Overview

This article highlights seven free VA loan calculators designed to support veterans and active-duty service members in simplifying their home financing journey. We understand how overwhelming this process can be, and these calculators offer unique features, including detailed cost insights and personalized support. By using these tools, you can empower yourself to make informed financial decisions regarding your VA loan options.

Each calculator serves as a valuable resource, addressing your specific needs and concerns. Imagine having a tool that not only clarifies your financial situation but also guides you step by step. With the right support, you can navigate the complexities of home financing with confidence.

We’re here to support you every step of the way, ensuring you have access to the information and resources you need. Take a moment to explore these calculators and discover how they can make your home financing process easier and more manageable.

Introduction

Navigating the complexities of home financing can feel particularly daunting for veterans and active-duty service members. We understand that you often face unique challenges in securing a mortgage. Fortunately, the advent of free VA loan calculators offers a streamlined solution, empowering you to make informed financial decisions with ease. But with so many options available, how can you determine which calculator best suits your needs and maximizes your benefits? In this article, we explore seven standout VA loan calculators, each designed to simplify the home financing process and enhance your journey toward homeownership.

F5 Mortgage: Streamlined VA Loan Calculator for Easy Home Financing

At F5 Mortgage, we understand how challenging the home financing process can be for veterans and active-duty service members. That’s why we’ve developed a free VA loan calculator that enables you to enter your financial information and receive precise projections of your monthly costs, total interest, and funding fees. This tool is designed with your needs in mind, simplifying the journey to homeownership so you can make informed decisions quickly and easily.

Imagine enhancing your home without the burden of initial costs—our VA financing offers just that. We want you to seize this opportunity to create a space that truly reflects your needs and aspirations. Our user-friendly estimator integrates seamlessly with our personalized consultation services, which emphasize a no-pressure guidance approach. We’re here to support you every step of the way, committed to helping you close your financing in under three weeks, ensuring a smooth and positive experience throughout the process.

Calculator.net: Comprehensive VA Mortgage Calculator with Detailed Cost Insights

At Calculator.net, we understand how overwhelming the mortgage process can be, especially for veterans. That’s why we provide a free VA loan calculator that is designed to help you estimate your monthly payments, total interest, and funding fees. This tool provides extensive cost insights, allowing you to grasp the financial implications of your borrowing decisions. By simply inputting details like the loan amount and interest rate, you can obtain a detailed breakdown of potential costs, which is essential for effective home financing planning.

Financial advisors often emphasize the importance of understanding these costs, as it can lead to significant savings. You can use our free VA loan calculator to compare various loan scenarios and make informed decisions that best suit your needs. Recent advancements in VA loan estimators, including features that offer real-time data and user-friendly interfaces, further enhance their utility.

Tools like Calculator.net illustrate how technology can streamline the loan process, ensuring that you are well-prepared to navigate your financing options. Remember, we’re here to support you every step of the way, helping you achieve your homeownership dreams with confidence.

NerdWallet: VA Mortgage Calculator with Benefits and Drawbacks Analysis

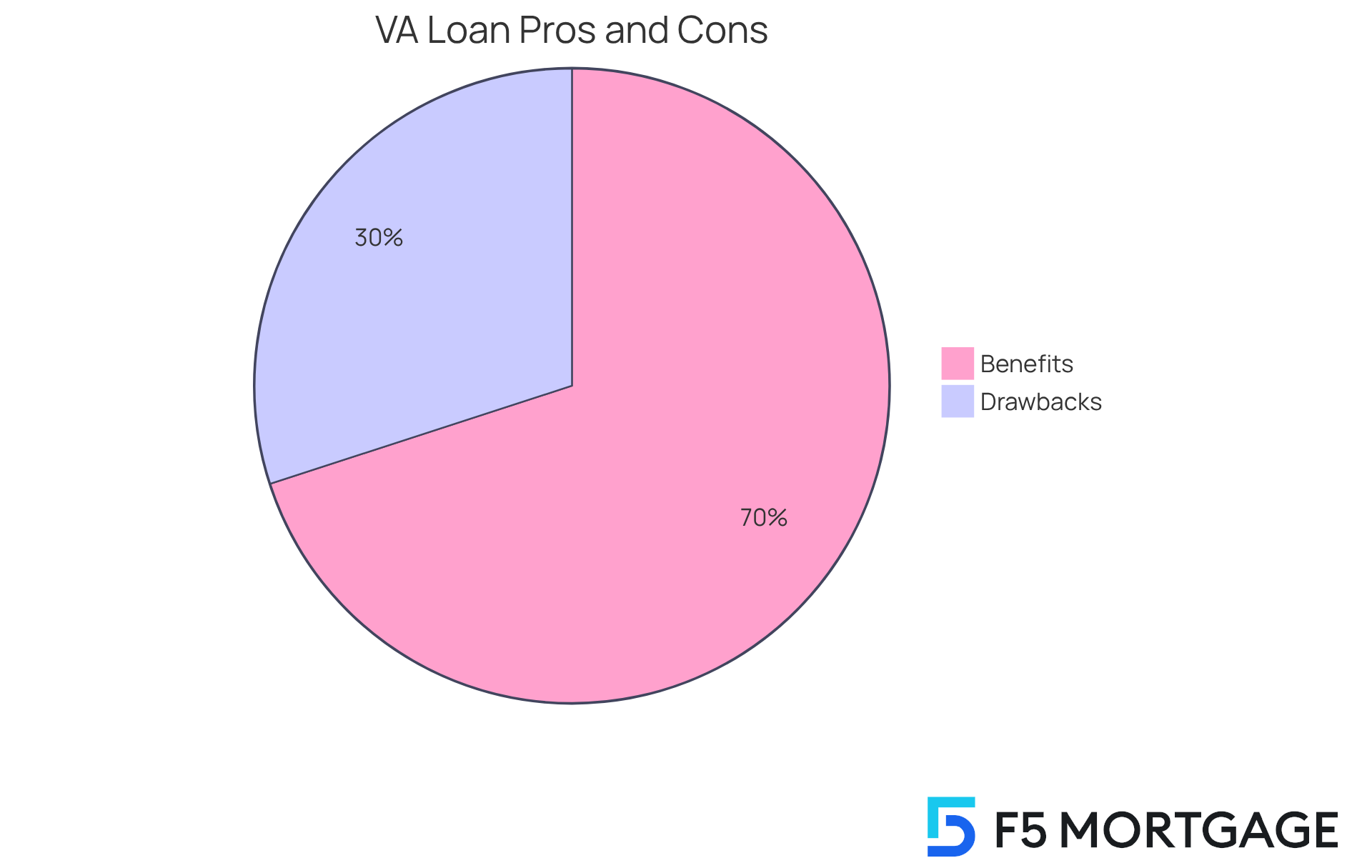

At NerdWallet, we understand how overwhelming the mortgage process can be, especially for veterans and their families. That’s why we offer a comprehensive free VA loan calculator that does more than just calculate monthly costs. This tool provides a detailed examination of the advantages and disadvantages linked to VA financing, helping you grasp the financial implications of your choices.

By assessing key elements like interest rates, financing terms, and the unique benefits of VA offerings—such as the absence of private mortgage insurance and competitive interest rates—you can make informed decisions that align with your financial goals. In 2025, understanding these subtleties is essential. VA financing continues to offer significant benefits, including no initial costs and no prepayment penalties. However, it also presents challenges, such as the VA funding fee and stricter appraisal standards.

With the insights provided by NerdWallet, you can navigate the complexities of VA financing with confidence. Remember, we’re here to support you every step of the way, ensuring you feel empowered in your financial journey.

Veterans United: Tailored VA Loan Calculator for Military Families

At Veterans United, we understand how challenging navigating home financing can be for military families. That’s why we offer a specialized free VA loan calculator that assists you in estimating monthly costs while taking into account unique aspects like military benefits and funding fees. This tool is tailored to your specific financial circumstances, ensuring you receive the precise information you need for informed home financing decisions.

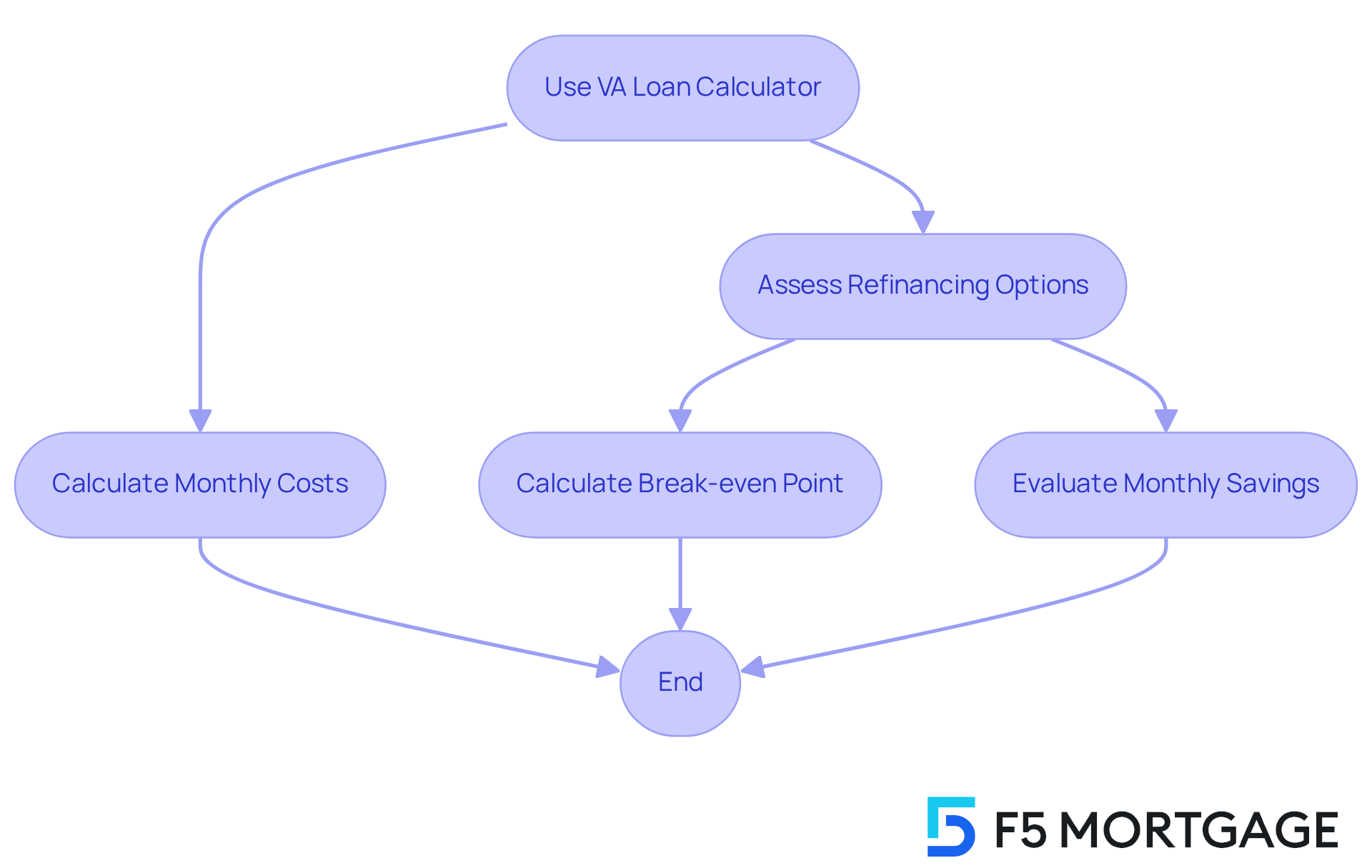

When considering refinancing options, understanding the break-even point is crucial. By calculating this point, you can see how long it will take to recoup the costs of refinancing through savings in monthly payments or interest rates. For example, if your refinancing costs are $4,000 and you save $100 each month, your break-even point would be just 40 months. This knowledge empowers you to make informed decisions, ensuring you stay in your home long enough to truly benefit from refinancing.

In Arizona, the average VA financing amount reaches $421,868, while in Alabama, it’s $326,863. Our tool is designed to assist you in effectively navigating these options, including the free VA loan calculator. Mortgage experts emphasize that understanding these distinct requirements is vital for military homebuyers. Resources like the free VA loan calculator from Veterans United are essential in streamlining the home financing process, and we’re here to support you every step of the way.

MortgageCalculator.org: VA Loan Calculator with Qualification and Comparison Tools

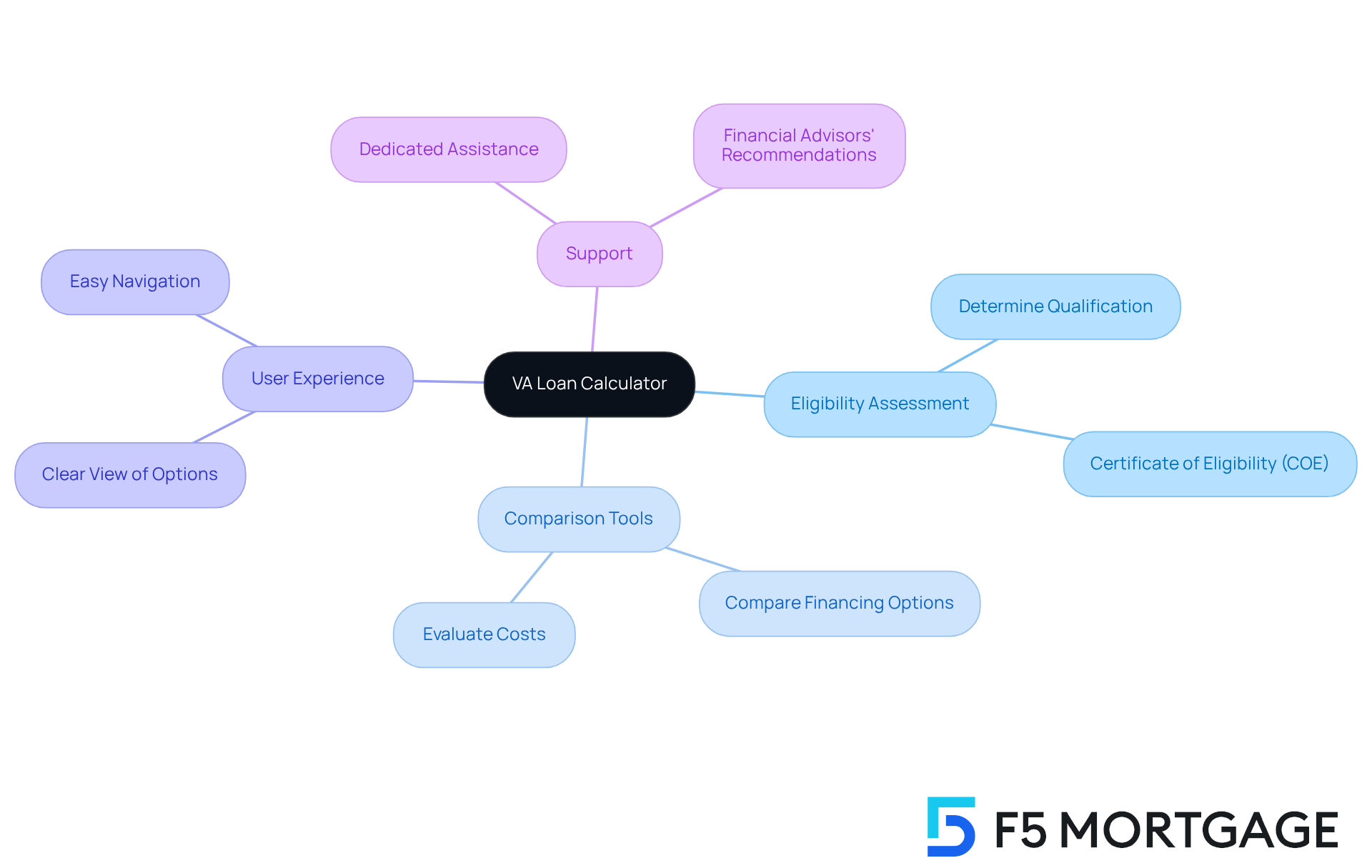

At F5 Mortgage, we understand how challenging navigating financing options can be for families. That’s why we offer a comprehensive free VA loan calculator, which is designed to evaluate your qualification and provide vital comparison tools. By entering your financial details, you can easily assess your eligibility for a VA program and compare it with other financing choices, including using a free VA loan calculator for refinancing opportunities with us.

This feature is essential for borrowers. It gives you a clear view of your options and the related expenses of each type of credit. With our competitive rates and dedicated support throughout the refinancing process, understanding these comparisons can significantly influence your decision-making.

We know how important it is to make well-informed choices tailored to your unique financial situation. Financial advisors often recommend utilizing such tools, and we’re here to support you every step of the way. Take control of your financial future with F5 Mortgage, and explore the possibilities that await you.

Navy Federal: VA Loan Calculator for Military Community Members

At F5 Mortgage, we understand how challenging navigating financing options can be for military community members. That’s why we provide customized financing solutions tailored to your unique needs. Our free VA loan calculator is specifically designed to help you calculate monthly costs based on your home’s purchase price and borrowing conditions. This empowering tool offers personalized support throughout your home financing journey.

When considering refinancing options, knowing how to calculate your break-even point is vital. By assessing refinancing expenses alongside potential monthly savings, you can make informed decisions about your loan. This ensures that you remain in your home long enough to recover costs effectively.

We’re here to support you every step of the way, guiding you through this process with the tools and knowledge needed for a successful home purchase or refinance. Let us help you achieve your homeownership dreams with confidence.

Zillow: User-Friendly VA Loan Calculator with Access to Lenders

We understand how challenging navigating home financing can be. While Zillow offers an easy-to-use VA financing estimator that helps you quickly gauge your monthly housing costs, F5 Mortgage goes a step further by providing a thorough refinancing method and a free VA loan calculator to enhance your experience. Our free VA loan calculator enables you to input your home price, down payment, and loan details, similar to Zillow’s features.

What truly sets F5 Mortgage apart is our commitment to making the process stress-free. We leverage user-friendly technology to simplify refinancing, assisting you at every stage. We ensure you comprehend all associated expenses, including financing fees and potential savings from eliminating private loan insurance through cash-out options.

With direct access to a network of lenders, we connect you with the best loan providers, guiding you confidently through your financing choices. Our dedicated support means you receive personalized guidance without any pressure, empowering you to make the best decision for yourself.

Experience rapid closing in under three weeks with F5 Mortgage. Our focus is on maximizing your savings while ensuring a smooth refinancing journey. Remember, we’re here to support you every step of the way.

US Bank: VA Mortgage Calculator with Process Insights and Documentation Guidance

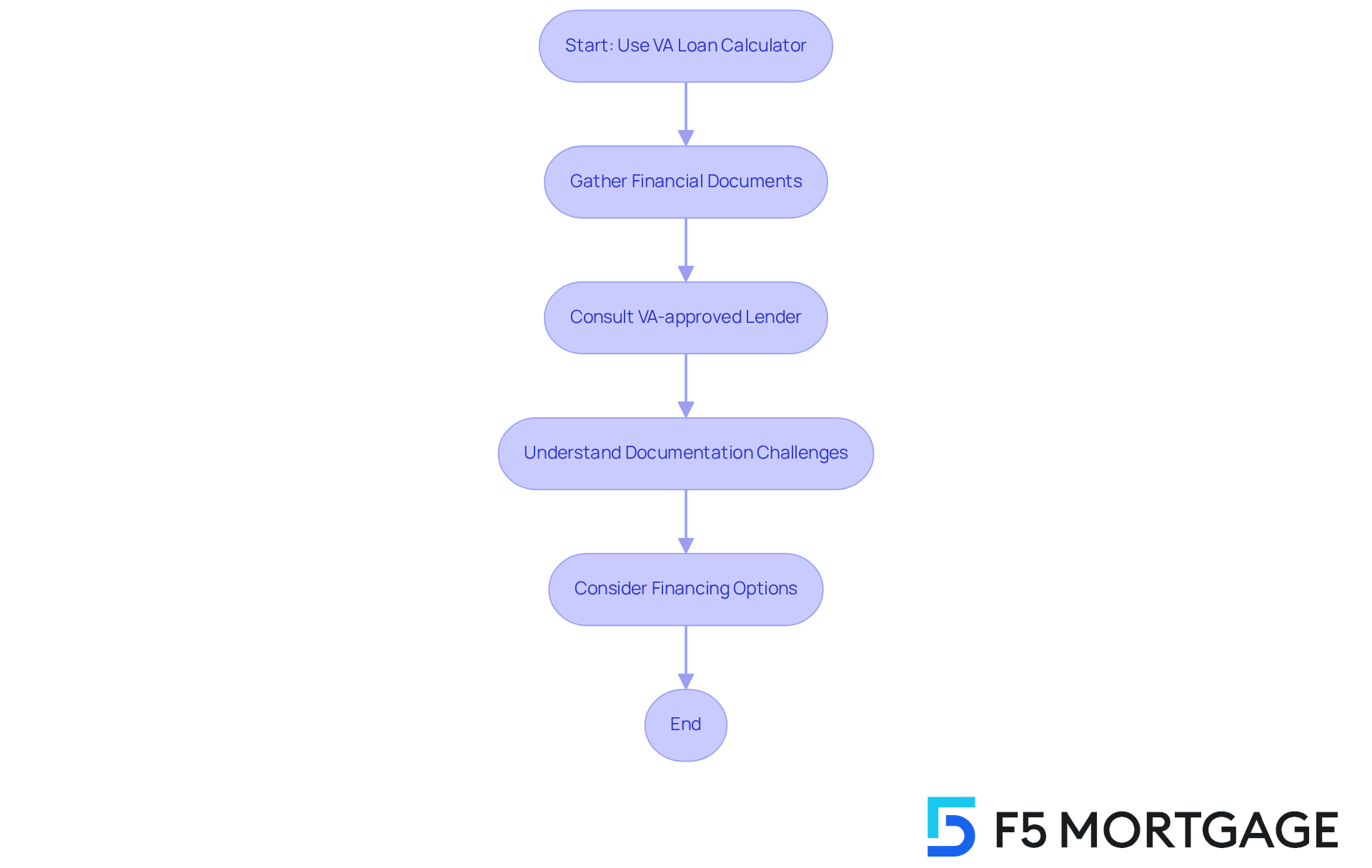

At F5 Mortgage, we understand how overwhelming the mortgage process can be, especially for first-time homebuyers. That’s why we offer a comprehensive free VA loan calculator that is designed to estimate monthly payments and provide insights into the mortgage process and necessary documentation. This tool, particularly the free VA loan calculator, is invaluable for those navigating the complexities of VA financing.

By guiding users through essential documentation, we aim to simplify the application process. We know how challenging this can be, and our goal is to reduce potential hurdles while boosting your confidence in obtaining VA financing. It’s important to be aware of common documentation challenges, such as:

- Securing the Certificate of Eligibility (COE)

- Understanding the VA funding fee structure, which ranges from 1.4% to 3.6% of the amount borrowed

To make the most of the free VA loan calculator, we encourage you to gather your financial documents early. Consulting with VA-approved lenders can provide you with personalized guidance tailored to your situation. If you’re considering changing your financing option, F5 Mortgage allows you to transition from an adjustable-rate plan to a fixed-rate one, helping you secure a lower rate for greater stability.

Understanding the nuances of negotiations is also essential for a successful home purchase. For instance, consider asking for repairs from sellers and carefully examining financial disclosures. We’re here to support you every step of the way, ensuring you feel empowered and informed throughout this journey.

Ratehub.ca: Mortgage Payment Calculator with VA Loan Payment Insights

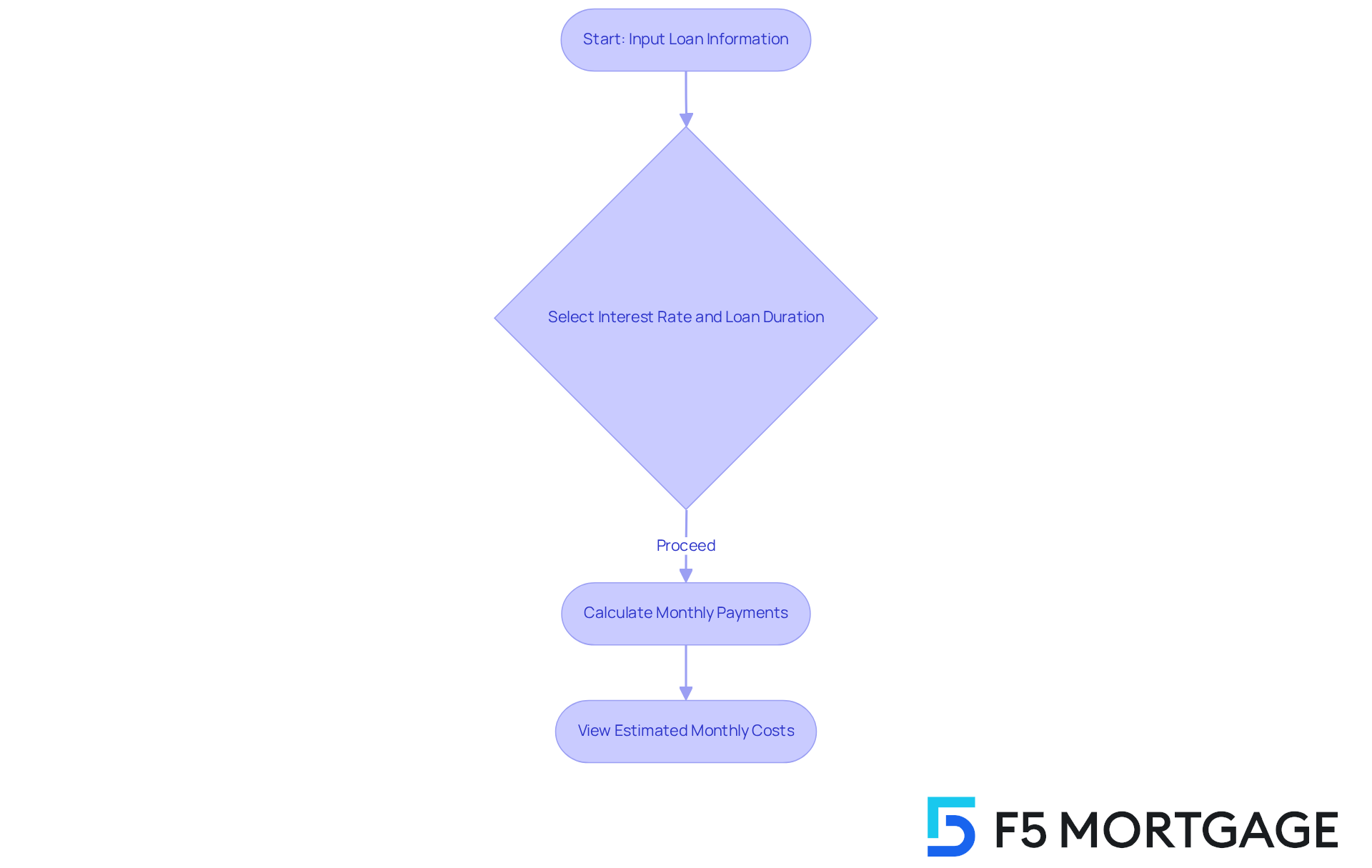

At Ratehub.ca, we understand how overwhelming managing financing costs can be, especially for veterans and active-duty service members. That’s why we offer a free VA loan calculator specifically designed to provide valuable insights into VA borrowing. By simply inputting your loan information, you can estimate your monthly expenses and see how different factors—like interest rates and loan durations—affect your total costs.

This tool not only streamlines the loan process but also includes a free VA loan calculator to empower you to make informed financial choices. By clarifying your cost structures, you can navigate the complexities of VA financing with greater confidence and clarity. We know how challenging this can be, particularly in 2025, when fluctuating interest rates may significantly impact your monthly obligations.

Financial advisors emphasize the importance of understanding mortgage payment structures for effective budgeting and long-term financial planning. With resources like Ratehub.ca, you’re not alone in this journey. We’re here to support you every step of the way, ensuring you have the tools and knowledge needed to make the best decisions for your financial future.

F5 Mortgage: Personalized Consultations to Maximize Your VA Loan Calculator Experience

At F5 Mortgage, we understand how challenging the home financing process can be. That’s why we prioritize personalized consultations to enhance your experience with the free VA loan calculator. Our dedicated team delivers tailored advice and insights, empowering you to fully grasp your options and effectively utilize these tools for informed decision-making.

This customized approach simplifies the complexities of home financing, allowing families like yours to navigate financial journeys with confidence. Imagine having the clarity to make strategic choices that align with your unique financial situation and homeownership goals.

In 2025, the impact of our personalized guidance becomes even more significant. We’re here to support you every step of the way, ensuring you feel understood and equipped to make the best decisions for your future. Let us help you turn your homeownership dreams into reality.

Conclusion

Navigating the complexities of home financing can be particularly daunting for veterans and active-duty service members. We understand how challenging this can be. The seven free VA loan calculators highlighted in this article serve as essential tools designed to simplify this process. They offer users the ability to estimate costs, evaluate their options, and make informed decisions tailored to their unique financial situations. Each calculator not only provides numerical insights but also emphasizes the importance of understanding the broader implications of financing choices.

Key insights from the article reveal that these calculators—from F5 Mortgage’s user-friendly estimator to Calculator.net’s comprehensive breakdowns—offer valuable features. These include:

- Cost comparisons

- Benefits and drawbacks analyses

- Tailored support for military families

By leveraging these resources, users can gain clarity and confidence as they embark on their homeownership journey. This ensures they are well-prepared to tackle the challenges of VA financing.

Ultimately, these tools are more than just calculators; they represent a commitment to empowering veterans and their families. By utilizing these resources effectively, individuals can take control of their financial futures. This allows them to navigate the path to homeownership with ease. Engaging with these calculators is a crucial step toward making informed decisions, maximizing benefits, and realizing the dream of owning a home.

Frequently Asked Questions

What is the purpose of the VA loan calculators mentioned in the articles?

The VA loan calculators are designed to help veterans and active-duty service members estimate their monthly payments, total interest, and funding fees, simplifying the home financing process.

How does the F5 Mortgage VA loan calculator assist users?

The F5 Mortgage VA loan calculator allows users to enter their financial information to receive precise projections of monthly costs, total interest, and funding fees, making the journey to homeownership easier.

What unique features does the Calculator.net VA loan calculator offer?

The Calculator.net VA loan calculator provides extensive cost insights by allowing users to input details like loan amount and interest rate, offering a detailed breakdown of potential costs to aid in effective home financing planning.

What advantages does the NerdWallet VA loan calculator provide?

The NerdWallet VA loan calculator not only calculates monthly costs but also analyzes the benefits and drawbacks of VA financing, helping users understand financial implications and make informed decisions.

What benefits does VA financing offer according to the articles?

VA financing offers benefits such as no initial costs, no private mortgage insurance, competitive interest rates, and no prepayment penalties.

What challenges are associated with VA financing?

Challenges of VA financing include the VA funding fee and stricter appraisal standards.

How quickly can F5 Mortgage help close financing?

F5 Mortgage aims to help users close their financing in under three weeks, ensuring a smooth and positive experience throughout the process.

Why is understanding costs important in the mortgage process?

Understanding costs is crucial as it can lead to significant savings and better financial decision-making when navigating home financing options.