Overview

Finding the right mortgage company can feel overwhelming, but you don’t have to navigate this journey alone. Start by evaluating essential criteria like:

- Reputation

- Financing options

- Fees

- Customer service

We know how challenging this can be, and that’s why thorough research and comparing multiple lenders is so important. This process not only ensures a smoother borrowing experience but also empowers you to make informed decisions that can lead to significant savings and greater satisfaction. Remember, we’re here to support you every step of the way.

Introduction

Navigating the complex landscape of home financing can feel overwhelming. We understand how challenging it can be to select the right mortgage company amidst countless options. Recognizing the essential role these organizations play in securing favorable loan terms is vital for any prospective homeowner. This guide is here to support you every step of the way, outlining the critical steps to:

- Identify a mortgage company

- Compare different lenders

- Choose a mortgage company that aligns with your unique financial needs

But what truly differentiates one lender from another? How can you ensure that you make the best decision for your future? Let’s explore these important questions together.

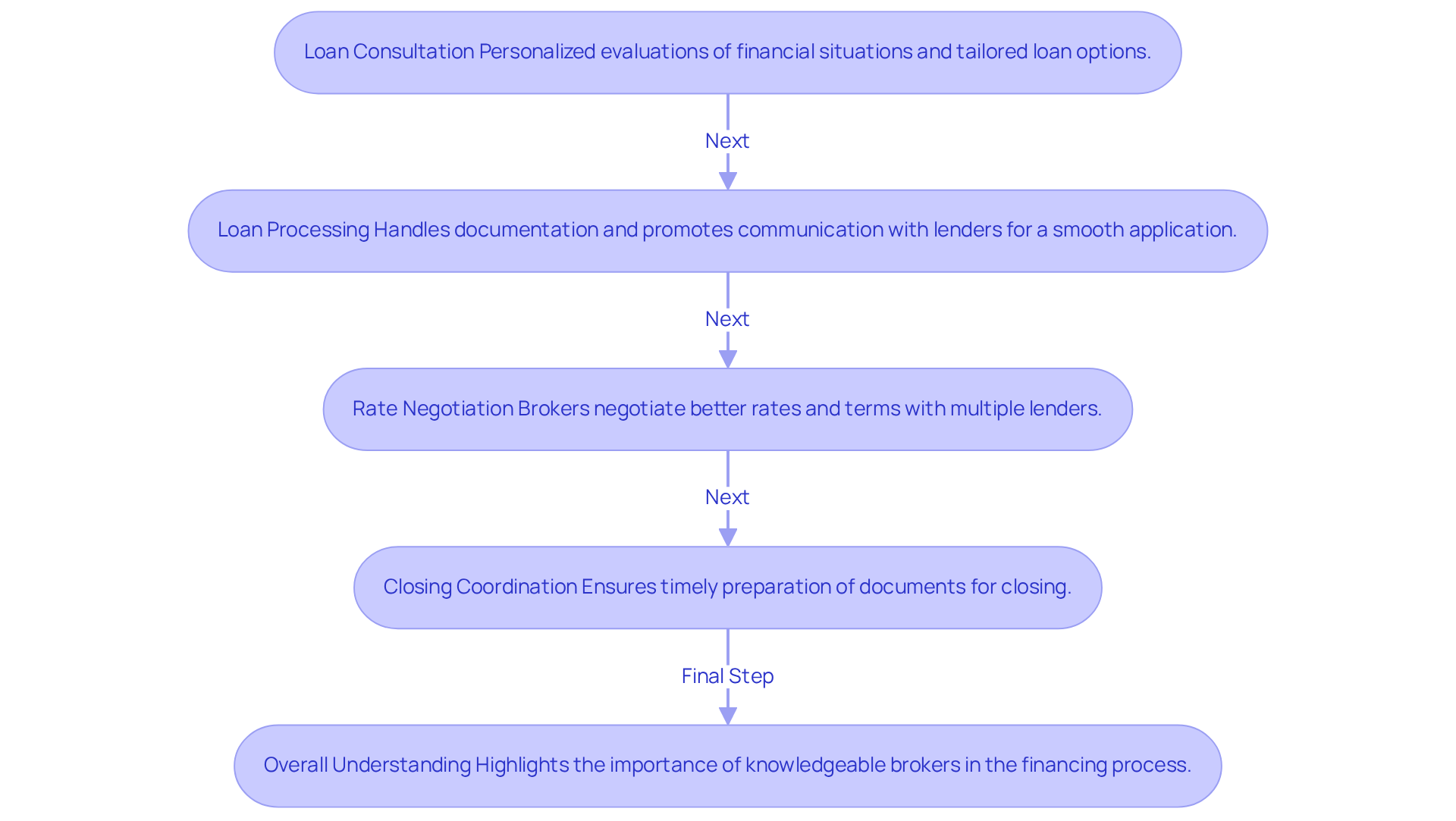

Understand the Role of a Mortgage Company

Navigating the world of home loans can feel overwhelming, but a financing organization serves as a vital intermediary between borrowers and lenders, simplifying this process for you. By offering a variety of services, they empower you to make informed decisions when selecting a mortgage company near me.

Loan Consultation: We know how challenging this can be. A mortgage company near me offers personalized consultations to evaluate your financial situation and recommend loan options tailored to your needs. This individualized approach significantly impacts your borrowing experience. Clients who engage in thorough consultations report high satisfaction rates, with F5 Mortgage boasting an impressive customer satisfaction rate of 94%. Their commitment to guiding you without pressure ensures that you choose what feels right for you.

Loan Processing: The organization handles all necessary documentation and promotes open communication with lenders, ensuring a smooth application experience. This is especially crucial in a market where the number of originated closed-end credits has fluctuated, with a notable decline of approximately 2.3 million from 2022 to 2023. With user-friendly technology, F5 Mortgage streamlines this process, making it stress-free for you.

Rate Negotiation: Experienced brokers leverage their relationships with multiple lenders to negotiate better rates and terms on your behalf. In 2025, many borrowers are opting for brokerage firms over direct lenders, underscoring the importance of expert negotiation in securing favorable financing terms. F5 Mortgage’s dedicated team tirelessly works with a mortgage company near me to find you the lowest interest rates available in California, utilizing their extensive network of lenders.

Closing Coordination: They also play a crucial role in coordinating the closing phase, ensuring that all necessary documents are prepared for a timely closing. For instance, with F5 Home Loans, most loans finalize in under three weeks, demonstrating the effectiveness that a committed lending company can offer. Clients often commend the speed and convenience of the process, sharing how simple and hassle-free their experience was.

Understanding these roles not only clarifies the financing process but also highlights the importance of choosing a knowledgeable broker who prioritizes your financial health. We’re here to support you every step of the way.

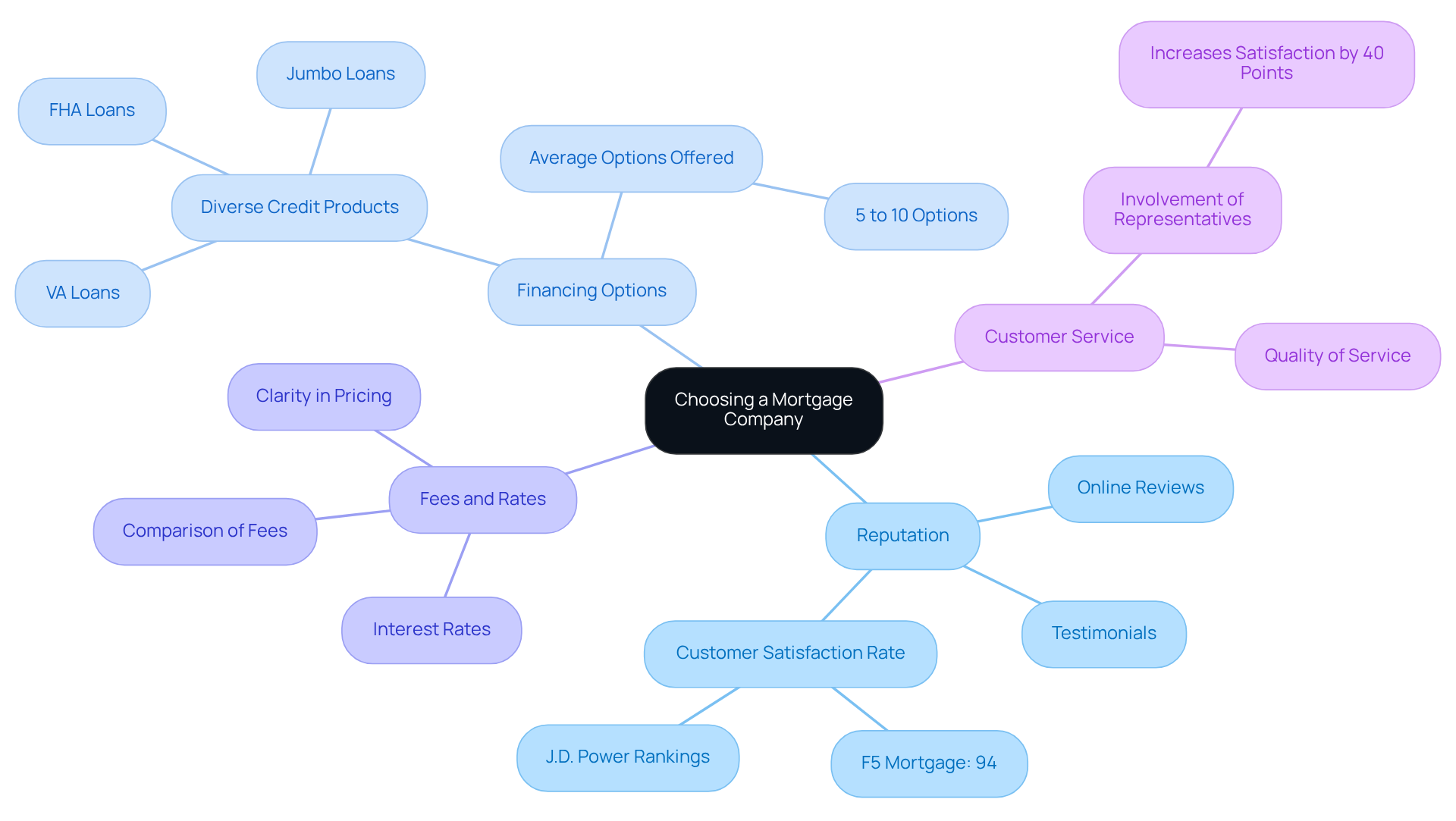

Identify Key Criteria for Choosing a Mortgage Company

When selecting a mortgage company near me, we know how challenging this can be. It’s essential to evaluate several key criteria to ensure a smooth and beneficial experience:

- Reputation: Investigate the company’s reputation through online reviews, testimonials, and ratings from past clients. A strong track record of customer satisfaction is indicative of a positive experience. For instance, firms such as F5 Mortgage, which boasts a 94% customer satisfaction rate, illustrate the significance of reputation in the lending sector.

- Financing Options: Verify that the organization offers a diverse range of credit products tailored to your financial needs, including FHA, VA, and jumbo financing. The average lending company usually provides approximately five to ten various financing options, but having a wider array can more effectively cater to distinct circumstances.

- Fees and Rates: Compare the fees and interest rates among various lenders. Clarity in pricing is essential to prevent unforeseen expenses, as concealed charges can greatly affect your total financial costs.

- Customer Service: Assess the quality of customer service offered. An attentive and informed team can significantly improve your loan experience. Research shows that including a representative in the application stage can increase overall satisfaction by as much as 40 points.

Select a mortgage company near me that understands your local market. Familiarity with local trends and specific state regulations can offer valuable insights, making the financing process smoother and more efficient.

By considering these factors, you can make an informed decision that aligns with your needs and supports you every step of the way.

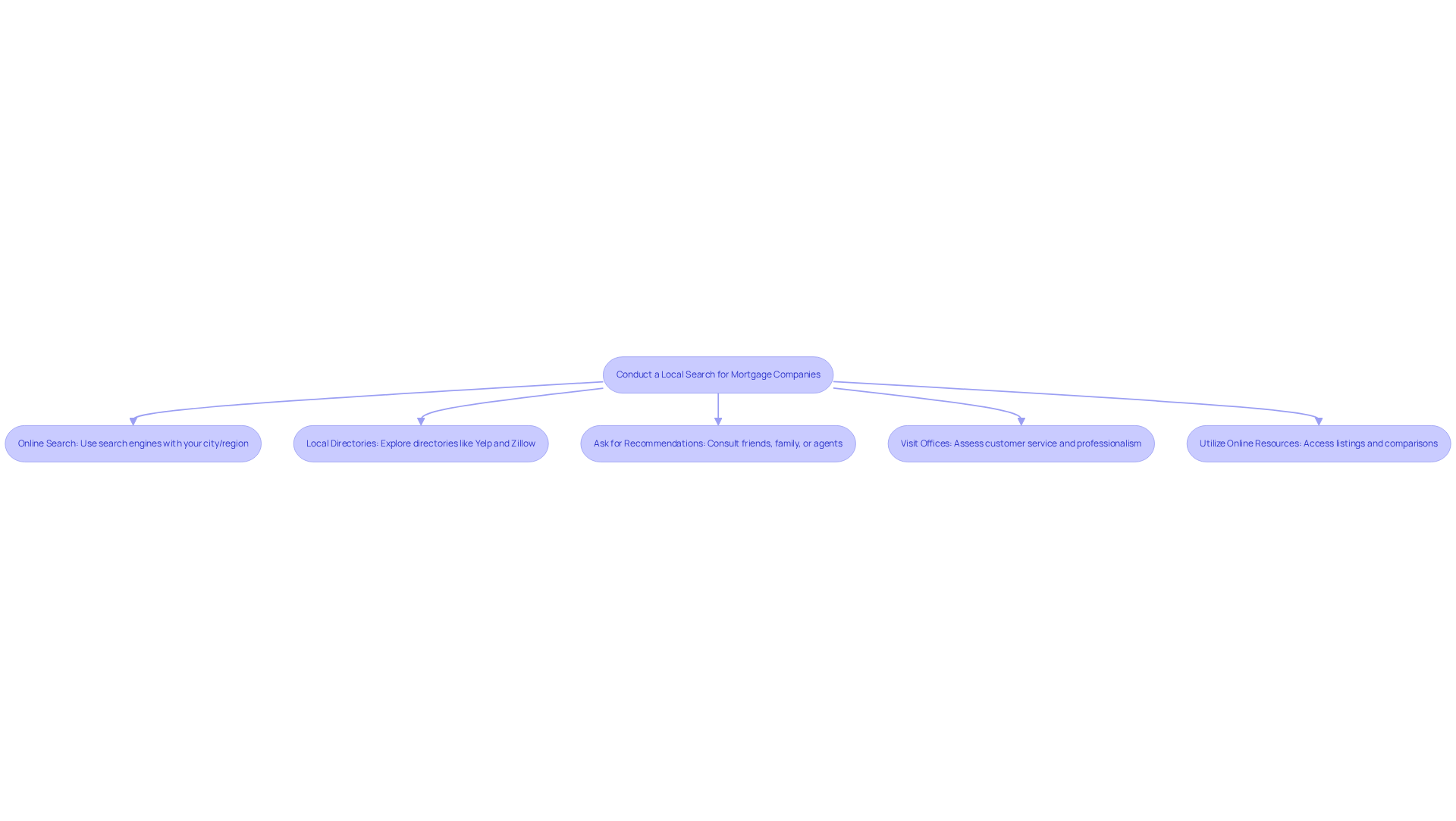

Conduct a Local Search for Mortgage Companies

Finding a reputable mortgage company near me can feel overwhelming, but we’re here to help you every step of the way. Consider these effective steps:

- Online Search: Start by utilizing search engines to locate mortgage companies. Including your city or region in the query can yield more relevant results, making your search easier.

- Local Directories: Explore local business directories and real estate websites that feature a mortgage company near me and lenders. Platforms like Yelp and Zillow offer user reviews and ratings, which can help you assess the reputation of a mortgage company near me.

- Ask for Recommendations: Don’t hesitate to consult friends, family, or real estate agents for their recommendations. Personal experiences can guide you to reliable loan brokers who have provided satisfactory service. Building relationships with local representatives can significantly enhance your experience.

If possible, visiting the offices of a mortgage company near me allows you to assess their customer service and professionalism firsthand. Engaging in face-to-face conversations can also facilitate direct inquiries about the services of a mortgage company near me.

Utilize online resources to connect you with a mortgage company near me and other loan brokers available in your area. Many websites offer comprehensive listings and comparisons, making it easier to find the right mortgage company near me that fits your needs.

Additionally, boosting your credit score can greatly improve your borrowing options. We know how challenging this can be, so order a copy of your credit report to check for errors or discrepancies. Paying down existing debts can help reduce your debt-to-income ratio, opening up more opportunities for you. With nearly 60% of homeowners choosing to retain their properties due to the rate-lock effect, understanding how to navigate the loan landscape is essential. Participating in thorough research and utilizing accessible resources can significantly improve your chances of finding a trustworthy loan broker who meets your specific needs. As industry specialists emphasize, maintaining strong communication with your loan broker can lead to higher satisfaction and better outcomes. F5 Mortgage is dedicated to connecting you with leading realtors and securing the finest loan deals, ensuring you have access to competitive rates and personalized service.

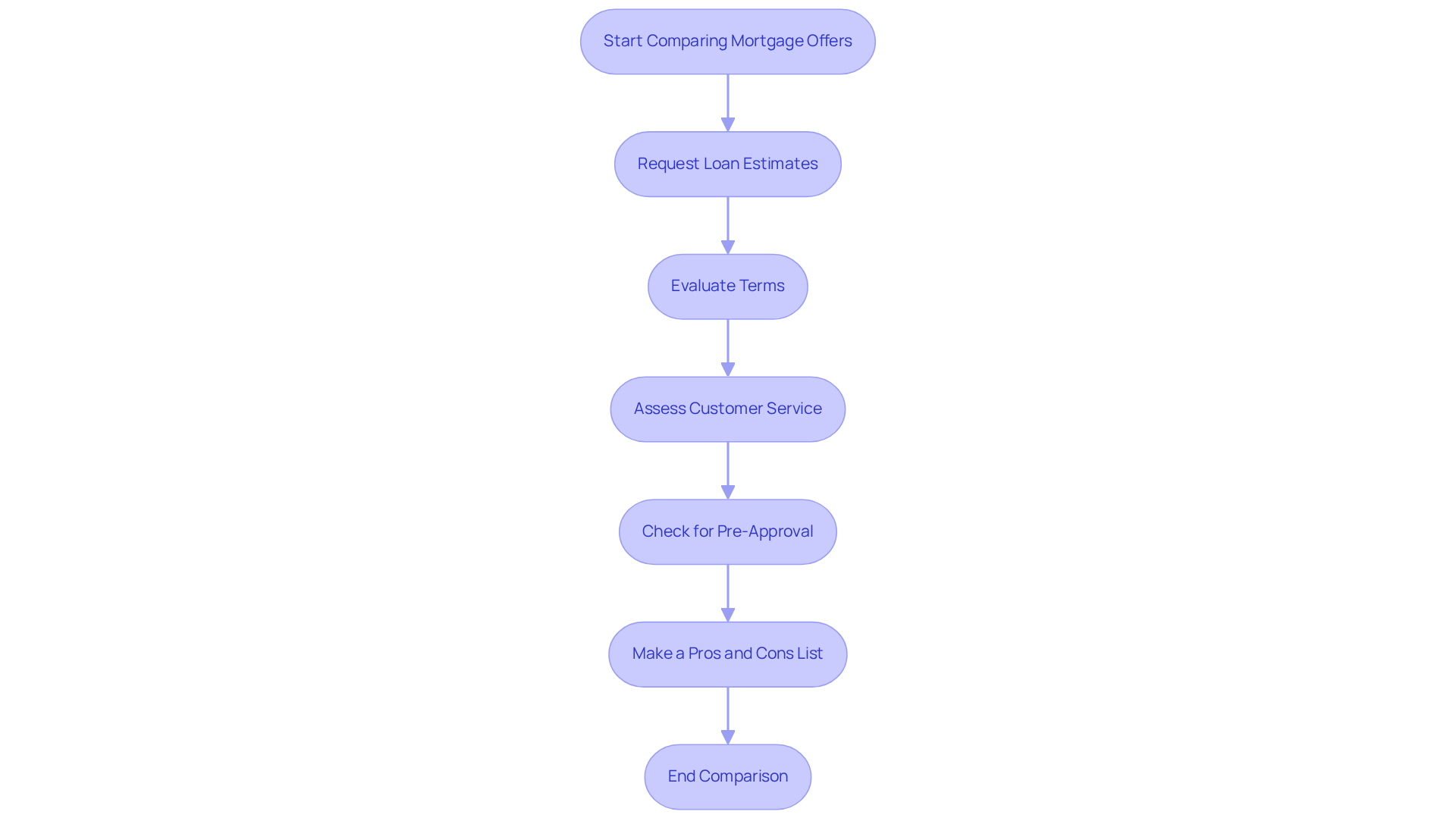

Compare Offers and Services from Multiple Companies

Once you have identified potential mortgage companies near me, we understand how crucial it is to effectively compare their offers. Here’s how you can navigate this process with confidence:

- Request Loan Estimates: Start by obtaining a Loan Estimate (LE) from each company. This document outlines the agreement’s terms, including interest rates, monthly payments, and closing costs, enabling a straightforward comparison.

- Evaluate Terms: Remember to look beyond just the interest rate. Consider the loan term, type of loan, and any additional fees that may apply. Understanding these factors can significantly impact your overall costs.

- Assess Customer Service: Pay attention to how each organization communicates with you. An attentive and supportive mortgage company near me can greatly enhance your mortgage journey, making it more seamless and less stressful.

- Check for Pre-Approval: Inquire about the pre-approval procedure and how quickly each organization can offer it. Quick pre-approval from a mortgage company near me can be a crucial advantage in competitive housing markets, providing you with leverage when making offers.

- Make a Pros and Cons List: Create a pros and cons list for each company based on your findings. This visual aid can help clarify your options and guide your decision-making process.

Comparing financing estimates is essential. We know how challenging this can be, and studies show that homebuyers can save between $600 to $1,200 each year by applying with various lenders. Additionally, understanding the key components of a Loan Estimate, such as loan amount, quoted interest rate, and closing costs, is crucial for making informed decisions. By following these steps, we’re here to support you every step of the way as you navigate the complexities of loan financing.

Finalize Your Choice and Prepare for the Application Process

Choosing a mortgage company near me like F5 Mortgage as your loan provider is an important step, and we understand how essential it is to prepare effectively for the application process. Here are some key steps to help ensure a smooth experience:

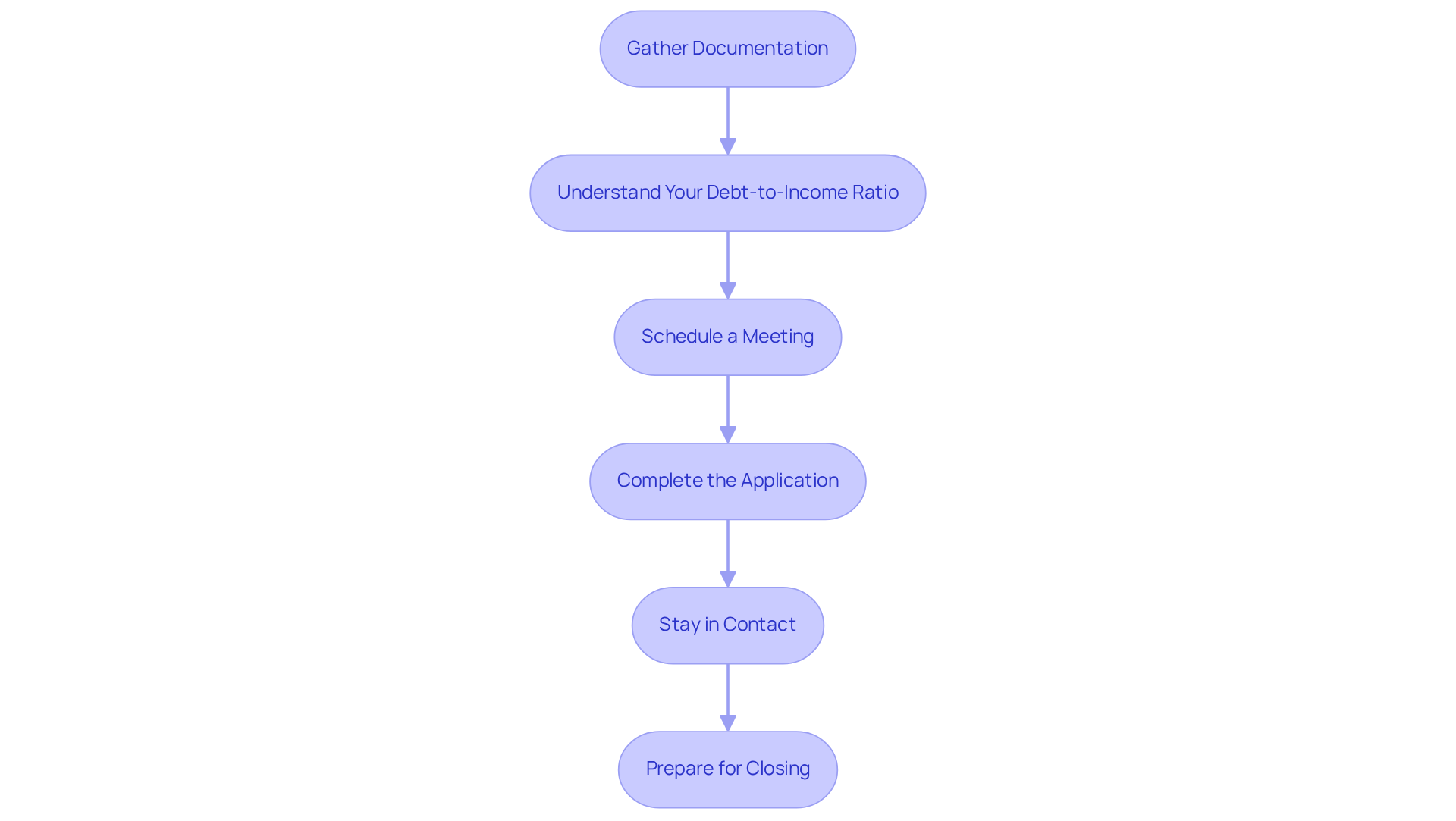

-

Gather Documentation: Start by collecting necessary documents such as proof of income, tax returns, bank statements, and identification. You’ll need two years of tax returns, at least two months of bank statements, and pay stubs. Having these ready not only streamlines your application but also demonstrates your financial stability, which is vital for approval. Remember, employment verification is essential as it confirms your current employment status and income stability.

-

Understand Your Debt-to-Income Ratio: It’s important to know that a maximum DTI ratio of 43% is usually required for home loans. This ratio reflects the balance between your existing debt and income. An improved DTI can lead to more competitive loan rates, so take a moment to evaluate your financial condition before applying.

-

Schedule a Meeting: We encourage you to arrange a meeting with the mortgage company near me to discuss your application and clarify any questions you may have. This face-to-face interaction significantly enhances communication and understanding of your needs. Research shows that effective communication with loan brokers can lead to a smoother application experience.

-

Complete the Application: When filling out the loan application form, be sure to provide all required information accurately. Being truthful about your financial condition is essential to prevent issues later on. Keep in mind that preapproval letters are typically valid for 60 to 90 days, so plan accordingly.

-

Stay in Contact: Maintaining open channels of communication with your loan broker throughout the process is crucial. Regular updates can help you navigate any additional requirements and keep your application on track.

-

Prepare for Closing: Once your application is approved, it’s time to prepare for the closing process. Understand what to expect and ensure you have the necessary funds for closing costs, which can include various fees and expenses associated with finalizing your mortgage.

We know how challenging this can be, but we’re here to support you every step of the way.

Conclusion

Finding the right mortgage company can truly shape your home-buying journey. It’s essential to approach this decision thoughtfully, as it can significantly influence your experience. By understanding the roles of mortgage companies, evaluating important criteria, and making thorough comparisons, you can navigate the lending landscape with confidence and clarity.

In this article, we’ve outlined various steps to help you in your selection process. We recognize how important loan consultations and rate negotiations are. By identifying key criteria such as:

- Reputation

- Financing options

- Customer service

you can ensure a smooth and beneficial mortgage experience. Engaging in local searches and comparing offers can enhance your chances of finding a company that truly aligns with your specific needs.

Ultimately, securing a mortgage is a journey that deserves diligence and informed decision-making. By utilizing the insights shared here, you can empower yourself to choose a mortgage company that not only meets your financial requirements but also provides the support you need throughout the process. Taking these steps can lead to a more satisfying and successful home-buying experience, reinforcing how vital it is to choose the right mortgage partner. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the role of a mortgage company?

A mortgage company acts as an intermediary between borrowers and lenders, simplifying the home loan process by offering various services, including loan consultations, loan processing, rate negotiation, and closing coordination.

How does a mortgage company assist with loan consultations?

A mortgage company provides personalized consultations to evaluate your financial situation and recommend loan options tailored to your needs, which significantly enhances the borrowing experience.

What are the benefits of loan processing by a mortgage company?

The mortgage company handles all necessary documentation and maintains open communication with lenders, ensuring a smooth application experience, which is made easier through user-friendly technology.

How do mortgage brokers negotiate rates?

Experienced mortgage brokers leverage their relationships with multiple lenders to negotiate better rates and terms on behalf of borrowers, often leading to more favorable financing options.

What is the significance of closing coordination?

Mortgage companies coordinate the closing phase by ensuring all necessary documents are prepared for timely closing, which can expedite the loan finalization process.

What criteria should I consider when choosing a mortgage company?

Key criteria include the company’s reputation, the variety of financing options offered, clarity in fees and rates, and the quality of customer service.

Why is a company’s reputation important?

A strong reputation, evidenced by positive online reviews and customer satisfaction rates, indicates a higher likelihood of a positive lending experience.

What types of financing options should a mortgage company offer?

A good mortgage company should provide a diverse range of credit products, including FHA, VA, and jumbo financing, to cater to various financial needs.

How can I assess customer service quality at a mortgage company?

You can assess customer service by researching reviews and testimonials, as well as considering how responsive and knowledgeable the staff are during the application process.

Why is local market knowledge important for a mortgage company?

Familiarity with local trends and specific state regulations can provide valuable insights, making the financing process smoother and more efficient for borrowers.