Overview

As homeowners navigate the complexities of borrowing against home equity in 2025, it’s essential to understand the main factors influencing HELOC rates. We know how challenging this can be, especially with elements like the prime interest rate, credit scores, and loan-to-value ratios at play. These factors collectively shape the cost of borrowing, and as the Federal Reserve adjusts interest rates, an average HELOC rate of around 7.25% is expected.

This means that homeowners must stay informed about how these changes will impact their borrowing costs. By strategically managing their equity, families can make more empowered financial decisions. Remember, we’re here to support you every step of the way as you navigate these important choices.

Introduction

Understanding the dynamics of Home Equity Lines of Credit (HELOCs) is crucial for homeowners looking to leverage their property’s value in 2025. We know how challenging this can be, especially with average rates projected to hover around 7.25%. The landscape of borrowing is evolving, making it essential to grasp the key factors that influence these rates.

As financial conditions fluctuate, how can homeowners navigate the complexities of HELOCs while ensuring they make informed decisions that align with their financial goals? This article delves into the critical elements affecting HELOC rates, providing insights that empower you to make strategic choices in an ever-changing market.

We’re here to support you every step of the way.

F5 Mortgage: Simplified HELOC Application Process and Competitive Rates

At F5 Mortgage, we understand how challenging the process of securing a home equity line of credit can be. That’s why we offer a simplified application process that allows homeowners to apply easily online, by phone, or through chat. Imagine being able to achieve pre-approval in under an hour—giving you swift access to the funds you need for important projects like home renovations or debt consolidation.

We partner with over twenty leading lenders to guarantee competitive lines of credit tailored to your unique financial situation. In 2025, the average heloc rates are expected to be around 7.25%, the lowest in three years, making this financing option even more appealing.

Our clients have shared positive experiences, highlighting how our user-friendly approach has made borrowing seamless. With a strong track record of 5-star reviews from satisfied clients, F5 Mortgage stands out as a reliable ally for homeowners looking to utilize their equity.

As you consider your options, remember to keep an eye on heloc rates, as fluctuations can impact your upcoming payments. We’re here to support you every step of the way, ensuring you feel confident and informed throughout the process.

HELOC Interest Rates: Factors Influencing Your Borrowing Costs

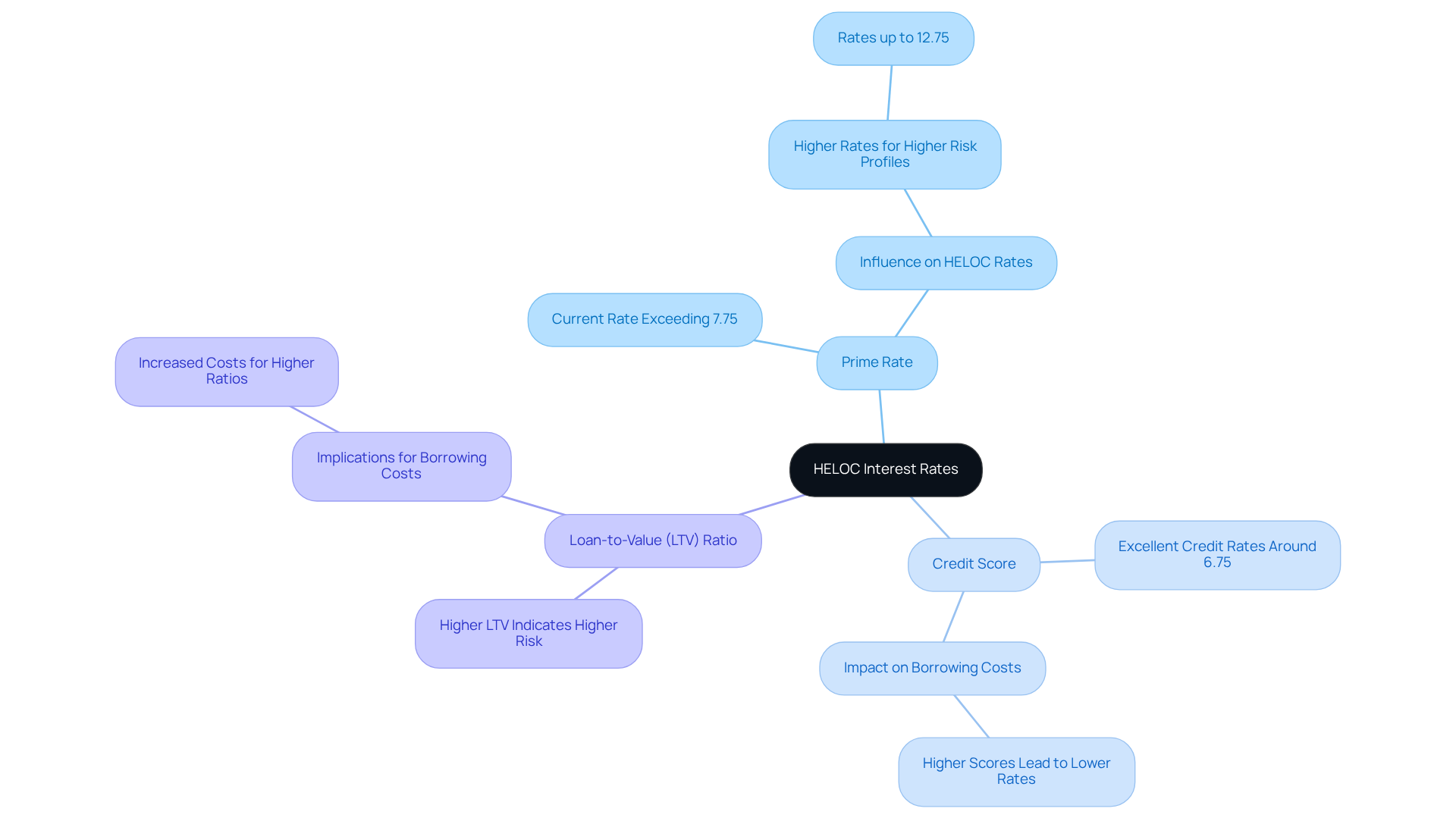

Navigating heloc rates and home equity line of credit interest levels can feel overwhelming, but understanding the key factors involved can help ease your concerns. Interest rates are influenced by essential elements such as the prime rate, your credit score, and the loan-to-value (LTV) ratio. When the Federal Reserve adjusts interest rates, the prime interest typically follows suit, directly affecting heloc rates for your home equity line of credit. For instance, with the prime interest exceeding 7.75% by late 2023, borrowers with higher risk profiles might encounter HELOC charges reaching as high as 10.75% or even 12.75%. On the other hand, those with excellent credit could secure HELOC rates around 6.75%, highlighting the significant role that credit scores play in determining borrowing costs.

Moreover, the LTV ratio is crucial in this equation. If your LTV ratio is higher, lenders may view you as a higher risk, leading to increased costs. Recent trends show that many property owners are sitting on substantial equity, which makes HELOC rates more attractive despite current borrowing costs. We know how challenging it can be to anticipate your borrowing expenses, but understanding these dynamics can empower you as a property owner.

Looking ahead to 2025, financial analysts suggest that while a slight easing in HELOC costs is possible, substantial reductions are unlikely due to ongoing economic challenges. Keeping a close eye on heloc rates and their fluctuations will be essential for property owners considering tapping into their equity. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

HELOC vs. Home Equity Loan: Key Differences in Rates and Terms

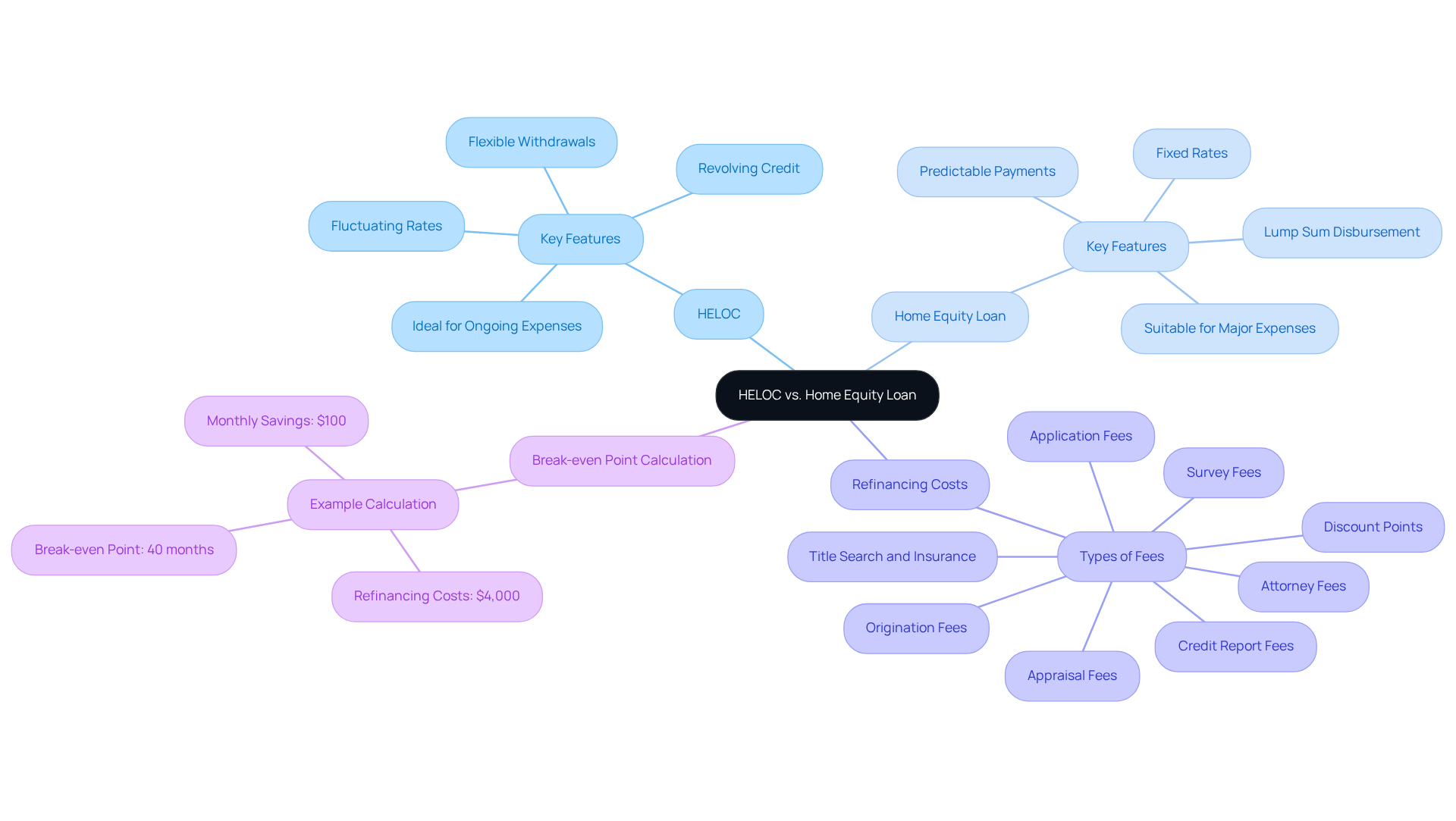

HELOCs and property equity loans provide unique structures and repayment terms tailored to meet diverse financial needs. HELOCs, or Home Equity Lines of Credit, typically feature fluctuating HELOC rates and function similarly to credit cards, allowing borrowers to access funds as needed. This flexibility makes HELOCs ideal for ongoing expenses, such as renovations or unexpected costs. On the other hand, residential equity loans offer a lump sum disbursement with stable interest rates, making them suitable for significant, one-time expenses like major property improvements or debt consolidation. Understanding these differences is essential for homeowners to choose the option that best aligns with their financial goals.

Current trends indicate that by mid-2025, the average HELOC rates will be around 8.27%, while property equity loans are slightly lower at about 8.26%. This minor price variation highlights the competitive landscape among lenders, influenced by factors such as HELOC rates, the Federal Reserve’s monetary policy, and market conditions.

When considering refinancing options, it’s crucial to grasp the costs involved. In California, refinancing typically incurs closing costs ranging from 2% to 5% of the loan amount, which can significantly affect your financial planning. For instance, if you refinance a $300,000 loan, you might encounter closing costs between $6,000 and $15,000. These costs encompass:

- Application fees

- Origination fees

- Credit report fees

- Appraisal fees

- Title search and insurance

- Discount points

- Attorney fees

- Survey fees

Calculating your break-even point—determining how long it will take to recoup these costs through savings in monthly payments—is vital. For example, if your refinancing costs are $4,000 and your monthly savings amount to $100, your break-even point would be 40 months.

Financial advisors often recommend evaluating your personal circumstances and long-term plans when choosing between these options. While HELOCs may present lower initial costs, they can lead to fluctuating payments over time. Homeowners anticipating ongoing costs might benefit more from a home equity line of credit, whereas those with a specific, substantial expense may find a home equity loan more advantageous due to its consistent payment structure. At F5 Mortgage, we provide personalized consultations to help clients navigate these options, ensuring you make informed decisions that align with your financial aspirations. We know how challenging this can be, and we’re here to support you every step of the way.

Pros and Cons of HELOCs: What You Should Consider Before Borrowing

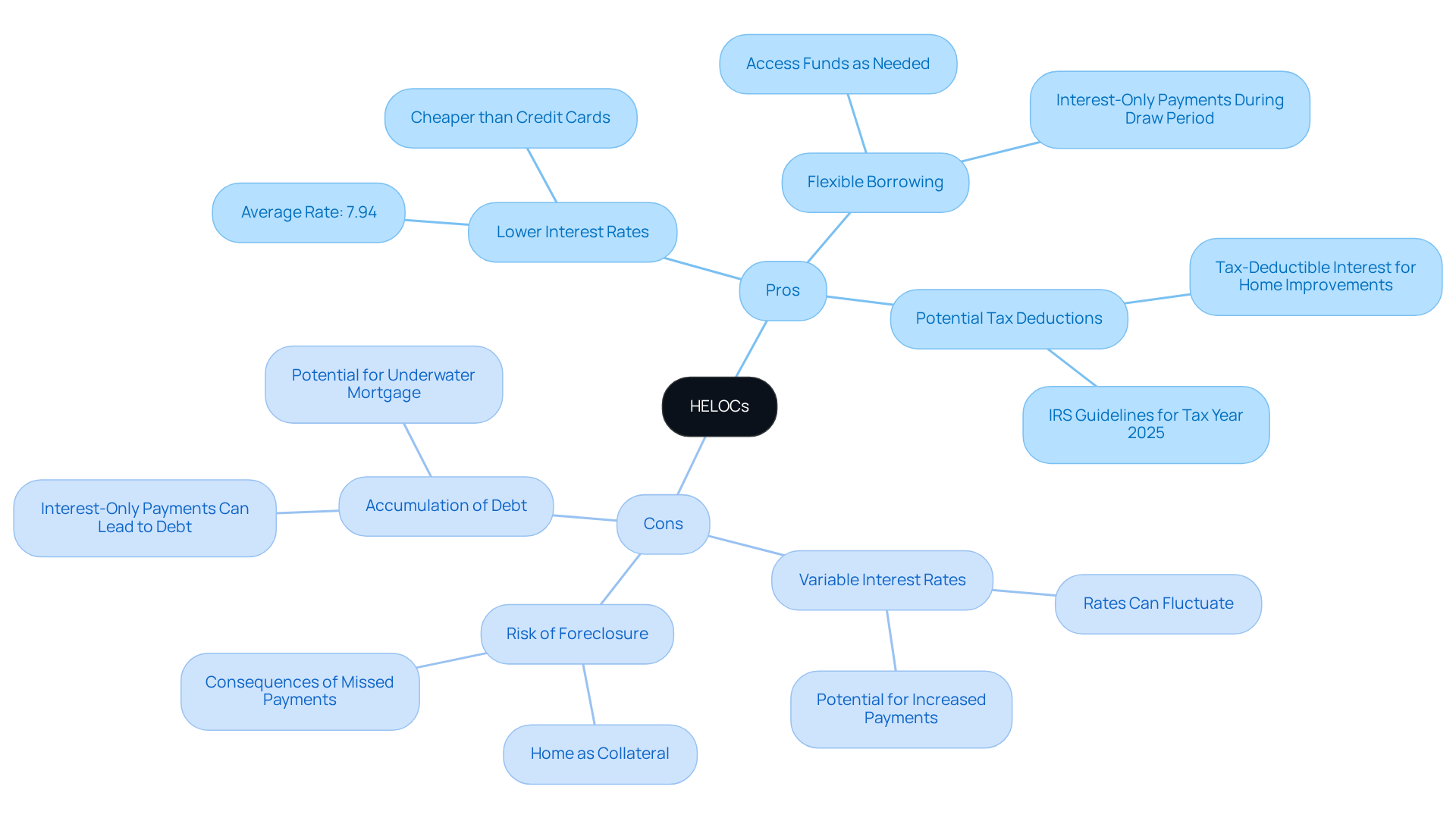

Home equity lines of credit (HELOCs) can be a valuable resource for property owners, offering several advantages that may ease financial burdens. For instance, they typically have much lower average interest rates compared to credit cards, which can soar up to 18%. With HELOC rates currently averaging around 7.94%, they present a more cost-effective borrowing option. Additionally, HELOCs provide flexible borrowing choices, allowing homeowners to access funds as needed, similar to a credit card. There may even be potential tax deductions available if the funds are used for property improvements.

However, we understand that these benefits come with important considerations. The variable interest rates, known as HELOC rates, associated with HELOCs can lead to rising monthly payments over time, especially if market conditions change. It’s crucial for property owners to recognize that failing to make timely payments could result in foreclosure, as the home serves as collateral for the loan. For example, while HELOCs allow for interest-only payments during the draw period—typically lasting 10 to 15 years—borrowers may experience significant payment increases when they transition to the repayment phase, which can extend up to 20 years.

Real-life scenarios highlight these risks: homeowners who do not manage their withdrawals carefully might find themselves accumulating debt quickly, particularly if they depend on interest-only payments. Moreover, borrowing against home equity can diminish an individual’s net worth and reduce their equity cushion, especially if property values decline. Therefore, it is essential for homeowners to thoughtfully assess their financial situation and repayment capabilities before opting for a home equity line of credit. We encourage you to prepare for potential interest increases and the responsibilities that accompany this type of borrowing, ensuring you feel confident and informed every step of the way.

Current HELOC Rates: What Borrowers Can Expect in 2025

As we approach mid-2025, many families may be wondering about the average HELOC rates, which currently hover around 8.27%. Some lenders are offering competitive proposals starting at 7.34%. A favorable interest rate, particularly HELOC rates, is generally considered anything at or below the national average, which sits in the low-8% range as of June. These percentages are shaped by various economic factors, including Federal Reserve policies and market conditions.

For example, anticipated reductions from the Federal Reserve’s upcoming meetings could further influence HELOC rates associated with home equity lines of credit. It’s crucial for borrowers to stay informed during this time. Additionally, fluctuations in property values and individual lender standards can affect the terms available to you. Most lenders typically require:

- A combined loan-to-value ratio of 85% or less

- A credit score of 620 or above

- A debt-to-income ratio under 43%

to qualify for a home equity line of credit.

We understand that navigating these options can feel overwhelming, but it’s important to explore various lenders. For instance, F5 Mortgage is recognized for its competitive offers and personalized service, which can help you uncover the best terms for your situation, potentially leading to significant savings. Recently, a borrower shared their success in obtaining a home equity line of credit at 6.80% APR by thoroughly researching their options. This story illustrates the benefits of taking the time to compare choices.

In summary, grasping the current landscape of HELOC rates and the factors that influence home equity line of credit costs is essential for homeowners looking to make the most of their home equity. Remember, we’re here to support you every step of the way as you explore your options.

Credit Score Impact: How Your Rating Affects HELOC Rates

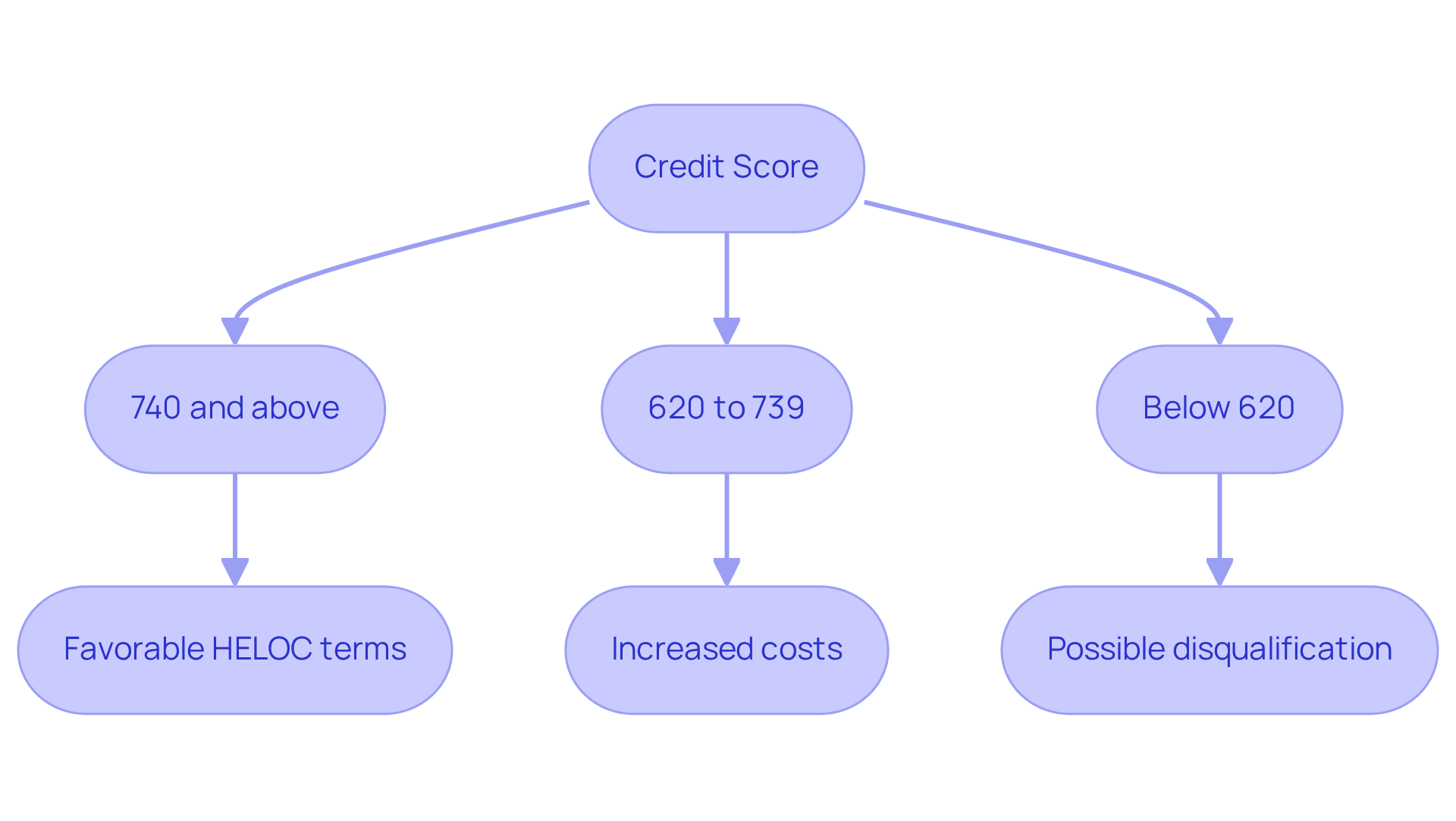

Understanding your credit score is essential when considering a Home Equity Line of Credit (HELOC). We know how challenging this can be, especially when a score of 740 or above typically qualifies you for the most favorable terms. On the other hand, scores under 620 may lead to increased costs or even disqualification, which can be concerning for homeowners.

Regularly checking your credit report is a proactive step you can take. By paying down debt and ensuring timely payments, you can work towards improving your score. Financial consultants emphasize that maintaining a credit score above 740 not only opens doors to reduced interest charges but also provides you with greater flexibility in your borrowing options.

As Greg McBride, chief financial analyst at Bankrate, wisely points out, ‘A credit score of 740 will typically get you the best HELOC rates, although some lenders set the bar even higher.’ Remember, we’re here to support you every step of the way as you navigate this important financial decision.

How to Apply for a HELOC: Step-by-Step Guide

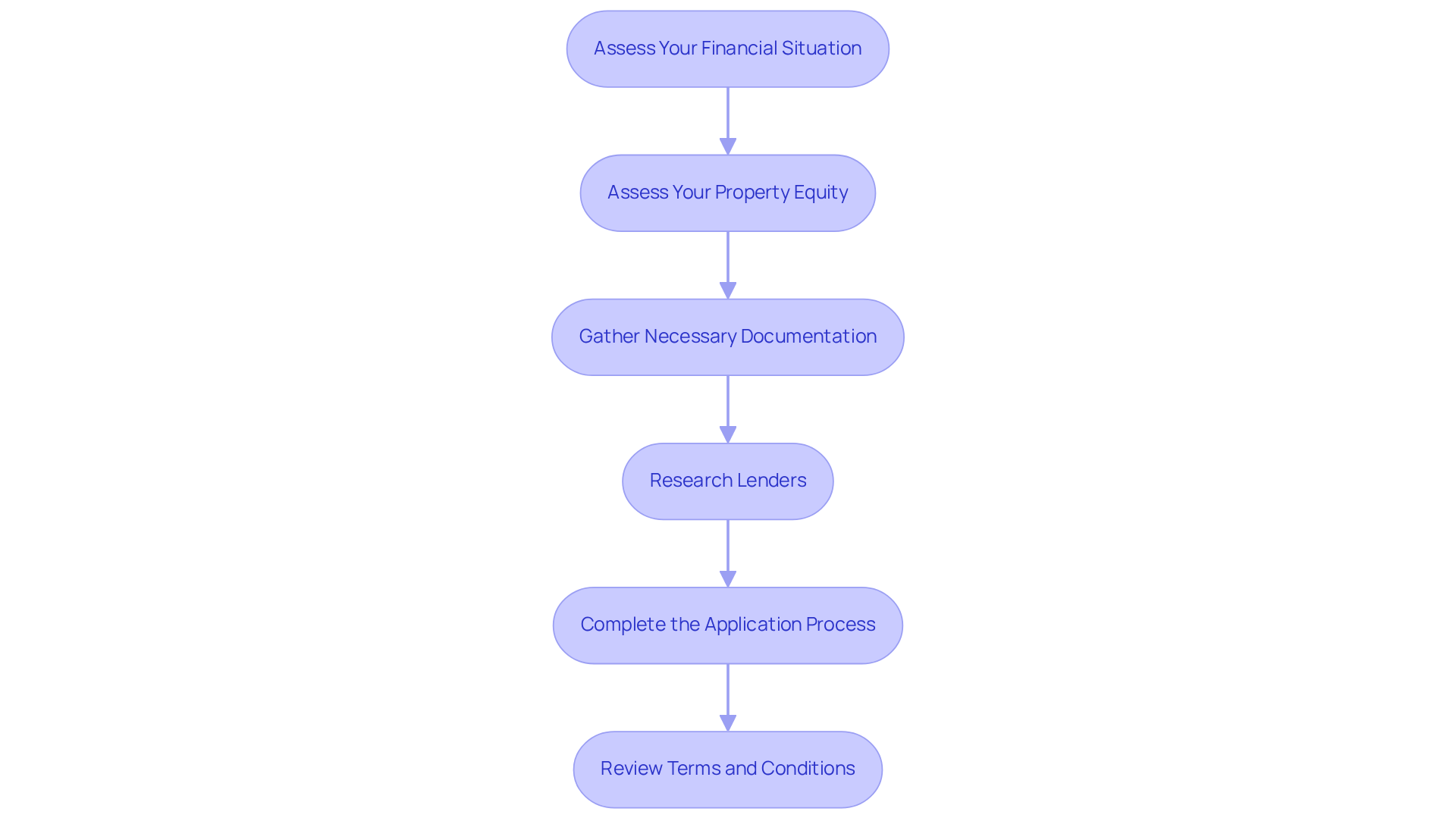

Applying for a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way. By following these essential steps, you can ensure a smoother process and increase your chances of approval:

Assess Your Financial Situation: Start by evaluating your financial health. This includes your credit score and debt-to-income ratio. Most lenders prefer a debt-to-income ratio of 43% or lower, although some may allow up to 50%. You’ll typically need a credit score of at least 680 for HELOC eligibility. To improve your chances, consider ordering a copy of your credit report to check for errors or discrepancies. Paying down existing debts can also help reduce your debt-to-income ratio, making you a more appealing candidate.

Assess Your Property Equity: Next, calculate how much equity you have in your home. Many lenders require property owners to maintain a minimum of 15-20% equity, allowing you to borrow up to 80-85% of your property’s worth. This means you should have paid down at least 20% of your initial loan amount or that your property has appreciated in value. Additionally, be aware that a cash-out home equity loan may have even higher equity requirements.

Gather Necessary Documentation: Preparing essential documents in advance can greatly expedite your application process. Gather your W-2s, bank statements, tax returns, pay stubs, and proof of identification. Typically, the application process takes between 2 to 6 weeks, with the average approval time around 30 days.

Research Lenders: Take the time to explore different options and compare fees and conditions from various lenders. This step is crucial, as interest rates can fluctuate daily. Different lenders may have varying requirements and closing costs, which can range from 2-5% of your maximum credit limit.

Complete the Application Process: When you’re ready, submit your application. This may include a home appraisal to verify its current value. Be prepared for potential waiting times, as some lenders may impose a waiting period of up to 6 months before granting a home equity line of credit.

Review Terms and Conditions: Before signing, carefully examine the terms of the home equity line of credit. Pay attention to interest rates, repayment periods, and any associated fees. Understanding these details about HELOC rates can help you avoid unexpected surprises down the line.

By following these steps and ensuring your financial circumstances are organized, you can simplify the HELOC application process and improve your chances of obtaining the funds you need. Remember, taking proactive steps to improve your credit score can significantly impact your mortgage opportunities. We know how challenging this can be, but with the right preparation, you can navigate this journey with confidence.

Understanding HELOC Fees: What Costs to Expect

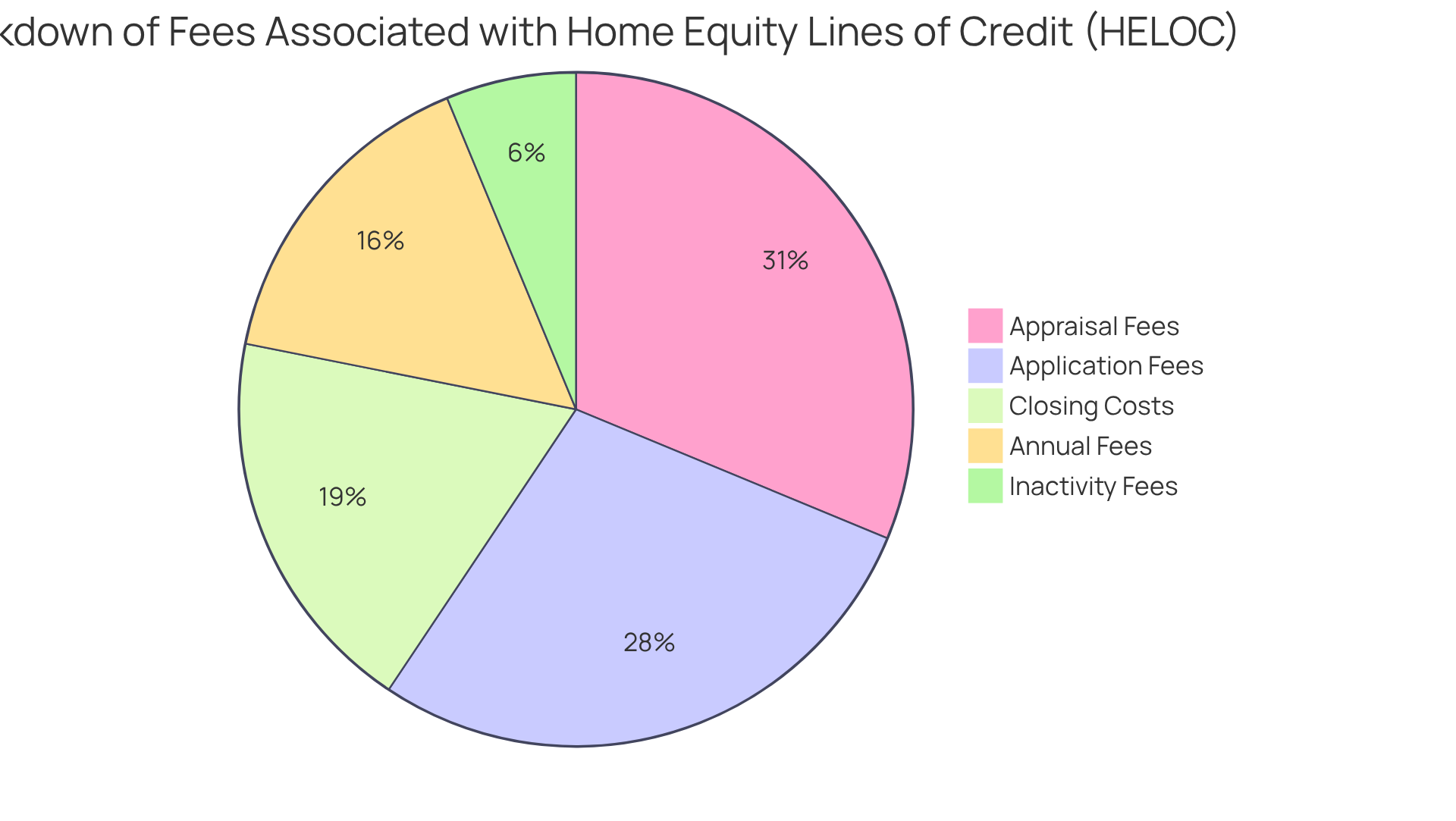

When considering a Home Equity Line of Credit, we understand how challenging it can be to navigate the potential fees that may impact your total expenses, particularly in relation to HELOC rates. It’s important to be aware of common charges, such as application fees, which typically range from $15 to $75. Appraisal fees can also vary, usually falling between $300 and $700 depending on your location. Lenders will request a home appraisal to determine your property’s current market value. This step is crucial as it reveals how much equity you possess, which can significantly influence your overall costs.

Closing costs for HELOCs generally range from 2% to 5% of the loan amount. For instance, if you’re looking at a $300,000 HELOC, closing costs could be anywhere from $6,000 to $15,000. Additionally, some lenders may impose annual fees, typically between $50 and $100, as well as inactivity fees if the line of credit remains unused for a certain period, usually ranging from $5 to $50.

While some lenders may offer HELOCs without closing costs, it’s essential to understand that these options often come with higher HELOC rates or other trade-offs. Understanding these costs upfront is vital for homeowners to budget effectively and avoid unexpected expenses during the borrowing process. By reviewing lender estimates and comparing offers, especially considering F5 Mortgage for competitive rates and personalized service, you can make informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

Flexibility of HELOCs: Borrowing and Repayment Options Explained

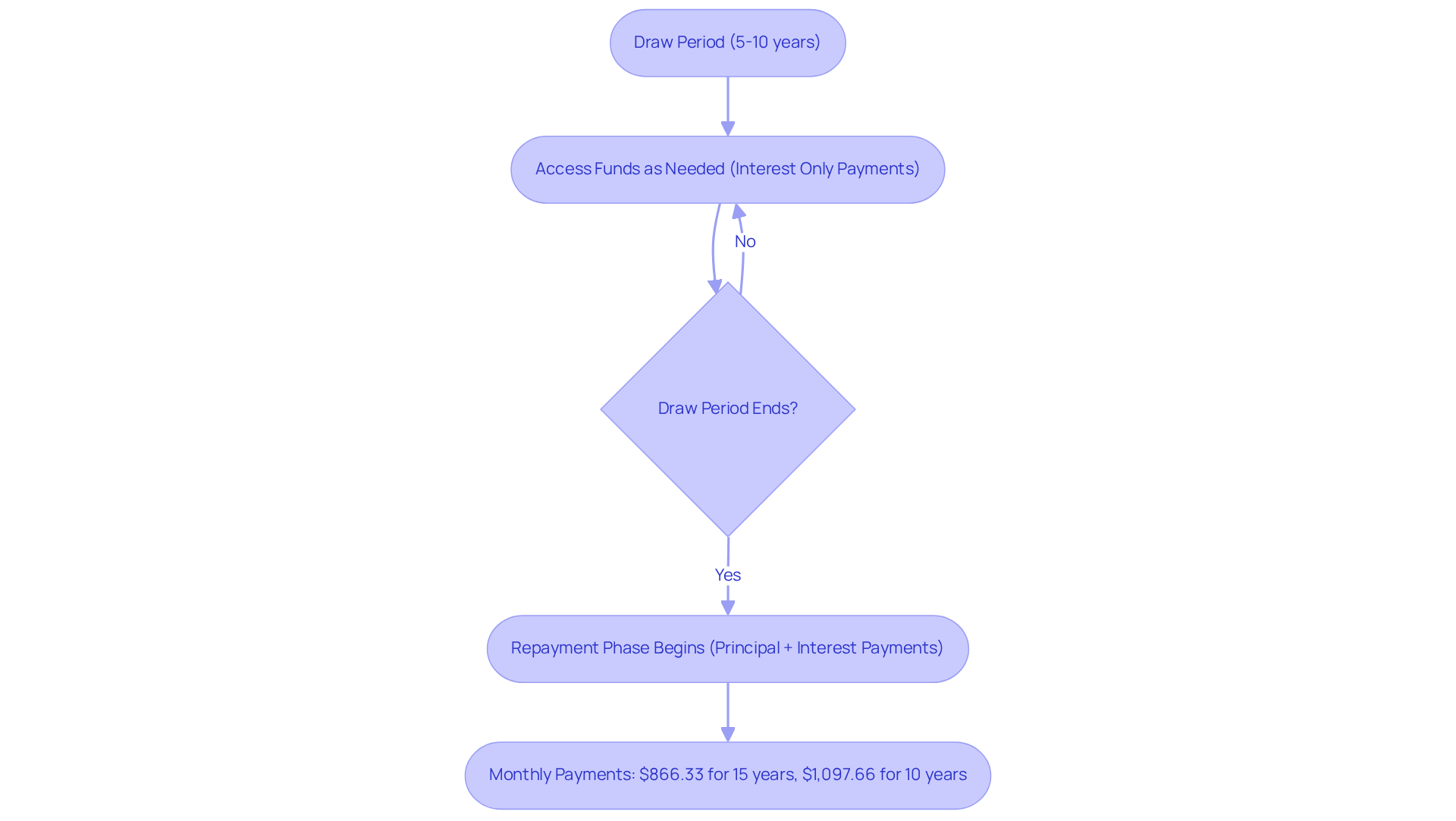

HELOCs provide remarkable flexibility in borrowing and repayment, making them a desirable option for property owners. We understand how challenging managing finances can be, especially during home improvements or debt consolidation. During the draw period, which typically lasts between 5 to 10 years, you can access funds as needed and are only responsible for paying interest on the amount drawn. This feature allows you to manage your cash flow effectively.

When the draw period ends, the repayment phase begins, requiring you to pay back both principal and interest. This transition can be planned strategically, encouraging you to budget effectively for your monthly payments. For instance, if you withdraw $90,000 from a home equity line of credit, your monthly payments may range from approximately $866.33 for a 15-year repayment period to $1,097.66 for a 10-year period, depending on the HELOC rates.

This repayment structure not only provides access to necessary funds but also empowers homeowners like you to make informed financial decisions. We’re here to support you every step of the way, ensuring you can comfortably meet your obligations while leveraging your home equity.

Common Pitfalls of HELOCs: What to Avoid When Borrowing

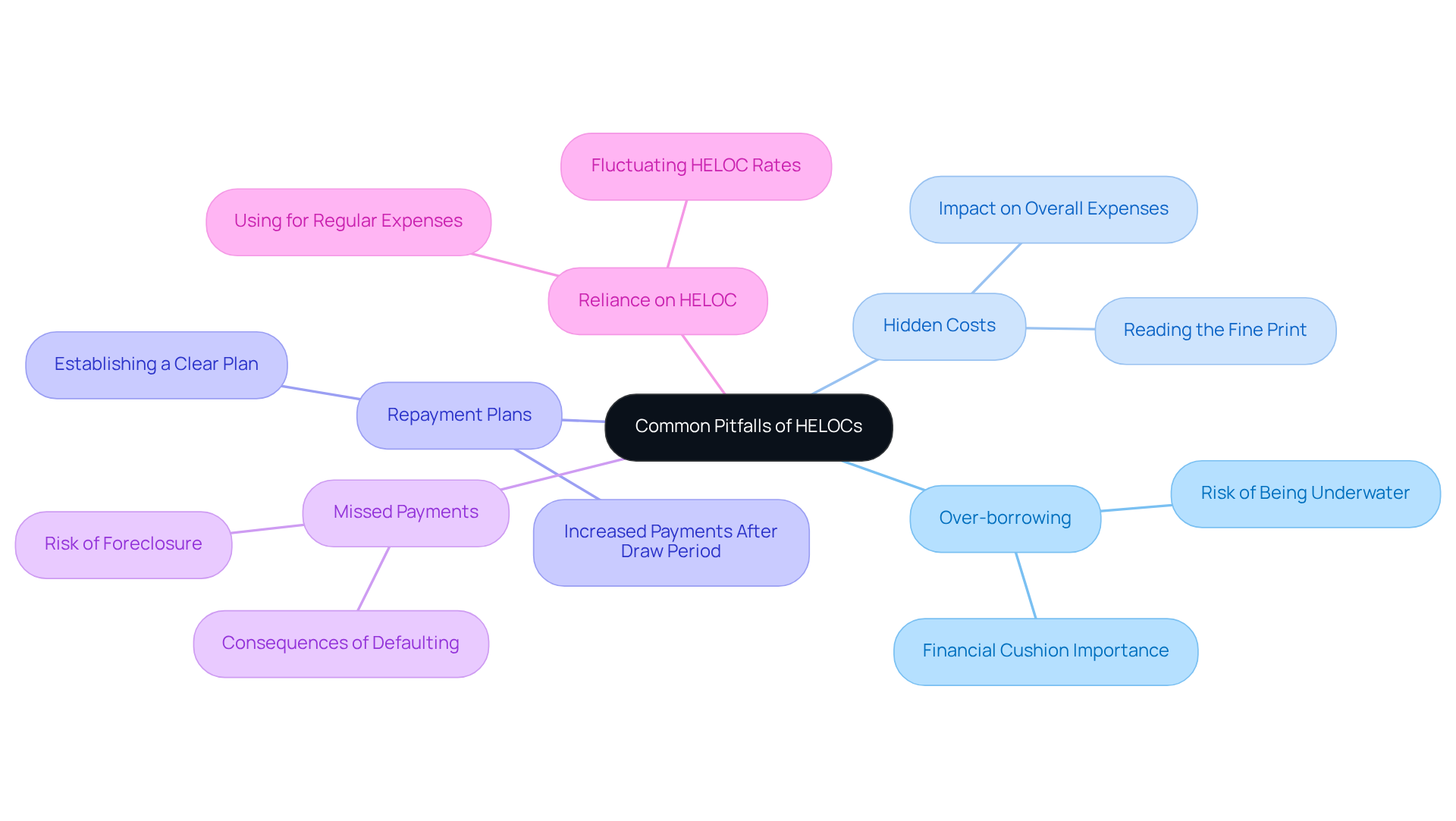

Navigating a Home Equity Line of Credit (HELOC) can be challenging for homeowners, and it’s important to be aware of some common pitfalls. We know how overwhelming it can be, especially when considering the risk of borrowing more than necessary. Over-leveraging can lead to financial strain, particularly if property values decline or interest rates rise. As Becky Conner-McDuffy, a senior loan officer, cautions, over-borrowing can leave homeowners feeling underwater if property values drop.

It’s essential to take the time to read the fine print regarding fees and terms. Hidden costs can significantly impact your overall expenses, and being informed is key to avoiding surprises. Additionally, establishing a clear repayment plan is crucial. Without one, you may face unexpected financial burdens, especially when the draw period ends and payments increase.

Missing payments on a home equity line of credit can have serious consequences, including foreclosure, as highlighted by Kyle Enright, president of lending at Achieve. We understand that relying too heavily on a HELOC for regular expenses can exacerbate financial challenges, particularly in an environment with fluctuating HELOC rates. In fact, total HELOC balances in the U.S. reached $380 billion at the end of Q1 2023, illustrating the growing reliance on this form of credit.

By being aware of these pitfalls, you can adopt a strategic approach. Consulting with financial advisors can empower you to make informed decisions and utilize HELOCs responsibly, ensuring you maintain financial stability. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the various factors that influence Home Equity Line of Credit (HELOC) rates is essential for homeowners looking to leverage their property equity effectively. We know how challenging this can be, and we’re here to support you every step of the way. In 2025, homeowners can expect competitive rates and a simplified application process through institutions like F5 Mortgage. By being informed about the dynamics of interest rates, credit scores, and the differences between HELOCs and home equity loans, you can make strategic decisions that align with your financial goals.

Key insights discussed include:

- The impact of the prime rate on borrowing costs

- The importance of maintaining a strong credit score

- The various fees associated with HELOCs

It’s crucial to carefully assess your financial situation and understand the terms of your loans to avoid common pitfalls, such as over-borrowing or mismanaging repayments. Remember, you are not alone in this journey.

Ultimately, being proactive and informed is vital when navigating the world of HELOCs. We encourage you to explore your options, compare lenders, and seek personalized advice to ensure you secure the best possible terms for your needs. The potential for significant savings and financial flexibility makes understanding and utilizing HELOCs a valuable endeavor for any homeowner. Take that first step today, and empower yourself with the knowledge you need to succeed.

Frequently Asked Questions

What is the application process for a HELOC at F5 Mortgage?

F5 Mortgage offers a simplified application process that allows homeowners to apply easily online, by phone, or through chat, with the possibility of achieving pre-approval in under an hour.

How does F5 Mortgage ensure competitive HELOC rates?

F5 Mortgage partners with over twenty leading lenders to provide competitive lines of credit tailored to individual financial situations. In 2025, average HELOC rates are expected to be around 7.25%, the lowest in three years.

What factors influence HELOC interest rates?

HELOC interest rates are influenced by the prime rate, the borrower’s credit score, and the loan-to-value (LTV) ratio. Changes in the Federal Reserve’s interest rates typically affect the prime interest rate, which in turn impacts HELOC rates.

How does a borrower’s credit score affect HELOC rates?

Borrowers with higher credit scores can secure lower HELOC rates, while those with lower credit scores may face higher rates. For example, borrowers with excellent credit could secure rates around 6.75%, whereas those with higher risk profiles might see rates as high as 10.75% to 12.75%.

What is the difference between a HELOC and a home equity loan?

A HELOC functions like a credit card with fluctuating rates, allowing borrowers to access funds as needed, making it suitable for ongoing expenses. In contrast, a home equity loan provides a lump sum with stable interest rates, ideal for significant one-time expenses.

What are the expected average rates for HELOCs and home equity loans by mid-2025?

By mid-2025, average HELOC rates are projected to be around 8.27%, while home equity loans are expected to be slightly lower at about 8.26%.

What costs should be considered when refinancing a HELOC or home equity loan in California?

Refinancing typically incurs closing costs ranging from 2% to 5% of the loan amount, which can include application fees, origination fees, credit report fees, appraisal fees, title search and insurance, discount points, attorney fees, and survey fees.

How can I calculate my break-even point when refinancing?

To calculate your break-even point, divide your total refinancing costs by your monthly savings. For example, if your refinancing costs are $4,000 and your monthly savings amount to $100, your break-even point would be 40 months.

How can F5 Mortgage assist clients in choosing between a HELOC and a home equity loan?

F5 Mortgage provides personalized consultations to help clients navigate their options, ensuring they make informed decisions that align with their financial aspirations.