Overview

This article aims to help families navigate the often complex world of home equity loans by identifying the key factors that influence interest rates. We know how challenging this can be, so let’s explore the elements that matter most:

- Credit scores

- Loan-to-value ratios

- Market trends

- Lender comparisons

Understanding how each of these factors affects the rates you might receive can empower you to make better financial decisions. For instance, a strong credit score can significantly lower your interest rate, while being aware of current market trends can help you time your loan application effectively.

By recognizing these elements, you can potentially reduce costs when seeking home equity financing. We’re here to support you every step of the way, guiding you toward informed choices that align with your financial goals.

Introduction

Navigating the world of home equity loans can feel overwhelming, especially when trying to grasp the many factors that influence interest rates. We understand how fluctuating economic conditions and diverse lender policies can create a complex landscape for borrowers, significantly impacting their financial decisions.

In this article, we will explore seven key factors that shape home equity loan interest rates, providing insights that empower homeowners like you to make informed choices. As the market continues to evolve, how can you effectively position yourself to secure the best possible terms amidst these changing dynamics? We’re here to support you every step of the way.

F5 Mortgage: Personalized Consultations for Home Equity Loan Interest Understanding

At F5 Mortgage, we understand how challenging property financing can be. That’s why we emphasize tailored consultations to help you navigate the intricacies of interest on home equity loan charges. By carefully evaluating your unique financial situation, our brokerage provides personalized advice that empowers you to make informed decisions.

This customized approach not only clarifies the complexities of interest levels but also significantly enhances your overall mortgage experience. We want you to feel supported and understood throughout the process, as this is crucial for achieving high satisfaction levels.

Our focus on personalized mortgage guidance is a vital element in building trust and loyalty among our clients. Ultimately, this leads to a more favorable experience in your property financing journey. Remember, we’re here to support you every step of the way.

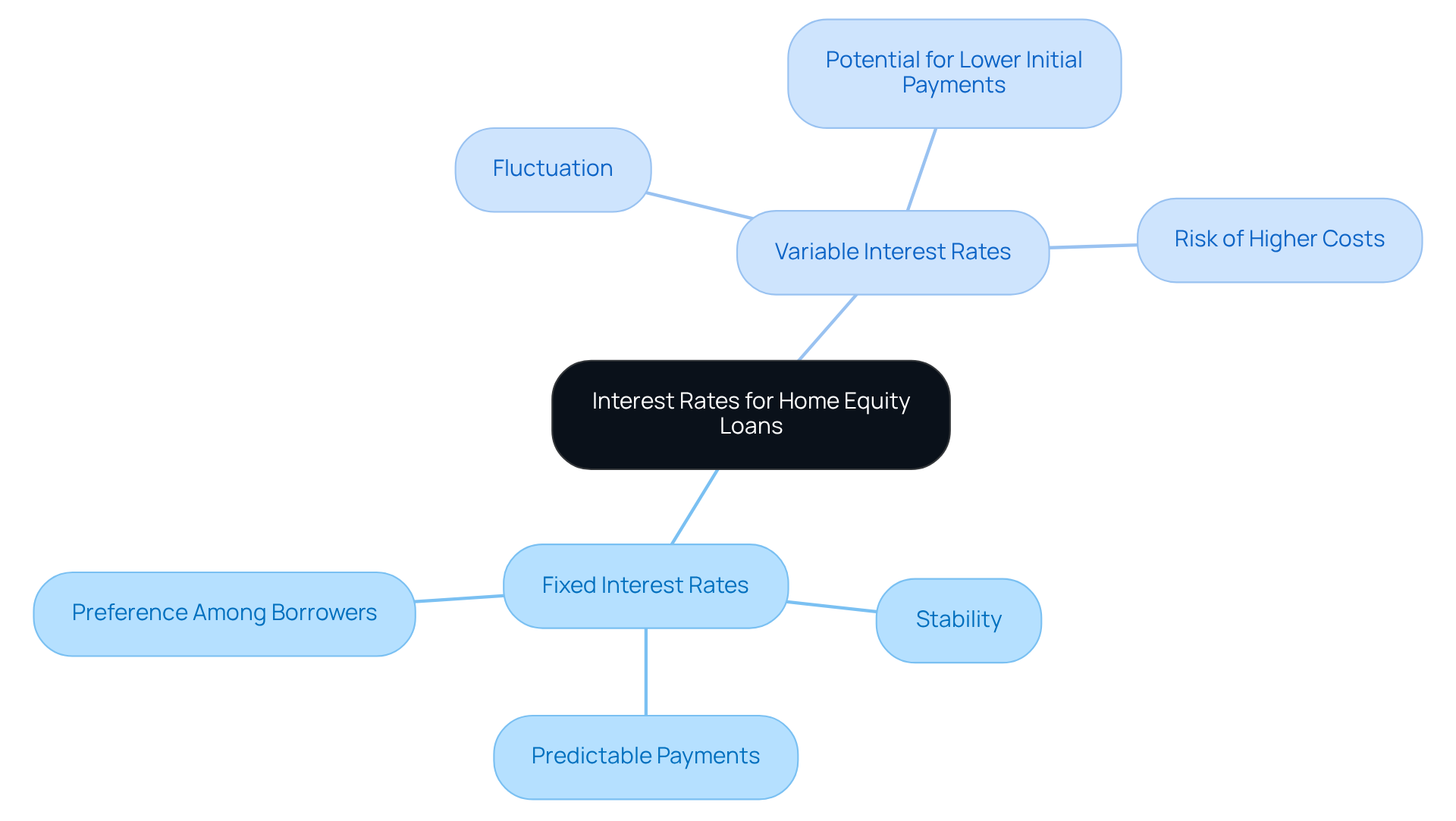

Fixed vs. Variable Interest Rates: Key Differences for Home Equity Loans

Understanding the difference between fixed and variable interest charges is crucial for borrowers contemplating interest on home equity loan options for property financing. Fixed charges offer stability, remaining unchanged throughout the borrowing period. This stability allows for predictable monthly payments, which can ease budgeting concerns. For families planning their finances, this predictability is especially beneficial, as it alleviates the anxiety of fluctuating costs. For example, as of June 2025, the average interest on home equity loan for a 10-year term is 8.42%, giving borrowers a clear expectation of their financial obligations.

On the other hand, adjustable rates can fluctuate based on market conditions, potentially leading to lower initial payments. However, this comes with the risk of higher costs over time if interest rates rise. Borrowers who feel confident in managing these fluctuations may find adjustable terms appealing, but they should weigh this against the potential for financial strain if rates increase significantly.

Statistics reveal a growing preference for fixed terms among borrowers, as many prioritize budgeting certainty to account for the interest on home equity loan. A recent survey indicated that a significant number of homeowners prefer fixed-interest loans for their reliability, particularly in an environment where the interest on home equity loan rates is volatile. Financial advisors often encourage clients to assess their risk tolerance and long-term financial goals when deciding between fixed and variable options. As one expert noted, ‘Choosing the right interest framework is a vital decision that can impact your financial well-being for years to come.’

Ultimately, the choice between fixed and variable options depends on individual circumstances, including financial stability and market outlook. We know how challenging this decision can be, so it’s essential for borrowers to thoughtfully evaluate their options. The right choice can lead to significant savings and peace of mind throughout the borrowing period.

Credit Scores: How They Impact Your Home Equity Loan Interest Rates

Understanding your credit score is crucial when exploring home equity financing options. We know how challenging this can be, but it’s important to recognize that higher credit scores typically lead to lower interest costs. Lenders often view these borrowers as less risky. For instance, those with credit scores of 680 or above are more likely to receive favorable offers, while individuals in the mid-700s often secure the most competitive terms.

To improve your chances of obtaining better financing conditions, it’s essential to regularly review your credit reports and take proactive steps to enhance your scores. Simple actions, like:

- Paying bills on time

- Reducing outstanding debt

- Maintaining a low credit utilization ratio

can make a significant difference. Experts emphasize that even minor improvements in credit scores can lead to substantial savings on interest.

Consider this: a borrower who raises their score from 650 to 700 could potentially save thousands over the life of a credit agreement. By focusing on credit wellness, you can position yourself to access more favorable mortgage rates. We’re here to support you every step of the way as you navigate this process.

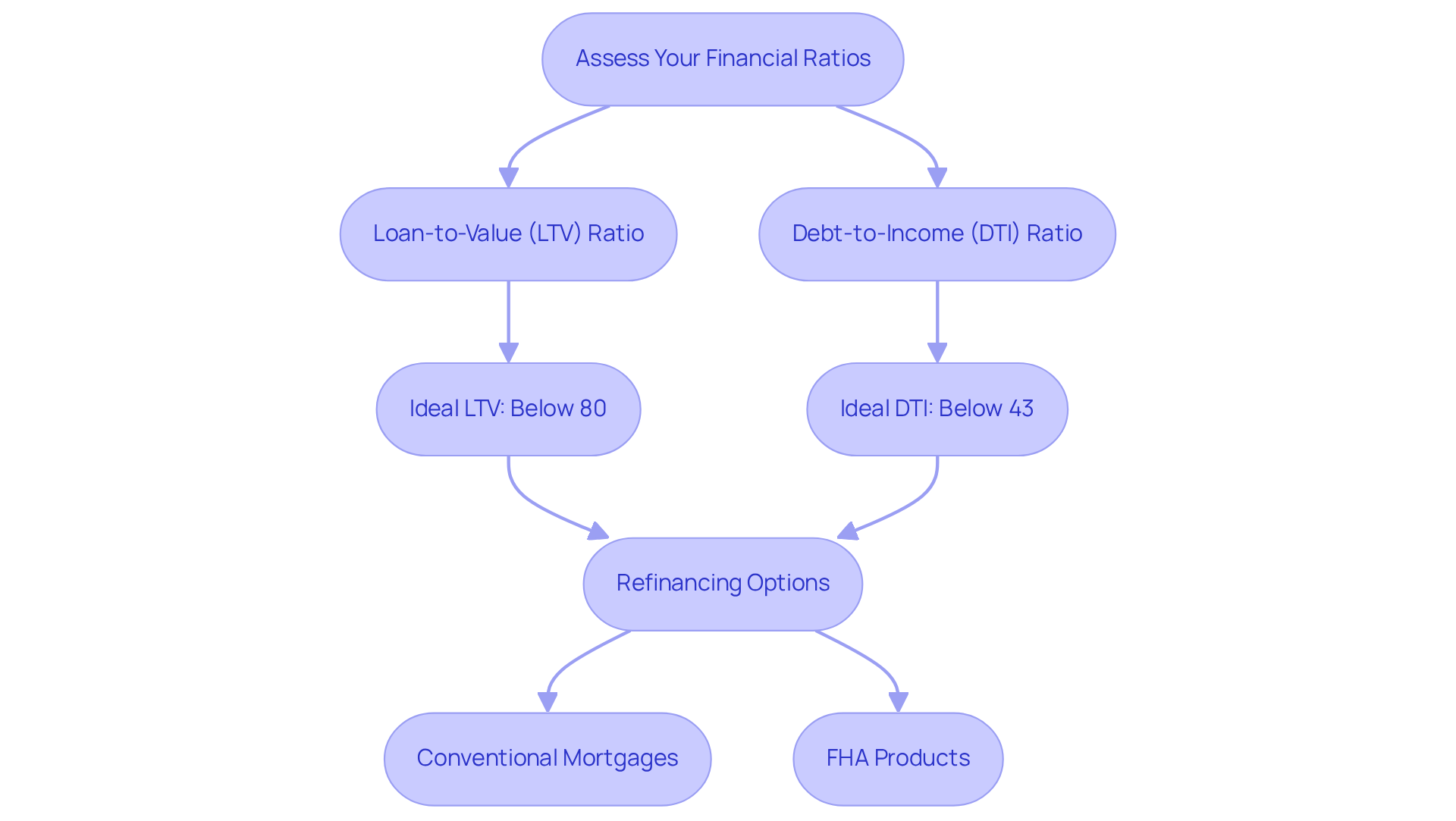

Loan-to-Value Ratios: Assessing Your Equity for Better Interest Rates

The loan-to-value (LTV) ratio is a crucial measure that lenders use to assess the risk of a property-backed advance. It’s calculated by dividing the total amount borrowed by the appraised value of the property. A lower LTV ratio often leads to better interest on home equity loan terms, as it indicates that you have more equity in your home. We know how important it is to secure the best credit terms, so aim for an LTV ratio below 80% to enhance your chances.

Understanding your debt-to-income (DTI) ratio is equally essential when considering refinancing options. Typically, a maximum DTI ratio of 43% is needed for residential financing. By working to improve your DTI, you can unlock more favorable mortgage terms that can ease your financial burden.

In Colorado, you have various refinancing alternatives at your disposal, including conventional mortgages and FHA products. These options can significantly assist homeowners in obtaining better terms and reducing monthly payments. By effectively utilizing both LTV and DTI ratios, you can optimize your property value and secure favorable interest on home equity loans. Remember, we’re here to support you every step of the way in this journey.

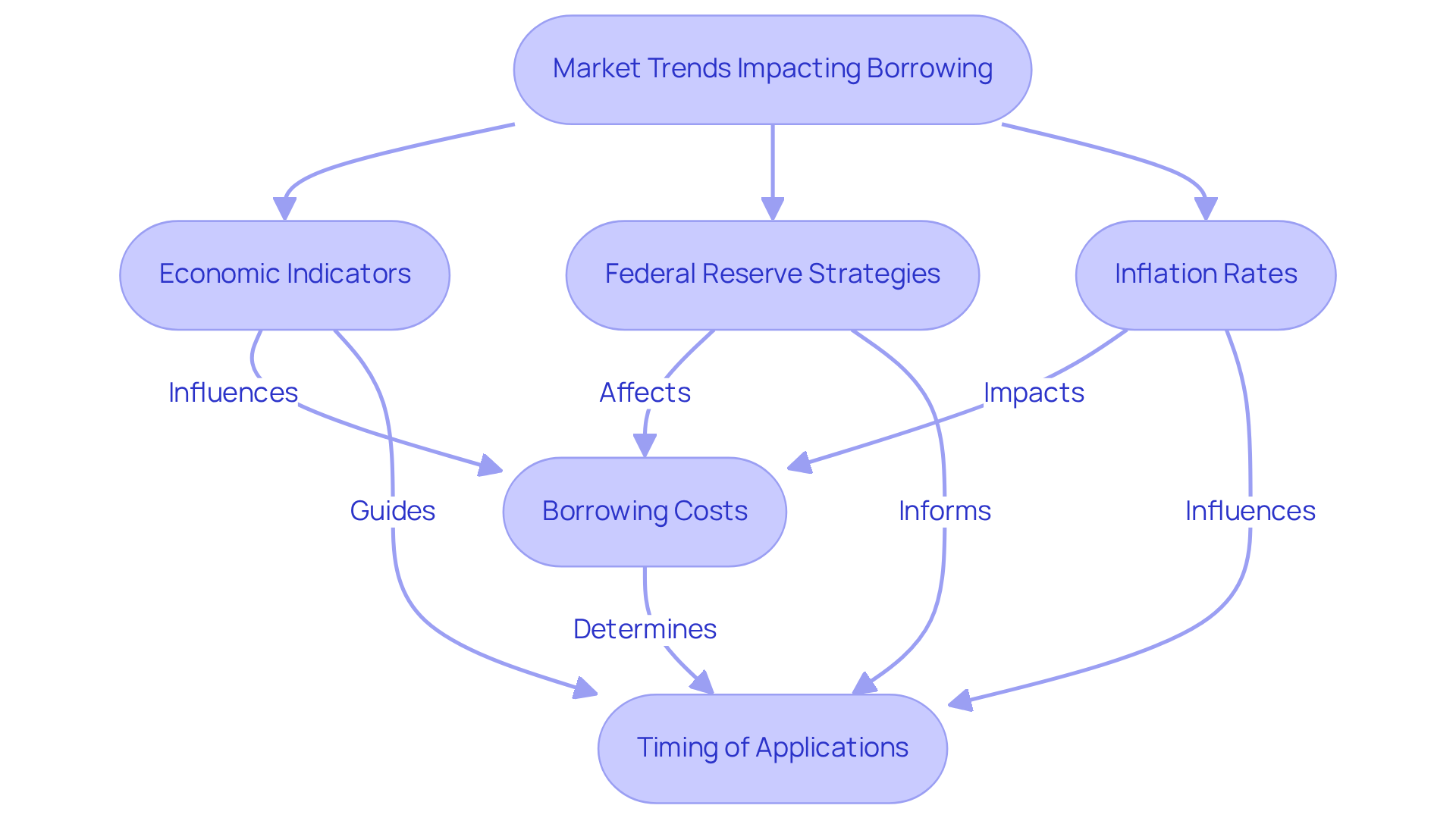

Market Trends: Timing Your Home Equity Loan Application for Optimal Rates

Market trends significantly influence residential borrowing interest levels, and it’s essential for borrowers to stay informed about economic indicators like inflation and Federal Reserve strategies. For example, as of June 18, 2025, residential collateral borrowing costs were recorded at 8.25%, while the typical HELOC charge stood at 8.27%. These rates are closely tied to the federal funds interest, which the Fed is expected to lower twice in 2025, potentially bringing the prime interest down to 7%.

Requesting a mortgage against property during times of declining interest rates can lead to substantial savings throughout the financing period. Historical data reveals that the average 30-year fixed mortgage percentage was 6.67% as of July 3, 2024, indicating a favorable environment for borrowers. Additionally, if inflation eases and stabilizes, home equity borrowing costs may decrease further, creating an opportune moment for prospective borrowers.

Economists highlight the significance of timing in loan applications. Lenders often adjust prices swiftly in response to market changes, and increased competition among lenders can lead to lower costs, especially in a softening property market. By keeping an eye on these trends, borrowers can position themselves strategically to secure the most favorable terms.

Case studies illustrate that borrowers who timed their applications according to market conditions often benefited from reduced costs. For instance, those who applied during the Fed’s earlier reductions in 2024 found themselves in a more advantageous borrowing position. Understanding these dynamics empowers clients to make informed decisions about their property financing, ultimately enhancing their financial outcomes. We’re here to support you every step of the way in navigating this process.

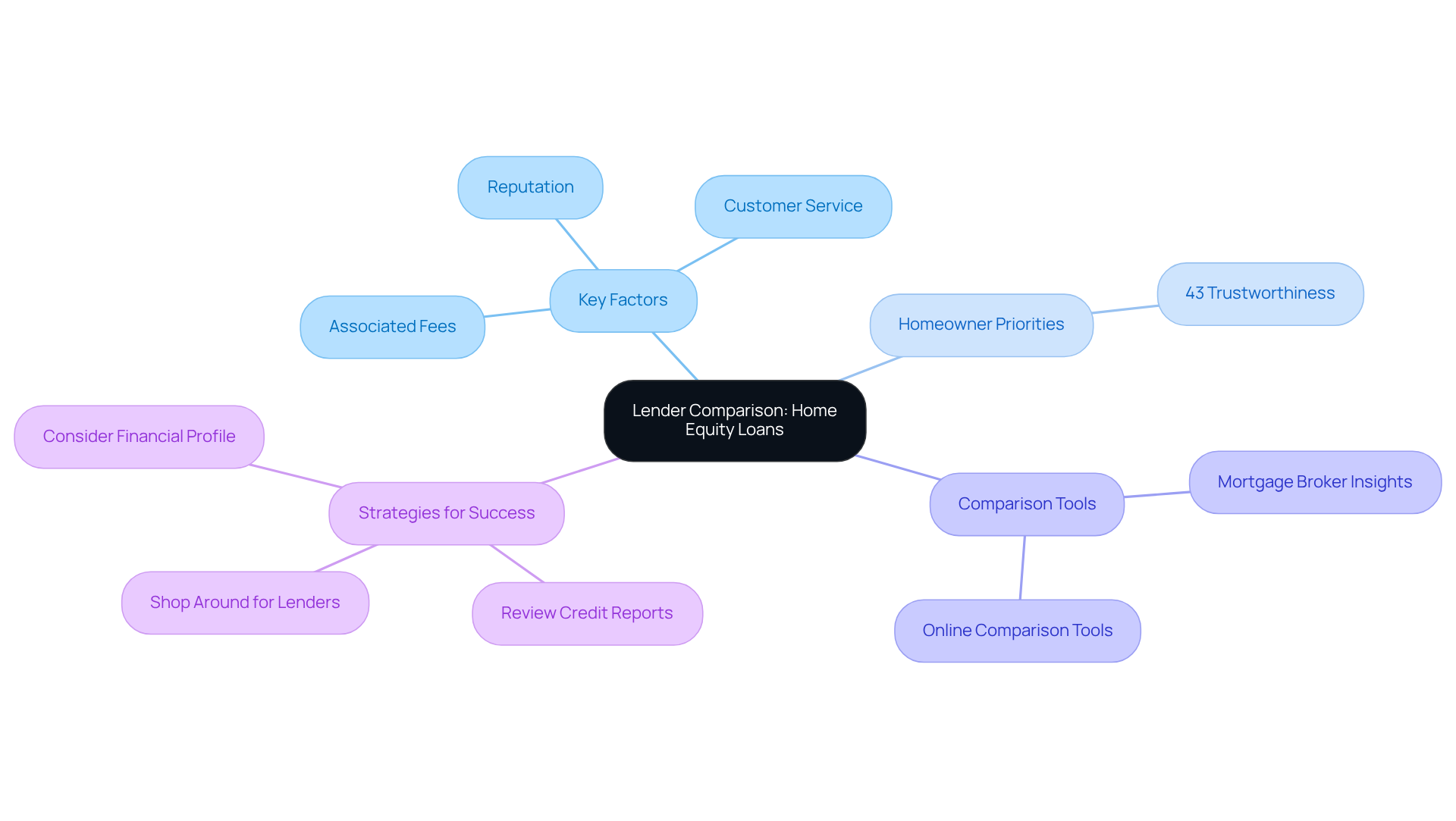

Lender Comparison: Finding the Best Home Equity Loan Interest Rates

When it comes to securing the best terms for interest on home equity loan financing, we understand how important it is for you to evaluate proposals from various lenders. Key factors to consider include:

- The lender’s reputation

- The quality of their customer service

- Any associated fees that could impact the overall cost of your financing

A recent survey shows that 43% of homeowners prioritize a lender’s trustworthiness in their decision-making process, underscoring the significance of partnering with someone reliable.

Utilizing online comparison tools can make this process easier for you, allowing for a quick evaluation of different offers and terms. Additionally, working with a mortgage broker can provide you with personalized insights, helping you find the most favorable loan options tailored to your needs. Experts suggest reviewing your credit reports and improving your credit scores, as those with scores of 740 or above may qualify for significantly lower offers, potentially reducing their costs by half a point.

Real-life examples reveal the benefits of thorough comparison; many borrowers have successfully secured advantageous terms by exploring their options rather than sticking with their current mortgage provider. With interest rates remaining steady, now is an excellent time for homeowners to investigate their options, including the interest on home equity loans, and seize the opportunities available in the current market. By being proactive and informed, you can navigate the complexities of home financing and make decisions that truly align with your financial goals. We’re here to support you every step of the way.

Understanding Costs: Fees and Closing Expenses in Home Equity Loans

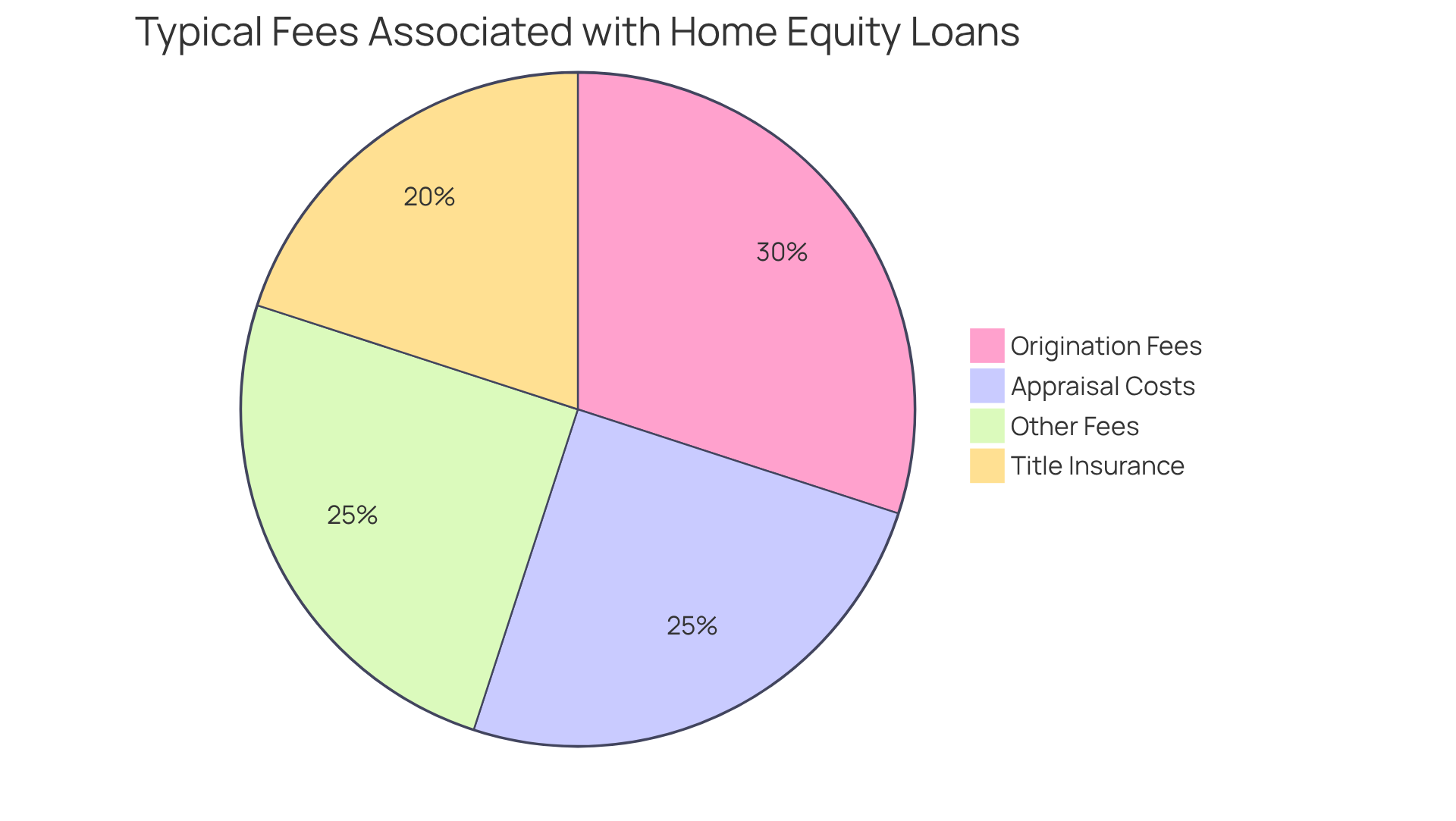

Navigating home equity financing can feel overwhelming, especially when it comes to understanding the various fees and closing costs involved. We know how challenging this can be, and it’s essential for borrowers to consider typical expenses like:

- Origination fees

- Appraisal costs

- Title insurance

Closing costs usually range from 2% to 5% of the borrowing amount, which can add up quickly. To help you tackle these costs effectively, we encourage you to proactively request a detailed breakdown of all associated fees from your lender. This transparency is crucial for making informed decisions.

As Kacie Goff, a personal finance contributor, emphasizes, understanding these costs can empower you to negotiate better terms and potentially save money. For instance, many lenders may be willing to waive or reduce fees for existing clients, especially those with a long-standing relationship. Additionally, by comparing offers from multiple lenders, you can identify the most favorable terms tailored to your needs.

By being knowledgeable and asking the right questions—like which fees can be negotiated—you can significantly impact your overall borrowing costs. Statistics indicate that typical charges linked with property value loans include:

- Appraisal fees, which generally range from $300 to $450

- Title insurance expenses, which can be between 0.5% and 1% of the borrowing amount

Comprehending these numbers aids you in predicting expenses and planning appropriately when seeking a home financing option. Remember, we’re here to support you every step of the way.

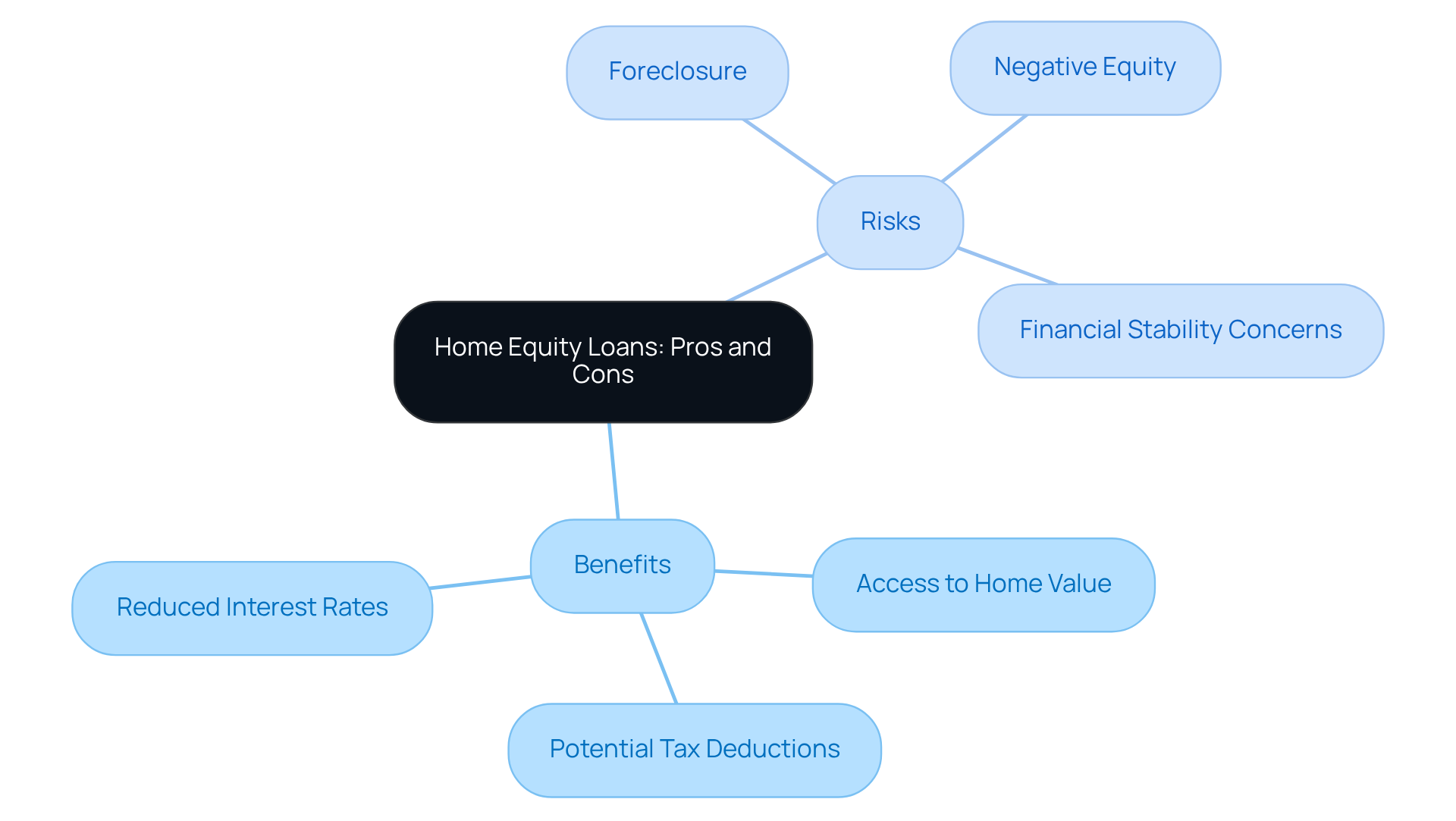

Pros and Cons: Evaluating Home Equity Loans for Your Financial Needs

Home collateral financing offers several benefits, particularly reduced interest on home equity loans compared to unsecured options. This makes them appealing for many borrowers. Additionally, the interest on home equity loans may provide potential tax deductions, further enhancing their attractiveness. However, it’s important to remember that they come with risks. Failing to make timely payments can lead to foreclosure, a serious consequence that should not be overlooked. We know how challenging this can be, which is why financial consultants emphasize the importance of evaluating your financial stability and long-term goals before committing to a property loan.

Recent data shows that merely 0.2 percent of mortgages are underwater, reflecting a substantial recovery in property values. This implies that many homeowners have accumulated value that can be utilized. However, it’s crucial for borrowers to remain vigilant, as the possibility of negative equity still exists, especially if property prices decrease.

Real-life instances illustrate the delicate balance between the advantages and dangers of residential asset financing. For instance, property owners seeking to consolidate high-interest debt may find that the interest on home equity loan options is beneficial. Yet, they must weigh this against the risk of losing their home if they encounter financial difficulties. Seeking guidance from a financial advisor can provide valuable insights into whether a property-backed borrowing option aligns with your personal financial needs and circumstances. Ultimately, understanding the full range of residential financing options—including their benefits and drawbacks—is essential for making informed financial choices. We’re here to support you every step of the way.

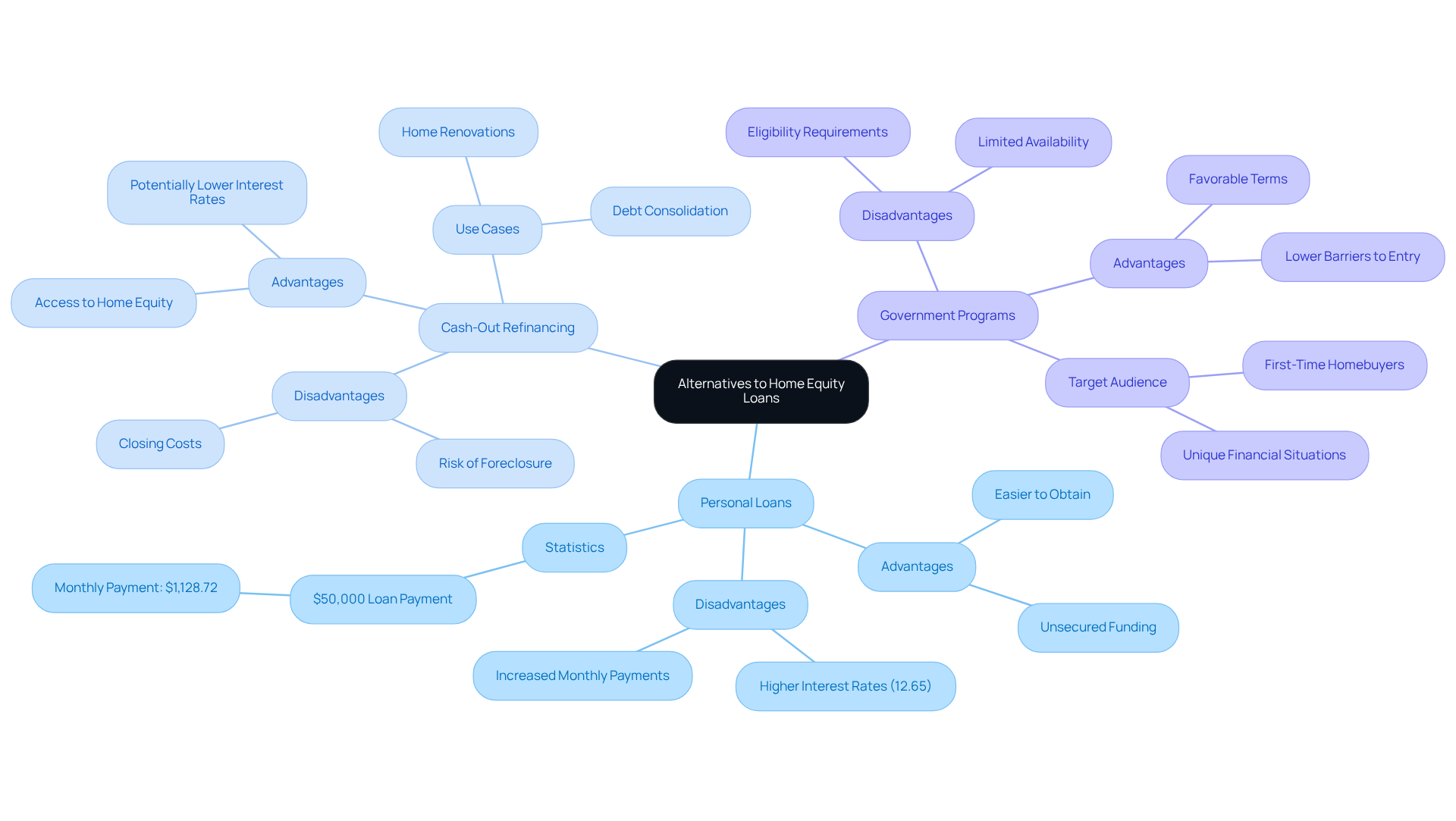

Alternatives to Home Equity Loans: Exploring Other Financing Options

When evaluating funding possibilities, we know how challenging this can be. Borrowers should explore alternatives to property-backed loans, such as personal loans, cash-out refinancing, and government programs. Each of these options has unique advantages and disadvantages that can significantly impact your financial outcomes.

Personal financing options offer unsecured funding, making them easier to obtain without using property value as collateral. However, they often come with higher interest rates, averaging around 12.65% for a $50,000 loan. This can lead to increased monthly payments compared to property-backed loans. For instance, a $50,000 property financing option at 8.25% results in a monthly payment of about $1,019.81 over five years, which is roughly $109 less than the personal financing payment.

Cash-out refinancing allows homeowners to tap into their home equity while potentially securing a lower interest on a home equity loan than personal financing. This option can be particularly beneficial for those looking to consolidate high-interest debt, such as credit card balances, which can have rates nearly three times higher than home financing.

Government programs may also offer viable financing solutions, especially for first-time homebuyers or those facing unique financial situations. These programs often feature favorable terms and lower barriers to entry, making them an appealing alternative.

Consulting with a mortgage broker can be invaluable in navigating these options. As industry experts, brokers can provide personalized advice tailored to your financial circumstances and goals. We’re here to support you every step of the way, ensuring you make informed decisions that align with your long-term objectives. By understanding the full spectrum of financing options, you can choose the path that best suits your needs.

Application Process: Steps to Secure Your Home Equity Loan

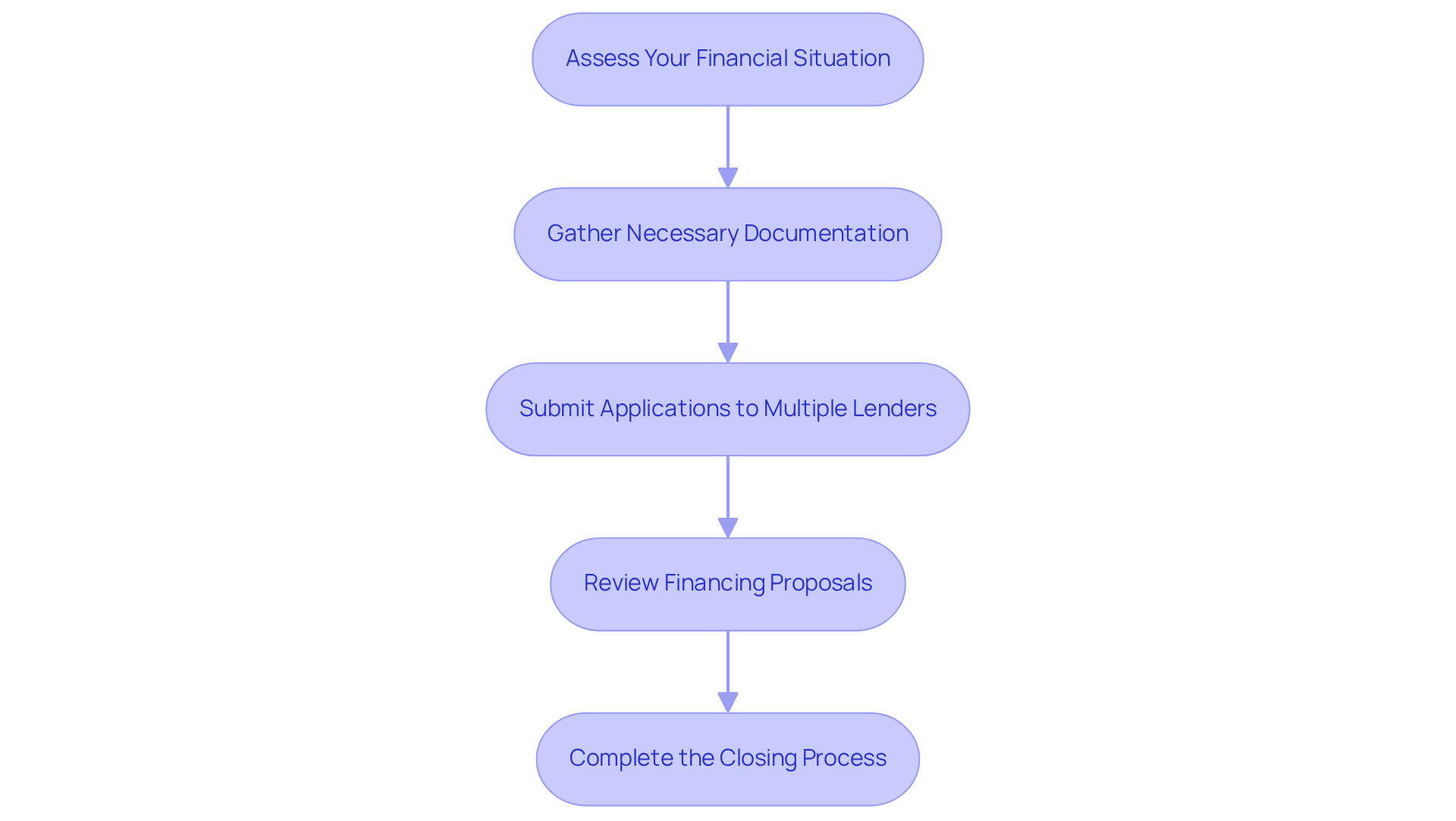

Obtaining a property-backed loan can be a significant step, and we understand how crucial it is to navigate this process smoothly. Here’s a streamlined approach to guide you through each step with care and clarity:

-

Assess Your Financial Situation: Start by evaluating your current financial health. Consider how much ownership you wish to access. Most lenders allow borrowing up to 85% of your home’s equity, so understanding your limits is essential.

-

Gather Necessary Documentation: Compile essential documents, such as proof of income, employment records, bank statements, and details about your property. This preparation is vital, as lenders typically require a comprehensive view of your financial standing.

-

Submit Applications to Multiple Lenders: To discover the best offers and conditions, submit your application to various lenders. This not only provides options but also allows you to compare offers effectively.

-

Review Financing Proposals: Once you receive financing proposals, take the time to carefully evaluate the terms, interest rates, and any associated fees. This step is critical, as it helps you select the most favorable option for your financial situation.

-

Complete the Closing Process: After selecting a lender, finalize the financing by signing the required documents and covering any closing costs. Be prepared for a brief waiting period, as this process typically takes two to six weeks.

Being well-prepared can truly streamline your application process and enhance your likelihood of approval. We know how challenging this can be, and statistics suggest that homeowners with a debt-to-income ratio near 40% and a credit score of 750 or above are more likely to obtain advantageous financing conditions. Additionally, understanding common challenges—such as documentation errors or insufficient equity—can help you navigate potential pitfalls effectively. By following these steps and staying organized, you can approach your home equity loan application with confidence, especially regarding the interest on home equity loan. We’re here to support you every step of the way.

Conclusion

Understanding the factors that influence home equity loan interest rates is crucial for making informed financial decisions. We know how challenging this can be, but the nuances of these factors—like credit scores, loan-to-value ratios, and market trends—play a pivotal role in determining the interest rates borrowers encounter. By grasping these elements, you can better position yourself to secure favorable terms and optimize your borrowing experience.

Key insights from our discussion highlight the importance of personalized financial assessments. The stability offered by fixed interest rates can provide peace of mind, while adjustable rates may present potential variability. Additionally, credit scores and LTV ratios are critical in shaping loan conditions. Staying attuned to market trends and comparing lenders can significantly influence the overall cost of borrowing.

Ultimately, navigating the complexities of home equity loans requires diligence and an understanding of both the benefits and risks involved. By taking proactive steps—such as improving your credit score, comparing lenders, and timing your applications wisely—you can enhance your chances of securing advantageous financing. Embracing this knowledge empowers you to make choices that align with your financial goals, ensuring a more secure and satisfying borrowing journey. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What personalized services does F5 Mortgage offer for home equity loan interest understanding?

F5 Mortgage provides tailored consultations to help clients navigate the complexities of interest on home equity loans by evaluating their unique financial situations and offering personalized advice.

How does F5 Mortgage’s approach enhance the mortgage experience?

Their customized approach clarifies the complexities of interest levels and supports clients throughout the process, leading to higher satisfaction levels and building trust and loyalty.

What are the key differences between fixed and variable interest rates for home equity loans?

Fixed interest rates remain unchanged throughout the borrowing period, providing stability and predictable monthly payments. Variable interest rates can fluctuate based on market conditions, potentially leading to lower initial payments but higher costs over time if rates rise.

Why do many borrowers prefer fixed interest rates for home equity loans?

Many borrowers prioritize budgeting certainty, especially in volatile interest environments, leading to a growing preference for fixed terms due to their reliability.

How do credit scores impact home equity loan interest rates?

Higher credit scores typically lead to lower interest costs, as lenders view these borrowers as less risky. Those with scores of 680 or above are more likely to receive favorable offers.

What steps can borrowers take to improve their credit scores?

Borrowers can improve their credit scores by paying bills on time, reducing outstanding debt, and maintaining a low credit utilization ratio.

How significant can improvements in credit scores be for loan terms?

Even minor improvements in credit scores can lead to substantial savings on interest; for instance, raising a score from 650 to 700 could save thousands over the life of a credit agreement.