Overview

The article “7 Essential Tips for Managing Your Balloon Loan Payments” aims to support families in navigating the complexities of balloon loans. We know how challenging this can be, and it’s crucial to address the emotional and financial concerns that come with large final payments. By emphasizing proactive financial planning, the article highlights the importance of:

- Budgeting

- Understanding refinancing options

- Selecting the right lender

These strategies are essential in mitigating risks and ensuring financial stability, empowering families to take control of their financial futures.

Introduction

Navigating the complexities of balloon loans can feel overwhelming for many borrowers. We understand how the looming threat of substantial final payments can create anxiety. These unique financing options, designed to ease initial cash flow, often lead to significant financial pressure at the end of their terms.

In this article, we offer essential tips for managing balloon loan payments, providing strategies that empower you to take control of your financial future.

- How can you prepare effectively to avoid the pitfalls associated with these loans?

- What proactive measures can you implement to ensure a smooth repayment journey?

We’re here to support you every step of the way.

F5 Mortgage: Personalized Solutions for Balloon Loans

At F5 Mortgage, we understand how challenging managing large payments can be. That’s why we offer tailored consultations designed to help you navigate these complexities with ease. By thoroughly evaluating your unique financial situation, we create personalized borrowing solutions that meet your specific needs. This approach ensures you are well-informed and empowered to make wise financial decisions regarding your large payments.

As a result, our clients experience enhanced satisfaction and confidence throughout . highlight how F5 Mortgage’s expertise in special financing options has enabled borrowers to manage their expenses effectively. These narratives showcase the significant impact of our tailored consultations on achieving financial stability.

Testimonials from our satisfied clients truly underscore our commitment to exceptional service. One client shared, ‘Jeff and his team are outstanding to work with. They made the process easy and worry-free, ensuring we understood everything fully.’ Another noted, ‘Alyssa and Jorge were both very patient with me & got me secured at rates I couldn’t believe.’ We know how important it is to feel supported, and we’re here to guide you every step of the way.

Understanding Balloon Loans: Structure and Functionality

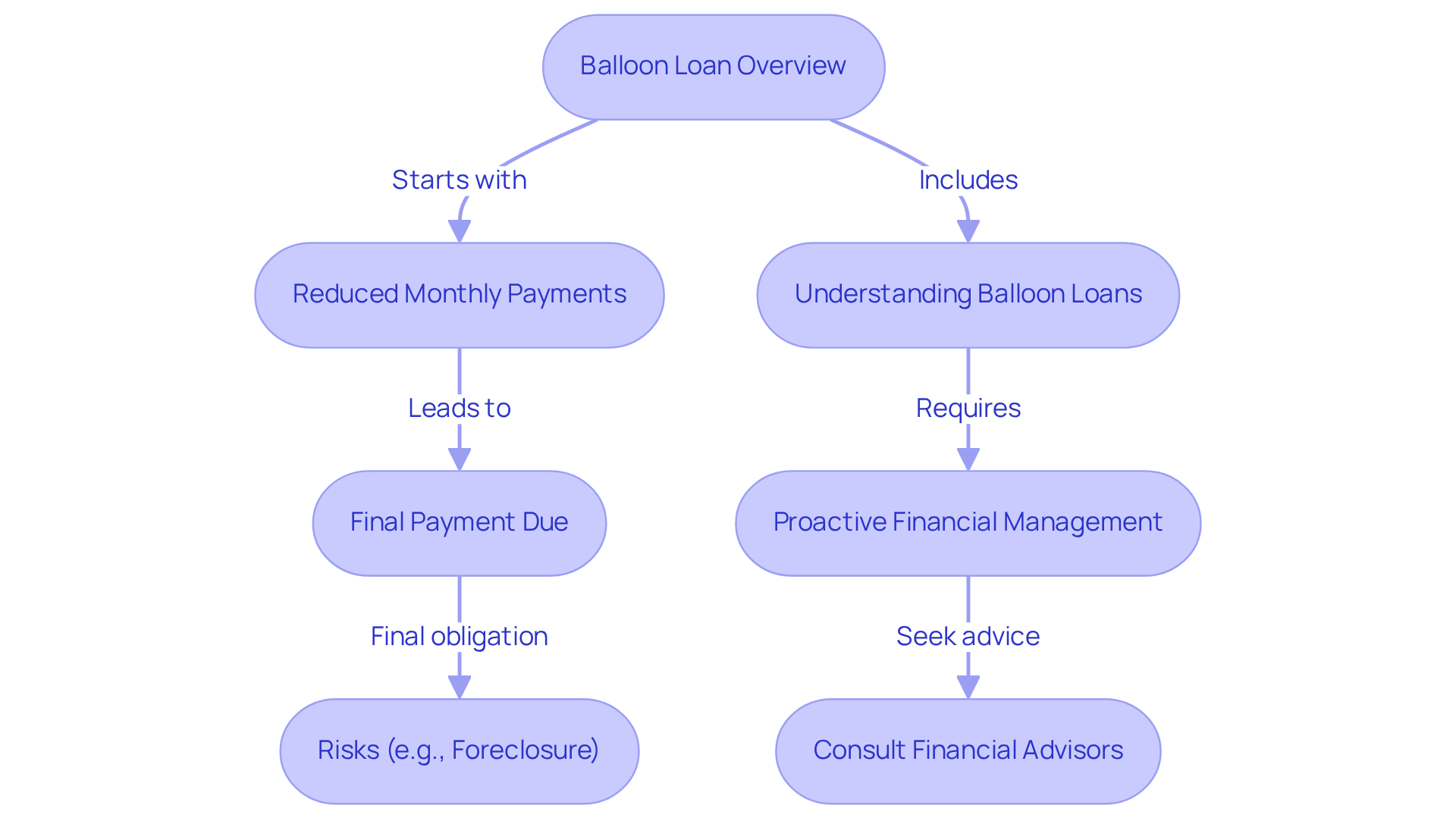

When considering financing options, it’s important to understand that some plans, like a balloon loan, offer reduced monthly installments, which lead to a significant final amount due at the end of the term. This final amount can feel daunting, but it’s a common structure designed to help families manage their finances. Typically, these credits can be considered a type of balloon loan, spanning shorter timeframes of 5 to 10 years, which makes them particularly appealing for those who expect an increase in income or plan to refinance before the large sum is due.

For instance, imagine a family financing $200,000 at a 4.5% interest rate. They would face monthly payments of about $1,013, culminating in a final amount of $175,066 after seven years. Understanding the structure of a balloon loan is crucial for families, as it allows for better planning and management of future financial obligations.

However, it’s essential to be aware of the risks involved, such as the potential for foreclosure if the large sum cannot be met. We know how challenging this can be, and we’re here to support you every step of the way. With careful evaluation and , these arrangements can be a beneficial choice for families anticipating positive changes in their financial situations.

Risks of Balloon Loans: What Borrowers Need to Know

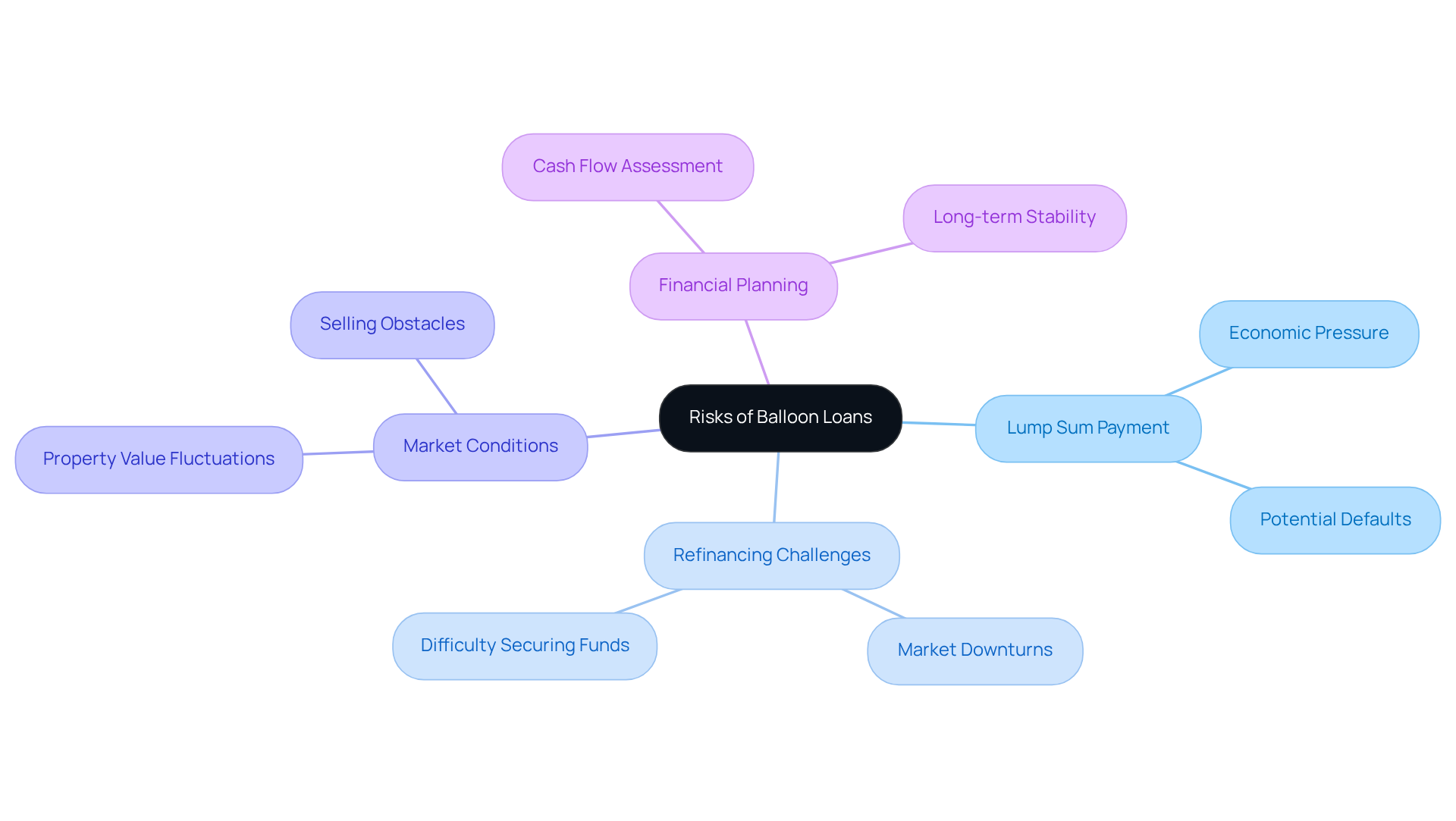

Balloon loans can initially seem appealing due to their lower upfront costs, but it’s important to recognize the considerable risks involved. We understand how challenging this can be. The most pressing concern is the that becomes due at the end of the balloon loan term, which can create substantial economic pressure if not properly prepared for. Statistics indicate that many borrowers face difficulties when confronted with balloon loans, particularly if their financial situation does not improve as they had hoped.

Additionally, borrowers might find themselves struggling with refinancing or selling their property if market conditions take a downturn. For instance, those who opted for an adjustable-rate mortgage due to its attractive lower payments may find themselves in a tough spot if they cannot secure the necessary funds for the final payment. This predicament can lead to defaults and, in some unfortunate cases, a balloon loan default or foreclosure.

Real-life examples illustrate the economic impact of these large final sums. Borrowers who anticipate a significant increase in income, perhaps through a promotion, may feel confident about managing their future obligations. However, if their financial prospects do not improve, they could face challenges in meeting the due date for the balloon loan. Furthermore, individuals planning to sell their property to cover this large sum may encounter obstacles if the real estate market does not show favorable trends.

In 2025, various news articles highlighted the economic strain that large final sums can impose, emphasizing the importance of careful planning and an understanding of cash flow needs. We’re here to support you every step of the way. It’s crucial for borrowers to assess their financial plans and consider potential market fluctuations to avoid the pitfalls associated with balloon loans and hefty repayments.

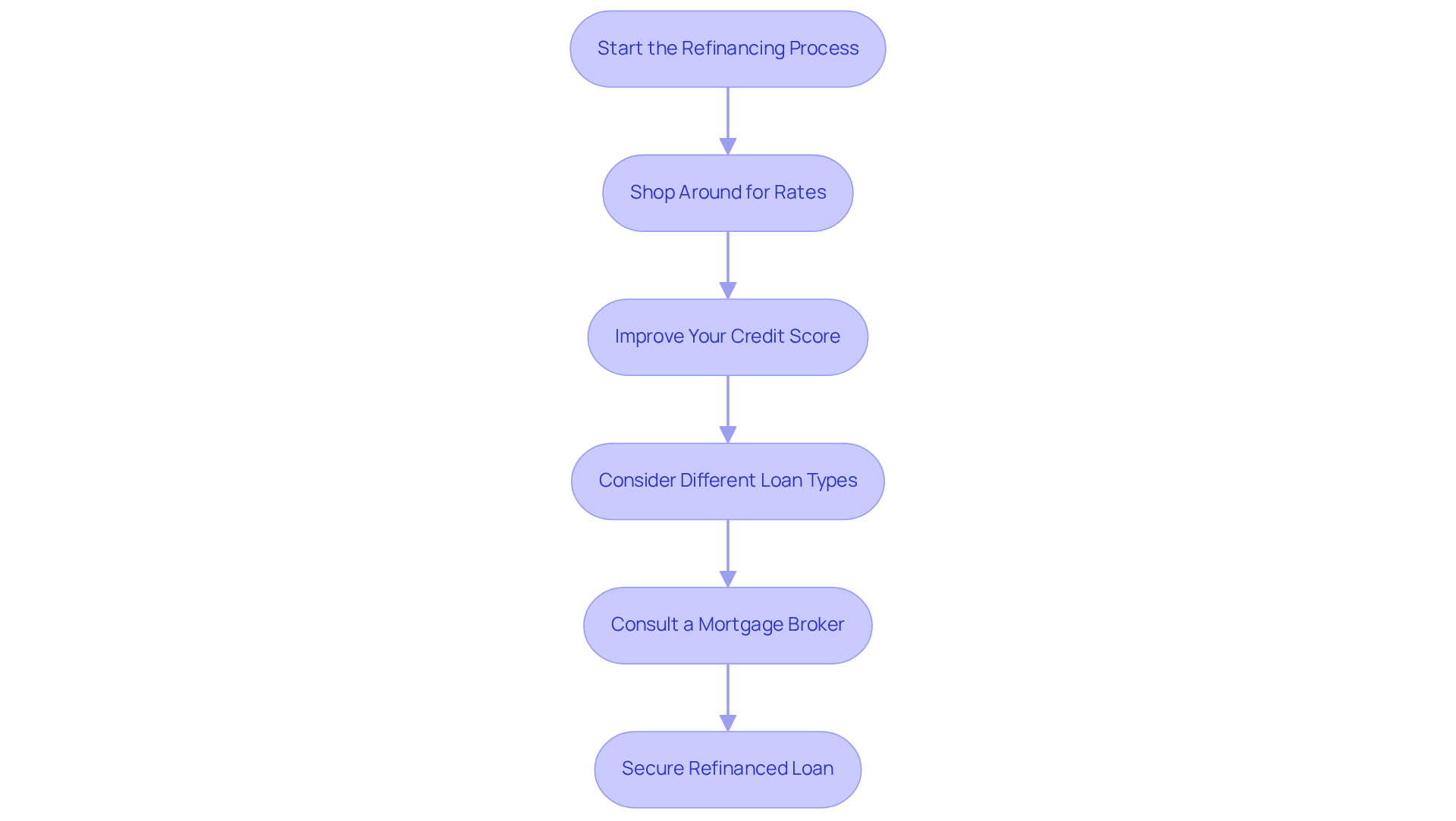

Refinancing Balloon Loans: Strategies for Homebuyers

Refinancing a large debt is a strategic action that can help alleviate the pressure of an upcoming large sum due. We understand how challenging this can be, which is why it’s essential for homebuyers to initiate the 6 to 12 months before the due date of the balloon loan payment. This timeframe allows borrowers to thoroughly assess different financing options, potentially securing a more advantageous interest rate or extending the term to improve affordability. It’s crucial for borrowers to examine their credit score and overall financial health, as these factors significantly impact eligibility for favorable refinancing terms.

In 2025, while the average duration required to refinance large loans may vary, borrowers should anticipate a process that generally extends over several weeks. To effectively navigate this journey, consider these supportive strategies:

- Shop Around: Compare offers from multiple lenders to find the best rates and terms.

- Improve Your Credit Score: Address any issues that may hinder your creditworthiness before applying.

- Consider Loan Types: Evaluate different loan products, such as fixed-rate or adjustable-rate mortgages, to determine what best suits your financial situation.

- Consult a Mortgage Broker: Engaging with a professional can provide insights into the best refinancing options available.

Timing is critical; studies show that borrowers who start the refinancing process early often secure better deals. For instance, individuals who began refinancing 12 months prior to their large repayment were able to lower their interest rates by an average of 0.5% compared to those who waited until the last moment. By utilizing these approaches, homebuyers can navigate the refinancing landscape efficiently, ensuring a smoother transition away from large sums, including options like a balloon loan.

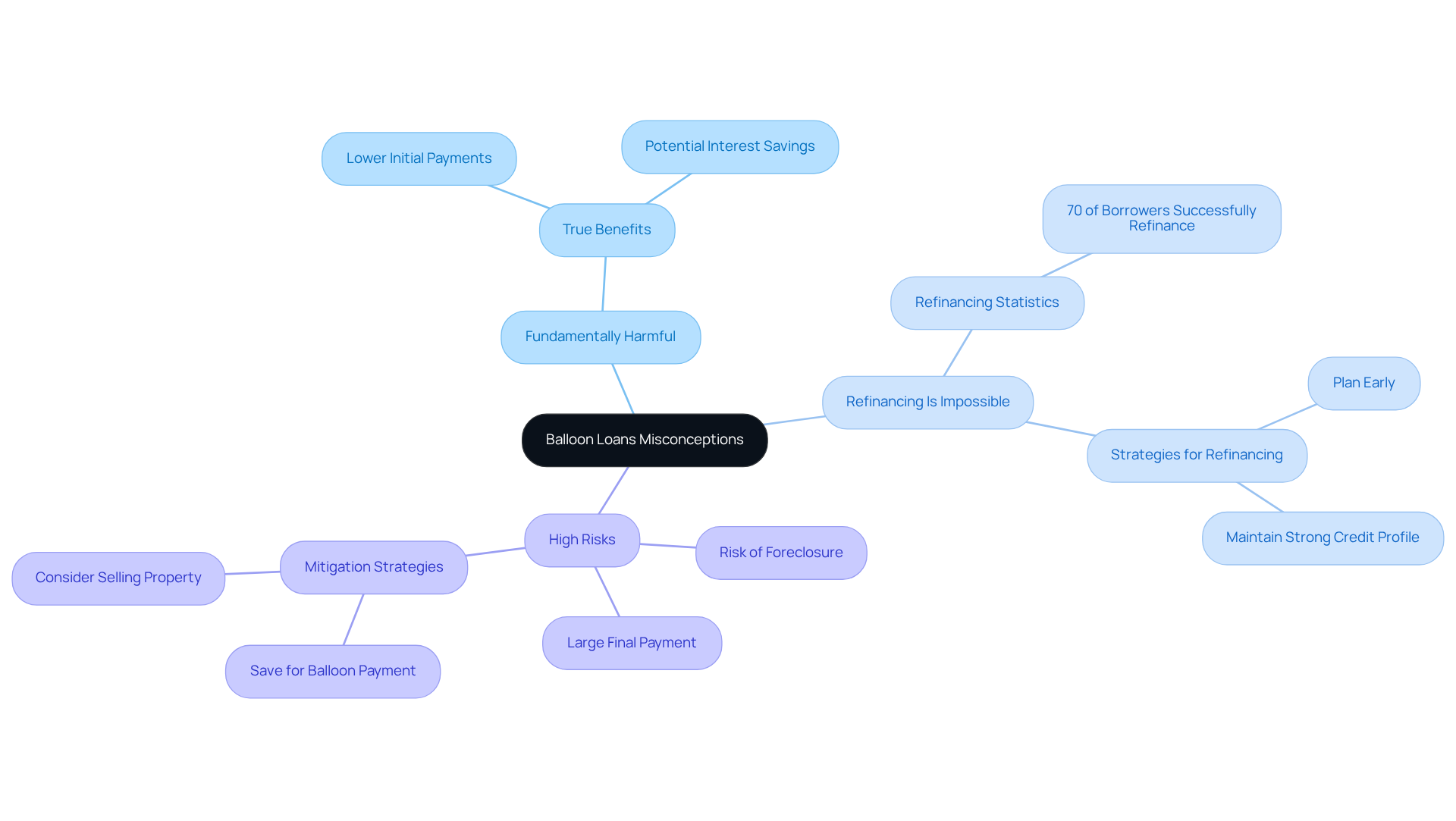

Debunking Myths: Common Misconceptions About Balloon Loans

Many families face misunderstandings about inflated financing. Some believe these options are fundamentally harmful, while others think refinancing is impossible. However, we know how challenging this can be, and we want to reassure you that financing options like a balloon loan can actually serve as beneficial alternatives for certain borrowers. This is especially true for those anticipating a substantial income increase or planning to sell their property before the balloon loan payment is due.

Additionally, refinancing opportunities are often available, particularly with competitive rates through F5 Mortgage. Research shows that around 70% of borrowers successfully refinance their large loans. This illustrates that with appropriate planning and a robust financial strategy, these loans can be managed effectively.

As Dana Hendrix, a Senior Mortgage Advisor, observes, “However, they come with significant risks, primarily the challenge of handling the substantial final sum.” By dispelling these misconceptions, we can recognize the potential dangers of a balloon loan, including the large sum due and the risk of foreclosure if refinancing fails. This understanding empowers you to explore your options and make informed decisions about your mortgage funding.

We encourage you to actively utilize a to evaluate your financial situation. Investigating the competitive rates and customizable loan options offered through F5 Mortgage can lead you toward a more manageable economic future. Remember, we’re here to support you every step of the way.

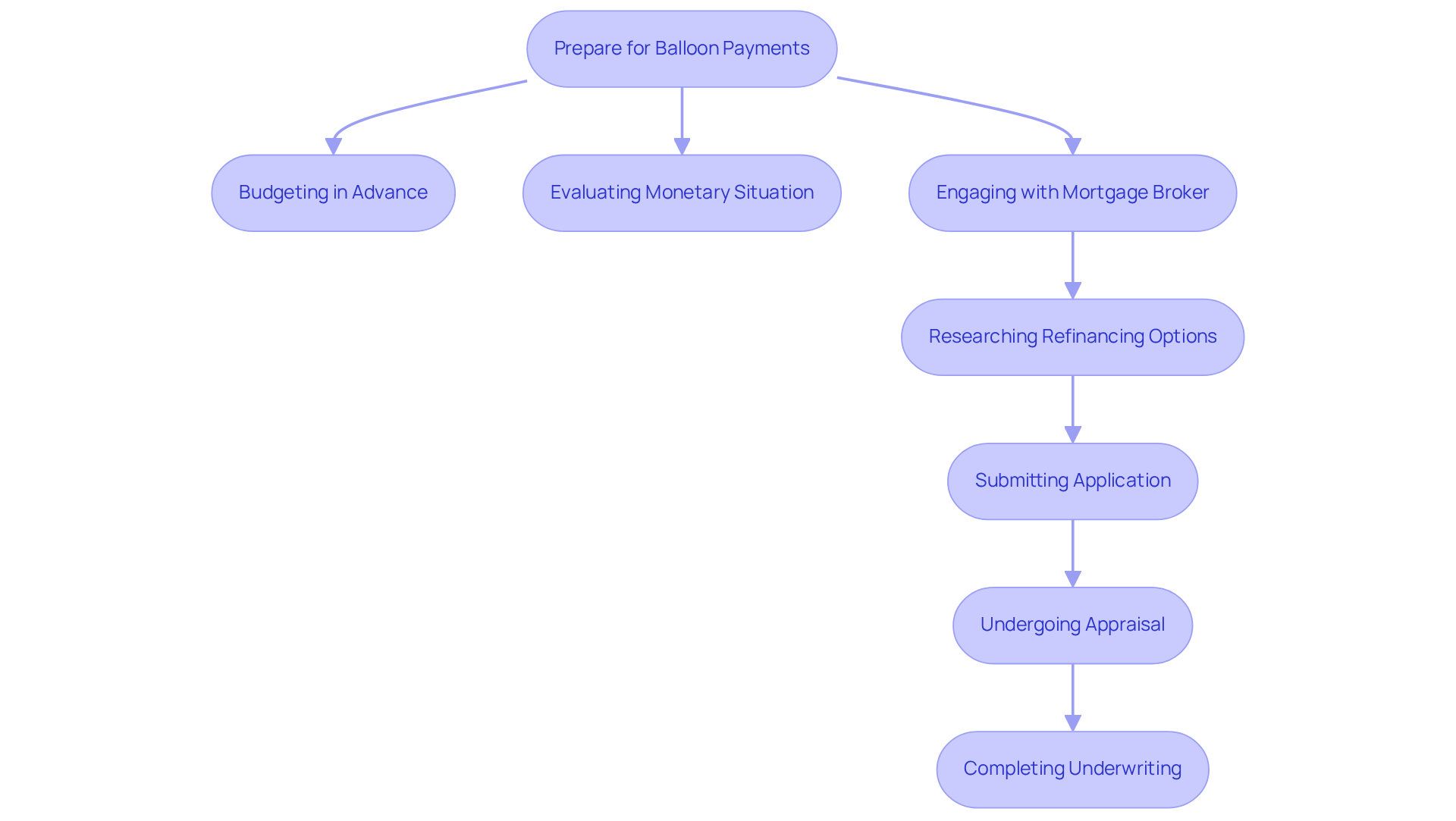

Preparing for Balloon Payments: Essential Tips for Borrowers

Preparing for a large sum due can feel overwhelming, but proactive monetary planning can make all the difference. Understanding your refinancing choices is a vital part of this strategy. We know how challenging this can be, so we encourage borrowers to start budgeting well in advance. Setting aside a specific amount each month helps build the necessary funds over time. This disciplined approach can significantly ease the financial burden when the balloon loan payment comes due.

Consistently evaluating your monetary situation is essential. This involves analyzing income, expenses, and possible fluctuations in interest rates that could influence your refinancing choices. Engaging with a knowledgeable mortgage broker, like F5 Mortgage, can provide invaluable insights. Personalized consultations help clients navigate their options effectively, ensuring they feel supported throughout the process.

F5 Mortgage offers a streamlined refinancing process, allowing borrowers to compare multiple lenders and find the best rates and terms tailored to their needs. The refinancing process typically involves several key steps:

- Researching options

- Submitting an application with property and financial information

- Undergoing an appraisal

- Completing the underwriting process

Additionally, consider tactics like refinancing or selling the property before the large sum is due, especially if market conditions are favorable.

Statistics suggest that many borrowers underestimate the savings required for large final sums. These payments often demand significant amounts, and balloon loans frequently require a substantial one-time payment at the end of the term. Without , this can lead to economic pressure. Therefore, establishing a clear budget and sticking to it is essential. Financial planners also emphasize the importance of creating an emergency fund to cover unexpected expenses, which can alleviate stress during this critical time.

By taking these steps and utilizing the support of F5 Mortgage, borrowers can prepare themselves financially. This preparation can help them avoid the drawbacks linked to adjustable-rate mortgages, including the risk of foreclosure and adverse effects on credit scores. Remember, we’re here to support you every step of the way.

Choosing the Right Lender: Navigating Balloon Loan Options

Selecting the right lender is crucial when navigating financing options with large payments. We understand how overwhelming this can be, and it’s essential to find and have a strong grasp of large payment agreements. F5 Mortgage stands out as an independent broker dedicated solely to you, ensuring access to a variety of financing options and competitive rates. By leveraging technology, F5 Mortgage refreshes the mortgage process, providing ultra-competitive rates without the stress of hard sales tactics.

It’s important to compare rates, fees, and customer service experiences. In 2023, the mortgage approval rate was 81.04%, showcasing a robust market for home buyers. This highlights the significance of choosing a lender with a proven track record. The average mortgage rate for a primary residence conventional mortgage was 6.593%, serving as a benchmark for borrowers considering their options.

Interacting with an informed lender like F5 Mortgage can significantly enhance your ability to manage large payment agreements effectively. As Shant Banosian, President of Rate, emphasizes, transparency in lending is vital for building borrower confidence. We know how challenging this can be, and staying informed about current trends in lender transparency can empower you in your decision-making process. If you have questions about balloon loans or wish to explore your options regarding balloon loans, we’re here to support you every step of the way. Reach out to F5 Mortgage today!

Conclusion

Understanding how to effectively manage balloon loan payments is crucial for maintaining your financial stability. We know how challenging this can be, and that’s why we’ve explored essential strategies in this article—from grasping the structure and risks of balloon loans to preparing for those significant final payments. By being informed and proactive, you can navigate these complexities with confidence and clarity.

Key insights include:

- The importance of budgeting well in advance

- Exploring refinancing options

- Choosing the right lender

Utilizing personalized solutions from experts like F5 Mortgage can significantly enhance your borrowing experience, ensuring that you are well-equipped to handle your financial obligations. Additionally, addressing common misconceptions surrounding balloon loans empowers you to make informed decisions that align with your financial goals.

In conclusion, managing balloon loans doesn’t have to be overwhelming. By taking the right steps—such as planning ahead, seeking professional guidance, and understanding the terms of your loan—you can avoid pitfalls and achieve a more secure financial future. Embrace this opportunity to explore tailored solutions that can lead to peace of mind and a successful homeownership experience.

Frequently Asked Questions

What services does F5 Mortgage provide for managing balloon loans?

F5 Mortgage offers tailored consultations to help clients navigate the complexities of managing large payments associated with balloon loans. They evaluate each client’s unique financial situation to create personalized borrowing solutions.

How does F5 Mortgage ensure client satisfaction?

F5 Mortgage focuses on providing exceptional service, resulting in enhanced satisfaction and confidence for clients throughout their homeownership journey. Testimonials from clients highlight the supportive and informative approach taken by the team.

What is a balloon loan?

A balloon loan is a type of financing option that features reduced monthly installments but requires a significant final payment at the end of the term. These loans typically span shorter timeframes of 5 to 10 years.

What are the benefits of a balloon loan?

Balloon loans can be appealing for families expecting an increase in income or planning to refinance before the large final sum is due. They allow for lower monthly payments, making them manageable in the short term.

What risks are associated with balloon loans?

The primary risk of balloon loans is the possibility of foreclosure if the borrower cannot meet the large final payment due at the end of the loan term. It is important for borrowers to plan and manage their future financial obligations carefully.

Can F5 Mortgage help clients mitigate the risks of balloon loans?

Yes, F5 Mortgage provides support through careful evaluation and proactive financial strategies, helping clients to make informed decisions and manage the potential risks associated with balloon loans effectively.