Overview

Navigating the complexities of VA loan benefits can be daunting, but the VA entitlement calculator is here to help. With its user-friendly interface, accurate data input validation, mobile compatibility, and comprehensive customer support, it’s designed to assist service members effectively. We know how challenging this can be, and these features truly enhance your experience.

Imagine having tailored calculations at your fingertips, along with real-time updates on VA guidelines. This not only provides clarity but also ensures your data is secure. By empowering veterans with these tools, you can make informed financial decisions about home financing, feeling confident every step of the way.

We’re here to support you, ensuring you have everything you need to access your VA loan benefits with ease and peace of mind.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially for service members eager to utilize their VA loan benefits. We understand how challenging this can be, which is why the F5 Mortgage VA Entitlement Calculator stands out as a supportive tool. It is designed to simplify the process, offering quick and accurate assessments of eligibility and potential borrowing amounts.

With numerous features available, you may wonder: what key elements truly enhance its effectiveness and user experience? In this article, we will explore seven essential features of the VA Entitlement Calculator, illustrating how they empower veterans to make informed financial decisions in today’s ever-evolving housing market.

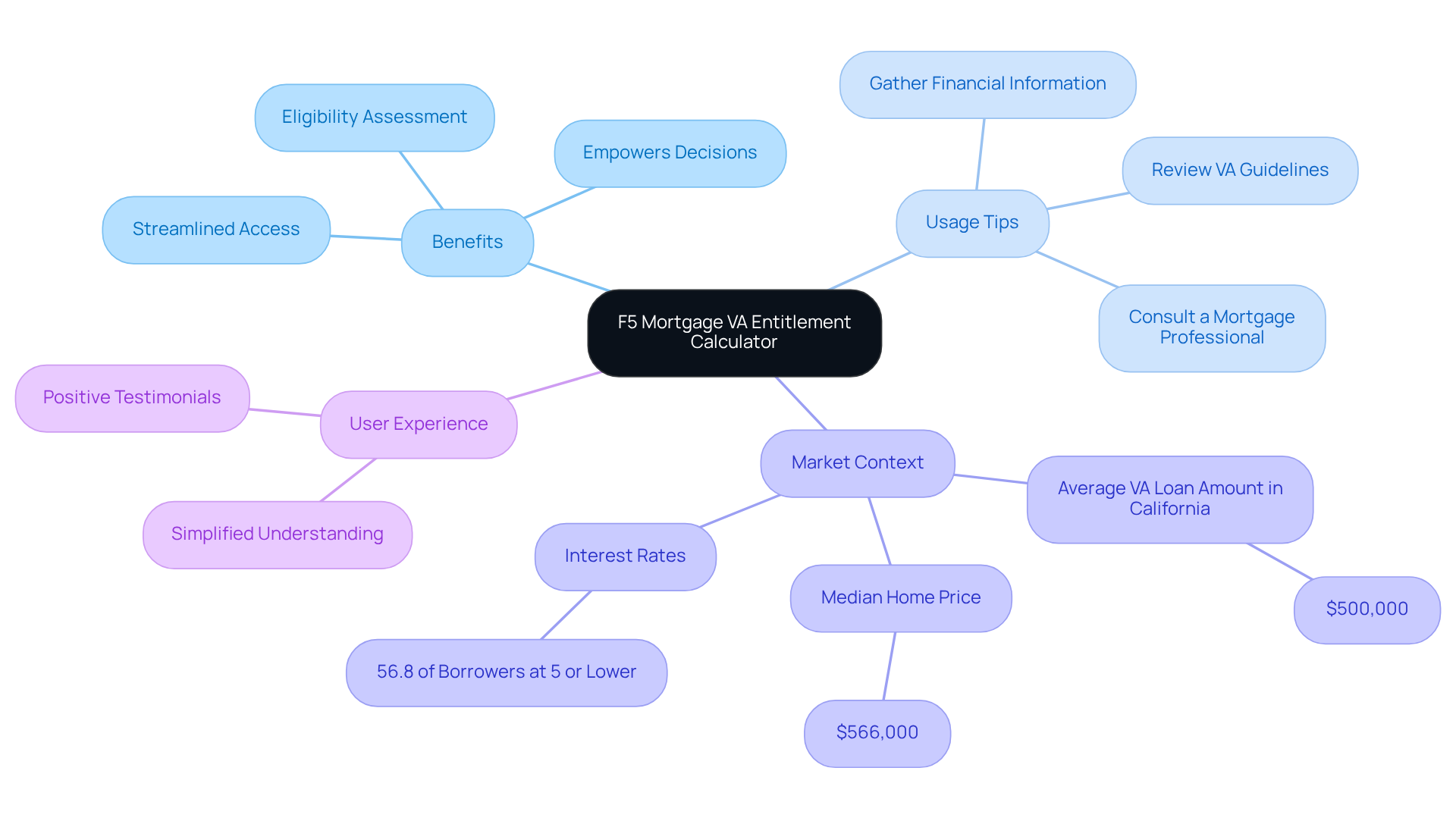

F5 Mortgage VA Entitlement Calculator: Streamlined Access to Benefits

The F5 Mortgage VA entitlement calculator provides service members a compassionate and streamlined method to access their VA loan benefits, especially in California’s competitive housing market. By simply entering basic information, users can quickly assess their eligibility and determine their potential borrowing amount. This efficient process not only saves valuable time but also empowers service members to make informed decisions about their home financing options.

We understand how overwhelming navigating the housing market can be. That’s why the calculator has been updated to reflect the latest VA guidelines, which include eligibility criteria and financing limits, ensuring that the results are both precise and dependable. With the in California around $500,000, compared to the median home price of $566,000, utilizing this tool can significantly shape a service member’s home financing strategy.

Moreover, with 56.8% of VA borrowers securing interest rates of 5% or lower, the calculator helps individuals effectively navigate the current market. For those considering down payment assistance programs, these options can enhance home buying opportunities by enabling more competitive offers and reducing mortgage payments. As one satisfied user shared, ‘Using the VA entitlement calculator simplified understanding my choices and preparing for my future.’ This tool is essential for former service members who wish to navigate the complexities of home financing with confidence.

Tips for Using the VA Entitlement Calculator:

- Gather your financial information beforehand to ensure accurate results.

- Review the latest VA guidelines to understand eligibility requirements.

- Consider consulting with a mortgage professional for personalized advice.

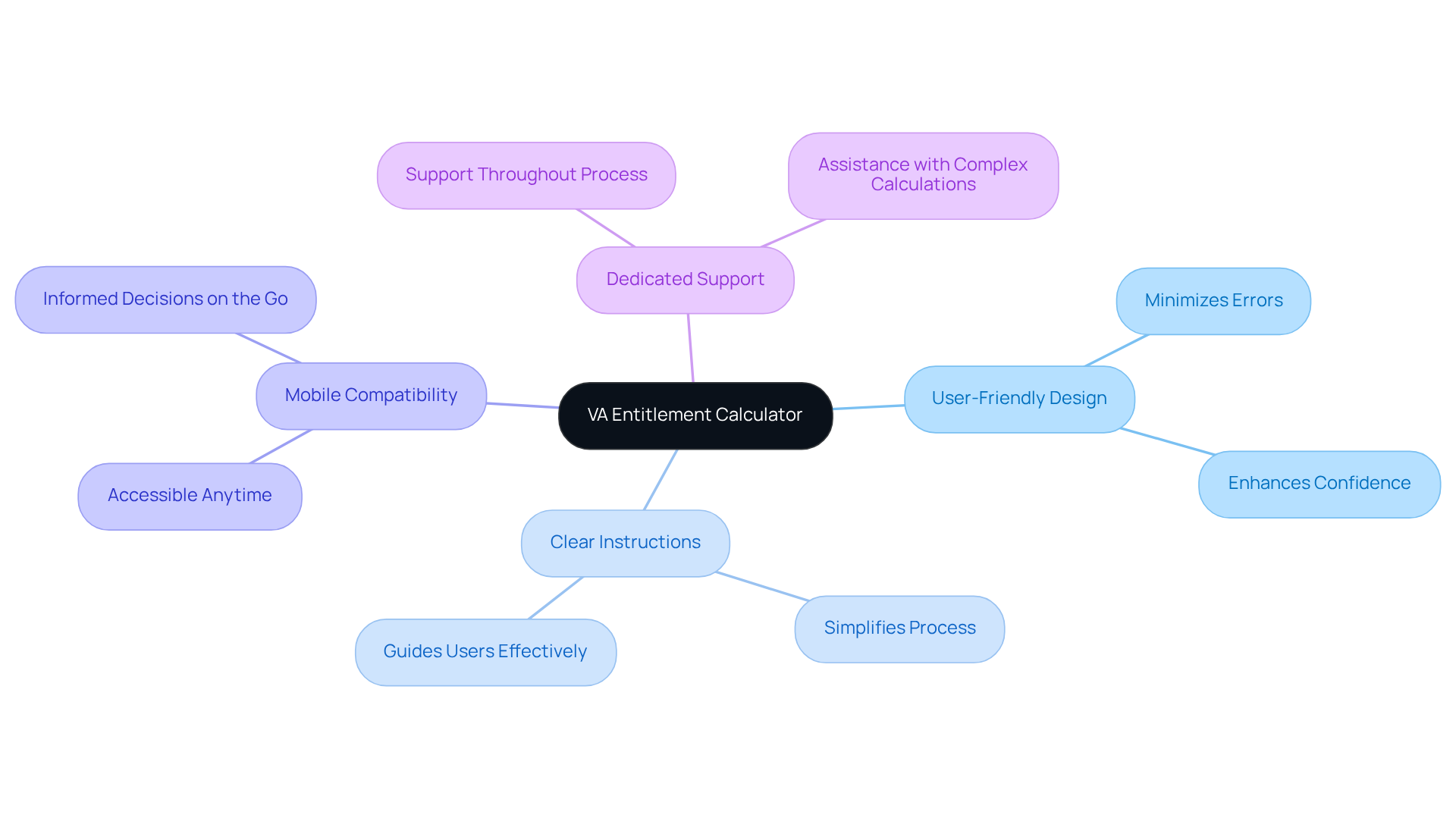

User-Friendly Interface: Simplifying VA Entitlement Calculations

The VA entitlement calculator from F5 is thoughtfully designed with a clean and intuitive interface that simplifies the calculation process for users. We understand how challenging this can be, and by providing clear instructions and straightforward input fields, the calculator minimizes the risk of errors. This enables veterans to efficiently obtain the information they need. This considerate design not only improves usability but also reflects F5’s commitment to making the loan process as stress-free as possible.

Focusing on intuitive design is essential, as it empowers individuals to navigate complex calculations with confidence, ultimately enhancing their overall experience in obtaining VA loans. Additionally, as part of the refinancing process, F5 offers competitive rates and access to a large network of lenders. This ensures families upgrading their homes receive the best possible terms tailored to their needs.

Moreover, the calculator’s mobile compatibility allows users to access it anytime, ensuring they can make informed decisions on the go. As emphasized by F5, ‘Navigating the financing calculation process can feel overwhelming, but the F5 Calculator is here to assist.’ This highlights the VA entitlement calculator’s role in simplifying the home financing journey. With , F5 is here to support you every step of the way.

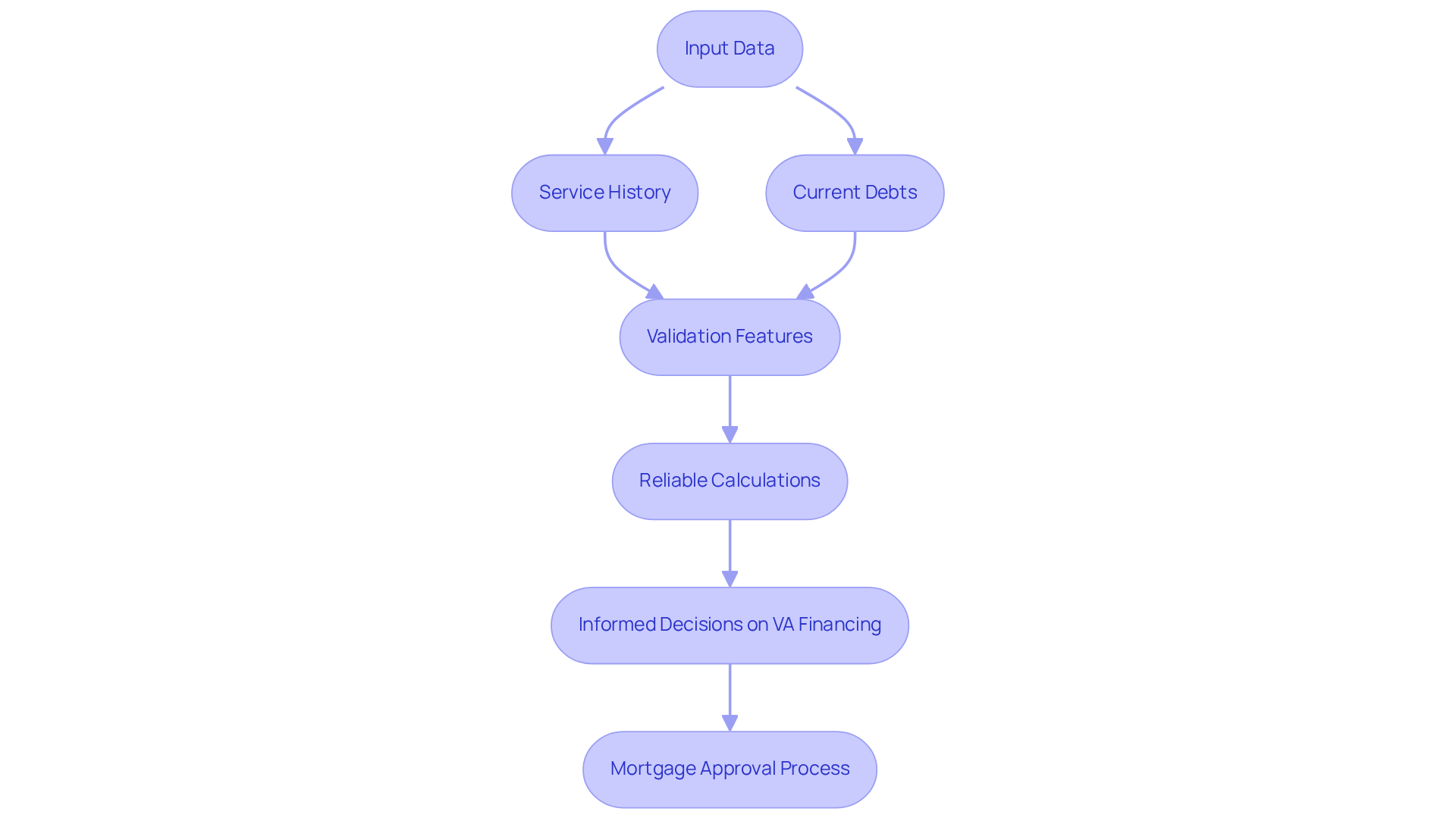

Accurate Data Input: Ensuring Reliable VA Entitlement Calculations

To achieve reliable calculations, the VA entitlement calculator requires you to input precise data, including your service history and any current debts. We understand how challenging this can be, which is why the VA entitlement calculator is equipped with validation features that alert you to discrepancies or missing information, ensuring that all inputs are accurate. This focus on data integrity is crucial, as it allows veterans to use the VA entitlement calculator for the most accurate evaluation of their VA entitlement, which is vital for effective financial planning.

Precise data entry is essential for making informed decisions, especially regarding VA financing, where the VA entitlement calculator directly affects your borrowing capacity and terms. Understanding the refinancing process in Colorado is equally important, as it shares commonalities with VA financing regarding eligibility criteria. Case studies have shown that inaccuracies in data entry can lead to significant financial missteps, underscoring the necessity of reliable assessments in the mortgage process.

By prioritizing data accuracy, F5 not only enhances your experience but also empowers you to make informed financial choices. Additionally, an approval from a lender indicates that, based on the provided financial information, you are a suitable candidate for a mortgage, which is an important aspect of the overall mortgage approval process. We’re here to every step of the way.

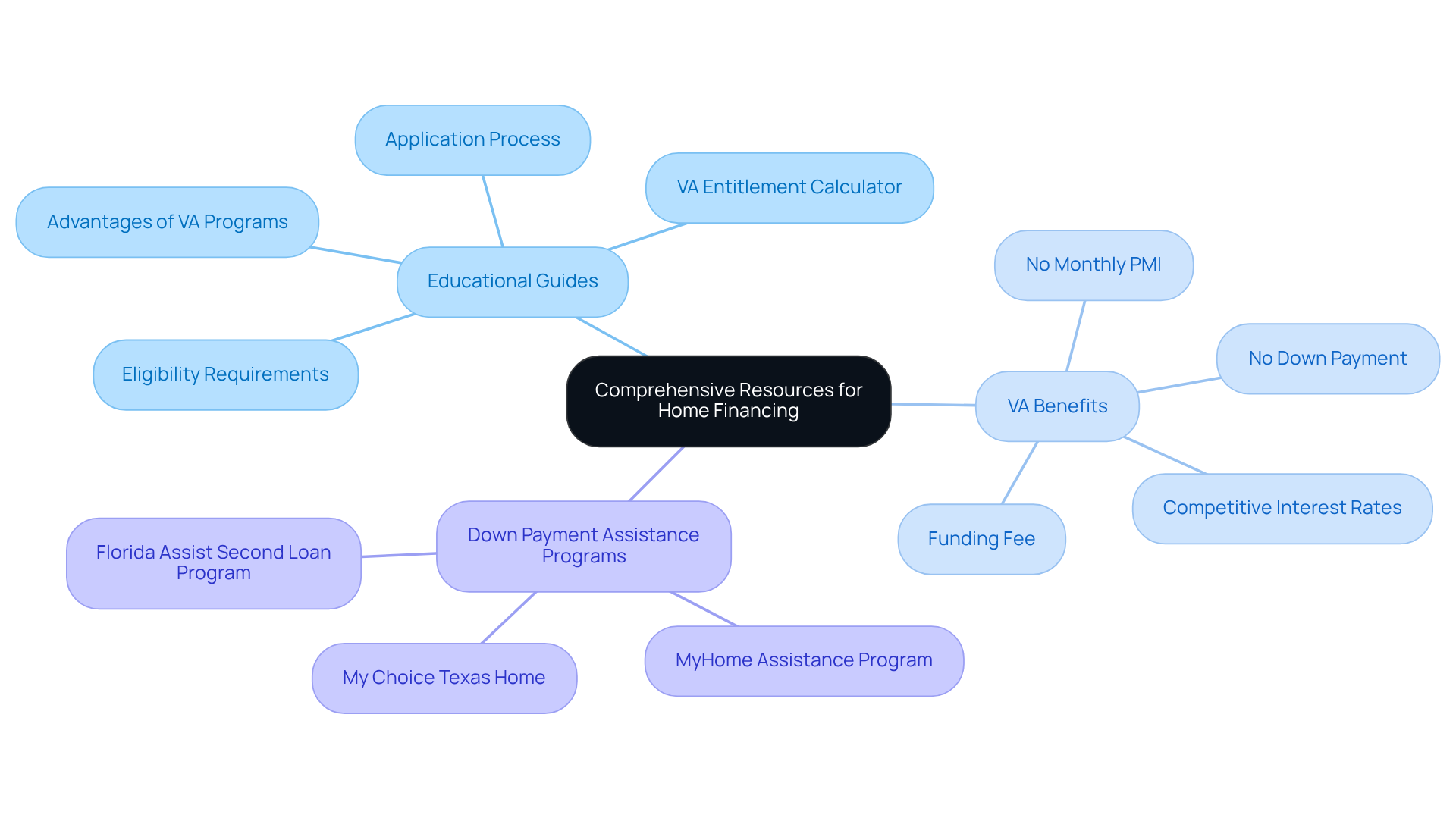

Comprehensive Resources: Supporting Users with Detailed Guides

At F5 Mortgage, we understand that navigating the world of home financing can be challenging, especially for our former service members. That’s why we offer a wide range of educational materials, including comprehensive guides on the advantages of VA programs, eligibility requirements, the application process, and a VA entitlement calculator. Our resources are designed to empower you with the knowledge needed to maneuver through the intricacies of VA financing efficiently.

One of the most significant benefits of VA financing is that it does not require monthly private mortgage insurance (PMI). This feature can lead to substantial savings on your monthly payments, allowing you to allocate those funds toward other important aspects of your life. Additionally, the option for no down payment makes homeownership more accessible for many veterans, helping to turn your dream of owning a home into a reality.

Moreover, the competitive interest rates associated with VA loans further enhance their affordability, making it easier for you to manage your financial commitments. We also offer a variety of down payment assistance programs across states like California, Texas, and Florida, which can significantly aid homebuyers like you. For example:

- The MyHome Assistance Program in California provides up to 3% of the home’s purchase price.

- Texas’s My Choice Texas Home program offers up to 5% for down payment and closing assistance.

- In Florida, initiatives such as the Florida Assist Second Loan Program can provide up to $10,000 to help with upfront expenses.

By ensuring that you have access to comprehensive information—including details about the VA funding fee and available assistance programs—F5 Mortgage is dedicated to facilitating well-informed decisions regarding your home financing options with the help of the VA entitlement calculator. We know how overwhelming this process can be, and our not only simplifies the mortgage journey but also enhances your overall experience as you seek to utilize your benefits. We’re here to support you every step of the way.

Real-Time Updates: Keeping Users Informed on VA Benefits

The VA entitlement calculator from F5 is continually updated to reflect the latest changes in VA loan policies and benefits. We understand how important it is for you to have access to precise and prompt information, empowering you to make informed choices based on the most current guidelines. By prioritizing your awareness, F5 Mortgage enhances your overall experience and fosters trust and confidence among its clientele.

As Chris Van Hollen mentioned, “The VA Home Loan has been assisting servicemembers in purchasing homes for more than 80 years, yet this funding resource continues to be significantly underused by far too many of our former military personnel.” We know how challenging it can be to navigate these options, and timely updates significantly influence VA loan decisions. They enable borrowers to effectively explore their choices and secure favorable terms.

With the upcoming on May 1, 2025, the importance of real-time information is underscored. This change directly impacts the financial well-being of veterans and their families. F5 Financing is dedicated to connecting clients with leading real estate agents and ensuring you obtain the best loan offers available.

To maximize the advantages of the VA entitlement calculator, we encourage you to stay informed about your VA benefits. By using the VA entitlement calculator regularly, you can maximize your home financing options. Remember, we’re here to support you every step of the way.

Integration of Loan Options: Exploring Diverse Financing Avenues

Navigating the mortgage process can feel overwhelming, especially for service members. The F5 Mortgage VA entitlement calculator serves as a valuable resource, providing not only entitlement calculations but also a comprehensive review of various financing options tailored to your unique financial situation. Imagine being able to explore choices like fixed-rate mortgages, FHA programs, and VA programs, all designed to meet your needs. This holistic approach empowers you to make informed comparisons among different financing options, ensuring you choose the most suitable path for your future.

With VA financing, you can enjoy complete funding and eliminate mortgage insurance costs, which may help lower your monthly expenses and make homeownership more accessible. It’s essential to stay informed about current trends in VA financing, as we’ve seen a rise in average amounts and a steady demand, even with fluctuating interest rates. Yet, it’s concerning that only 10 to 15 percent of qualified service members currently take advantage of these valuable . This highlights a pressing need for increased awareness and education.

We know how challenging this can be, but financial advisors emphasize the importance of understanding your choices. We’re here to support you every step of the way, encouraging you to take action and explore the opportunities available to you. By doing so, you can unlock the door to homeownership and secure a brighter future for you and your family.

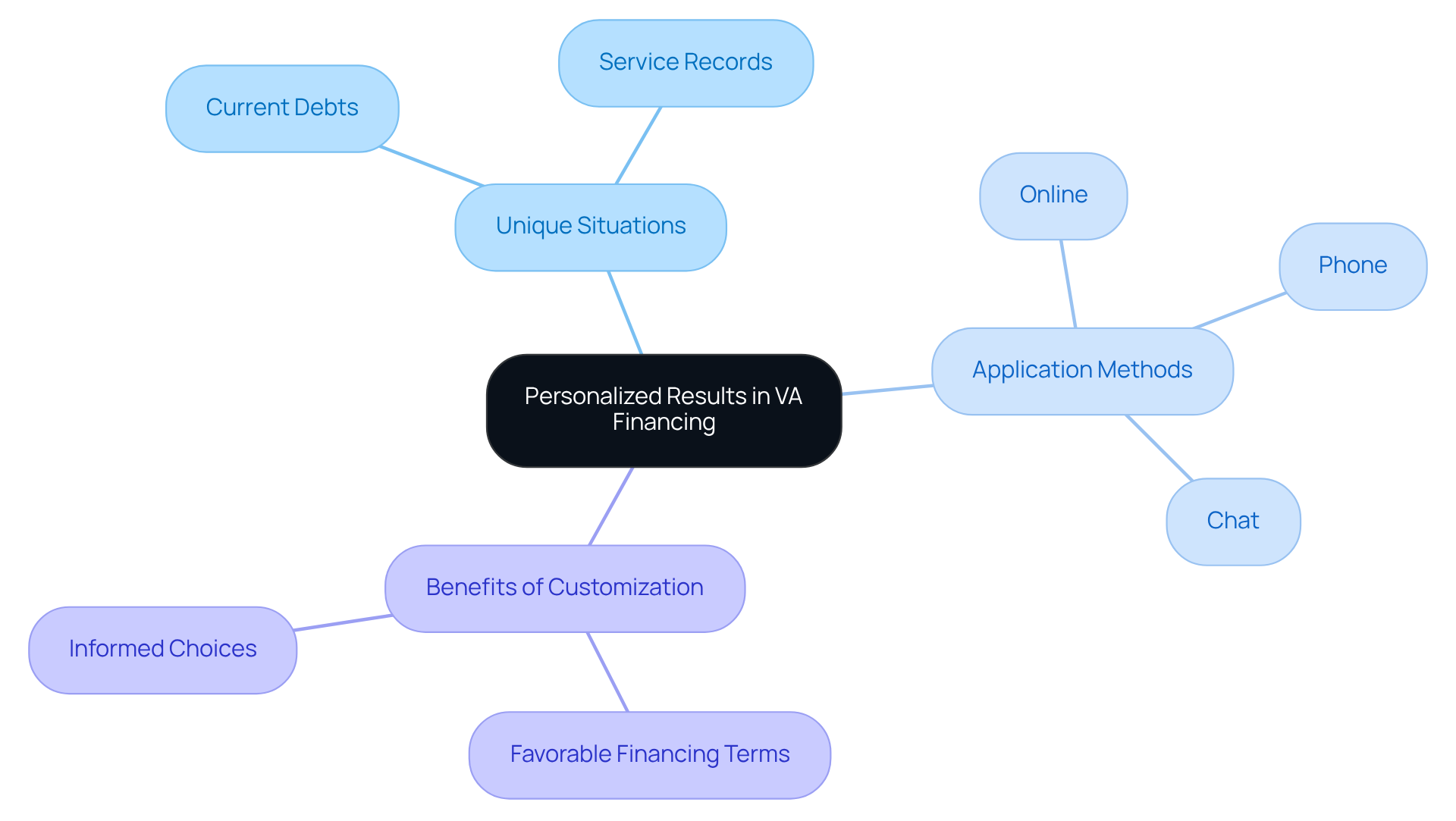

Personalized Results: Tailoring Calculations to Individual Needs

The VA entitlement calculator from F5 Mortgage provides personalized results that accurately reflect your unique situation. We understand that navigating finances can be challenging, especially when considering factors like current debts and service records. This VA entitlement calculator generates figures that accurately reflect the distinct financial circumstances of former service members, empowering you to make informed choices about your home financing options.

At F5 Mortgage, we believe in the importance of personalized financial solutions. Our convenient application options—whether online, by phone, or through chat—ensure that you receive the support you need throughout the process. Financial advisors emphasize that understanding your personal situation is crucial. It allows for more accurate financing alternatives that align with your needs as a former service member.

Statistics show that those who utilize customized mortgage options are often in a better position to secure favorable financing terms. This can significantly enhance your home purchasing experience. By grasping how individual factors influence VA financing calculations, you can take full advantage of the VA Home Loan Guaranty. We’re here to support you every step of the way, helping you make that align with your homeownership goals.

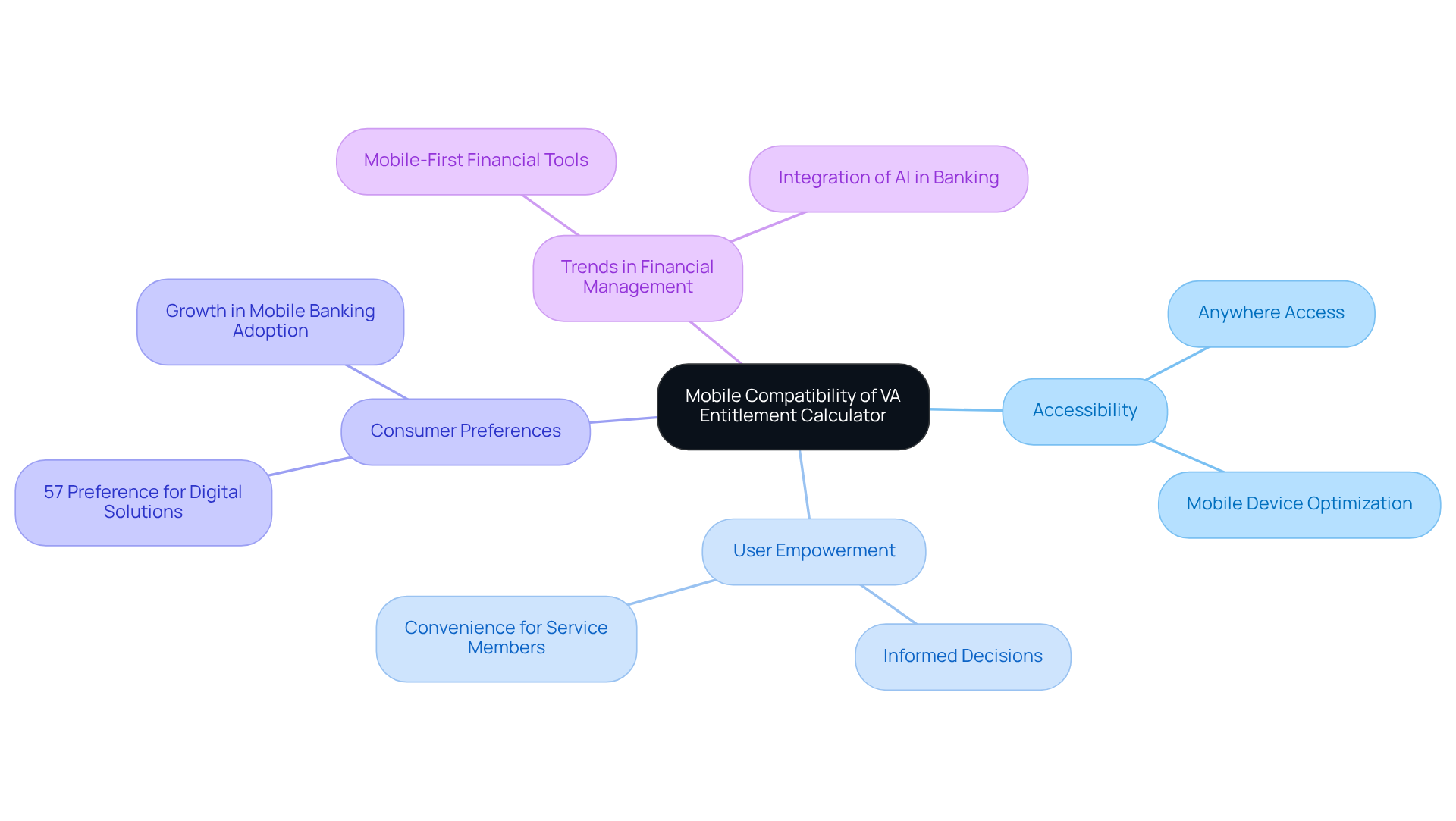

Mobile Compatibility: Accessing VA Entitlement Calculations Anywhere

The va entitlement calculator is thoughtfully designed for mobile devices, allowing you to access it anytime and anywhere. This mobile optimization is essential for those who need to use the va entitlement calculator to calculate their VA loan entitlement while on the go, whether at home or deployed. By focusing on mobile access, F5 Mortgage enhances convenience and engagement for service members, helping you manage your home financing needs effectively.

We know how challenging this can be, and tech experts emphasize that mobile compatibility in financial tools streamlines your experience. It empowers you to make informed decisions quickly. As mobile banking continues to grow, with 57% of consumers preferring digital solutions, having access to mortgage calculators on mobile devices becomes increasingly vital.

This trend signifies a wider movement towards mobile-first financial management. Tools such as the va entitlement calculator are essential for simplifying complex calculations and improving accessibility for service members. We’re here to support you every step of the way in .

Customer Support Features: Assisting Users with Their Queries

At F5 Mortgage, we understand how challenging navigating the mortgage process can be, especially for our veterans. That’s why we provide comprehensive customer support features, which include the VA entitlement calculator, to assist you every step of the way. Our live chat, email support, and dedicated helpline are always available to address any questions or concerns you may have, ensuring you feel supported throughout your journey.

Our commitment to exceptional customer service is reflected in the positive feedback we receive from clients. Testimonials highlight the personalized guidance provided by our loan officers, like Jeff and John, who take the time to understand your unique needs. This concierge approach simplifies lender interactions, making sure that every client feels valued and well-informed.

We know how important it is for you to have a trusted partner in this process. With our by your side, you can move forward with confidence, knowing that we are here to support you at every turn.

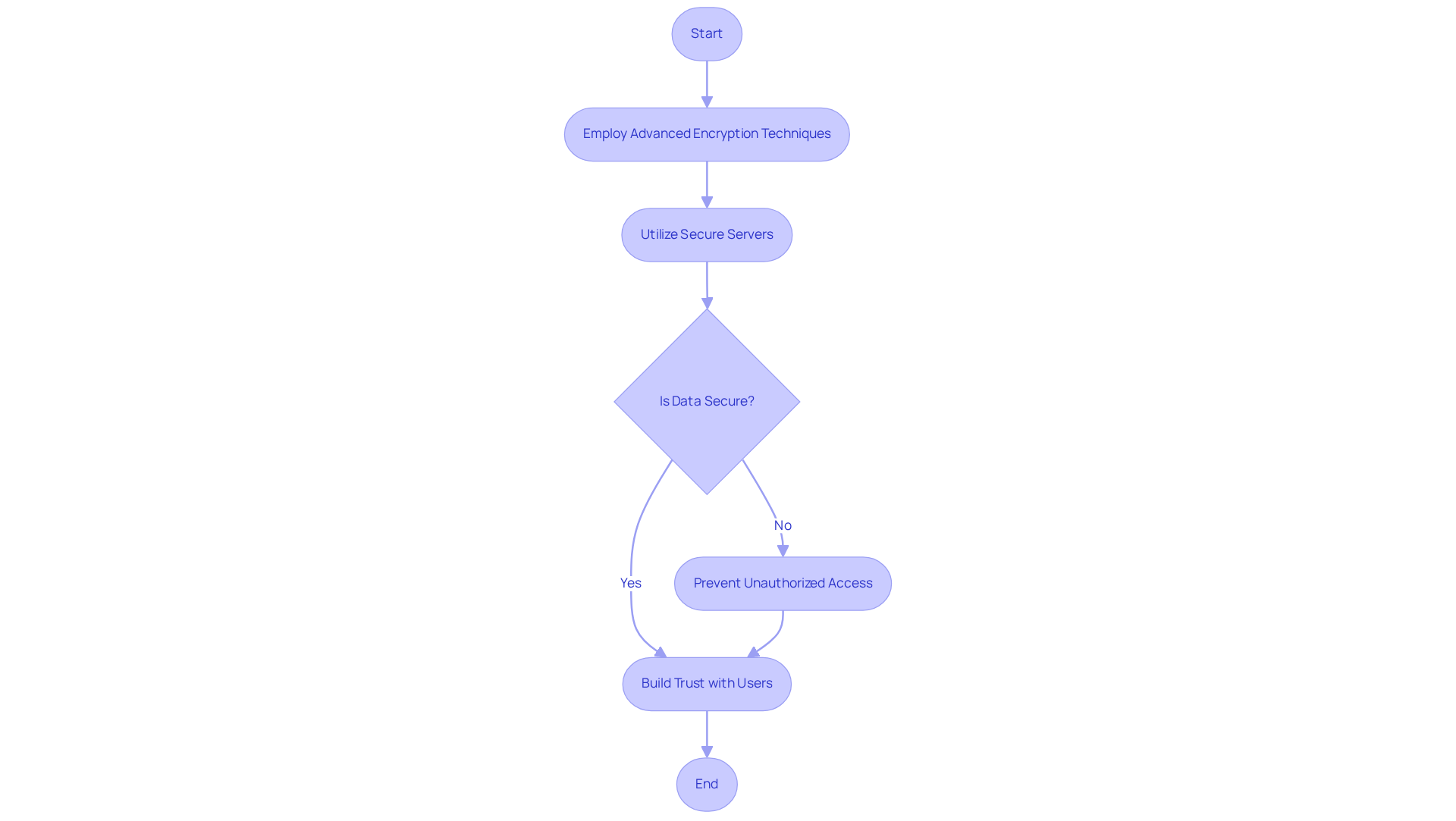

Security Measures: Protecting User Data in VA Entitlement Calculators

At F5, we understand how important your personal information is, especially when it comes to financial matters. That’s why the VA entitlement calculator by F5 is designed with strict security protocols to ensure your data remains safe. By employing advanced encryption techniques and utilizing secure servers, we protect all personal information entered, effectively preventing unauthorized access.

In today’s world, where the risk of data breaches is a growing concern, this commitment to data security is crucial. Cybersecurity specialists emphasize that strong security measures are vital for preserving trust, particularly in tools that manage sensitive information. As cybersecurity expert Ike Suri points out, ‘There truly is a rise in cyber crime that has impacted the mortgage industry.’

By prioritizing these security measures, F5 Finance not only enhances your experience but also builds trust, enabling you to use the VA entitlement calculator with peace of mind. With over 1,000 families helped and a of 94%, F5 Mortgage demonstrates its reliability and commitment to protecting your data while providing efficient services. We know how challenging this process can be, and we’re here to support you every step of the way, including a fast closing process for most loans.

Conclusion

The F5 Mortgage VA entitlement calculator is a vital resource for service members seeking to navigate the complexities of home financing. We understand how challenging this can be, and this calculator simplifies the process of determining eligibility and potential borrowing amounts. It empowers users to make informed decisions tailored to their unique financial situations. With features like real-time updates, personalized results, and a user-friendly interface, it enhances the experience of accessing VA loan benefits.

Key features of the VA entitlement calculator include:

- Mobile compatibility

- Accurate data input requirements

- Comprehensive resources that support users in understanding their financing options

The emphasis on security measures reinforces the trustworthiness of this tool, ensuring that sensitive information remains protected. By integrating diverse loan options and providing dedicated customer support, the calculator enables veterans to explore all available avenues for homeownership.

Ultimately, utilizing the F5 Mortgage VA entitlement calculator is not just about accessing benefits; it unlocks opportunities for service members to achieve their homeownership dreams. As the housing market continues to evolve, staying informed and utilizing such tools can significantly impact financial planning. We encourage service members to take full advantage of this resource, ensuring they navigate their home financing journey with confidence and clarity.

Frequently Asked Questions

What is the purpose of the F5 Mortgage VA entitlement calculator?

The F5 Mortgage VA entitlement calculator helps service members access their VA loan benefits by allowing them to quickly assess their eligibility and potential borrowing amount through a streamlined process.

How does the calculator help service members in California’s housing market?

The calculator provides timely and accurate information regarding VA loan eligibility and financing limits, which is crucial in California’s competitive housing market, where the average VA loan amount is around $500,000.

What are some key features of the F5 Mortgage VA entitlement calculator?

The calculator features a user-friendly interface, mobile compatibility, and validation features to ensure accurate data input, minimizing errors and enhancing the overall user experience.

What should users do to ensure accurate results when using the calculator?

Users should gather their financial information beforehand, review the latest VA guidelines to understand eligibility requirements, and consider consulting with a mortgage professional for personalized advice.

How does the calculator support veterans in understanding their home financing options?

By providing clear instructions and straightforward input fields, the calculator simplifies complex calculations, empowering veterans to make informed decisions about their home financing.

What is the significance of accurate data input in the VA entitlement calculator?

Accurate data input is crucial for reliable calculations, as it directly affects the evaluation of VA entitlement, borrowing capacity, and mortgage terms, helping veterans to make informed financial choices.

Can the F5 Mortgage VA entitlement calculator be accessed on mobile devices?

Yes, the calculator is mobile compatible, allowing users to access it anytime and make informed decisions on the go.

What additional support does F5 offer during the refinancing process?

F5 offers competitive rates, access to a large network of lenders, and dedicated support throughout the refinancing process to ensure users receive the best possible terms tailored to their needs.