Overview

Navigating the journey to homeownership can be both exciting and overwhelming, especially for first-time buyers in Pennsylvania. This article outlines a comprehensive five-step process designed just for you. We know how challenging this can be, which is why we emphasize the importance of:

- Pre-approval

- Property searching

- Making an offer

- Home inspection and appraisal

- Closing

Each step is not just a checklist; it’s supported by practical advice, statistics, and valuable resources. For instance, down payment assistance programs are available to empower you and streamline your path to owning a home. By understanding these steps, you can approach the process with confidence and clarity.

We’re here to support you every step of the way. Let’s embark on this journey together, ensuring you have the knowledge and tools needed to make informed decisions in your quest for a new home.

Introduction

Navigating the journey to homeownership can feel overwhelming, particularly for first-time buyers in Pennsylvania. We understand how challenging this can be, and recognizing the intricacies of the home buying process is crucial for making informed decisions and steering clear of common pitfalls. This guide provides a compassionate overview of the five essential steps that will empower you to approach your property search with confidence and clarity. Yet, with numerous options and potential challenges, how can you ensure you are well-prepared to seize the opportunities that await you in the market? We’re here to support you every step of the way.

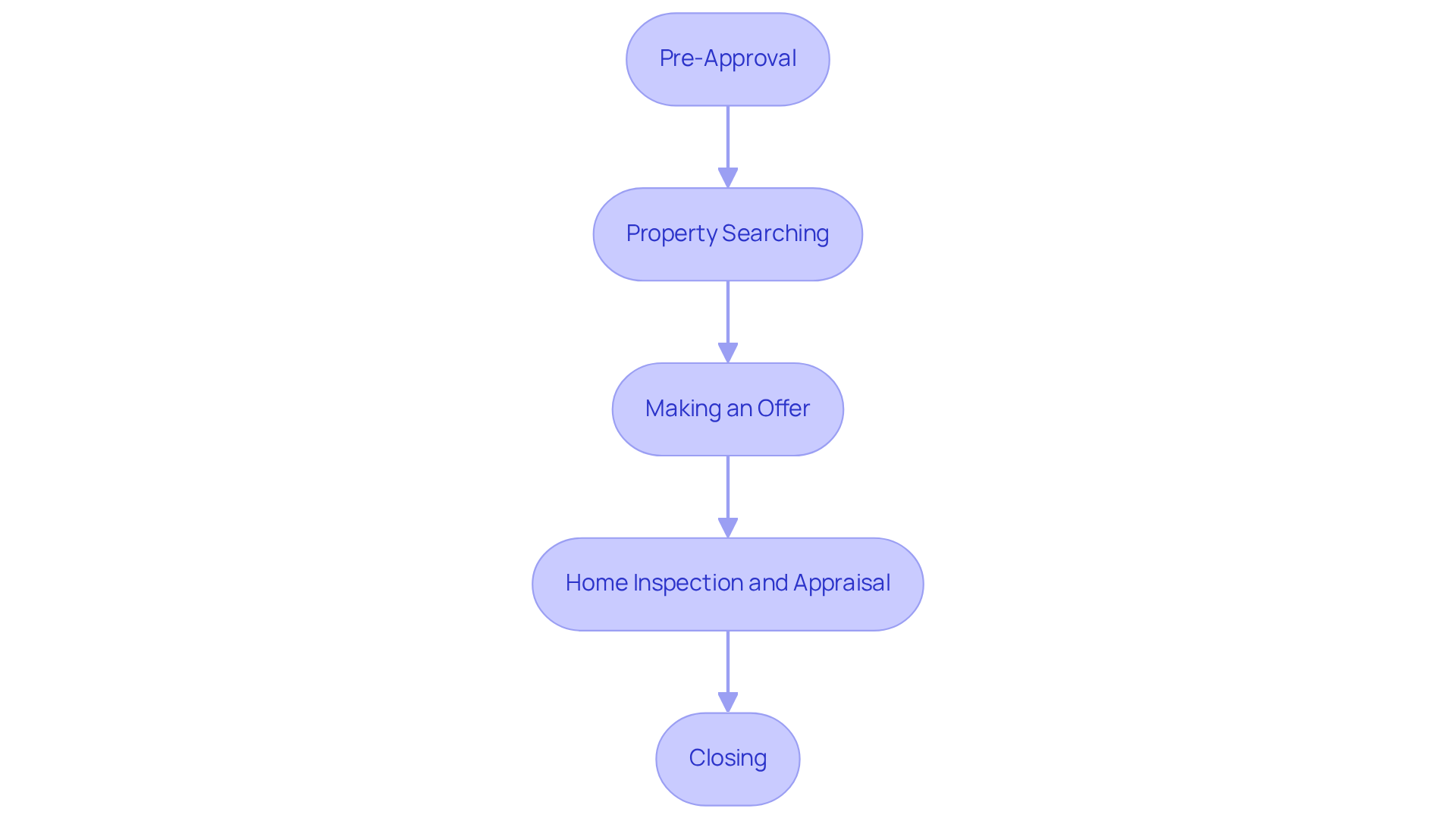

Understand the First-Time Home Buyer Process in Pennsylvania

For a first time home buyer pa, navigating the property purchasing process can feel overwhelming, but understanding the key stages can empower you to make informed decisions.

-

Pre-Approval: Securing a mortgage pre-approval is a crucial first step before you embark on your home search. This not only clarifies your budget but also signals to sellers that you are a serious contender in the market. In 2025, approximately 68% of first-time home buyers PA successfully obtained pre-approval, highlighting its importance. At F5 Mortgage, we’re here to connect you with top realtors and help you navigate available homebuyer assistance programs to ensure you get the best deal possible.

-

Property Searching: With your pre-approval in hand, you can start exploring residences that meet your needs. We know how challenging this can be, so utilize online platforms, attend open houses, and consider enlisting the help of a knowledgeable real estate agent to streamline your search. The typical mortgage for a first time home buyer pa in 2024 was $264,840, which can help you set realistic expectations for your budget. F5 Finance leverages user-friendly technology to simplify this process, ensuring you have the tools to make informed choices.

-

Making an Offer: Once you find a property that resonates with you, it’s time to make an offer. This involves negotiating the price and terms with the seller, a pivotal moment in your home buying journey. At F5 Mortgage, our commitment to no-pressure guidance means you can feel confident in your decisions. Remember to consider applying for down payment assistance loans to strengthen your offer.

-

Home Inspection and Appraisal: After your offer is accepted, arrange for a home inspection to uncover any potential issues. An appraisal will also be necessary to confirm the property’s value, ensuring you are making a sound investment. In 2024, the average down payment for a first time home buyer pa in Pennsylvania was $38,062, making it an important financial consideration. F5 Mortgage provides down payment assistance financing, enabling you to present a more competitive offer and decrease your total financing amount.

-

Closing: The final step is the closing process, where you finalize your mortgage details and officially take ownership of your new home. In Pennsylvania, most loans close in less than three weeks, making this an efficient part of the process. F5 Lending boasts a customer satisfaction rate of 94%, reflecting its commitment to providing a smooth and supportive experience for homebuyers.

By familiarizing yourself with these stages, you can approach your property purchasing journey with confidence and clarity. Remember, F5 Mortgage is here to assist you with personalized consultations and a variety of loan options tailored to your unique situation. As Rep. Ryan Bizzarro pointed out, recent legislative efforts could assist up to 4,000 additional first time home buyer PA in purchasing their initial residence each year, further increasing the opportunities accessible to you.

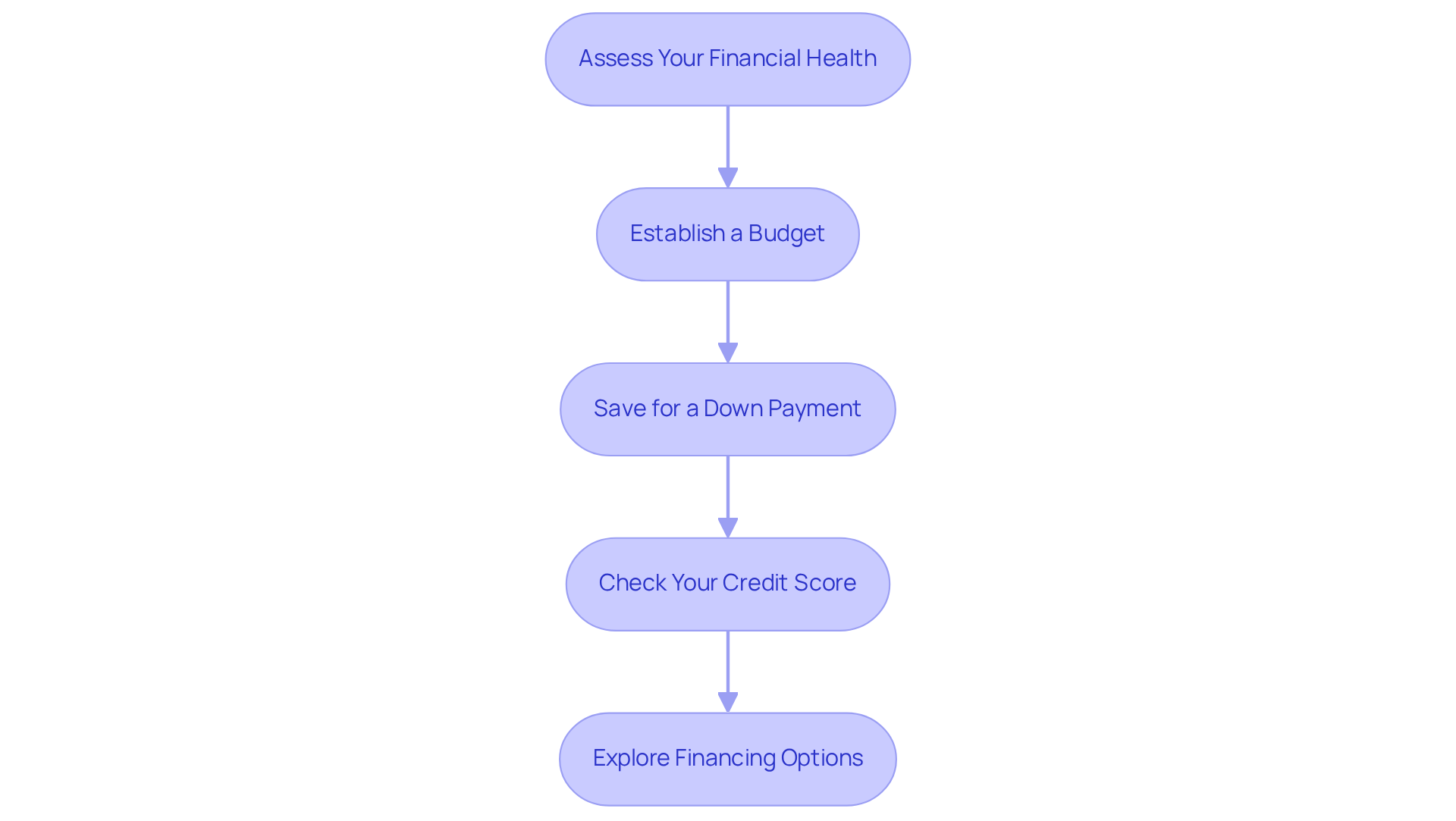

Prepare Financially for Home Ownership

Preparing financially for homeownership can feel overwhelming, but taking it step by step can make the journey smoother. Here are some key steps to guide you:

- Assess Your Financial Health: Start by reviewing your income, expenses, and savings. Calculate your debt-to-income (DTI) ratio, ideally a maximum of 43%, to understand how much you can afford to borrow. A better DTI can lead to more competitive mortgage rates, giving you a clearer picture of your financial standing.

- Establish a Budget: Create a detailed budget that includes not just your mortgage payment but also property taxes, homeowners insurance, maintenance costs, and utilities. This holistic approach will help you anticipate all financial responsibilities associated with homeownership, alleviating some of the stress.

- Save for a Down Payment: In Pennsylvania, the average down payment percentage ranges from 3% to 20% of the home’s purchase price, which is currently around $286,600. Aim to save within this range, and explore down payment assistance programs like the ‘1st Home Allegheny’ initiative, which offers forgivable funds up to $45,000 for qualified first time home buyer pa. To qualify, buyers must meet specific income requirements, ranging from $68,700 for a two-person household at 80% of the area median income to $123,000 for a five-person household at 115% of AMI. FHA mortgages, which are supported by the government, are also a wonderful option for first time home buyer pa, as they typically require smaller down payments and have more flexible credit criteria.

- Check Your Credit Score: A higher credit score can greatly influence your mortgage rates. Obtain a copy of your credit report and address any issues proactively. This can enhance your creditworthiness before you apply for a mortgage, making the process easier.

- Explore Financing Options: Research various mortgage types, including FHA, VA, and conventional loans, to find the best fit for your financial situation. FHA loans, in particular, are accessible to homeowners with lower credit scores and have less stringent DTI requirements. Understanding the nuances of each option empowers you to make informed decisions.

By following these steps, you will be well-equipped to manage the financial responsibilities of homeownership, paving the way for a successful purchase. Remember, we know how challenging this can be, and we’re here to support you every step of the way. Additionally, consider utilizing resources like F5 Mortgage’s extensive buyer’s guide and refinancing guides to further enhance your journey.

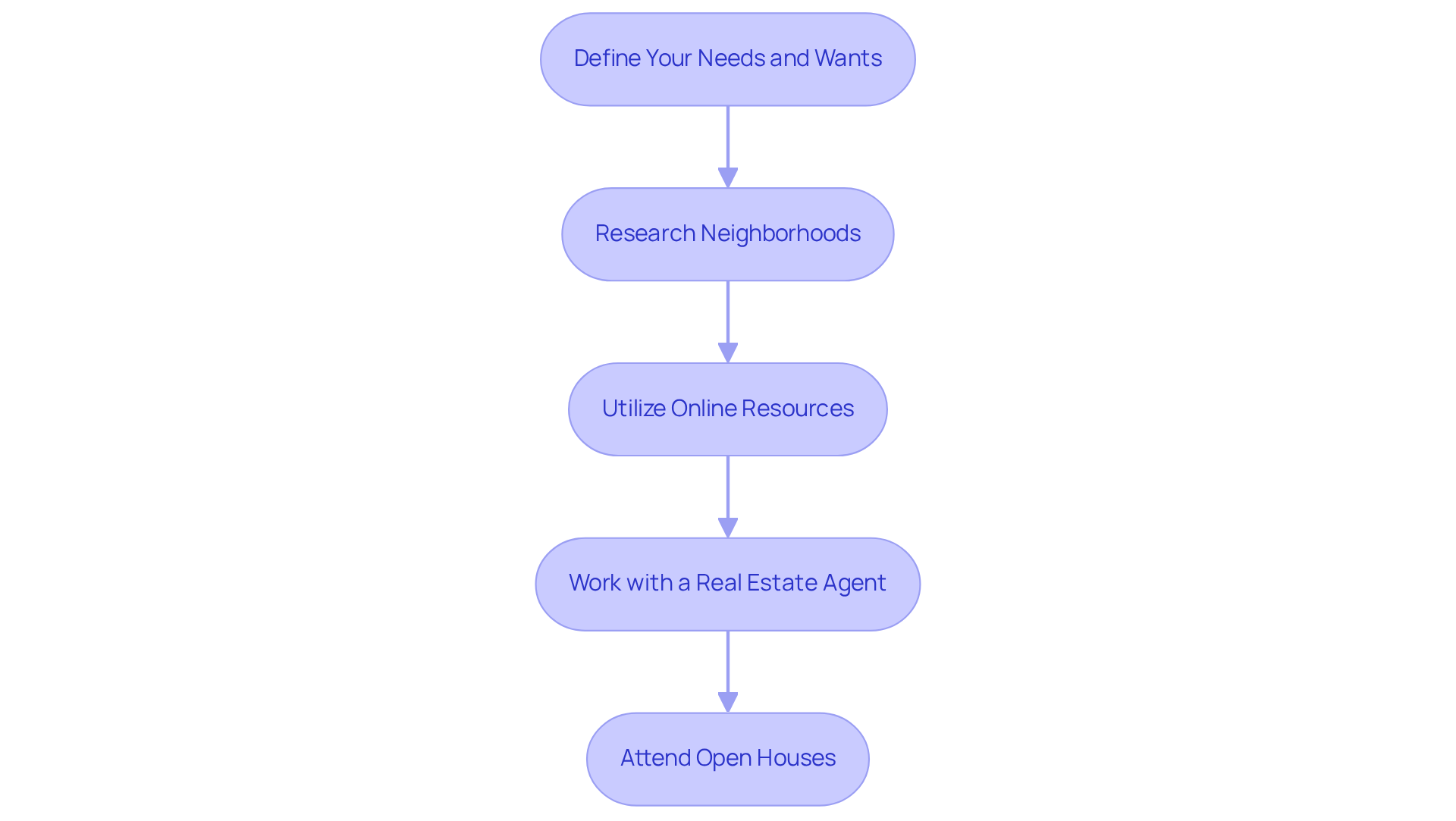

Search for Your Ideal Home

Searching for your ideal home can feel overwhelming, but with the right strategies, you can navigate this journey with confidence:

-

Define Your Needs and Wants: Start by making a list of your must-haves, such as the number of bedrooms and preferred location. Don’t forget to include nice-to-haves, like a pool or garage, to help visualize your dream home.

-

As a first time home buyer in PA, you should research neighborhoods to explore different areas in Pennsylvania that align with your lifestyle and budget. Consider essential factors like schools, amenities, and commute times. We know how important it is to find a community that feels just right.

-

Utilize Online Resources: Leverage real estate websites and apps to browse listings, view photos, and read descriptions. Setting up alerts for new listings that match your criteria can help you stay ahead of the game.

-

Work with a Real Estate Agent: Partnering with a knowledgeable agent can make a significant difference. They can provide valuable insights, help you navigate the market, and negotiate on your behalf. As one local representative wisely notes, “Grasping the subtleties of each neighborhood can create a considerable impact on your property purchasing experience.” At F5, our dedicated loan officers and Account Managers are here to support you every step of the way, ensuring your offer is accepted and reducing the runaround often linked with property purchasing.

-

Attend Open Houses: Visiting open houses allows you to experience properties and neighborhoods firsthand. Take notes and ask questions to gather as much information as possible; this will empower you in your decision-making process.

By following these steps and leaning on the support of F5’s dedicated team, first time home buyers in PA can simplify their property search and find a home that truly meets their needs.

Secure Financing with a Mortgage Broker

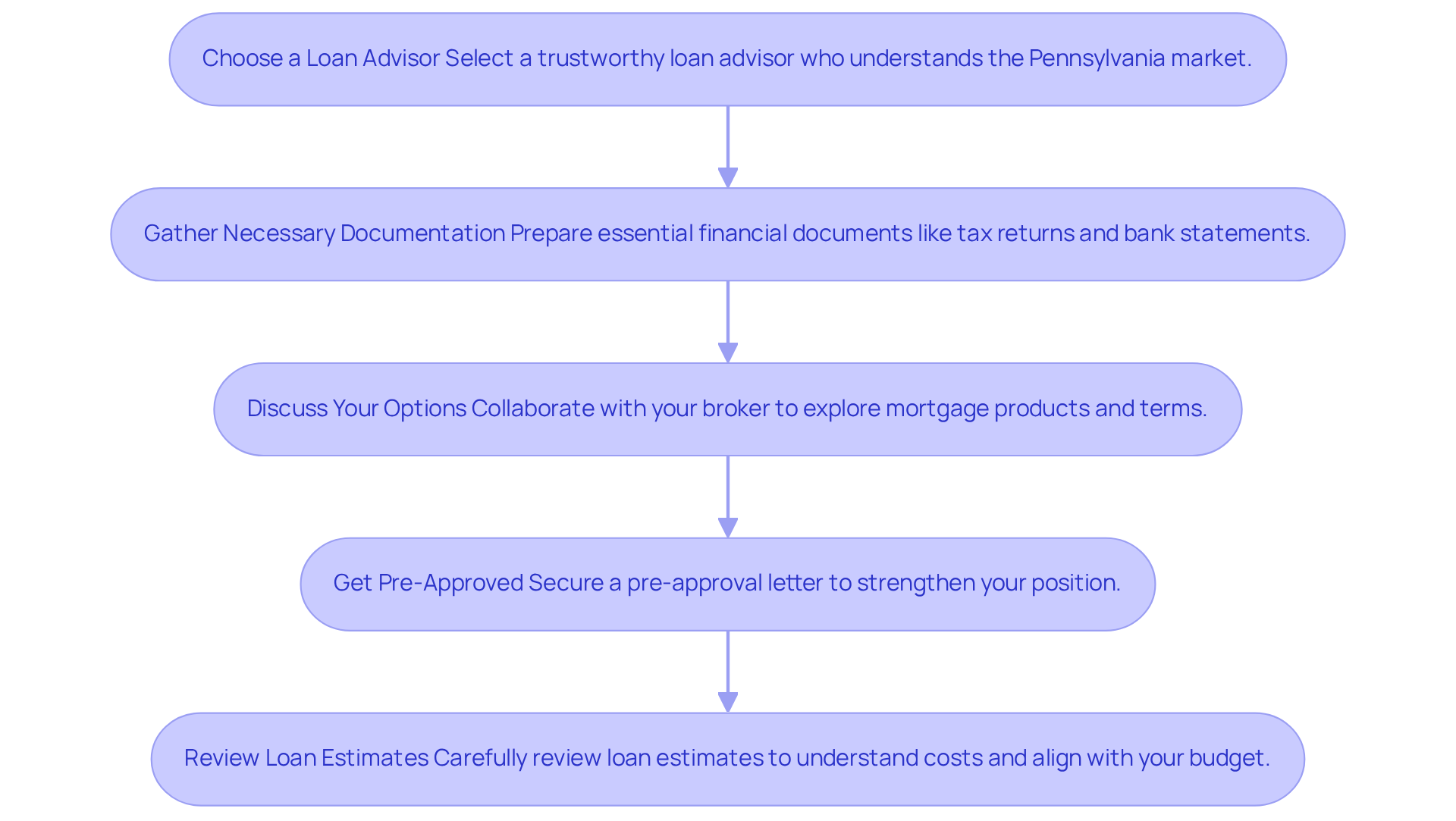

Securing financing for your home purchase can feel overwhelming, but by following a few key steps, you can streamline the process and enhance your chances of success.

-

Choose a loan advisor: Start by investigating and selecting a trustworthy loan advisor for first time home buyers PA who understands the Pennsylvania market. We know how challenging this can be, and an informed broker, like F5, can help you navigate the various financing options available. F5 Finance uses user-friendly technology to simplify the process, ensuring a stress-free experience tailored to your unique situation while maintaining transparency and avoiding aggressive sales tactics.

-

Gather Necessary Documentation: Prepare essential financial documents, such as tax returns, pay stubs, bank statements, and any additional information your broker may request. Having these documents ready will expedite your application process and help you move forward with confidence.

-

Discuss Your Options: Collaborate with your broker to explore different mortgage products, interest rates, and terms. It’s crucial to ask questions and clarify any uncertainties to fully understand each option available to you. For instance, the Keystone Home Loan Program offers a minimum down payment of 3% to 5%, which can be especially beneficial for first time home buyer PA. F5’s diverse loan programs include both standard and nontraditional options, ensuring you have access to a wide range of solutions.

-

Get Pre-Approved: Secure a pre-approval letter from your broker. This document not only strengthens your position when presenting an offer on a property but also provides you with a clear understanding of your budget. Additionally, programs like the Keystone Advantage Assistance Loan offer up to $6,000 for down payment assistance, which can further support your financing needs. F5’s client-focused approach ensures that you receive tailored guidance throughout this process.

-

Review Loan Estimates: After locating a residence, your broker will provide loan estimates. Take the time to carefully review these documents to understand the associated costs and ensure they align with your financial plan. Remember, you may qualify for up to $15,000 in down payment and closing cost assistance through programs like the Access Home Modification Program. F5 Mortgage is committed to transparency, empowering you to make informed decisions.

By following these steps and utilizing accessible programs, you can effectively obtain the funding needed to buy your ideal home in the state. As mortgage professional Jessica Merritt emphasizes, ‘Understanding your financing options is crucial for first time home buyer PA to successfully navigate the complexities of the mortgage process.’ We’re here to support you every step of the way.

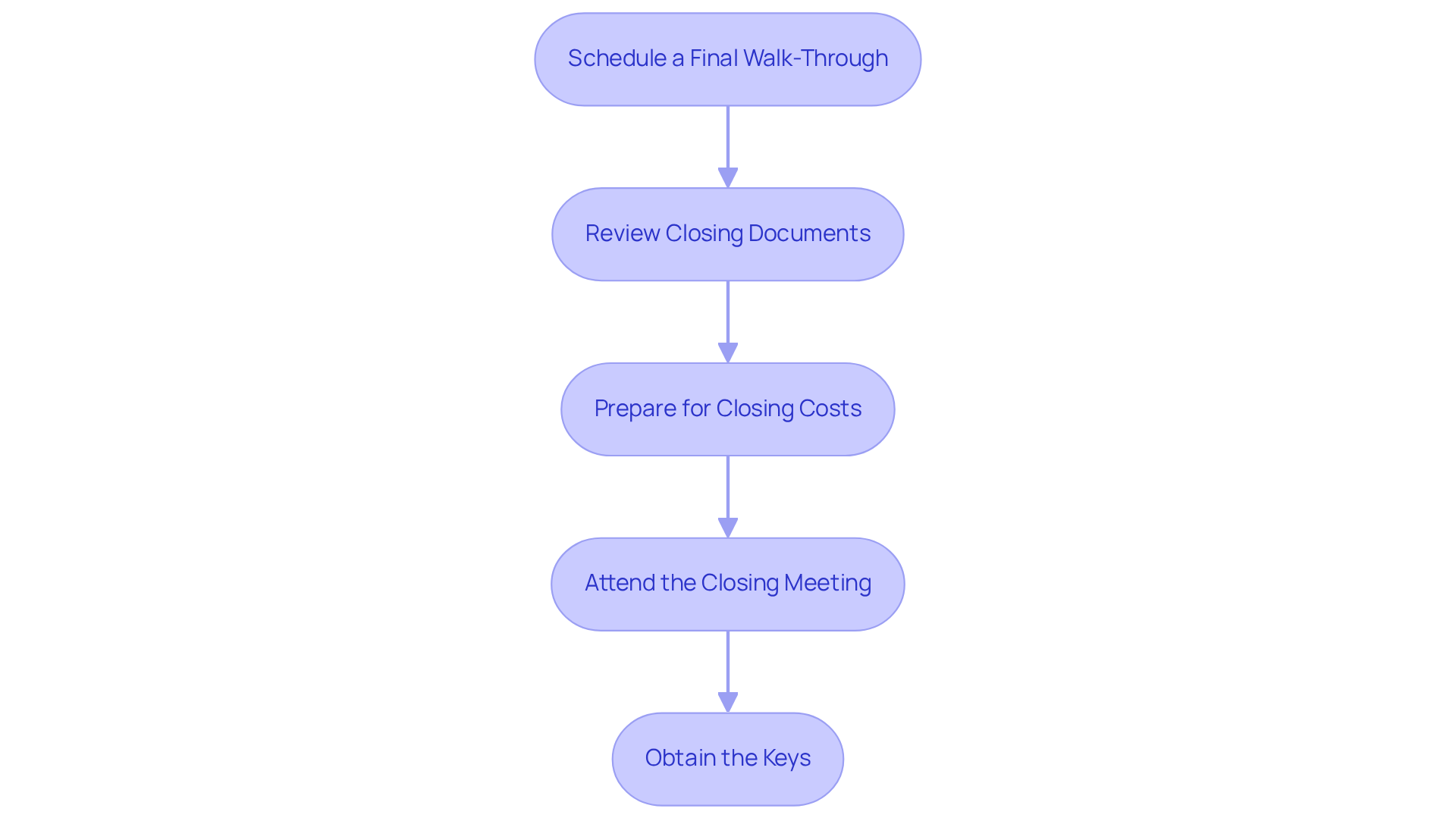

Finalize Your Purchase and Close the Deal

Finalizing your purchase and closing the deal can feel overwhelming, but it involves several important steps that will guide you through this journey:

-

Schedule a Final Walk-Through: Before closing, it’s essential to conduct a final walk-through of the property. This step allows you to ensure it meets the agreed-upon condition. In fact, approximately 85% of buyers find this essential to confirm that any negotiated repairs have been completed.

-

Review Closing Documents: Familiarizing yourself with the closing documents is crucial. The Closing Disclosure outlines all costs associated with the transaction, detailing your financial obligations and the terms of your mortgage. Understanding these documents will empower you as you move forward.

-

Prepare for Closing Costs: It’s important for a first time home buyer in PA to be ready for the closing expenses, which generally vary from $4,000 to $14,000 in Pennsylvania, depending on the property’s price. These costs can include the deed transfer tax, which is 1% of the property’s sale price, typically split between you and the seller.

-

Attend the Closing Meeting: On closing day, you will meet with your broker, the seller, and possibly an attorney to sign the final paperwork and transfer ownership. This meeting is a critical step in the process, where you can discuss any last-minute details and ensure that everyone is aligned.

-

Obtain the Keys: Once all documents are signed and funds are transferred, you will receive the keys to your new residence, officially making it yours. This moment signifies the peak of your property purchasing journey, offering a feeling of achievement and enthusiasm.

By understanding and preparing for the closing process, we know how challenging this can be, and we’re here to support you every step of the way. This preparation will help ensure a successful and stress-free home buying experience.

Conclusion

Navigating the journey of becoming a first-time home buyer in Pennsylvania can be both exciting and daunting. We understand how challenging this can be. By grasping the essential steps—from securing mortgage pre-approval to finalizing your purchase—you can approach this significant milestone with confidence. Each stage of the process is designed to empower you, ensuring that informed decisions lead to successful homeownership.

Key insights discussed throughout this guide highlight the importance of:

- Financial preparation

- Effective property searching

- Securing the right financing options

From assessing your financial health and establishing a budget to exploring various mortgage types and finalizing your purchase, these steps create a comprehensive roadmap for first-time buyers. Remember, utilizing resources and support from knowledgeable professionals, such as F5 Mortgage, can further enhance your experience and help navigate any challenges that may arise.

Ultimately, the journey to homeownership is not just about acquiring a property; it’s about laying the foundation for a future filled with stability and growth. By embracing the outlined steps and seeking guidance when needed, first-time home buyers in Pennsylvania can turn their dream of owning a home into a reality. Take action today, and begin your journey with the confidence that you have the tools and support necessary to succeed.

Frequently Asked Questions

What is the first step for a first-time home buyer in Pennsylvania?

The first step is securing a mortgage pre-approval, which clarifies your budget and shows sellers that you are a serious buyer.

Why is mortgage pre-approval important for first-time home buyers in Pennsylvania?

Mortgage pre-approval is important because it helps clarify your budget and signals to sellers that you are a serious contender in the market.

What should I do after obtaining pre-approval?

After obtaining pre-approval, you can start searching for properties that meet your needs, utilizing online platforms, attending open houses, and considering the assistance of a knowledgeable real estate agent.

What was the typical mortgage amount for first-time home buyers in Pennsylvania in 2024?

The typical mortgage amount for a first-time home buyer in Pennsylvania in 2024 was $264,840.

What should I consider when making an offer on a property?

When making an offer, you should negotiate the price and terms with the seller and consider applying for down payment assistance loans to strengthen your offer.

What is the purpose of a home inspection and appraisal?

A home inspection uncovers any potential issues with the property, while an appraisal confirms the property’s value to ensure you are making a sound investment.

What was the average down payment for first-time home buyers in Pennsylvania in 2024?

The average down payment for first-time home buyers in Pennsylvania in 2024 was $38,062.

How long does the closing process typically take in Pennsylvania?

In Pennsylvania, most loans close in less than three weeks.

What steps should I take to prepare financially for homeownership?

You should assess your financial health, establish a budget, save for a down payment, check your credit score, and explore various financing options.

What is a good debt-to-income (DTI) ratio for potential home buyers?

A good debt-to-income (DTI) ratio for potential home buyers is ideally a maximum of 43%.

What down payment assistance programs are available for first-time home buyers in Pennsylvania?

Programs like the ‘1st Home Allegheny’ initiative offer forgivable funds up to $45,000 for qualified first-time home buyers, depending on income requirements.

What types of mortgages should first-time home buyers consider?

First-time home buyers should consider various mortgage types, including FHA, VA, and conventional loans, to find the best fit for their financial situation.

How can a higher credit score benefit a home buyer?

A higher credit score can lead to more competitive mortgage rates, enhancing your creditworthiness before applying for a mortgage.