Overview

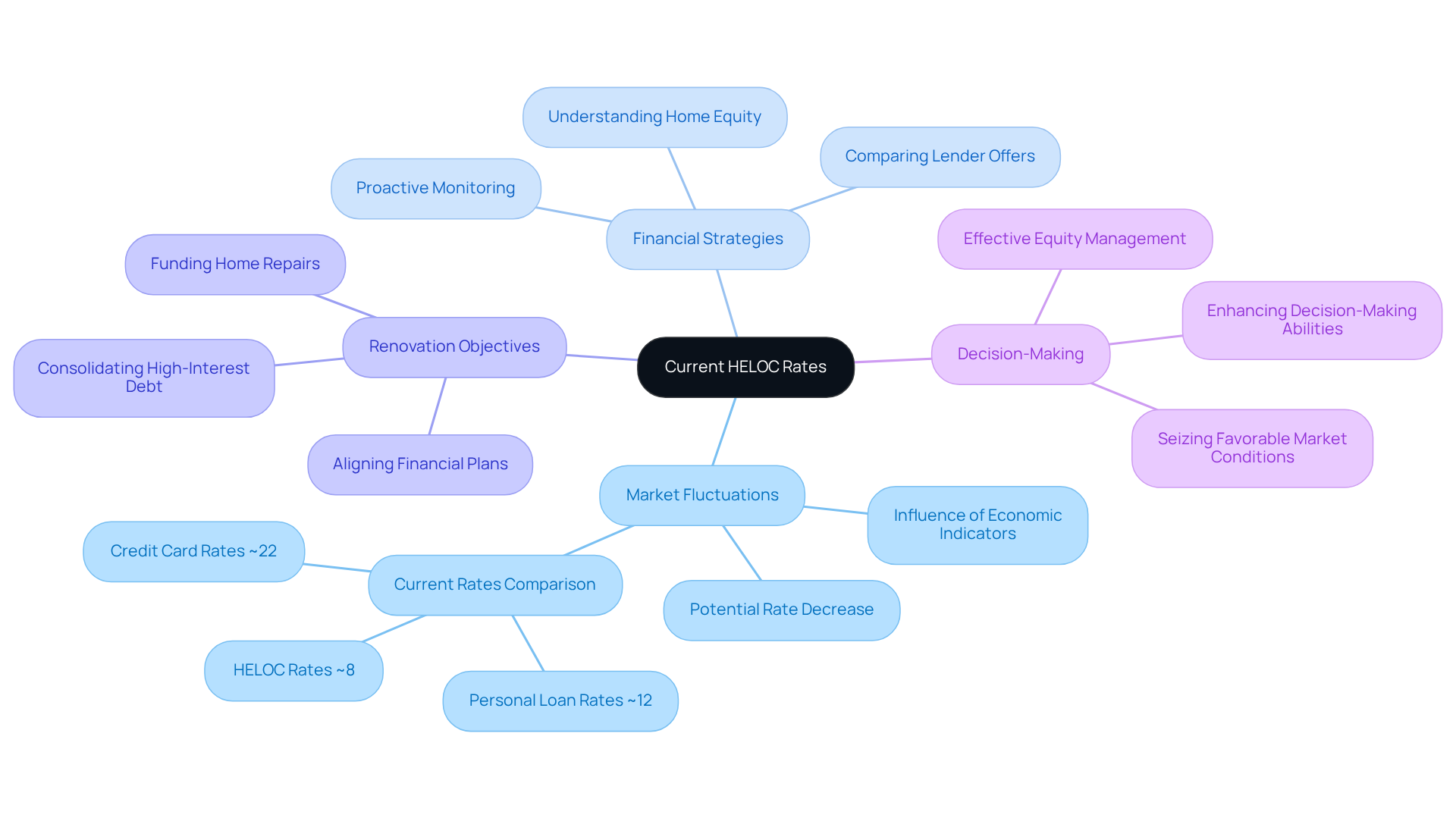

The article titled “7 Key Insights on HELOC Rates Today for Home Improvement” offers valuable insights into the current trends and strategies surrounding Home Equity Line of Credit (HELOC) rates. We understand how challenging it can be for homeowners to navigate financing options for renovation projects. This article highlights essential steps that can empower you, such as:

- Understanding current HELOC rates

- Improving your credit scores

- Utilizing comparison tools

By following these steps, you can secure favorable financing options to enhance your property. Insights from industry experts and data on market trends support these recommendations, ensuring you feel informed and confident as you embark on your home improvement journey.

Introduction

Navigating the world of Home Equity Lines of Credit (HELOCs) can feel overwhelming. We understand how challenging it is, especially with fluctuating rates and a myriad of options available. Homeowners today have a unique opportunity to leverage their property equity for essential renovations. However, understanding the current landscape of HELOC rates is crucial for making informed financial decisions.

With rising interest rates and varying lender offers, how can you effectively secure the best terms for your home improvement projects? This article delves into seven key insights on HELOC rates. We’re here to support you every step of the way, equipping you with the knowledge needed to enhance your home while maximizing your financial benefits.

F5 Mortgage: Personalized Consultations for Competitive HELOC Rates

At F5 Mortgage, we understand how challenging it can be to navigate today. Our tailored consultations are designed to help you manage these complexities with ease. By taking the time to understand your , we can recommend customized solutions that align perfectly with your .

This personalized approach not only simplifies your decision-making process but significantly enhances your chances of that meet your specific needs. We know homeowners can improve their prospects for favorable rates by taking actionable steps like:

- Paying down high-rate debt

- Avoiding new credit applications

- Reviewing credit reports for errors

Engaging with a knowledgeable , such as those at F5 Mortgage, who has access to a wide network of lenders, is crucial in this journey. Our clients often share how our dedicated team provides , ensuring a smooth and stress-free experience.

This strategic partnership is especially important now, as many property owners believe their real estate equity has increased over the past year, which is reflected in the HELOC rates today. This trend suggests a growing interest in . With and , you can feel confident as you take steps toward enhancing your property. We’re here to support you every step of the way.

LendingTree: Compare Current HELOC Rates from Multiple Lenders

Homeowners, we understand how important it is to find the right . By comparing offers from various lenders, including F5 Mortgage, you can discover that meet your unique needs. This comparison is essential for recognizing the , ensuring you secure the .

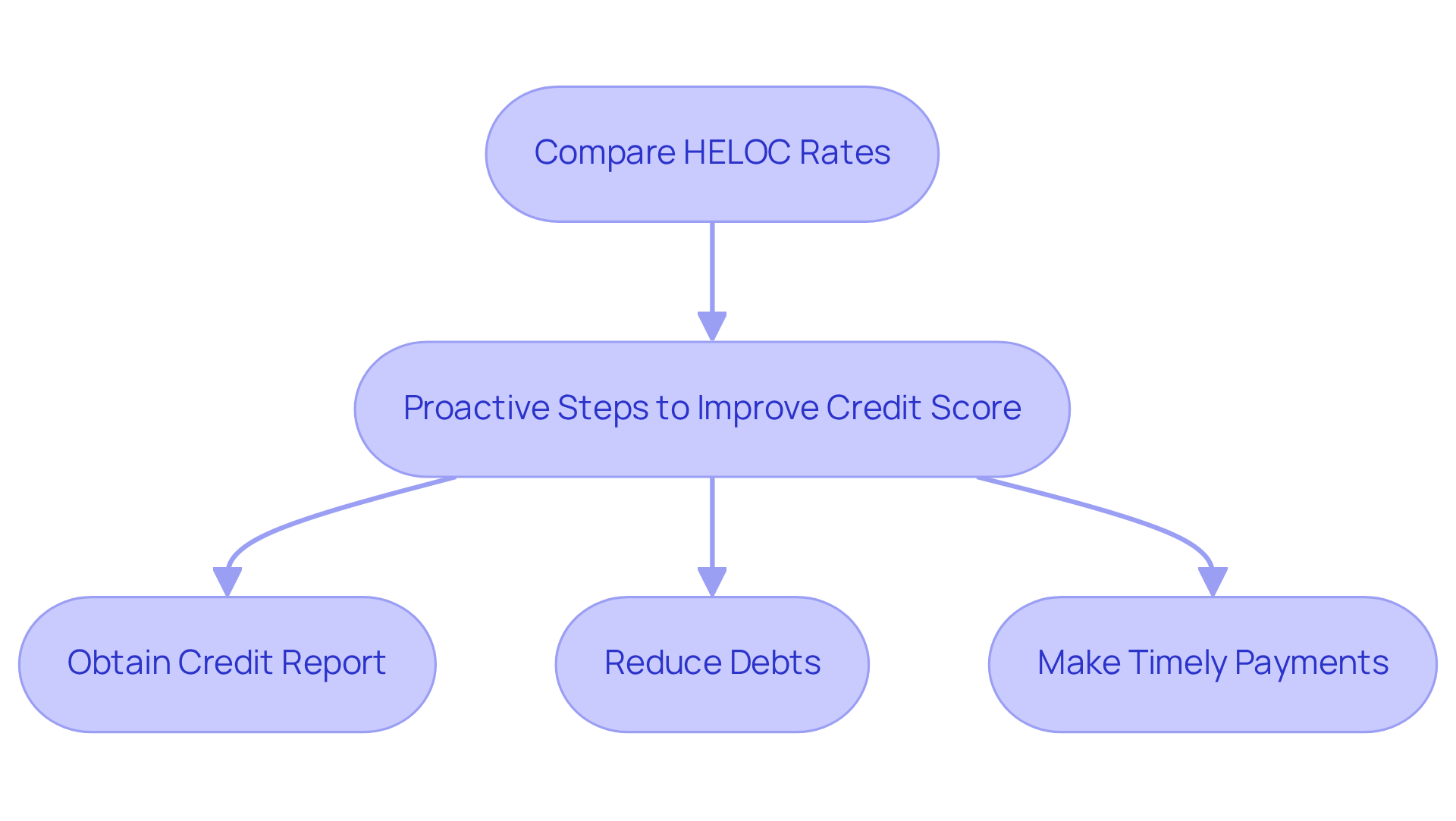

To enhance your chances of qualifying for better home equity line of credit terms, consider taking proactive steps to . Start by:

- Obtaining a copy of your credit report to identify any errors

- Reducing your current debts

- Ensuring that you make timely payments

These actions can significantly improve your financial standing.

, which could affect HELOC rates today. This makes it even more crucial for property owners to compare offers. can help you navigate these options, empowering you to that benefit your family.

Bankrate: Insights on Average HELOC Interest Rates and Best Practices

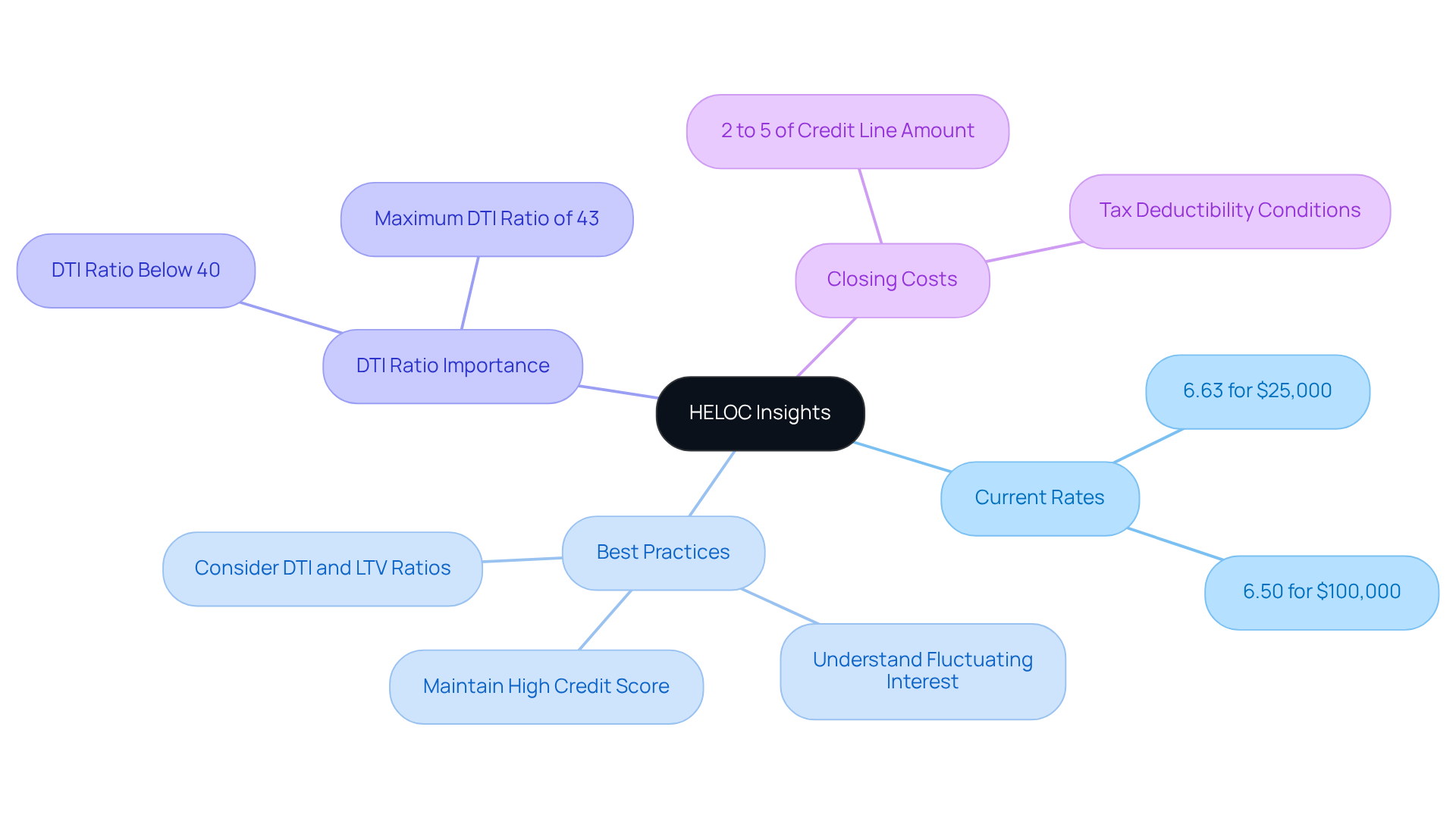

Understanding and the current landscape of home equity line interest levels is vital for homeowners who want to make the most of their home equity. We know how challenging this can be, especially with recent information indicating a . Currently, the heloc rates today are approximately 6.63% for $25,000 and about 6.50% for $100,000. This trend reflects a broader market shift, influenced by anticipated reductions from the Federal Reserve, which may lead to even lower HELOC rates today in the coming months.

To navigate the HELOC application process successfully, homeowners should follow several :

- Maintaining a high credit score is essential, as it directly impacts the terms offered by lenders.

- Understanding the implications of is crucial, as these can change during both the draw and repayment phases, potentially increasing total repayment costs.

Real-life examples illustrate how these best practices can lead to success. Homeowners who actively monitored their credit scores and engaged in pre-application consultations with lenders often secured more favorable terms. In fact, statistics show that borrowers with a below 40% had a significantly higher likelihood of approval, highlighting the importance of being financially prepared. Generally, a maximum DTI ratio of 43% is required for residential loans, which can influence the competitiveness of mortgage costs.

Experts recommend that prospective borrowers also consider the when applying for a . Typically, borrowing 80% or less of a home’s value can lead to lower interest rates. Furthermore, researching lender evaluations and understanding regional availability can enhance the chances of securing a favorable home equity line of credit.

It’s important for property owners to be aware that HELOCs usually incur ranging from 2% to 5% of the credit line amount. Additionally, it’s essential to note that the interest paid on a HELOC is tax-deductible only if the funds are used for property improvements, according to external sources. By staying informed about typical costs and adhering to these best practices, homeowners can position themselves to negotiate better conditions and maximize their home equity.

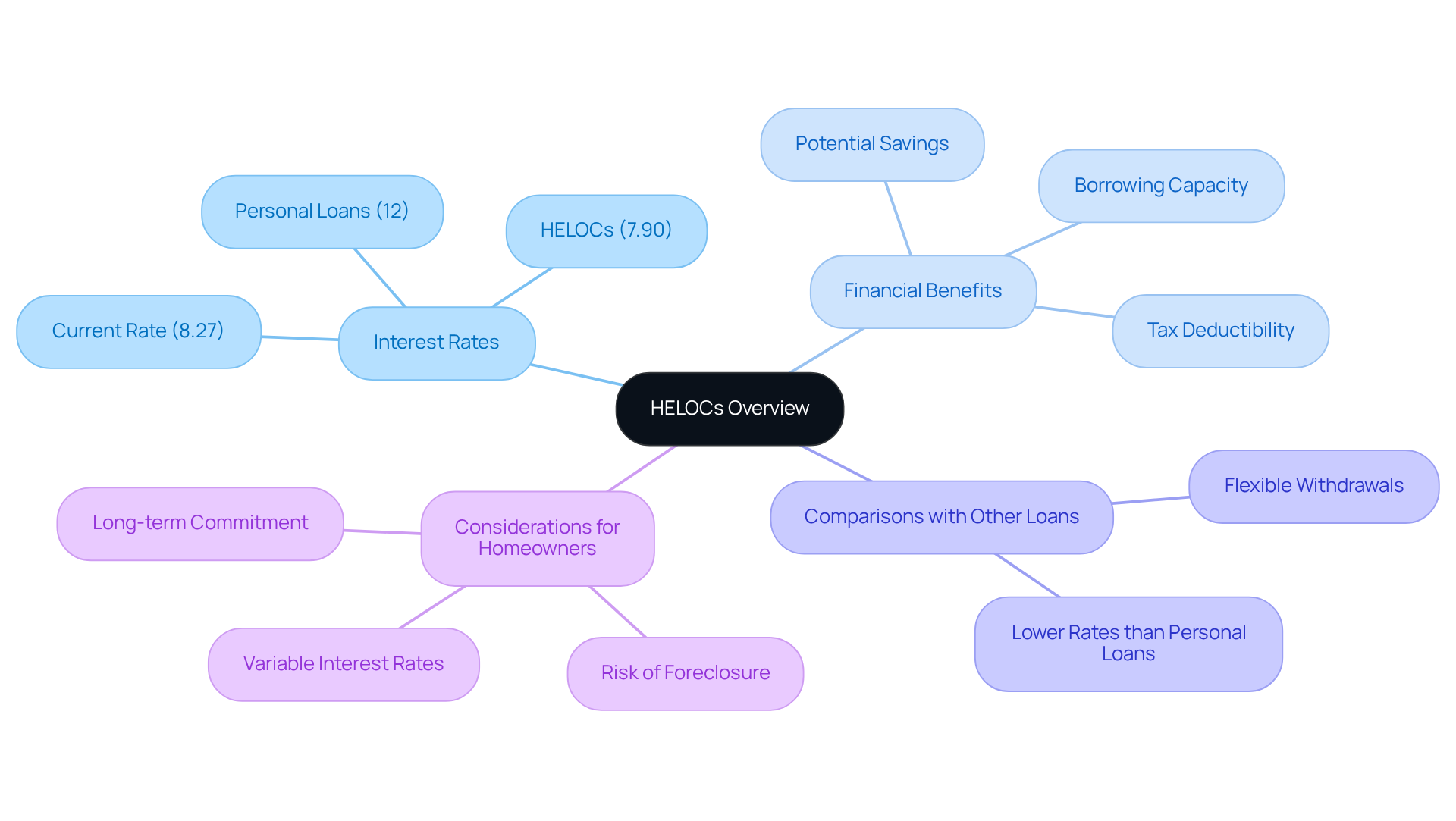

Forbes: Best HELOCs with Low Rates for 2025

In 2025, homeowners looking to enhance their living spaces can find hope in a variety of highly-rated (HELOCs) that offer attractive terms. While the today hover around 8.27%, which is higher than traditional mortgage rates, they remain lower than personal loans and credit cards. This makes HELOCs a compelling choice for those wanting to tap into their property equity for renovations or significant expenses.

Financial analysts emphasize the importance of these , noting that they can lead to . For instance, property owners who choose a line of credit with a 7.90% APR instead of a personal loan at 12% could save thousands in interest fees, especially if they use the funds for renovations that boost property value.

The financial benefits of selecting are evident in case studies where homeowners have successfully financed renovations, resulting in increased equity and improved living spaces. With the right line of credit, homeowners can , minus the existing mortgage balance, allowing for significant borrowing capacity.

As the market evolves, we encourage homeowners to explore various HELOC alternatives, comparing prices and terms to find the most suitable option for their financial situation. By doing so, they can maximize their savings and achieve their renovation goals efficiently. Additionally, understanding (ARMs) can offer further financing options. ARMs typically feature lower introductory rates that adjust based on market conditions, usually every six months, with interest adjustment caps that protect borrowers from sharp rate increases. This makes ARMs a viable alternative for those planning to refinance or pay off their mortgage quickly.

It’s also important to note that interest paid on a may be tax-deductible if used for home improvements, adding another layer of financial benefit. The typical repayment period for home equity lines of credit ranges from 10 to 20 years, which is essential for understanding the long-term commitment involved in securing such a loan. As prices begin to decrease this year, make variable-interest products like HELOCs increasingly appealing, as noted by Matthew Sanford, administrative vice president of mortgage lending. Homeowners should thoughtfully consider their options and consult with a to determine the best strategy for their needs.

Desjardins: Versatile Line of Credit with Competitive Rates

At Desjardins, we understand how important it is for property owners to have the when it comes to funding renovations or enhancements. Our line of credit offers attractive terms at that can truly make a difference in your improvement journey. With our , you can access funds as needed, which is especially helpful for ongoing projects that require attention.

By choosing Desjardins, you can benefit from HELOC rates today while maintaining . This empowers you to plan strategically for your . We know how challenging this can be, and our adaptable approach not only supports urgent renovation requirements but also helps you .

This way, you can , free from the pressure of rigid repayment plans. We’re here to support you every step of the way, ensuring that your are within reach.

Huntington Bank: Comprehensive Guide to Home Equity Lines of Credit

A comprehensive guide to is essential for property owners seeking to utilize their asset’s equity for enhancements. We understand how challenging this can be, and such resources break down the , covering everything from the to repayment strategies. Clients who utilized detailed guides reported feeling more empowered and informed throughout their journey, leading to more confident decision-making.

Understanding the nuances of HELOCs is crucial. One expert notes that ‘ is available to those who learn about it and work for it,’ highlighting the value of education in navigating . By following structured guides, the , ensuring they make informed choices that align with their financial goals.

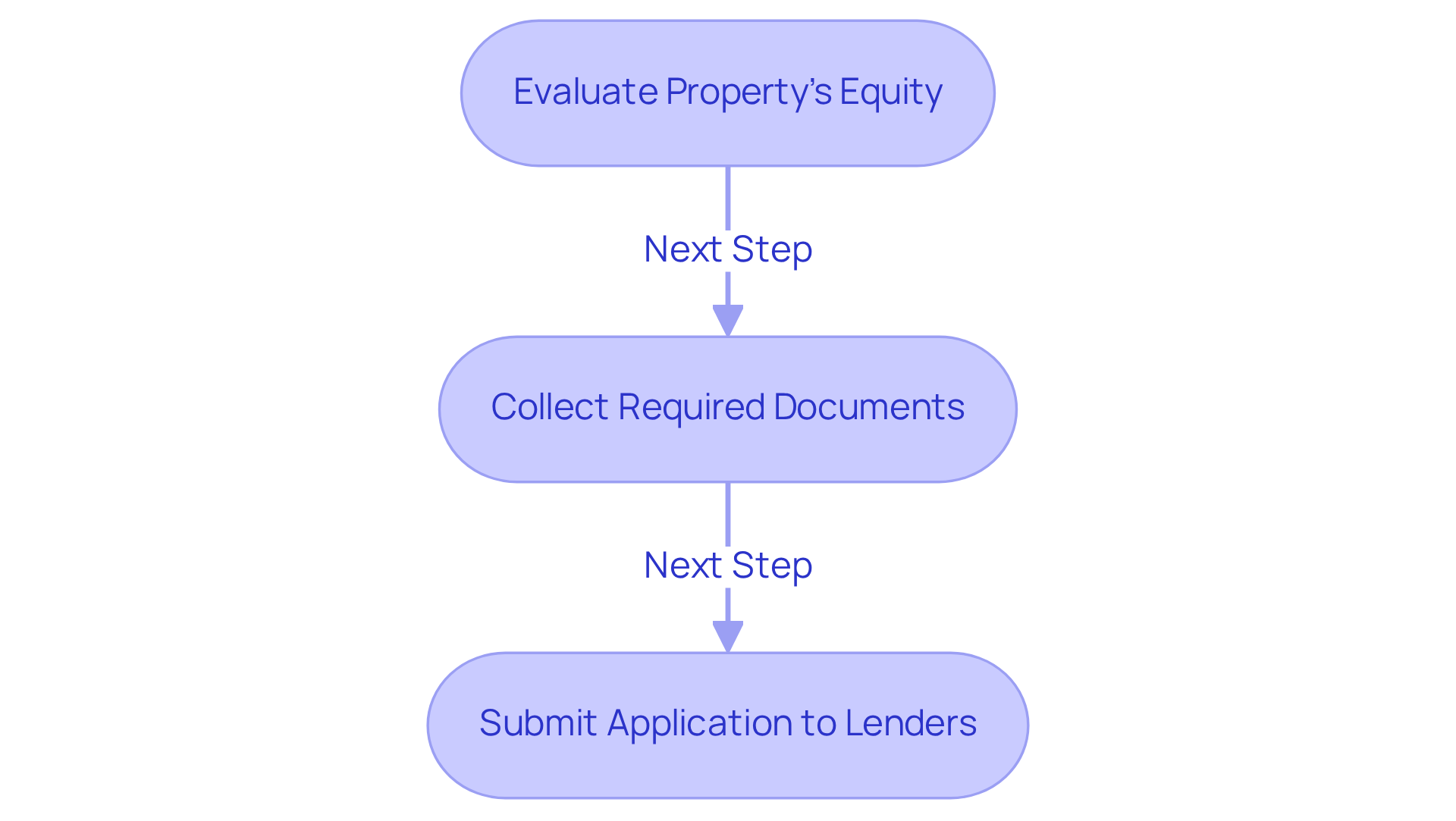

The home equity line of credit application procedure generally includes several essential steps:

- Evaluating your property’s equity

- Collecting required documents

- Sending your application to lenders

Essential documents include Social Security numbers, bank statements, tax returns, and pay stubs. A well-structured guide can streamline this process, providing clarity on what to expect at each stage. This not only reduces anxiety but also enhances the likelihood of a successful application.

Real-world examples illustrate the effectiveness of these guides. Homeowners who engaged with reported smoother experiences, with many achieving their renovation goals more efficiently. By utilizing the appropriate information, clients can navigate the credit line application process confidently, ultimately transforming their financial futures through informed property enhancement investments.

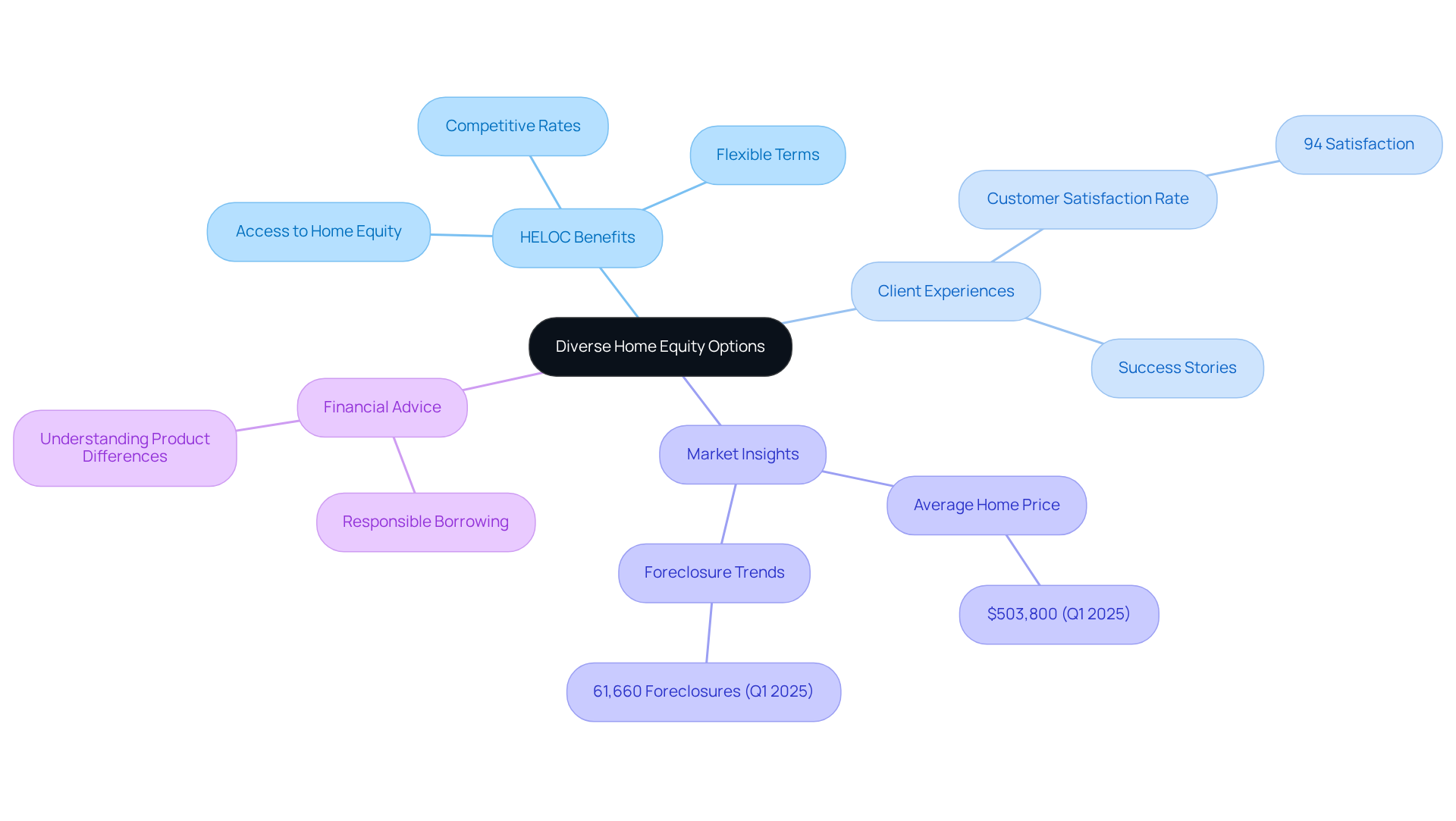

PSECU: Diverse Home Equity Options with Competitive HELOC Rates

At F5 Mortgage, we understand how important it is for homeowners to have . That’s why we offer a variety of equity options, including attractive designed to meet your unique financial needs. These flexible products allow you to , making them ideal for funding renovation projects or consolidating debt. On average, you can access 80% to 90% of your home’s equity, giving you choices that come with .

Many of our clients have successfully while keeping their budgets on track. Stories from satisfied customers speak volumes about the . One client shared how our team guided them step-by-step through the process, ensuring everything went smoothly. In today’s market, , with HELOC rates today often around 8%, are more competitive than traditional credit options, making them a practical choice for significant expenses.

As of Q1 2025, the average acquisition cost for a property in the U.S. stood at $503,800. With property values on the rise, more homeowners are looking to leverage their equity. of matching HELOC products with your specific needs. As one advisor wisely noted, “Be comfortable with the total amount you’re borrowing and how it fits into your budget.” This thoughtful approach not only maximizes the benefits of equity products but also promotes your long-term financial health.

Additionally, with most loans at F5 Mortgage closing in under three weeks and a , you can feel confident in choosing us for your equity needs. We’re here to .

Vancity: Flexible HELOC Access for Home Improvement Projects

At F5 Mortgage, we understand how challenging it can be to embark on renovation projects. Our adaptable credit line access is designed to meet the needs of property owners like you, providing a . With our , you can draw funds as needed, which is especially beneficial for projects that may have fluctuating costs.

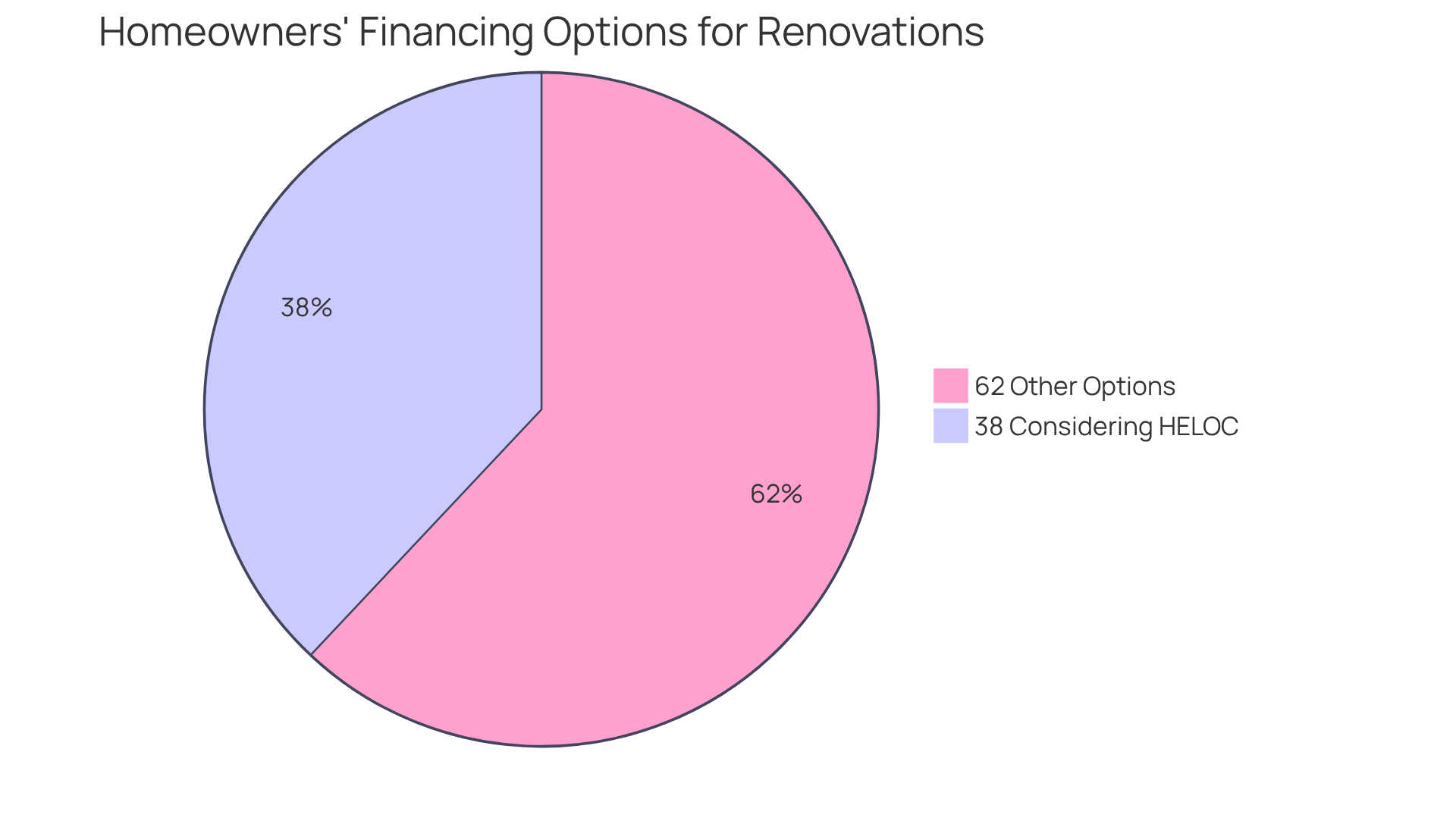

Did you know that 38% of in the next two years are considering a or home equity loan for financing, particularly given the ? This reflects a , particularly in light of HELOC rates today, to support such projects. By choosing F5 Mortgage, you can ensure that the are readily available, allowing you to complete your renovations without unnecessary delays.

Our financial specialists emphasize that managing variable expenses efficiently with a home equity line of credit, particularly given the HELOC rates today, can lead to . Homeowners who strategically utilize their HELOCs often report greater satisfaction and reduced financial stress during their projects, especially in light of HELOC rates today. This showcases the practical advantages of this funding option.

With attractive prices and a 5/5 star rating on platforms like Google and Lending Tree, our clients consistently praise the we provide. We’re here to support you every step of the way. Contact us today for a and experience our commitment to transparency and client empowerment in the mortgage process.

CBS News: Expert Insights on Current HELOC Rates

illuminate the changing landscape of , providing with vital information to navigate these .

We understand how challenging this can be, and by staying informed about these developments, you can proactively adjust your .

This ensures that your plans align with your renovation objectives.

This proactive approach not only but also positions you to seize favorable market conditions.

Ultimately, this leads to more , empowering you every step of the way.

LendingTree: HELOC Calculator for Effective Budgeting

Homeowners, we understand how challenging it can be to plan your home enhancement projects. Utilizing resources like the from LendingTree can make this process easier. This helpful tool allows you to estimate potential monthly payments based on various borrowing amounts and interest rates, giving you a clearer picture of how much equity you can access without exceeding your financial limits. For example, if you’re considering a HELOC of $30,000 at an interest rate of 4%, you can quickly see what your monthly payments might look like, including interest-only options during the draw period.

Budgeting effectively is crucial, especially since residential renovations can often lead to unexpected expenses. In fact, in 2023, 56% of Baby Boomers undertook , with median spending on kitchen renovations reaching $25,000. Financial planners recommend creating a detailed budget that considers both anticipated and surprise costs. By using , you can keep track of your expenses and ensure that you remain within your while embarking on significant projects.

Imagine you’re planning a kitchen remodel. By utilizing a , you can determine that borrowing $25,000 would result in manageable monthly payments. This proactive strategy not only supports your but also empowers you to make informed decisions about the scope of your renovations.

Experts highlight the importance of careful budgeting when dealing with . As Linda Bell, a certified HELOC specialist, wisely notes, ‘Renovations will likely increase the worth of your property, which will benefit you in the future, particularly in light of HELOC rates today.’ By incorporating budgeting tools into your financial strategy, you can navigate the complexities of more effectively, ensuring that your projects enhance both your living space and property value. It’s also vital to recognize the , such as the potential for foreclosure if payments are missed, which underscores the need for thoughtful financial planning.

Conclusion

Navigating the landscape of Home Equity Line of Credit (HELOC) rates today is essential for homeowners looking to leverage their property equity for improvements. We know how challenging this can be, but understanding these rates and the factors influencing them can empower you to make informed decisions that align with your renovation goals and financial strategies.

Throughout this article, we emphasize the importance of personalized consultations with mortgage brokers, such as F5 Mortgage, to help you secure competitive rates. We encourage you to take proactive steps, like improving your credit scores and comparing offers from multiple lenders, to enhance your chances of qualifying for favorable terms. Moreover, best practices, including understanding the implications of interest rate fluctuations and maintaining a manageable debt-to-income ratio, are crucial for successful HELOC applications.

Ultimately, the significance of staying informed about current HELOC rates and market trends cannot be overstated. By actively engaging with available resources and seeking expert guidance, you can maximize your equity potential and achieve your home improvement aspirations. Embracing this proactive approach not only leads to better financial outcomes but also fosters a sense of confidence in managing your property investments.

Frequently Asked Questions

What is F5 Mortgage’s approach to helping clients with HELOC rates?

F5 Mortgage offers personalized consultations to understand each client’s unique financial situation, allowing them to recommend customized solutions that align with home improvement goals and enhance the chances of securing competitive HELOC rates.

What actionable steps can homeowners take to improve their prospects for favorable HELOC rates?

Homeowners can improve their chances by paying down high-rate debt, avoiding new credit applications, and reviewing credit reports for errors.

Why is it important to engage with a knowledgeable mortgage broker like F5 Mortgage?

A knowledgeable mortgage broker has access to a wide network of lenders and can provide no-pressure guidance, ensuring a smooth and stress-free experience for clients seeking HELOC options.

What current trend is influencing HELOC rates for property owners?

Many property owners believe their real estate equity has increased over the past year, which is reflected in the current HELOC rates, leading to a growing interest in utilizing equity for renovations.

How can homeowners compare HELOC offers from different lenders?

Homeowners can compare offers from various lenders, including F5 Mortgage, to discover competitive prices and personalized service that meet their unique needs, ensuring they secure the best terms available.

What steps can homeowners take to boost their credit score for better HELOC terms?

Homeowners can boost their credit score by obtaining a copy of their credit report to identify errors, reducing current debts, and ensuring timely payments.

What are the current average HELOC interest rates?

The average HELOC rates today are approximately 6.63% for $25,000 and about 6.50% for $100,000, reflecting a broader market shift influenced by anticipated interest rate reductions from the Federal Reserve.

What best practices should homeowners follow during the HELOC application process?

Homeowners should maintain a high credit score, understand the implications of fluctuating interest levels during the draw and repayment phases, and monitor their credit scores while engaging in pre-application consultations with lenders.

What is the significance of the debt-to-income (DTI) ratio in securing a HELOC?

A DTI ratio below 40% significantly increases the likelihood of approval for a HELOC, while a maximum DTI ratio of 43% is typically required for residential loans.

Are there any costs associated with HELOCs that homeowners should be aware of?

Yes, HELOCs usually incur closing costs ranging from 2% to 5% of the credit line amount, and the interest paid may be tax-deductible only if the funds are used for property improvements.