Overview

This article presents a caring five-step process designed to help you buy a new house with confidence. We understand how challenging this journey can be, so we focus on:

- Assessing your readiness

- Establishing a budget

- Researching properties

- Navigating the buying process

- Managing your new home after purchase

Each step is filled with practical advice and current statistics, highlighting the importance of financial evaluation and market understanding.

We’re here to support you every step of the way, ensuring you have the professional guidance needed for a successful home-buying experience. By addressing your emotions and concerns, we aim to empower you to make informed decisions that will lead to a fulfilling new chapter in your life.

Introduction

Navigating the journey to homeownership can often feel daunting. We know how challenging this can be, especially as rising costs leave many potential buyers feeling uncertain. Understanding the essential steps to confidently purchase a new house is crucial for anyone looking to make this significant investment.

What factors should one consider to ensure a successful buying experience? How can prospective homeowners prepare themselves to face the complexities of the real estate market? We’re here to support you every step of the way, empowering you to make informed decisions.

Assess Your Readiness for Homeownership

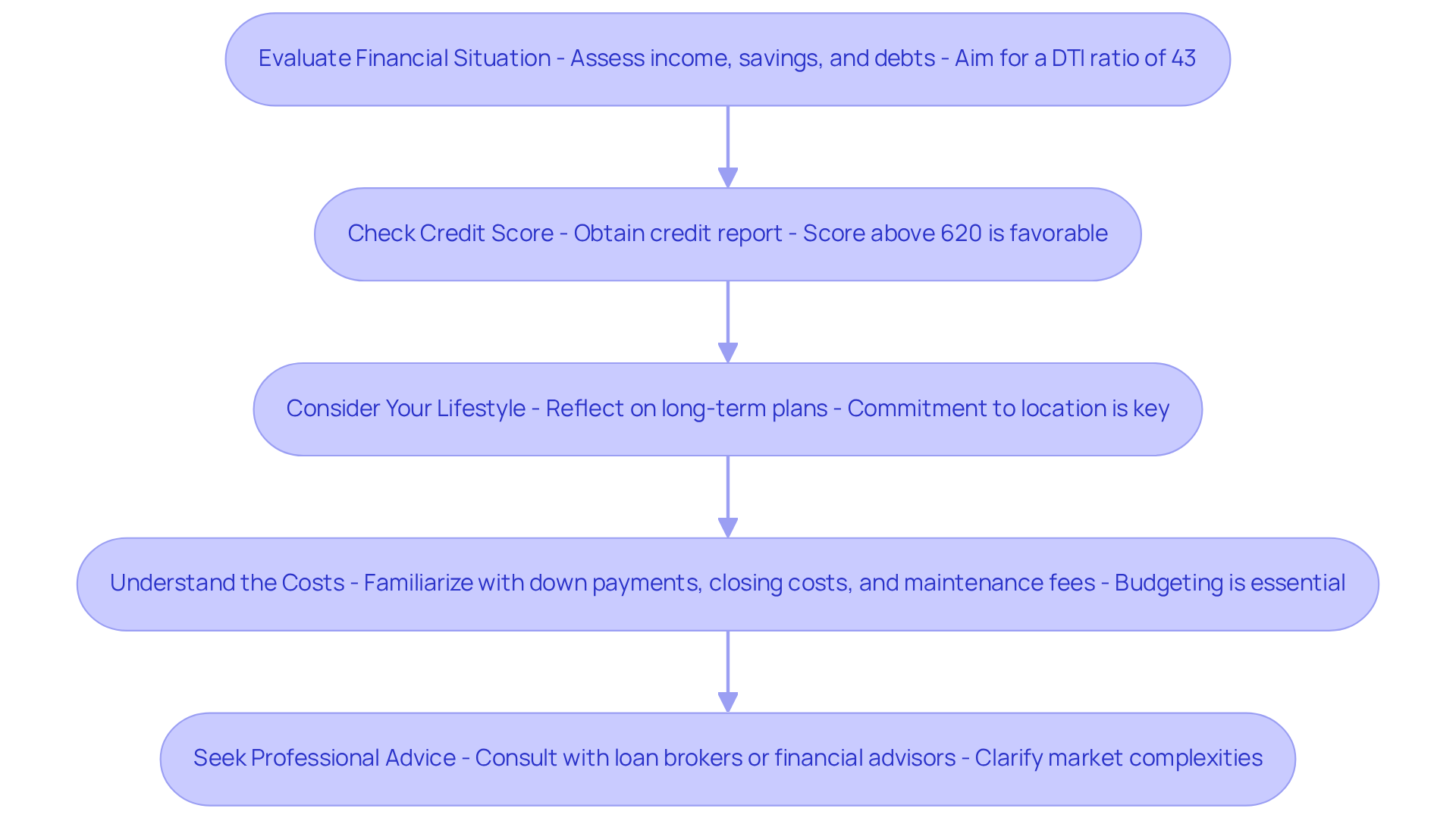

To assess your readiness for homeownership, let’s walk through these important steps together:

- Evaluate Your Financial Situation: Start by taking a close look at your income, savings, and existing debts. A stable income and a manageable debt-to-income ratio are crucial. Ideally, aim for a maximum debt-to-income (DTI) ratio of 43% for property loans, as this can significantly impact your financing options. With 49% of Americans feeling that homeownership is becoming unrealistic in 2025 due to rising costs, understanding your financial landscape is more important than ever if you plan to buy a new house.

- Check Your Credit Score: Make sure to obtain your credit report and review your score. Generally, a score above 620 is favorable for most mortgage options. As of 2025, average credit scores for homebuyers hover around this threshold, so knowing where you stand is essential.

- Consider Your Lifestyle: Reflect on your long-term plans. Are you ready to settle down in one location for several years? Owning property is a long-term commitment, and 34% of property owners now view their current residence as their permanent home, which impacts their plans to buy a new house due to concerns about interest rates.

- Understand the costs: Familiarize yourself with the expenses associated with buying a new house, including down payments, closing costs, and ongoing maintenance fees. With 74% of , effective budgeting is key to navigating the current market. Additionally, understanding the approval process for financing is essential; it usually involves an estimate of your borrowing amount, interest rate, and potential monthly payments based on your financial details.

- Seek Professional Advice: Don’t hesitate to consult with a loan broker or financial advisor for insights tailored to your specific situation. Engaging with professionals can help clarify the complexities of the market, especially since 1 in 4 homebuyers express confusion over recent changes in commission laws. For self-employed individuals, understanding how income is calculated through bank statement loans can also be beneficial in obtaining the right financing.

Remember, we know how challenging this process can be, and we’re here to support you every step of the way.

Establish Your Budget and Financing Options

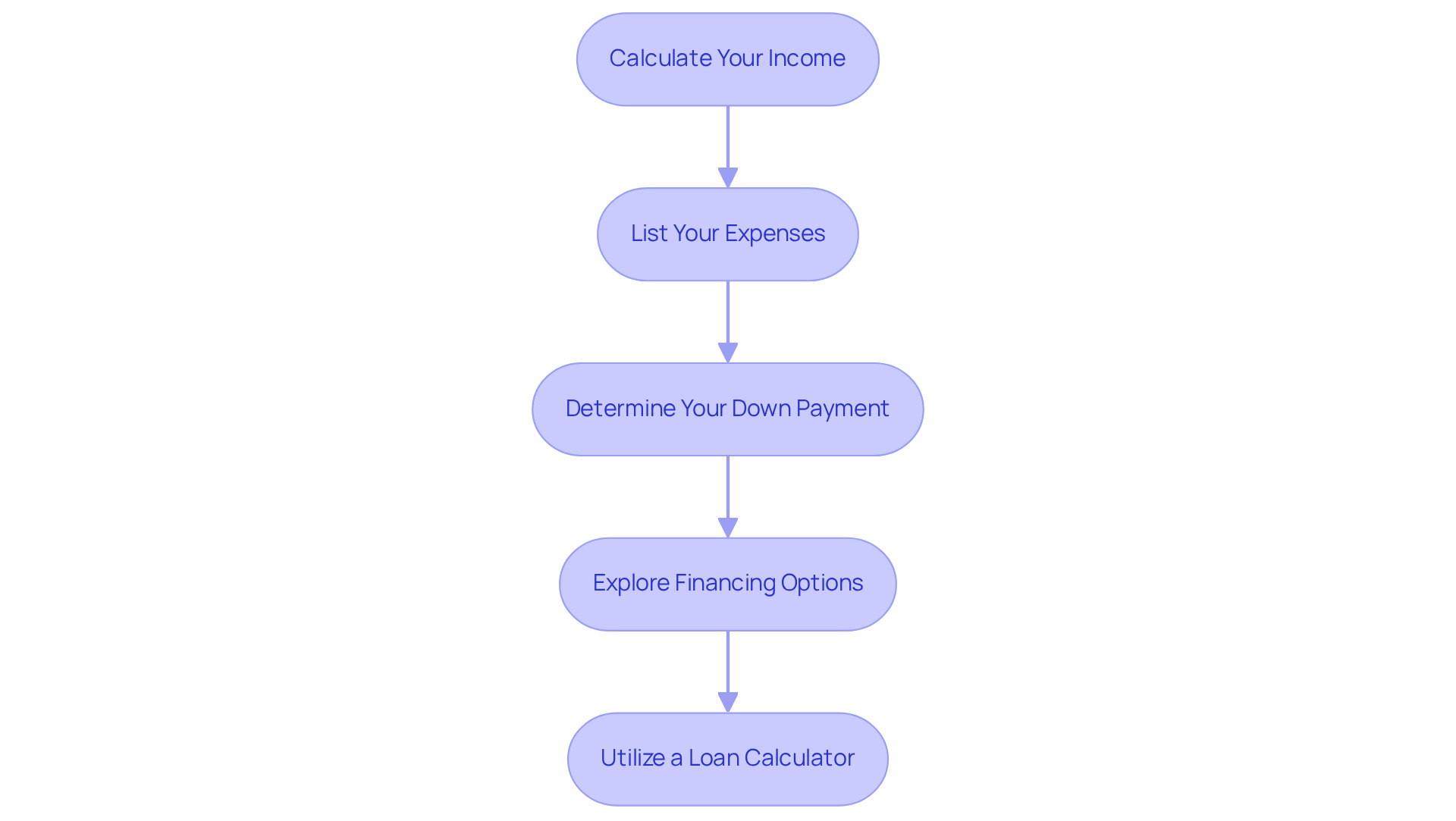

To effectively establish your budget and explore financing options, we understand how challenging this can be. Here are some steps to guide you:

- Calculate Your Income: Begin by determining your total monthly income. Factor in all sources, such as salaries, bonuses, and any side jobs. This comprehensive view will provide a solid foundation for your budget.

- List Your Expenses: Document all monthly expenses, including debts, utilities, groceries, and entertainment. Comprehending your expenditure patterns is essential for determining how much you can set aside for a loan.

- Determine Your Down Payment: Assess how much you can afford to put down on a home. A larger down payment not only decreases your monthly housing payments but can also improve your chances of obtaining favorable financing terms.

- Explore Financing Options: Investigate various types of home financing available in 2025, such as fixed-rate, FHA, and VA products. VA loans, in particular, offer significant benefits, including no down payment and through F5 Mortgage. Each option has distinct requirements and benefits. Consider securing pre-approval for a loan, which will clarify your borrowing capacity and streamline the process to buy a new house. Remember, current loan interest rates differ by category, so be sure to investigate these rates to make informed choices.

- Utilize a Loan Calculator: Take advantage of online loan calculators to estimate your monthly payments based on different borrowing amounts and current interest rates. This tool can help you visualize how different scenarios impact your budget and financial planning.

We’re here to support you every step of the way. F5 Mortgage has successfully assisted over 1,000 families, boasting a customer satisfaction rate of 94%. This reflects our commitment to helping clients navigate the financing process with transparency and personalized support. Take the first step toward the right mortgage by applying online or contacting F5 Mortgage today!

Research Properties and Choose the Right Location

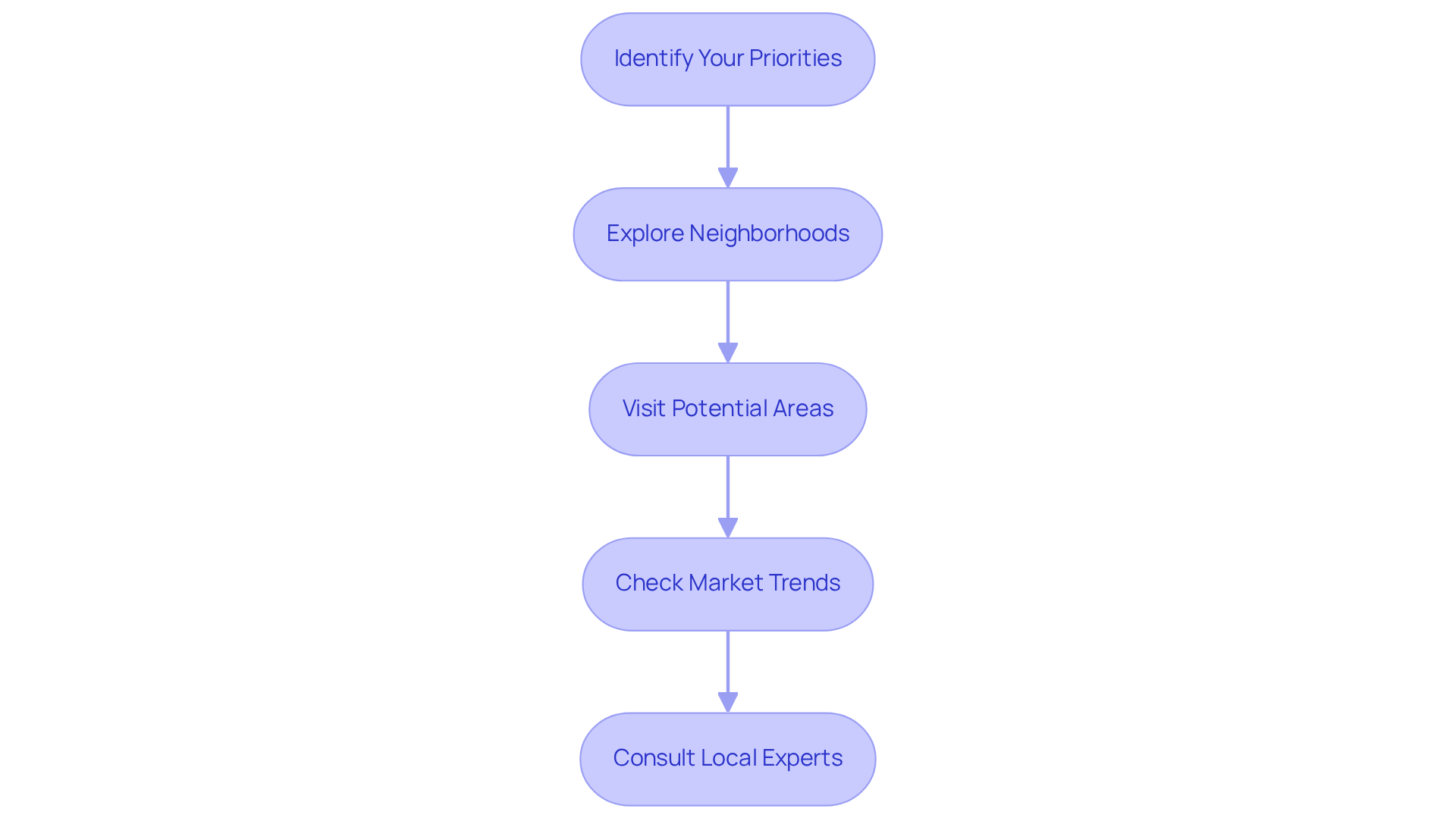

When it comes to and selecting the right location, we understand how overwhelming this process can feel. Here are some steps to guide you through it:

- Identify Your Priorities: Start by listing your must-haves, like the number of bedrooms or yard size, as well as your deal-breakers, such as proximity to schools or public transport. We know how important these factors are for your family’s comfort.

- Explore Neighborhoods: Take the time to research various neighborhoods, considering aspects like safety, school ratings, and local amenities. Websites like Zillow and local real estate listings can provide valuable insights to help you make informed decisions.

- Visit Potential Areas: It’s essential to visit neighborhoods at different times of the day. This will help you get a genuine feel for the community and its atmosphere, ensuring it aligns with your family’s lifestyle.

- Check Market Trends: Understanding property values and market trends in your desired areas is crucial. Knowing whether it’s a buyer’s or seller’s market can significantly impact your purchasing strategy when you want to buy a new house, empowering you to make the best choice.

- Consult Local Experts: Finally, consider working with a local real estate agent. They can offer expert insights into the market and assist you in finding properties that meet your criteria, providing support every step of the way.

Navigate the Buying Process: From Offer to Closing

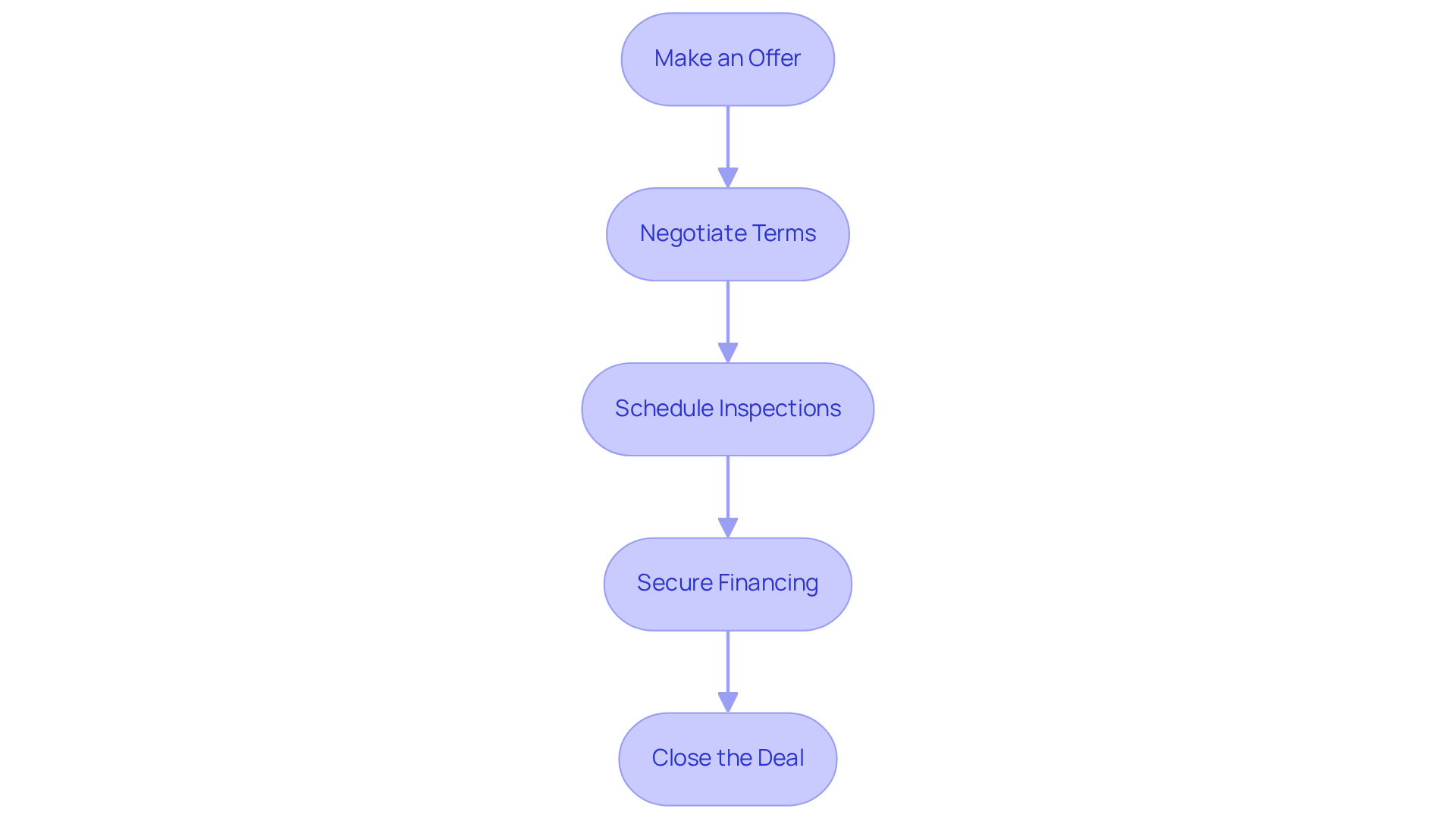

Navigating the buying process to buy a new house from offer to closing can feel overwhelming, but we’re here to support you every step of the way. Follow these steps to make your journey smoother:

- Make an Offer: Once you discover a property you like, collaborate with your real estate agent to create a competitive proposal based on market analysis. It’s common to include contingencies for repairs or upgrades in your offer. This can be a strategic move to ensure the property meets your standards and gives you peace of mind.

- Negotiate Terms: Be prepared to negotiate with the seller on price, closing costs, and any repairs needed before closing. If the seller counters your initial offer, your agent can facilitate discussions to reach a mutually beneficial agreement. Remember, it’s okay to walk away if the terms don’t align with your goals; your comfort is paramount.

- Schedule Inspections: Once your offer is accepted, arrange a property inspection to identify any potential issues with the premises. This step is crucial for understanding the state of the residence and ensuring that any necessary repairs are addressed before you buy a new house. We know how important it is to feel secure in your new home.

- Secure Financing: Finalize your mortgage application with F5 Mortgage, which leverages technology to provide competitive rates and a stress-free experience. Ensure you provide all necessary documentation for approval. Your lender will send a and later a Closing Disclosure detailing your final costs. F5 Mortgage can also connect you with leading realtors to assist you in your journey to buy a new house.

- Close the Deal: Review all closing documents carefully, attend the closing meeting, and confirm fund transfers. Once finished, you will receive the keys to your new residence, marking the successful conclusion of your property-buying journey. Celebrate this milestone; you’ve earned it!

Manage Your New Home: Essential Post-Purchase Steps

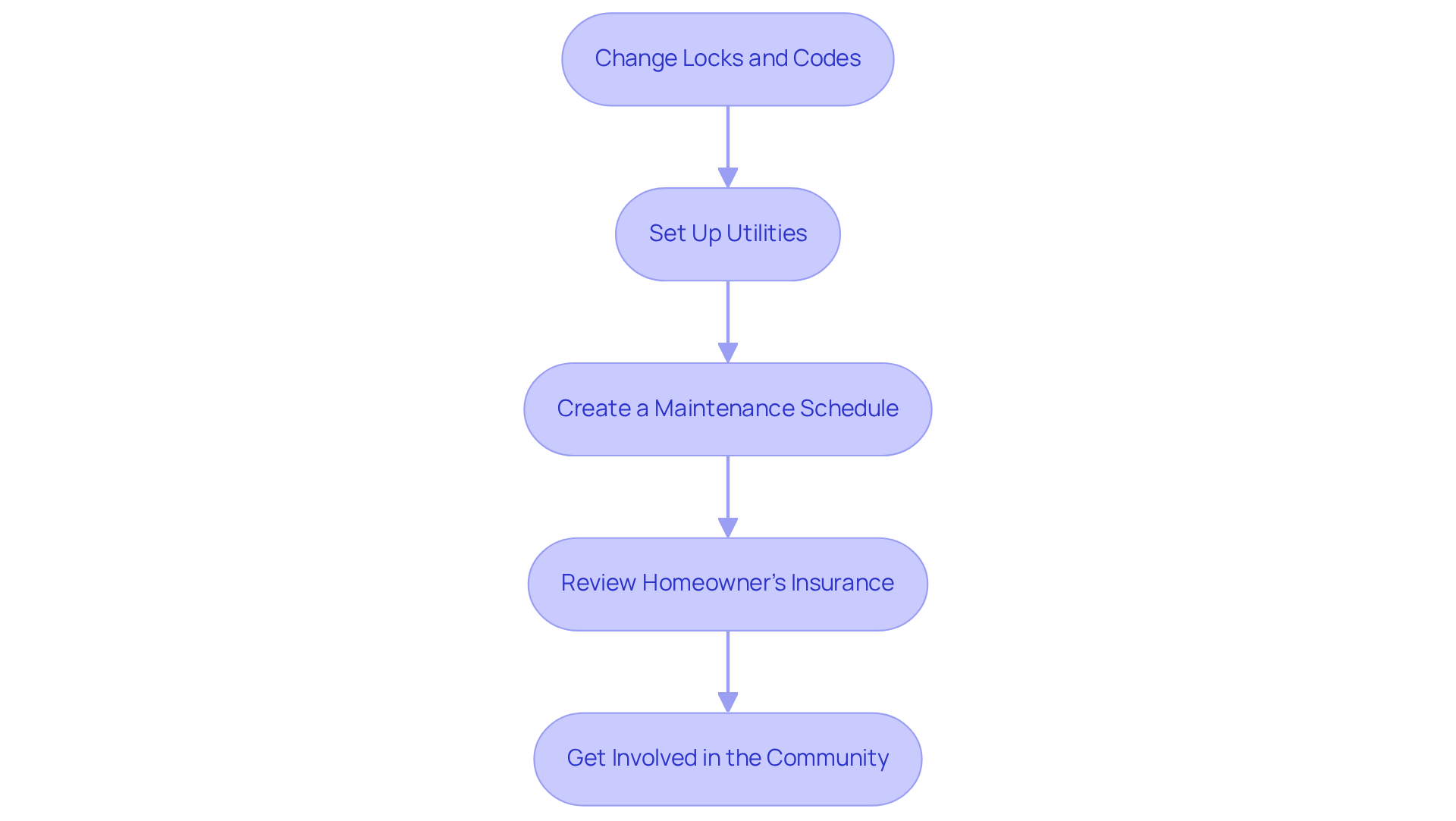

Managing your new home can feel overwhelming, but we’re here to support you every step of the way. Here are some essential steps to help you settle in comfortably:

- Change Locks and Codes: For your peace of mind, it’s crucial to change the locks and any garage codes immediately after moving in. This simple act can significantly enhance your security.

- Set Up Utilities: Make sure all essential services—like electricity, water, gas, and internet—are set up and functioning before you officially move in. This will create a welcoming environment from day one.

- Create a Maintenance Schedule: Establishing a routine for regular home maintenance tasks, such as changing air filters and checking smoke detectors, can prevent future issues and keep your home safe and comfortable.

- Review Homeowner’s Insurance: It’s important to ensure your is active and covers all necessary aspects of your property. This safeguard will give you peace of mind as you settle into your new space.

- Get Involved in the Community: Familiarize yourself with your new neighborhood. Consider joining local groups or associations to build connections and enhance your living experience. Remember, we know how challenging this transition can be, and engaging with your community can make it much easier.

Conclusion

Buying a new house can feel overwhelming, but with the right steps and knowledge, you can build confidence throughout the process. We understand how important it is to assess your financial readiness, establish a realistic budget, and research properties thoroughly. These crucial steps empower you to make informed decisions. By following a structured approach, you can navigate the complexities of homeownership with assurance.

Key points to consider include:

- Evaluating your financial situation and credit score

- Understanding the various costs associated with home buying

- Seeking professional advice

Remember, researching neighborhoods and market trends is vital, as these elements significantly influence your property selection. Managing the buying process effectively—from making an offer to closing the deal—ensures a smoother transition into your new home.

Ultimately, this journey is not just about securing a property; it’s about creating a place to call home. By taking the necessary steps and staying informed, you can approach this significant investment with clarity and confidence. Embrace the process, stay engaged, and remember that each step you take brings you closer to achieving your dream of homeownership. We’re here to support you every step of the way.

Frequently Asked Questions

How can I assess my readiness for homeownership?

To assess your readiness, evaluate your financial situation by reviewing your income, savings, and debts; check your credit score; consider your long-term lifestyle plans; understand the costs associated with buying a home; and seek professional advice from a loan broker or financial advisor.

What is a manageable debt-to-income ratio for home loans?

Ideally, aim for a maximum debt-to-income (DTI) ratio of 43% for property loans, as this can significantly impact your financing options.

What credit score is generally favorable for mortgage options?

A credit score above 620 is generally favorable for most mortgage options.

What long-term commitment should I consider before buying a home?

You should be ready to settle down in one location for several years, as owning property is a long-term commitment.

What costs should I be familiar with when buying a new house?

Familiarize yourself with expenses such as down payments, closing costs, and ongoing maintenance fees.

How can I effectively establish my budget and explore financing options?

Start by calculating your total monthly income, listing your expenses, determining your down payment, exploring various financing options, utilizing a loan calculator, and seeking pre-approval for a loan.

What are some financing options available for homebuyers in 2025?

Financing options include fixed-rate mortgages, FHA loans, and VA loans, each with distinct requirements and benefits.

How can a larger down payment benefit me?

A larger down payment decreases your monthly housing payments and can improve your chances of obtaining favorable financing terms.

How can I estimate my monthly payments for a mortgage?

You can utilize online loan calculators to estimate your monthly payments based on different borrowing amounts and current interest rates.

What support does F5 Mortgage offer to homebuyers?

F5 Mortgage has successfully assisted over 1,000 families with a customer satisfaction rate of 94%, providing transparency and personalized support throughout the financing process.