Overview

Navigating the FHA appraisal process can feel daunting for homebuyers, but understanding its significance is crucial. This process not only verifies property value and condition but also plays a vital role in loan approval. By grasping these key insights, you can feel more empowered in your homebuying journey.

We know how challenging this can be, and that’s why it’s essential to familiarize yourself with the steps for successful appraisals. From understanding common requirements to taking proactive measures, there are ways to address potential issues before they arise. This knowledge can enhance your chances of securing financing.

Remember, you’re not alone in this process. We’re here to support you every step of the way, ensuring a smoother homebuying experience. By being informed and prepared, you can approach the appraisal process with confidence and peace of mind.

Introduction

Understanding the intricacies of the FHA appraisal process can feel overwhelming for homebuyers seeking financing in a competitive market. We know how challenging this can be. This evaluation not only determines a property’s market value but also ensures it meets the safety and livability standards set by the Federal Housing Administration.

As the landscape of FHA appraisals evolves, you may wonder:

- How can you navigate potential pitfalls?

- What proactive steps can you take to enhance your chances of a successful appraisal?

In this article, we’re here to support you every step of the way as we delve into seven key insights that empower you to approach the FHA appraisal process with confidence and clarity.

F5 Mortgage: Expert Guidance on FHA Appraisals

At F5 Mortgage, we understand how challenging the mortgage process can be, especially when it comes to the FHA appraisal. We’re here to support you every step of the way, ensuring that homebuyers like you are well-informed about this critical aspect. Understanding the is essential, as it verifies the property’s worth and condition, directly influencing loan approval. In 2025, the typical closing duration for FHA loans is around 43 days, but the evaluation itself may take less time, making prompt preparation vital for purchasers.

The process of FHA appraisal involves a thorough examination by an FHA-approved assessor. This professional evaluates the property based on the Federal Housing Administration’s Minimum Property Requirements, which include assessing structural integrity, health and safety issues, and overall livability. It’s important to note that a property valuation is valid for 180 days, and the FHA appraisal allows up to 120 days for necessary repairs following a valuation, providing some flexibility for buyers.

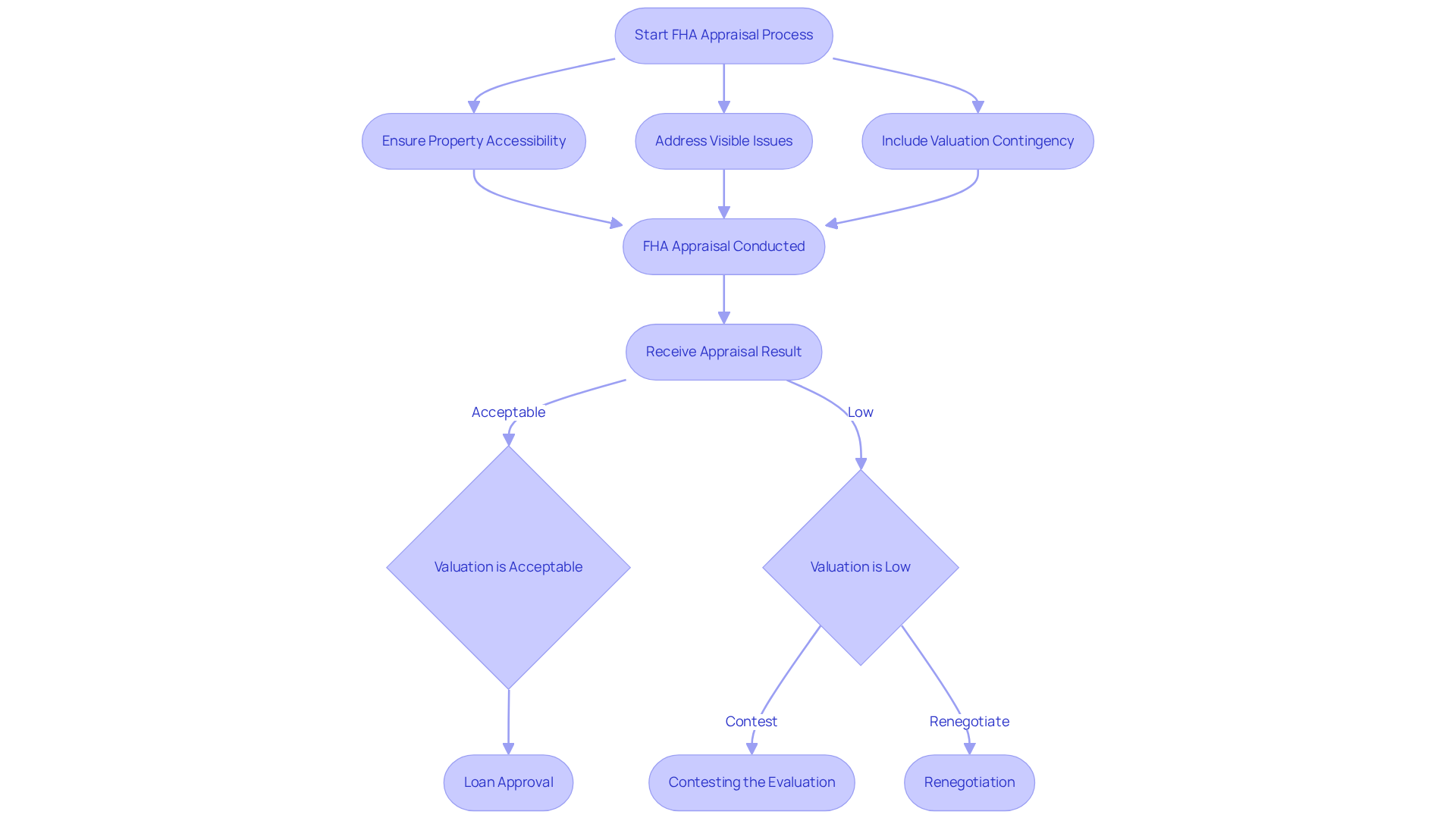

To ensure a successful appraisal, here are some proactive steps you can take:

- Make sure all areas of your home are accessible for inspection.

- Address any visible issues that could raise concerns, such as mold or structural damage.

- Consider including a valuation contingency in your purchase agreement, which allows for renegotiation or withdrawal if the assessment comes in lower than expected.

F5 Mortgage’s dedicated team of independent mortgage brokers has successfully managed numerous FHA appraisals, providing personalized guidance and support. Our commitment to your satisfaction and our deep understanding of FHA guidelines position us as a trusted partner for families seeking FHA loans and assistance with the FHA appraisal process aimed at achieving homeownership. As Abby Badach Doyle emphasizes, “You can contest a low evaluation if you firmly think the evaluator erred,” highlighting the importance of understanding the evaluation process.

Understand the FHA Appraisal Process

The FHA appraisal procedure is a crucial step in securing a mortgage, as it determines the property’s market value and ensures compliance with safety regulations. This evaluation, which is an FHA appraisal, is conducted by an FHA-approved appraiser and includes a thorough inspection of the home’s condition, identification of safety hazards, and a comparison with similar properties in the area. In 2025, approximately 85% of homes successfully meet FHA assessments, highlighting the thoroughness of this evaluation.

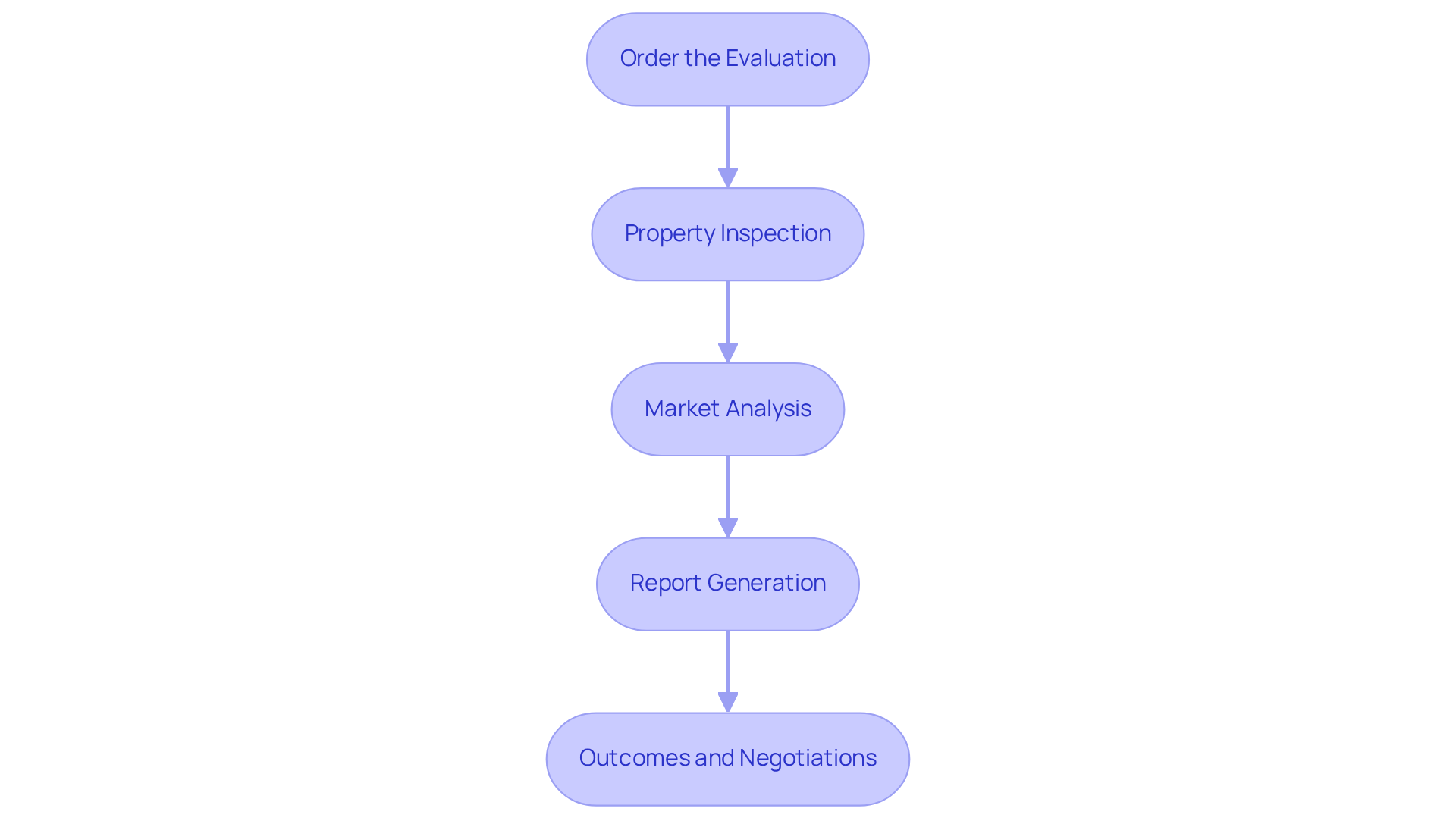

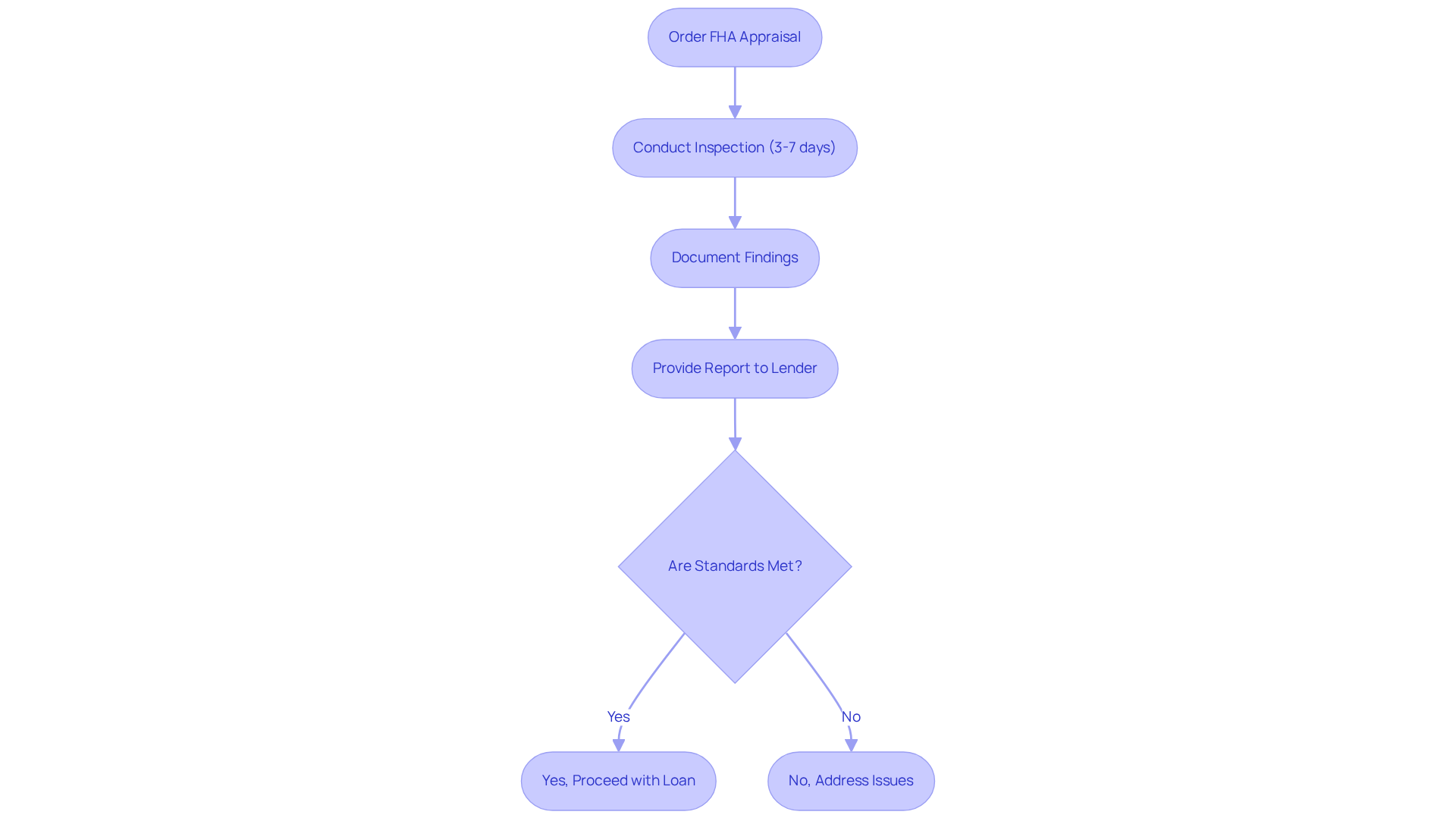

Understanding the can feel overwhelming, but we’re here to guide you. It typically follows these steps:

- Order the Evaluation: After signing the purchase agreement, the lender requests an assessment.

- Property Inspection: The appraiser visits to assess the property’s condition and identify potential issues, such as structural problems or safety hazards like asbestos. It’s essential for buyers to also secure a home inspection, as FHA evaluations may not uncover all necessary repairs.

- Market Analysis: The appraiser compares the property to similar homes nearby to determine its fair market value.

- Report Generation: A comprehensive report is created, detailing the appraiser’s findings and the determined value of the property.

We understand how vital it is for homebuyers to grasp how [FHA appraisal processes](https://f5mortgage.com/7-key-factors-influencing-heloc-loan-rates-you-should-know/) work. These assessments, particularly the FHA appraisal, not only influence loan approval but also highlight any repairs that need attention before closing. Recent changes in FHA appraisal regulations require lenders to provide clearer instructions for disputing assessments, which can be beneficial for buyers who may wish to challenge the assessed value. For instance, a recent case in Vermont revealed a drop in median appraised values for FHA single-family purchase loans, underscoring the need to be prepared for varying outcomes across different states.

Real-world examples illustrate the significance of FHA appraisals. In one instance, a home received a FHA appraisal that was lower than the purchase price due to necessary repairs, prompting the buyer to negotiate a lower price with the seller. Such scenarios highlight the importance of being proactive and informed during the evaluation process, ensuring that buyers are ready to face any challenges that may arise.

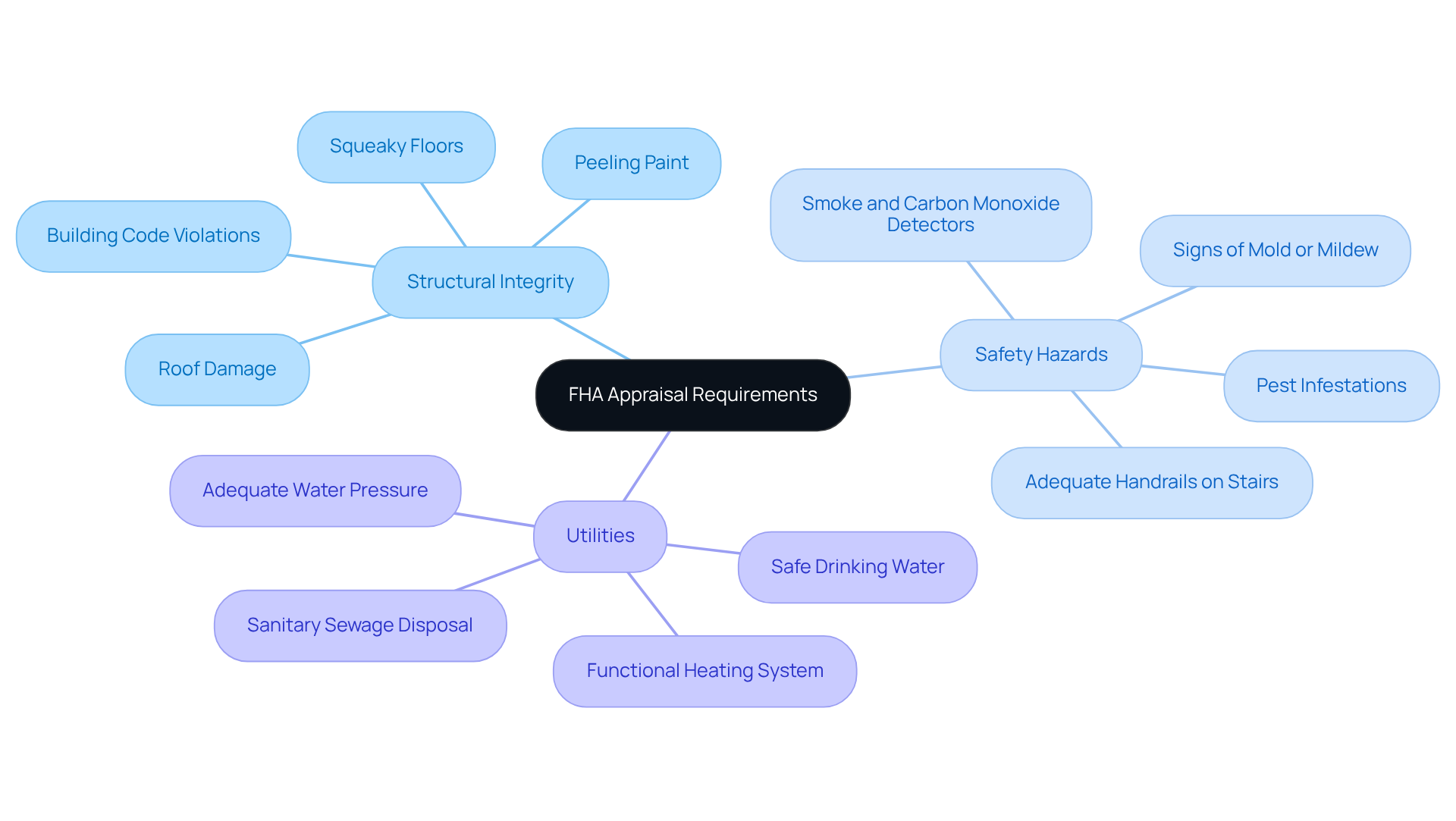

Know the Common FHA Appraisal Requirements

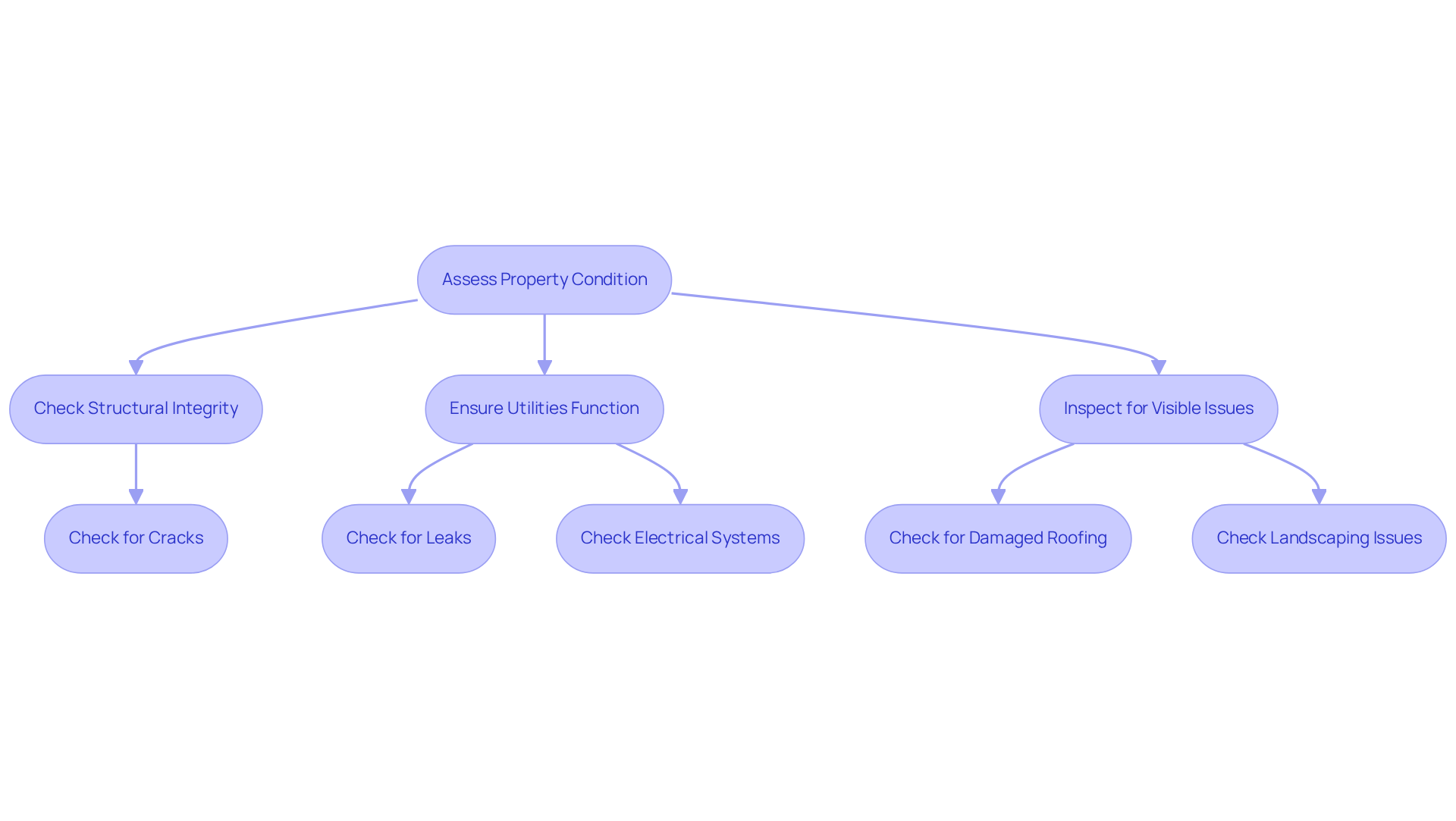

Understanding is essential for homebuyers, especially for ensuring a smooth mortgage process. We know how challenging this can be, and we’re here to support you every step of the way. These requirements focus on making sure that the property is structurally sound, free from safety hazards, and equipped with functioning utilities.

During the appraisal, inspectors will look for issues such as:

- Peeling paint

- Roof damage

- Adequate access to the property

It’s also crucial that all stairs have appropriate handrails and that the home is sealed from the elements. This includes a thorough review of the roof, siding, and windows. Additionally, properties must provide access to safe, clean drinking water and adequate water pressure.

By comprehending these requirements, you can tackle potential problems in advance, greatly enhancing your chances of a favorable evaluation result. For instance, properties must have safe and sanitary sewage disposal, and any signs of mold or mildew can negatively impact the valuation.

Being proactive is key. Simple repairs, like fixing squeaky floors or ensuring that smoke and carbon monoxide detectors are installed and functioning, can significantly improve your chances of meeting FHA standards and securing your financing. Remember, all bedrooms must have at least two points of egress, which is crucial for safety compliance.

FHA appraisals are generally more thorough than standard assessments, making it vital for buyers to be well-informed about these guidelines. Taking these steps not only prepares you for the evaluation but also gives you peace of mind as you navigate this important journey.

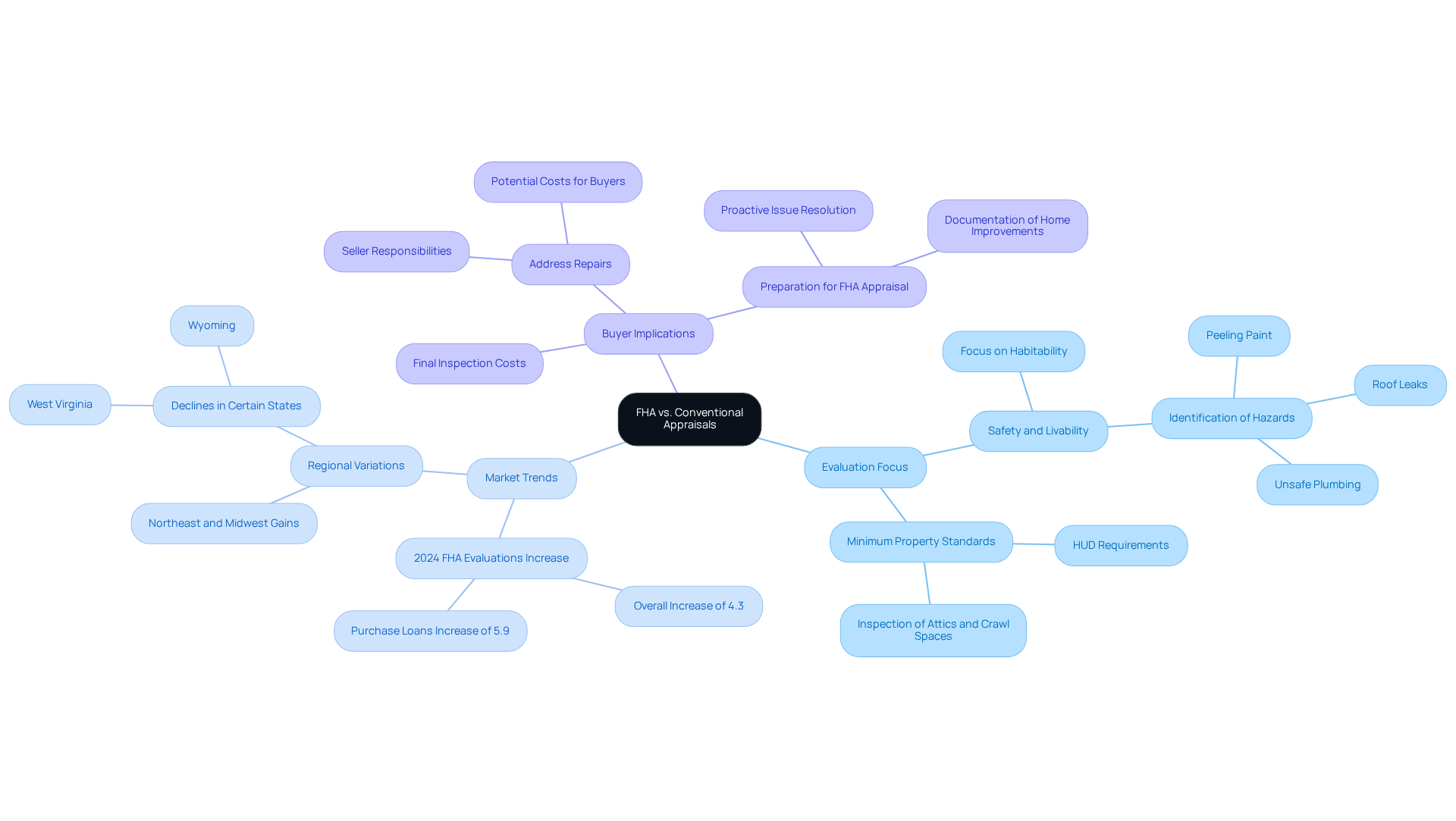

Recognize the Differences Between FHA and Conventional Appraisals

FHA evaluations stand apart from traditional assessments due to their strong focus on safety and livability. While traditional evaluations primarily look at market value, an FHA appraisal determines whether a property meets the (MPS) set by HUD. This thorough approach means that FHA appraisal professionals are more likely to identify issues that could affect the home’s habitability, such as peeling paint, roof leaks, or unsafe plumbing. For instance, properties built before 1978 with flaking paint may face valuation challenges, as the FHA appraisal guidelines require remediation of such hazards before loan approval.

In 2024, FHA evaluations increased by 4.3 percent compared to the previous year, with assessments for purchase loans specifically rising by 5.9 percent. This highlights the growing significance of these evaluations in the homebuying journey. FHA evaluations are valid for 120 days, extendable to one year if updated, providing buyers with some flexibility in the market. However, if an evaluation reveals deficiencies, sellers are typically responsible for addressing these repairs within 120 days to meet FHA standards. A final inspection may also be necessary, which could lead to additional costs for buyers.

Understanding these differences is vital for homebuyers, particularly those considering an FHA appraisal. The emphasis on safety ensures that homes financed through FHA loans provide secure living conditions. It’s essential for buyers to prepare thoroughly for the evaluation process. By proactively addressing potential issues, you can streamline your loan application and improve your chances of approval. We know how challenging this can be, and we’re here to support you every step of the way.

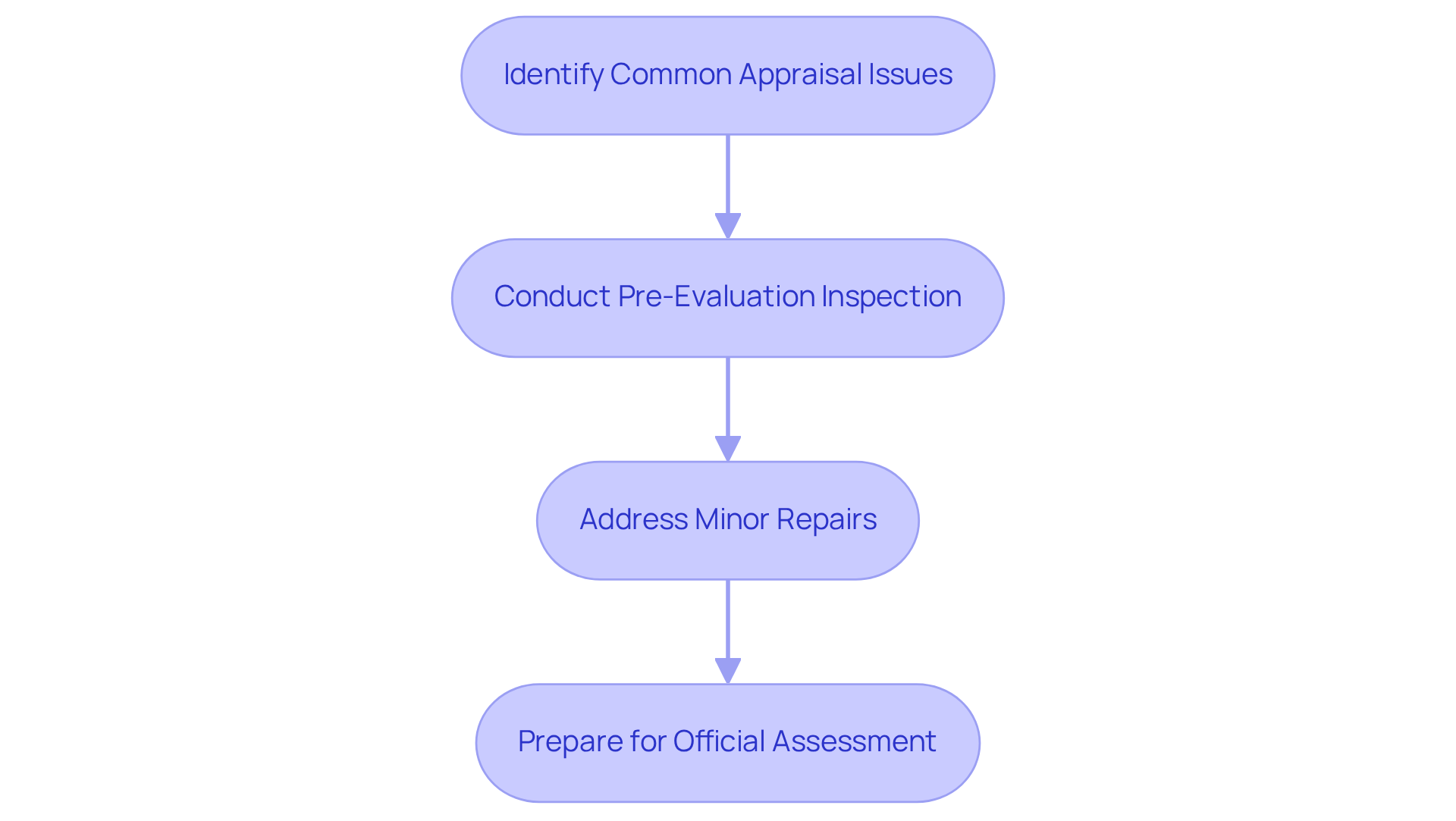

Address Common Appraisal Issues Effectively

Common evaluation issues can be quite concerning, often stemming from safety hazards, inadequate access, and structural deficiencies. We know how challenging this can be. Statistics reveal that evaluation issues delayed 5% of contract closings in January 2025, highlighting the importance of addressing these problems proactively.

Carrying out a pre-evaluation inspection can significantly enhance your evaluation results. This step allows buyers to identify and resolve issues—like peeling paint, broken windows, or faulty utilities—before the official assessment takes place. Real estate experts emphasize the importance of these inspections, noting that tackling small repairs can lead to a more positive evaluation outcome. For instance, Keri White, an experienced real estate agent, encourages sellers to undertake essential repairs prior to the evaluation. She stresses that the assessment is primarily concerned with the value of the home—not just the repairs themselves.

By taking the initiative to address these issues, you not only improve your chances of a favorable evaluation but also simplify the entire home purchasing process. Additionally, it’s important to remember that 15% of buyers have FHA loans, making FHA appraisal insights particularly relevant for families looking to upgrade their homes. We’re here to every step of the way in navigating these challenges.

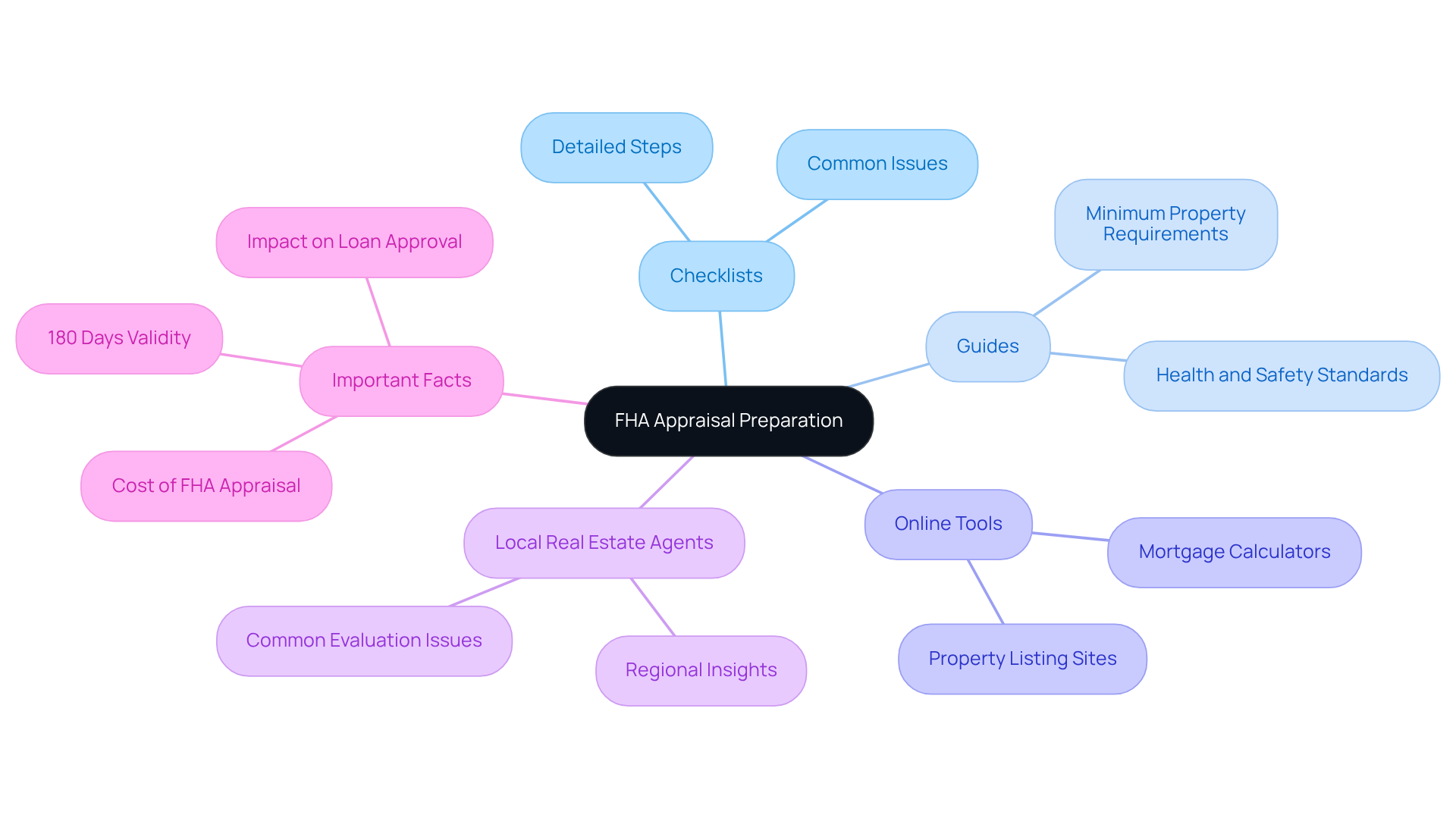

Utilize Resources for FHA Appraisal Preparation

Homebuyers, we understand how challenging the FHA appraisal process can be. To help you prepare effectively, consider leveraging a variety of resources, such as:

- Detailed checklists

- Informative guides

- Online tools

Websites like HUD.gov offer comprehensive details on FHA evaluation criteria, including the (MPR) that ensure safety and habitability standards.

Local real estate agents can provide valuable insights into common evaluation issues specific to your region, assisting you in navigating potential challenges. It’s also important to know that FHA evaluations are valid for 180 days, which can influence your planning and expectations.

At F5 Mortgage, we are here to support you every step of the way. We improve this preparation process by offering tailored consultations, helping you understand what to anticipate during the evaluation. This includes being aware of possible health and safety risks, such as lead-based paint and poor ventilation.

Grasping that the evaluation can influence loan approval and might necessitate renegotiation of the purchase price if the assessment falls short of expectations is vital for you as a purchaser. This thorough approach empowers you to tackle your FHA appraisal with confidence, ensuring you are adequately prepared to meet the essential criteria.

To optimize your readiness, we encourage you to actively employ these resources and stay informed about the evaluation process. Remember, you are not alone in this journey; we are here to help you succeed.

Understand the Role of the Appraiser in FHA Loans

The FHA appraisal plays a vital role in the FHA loan process, ensuring that the property is valued accurately and meets HUD’s minimum property standards. They conduct thorough inspections, document their findings, and provide detailed reports to the lender. Typically, FHA appraisals occur early in the loan journey, right after an offer is accepted, making these FHA appraisals essential for moving forward with the loan.

In 2025, appraisers are expected to complete inspections within 3 to 7 days of the order being placed, reflecting their efficiency in this important process. This FHA appraisal not only establishes the market value of the property but also identifies any issues that need to be addressed before the loan can proceed. Serious problems, such as a roof with less than two years of life left or structural damage, can jeopardize FHA loans, emphasizing the importance of the FHA appraisal findings.

Real-life examples highlight how crucial the appraiser’s assessment can be. In cases where properties have fallen short of FHA standards, buyers have successfully negotiated repairs with sellers or opted to cover the costs themselves, showcasing the appraiser’s role as a mediator in these transactions. Additionally, the FHA appraisal amendatory clause protects buyers’ earnest funds if they decide to withdraw from an agreement due to assessment concerns, further illustrating how the FHA appraisal influences the home purchasing process.

Moreover, homes must be free from wood-destroying insect infestations and chipping or peeling lead-based paint to pass the FHA evaluation, which are essential components of the standards. Understanding the appraiser’s responsibilities and the implications of their evaluations empowers buyers to navigate the with greater confidence, ensuring they select properties that meet the necessary financing requirements.

Assess Property Condition for Better Appraisal Outcomes

To achieve better evaluation results, we understand how important it is for you to thoroughly examine the state of your property. Start by checking for and ensuring that all utilities are functioning well. Don’t overlook any visible issues, such as damaged roofing or landscaping, as these can significantly impact your evaluation. By showcasing a well-kept property, you can enhance your chances of receiving a positive evaluation. Remember, we’re here to support you every step of the way as you navigate this process.

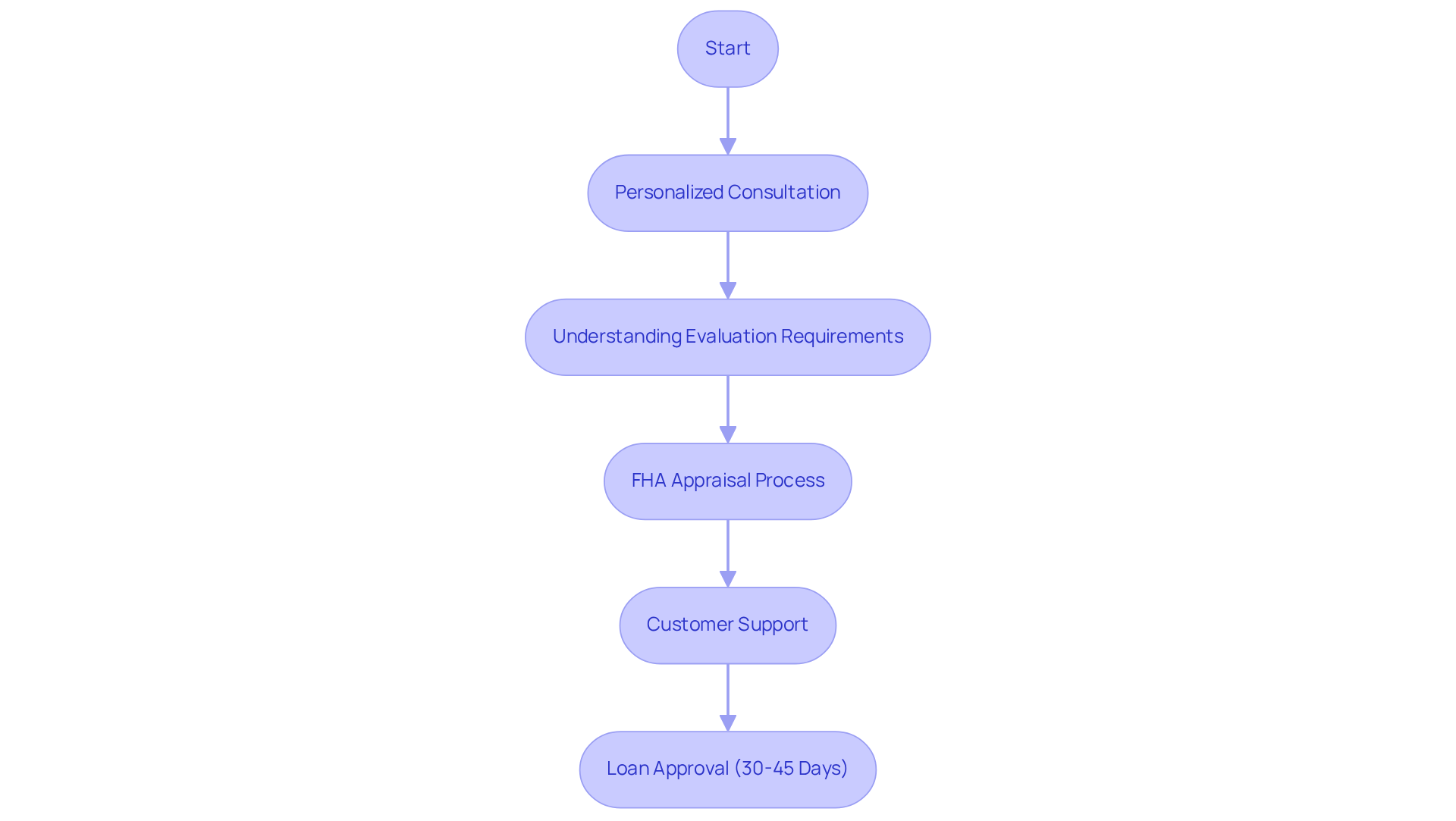

Leverage F5 Mortgage’s Support for FHA Appraisals

At F5 Mortgage, we understand how challenging the FHA appraisal process can be for families. That’s why we offer comprehensive assistance to ensure you feel well-prepared and confident every step of the way. Through personalized consultations, you will gain access to essential industry resources that clarify the evaluation requirements, addressing your concerns with care and expertise.

Our dedicated team is here to support you, making your experience of securing FHA loans as smooth as possible. With a remarkable of 94%, the positive testimonials from families who have successfully navigated the evaluation speak volumes. For example, the Johnson family shared how our expert assistance allowed them to focus on their home renovations instead of the complexities of financing.

This level of support not only increases your chances of a successful evaluation but also empowers you to tackle your home purchasing journey with confidence. Notably, over 80% of FHA participants are first-time homebuyers, highlighting the importance of our guidance in helping families achieve their homeownership dreams.

Additionally, you can expect an average approval time of 30 to 45 days for FHA loans in Texas. This efficiency demonstrates our commitment to your needs, ensuring that we are here to support you every step of the way.

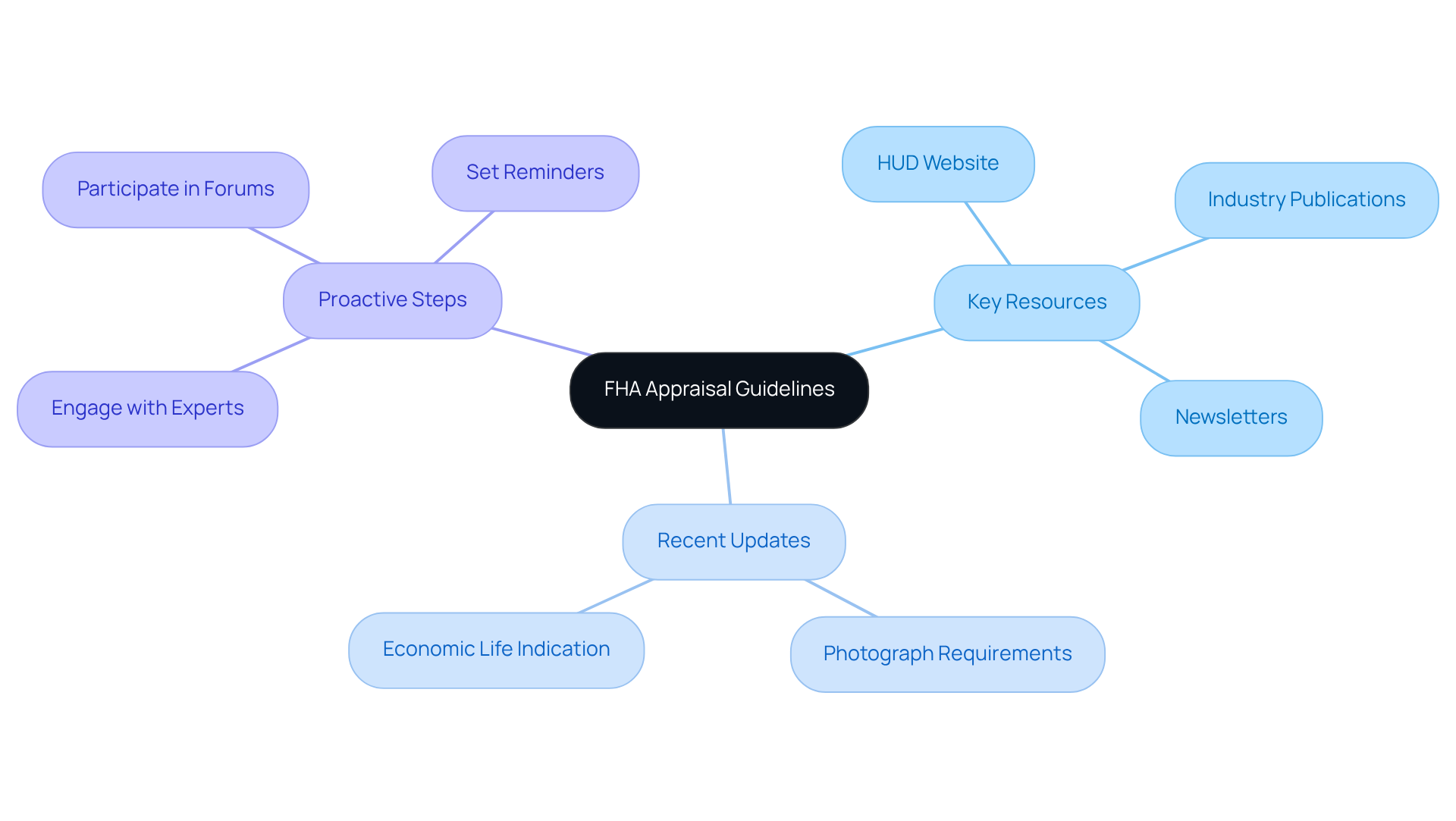

Stay Updated on FHA Appraisal Guidelines

Navigating the FHA evaluation process can feel overwhelming, but we’re here to help you every step of the way. It’s essential to stay informed about changes in regulations. Regularly checking resources like HUD’s official website and reputable industry publications will ensure you have access to the latest information on policy changes and requirements.

For instance, recent updates to the [FHA appraisal policies](https://f5mortgage.com/understanding-the-va-irrrl-program-key-benefits-and-eligibility), such as the removal of specific photograph requirements and the elimination of the need for appraisers to indicate the remaining economic life of properties, have simplified certain processes. These changes are designed to help you comply with evolving standards more easily. With , it’s crucial to remain proactive in seeking out this information.

Engaging with mortgage experts and participating in industry forums can provide valuable insights, helping you feel informed and confident as you move forward on your homeownership journey. To further empower yourself, consider subscribing to industry newsletters or setting reminders to check for updates on FHA guidelines. Remember, we understand how challenging this can be, and we are committed to supporting you through this process.

Conclusion

Understanding the FHA appraisal process is vital for homebuyers. It plays a crucial role in determining property value and ensuring compliance with safety standards. Successfully navigating this process can significantly influence loan approval and enhance the overall homeownership experience. By being informed about appraisal requirements, common issues, and proactive steps, buyers can improve their chances of a favorable evaluation outcome.

Key insights emphasize the importance of preparation. Addressing potential property issues before the appraisal and understanding the role of the appraiser are essential. It’s important to recognize that FHA appraisals differ from conventional ones. They focus more on safety and livability, which can affect the financing process.

Utilizing resources and expert guidance, such as that provided by F5 Mortgage, can empower homebuyers to tackle the complexities of FHA appraisals with confidence.

Ultimately, staying updated on FHA appraisal guidelines and leveraging available support can make a significant difference in the homebuying journey. Embracing these insights will not only help in securing a successful appraisal but also pave the way for a smoother path to homeownership. Taking proactive measures and seeking expert assistance ensures that buyers are well-equipped to navigate the challenges of the FHA appraisal process. This preparation leads to informed decisions and successful outcomes.

Frequently Asked Questions

What is the purpose of an FHA appraisal?

The FHA appraisal verifies a property’s worth and condition, which directly influences loan approval. It ensures that the property meets the Federal Housing Administration’s Minimum Property Requirements.

How long does the FHA appraisal process typically take?

In 2025, the typical closing duration for FHA loans is around 43 days, but the appraisal evaluation itself may take less time. Prompt preparation is crucial for buyers.

Who conducts the FHA appraisal?

An FHA-approved appraiser conducts the FHA appraisal, performing a thorough examination of the property based on safety regulations and market value.

What are some key steps in the FHA appraisal process?

The FHA appraisal process typically includes ordering the evaluation after signing the purchase agreement, property inspection by the appraiser, market analysis comparing the property to similar homes, and report generation detailing the appraiser’s findings.

What common issues do appraisers look for during an FHA appraisal?

Appraisers check for issues such as peeling paint, roof damage, adequate access to the property, functioning utilities, and safety hazards like mold or structural problems.

How long is a property valuation valid after an FHA appraisal?

A property valuation from an FHA appraisal is valid for 180 days. The FHA allows up to 120 days for necessary repairs following a valuation.

What can buyers do to prepare for a successful FHA appraisal?

Buyers can ensure all areas of the home are accessible for inspection, address visible issues like mold or structural damage, and consider including a valuation contingency in the purchase agreement.

What should buyers do if they disagree with a low appraisal?

Buyers can contest a low evaluation if they believe the appraiser made an error, as highlighted by experts in the field.

Why is it important to understand FHA appraisal requirements?

Understanding FHA appraisal requirements helps homebuyers ensure their property is structurally sound and free from safety hazards, which is essential for a smooth mortgage process.

What are some proactive steps buyers can take to meet FHA appraisal standards?

Buyers can tackle potential problems in advance, such as making simple repairs, ensuring smoke and carbon monoxide detectors are functioning, and confirming that all bedrooms have at least two points of egress for safety compliance.