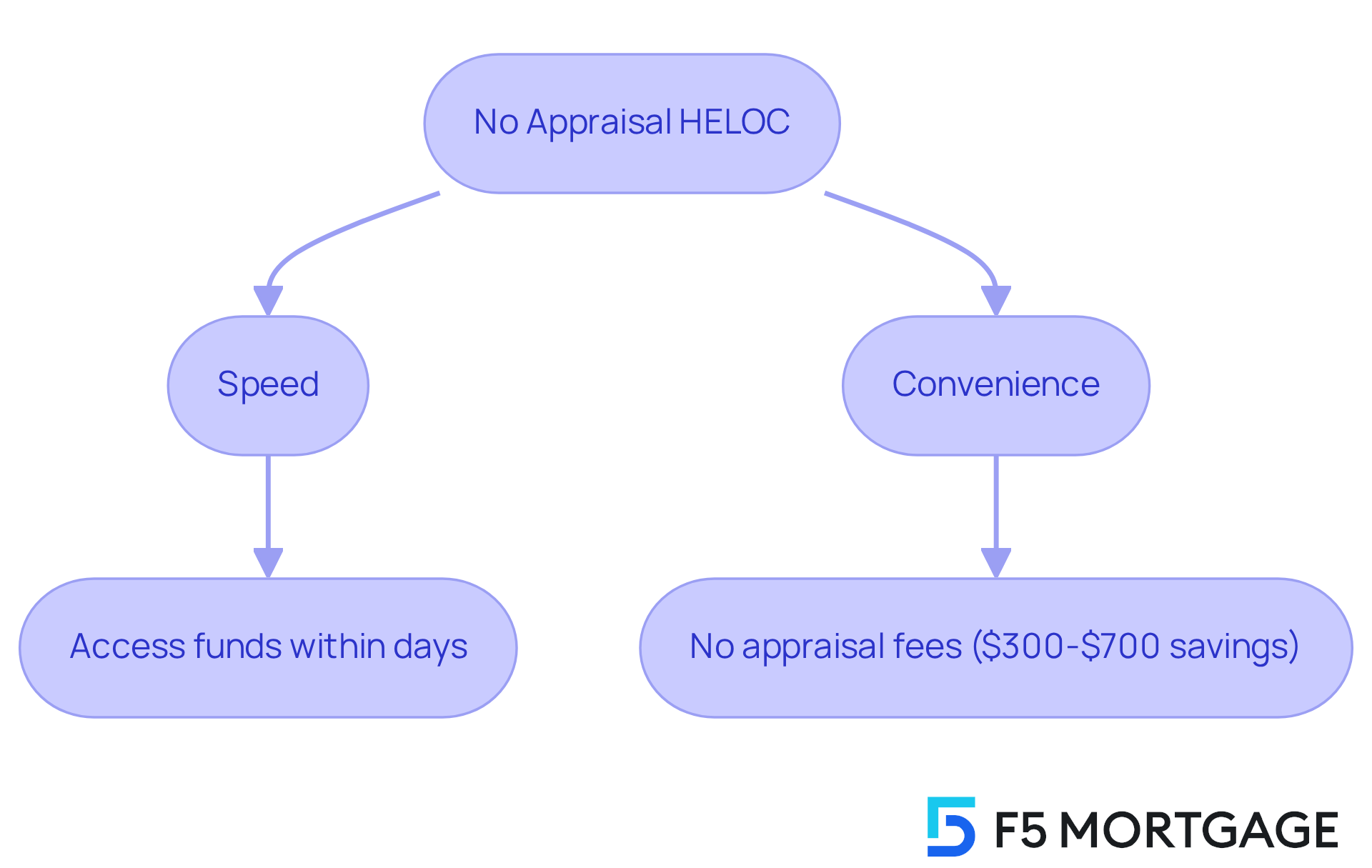

Benefits of No-Appraisal HELOCs: Speed and Convenience

s offer significant advantages, particularly in terms of . By removing the lengthy appraisal process, families can often secure approval and access funds within just a few days. This quick turnaround is particularly beneficial for those looking to , consolidate debt, or address unexpected expenses.

Moreover, with the no appraisal HELOC, the absence of —typically ranging from $300 to $700—means more savings, allowing families to allocate their resources more effectively. We know how challenging can be, and financial specialists emphasize that these loans not only simplify the borrowing process but also reduce the often associated with traditional equity loans.

For instance, families have successfully used appraisal-free to swiftly finance renovations, enhancing their living spaces without the delays that often come with traditional funding methods. This combination of speed and cost-effectiveness makes no appraisal HELOC an appealing choice for families looking to improve their homes. We’re here to as you .

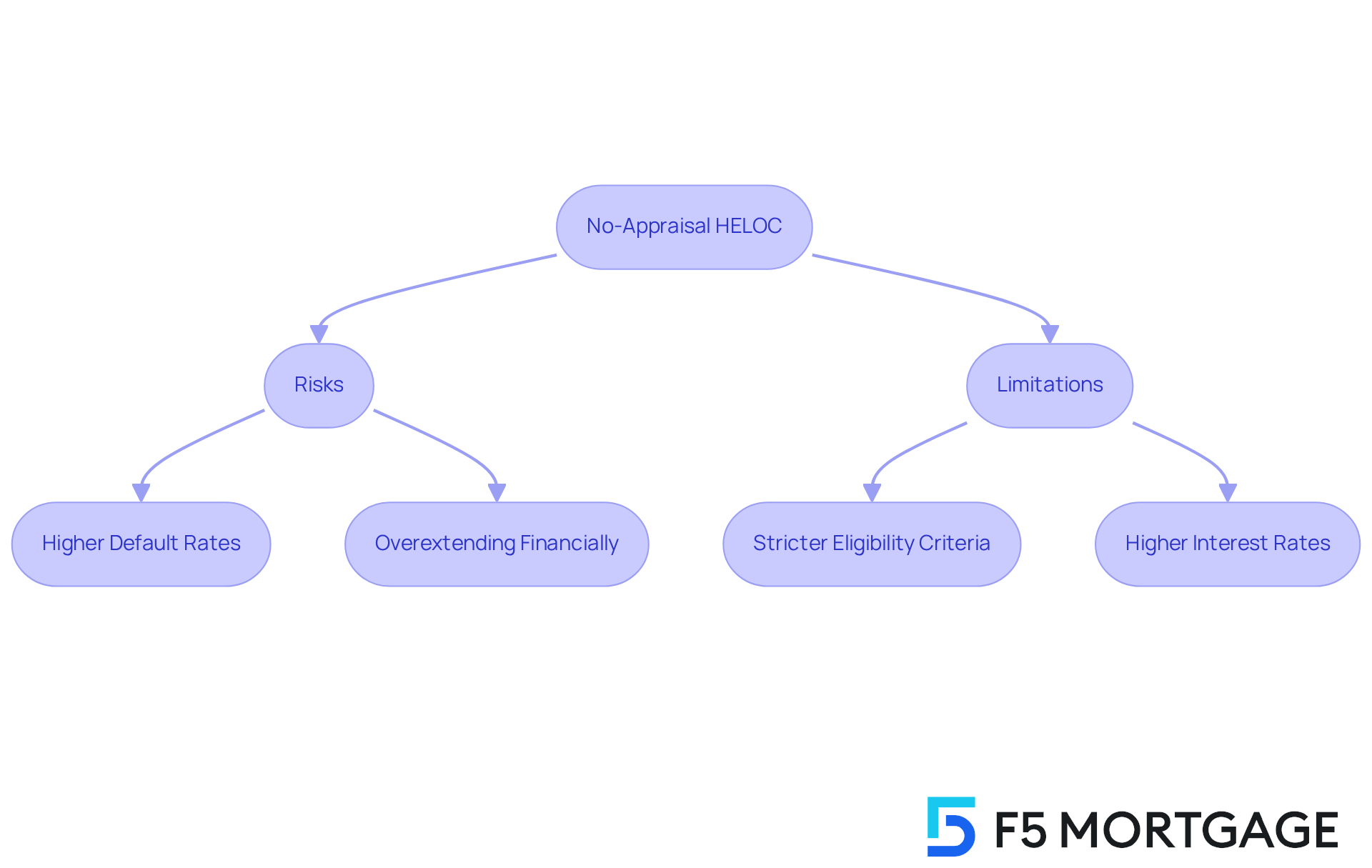

Drawbacks of No-Appraisal HELOCs: Risks and Limitations

can offer some , but it also comes with risks and limitations that you should carefully consider. One major concern is the lack of a formal appraisal, which can cloud the true market value of your home. This uncertainty might lead you to access more equity than you can realistically repay, increasing the risk of default. In fact, data shows that borrowers using [no appraisal HELOC](https://debt.org/blog/helocs-on-the-rise-be-careful) may face due to this lack of clarity.

Additionally, lenders often set or higher interest rates for options that don’t require an appraisal, which can complicate affordability. For instance, while a credit score of around 620 may qualify you for a HELOC, those opting for appraisal-free products might encounter extra hurdles that could limit your .

We understand how challenging this can be, and frequently caution against relying solely on HELOCs without fully grasping the . It’s crucial to have a well-defined plan for borrowing, especially with and the potential for market fluctuations. As you explore these options, approach them with caution and ensure you don’t overextend yourself financially, particularly in today’s unpredictable economic landscape. We’re here to support you every step of the way.

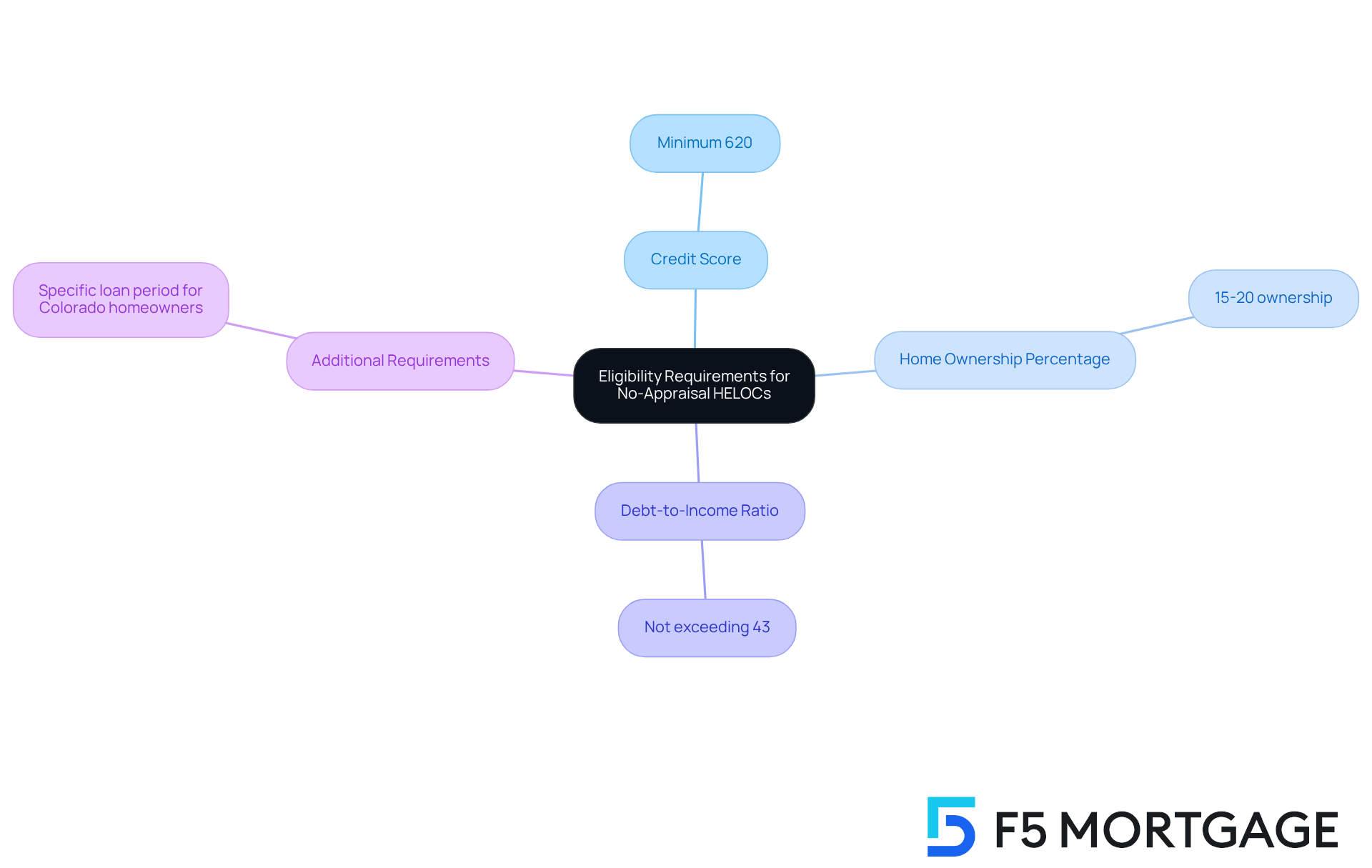

Eligibility Requirements for No-Appraisal HELOCs: What You Need to Qualify

Navigating the world of (HELOC) can feel overwhelming, especially when you’re trying to understand the specific requirements involved. We know how challenging this can be, and we’re here to support you every step of the way. To qualify for a , borrowers usually need to meet certain criteria, such as having a , adequate home value, and a stable income.

Most lenders look for a minimum credit score of around 620. However, some may have lower requirements, which can be a relief for many homeowners. Additionally, it’s essential to have at least 15-20% ownership in your property to qualify for this type of financing.

Another important factor is your , which should not exceed 43% to ensure approval. For homeowners in Colorado, it’s also necessary to hold your existing loan for a specific period before refinancing, as this can impact your eligibility. By meeting these requirements, you can significantly enhance your chances of approval, especially if you’re considering . Remember, taking these steps can open doors to for you and your family.

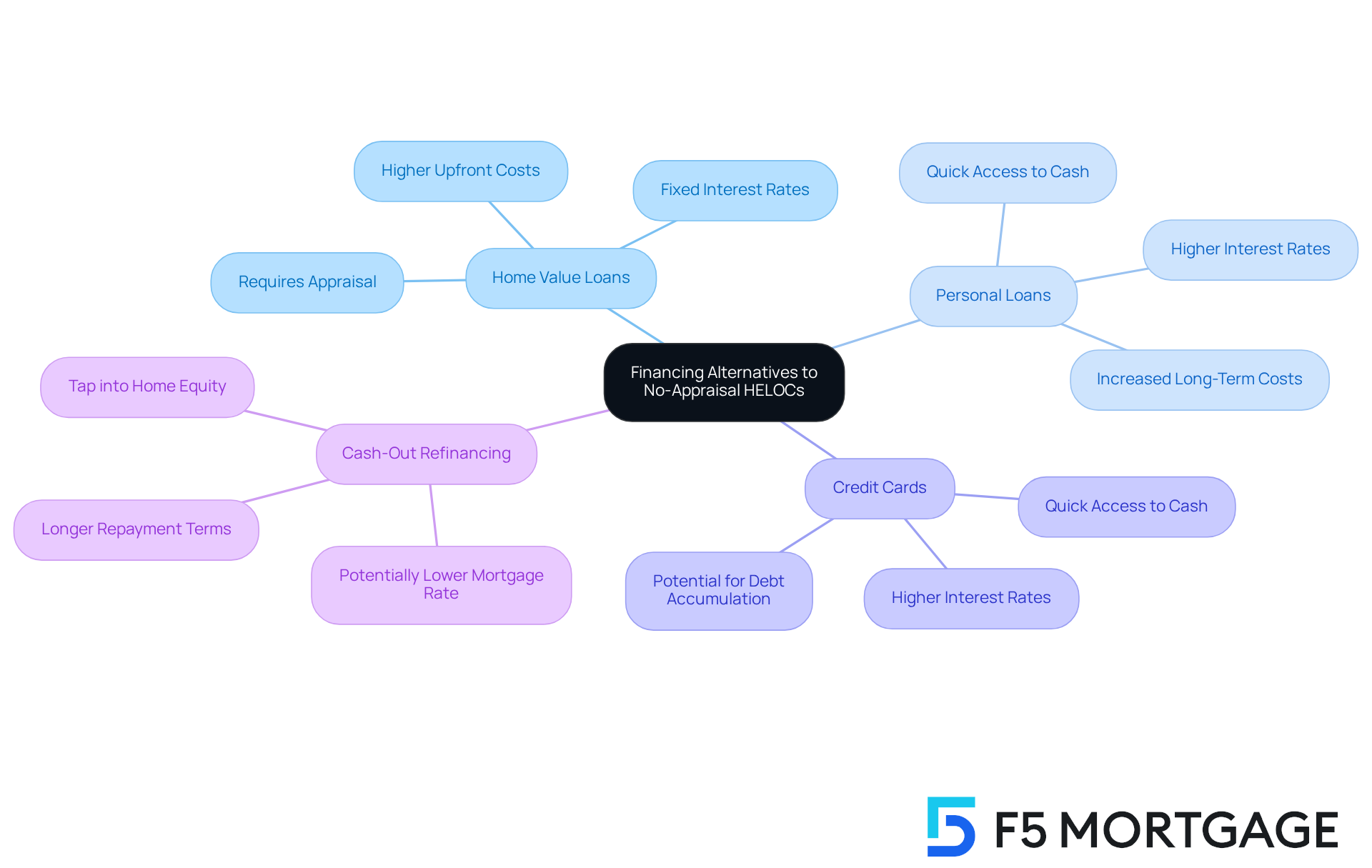

Alternatives to No-Appraisal HELOCs: Exploring Other Financing Options

Families navigating financing options often encounter various alternatives to . For example, can provide a lump sum based on your home’s value, but they typically require a complete appraisal. While these loans often come with —making budgeting a bit easier—they may involve higher upfront costs.

Personal loans and credit cards offer quick access to cash, yet they usually carry higher interest rates, which can lead to increased long-term costs. presents another possibility, allowing homeowners to while potentially securing a lower mortgage rate. This option can be particularly beneficial if are favorable.

Each of these options has its . We know how challenging it can be to make these decisions. It’s essential for families to carefully assess their and before making a choice. Remember, we’re here to .

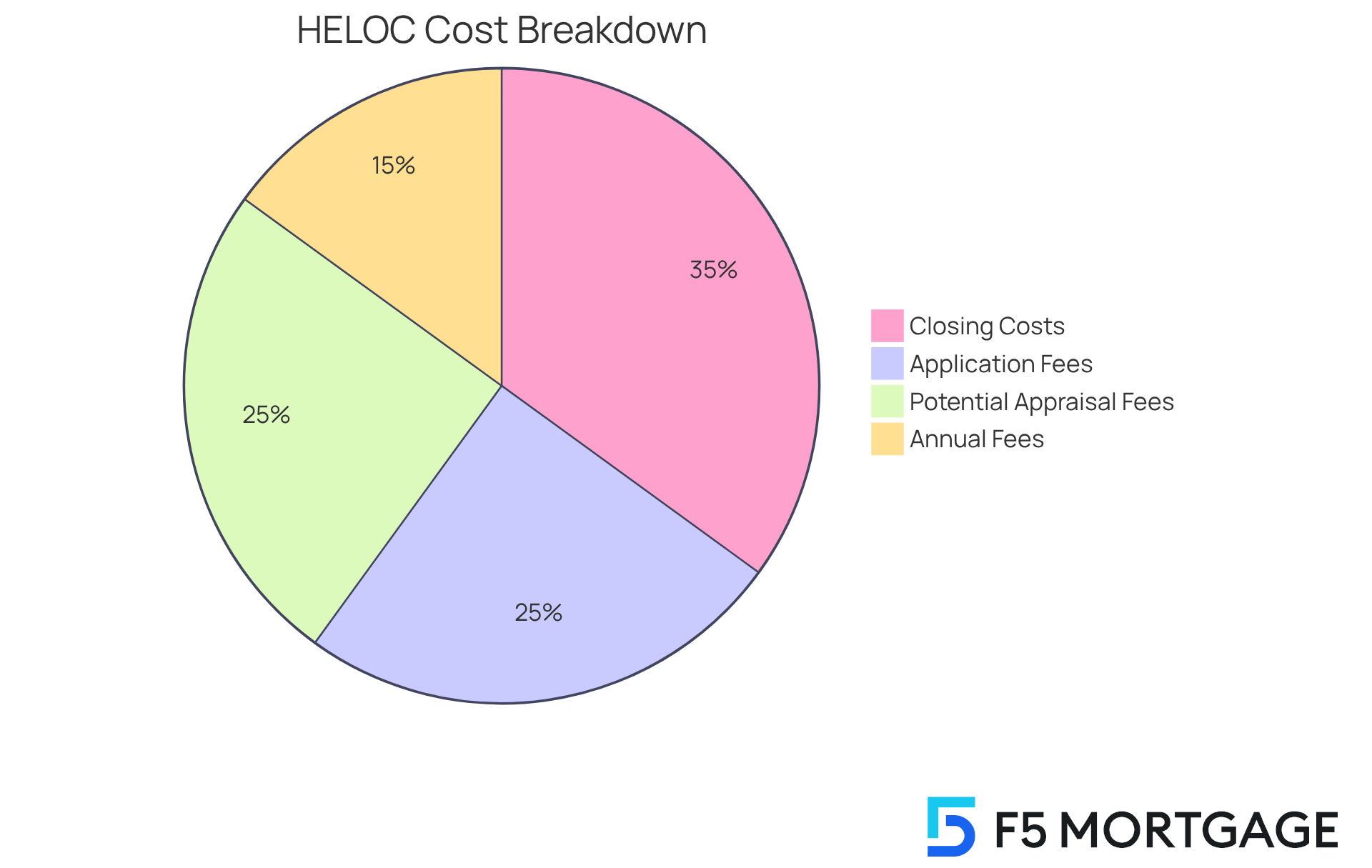

Cost Considerations for No-Appraisal HELOCs: Fees and Interest Rates

When considering , it’s important to recognize the various expenses involved. We understand how overwhelming this can be. While many lenders may , other costs, such as , may still apply. Interest rates for no appraisal heloc typically range from 4.99% to 12.49%. These rates can be influenced by factors like the lender’s policies and your credit profile.

As of 2025, the has recently dropped to 8.10%, reflecting broader market trends and Federal Reserve policies. It’s crucial for you to from multiple lenders. For instance, is known for its , making it a great option to consider. By doing so, you can secure the most favorable terms for your situation.

on fees by choosing a no appraisal heloc, which eliminates appraisal costs that usually range from $300 to $700. We know how important it is to evaluate proposals carefully. By comparing offers, you can find the and minimize your total costs. Remember, while appraisals play a significant role in establishing property value and assets for mortgage rates, there are ways to navigate this process effectively. We’re here to support you every step of the way.

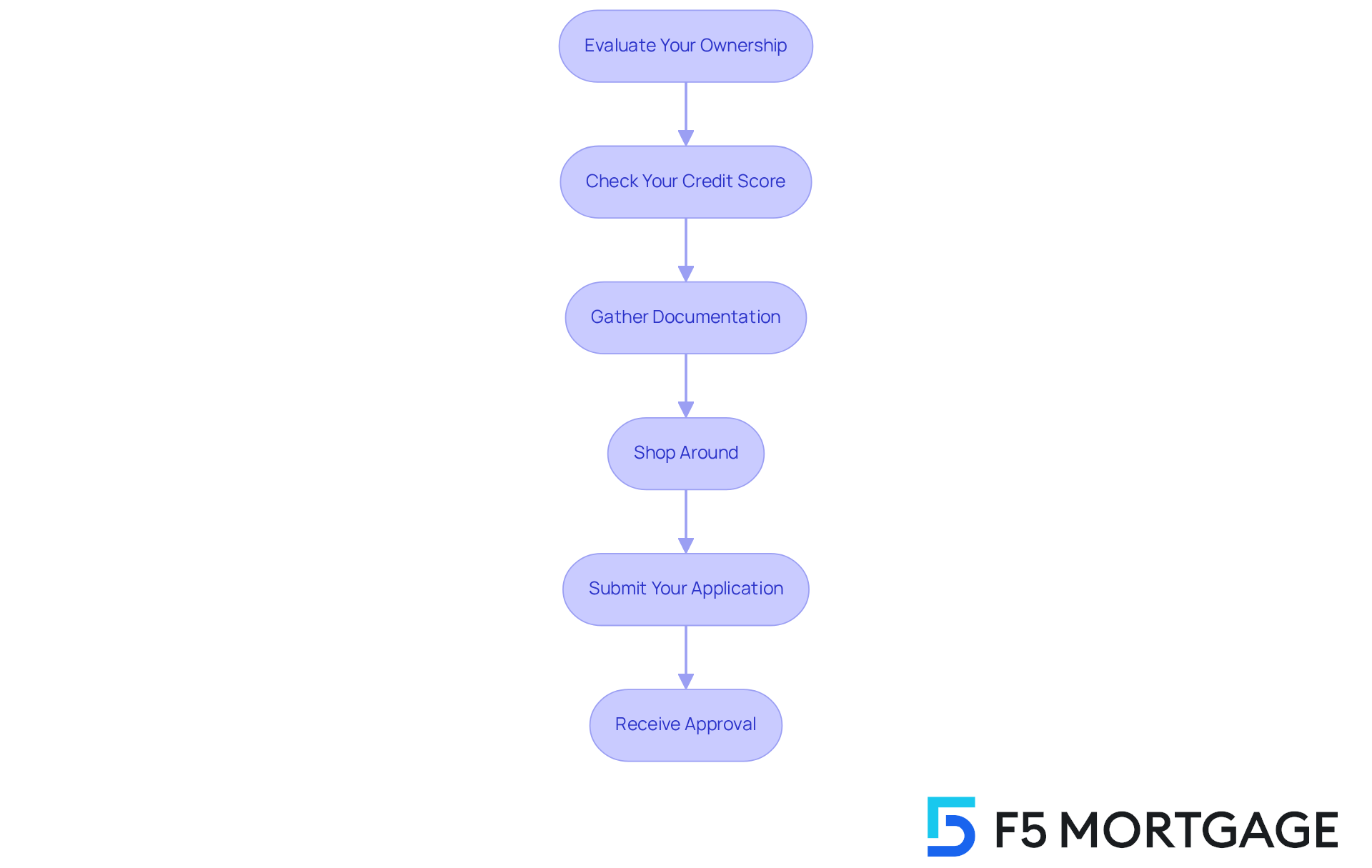

How to Apply for a No-Appraisal HELOC: Step-by-Step Guide

Applying for a can feel overwhelming, but it doesn’t need to be. By following these straightforward steps, you can simplify the process and feel more confident about your financial decisions.

- Evaluate Your Ownership: Start by understanding how much ownership you have in your property. This is crucial because it directly impacts your borrowing ability. Many lenders require homeowners to maintain a . This means you should have paid down at least 20% of your initial loan amount or your property needs to have . Remember, may have even higher equity requirements.

- Check Your Credit Score: We know how important your . Ensure it meets the lender’s requirements, which typically hover around 680 or higher for favorable terms.

- Gather Documentation: Prepare the necessary documents, such as proof of income, details of your existing mortgage, and any recent property improvements that may enhance your home’s value. Being organized can make this step much easier.

- Shop Around: Don’t hesitate to . This is your opportunity to find the best terms and interest rates. As a reference, the national average HELOC rate is approximately 8.12%. Consider reaching out to F5 Mortgage for that can cater to your unique situation.

- Submit Your Application: Once you’ve chosen a lender, complete the application process, ensuring all required information is accurate and complete. Typically, a maximum of a 43% is needed for property loans, which can lead to more competitive mortgage rates.

- Receive Approval: If you receive approval, take the time to carefully review the terms and conditions before accessing your funds. Approval durations for can be significantly quicker with no appraisal heloc than conventional methods, often taking just five days.

By following these steps, you can efficiently navigate the no appraisal heloc application process and access the funds you need for . Remember, we’re here to support you every step of the way.

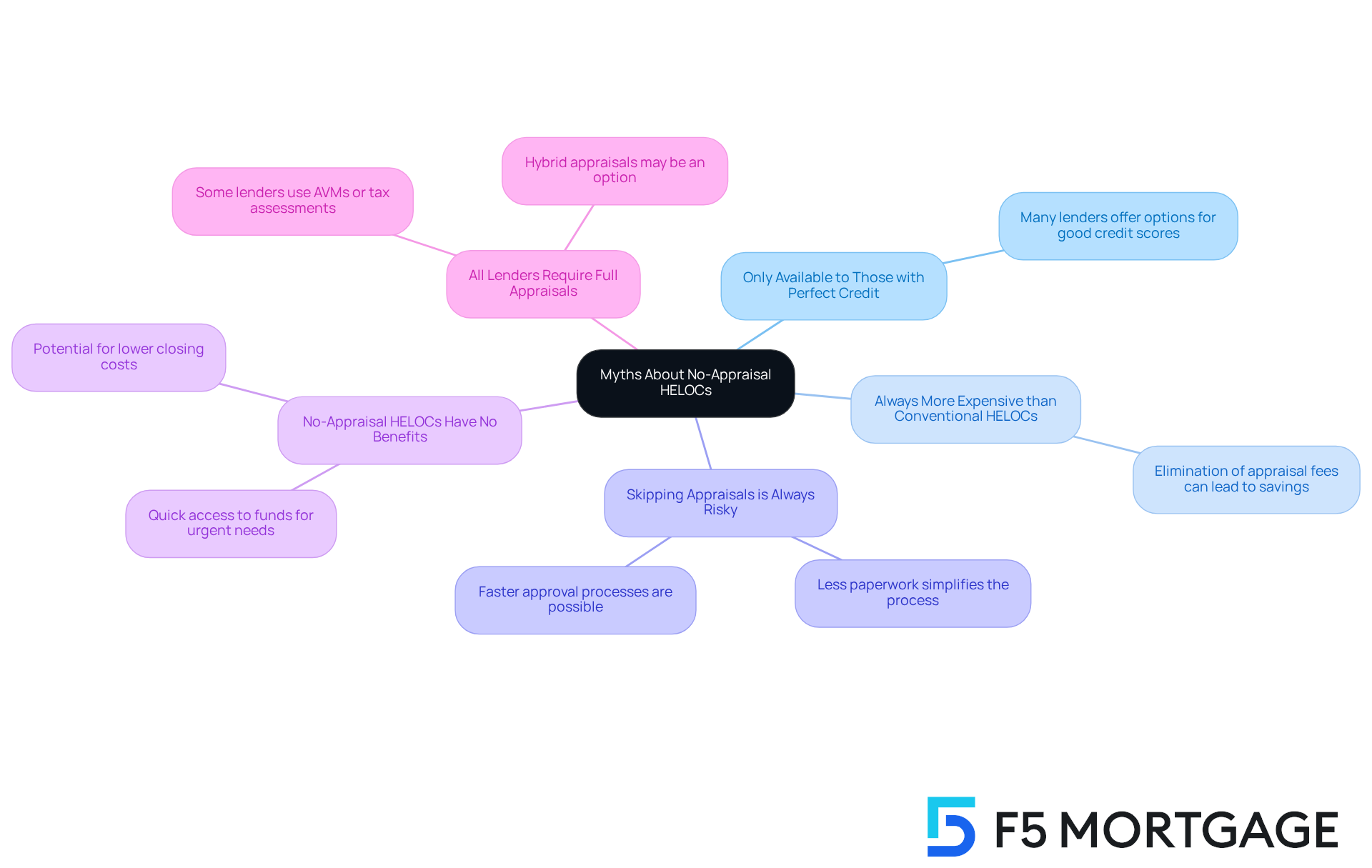

Myths About No-Appraisal HELOCs: Debunking Common Misunderstandings

Many myths surround , which often leads to confusion for prospective borrowers. We understand how challenging this can be. A common misconception is that these loans are only available to those with . In reality, many lenders offer options for borrowers with good credit scores, significantly broadening access for .

Another widely held belief is that no appraisal heloc are always more expensive than conventional . However, the elimination of appraisal fees can lead to . For instance, many borrowers who once thought they needed perfect credit have successfully obtained a no appraisal heloc. This shows that can empower families to manage their financing choices more effectively.

By debunking these myths, homeowners can that align with their financial goals. We’re here to support you every step of the way in .

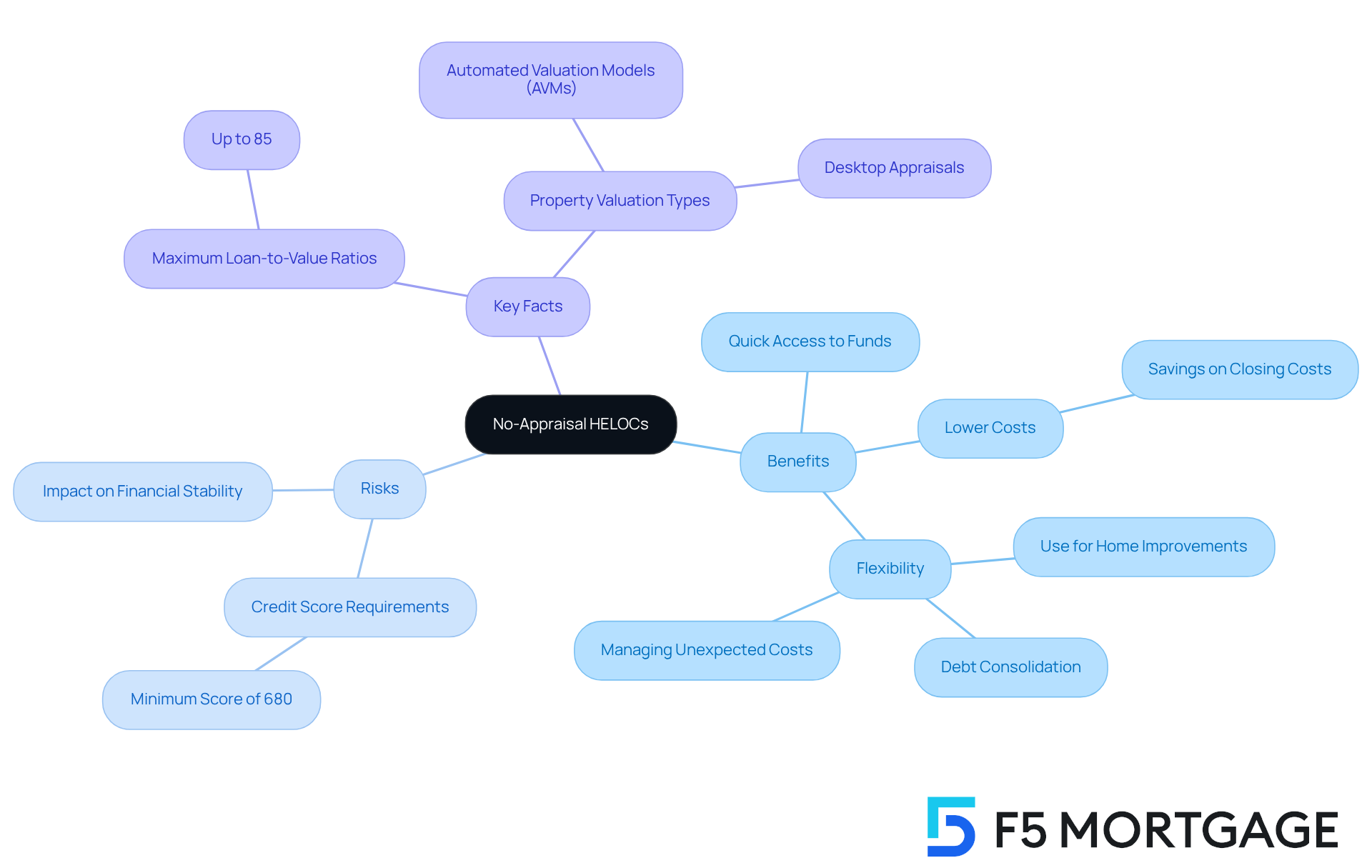

Key Takeaways on No-Appraisal HELOCs: Essential Facts You Should Know

offers a streamlined solution for without the delays associated with traditional appraisals. These loans allow property owners to —often within days—making them an attractive option for those who need immediate cash for renovations or other expenses. For instance, many families have successfully used a no appraisal heloc to:

- Fund

- Consolidate debt

- Manage unexpected costs

This showcases the flexibility these loans offer.

However, while the speed and reduced costs are significant benefits, it’s important for borrowers to stay alert to potential risks. A solid credit score, generally around 680 or higher, is often required to qualify for these loans. Moreover, is vital, as it can impact long-term financial stability.

Before applying for a no appraisal heloc, families should familiarize themselves with key facts, such as:

- The that can reach up to 85%

- The that lenders may accept, including Automated Valuation Models (AVMs)

Research indicates that many borrowers are unaware of the , which highlights the need for education to make informed decisions. For example, opting for a HELOC without an appraisal can save families $300 to $400 in closing costs compared to traditional loans that require an appraisal.

In summary, no appraisal heloc offers a range of benefits, including quicker access to funds and , but it also comes with risks that families need to consider. By thoroughly exploring these options and , families can confidently navigate their choices for enhancing their homes. We know how challenging this process can be, and we’re here to support you every step of the way.

Conclusion

No appraisal HELOCs offer a wonderful opportunity for families eager to tap into their home equity without the hassle of traditional appraisals. This streamlined approach enables homeowners to access funds quickly, often within days. It’s an appealing option for those looking to finance home improvements or manage unexpected expenses. By removing appraisal fees and minimizing the time needed to access funds, families can effectively address their financial needs while steering clear of the complexities associated with conventional equity loans.

Throughout this discussion, we highlight both the benefits and potential drawbacks of no appraisal HELOCs. Families can enjoy significant advantages, such as quicker access to funds and lower overall costs. However, it’s essential to remain aware of the risks involved in borrowing against home equity. Understanding eligibility requirements and the implications of these loans is crucial for making informed financial decisions. Additionally, exploring alternatives and weighing the pros and cons can empower families to choose the best option for their unique circumstances.

Ultimately, the true value of no appraisal HELOCs lies in their ability to provide swift financial solutions for families looking to enhance their homes or navigate financial challenges. As homeowners consider this financing option, it’s vital to stay informed and consult with trusted mortgage professionals. By doing so, families can ensure they make choices that align with their long-term financial goals. We know how challenging this can be, and we’re here to support you every step of the way. Confidently harness the benefits of no appraisal HELOCs while mitigating potential risks, paving the way for a more secure financial future.

Frequently Asked Questions

What is a no-appraisal HELOC?

A no-appraisal HELOC (Home Equity Line of Credit) allows homeowners to access funds based on their home’s worth without undergoing a formal property assessment. This process typically utilizes automated valuation models or current asset calculations instead of traditional appraisals.

How does F5 Mortgage support homeowners seeking no-appraisal HELOCs?

F5 Mortgage LLC focuses on providing no appraisal HELOC options, making it easier for families to access funds quickly—often within days—while eliminating the lengthy appraisal process. They utilize cutting-edge technology and a client-focused strategy to help homeowners navigate their financing options confidently.

What are the benefits of a no-appraisal HELOC?

The main benefits of a no-appraisal HELOC include a faster approval process—often within a few days—lower costs due to the absence of appraisal fees (which can range from $300 to $700), and the ability to quickly access funds for purposes like home renovations, debt consolidation, or unexpected expenses.

How does the no-appraisal HELOC process differ from traditional refinancing?

Traditional refinancing typically requires a formal appraisal to determine the current market value of a property, which can take time. In contrast, a no-appraisal HELOC simplifies this process by using existing equity calculations, allowing homeowners to access their assets more efficiently, especially in a declining mortgage rate environment.

Who can benefit from a no-appraisal HELOC?

Families looking for quick access to funds for renovations, debt consolidation, or to address unexpected expenses can benefit significantly from a no-appraisal HELOC. The streamlined process and cost savings make it an attractive option for those needing immediate financial relief.